6 minute read

Does Avatrade Have Fees

by ForexMakets

Does Avatrade Have Fees

If you're a forex trader, chances are you've asked yourself: Does AvaTrade have fees? This is a crucial question, especially if you're aiming to maximize your trading profits. In this comprehensive guide, we'll dive deep into the fee structure of AvaTrade, what costs to expect, and how to minimize them.

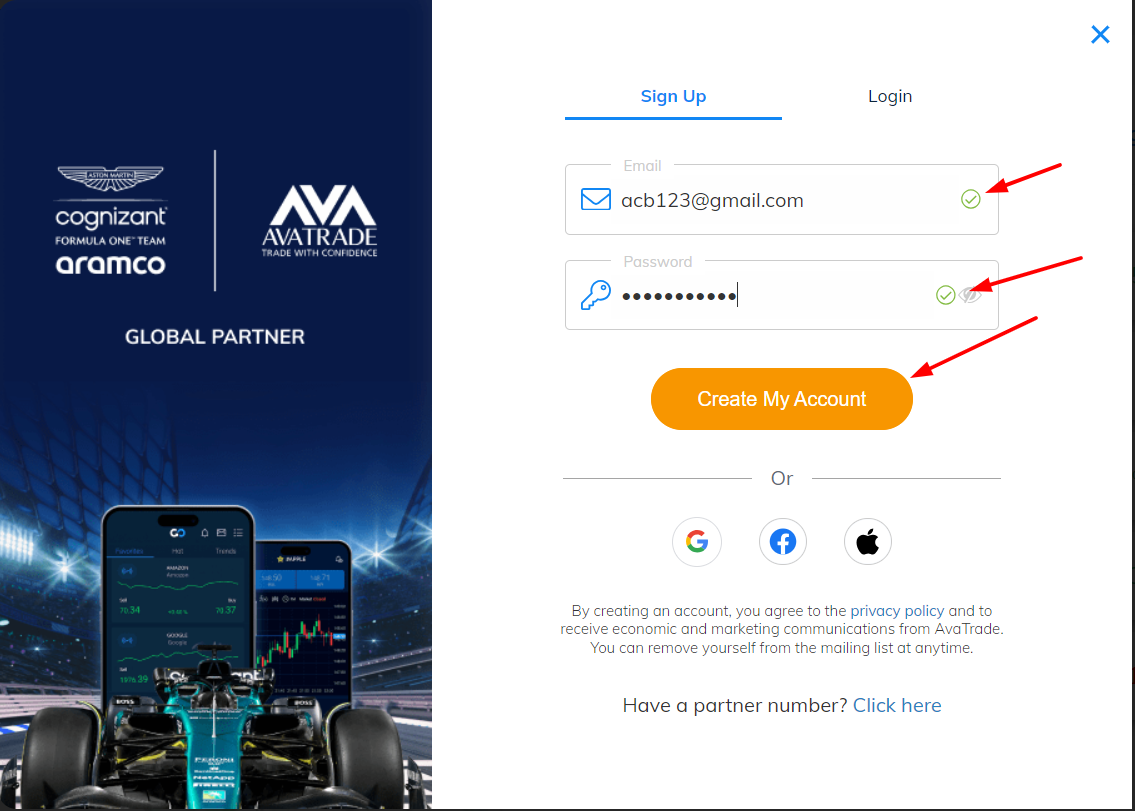

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

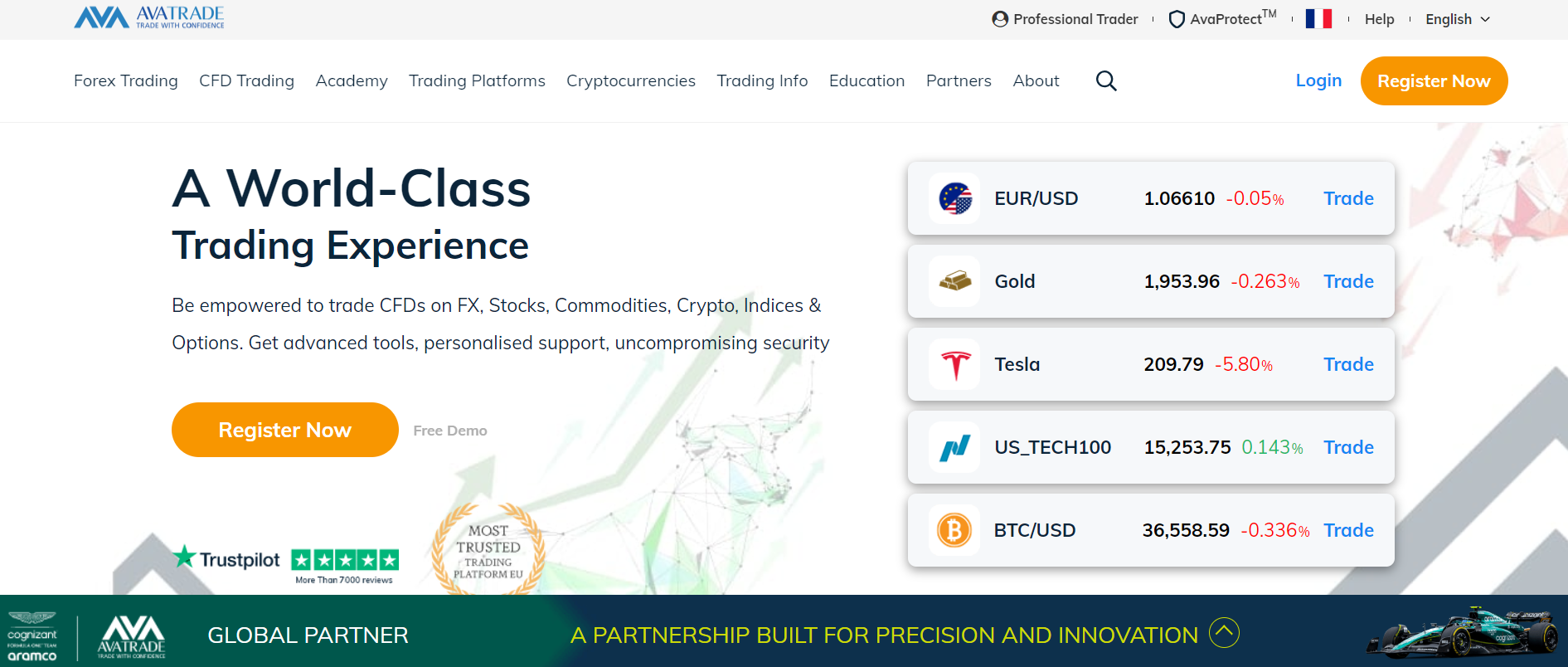

1. Introduction to AvaTrade

AvaTrade is one of the most well-established brokers in the world of online trading. Founded in 2006, it offers a wide range of instruments including forex, commodities, indices, stocks, and cryptocurrencies. Regulated in multiple jurisdictions, AvaTrade caters to both retail and professional traders. However, like any broker, AvaTrade isn't free. So let's break down the costs involved.

2. Understanding Broker Fees

Before diving into AvaTrade specifically, it's important to understand the types of broker fees you might encounter:

Spreads (difference between bid and ask price)

Commissions

Swap fees (overnight holding fees)

Inactivity fees

Deposit & withdrawal fees

Knowing how these apply to AvaTrade is essential for making cost-effective decisions.

3. Types of AvaTrade Fees

AvaTrade employs a spread-only pricing model for most of its offerings. This means you won't pay traditional commissions on most trades.

Spreads: This is AvaTrade’s primary fee.

Swap fees: Applied for overnight positions.

Inactivity fee: Charged after 3 months of no activity.

Administrative fee: Applied after 12 months of inactivity.

Deposit/Withdrawal fees: Generally free, but can vary depending on the method.

✅ Important: There are no hidden commissions on standard forex trades.

4. AvaTrade Spreads: Competitive or Not?

AvaTrade offers variable spreads, which means they can change based on market conditions. For major pairs like EUR/USD:

Average spread is around 0.9 to 1.3 pips

While not the lowest in the industry, it’s still competitive. Other pairs and instruments might have higher spreads.

✅ Good to know: Zero-commission structure means spreads are your main cost. 👉 Join Avatrade Now

5. Swap Fees at AvaTrade (Overnight Fees)

If you're holding positions overnight, AvaTrade applies swap fees based on interbank rates and instrument volatility. These are typical of any broker offering leveraged trading.

Varies per instrument

Can be negative or positive

Islamic (swap-free) accounts are available

❌ Warning: High leverage can amplify swap costs significantly.

6. AvaTrade Inactivity Fees

AvaTrade charges an inactivity fee of $50 after three months of no trading activity. After 12 months, an additional administration fee of $100 kicks in.

Inactivity Fee: $50 (after 3 months)

Admin Fee: $100 (after 12 months of total inactivity)

❌ Caution: These can add up if you don’t monitor your account.

7. Deposit & Withdrawal Fees: What You Need to Know

AvaTrade generally does not charge fees for deposits or withdrawals. However:

Your payment provider might charge you.

Wire transfers may take longer and sometimes involve a third-party fee.

✅ Pro Tip: Use e-wallets like Skrill or Neteller for faster processing and fewer issues.

8. AvaTrade Commission Structure

Most AvaTrade accounts operate on a spread-only basis, meaning no additional trading commissions are charged. Exceptions may include:

CFD stocks in certain regions

Professional account types with custom structures

✅ Highlight: Great for beginner traders looking for simplicity.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

9. Hidden Costs You Should Be Aware Of

While AvaTrade is relatively transparent, always be mindful of the following:

Currency conversion fees

Third-party charges

Unused leverage can increase swap charges indirectly

❌ Hidden cost alert: Using leverage on volatile assets can quietly drain your account overnight.

10. AvaTrade vs Other Brokers: Fee Comparison

Without using tables, let’s list how AvaTrade compares to competitors like Exness, XM, and Pepperstone:

Exness: Offers ultra-tight spreads but may charge commissions on some account types. 👌 If you choose Exness, 👉 Click here to open an account

XM: Low spreads with negative balance protection but has both spreads and commissions.

Pepperstone: Razor account has raw spreads plus commission, but highly competitive for scalpers.

AvaTrade: Spread-only model, beginner-friendly, but slightly higher spreads in some cases.

✅ Advantage: No complex tiered pricing models to confuse new traders.

11. How AvaTrade Makes Money

AvaTrade profits from:

Spreads on every trade

Swap fees for overnight positions

Inactivity & admin fees

They do not rely on commissions, which makes their fee model easier to predict for most traders.

12. How to Avoid or Minimize Fees with AvaTrade ✅

Here’s how savvy traders avoid unnecessary costs:

Trade frequently to avoid inactivity charges

Use swap-free account if eligible

Close trades before rollover if swap fees matter to you

Use e-wallets for deposits and withdrawals

Choose high-liquidity pairs like EUR/USD to enjoy lower spreads

✅ Strategy: Monitor spread changes during news events to avoid paying more.

13. Is AvaTrade Worth It for Low-Cost Trading?

If you’re a trader who values clarity and predictability, AvaTrade's no-commission model and transparent spread pricing is a solid choice. It's especially attractive for:

Beginner traders ✅

Swing traders ✅

Those who want Islamic account options ✅

However, scalpers or high-frequency traders might find spreads slightly limiting compared to raw-spread brokers.

14. Conclusion: Should You Worry About AvaTrade Fees?

In the grand scheme, AvaTrade’s fees are reasonable and transparent. While they’re not the lowest-cost provider on the market, they strike a balance between usability, regulation, and customer support. For many traders, that’s a trade-off worth making.

✅ Bottom line: If you're seeking a reliable, regulated, and beginner-friendly broker, AvaTrade deserves your attention.

15. FAQs About AvaTrade Fees

1. Does AvaTrade charge commissions? No. AvaTrade uses a spread-only model for most trades.

2. What is the inactivity fee at AvaTrade? $50 after 3 months of inactivity, plus $100 admin fee after 12 months.

3. Are there swap-free accounts on AvaTrade? Yes, Islamic accounts are available upon request.

4. How can I avoid deposit/withdrawal fees? Use e-wallets like Skrill or Neteller.

5. Are AvaTrade spreads fixed or variable? Variable. They depend on market conditions.

6. Does AvaTrade charge for withdrawals? No, but your bank or payment provider might.

7. How does AvaTrade make money? Through spreads, swap fees, and inactivity charges.

8. Is AvaTrade good for beginners? Yes. Simple fee model and easy-to-use platform.

9. Can I trade with zero fees on AvaTrade? Not entirely. You'll still pay spreads and possibly swaps.

10. Which assets have the lowest fees on AvaTrade? Major forex pairs like EUR/USD or USD/JPY typically offer the lowest costs.

Ready to Trade Without the Fee Confusion?

👉 Start your trading journey today with AvaTrade and experience a transparent, regulated platform that puts you first. 👉 Open Avatrade Account Fast!

✅ No commissions.✅ No withdrawal fees.✅ Beginner-friendly platform.

Trade smarter. Trade with confidence. Choose AvaTrade.

💥 Read more: