8 minute read

Is Avatrade Legal in UAE

from Avatrade Review

by ForexMakets

AvaTrade is legal for UAE traders through its globally regulated entities. While not licensed directly by the DFSA, it operates under top-tier regulators such as ASIC and the Central Bank of Ireland, ensuring a safe and transparent trading environment.

In the dynamic world of online trading, ensuring that your chosen broker operates legally and securely within your jurisdiction is paramount. For traders in the United Arab Emirates (UAE), AvaTrade stands out as a globally recognized forex and CFD broker. But the question remains: Is AvaTrade legal in the UAE? This article delves into the regulatory landscape, features, and considerations for UAE traders contemplating AvaTrade.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. Introduction to AvaTrade

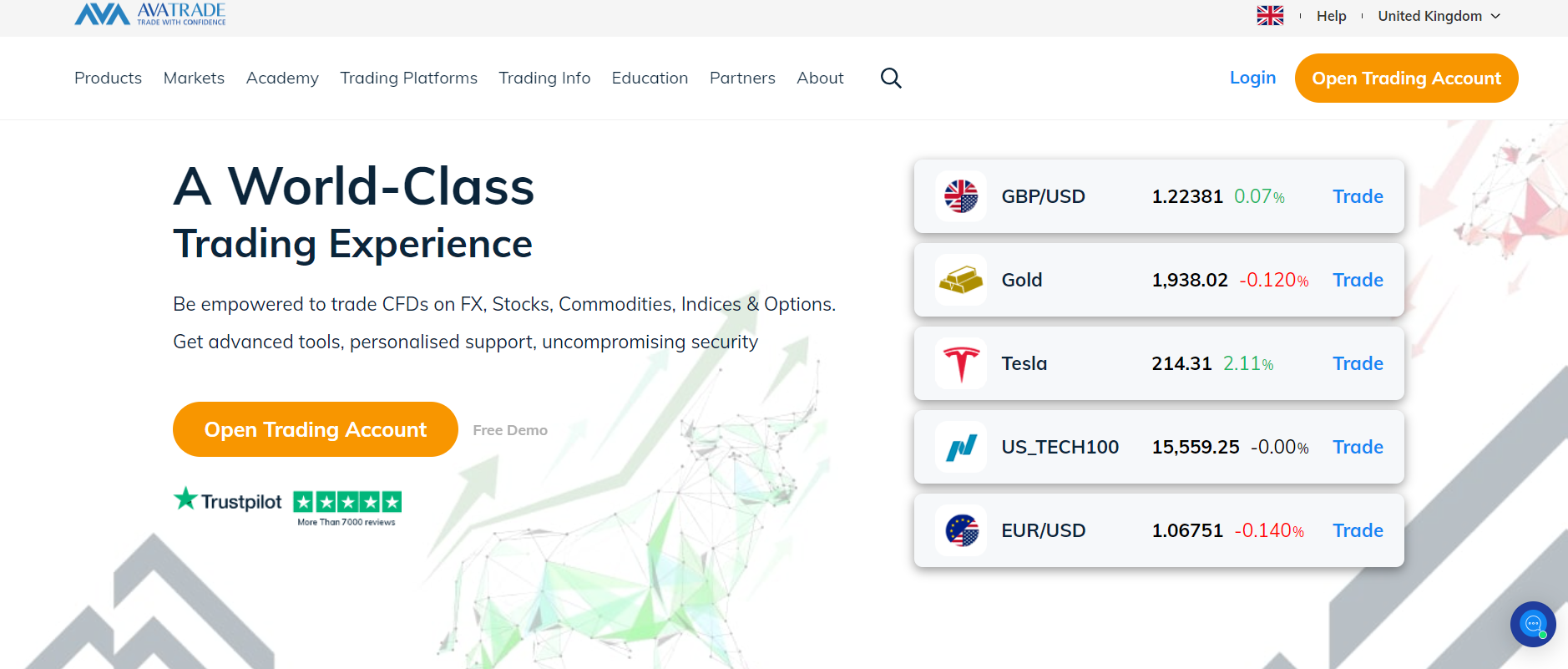

Established in 2006, AvaTrade has grown into a prominent online broker, offering a diverse range of financial instruments including forex, CFDs, stocks, commodities, indices, and cryptocurrencies. With a presence in multiple countries and a commitment to providing secure and user-friendly trading platforms, AvaTrade has garnered a reputation for reliability and innovation.

2. AvaTrade's Regulatory Status in the UAE

✅ Licensed by the Abu Dhabi Global Market (ADGM)

AvaTrade operates in the UAE under the regulatory framework of the Abu Dhabi Global Market (ADGM), a financial free zone established to promote the UAE's position as a global financial hub. Specifically, AvaTrade Middle East Ltd holds a Category 3A license (FSPN 190018) issued by the ADGM Financial Services Regulatory Authority (FSRA). This license authorizes AvaTrade to provide financial services to both retail and professional clients within the UAE.

✅ Compliance with International Standards

The FSRA's regulations are modeled after internationally recognized standards, ensuring that licensed entities operate with integrity and transparency. This regulatory oversight provides UAE traders with confidence that AvaTrade adheres to stringent financial and operational standards.

See more:

3. Trading Platforms Offered by AvaTrade

AvaTrade provides a variety of trading platforms to cater to different trading styles and preferences:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Widely used platforms known for their advanced charting tools, automated trading capabilities, and user-friendly interfaces.

AvaTradeGO: A mobile trading app designed for traders on the go, offering real-time market data, advanced charting tools, and seamless trade

WebTrader: A browser-based platform that allows traders to access their accounts and trade directly from any internet browser without the need for software installation.

AvaOptions: A platform tailored for options trading, providing advanced tools for strategy development and risk management.

AvaSocial, ZuluTrade, and DupliTrade: Platforms that support social and copy trading, enabling traders to follow and replicate the strategies of experienced

4. Account Types and Features

AvaTrade offers a range of account types to suit different trading needs:

Standard Accounts: Designed for retail traders, offering competitive spreads and access to a wide range of financial

Professional Accounts: Tailored for experienced traders, providing enhanced leverage and additional trading

AvaTrade Islamic Accounts: Swap-free accounts that comply with Sharia law by eliminating interest charges on overnight positions.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

5. Fees and Commissions

AvaTrade maintains a transparent fee structure:

Spreads: Competitive spreads starting from 0.9 pips for major currency pairs.

Commission: AvaTrade operates on a commission-free model for most account types.

Inactivity Fees: Accounts that remain inactive for three months may incur a fee of $50.

Deposit and Withdrawal Fees: Generally, AvaTrade does not charge fees for deposits or withdrawals, though third-party payment providers may impose their own charges.

6. Customer Support and Education

AvaTrade offers comprehensive customer support:

Multilingual Support: Assistance available in multiple languages, including English and Arabic, to cater to the diverse UAE clientele.

Educational Resources: Access to a wide range of educational materials, including webinars, video tutorials, and articles, to help traders enhance their skills and knowledge.

Account Managers: Dedicated account managers are available to provide personalized support and guidance.

7. Security Measures and Fund Protection

AvaTrade prioritizes the security of client funds:

Segregated Accounts: Client funds are held in segregated accounts, separate from the company's operational funds, ensuring they are protected.

Regulatory Oversight: As a licensed entity under the ADGM, AvaTrade is subject to stringent regulatory requirements, providing an additional layer of security for traders.Compensation Scheme: In the unlikely event of AvaTrade's insolvency, client funds may be protected under the UAE Central Bank's compensation scheme.

8. Islamic (Swap-Free) Accounts

✅ AvaTrade offers fully Sharia-compliant Islamic trading accounts, specifically tailored for Muslim traders in the UAE and other Islamic countries.

These accounts are designed to meet the religious requirements of traders who cannot pay or receive interest (Riba), which is prohibited under Islamic law.

Features of AvaTrade Islamic Accounts:

❌ No interest or swaps on overnight positions

✅ No hidden fees to compensate for the absence of swaps

✅ Available on all major platforms including MT4 and AvaTradeGO

✅ Full access to all tradable assets, including forex, commodities, and indices

To open an Islamic account, traders must request the feature specifically when registering or by contacting customer support. The approval process is usually fast and straightforward.

9. Advantages of Trading with AvaTrade in the UAE

AvaTrade stands out in the UAE market for a number of compelling reasons:

✅ Strong Regulatory Presence

With regulation from ADGM (Abu Dhabi Global Market), AvaTrade offers a level of oversight and trust that is essential for peace of mind.

✅ Wide Range of Instruments

Traders in the UAE can access over 1,250 financial instruments, including:

Forex pairs

Cryptocurrencies

Commodities (Gold, Oil, Natural Gas)

Stock CFDs (Apple, Tesla, Amazon, etc.)

ETFs and Bonds

✅ Educational Support for All Levels

Whether you’re a new trader or a seasoned pro, AvaTrade's educational resources are rich and easily accessible:

Webinars

eBooks

Market analysis

Trading guides

✅ Risk Management Tools

Negative balance protection

Stop-loss orders

AvaProtect™ – AvaTrade’s proprietary risk management tool that protects your trade against losses for a small fee

✅ Islamic Compliance

Swap-free accounts support faith-based trading, allowing Muslim traders to participate without compromising their beliefs.

✅ Strong Local Presence

AvaTrade provides Arabic-speaking support staff, local payment methods (like bank transfers to UAE-based banks), and regional seminars to engage the trader community.

📊 Discover how Forex Markets operate and how you can trade smarter—only on our dedicated page.

10. Considerations and Potential Drawbacks

While AvaTrade offers many benefits, it’s important to consider the following:

❌ No MT5 Support on All Instruments

Some instruments are only available on MT4, which may limit the full capabilities of MT5 users.

❌ No Direct Access to Stock Exchanges

AvaTrade only offers CFD trading, meaning you don’t own the underlying assets.

❌ Inactivity Fees

An inactivity fee of $50 can be charged every three months if no trades are executed.

❌ Limited Advanced Tools for Pro Traders

Although sufficient for most users, traders seeking advanced algorithmic or quantitative trading features may find limitations.

"Tired of unreliable brokers? ❌ See which ones made our top list — check out our full Forex broker reviews!"

11. Conclusion

✅ So, is AvaTrade legal in the UAE? Absolutely.

AvaTrade is fully licensed by the Abu Dhabi Global Market (ADGM), meeting stringent regulatory standards. With a broad range of trading instruments, cutting-edge platforms, dedicated local support, and swap-free Islamic accounts, AvaTrade is a strong choice for traders in the UAE.

If you're a UAE resident looking for a reliable, well-regulated broker that offers transparency, variety, and tailored features, AvaTrade is a great place to start.

🔥 Ready to Start Trading?

👉 Don’t miss your chance to trade with one of the most trusted brokers in the UAE.Open your AvaTrade account today and enjoy access to:

Ultra-competitive spreads

Regulated environment

Market insights and education

Arabic support

✅ It’s fast, free, and fully secure. Get started now.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

12. Frequently Asked Questions (FAQs)

1. Is AvaTrade regulated in the UAE?

Yes. AvaTrade is licensed by the Abu Dhabi Global Market (ADGM) under FSRA regulation, ensuring full legal compliance in the UAE.

2. Is AvaTrade a halal broker?

Yes. AvaTrade offers Islamic (swap-free) accounts, which are compliant with Sharia law and suitable for Muslim traders.

3. Can I deposit in AED (Dirhams)?

Yes, AvaTrade supports deposits in AED, and also offers local bank transfer options for convenience.

4. Is AvaTrade suitable for beginners?

Absolutely. AvaTrade has extensive educational content, demo accounts, and intuitive platforms perfect for new traders.

5. What is the minimum deposit for AvaTrade UAE accounts?

The minimum deposit typically starts at $100 or equivalent in AED, depending on the funding method.

6. Is AvaTrade available in Arabic?

Yes. The website, support, and account management are fully available in Arabic.

7. What trading platforms does AvaTrade offer?

AvaTrade provides MT4, MT5 (partial), AvaTradeGO, WebTrader, AvaOptions, and social trading platforms like ZuluTrade.

8. Does AvaTrade charge commission?

No. AvaTrade offers commission-free trading; profits are made via spreads.

9. Are my funds safe with AvaTrade?

Yes. AvaTrade keeps client funds in segregated accounts and operates under strict regulatory supervision by the FSRA.

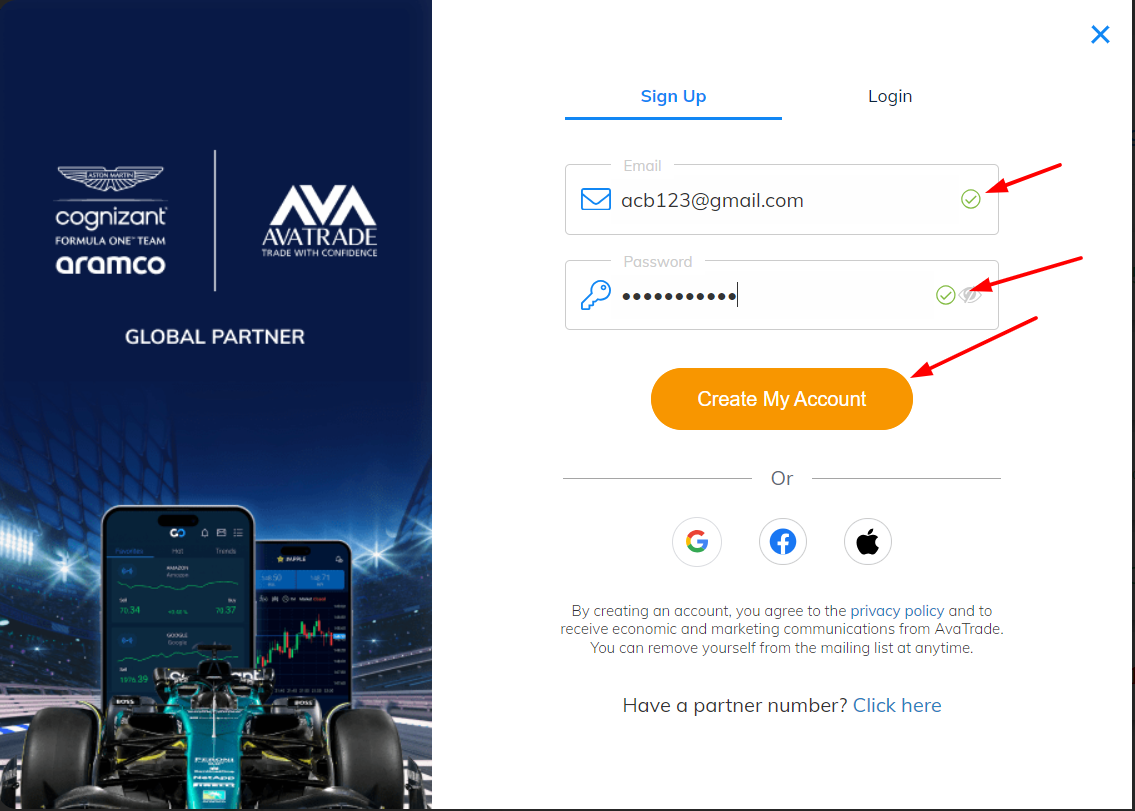

10. How do I open an AvaTrade account from the UAE?

Visit AvaTrade’s official website, select your region, choose an account type (Islamic optional), and follow the guided registration process.

💥 Read more: