2023–2024

2023–2024

CITY OF ORLANDO COUNCIL

Mayor Buddy Dyer

Jim Gray, District 1 Commissioner

Tony Ortiz, District 2 Commissioner

Robert F. Stuart, District 3 Commissioner

Patty Sheehan, District 4 Commissioner

Shan Rose, District 5 Interim Commissioner

Bakari F. Burns, District 6 Commissioner

CITY OF ORLANDO STAFF

Sherry Gutch, Director of Placemaking

Brooke Bonnett, Economic Development Director

Lillian Scott-Payne, Economic Development Deputy Director

Timothy Johnson, Economic Development Deputy Director

Eric Ushkowitz, Business Development Services Division

Manager

Kim King-Maysonet, Business Development Services

Assistant Division Manager

ORLANDO MAIN STREETS

EXECUTIVE DIRECTORS

Jennifer Marvel, Audubon Park

Mike Griffin, City District

Amelia Harrison, College Park

Stephanie Ziglar, Curry Ford West

Amil Cordova, Gateway District

Allex Englett, Ivanhoe Village

Angie Folks, Milk District

Joanne Grant, Mills 50

Misty Heath, SoDo District

Lisa Cuatt, Thornton Park District

Justin Kinsey, West Lakes District

Natasha Gaye, Parramore District City of Orlando

Orlando, FL 32801

246.2821 GAI CONSULTANTS’ COMMUNITY SOLUTIONS GROUP (CSG)

Peter Sechler, Vice President, Director of CSG

Laura Smith, Urban Analytics Director

Natalie Frazier, Urban Analytics Manager

Hannah Hollinger, Senior Planner

The City of Orlando has invested in creating this Market Report to highlight and promote the City's twelve (12) Main Streets as well as the Lake Nona District, all located within the City of Orlando.

This Market Report includes an economic outlook for both the United States and the State of Florida, along with a comprehensive overview of the City of Orlando, highlighting its historical and current residential and commercial market characteristics and employment trends. This report also introduces the Main Street America Program and outlines the benefits these Main Street districts provide to the community.

Additionally, this Market Report presents a data-driven analysis of historical and current commercial market trends in the

Lake Nona District and the 12 Orlando Main Street Districts. The commercial markets specifically examined as part of this Market Report include the office, retail, industrial/ flex, for-rent multi-family, and hotel sectors within each district. Each district overview includes highlighting the district’s unique characteristics, anchor developments, and priority projects.

The purpose of this Market Report is to serve as a tool for promoting and marketing the City of Orlando’s Main Street Districts and the Lake Nona District, helping the City and interested third parties understand the complex marketdriven statistics, performance indicators, and historical trends occurring within each of these defined districts.

The beginning of the latest recovery from the COVID-19 induced recession was officially announced by the National Bureau of Economic Research (“NBER”), with the Business Cycle Dating Committee of NBER announcing in July 2021 that a trough in monthly economic activity occurred in the U.S. economy in April 2020. The previous peak in economic activity occurred in February 2020, marking the beginning of the current business cycle. The recession lasted two months, which makes it the shortest U.S. recession on record. The NBER chronology does not identify the precise moment that the economy entered a recession or expansion. In the NBER’s convention for measuring the duration of a recession, the first month of the recession is the month following the peak and the last month is the month of the trough. Since the most recent trough was in April 2020, the last month of the recession was April 2020, and May 2020 was the first month of the subsequent expansion.

The broadest measure of the U.S. economy, real gross domestic product (GDP), increased at an annual rate of 2.8% in the second quarter of 2024 (“2Q24”) following a GDP increase at annual rate of 1.4% in the first quarter of 2024 (“1Q24”). Increases in GDP are reflected by increases in consumer spending (both services and goods), private inventory investment, nonresidential fixed investment. Within services, the leading contributors were health care, housing and utilities, and recreation services. Within goods, the leading contributors were motor vehicles, recreational goods and vehicles, furnishings and durable household equipment, and gasoline and other energy goods. Private inventory investment increased primarily reflect increases in wholesale and retail trade industries that were offset by a decrease in mining, utilities, and construction industries.

U.S. inflation, as measured by the 12-month change in the Consumer Price Index (CPI), fell to 3.0% in June 2024 after reaching a 12-month peak of 3.7% in August 2023. Since early 2023, the CPI has been fluctuating

slightly while steadily declining overall. CPI measures the change in prices paid by consumers for goods and services such as food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy dayto-day. The CPI is expected to continue its downward trend through 2024 although at a slower pace.

The Federal Reserve (Fed) adjusts Fed Fund Rates in response to the economy, while also trying to achieve conditions that satisfy their dual mandate, as set by Congress: keep prices stable and maximize employment. The Fed raises rates when the economy starts experiencing too much inflation, and cuts rates when the economy has too high unemployment. Other data that factor into Fed monetary policy decisions include gross GDP, consumer spending, industrial production, and major events like a financial crisis,

global pandemic, or a massive terrorist attack. Since August 2023, the Fed left the target for the Fed Funds Rate unchanged at 5.25%-5.50%, although it has signaled that rates may be held “higher for longer” if inflation remains persistent.

The economy is still evolving at unprecedented rates. Personal saving was $703.0 billion at the end of 2Q24, compared with $671.0 billion at the end of the 1Q24. The personal saving rate—personal saving as a percentage of disposable personal income—was 3.4% at the end of 2Q24, noticeably up when compared with 3.2% at the end of 1Q24. In the 2Q24, personal income increased $50.4 billion in June 2024 compared with an increase of $122.0 billion in March 2024, and Disposable Personal Income (DPI) increased $37.7 billion, or 0.2%, in June 2024, compared with an increase of $104.0 billion, or 0.5%, in March 2024.

Sources: Federal Reserve Economic Data (FRED); GAI Consultants.

The “Great Global Work-From-Home Experiment” created by the COVID-19 pandemic has changed how employees work and expect to work far into the future. As organizations ease back into office life, employees and employers are navigating a new chapter in this experiment. One that is now blending remote work flexibility and on-site work. This new chapter is still being written as 2024 progresses and more employees return to the office for at least part of their week. While the Bureau of Labor Statistics (BLS) collects annual data on the location of work for full-time employees, data was not collected in 2020 due to the COVID-19 pandemic. However, BLS data from 2016-2019 indicates that on average roughly 82% of full-time employees worked at their workplace compared to an average of roughly 23% of full-time employees who worked at their home (some or all the time). Comparatively, 2022 BLS data showed that roughly 69% of full-time employees worked at their workplace compared to an average of 35% of full-time employees who worked at their home.

With the Fed in the process of raising interest rates at the most aggressive pace since the 1980s, the risk of recession remains a concern. Rising prices and the monetary policy response add uncertainty to the U.S. economic outlook. Factors including elevated inflation, high interest rates, dissipating pandemic savings, lower government spending, and the resumption of mandatory student loan repayments are fueling expectations that GDP growth will likely fall below 1.0% in 2024. Inflation and interest rates should gradually normalize, and quarterly annualized GDP growth should converge toward its potential of near 2% in 2025.

The unemployment rate, at 4.1%, has begun to slowly tick up since the end of 2Q24 and is expected to continue throughout the year. Labor market tightness will moderate somewhat over the coming quarters but will remain acute relative to previous economic downturns, reflecting persistent labor shortages in some industries and labor hoarding in others. This should prevent overall economic growth from slipping

Florida’s economy outperformed the nation during the pandemic, with activity up 11% from the end of 2019 to 2022—more than double the 5% increase recorded nationally. A much stronger demographic profile will help Florida keep an edge over the nation, but the outperformance gap is expected to shrink as growth in the state shifts into lower gear. Signs of a slowdown are evident, with employment growth shifting more in line with the national pace recently. Some deterioration in the labor market is anticipated, with a slower economic backdrop putting upward pressure on the unemployment rate. Over the near-term, the challenges for Florida will continue to center on labor supply. The unemployment rate currently stands at 3.2%—only marginally above 2.4% all-time low at the start of 2006. Strong population growth will continue to lend a hand by adding more workers to the market.

From 2023-2026, Florida’s economy, as measured by Real Gross State Product (RGSP), is anticipated to expand at an average annual rate of 1.2%. RGSP is projected to decelerate during the economic slowdown with growth slowing to 0.8% in 2024 and 2025, then accelerating to just over 1.5% by 2026. Personal income growth is projected to average 2.2% through 2026. Following the inflation-driven contraction in 2022, growth is expected to average 2.9% through 2025 and 2026, likely reaching 3.0% by year end 2026. Florida’s average growth will likely be about 0.2 percentage points higher than the national rate through 2026.

Payroll job growth in Florida will falter with a slowdown in the U.S. economy, but not in every sector. After yearover-year growth of 4.6% in 2021 and job growth of 5.3% in 2022, payroll employment in 2023 decelerated

too deeply into contractionary territory and facilitate a rebound in the following months. Forecasts indicate that overall growth will return to more stable prepandemic rates, inflation will drift closer to 2%, and the Fed will likely lower rates to near 5%. However, due to an aging labor force we expect tightness in the labor market to remain an ongoing challenge for the foreseeable future.

The Fed’s efforts to restore inflation back to 2% will slowly tighten household and business spending, likely generating a mild downturn by the end of 2024. As inflation continues to steadily return to its prepandemic levels, CPI has remained surprisingly stable but is expected to continue to subside to an annual rate of 2.7% by the end of 2024. This will in part be due to the Fed’s aggressive inflation reduction efforts, but also because of easing demand for goods and services, the pass-through from softer housing price inflation, and cooling wage growth leading into 2025.

to 2.6% and has continued to grow at a 2.1% year-overyear rate in March 2024. This, however, is expected to contract by 0.5% in 2025. Job growth will likely returns to a positive condition in 2026.

Housing starts will be suppressed by the slowdown and higher mortgage rates. Total starts of 158,349 in 2020 jumped to 193,049 in 2021 and held at 192,213 in 2022—although higher interest rates and a slowing economy resulted in housing starts falling to 125,270 in 2023. Housing starts are expected to further decline in 2024 before climbing to 147,100 in 2025 and 149,000 in 2026. Rapid house-price appreciation has been largely corrected, with demand dampened by rising mortgage rates, decreasing affordability, and the slowing economy.

The City of Orlando, often called “The City Beautiful,” is renowned for its world-class attractions, diverse culture, and thriving economy. As the county seat of Orange County, the City spans approximately 119 square miles and is home to over 325,000 residents. Centrally situated in Central Florida, the City is strategically positioned at the crossroads of major thoroughfares, including Interstate-4 and State Road 408, ensuring convenient access for commuters and travelers. Additionally, the Orlando Executive Airport and Orlando International Airport significantly enhance the City’s domestic and international connectivity.

Recognized as the heart of the four-county Metropolitan Statistical Area (MSA) known as the “Orlando MSA,” the City includes its home county, Orange, along with Lake, Osceola, and Seminole Counties. With a population exceeding 325,000, the City stands as the largest city in both Orange County and the broader four-county MSA.

The City operates under a Mayor/City Council government structure and offers a comprehensive array of municipal services to its residents. These services include police and fire protection, landuse planning and zoning, code enforcement, neighborhood improvement, street and drainage construction and maintenance, traffic engineering, recreational and cultural activities, refuse collection, and stormwater and water reclamation.

The City’s rich history reflects its significant progress. From its beginnings as a citrus industry hub in the 19th century to becoming a tourism destination in the 20th century, the City has continually evolved. Today, the City is an inclusive community with a high quality of life, supported

by industries such as academic research, computer simulation and training, and hospitality. The City’s ability to adapt and grow in response to market demands ensures its status as a world-class city.

Renowned for its iconic theme parks, including Walt Disney World Resort and Universal Orlando Resort, the City draws millions of visitors from around the globe each year. While globally famous for its theme parks, the City’s identity extends far beyond tourism. Its economy is diverse, with significant growth in technology, healthcare, and aerospace sectors. The City has made substantial efforts to diversify its economic base, moving from its roots in the citrus industry to becoming a hub for high-tech, high-wage careers. Key industries now include digital media, life sciences, and modeling, simulation, and training.

Beyond its famous attractions, the City boasts a rich cultural scene, with numerous museums, theaters, and art galleries. The Dr. Phillips Center for the Performing Arts and the Orlando Museum of Art are just a few examples of the City’s commitment to the arts. Downtown Orlando is a bustling hub of activity, featuring a variety of dining, shopping, and entertainment options.

The City’s vision is to become the premier futureready city in the United States. This vision is supported by proactive strategies to stay ahead of opportunities and ensure that the City remains a global destination where everyone can thrive. The City’s leadership is committed to fostering an inclusive environment with a high quality of life and a robust economic foundation.

As a leader in the 21st-century innovation economy, the City is home to Lake Nona, a 7,000acre master-planned community developed by Tavistock Development Company, which serves as an international hub for health and biotech services. The 2020s have brought exciting developments, such as video game developer Electronic Arts relocating its Florida headquarters to Downtown Orlando’s Creative Village. Additionally, the City has partnered with Dr. Phillips Charities to develop The Packing District, a 202acre neighborhood featuring mixed-use residential hubs, a 40-acre urban farm, and over 1 million square feet of retail and office space.

The City’s economy is diverse, with strong sectors in tourism, technology, healthcare, and education. Orlando is also a major center for conferences and conventions, hosting numerous events at the Orange County Convention Center. The City’s strategic location and excellent transportation infrastructure, including Orlando International Airport, make it a key gateway to the rest of Florida and beyond.

Residents of the City enjoy a high quality of life, with access to beautiful parks, recreational facilities, and a warm, sunny climate year-round. The City’s commitment to sustainability and innovation is evident in its numerous green initiatives and smart city projects. Orlando is much more than its famous theme parks. It is a dynamic city with a diverse economy, a forward-thinking vision, and a dedication to innovation and inclusivity. Whether visiting for its attractions or considering it as a place to live and work, the City of Orlando offers a unique blend of opportunities and experiences.

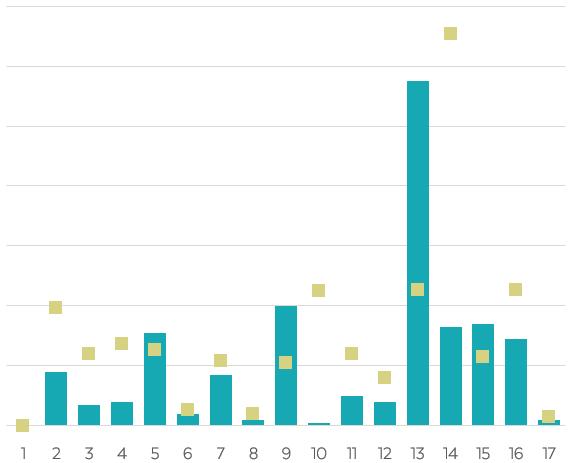

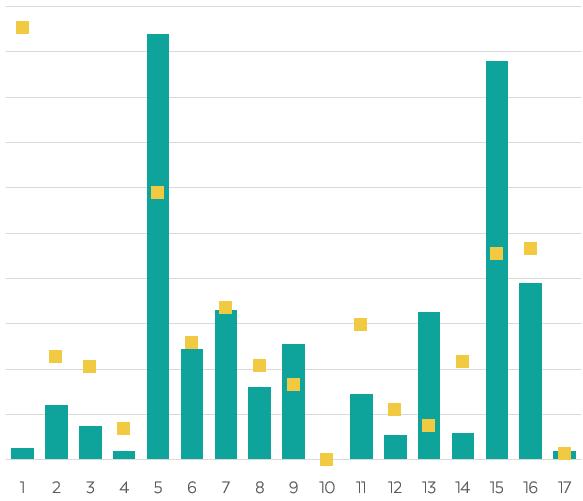

As of year-end 2023, the City of Orlando’s total employees compose approximately 40% of the total employment within Orange County. The City’s employment sector is primarily dominated by the health care and social assistance, educational services, transportation and utilities, and professional services industries, as illustrated in the table below.

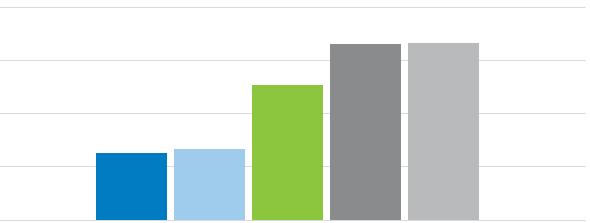

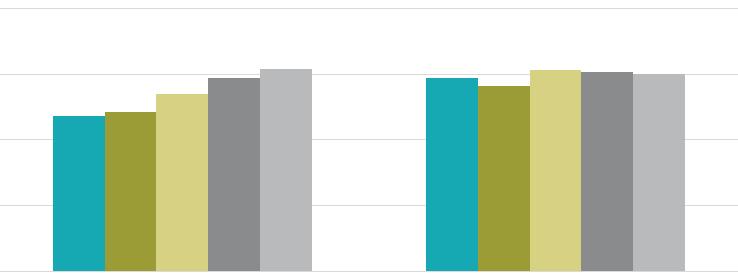

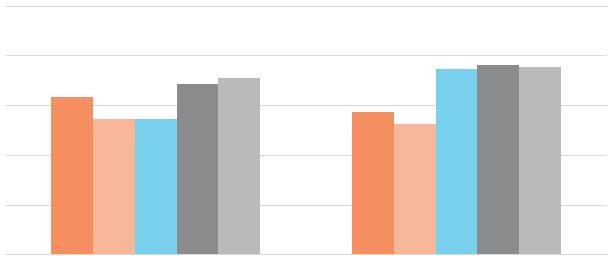

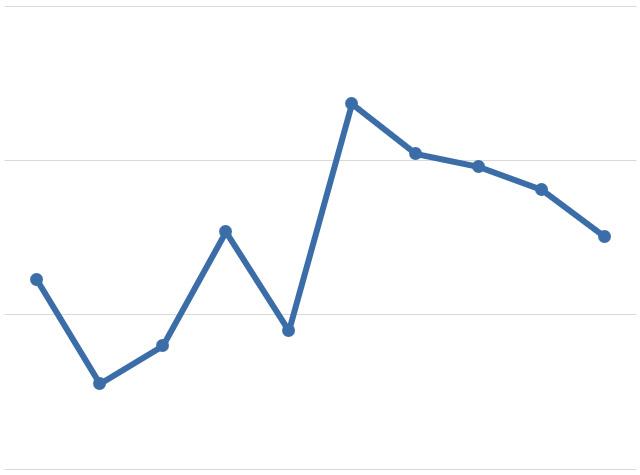

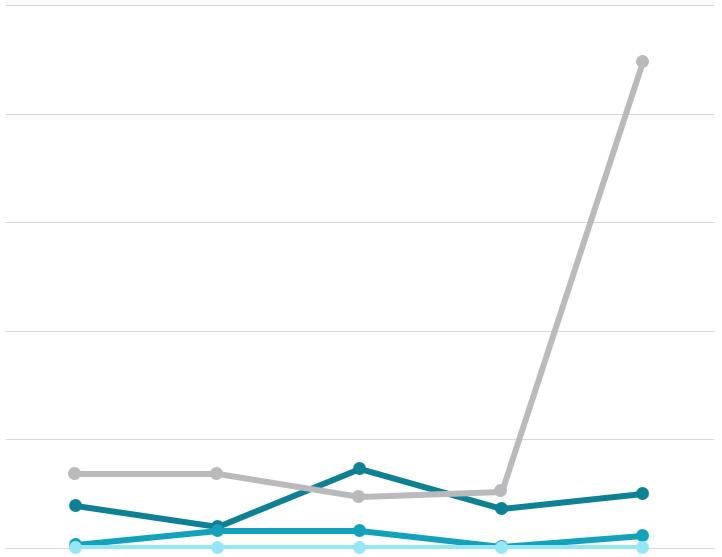

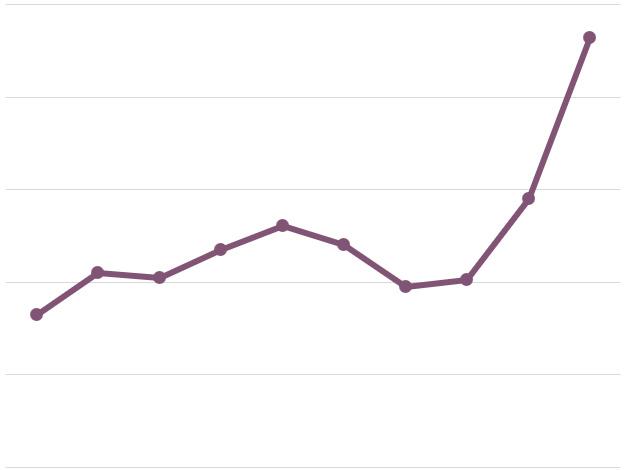

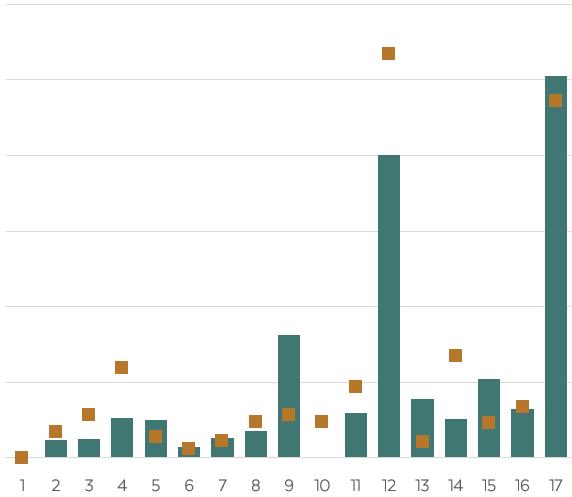

Over the 10-year period, from 2014 to 2023, the City’s total employment has experienced a compound annual growth rate (“CAGR”) of 2.3%. The figure above illustrates the City’s total annual employment trends from 2014 through 2023.

In addition, the City’s total employment increased from 300,203 employees in 2014 to 332,864 employees in 2023—resulting in a net increase of 32,661 total employees. The increase in employment was primarily driven by increases in the transportation and utilities, educational services, finance and insurance, health care and social assistance, and public administration industries.

For year-end 2023, the total sales tax collections in the City were over $3.0 billion, experiencing an increase of 3.0% from the prior year, 2022. The sales tax collections within the City were primarily stimulated by a sales tax levy against auto dealers, hotel/motel accommodations, and admissions and recreation services—combined, composing 38% of the City’s total sales tax collections for 2023. The City’s capture of sales tax collections within the County is 69%, which remained unchanged from the prior year. The table below reflects the top 10 sales tax collections, represented in millions (“M”) by Kind Code for the City as of year-end 2023.

As of year-end 2023, residents of the City spent an estimated $11.421 billion, with 34% allocated to housing, 30% to retail goods, 12% to food (both away from home and at home), 7.5% to health care, and 4.0% to entertainment and recreation. This spending pattern highlights the dominance of housing and retail, which together account for 64% of total expenditures. Additionally, food and health care make up 19.3% of the consumer spending budget, while entertainment and recreation represents the smallest portion of consumer spending. Within the broader context, total expenditures within the City make up approximately 23.7% of the consumer spending within the County, with over $48.251 billion in total expenditures as of year-end 2023.

As of year-end 2023, the City of Orlando’s forsale residential market included 80,147 residential units. Single-family homes made up the majority, at 64%, while residential condominium (“condo”) accounted for 36% of the total. The City’s residential units represent approximately 15% of the total single-family residential units and 55% of the total residential condos within Orange County.

As of year-end 2023, the average single-family residential assessed value and taxable value per unit, at $294,947 and $255,520, respectively, were both greater than those of residential condo units—with an assessed value and taxable value per unit of $149,530 and $137,241, respectively.

Year-over-year, year-end 2022 through year-end 2023, total single-family units and residential condo units within the City saw an increase of 2.0% and 0.2%, respectively. Over the past five years, 2019 through 2023, total inventory of forsale residential units within the City experienced an increase of 13% with the addition of 5,058

new single-family residential units and 4,149 new residential condo units. The following figures illustrate the change in annual inventory for both single-family residential units and residential condo units from 2019 through 2023.

In addition, the City experienced a total of 1,819 single-family unit sales and 1,304 residential condo unit sales in 2023, as illustrated in the table below.

By the end of 2023, the total sales price for singlefamily residential units reached approximately $991.7 million, while residential condo unit sales amounted to around $321.9 million. The average sales price per sq. ft. for single-family homes in the City was $346.26 per sq. ft.; this was significantly greater than the City’s average sales price per sq. ft. for residential condo units, at $222.78 per sq. ft. during the same period.

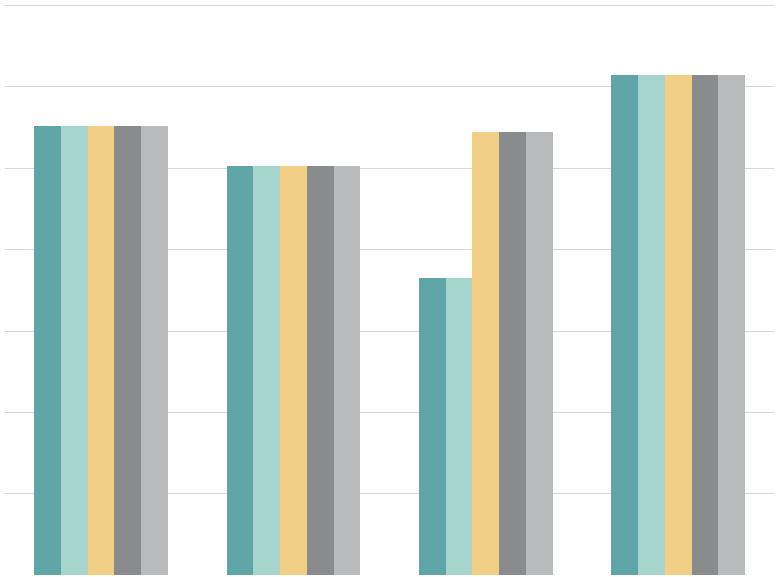

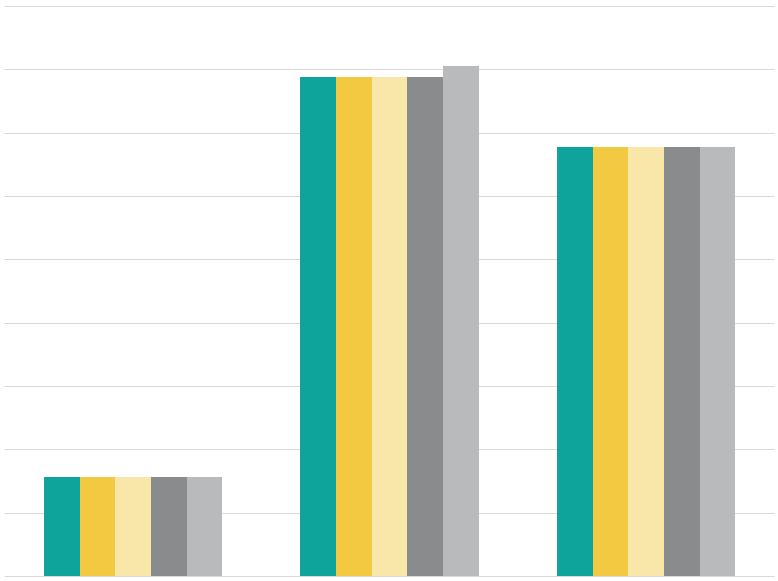

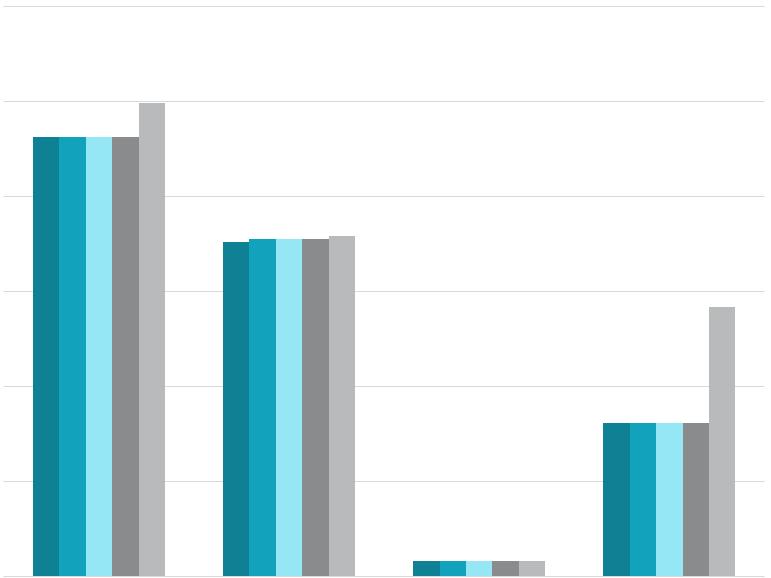

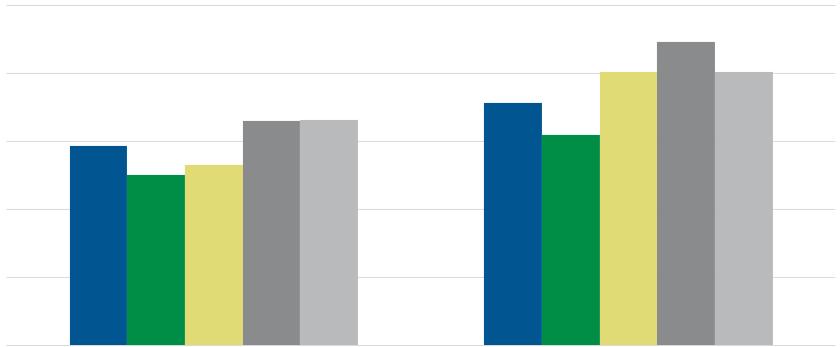

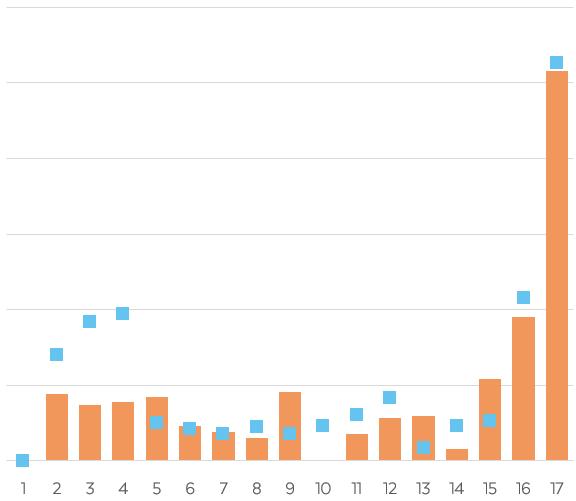

As of year-end 2023, the City’s commercial real estate market composed nearly 123.5 million square feet (“sq. ft.”) of office, retail, and industrial/ flex space, in addition to 30,620 hotel rooms, and 71,050 for-rent multi-family residential units, as illustrated in the market characteristics table below.

Industrial/flex space composed the majority of the City’s office, retail, and industrial/flex inventory at 51% of the total share, following by office and retail space with 26% and 23%, respectively, of the total, as of year-end 2023. Specifically, the office space within the City consisted of 42% Class A space, 35% Class B space, and the remaining portion as Class C space.

Industrial/flex properties within the City had the highest occupancy rate compared to the City’s retail and office properties as of year-end 2023. Moreover, occupancy rates for both the City’s hotel and for-rent multi-family markets were approximately 75% and 92%, respectively. In addition, average rental rates for retail properties were slightly higher than those for office properties and significantly higher than those for industrial/ flex properties within the City as of year-end 2023.

There were 767 lease transactions that occurred in the City’s office, retail, and industrial/flex markets—resulting in a total of 5.10 million sq. ft. leased during 2023. Leasing activity refers to the volume of square footage that is committed to and actually signed in a given period of time, including direct leases, subleases and renewals of existing leases.

Gross absorption measures the total sq. ft. occupied within existing buildings over a given period, without accounting for vacated space. As of year-end 2023, there was a total of 5.06 million sq. ft. absorbed into the City’s office, retail, and industrial/flex markets, in addition to 1,732 units absorbed into the City’s for-rent multi-family residential market during this same time frame. The City’s industrial/flex market composed the greatest amount of gross absorption at 57% for year-end 2023, followed by office space with 30% of the total share.

The following pages illustrate major development activities, year-over-year snapshots, and five-year annual trends for the City’s commercial real estate market.

Office space increased 2.6% from the prior year, from 31.7 million sq. ft. to 32.5 million sq. ft.

Vacancy rates increased 1.5 percentage points from 6.0% to 7.5%.

Average rental rates per sq. ft. increased 4.7%, from $25.83 to $27.04 per sq. ft.

Leasing activity of

By the end of 2023, the City saw the addition of approximately 1.87 million sq. ft. of new office, retail, and industrial/flex inventory across 24 buildings, in addition to 2,871 forrent multi-family units within 11 properties and 315 hotel rooms within 3 properties.

Within the City, there is approximately 75,000 sq. ft. of office space, 36,160 sq. ft. of retail space, 2.47 million sq. ft. of industrial/flex space, 4,482 for-rent multi-family units, and 285 hotel rooms currently under-construction within the City as of year-to-date 2024, through August 2024. During this same time frame, there is approximately 9.63 million sq. ft. of proposed office, retail, and industrial/ flex space; as well as 13,340 proposed forrent multi-family residential units, and 1,360 proposed hotel rooms within the City as of year-to-date 2024, through August 2024.

Retail space decreased 1.5% from the prior year, from 28.3 million sq. ft. to 27.9 million sq. ft.

Vacancy rates decreased 0.2 percentage points, from 3.2% to 3.0%.

Average rental rates per sq. ft. increased 1.9%, from $27.98 to $28.51.

Leasing activity of retail space decreased 46%

Industrial/flex space increased 1.9% from the prior year, from 61.9 million sq. ft. to 63.1 million sq. ft.

Vacancy rates increased 0.8 percentage points, from 1.5% to 2.3%.

Average rental rates per sq. ft. decreased 3.2% from $12.66 to $12.26.

Leasing activity increased 552%.

Over the past five years, 2019 to 2023, total inventory of commercial space within the City experienced increases of nearly 2.7 million sq. ft. of office space, 178,800 sq. ft. of retail space, and 4.4 million sq. ft. of industrial/flex space. During this same time frame, total hotel and multi-family inventory also increased by 3,268 rooms and 11,967 units, respectively, within the City.

Comparatively, new inventory within the City over the past five years accounted for 33% of the County’s new commercial space (including office, retail, and industrial/flex space), 38% of new hotel rooms, and 36% of new for-rent multi-family units.

Hotel inventory increased 1.4% from the prior year, from 30,201 rooms to 30,620 rooms.

Vacancy rates for hotel properties decreased 0.2 percentage points, from 25.5% to 25.3%.

Average daily rate (“ADR”) for hotel rooms decreased 2.3%, from $148.86 to $145.39.

Vacancy rates in the City saw significant increases over the past five years: 1.6 percentage points in the office market, 3.6 percentage points in the hotel market, and 2.2 percentage points in the rental multifamily market. Rising vacancy rates are likely due to a shortage of desirable rental spaces and rental costs exceeding what the local market can afford.

In contrast, City’s retail and industrial/flex markets experienced a decline in vacancy rates over the past five years by 0.4 and 0.2 percentage points, respectively. A decline in vacancy rates may be attributed to an increase in healthy spending and demand for rentable spaces within the City.

For-rent multi-family units increased 5.8% from the prior year, from 67,128 units to 71,051 units.

Vacancy rates increased 1.1 percentage points from the prior year, from 7.0% to 8.1%.

Average rental rates per unit decreased 2.6%, from $1,717 to $1,673.

Over the past five years, 2019 to 2023, the average rental rates per sq. ft. for commercial space within the City experienced increases of 17% for office, 31% for retail, and 54% for industrial/flex. Additionally, average daily rates for hotel rooms and average rental rates per unit for multi-family increased 12% and 22%, respectively. Increases in average rental rates may be attributed to rising operating and fixed costs, as well as properties in desirable locations or with premium amenities that can command higher rents.

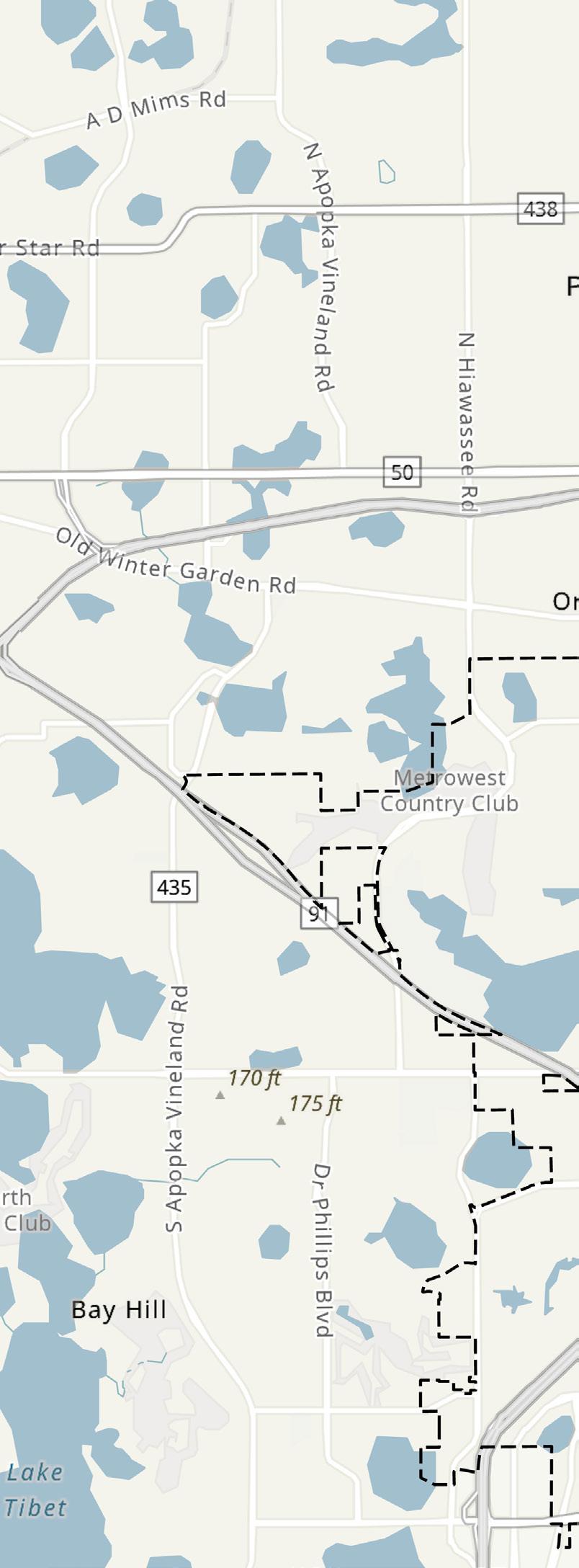

The Lake Nona District (“Lake Nona”) is a masterplanned community developed by Tavistock Development Company, located in southeastern Orlando. Spanning approximately 17 square miles, Lake Nona is conveniently located near major thoroughfares, including State Road 417 and Narcoossee Road, as depicted in the map on the following page. Lake Nona’s proximity to Orlando International Airport further enhances accessibility for both residents and visitors.

Recognized as one of the fastest-growing communities in the nation, Lake Nona is celebrated for its well-designed neighborhoods, top-tier educational institutions, thriving business and research hubs, vibrant retail and entertainment centers, and diverse workspaces.

Prioritizing collaboration and innovation, Lake Nona’s mission is to create the ideal place that inspires human potential. From a growing health and life sciences campus to groundbreaking connectivity, engaging community events and dedicated investment in the arts, Lake Nona’s vision is to create an environment designed for people, institutions, and businesses to thrive.

Supporting both the mission and vision, Lake Nona prioritizes the goal of fostering a collaborative ecosystem by strategically locating organizations and businesses close to one another. Currently, the focus is on two key ecosystems: health care and human potential. Additionally, Lake Nona is dedicated to integrating community art into its developments, aiming to create unique and memorable experiences for both residents and visitors.

At the heart of Lake Nona lies its acclaimed “Medical City,” which hosts a cluster of world-class medical and research institutions such as Nemours Children’s Hospital, the Orlando Veterans Affair (“VA”) Medical Center, and the University of Central Florida (“UCF”) College of Medicine, and UCF Academic Health Sciences Campus. In addition, the Guidewell Innovation Center is also located within Lake Nona, featuring a medical innovation hub for start-ups and healthcare entrepreneurs. Complementing its healthcare focus, Lake Nona offers robust educational opportunities through institutions such as Lake Nona High School, and Valencia College’s Lake Nona Campus.

Residents can also enjoy a vibrant lifestyle with numerous shopping and entertainment destinations including the Lake Nona Town Center

featuring a walkable urban center with a variety of retail, dining, entertainment, and other amenities. Lake Nona also boasts a sports and performance district that is dedicated to sports and human potential, including facilities like the U.S. Tennis Association National Campus, one of the largest tennis facilities in the world with a state-of-the art training center. In addition to these sports facilities, Lake Nona features numerous parks, trails, and the exclusive Lake Nona Golf & Country Club.

Moreover, visitors to Lake Nona can stay at the Lake Nona Wave Hotel. Having opened in December 2021, this central landmark features a distinctive curved glass façade inspired by energy wavelengths. The hotel offers 216 guest rooms, 16 one-bedroom suites, and two penthouse suites.

City of Orlando

Lake Nona District

Lake Nona aims to foster a sustainable, innovative, and connected community that maximizes human potential and enhanced infrastructure. Key priority projects and programs within Lake Nona include:

Lake Nona West — A new lifestyle shopping center currently under development. Once complete, the project will feature Target as its anchor tenant, along with a mix of shops, restaurants, and entertainment spaces.

Medical City — Lake Nona’s Medical City is continuously evolving with several new projects, including hospital expansions such as AdventHealth Lake Nona and UCF Lake Nona Hospital, as well as ongoing enhancements and expansions to Nemours Children’s Hospital.

Advanced Technologies — Lake Nona plans to further integrate advanced technologies, including smart city infrastructure and renewable energy solutions, to promote a sustainable and efficient living environment. Some of these key advancements include: the autonomous shuttle program, a driver-less transportation option that use technology to navigate, and the Lilium Veriport; in partnership with Greater Orlando Aviation Authority (“GOAA”), Lake Nona is constructing the nation’s first high-speed, electric air mobility hub.

Lake Nona’s emphasis on top-tier education and business development will attract leading institutions and companies. By prioritizing collaboration, cultural enrichment, and environmental stewardship, Lake Nona aims to create a thriving, forward-thinking community.

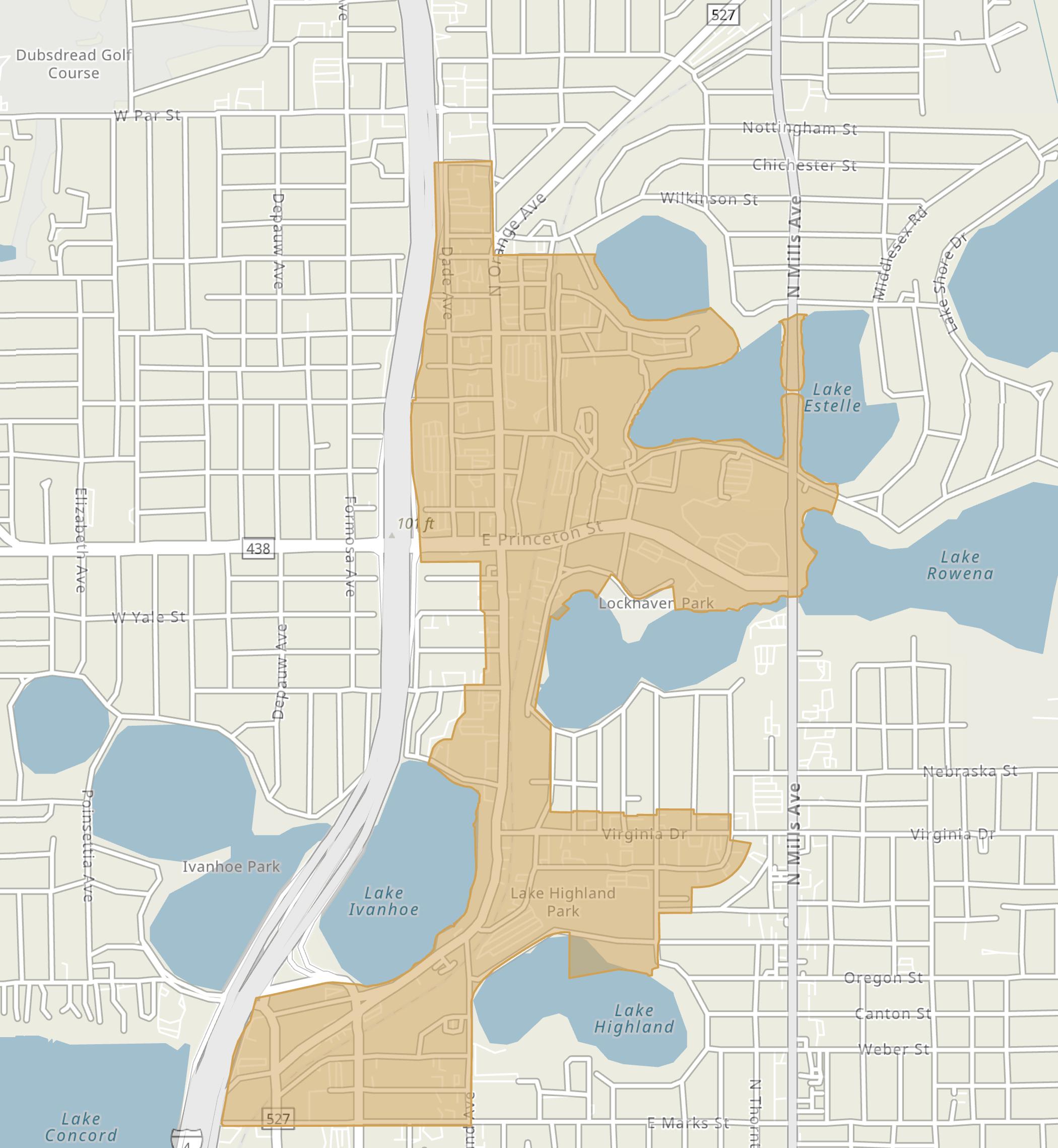

As of year-end 2023, Lake Nona’s total employees compose approximately 2.3% of the total employment within the City. Lake Nona’s employment sector is primarily dominated by the health care and social assistance, accommodation and food services, and retail trade industries, as illustrated in the table below.

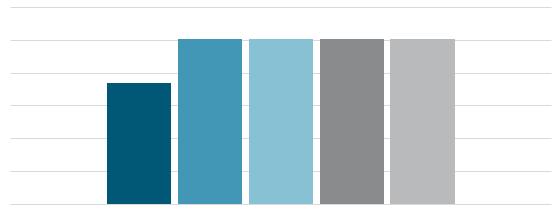

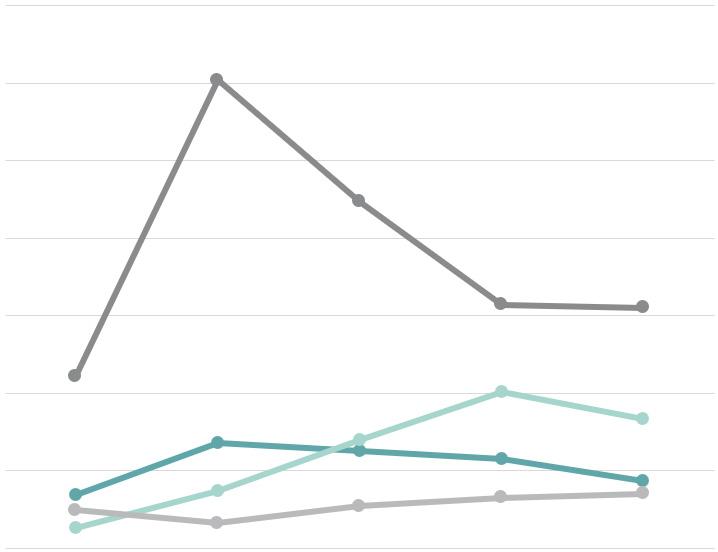

Over the 10-year period, from 2014 to 2023, Lake Nona’s total employment has experienced a compound annual growth rate (“CAGR”) of 26%. This growth rate is significantly higher than the City’s 2.3% CAGR during the same period. The figure above illustrates Lake Nona’s total annual employment trends from 2014 through 2023.

In addition, Lake Nona’s total employment increased from 892 employees in 2014 to 8,732 employees in 2023—resulting in a net increase of 7,840 total employees. During this same time frame, Lake Nona has captured approximately 10% of the City’s total growth in employment.

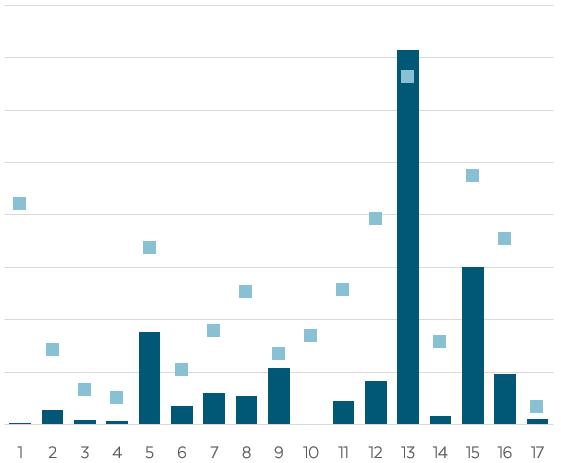

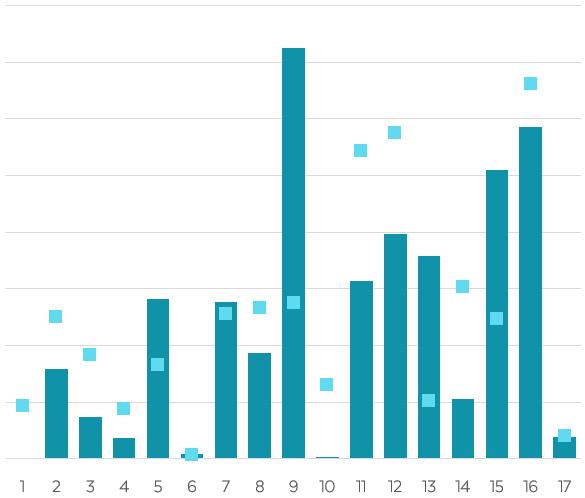

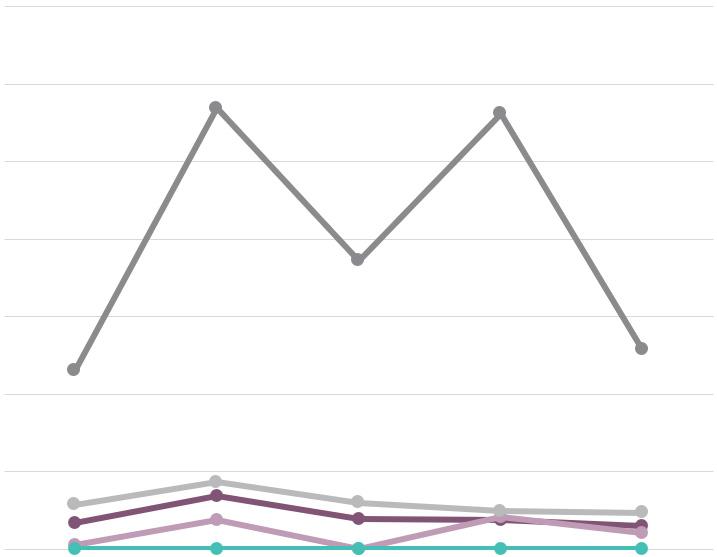

A location quotient (“LQ”) is an analytical statistic that measures how concentrated a particular industry is within an area. The above figure illustrates the concentration of employment by industry sector within Lake Nona, as compared to the concentration within the City for year-end 2023. Lake Nona has a higher concentration of industry professionals (LQ greater than 1.0) in the agricultural and mining, retail trade, educational services, health care and social assistance, accommodation and food services, and other services (excluding public administration) industries. However, there are no industries in which Lake Nona and the City are equally specialized (LQ equals 1.0).

As of year-end 2023, residents of Lake Nona spent an estimated $1.0 billion, with 33% allocated to housing, 31% to retail goods, 11% to food (both away from home and at home), 7.5% to health care, and 4.2% to entertainment and recreation. This spending pattern highlights the dominance of housing and retail, which together account for 64% of total expenditures. Additionally, food and health care make up 18.5% of the consumer spending budget, while entertainment and recreation represents the smallest portion of consumer spending. Within the broader context, total expenditures within Lake Nona make up approximately 8.8% of the consumer spending within the City, with over $11.421 billion in total expenditures as of year-end 2023.

As of year-end 2023, Lake Nona’s for-sale residential market included 6,017 residential units. Single-family homes made up the majority, at 98%, while condominium (“condo”) accounted for just 2% of the total. Lake Nona’s residential units represent 11.5% of the total single-family residential units and 0.4% of the total condos within the City.

Lake Nona encompasses two condo properties, including the Gatherings on Lake Nona and Kensington Shores. Lake Nona also boasts several single-family residential neighborhoods such as Laureate Park, Isles of Lake Nona, Summerdale Park, Laurel Pointe, Somerset Crossings, Enclave at Village Walk, Village Walk, Somerset Park, and NorthLake Park.

Year-over-year, year-end 2022 through year-end 2023, total single-family residential units within Lake Nona saw an increase of 2.1%. Comparatively, total condo units within Lake Nona remained unchanged during this same time period. Over the past five years, 2019 to 2023, total inventory of forsale residential units within Lake Nona experienced an increase of 24% with the addition of 1,156 new single-family residential units and 27 new condo units.

The figures below illustrate the change in annual inventory for both single-family residential units and condo units from 2019 to 2023.

As of year-end 2023, the average single-family residential assessed value and taxable value per unit at $516,180 and $465,303, respectively, were both greater than those of residential condo units—with an assessed value and taxable value per unit of $422,370 and $235,090, respectively.

In addition, Lake Nona experienced a total of 361 single-family unit sales and 16 condo unit sales in 2023. Lake Nona’s residential unit sales represent 4.4% of the total single-family residential unit sales and 1.1% of the total condo unit sales within the City, as illustrated in the table below.

By the end of 2023, the total sales price for singlefamily residential units reached approximately $292.7 million, while condo unit sales amounted to around $10.0 million. The average sales price per sq. ft. for single-family homes in Lake Nona was slightly lower than the City’s average, at $346.26 per sq. ft. In contrast, the average sales price per sq. ft. for condo units in Lake Nona was significantly higher than the City’s average, at $222.78 per sq. ft. during the same period.

As of year-end 2023, Lake Nona’s commercial real estate market composed nearly 3.7 million square feet (“sq. ft.”) of office, retail, and industrial/flex space, in addition to 560 hotel room and 2,430 forrent market-rate multi-family residential units, as illustrated in the market characteristics table below.

Office space composed the majority of Lake Nona’s office, retail, and industrial/flex inventory at 63% of the total share, followed by retail space with 35% of the total, as of year-end 2023. Specifically, the office space within Lake Nona consisted of 90% Class A space, 8.8% Class B space, and the remaining portion as Class C space.

Although office space composed the majority of commercial inventory within Lake Nona, office properties had a significantly lower occupancy rate compared to the retail and industrial/flex properties, both of which were fully occupied as of year-end 2023. Moreover, occupancy rates for both Lake Nona’s hotel and for-rent multifamily markets were approximately 80% and 84%, respectively. Additionally, average rental rates for retail properties were significantly higher than those for office and industrial/flex properties within Lake Nona as of year-end 2023.

In addition, Lake Nona’s average rental rates for its commercial real estate markets were greater than those for the City as of year-end 2023.

There were 11 lease transactions that occurred in Lake Nona’s office, retail, and industrial/flex markets—resulting in a total of 36,680 sq. ft. leased during 2023. Leasing activity refers to the volume of square footage that is committed to and actually signed during a given period of time, including direct leases, subleases and renewals of existing leases.

Gross absorption measures the total sq. ft. occupied within existing buildings over a given period, without accounting for vacated space. As of year-end 2023, industrial/flex space composed the majority of commercial gross absorption within Lake Nona, closely followed by office space. In addition, there were 503 units absorbed into the Lake Nona for-rent multi-family residential market during this same time frame.

The following pages illustrate major development activities, year-over-year snapshots, and five-year annual trends for Lake Nona’s commercial real estate market.

Office space increased 23.5% from the prior year from 1.87 million to 2.31 million sq. ft.

Vacancy rates for office properties increased 15 percentage points, from 7.5% to 22.7%.

Average rental rates per sq. ft. decreased 6.0%, from $37.00 to $34.78.

Leasing activity of office space decreased 84%

By the end of 2023, Lake Nona saw the addition of approximately 543,870 sq. ft. of new office, retail, and industrial/flex space across 6 buildings, along with 566 rental multi-family units within 2 buildings. Some of the major development activity throughout the past year is illustrated in the graphic below.

Within Lake Nona, there is approximately 83,490 sq. ft. of office space, 8,000 sq. ft. of retail space, and 887 rental multi-family units currently under-construction as of year-to-date 2024, through August 2024.

Retail space increased 3.2% from the prior year, to 1.28 million sq. ft.

Vacancy rates for retail properties decreased 0.1 percentage points, from 0.1% to 0.0%.

Average rental rates per sq. ft. increased 7.3%, from $42.84 to $45.95.

Leasing activity of retail space decreased 53%

Industrial/flex space increased 100% from the prior year, from zero sq. ft. to 95,000 sq. ft.

Since industrial/flex space was created in Lake Nona in 2023, there is no year-overyear performance data available for this property use.

Hotel inventory remained unchanged from the prior year, at 558 rooms.

Vacancy rates for hotel properties decreased 1.3 percentage points, from 21.1% to 19.8%.

Average daily rate (“ADR”) for hotel rooms decreased 2.7%, from $190.17 to $185.01.

Over the past five years, 2019 through 2023, total inventory of commercial space within Lake Nona experienced increases of nearly 1.6 million sq. ft. of office space, 322,400 sq. ft. of retail space, and 95,000 sq. ft. of industrial/flex space. During this same time frame, total hotel and multi-family inventory also increased by 235 rooms and 1,220 units, respectively, within Lake Nona.

Comparatively, the new inventory in Lake Nona over the past five years accounted for 4.7% of the City’s new commercial space (including office, retail, and industrial/flex space), 7.2% of new hotel rooms, and 10.2% of new rental units.

Over the past five years, Lake Nona saw vacancy rate increases of 7, 3, and 10 percentage points in the office, hotel, and for-rent multi-family markets, respectively. Rising vacancy rates are likely due to a shortage of desirable rental spaces and high rental costs exceeding what the local market can afford. However, notable increases from 2020-2022 may also be a result of the COVID-19 pandemic. In contrast, Lake Nona’s retail market experienced a 1 percentage point decline in vacancy rates over the past five years, which may be attributed to an increase in spending, demand for rentable spaces, and a growing population residing in Lake Nona.

For-rent multi-family units increased 30.4% from the prior year, to 2,430 units.

Vacancy rates decreased 1.3 percentage points for multi-family properties, from 17.1% to 15.8%.

Average rental rates per unit decreased 2.1%, from $2,188 to $2,141.

Over the past five years, 2019 to 2023, the average rental rates per sq. ft. for commercial space within Lake Nona experienced increases of 35% for office and 28% for retail. During this same time frame, average daily rates for hotel rooms increased 48% and average rental rates per unit for multi-family increased 20%. Increases in average rental rates may be attributed to rising operating and fixed costs, as well as properties in desirable locations or with premium amenities that can command higher rents.

Everyone should have access to an inclusive and resilient Main Street—a place with a vibrant local economy, rich character, and welcoming spaces that cater to both residents and visitors. For over four decades, Main Street America has been revitalizing downtowns and neighborhood commercial districts. Established in 1980 as the National Main Street Center, a program of the National Trust for Historic Preservation, the network has facilitated more than $101 billion in local reinvestment, rehabilitated 335,000 buildings, created 782,000 new jobs, and launched 175,000 new businesses in over 2,000 communities, as depicted in the map below.

Main Street America leads a collaborative movement with partners and grassroots leaders that advances shared prosperity, creates resilient economies, and improves quality of life through place-based economic development and community preservation in downtowns and neighborhood commercial districts across

the country. The Main Street America network comprises small towns, mid-sized communities, urban commercial districts, and thousands of organizations, individuals, and local leaders, all of which embody the rich diversity that makes this country unique.

Working in collaboration with thousands of local community partners across the nation who share their commitment to advancing shared prosperity, creating resilient economies, and improving quality of life, Main Street America partners with a range of nationally recognized corporations, foundations, government entities, and organizations to deliver grants and technical services to support thriving local economies and inviting public spaces. Partnerships include American Express, T-Mobile, Grow with Google, GM, The Hartford, the Truist Foundation, U.S. Department of Transportation, and many more.

Main Street America supports communities nationwide through its “Main Street Approach” and comprehensive programming. This approach offers a practical, adaptable framework for community-based revitalization, tailored to local conditions. It helps communities start and grow their revitalization efforts with the help of the Main Street America team.

Central to this approach are Transformation Strategies, which provide a focused plan for revitalizing and strengthening a downtown or commercial district’s economy. These strategies are implemented through activities in four key areas, known as the Four Points:

Economic Vitality — Focuses on capital, incentives, and other economic and financial tools to assist new and existing businesses, catalyze property development, and create a supportive environment for entrepreneurs and innovators that drive local economies.

Design — Supports a community’s transformation by enhancing the physical and visual assets that set the commercial district apart.

Promotion — Positions the downtown or commercial district as the center of the community and hub of economic activity, while creating a positive image that showcases a community’s unique characteristics.

Organization — Involves creating a strong foundation for a sustainable revitalization effort, including cultivating partnerships, community involvement, and resources for the district.

The Orlando Main Streets Program is a comprehensive initiative aimed at revitalizing and strengthening neighborhood commercial districts within the City of Orlando. Established in 2008 by Mayor Buddy Dyer and the Orlando City Council, the program recognizes the vital role that these districts play in the overall health of the City’s neighborhoods. The Orlando Main Streets Program provides annual financial support, technical assistance, and intensive training to help these Main Street districts thrive and become vibrant centers of commerce and community life.

As a Main Street America Coordinating Program, the Orlando Main Streets Program is part of a larger grassroots network that includes over 40 Coordinating Programs and more than 2,000 neighborhoods and communities across the country. This network is dedicated to creating high-quality places and building stronger communities through preservation-based economic development. The program aligns with Main Street America’s mission to provide technical expertise, education, resources, and support to designated Main Street districts. It guides these districts in developing asset-based economic development strategies that achieve measurable results such as investment, business growth, and job creation. The program operates according to the “Main Street Approach”, aligning with the Four Points: economic vitality, design, promotion, and organization.

The vision for the Orlando Main Street districts is to be organizationally sound, economically viable, and vibrant centers of commerce. These districts aim to inspire community and visitor engagement, creating a unique sense of place and local business

prosperity through collaborative partnerships with businesses, stakeholders, and residents. Each district develops an individual work plan envisioned and implemented by a non-profit Board of Directors, ensuring that the initiatives are community-driven and reflective of local needs and aspirations.

The Orlando Main Street districts receive ongoing technical assistance and training in the Main Street Approach from both the Orlando Main Streets Program and Main Street America. Each district employs a full-time Executive Director who oversees the implementation of programs and initiatives. These districts also raise matching funds, incorporate their organizations, and develop annual work plans to guide their efforts.

In addition, the Orlando Main Streets Program plays a crucial role in enhancing the economic and social vitality of the City of Orlando’s neighborhoods. By providing the necessary support and resources, it helps create dynamic and attractive places for residents and visitors alike. The program’s focus on asset-based economic development strategies has led to significant outcomes, including increased investment, business growth, and job creation within its Main Street districts. Overall, the Orlando Main Streets Program contributes to the prosperity and quality of life in the City of Orlando.

The Orlando Main Streets program was established to support and enhance the city’s neighborhood commercial districts. Launched in 2008 by Mayor Buddy Dyer and the Orlando City Council, this initiative aims to create, define, and strengthen these districts through financial support, technical assistance, and intensive training. Each district develops its own work plan, guided by a nonprofit Board of Directors, to foster local business growth and community engagement.

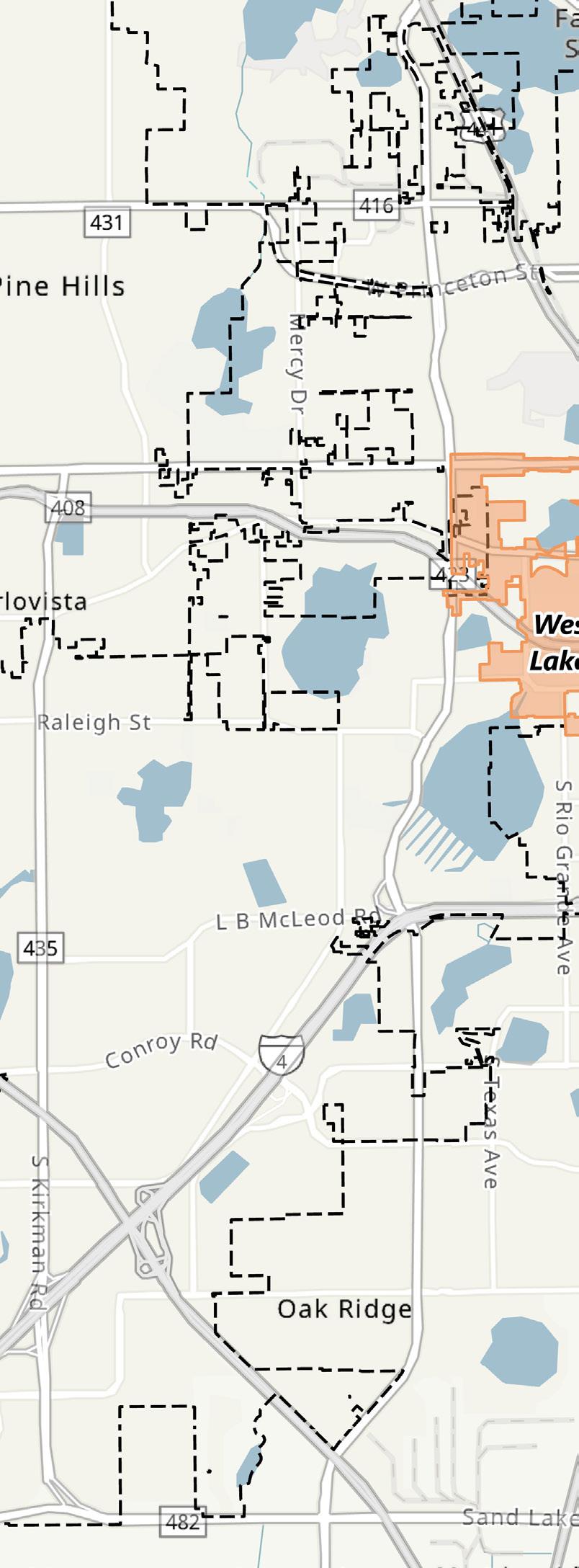

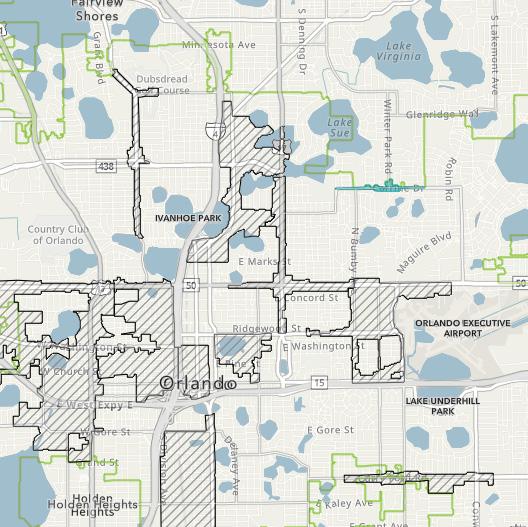

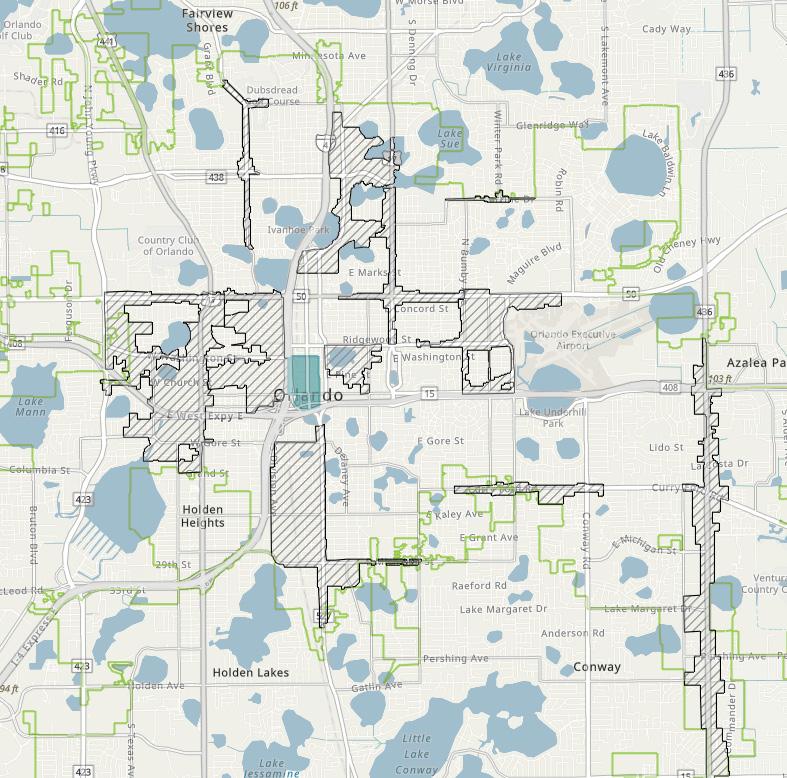

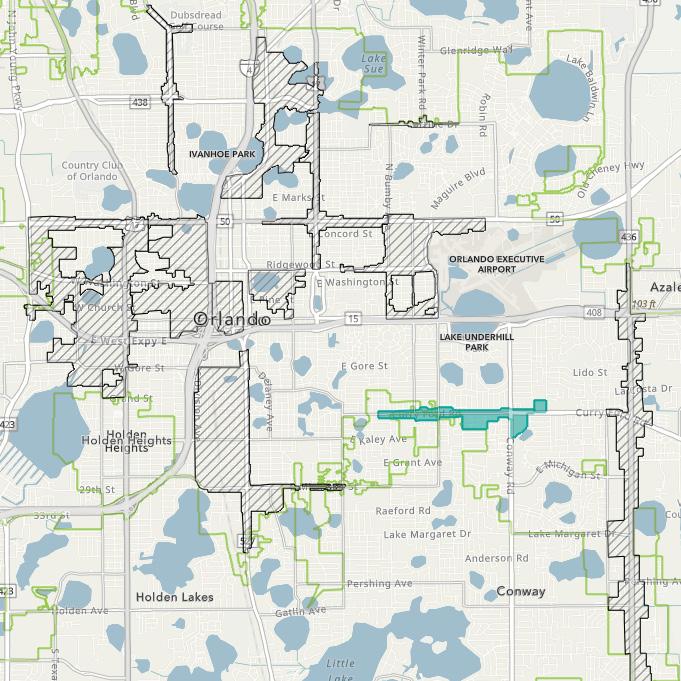

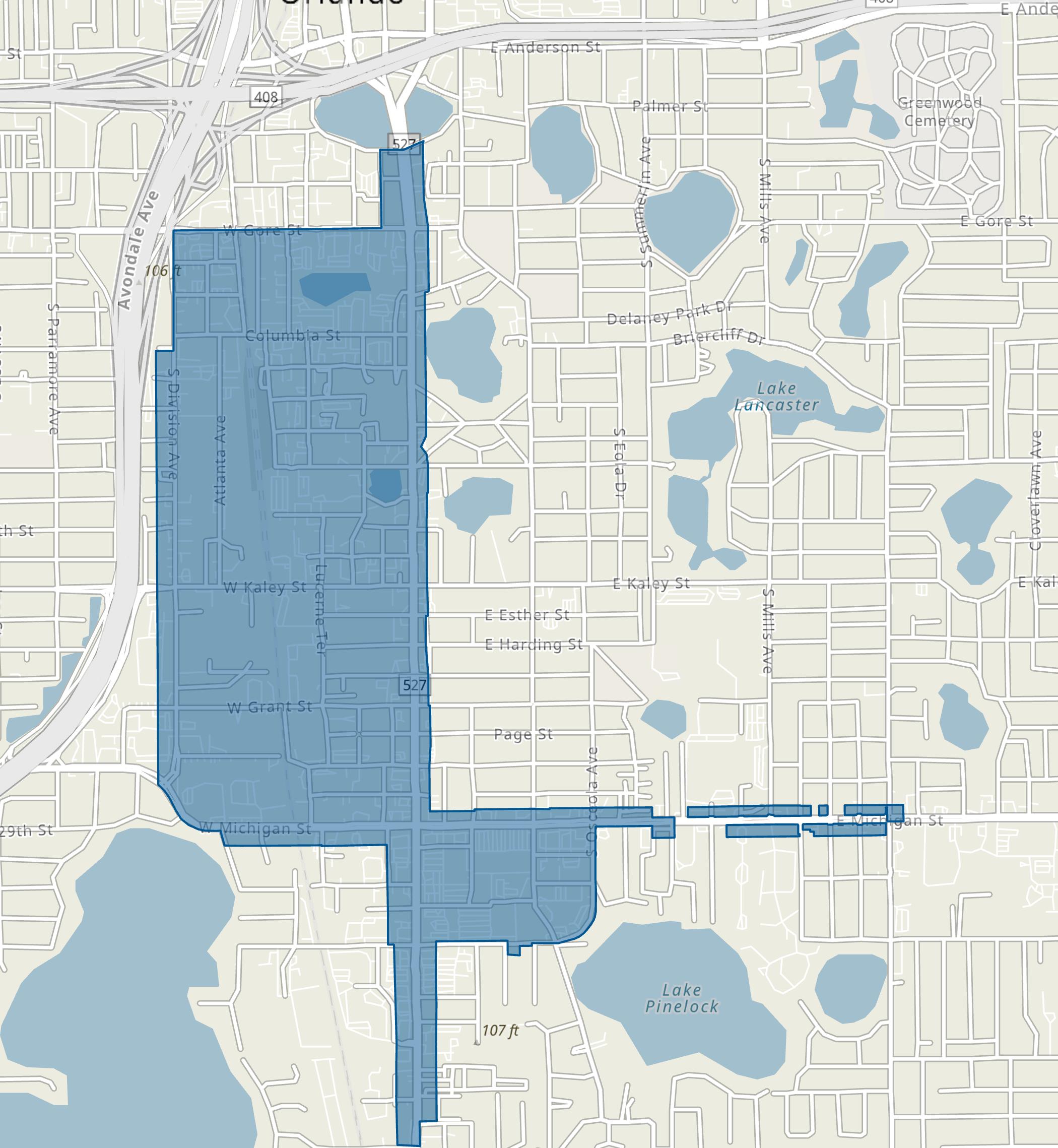

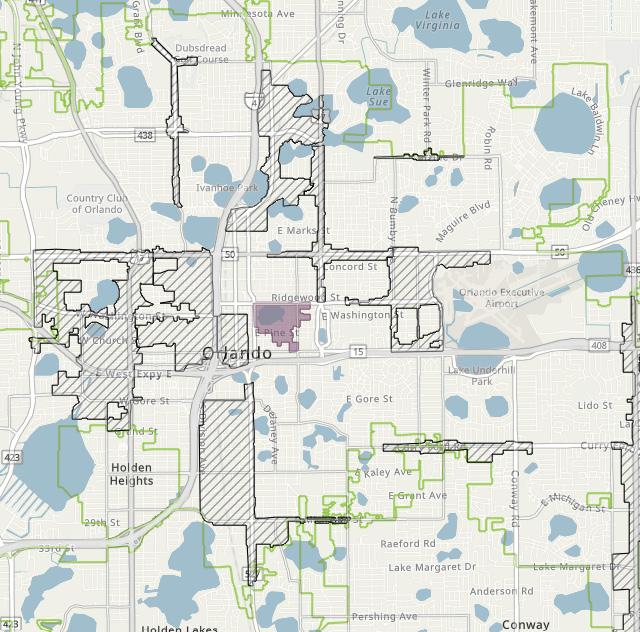

The program emphasizes the importance of community involvement and collaboration, ensuring that revitalization efforts are inclusive and sustainable across all twelve (12) of the Orlando Main Street Districts, listed below and illustrated in the adjacent map:

▪ Audubon Park Garden District

▪ City District

▪ College Park

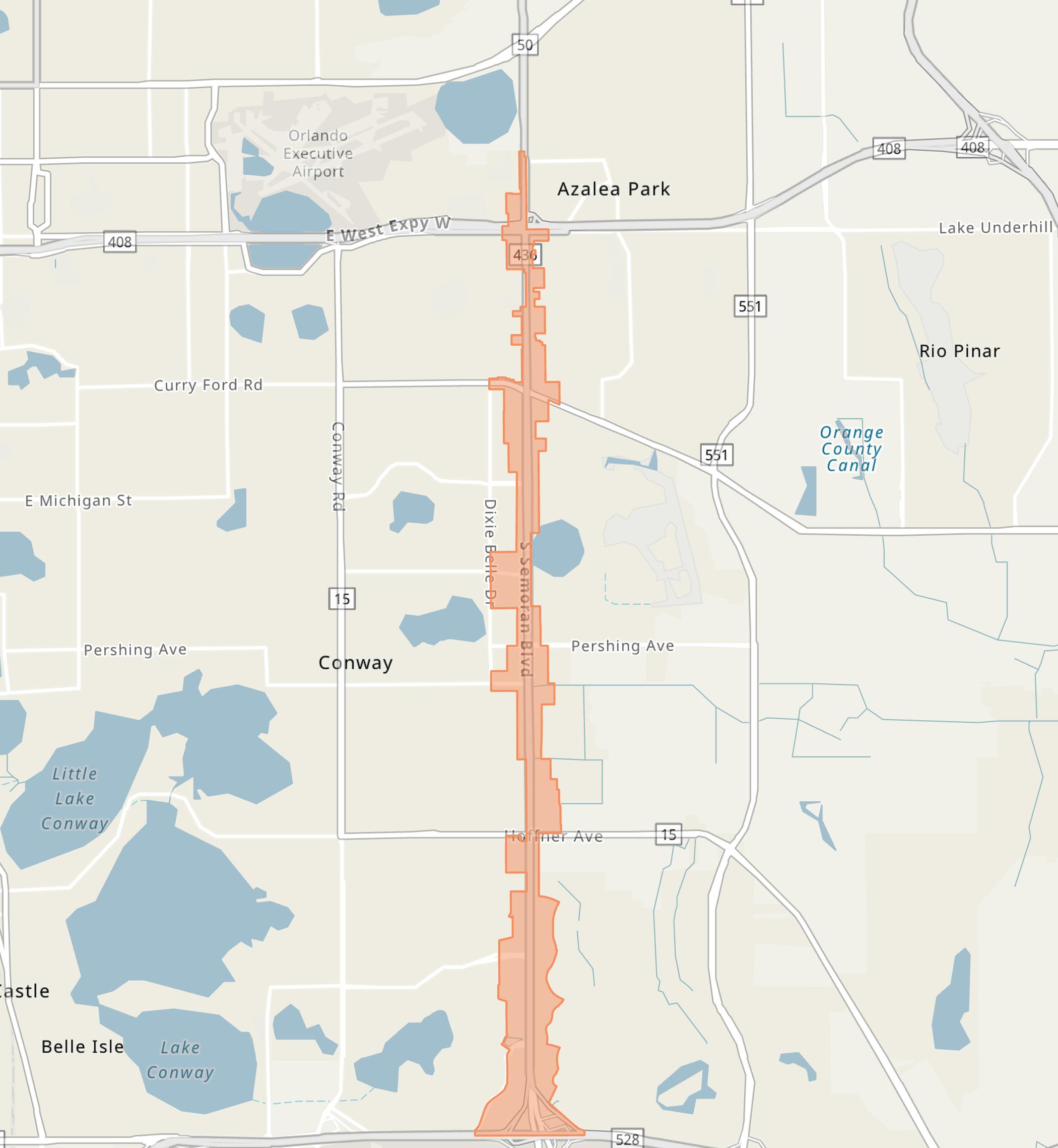

▪ Curry Ford West

▪ Gateway Orlando District

▪ Ivanhoe Village

▪ The Milk District

▪ Mills 50 District

▪ SoDo District

▪ Thornton Park District

▪ West Lakes District

▪ Parramore District

Residents have several ways to get involved in their local Main Street Program, contributing to the vibrancy and growth of their neighborhoods. Some key ways to participate include:

Volunteer: Join committees or participate in events organized by the local Main Street district. Volunteering is a great way to meet neighbors and make a positive impact on the community.

Attend Events: Support local businesses and enjoy community events such as festivals, markets, and cultural activities. These events often need volunteers and attendees to be successful.

Join a Board or Committee: Many Main Street programs have boards or committees that guide their activities. Residents can apply to serve on these boards, playing a crucial role in decisionmaking and strategic planning. By participating, residents help ensure their district meets the community’s needs and aspirations.

Become a Member: Some districts offer membership programs for residents and businesses. Membership often includes benefits such as networking opportunities, discounts, and the chance to have a say in district initiatives.

Support Local Businesses: Frequenting local shops, restaurants, and services helps to strengthen the local economy and supports the goals of the Main Street program.

Stay Informed: Sign up for newsletters or follow the local Main Street district on social media to stay updated on news, events, and opportunities to get involved.

By participating in these activities, residents can play a crucial role in enhancing the quality of life and economic vitality of their neighborhoods.

The Audubon Park Garden District (“Audubon Park”), part of the Main Street America program, is an award-winning Eco-District renowned for its unique shopping and dining experiences. Covering roughly 19.2 acres along Corrine Drive, Audubon Park is conveniently located near major thoroughfares like U.S. Highway 17 and State Road 50 (Colonial Drive), as shown on the map on the following page. This vibrant district is celebrated for its eclectic mix of vintage shops, cafes, bakeries, music venues, bookstores, craft beer spots, boutiques, urban farmlettes, and top-notch professional services. Located near Winter Park, Leu Gardens, and downtown Orlando, Audubon Park offers some of the best shopping, dining, services, and activities in Central Florida.

Originally developed in the 1950s and 1960s to serve the nearby Orlando Air Force Base and later the Naval Training Center Orlando, Audubon Park has since blossomed into a lively community filled with distinctive businesses and numerous events. In 2017, Audubon Park was designated a Community Wildlife Habitat by the National Wildlife Federation (“NWF”), becoming the first neighborhood in Central Florida and the 18th in Florida to earn this recognition. This designation reflects the community’s commitment to creating wildlife habitats in yards, schoolyards, business properties, community gardens, and other local spaces. Since 2008, Audubon Park has been instrumental in planting over 1,000 native and Florida-friendly trees, shrubs, ground covers, and perennials within the community.

Focusing on creativity and sustainability, Audubon Park’s mission prioritizes promoting its community, culture, and businesses through local events, cultural celebrations, and neighborhood

improvement projects, with an emphasis on sustainability and the arts. A key part of this mission is collaborating with local agencies to enhance walkability and bikeability along Corrine Drive.

At the heart of Audubon Park is the East End Market, a neighborhood market and food hall that showcases some of Central Florida’s top food entrepreneurs, artisans, and chefs. This two-story building houses a dozen merchants, a private event space, an incubator kitchen, offices, retail shops, a cocktail lounge, and a world-class ramen restaurant. The property is beautifully landscaped with Floridafriendly plants and includes a working market garden. East End Market serves not only as a hub for local food and culture but also as a community space that fosters creativity and collaboration.

Nearby Audubon Park, Leu Gardens and the Historic Leu House Museum can also be found. This 50acre property is filled with diverse plant species and charming artifacts. The gardens feature various themed areas, such as the white garden with snowwhite orchids, the arid garden with cacti, and Mary Jane’s Rose Garden, which boasts 215 varieties and 650 plants. Leu Gardens also showcases magnolias, palms, hibiscus, bananas, bamboo, ferns, azaleas, and fruit trees throughout the property.

Audubon Park’s 2023 Annual Report highlights that Audubon Park Main Street invested over $255,800 into the district, with 50% coming from private investments. The district also created 11 new jobs, and benefited from 563 volunteer hours contributed by residents and business owners.

Audubon Park aspires to be Orlando’s premier destination neighborhood and Eco-District, embodying the community’s creativity, vibrancy, and unwavering commitment to sustainability and diversity. Key priority projects and programs within Audubon Park include:

Eco-District Initiative — Audubon Park became Central Florida’s first Eco-District, obtaining the Community Wildlife Habitat certification in 2017 by the NWF. Since then, numerous sustainability and Eco-friendly projects have been completed, example of these include:

Song Bird Park - In collaboration with GreenUp Orlando and local volunteers, Audubon Park transformed Song Bird Park into an urban bird sanctuary. Completed in 2016, this small pocket park is now hosts a variety of bird species.

Monarch Initiative - In 2018, Monarch Butterfly habitats were planted throughout Audubon Park, in tandem with The HIVE, which sponsored and planted a native plant demonstration garden. These initiatives aimed to raise awareness about the value of nature and promote conservation action. It also included digital campaigns with tailored content on online platforms.

Audubon Park Community Market — To promote community and provide a space for locals to interact with small businesses, every Monday, Audubon Park organizes a community market. Since 2009, the Audubon Park Market has brought together visitors and fellow neighbors to promote the community.

Legend

City of Orlando

Audubon Park

Main Street District

Orlando Main Streets

As of year-end 2023, Audubon Park’s total employees compose approximately 0.1% of the total employment within the City. Audubon Park employment sector is primarily dominated by the health care and social assistance, professional services, and accommodation and food service industries, as illustrated in the table below.

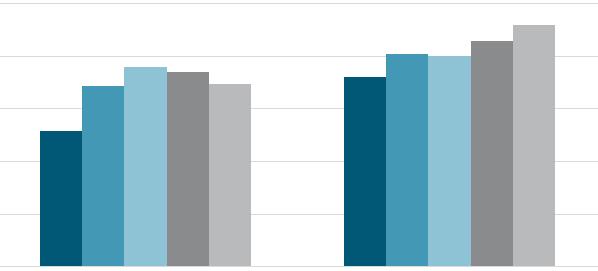

Over the 10-year period, from 2014 to 2023, Audubon Park’s total employment has experienced a compound annual growth rate (“CAGR”) of 3.6%. This growth rate is slightly higher than the City’s 2.3% CAGR during the same period. The figure above illustrates Audubon Park’s total annual employment trends from 2014 through 2023.

In addition, Audubon Park’s total employment increased from 251 employees in 2014 to 359 employees in 2023—resulting in a net increase of 108 total employees. During this same time frame, Audubon Park has captured approximately 0.1% of the City’s total growth in employment.

A location quotient (“LQ”) is an analytical statistic that measures how concentrated a particular industry is within an area. The above figure illustrates the concentration of employment by industry sector within Audubon Park, as compared to the concentration within the City for year-end 2023. Audubon Park has a higher concentration of industry professionals (LQ greater than 1.0) in the construction, management of companies, health care and social assistance, arts, entertainment, and recreation, and other services (excluding public administration) industries.

As of year-end 2023, the Audubon Park area has no residents, making consumer spending data unavailable.

As of year-end 2023, Audubon Park’s commercial real estate market composed nearly 118,564 square feet (“sq. ft.”) of office and retail space, as illustrated in the market characteristics table below. To note, Audubon Park does not contain any industrial/flex space, hotel rooms, or multi-family residential units.

Retail and office space composed 88% and 12%, respectively, of Audubon Park’s commercial inventory as of year-end 2023. Specifically, the office space within Audubon Park consisted of zero Class A space, 17% Class B space, and 83% Class C space. Additionally, retail properties had a slightly lower occupancy rate compared to office properties which were fully occupied as of year-end 2023. In addition, Audubon Park’s average rental rates for both office and retail markets were greater than those for the City as of year-end 2023.

Leasing activity refers to the volume of square footage that is committed to and actually signed in a given period of time, including direct leases, subleases and renewals of existing leases. In contrast, gross absorption measures the total sq. ft. occupied within existing buildings over a given period, without accounting for vacated space. As of year-end 2023, there was zero leasing activity, gross absorption, or new development construction within Audubon Park’s commercial real estate market.

The subsequent figures illustrate the year-over-year snapshots and five-year annual trends for Audubon Park’s commercial real estate market.

It is important to note, as of year-end 2023, the Audubon Park area has no residential units, making for-sale residential data unavailable.

Office space remained unchanged from the prior year, at 14,794 sq. ft.

Vacancy rates for office properties remained unchanged from the prior year, at 0.0%.

Average rental rates per sq. ft. increased 5.0%, from $29.39 to $30.86.

Retail space remained unchanged from the prior year, at 103,770 sq. ft.

Vacancy rates for retail properties increased 1 percentage point from the prior year to 1.2% vacancy.

Average rental rates per sq. ft. decreased 1.1%, from $30.35 to $30.00.

Over the past five years, 2019 to 2023, total inventory of Audubon Park’s commercial space remained unchanged.

Vacancy rates in Audubon Park’s retail market decreased 5 percentage points, while the office market remained unchanged. A decline in vacancy rates may be attributed to an increase in healthy spending behaviors, as well as an increase in demand for rentable spaces within the district.

From 2019 to 2023, Audubon Park’s average rental rates per sq. ft. increased by 30% for office space and 1.9% for retail space, which may be attributed to rising operating and fixed costs to upkeep a property.

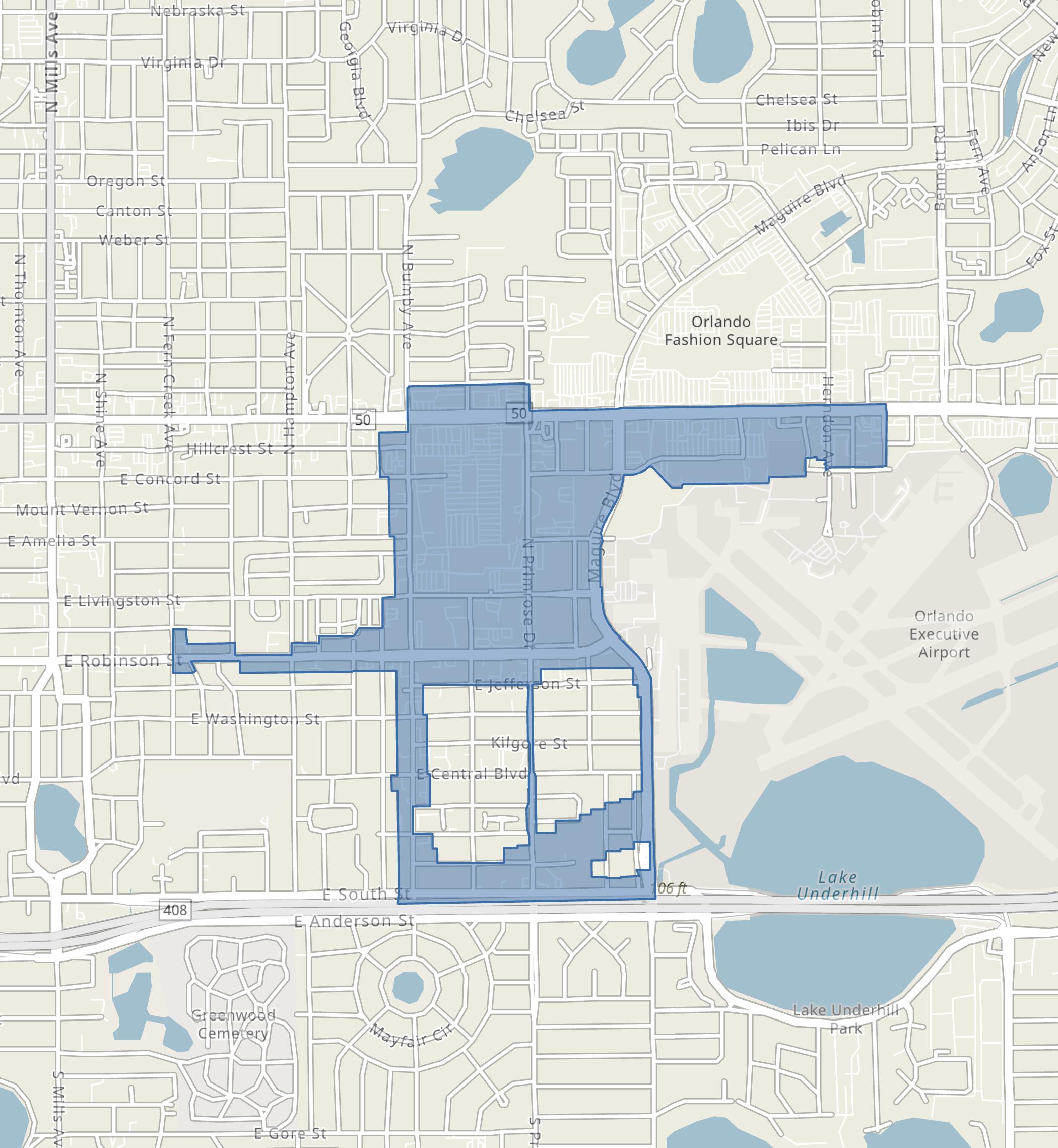

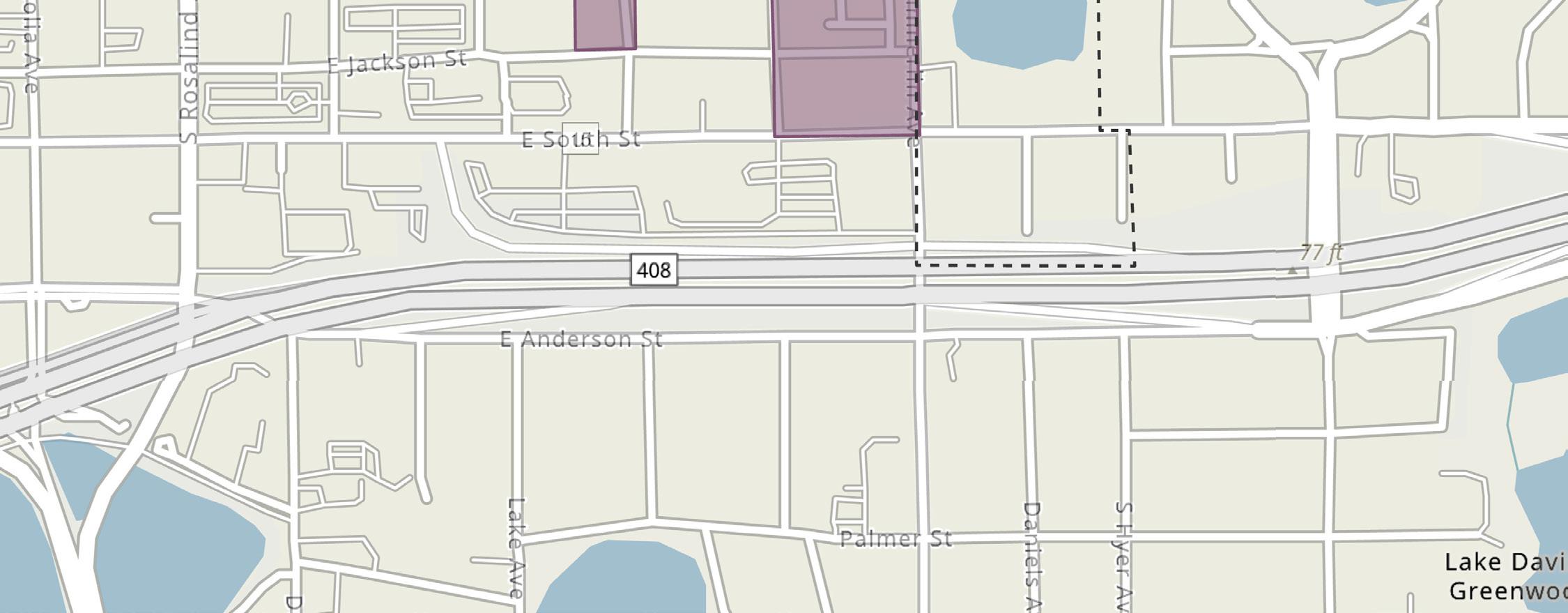

The City District Main Street (“City District”), part of the Main Street America program, is a hub of diversity and authenticity. Formerly known as the Church Street District, the City District spans approximately 102 acres in Downtown Orlando, encompassing Downtown’s historic Central Business Art and Entertainment Districts. It is situated near major thoroughfares, including Interstate-4 and State Road 408, as depicted in the map on the following page.

Established during the Great Recession through a collaborative effort among business owners, the City District was created to strengthen economic development in downtown Orlando. With ongoing support from local merchants, the City District has continued to grow.

The City District serves as a policy influencer and a catalyst for business and community enhancement, ensuring economic stability through event programming, design, marketing, and promotion. Its strategic programs and initiatives aim to transform downtown Orlando into a dynamic hub that blends history, culture, and events. Since its inception, the City District has welcomed over 300 new businesses and, in 2023, invested over $100,000 into programming within downtown Orlando.

Focusing on local business and urban living, the City District positions itself at the crossroads of business, nightlife, dining, arts, and entertainment, where the rhythm of the workday transitions into the vibrant beat of nightlife. Both visitors and residents can enjoy street cafes, immerse themselves in the arts, and explore Downtown Orlando’s walkable green spaces while visiting nearby shops. The district’s primary goal is to shape the heart of Orlando into

a place that captures the essence of its past while building a promising future. This commitment to preserving its heritage is evident in the upkeep and continued use of many historic buildings, including the First National Bank, the Tinker Building, the Beacham Theater, the Angebilt, and the Metcalf Building.

At the heart of Downtown Orlando, the First National Bank Building at 190 South Orange Avenue/1 West Church Street stands as a testament to the city’s history and architectural elegance. Nestled among towering structures like the former SunTrust Center and the Truist Building, it remains a focal point of these Orlando landmarks.

While sports in Downtown Orlando are often associated with major teams like the Orlando Magic and the Orlando City Soccer Club, and their impressive venues like the KIA Center and Inter&Co Stadium, the Tinker Building at 16-18 West Pine Street holds its own legendary status in the city’s sports history.

The Beacham Theater, constructed in 1921 by Braxton Beacham Sr., is another iconic venue in Orlando. Initially hosting vaudeville stars in the 1920s, it has since evolved into a thriving nightclub and live music destination, featuring artists like B.B. King, Ray Charles, and The Police, and reflecting a rich tapestry of history and cultural significance. The Angebilt Hotel at 37 North Orange Ave, now home to The Bellhop and Parlay on the ground floor with offices above, has a dramatic history marked by financial challenges, natural disasters, and celebrity visits, contributing to its century-long presence in Downtown Orlando.

Finally, the Metcalf Building, located at the southwest corner of Orange Ave and Pine St., was constructed in 1923 as one of Downtown Orlando’s first high-rise buildings. Purchased by real estate investor Henry W. Metcalf in 1930, the building’s historical significance continues today, serving as home to various offices and businesses.

The City District’s 2023 Annual Report highlights that the City District Main Street invested nearly $27.2 million into the district, with 0.5% coming from private investments. The district also welcomed 110 new businesses, created 403 jobs, and benefited from 1,105 volunteer hours contributed by residents and business owners.

The City District strives to activate streets, attract, assist and promote local businesses, nurture nightlife, dining, arts and culture, and preserve its history. Key priority projects and programs within the City District include:

City District Traffic Art Program — community-driven initiative strives to promote local art and enhance the urban environment. Local artists are invited to submit proposals for transforming traffic signal boxes into vibrant pieces of art which are displayed throughout the area. This program not only beautifies public space but also fosters community pride and support for local culture.

Third Thursday Orlando — Partnering with CityArts, the Downtown Arts District, the History Center, and local businesses, this monthly event features art, music, markets, history, food, and entertainment—offering a diverse cultural experience. Enjoy a free art gallery, live music, complimentary admission to the history center, and various food and drink specials from local vendors.

Business of the Month — This Award celebrates outstanding Downtown Orlando businesses for their significant contribution and positive impacts on the community.

New Programs Coming Soon — Additional programs coming soon to the City District include a Retail Incubator, revitalizing downtown retail by offering small businesses space and essential education; and Window Wraps, a collaboration between property owners and local artists to bring life to vacant building windows through vibrant vinyl wraps.

City of Orlando

City District

Main Street

Orlando Main Streets

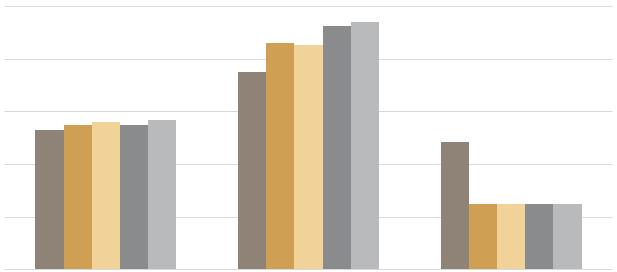

As of year-end 2023, the City District’s total employees compose approximately 6.0% of the total employment within the City. The City District’s employment sector is primarily dominated by professional services, public administration, and real estate and leasing industries, as illustrated in the table below.

Over the 10-year period, from 2014 to 2023, the City District’s total employment has experienced a compound annual growth rate (“CAGR”) of 4.5%. This growth rate is slightly higher than the City’s 2.3% CAGR during the same period. The figure above illustrates the City District’s total annual employment trends from 2014 through 2023.

In addition, the City District’s total employment increased from 14,657 employees in 2014 to 22,694 employees in 2023—resulting in a net increase of 8,037 total employees. During this same time frame, the City District has captured approximately 11% of the City’s total growth in employment.

A location quotient (“LQ”) is an analytical statistic that measures how concentrated a particular industry is within an area. The above figure illustrates the concentration of employment by industry sector within the City District, as compared to the concentration within the City for year-end 2023. The City District has a higher concentration of industry professionals (LQ greater than 1.0) in the management of companies, public administration, information and finance, professional services, and real estate and leasing industries.

As of year-end 2023, residents of the City District spent an estimated $63.3 million, with 34% allocated to housing, 29% to retail goods, 12% to food (both away from home and at home), 6.9% to health care, and 3.9% to entertainment and recreation. This spending pattern highlights the dominance of housing and retail, which together account for 64% of total expenditures. Additionally, food and health care make up 18.8% of the consumer spending budget, while entertainment and recreation represents the smallest portion of consumer spending. Within the broader context, total expenditures within the City District make up approximately 0.6% of the consumer spending within the City, with over $11.421 billion in total expenditures as of year-end 2023.

As of year-end 2023, the City District’s forsale residential market included 305 residential condominium (“condo”) units. To note, there are zero single-family homes located within the City District as of year-end 2023. The City District’s residential condo units represent 1.1% of the total residential condos within the City.

The City District encompasses one residential condo property, the Solaire at the Plaza. Total inventory of residential condo units within the City District has remained unchanged over the past five years, 2019 through 2023. As of year-end 2023, the average assessed value per unit was $238,780 and the taxable value per unit was $217,430 for all residential condo units within the City District.

In addition, the City District experienced a total of 27 residential condo unit sales in 2023; representing 1.8% of the total residential condo unit sales within the City, as illustrated in the following table.

RESIDENTIAL SALES ACTIVITY

By the end of 2023, the total sales price for residential condo units exceeded $9.9 million. Furthermore, the average sales price per sq. ft. for residential condo units in the City District, at $361.03 per sq. ft., was significantly higher than the City average, at $222.78 per sq. ft., during the same period.

As of year-end 2023, the City District’s commercial real estate market composed about 6.0 million square feet (“sq. ft.”) of office and retail space, in addition to 545 hotel rooms, and 614 for-rent market-rate multi-family residential units, as illustrated in the market characteristics table below.

To note, the City District does not contain any industrial/flex space as of year-end 2023.

Office space composed the majority of the City District’s office and retail inventory at 91% of the total share, followed by retail space with 9% of the total, as of year-end 2023. Specifically, the office space within the City District consisted of 75% Class A space, 19% Class B space, and the remaining portion as Class C space.

Office properties within the City District had a slightly higher occupancy rate compared to that of retail properties as of year-end 2023. Moreover, occupancy rates for both the City District’s hotel and for-rent multi-family markets were approximately 69% and 93%, respectively. In addition, average rental rates for retail properties were slightly higher than those for office properties within the City District as of year-end 2023. In addition, the City District’s average rental rates for its commercial real estate markets were greater than those for the City as of year-end 2023.

There were 64 lease transactions that occurred in the City District’s office and retail markets— resulting in a total of 254,192 sq. ft. leased during 2023. Leasing activity refers to the volume of square footage that is committed to and actually signed in a given period of time, including direct leases, subleases and renewals of existing leases.

Gross absorption measures the total sq. ft. occupied within existing buildings over a given period, without accounting for vacated space. As of year-end 2023, total gross absorption of office and retail space within the City District was approximately 404,330 sq. ft., with office space composing the majority of commercial gross absorption within the City District at 92%. In addition, the City District’s for-rent multifamily residential market experienced a negative absorption of 3 units during this same time frame.

The following pages illustrate major development activities, year-over-year snapshots, and five-year annual trends for the City District’s commercial real estate market.

Office space remained unchanged from the prior year at 5.52 million sq. ft.

Vacancy rates for office properties decreased 3 percentage points, from 11.5% to 8.7%.

Average rental rates per sq. ft. increased 4.6%, from $27.55 to $28.81.

Leasing activity of office space decreased 39%

Over the past five years, 2019 through 2023, the City District saw the addition of 180 hotel rooms and 449,676 sq. ft. of office space within one building, the Truist Plaza at Church Street Station, which was completed in 2019— featuring the AC Hotel Orlando Downtown, which opened in 2021.

Within the City District, there is zero sq. ft. of commercial inventory under-construction as of year-to-date 2024, through August 2024. However, during this same time frame, there is one proposed development project within the City District, the Edge at Church Street Station, which will feature approximately 198,000 sq. ft. of office space and 240 multi-family rental units. Major development activity throughout the past five-year period and proposed development activity is illustrated in the graphic below.

Retail space remained unchanged from the prior year at 502,240 sq. ft.

Vacancy rates for retail properties decreased 4 percentage points, from 20% to 16%.

Average rental rates per sq. ft. increased 17%, from $26.87 to $31.38.

Leasing activity of retail space decreased 2%

There is zero industrial/ flex space located within the City District as of year-end 2023, therefore performance data is not available for this property use.

Hotel inventory remained unchanged from the prior year, at 545 rooms.

Vacancy rates for hotel properties decreased 0.4 percentage points from 31.4% to 31.0%.

Average daily rate (“ADR”) for hotel rooms decreased 3.0%, from $178.66 to $173.25.

Over the past five years, 2019 through 2023, the City District’s commercial space (i.e., office and retail space) did not experience any increase in inventory.

During this same time frame, total hotel rooms increased by 180 rooms, and multi-family inventory also remained unchanged within the City District.

Comparatively, the new hotel inventory in the City District over the past five years accounted for 5.5% of the new hotel rooms within the City.

Vacancy rates in the City District saw significant increases over the past five years of 2 percentage points in the office market, 14 percentage points in the retail market, 9 percentage points in the hotel market, and 2 percentage points in the rental multi-family market. Rising vacancy rates are likely due to a shortage of desirable rental spaces and high rental costs exceeding what the local market can afford. However, notable increases from 2020-2022 may also be a result of the COVID-19 pandemic.

For-rent multi-family units remained unchanged from the prior year at 614 units. Vacancy rates increased 0.5 percentage points for multi-family properties, from 6.5% to 7.0%.

Average rental rates per unit increased 2.1%, from $1,793 to $1,831.

Over the past five years, 2019 through 2023, the City District’s average rental rates per sq. ft. experienced increases of 6.7% for office and 87% for retail. During this same time frame, average daily rates for hotel rooms increased 3.9% and average rental rates per unit for multi-family increased 4.6%. Increases in average rental rates may be attributed to rising operating and fixed costs, as well as properties in desirable locations or with premium amenities that can command higher rents.

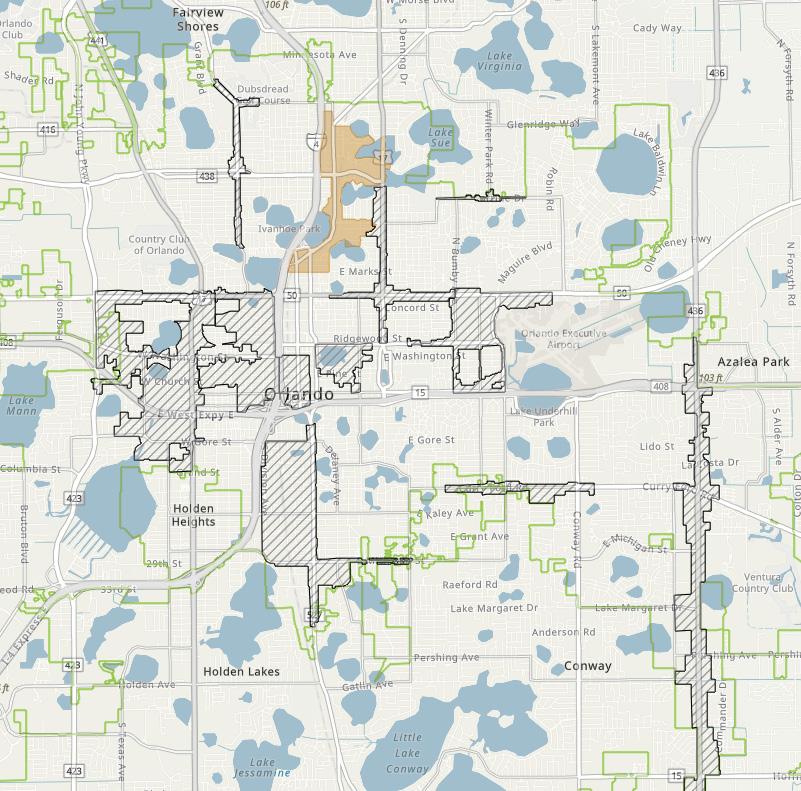

The College Park Main Street (“College Park”), part of the Main Street America program, is a vibrant neighborhood located just outside of downtown Orlando, offering the charm of small-town living within an urban environment. Spanning about 96 acres along Edgewater Drive, College Park is situated between major thoroughfares, including Interstate 4 to the east, State Road 50 to the south, and U.S. Highway 441 to the west, as shown on the map on the following page.

College Park is home to some of Central Florida’s finest local retailers, award-winning restaurants, and small businesses. The area offers a lively lifestyle with a range of services, charming bungalow-style homes, brick-lined streets, and numerous parks and lakes, making it an inviting and comfortable place for residents to call home.

College Park features a vibrant main street, Edgewater Drive, lined with shops, restaurants, unique art displays, and hosts community events. The neighborhood, known for its distinctive 1900s bungalow homes, is surrounded by lakes and parks that reflect the community’s rich history. This pride is evident in the annual events, which showcase the vibrancy and shared values of College Park.

With a focus on quality of life, College Park envisions a thriving community anchored by a robust business district. As one of the 12 Orlando Main Street Programs, College Park is dedicated to maintaining the area’s economic integrity while fostering a strong sense of community. To achieve this vision, the district aims to revitalize and promote the business area, preserving its unique character and nurturing a vibrant local community.

Directly adjacent the College Park Main Street is the Dubsdread Golf Course. In 1925, Carl Dann, the owner of the largest real estate management business in the area, decided to build a golf course after a falling out with the Country Club of Orlando in 1923. Dubsdread Golf Course quickly became a popular spot for the rich and famous, attracting both professional and amateur golfers, as well as gamblers. During World War II, it served as a social club for officers from the Orlando Army Air Force Base. The Dann family owned Dubsdread until the City of Orlando purchased it in 1978. Today, it remains a thriving golf course.

Edgewater High School, located along College Park Main Street, is a cornerstone of the community. Known for its strong academic programs and vibrant extracurricular activities, the school plays a significant role in shaping the lives of local students.