Fostering Innovation & Entrepreneurship

The Georgia Chamber Foundation is excited to continue to produce tailored insights on issues of the utmost importance to the statewide business community. This year, these reports will align with the Georgia Chamber’s new strategic plan: GEORGIA|2050

More information about GEORGIA|2050 and the focus pillar of this report, Innovation and Entrepreneurship, is included below. The data included here illustrates top challenges and opportunities in the state, as well as actionable solutions to foster creativity and increase opportunity for Georgians.

GEORGIA|2050 is built to assist the statewide business community in navigating through the fastest economic transitions in history. For decades, Georgia has thrived under a foundation of steady, pro-business policies and visionary political leadership. This stability has sent a clear message to companies— both global and local—that Georgia is committed to their success. We have proven ourselves as a state that listens, acts, and partners with businesses to meet their challenges and cultivates a future of shared growth. This reliable environment has attracted quality investment, creating jobs and opportunities for generations to come.

As we look to the future, we recognize this stability faces challenges. GEORGIA|2050 is our bold initiative to anticipate risks and equip leaders with the tools they need to sustain and enhance Georgia’s business climate. This plan offers forward-thinking solutions to mitigate risk and capitalize on opportunities in an increasingly complex and interconnected global economy. We stand as a united force for prosperity.

Georgia’s future depends on the strength of its partnerships—main street businesses, corporate giants, locally-elected leaders, the Governor’s Office, local chambers, and more. Through GEORGIA|2050 , we will elevate these partnerships, fostering a culture of corporate citizenship, free enterprise, and collaborative servant leadership.

companies indicate that the customer experience is one of the primary drivers of innovation and technological adaptation

indicate their companies will increase investment in A.I. technologies over the next 3 years

indicate that graduating high school seniors are unprepared for the workforce, citing a lack of critical thinking and problem-solving skills

Georgia’s innovation economy encompasses a wide range of sectors, thriving under technological innovation, research and development (R&D) efforts, scientific research, and entrepreneurship. Several key trends are expected to continue to drive and shape innovation over the next three to five years.

What innovations do Georgia executives anticipate their companies increasing investment in over the next 3 years? 2023

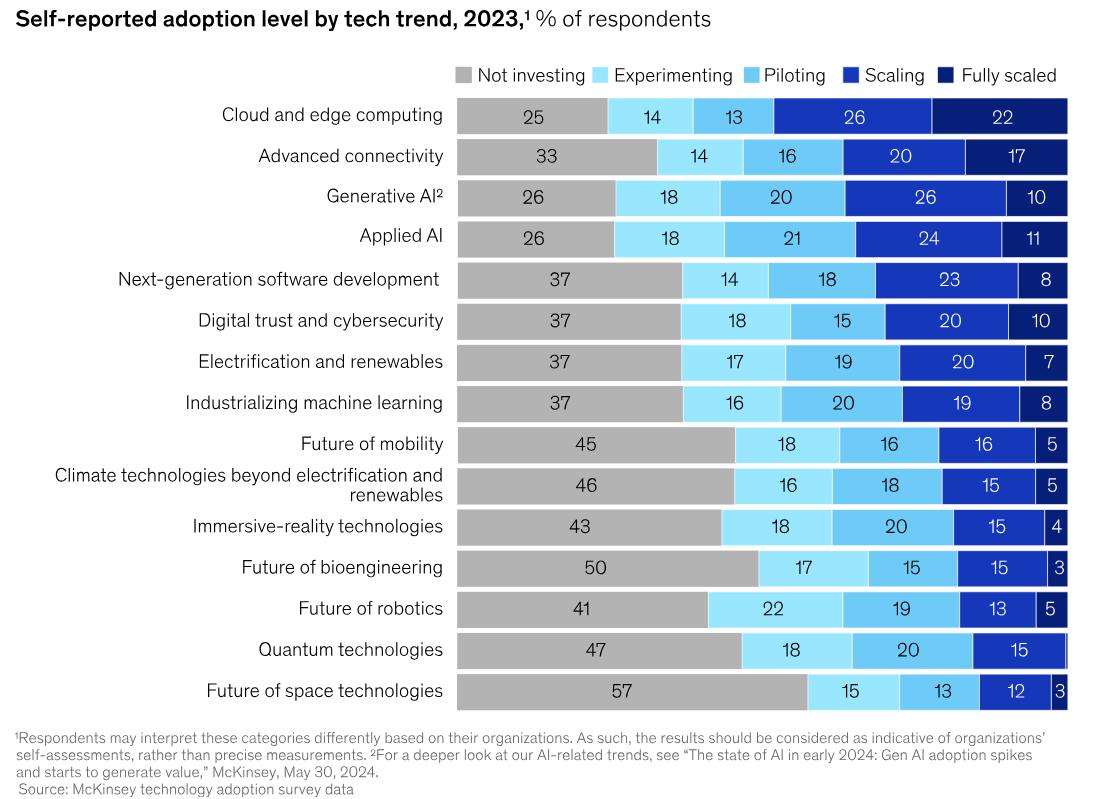

The growing expanse of artificial intelligence (A.I.) technology is evolving the landscape of entrepreneurship and enriching the work of existing industries.

Key Georgia sectors, such as manufacturing, supply chain logistics, and retail and hospitality, are leveraging A.I. and advanced technologies in a variety of capacities to model and streamline processes, integrate physical systems, and enhance existing capabilities. Generative A.I. use alone has increased from 55% in 2023 to 75% in 2024.1 64% of Georgia executives report anticipating increasing company investment in A.I. in the next three years.2

Entrepreneurs and start-ups can leverage advanced technologies to assist with remedial business tasks, allowing more time for meaningful strategy development and networking. Technology can assist with creative or brainstorming phases, creating branding, and process development.3

New sectors and businesses aimed at furthering A.I. use and technology continue to develop. Additionally, supply chains and supporting networks develop around hotbeds for this activity, further expanding entrepreneurial ecosystems in regions with growing technology sectors.4,5

The customer experience continues to drive innovation across all sectors as companies seek to stand apart from competitors by improving access and efficiency for their products and services. Not only are companies investing in internal innovation to improve experiences, but entrepreneurs may find new opportunities in crafting new technologies and services that integrate with existing systems.8

Intellectual property protections increase incentives for organizations and people to innovate by creating a window in which they can fully leverage the success of newly developed products or services. While protections are best enacted at a national level to avoid patchwork regulations between states, strong intellectual property rights are crucial to support an innovative ecosystem. The U.S. Chamber of Commerce reports that the United States ranks first among developed countries for protections, just ahead of countries like the United Kingdom, France, and Germany.9

STEM industries contribute significantly to Georgia’s innovation economy, which primarily encompasses technological, physical, and life science sectors.

Georgia has more than 2.1 million STEM professionals and is expected to add more than 186,000 STEM jobs over the next five years, which is twice the national average.10 Georgia also ranks 9th nationally for the number of high-tech jobs and 14th nationally for STEM doctorates.11,12

field. States like Alabama and West Virginia have high rates, at 15.5% and 15.1%, respectively.13

This indicates that while Georgia has overall strength in numbers of talent, there is an opportunity to retain more in-state talent and to grow the share of workers in the STEM and innovation sectors. Additionally, it is equally important to support on-ramps for all levels of certifications, training, and degree options.

Georgia has over 2.5 times the amount of survey researchers compared to the national average, and notably higher concentrations of workers in environmental engineering, epidemiology and microbiology, and food science technology. By 2035, the STEM occupations projected to grow by the most jobs include data scientists, actuaries and statisticians.14

However, when comparing STEM workers by education, Georgia falls closer to the middle percentiles of all the states. Of all workers in Georgia with a bachelor’s degree or higher, about 10% work in a STEM field. States like California and Virginia have notably higher rates at 14% and 12.7%, respectively. Of all workers in Georgia with skilled technical training beyond high school but not a bachelor’s or advanced degree, about 12% of workers are in a STEM

According to The National Science Board’s most recent ‘State of U.S. Science and Engineering’ report, there is a growing need to bolster domestic STEM workers across the nation. The report highlights that 43% of doctoral talent in the United States comes from abroad, particularly from India and China. The report supports diversifying talent pools from abroad and supporting domestic STEM talent pools as well.15

Georgia performs well in undergraduate education affordability, ranking 9th for lowest average cost of a four-year education program.16 This is due to the state’s robust funding for students in good academic standing through programs like the HOPE Scholarship. The state is well-positioned to support talent, particularly from in-state, and therefore maintains an opportunity to retain more workers through their pursuit of advanced degrees and training.

However, employers continue to express that employee adaptability and resourcefulness need to be improved. According to the Georgia Chamber’s 2025 Executive Insights Survey, 30% of executives’ top concern is that K-12 students are not prepared for the workforce.17 Not only is there room for improvement in core capabilities such as reading and math skills, but also in students’ capacity for problem solving, thinking critically, and adapting to challenges. These skills are necessary to support life-long learning, innovation, and entrepreneurship.

T hough Georgia’s business climate ranks highly among states, garnering funding for research and development (R&D), seed funding, expansion, and venture capital can be a barrier to starting and scaling businesses in the state. Low reimbursement rates, increased regulation, and uncompensated care have caused many hospitals to struggle financially, and low patient volumes amplify these issues in rural communities.

Businesses continue to be the single greatest expender of R&D funds , performing 78% of all R&D in the United States by value—$697 billion worth of R&D, compared to the federal government expenses at $71.5 billion.18,19

In Georgia, businesses lead the way in R&D performance by value. Georgia’s higher education institutions also contribute a far greater portion of total funding than the national average. The business sector performs 70.7% of all R&D in Georgia, valued at $8.6 billion. Higher education institutions in the state perform 26.6% of all R&D, compared to only 10.5% of total R&D performance in the U.S.19

Georgia’s strong performance in higher education R&D is reflected in dramatic increases in federal R&D dollars flowing to the state’s research universities. In 2016, the state ranked 12th in university R&D expenditures; today, Georgia ranks 8th in the U.S., with more than $3.7 billion in annual R&D expenditures at its research universities.20 The strength of research at Georgia’s universities makes them one of the state’s greatest innovation assets.

Additionally, a greater portion of business R&D in Georgia is self-funded compared to national levels. Georgia’s business sector funds 98.7% of total R&D performed, compared to 95.3% nationally.21 This underscores the importance of maintaining a healthy business climate, which allows businesses to grow, diversify, and reinvest in their initiatives in addition to their core operations.

Leaders can grow Georgia’s R&D ecosystem by pulling in additional investors and funders for both public and private research initiatives. Our research universities have the dual responsibility of bringing investments and executing cutting edge research to Georgia while also operating incubators and accelerator programs to support the next generation of entrepreneurs. This dynamic concentration of talent ensures companies not only have access to an unparalleled pool of diverse talent but also have a wealth of collaborative partners to work alongside.

Venture capital investment increased by nearly 40% from 2018 to 2023, and $267 billion in GDP is derived directly from STEM industries. 22,23 However, Georgia ranks 34th by increase in venture capital investment nationally, and the venture capital market is increasingly tough to crack.24 The venture capital market is even more concentrated than it was 10 years ago. As of 2021, over 50% of venture capital funding took place between markets in San Francisco, New York, and Boston.25

However, the surge in venture capital funding since 2019 has led to an influx of new businesses and funding markets. These have opened avenues in traditionally smaller markets and cities such as Atlanta, which ranked 7th in venture capital share outside of the largest five markets in 2021.26

The growth in Atlanta’s market supports access for entrepreneurs and businesses across the state, and investment in the state continues to grow. From 2020 to 2024, 1,226 startup businesses received venture capital funding, totaling $12.1 billion in investment. While the majority of this investment took place in the Atlanta region, about $23.8 million was directed to the central Georgia corridor from Athens to Warner Robins, and to coastal regions. Georgia excels in IT sector investment, with notable funds directed to the financial services and healthcare sectors.27

As the state’s investment market grows, leaders should consider increasing access to seed, startup, early-stage and expansion capital, all of which are critical in helping individuals and businesses take the next step in growing their ideas and businesses.28

New business growth is vital to a dynamic, thriving economy that fosters competition and innovation. Georgia traditionally excels in levels of business applications, though applicants suffer with both fully forming businesses from the application stage, and in surviving and growing their business ideas.

Business applications grew by 73% across Georgia, and well over 100% in rural and hub communities over the last five years. 29 Georgia supports a strong business climate, which attracts innovators, which is important to continuing to foster the state’s ecosystem of collaborative incubators, accelerators, and corporate partners in the state.

Georgia had the 35th lowest one-year survival rate in the nation in 2023, with only 71.6% of businesses surviving from the previous year.30,31 Survival rate has since rebounded; 75.6% of businesses that opened by March of 2023 in Georgia survived until March of 2024. Despite the improvement, this is compared to 78.5% business survival nationwide and is lower than every neighboring state. Georgia’s 5-year survival rate is more aligned with Southern neighbors, though it remains the lowest.32

This may indicate that Georgia entrepreneurs are more willing to take risks on business ideas, but ultimately, it suggests that fewer entrepreneurs have the resources they need to succeed compared to other states in the region. One distinct advantage Georgia has is the nonprofit Georgia Research Alliance (GRA), which powers more university innovation in the state. A key GRA program helps scientists at public and private research universities move their inventions out of the lab and into the market. GRA does this by providing a series of grants and loans to “de-risk” the technologies very early on, as well as sharing strategic advice and guidance for university startups. More than 220 startups are in the GRA portfolio; over time, they have attracted more than $1.4 billion in outside venture investment.

The Georgia Research Alliance (GRA) works to drive more impact out of university research and entrepreneurship. GRA’s Innovation & Entrepreneurship program helps university researchers turn their discoveries into products by providing early-stage grants and startup guidance.

To learn more, visit https://gra.org/

Hosted through the Georgia Institute of Technology, the Advanced Technology Development Center offers coaching, curriculum and networks for aspiring tech startups.

To learn more, visit https://atdc.org/

The R.I.C.E. supports a mission of economic mobility, particularly for Black and traditionally underserved entrepreneurs. The Center supports programs from startup support to industry-specific resources and labs.

To learn more, visit https://russellcenter.org/about-us/

The University of Georgia’s Small Business Development Center supports 18 physical locations across the state. The Center focuses on small business support, including scaling and initial startup services.

To learn more, visit https://georgiasbdc.org/.

F.L.E.X. focuses on creating prosperity and revitalizing rural entrepreneurial ecosystems through educating students on establishing small businesses. The initiative centers around a Shark Tank-like competition which culminates in funds awards to students who win to launch their own small business operations.

To learn more, visit https://georgiaflex.org/

1. Taylor, A. (2024, December 9). IDC’s 2024 AI opportunity study: Top five ai trends to watch. The Official Microsoft Blog.

2. Georgia Chamber of Commerce Foundation. (2025, January). Georgia Chamber 2025 Executive Insights Survey.

3. Brown, S. (2024, January 17). How Generative A.I. is Changing Entrepreneurship. MIT Management Sloan School.

4. Shrivastava, R. (2025, April 10). AI 50. Forbes.

5. Somers, M. (2023, December 11). 10 Startups harnessing the power of A.I.. MIT Management Sloan School

6. Yee, L. et al. (2024, July 16). McKinsey Technology Trends Outlook 2024. McKinsey.

7. Institute of Sustainability Studies, Lexicon. (2025, February 7). How technology drive resource efficiency in business

8. Mann, K. (2022, March 22). Customer Experience Innovation: The New Battlefield for Business. Forbes.

9. US Chamber of Commerce (2025, April 15). 2025 International IP Index Report.

10. Science is US. (2023, August 29). State Spotlight: Georgia

11. CompTIA. (2024). State of the Tech Workforce 2024.

12. National Science Foundation (2024, October) Survey of Earned Doctorates (2023). Dataset. National Center for Science and Engineering Statistics.

13. National Science Board: Science and Engineering Indicators. (2024 May). The STEM Labor Force: Scientists, Engineers, and Skilled Technical Workers. National Science Foundation.

14. Lightcast Data Software (Accessed 2025, May). Occupation Table, STEM Occupations (SOC 2021)

15. Mckenzie, L. (2014, March 18). US Still Leads the World in R&D Spending but Faces ‘Crisis’ in STEM Workforce, NSF Board Argues. AIP Foundation.

16. National Science Board: Science and Engineering Indicators. (Accessed 2025, May). Average Undergraduate Charge at Public 4-Year Institutions. National Science Foundation.

17. Georgia Chamber of Commerce Foundation. (2025, January). Georgia Chamber 2025 Executive Insights Survey.

18. National Center for Science and Engineering Statistics. (2025, February 27). U.S. R&D Totaled $892 Billion in 2022; Esti mate for 2023 Indicates Further Increase to $940 Billion. National Science Foundation.

19. National Center for Science and Engineering Statistics. (2025, February. Accessed 2025, May). Release: National Pat terns of R&D Resources, Cycle year 2022 to 2023, Table 10. National Science Foundation.

a. **Note that the NSF counts ‘non federal’ funding as a part of business sector-funded performance value totals for the business sector. Written estimates in this report therefore vary slightly from the data provided in table 10 in accordance with NSF written estimates provided by source 18.

20. National Center for Science and Engineering Statistics. (Accessed 2025). Release: Higher Education Research and Development (HERD) Survey, Cycle year 2023, Table 67. National Science Foundation.

21. National Center for Science and Engineering Statistics. (2025, February. Accessed 2025, May). Release: National Pat terns of R&D Resources, Cycle year 2022 to 2023, Table 10. National Science Foundation.

22. Georgia Chamber of Commerce Foundation. (2025, January). Economic Competitiveness Redbook, page 102

23. Science is US. (2023, August 29). State Spotlight: Georgia.

24. Georgia Chamber of Commerce Foundation. (2025, January). Economic Competitiveness Redbook, page 102

25. Florida, R. (2023, December 7). Where US Tech Investment is Growing the Most. Bloomberg.

26. Florida, R. (2023, December 7). Where US Tech Investment is Growing the Most. Bloomberg.

27. National Venture Capital Association. (Accessed 2025, May). Georgia VC State Data.

28. Peek, S. (2021, January 11). Business Financing: What is Venture Capital? US Chamber of Commerce, 2025 CO

29. Georgia Chamber of Commerce Foundation. (2025, January). Economic Competitiveness Redbook, page 94.

30. Bawden-David, J. (2023, October 7) States with the Best Business Survival Rates. Trademark Engine.

31. US Bureau of Labor Statistics. (Accessed 2025, May). Business Employment Dynamics: Establishment Age and Survival Data: Table 7. Survival of private sector establishments by opening year, Georgia.

32. US Bureau of Labor Statistics. (Accessed 2025, May). Business Employment Dynamics: Establishment Age and Survival Data: Table 7. Survival of private sector establishments by opening year, National.

33. Georgia Research Alliance (Provided in partnership 2025, June).