6 minute read

Avatrade Vs Tickmill 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs Tickmill 2025: Compared - which is better broker?

In 2025, the Forex market is more dynamic and competitive than ever before. With thousands of brokers operating globally, choosing the right platform to trade can be a make-or-break decision for both beginners and experienced traders.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Among the top contenders, Avatrade and Tickmill stand out as two of the most discussed brokers in the trading community. But when it comes down to performance, security, user experience, and long-term potential, the question remains:

Avatrade vs Tickmill – which broker should you trust in 2025?

This in-depth comparison will guide you through everything you need to know: from trading features to regulation, from spreads to usability. ✅ We'll break down the real advantages and challenges of each broker in a language every trader can understand. Whether you’re just starting or already a seasoned scalper, this guide is tailored to help you make an informed decision and ultimately maximize your profits.

1. Quick Overview – Avatrade and Tickmill at a Glance

🔹 Avatrade – A Veteran with Global Reach

Founded in 2006, Avatrade is a well-established international broker, operating across over 150 countries. It's regulated by several Tier-1 bodies including:

✅ Central Bank of Ireland

✅ ASIC (Australia)

✅ FSCA (South Africa)

✅ FSA (Japan)

✅ ADGM (Abu Dhabi)

With a suite of platforms and tools for beginners and professionals alike, Avatrade continues to lead the market in user-friendly technology, regulatory compliance, and product diversity.

👉 Read more: Avatrade Broker Review 2025: Pros & Cons A Comprehensive Review

🔹 Tickmill – A Lean, Low-Cost Alternative

Launched in 2014, Tickmill has quickly made a name for itself thanks to its ultra-low spreads, fast order execution, and scalper-friendly environment. Tickmill is regulated by:

✅ FCA (UK)

✅ CySEC (Cyprus)

✅ FSA (Seychelles)

While it offers fewer trading products, it’s popular among traders who prefer raw pricing and tight spreads – especially those using high-frequency strategies.

2. Avatrade vs Tickmill – Deep Comparison by Key Factors

When comparing Avatrade vs Tickmill, let’s break down each component traders care about most:

⚙️ Trading Platforms

Avatrade:

Supports MetaTrader 4, MetaTrader 5

Offers AvaTradeGO mobile app

Includes AvaOptions for options trading ✅

Browser-based WebTrader available

Tickmill:

Supports MetaTrader 4 and MetaTrader 5

No proprietary platform

No support for options ❌

Verdict: Avatrade provides a more flexible trading environment, with additional platforms like AvaOptions and mobile-first tools.

💼 Account Types

Avatrade:

Standard accounts

Islamic (Swap-free) accounts ✅

Demo accounts

Tickmill:

Classic

Pro

VIP

Islamic account also available

Both brokers offer tailored account types, but Avatrade keeps it simpler, which is better for new traders.

📊 Product Offering

Avatrade:

Over 1250 instruments including:

Forex

Cryptocurrencies

Stocks

Indices

ETFs

Options ✅

Tickmill:

Forex

CFDs on indices, oil, and metals

Limited cryptocurrencies ❌

Avatrade clearly wins here with a broader range of markets and instruments, allowing you to diversify and hedge easily. ✅

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

💵 Spreads & Fees

Tickmill:

Known for tight spreads, especially on Pro account

Low commissions

Avatrade:

Competitive spreads (variable)

Zero commission trading ✅

While Tickmill has lower raw spreads, Avatrade’s zero-commission structure and bonuses make it attractive for long-term traders. For swing or position traders, fees are a non-issue.

🔐 Regulation & Trust

Both brokers are regulated by top-tier financial authorities, but Avatrade is regulated in more jurisdictions, giving it a slight edge in terms of fund safety and international credibility. ✅

3. Why More Traders Prefer Avatrade in 2025

Let’s look at some powerful reasons why Avatrade is gaining a competitive edge over Tickmill this year:

✅ More trading assets: From cryptocurrencies to options, ETFs, and stocks – more opportunities.

✅ Award-winning mobile app: Trade anytime with AvaTradeGO, packed with smart risk management tools.

✅ Rich education tools: Webinars, market analysis, tutorials for traders at every level.

✅ Fast and reliable execution: Zero dealing desk execution with global servers.

✅ No commission structure: Especially beneficial for new traders who need simple cost management.

Tickmill may win in raw pricing for scalpers, but Avatrade wins the long-term trader's heart with a full ecosystem that scales as you grow. ✅

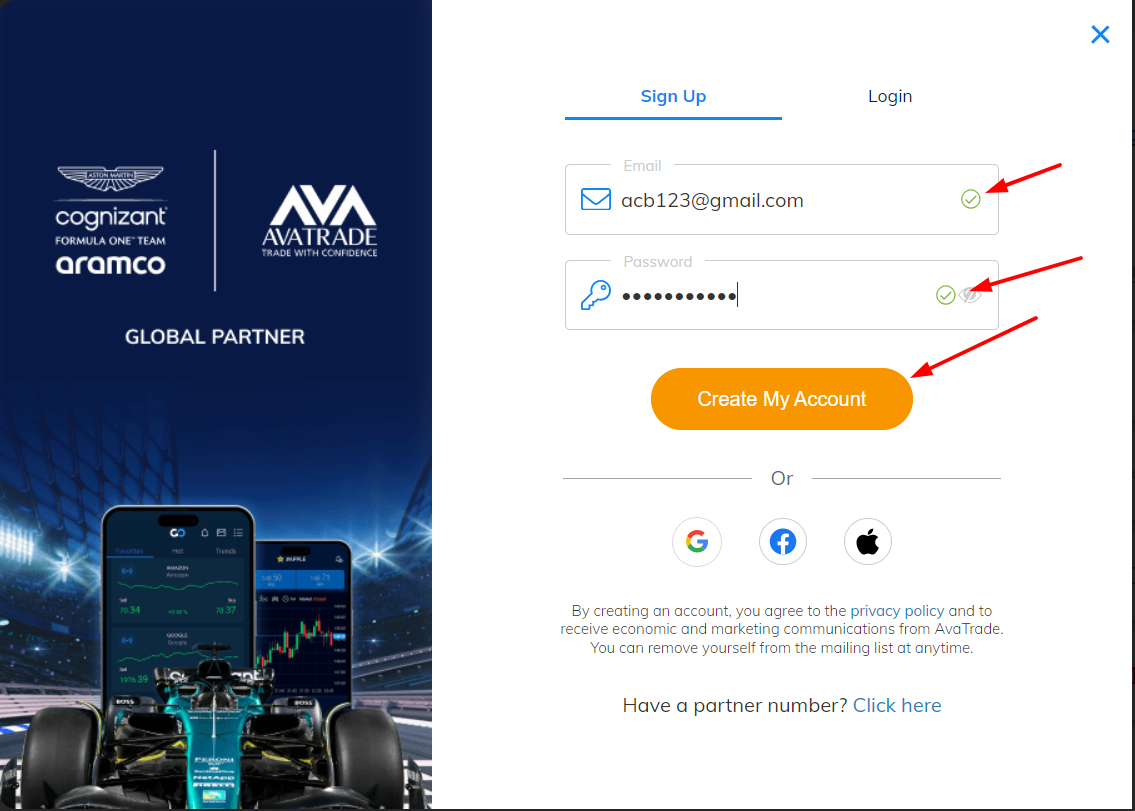

4. How to Open an Account with Avatrade – Step-by-Step

Getting started with Avatrade is quick and beginner-friendly. Here’s how you can open your trading account in under 5 minutes:

Go to the official Avatrade registration page.

Fill in your basic details (name, email, country).

Submit KYC documents (ID + proof of address).

Fund your account using:

Credit/Debit card

E-wallets (Neteller, Skrill)

Bank transfer

Start trading via:

MT4 / MT5

AvaTradeGO app

AvaOptions for advanced strategies

✅ With 0% deposit fees and multiple base currencies, the funding process is fast and secure. 👉 Open Avatrade Account Fast!

5. Avatrade vs Tickmill – Key Advantages of Avatrade

Here’s a summary of why Avatrade stands out when comparing the two:

✅ More instruments (Forex, crypto, stocks, options, indices)

✅ No commissions, fair spreads

✅ User-friendly platforms and mobile app

✅ Strong international regulation

✅ 24/5 multilingual customer support

✅ Great bonuses and referral rewards

✅ Trading Central integration for signals and analysis

If you want flexibility, security, and strong trading tools – Avatrade is the broker to trust in 2025.

6. FAQs – Traders Ask, We Answer

1. Is Avatrade good for beginners?

✅ Yes. With user-friendly platforms and free educational resources, it's ideal for newcomers.

2. Does Tickmill have lower spreads than Avatrade?

✅ Yes – for Pro accounts, spreads are lower. ❌ However, it charges commission, which may cancel the benefit.

3. Is Avatrade a safe broker?

✅ Absolutely. It is regulated across five continents and has no history of fund misuse.

4. Can I trade cryptocurrencies with Avatrade?

✅ Yes, including major cryptos like Bitcoin, Ethereum, and Ripple.

5. Does Avatrade offer bonus programs?

✅ Yes, they frequently offer deposit bonuses and referral incentives.

6. What is the minimum deposit at Avatrade?

✅ Starting from $100, very accessible for new traders.

7. Does Avatrade charge withdrawal fees?

✅ No, withdrawals are free on most methods.

8. Which broker offers better trading platforms?

✅ Avatrade, with AvaTradeGO and AvaOptions.

9. Does Tickmill offer options trading?

❌ No. Avatrade is the only one offering options via its proprietary platform.

10. Should I choose Avatrade or Tickmill in 2025?

✅ Avatrade – it's more versatile, safer, and packed with useful features for modern traders.

7. Final Verdict – Avatrade is the Better Broker in 2025

While Tickmill remains a competitive low-cost option for scalpers and advanced traders, it lacks the diversification, flexibility, and innovation offered by Avatrade. In 2025, traders want more than just tight spreads – they want:

✅ A secure environment

✅ Cutting-edge tools

✅ Comprehensive market access

✅ Easy funding/withdrawals

✅ Helpful support

Avatrade delivers on all fronts. For traders who aim for growth, security, and ease of use — Avatrade is the smarter choice.

Don’t just trade — trade smart. Open your Avatrade account today and take your trading journey to the next level. ✅

💥 Read more:

Avatrade Vs eToro 2025: Compared - which is better broker?

Avatrade Vs Octafx 2025: Compared - which is better broker?