6 minute read

Avatrade Vs Eightcap 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs Eightcap 2025: Compared - which is better broker?

In the world of online Forex trading, selecting the right broker is one of the most critical decisions a trader can make. As we step into 2025, the competition among brokers has become fiercer than ever. Among the standout names in the industry are Avatrade and Eightcap—two highly respected brokers offering advanced trading services. But the question remains: Avatrade Vs Eightcap, which one truly offers the better deal for traders in 2025?

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

This in-depth comparison is designed to give you a clear, trader-focused perspective, helping you understand the strengths and weaknesses of both platforms. Whether you're a beginner or a seasoned investor, this guide will arm you with the knowledge you need to make the right decision—and even better, to take your trading career to the next level with the right partner.

⚡ Introduction to Avatrade and Eightcap

Avatrade was founded in 2006 and is known for its regulatory compliance, vast trading instruments, and beginner-friendly environment. It has grown into one of the most trusted Forex brokers, operating across multiple jurisdictions and providing tools tailored for both new and advanced traders.

👉 Read more: Avatrade App Review

Eightcap, on the other hand, was established in 2009. It's an Australian-based broker that gained popularity for its tight spreads and excellent integration with MetaTrader platforms. Although newer, Eightcap has quickly made a name for itself among tech-savvy traders.

✅ Avatrade has a more established global presence and is regulated by more Tier-1 authorities compared to Eightcap.

📊 Trading Platforms & Tools

Both Avatrade and Eightcap offer the popular MetaTrader 4 and MetaTrader 5 platforms. However, Avatrade goes beyond with its proprietary AvaTradeGO app and integration with DupliTrade and ZuluTrade for social and copy trading.

Avatrade’s Tools: AvaProtect, Autochartist, Trading Central

Eightcap’s Tools: Capitalise.ai, economic calendar, and Smart Trader Tools

✅ Avatrade’s wider range of third-party tools and risk management features gives it a strong edge, especially for beginners seeking extra protection.

💰 Trading Fees & Spreads

When comparing Avatrade Vs Eightcap in terms of trading fees, it’s important to consider the total cost of trading, including spreads, commissions, and overnight fees.

Eightcap: Known for ultra-tight spreads—as low as 0.0 pips on RAW accounts, but charges a commission.

Avatrade: Offers commission-free trading with slightly higher spreads, starting from 0.9 pips.

✅ Avatrade's no-commission model simplifies cost calculations for beginner traders. ❌ Eightcap may appeal to scalpers, but the commission-based model can be confusing for newcomers.

🧩 Regulation and Security

In terms of regulatory strength:

Avatrade: Regulated by ASIC, FSCA, FSA Japan, Central Bank of Ireland, and others.

Eightcap: Licensed by ASIC and SCB.

✅ Avatrade clearly wins here with more diverse and strict global licenses. This ensures a higher degree of client fund safety and operational transparency.

🔧 Account Types and Accessibility

Both brokers offer multiple account types, but Avatrade provides a more user-friendly and simplified structure.

Avatrade: Retail, Professional, and Islamic accounts with fixed and floating spreads.

Eightcap: Standard and RAW accounts with a focus on variable spreads.

✅ Avatrade's account types are better suited for a variety of trader profiles—from Islamic traders to professionals.

Market Instruments

When we talk about Avatrade Vs Eightcap in terms of available assets:

Avatrade: Offers over 1,250 instruments, including Forex, stocks, indices, commodities, crypto, ETFs, bonds, and options.

Eightcap: Offers around 800 instruments, with a strong emphasis on crypto trading.

✅ Avatrade provides a more diverse portfolio, suitable for traders who want broad market exposure.

⚙️ Leverage & Margin

Leverage can vary depending on your jurisdiction:

Avatrade: Up to 1:400 in some regions.

Eightcap: Also offers up to 1:500 under certain conditions.

Although Eightcap might offer higher leverage, Avatrade’s risk controls and negative balance protection are more refined.

✅ Avatrade provides stronger risk management, which is crucial for long-term success.

🎓 Education & Customer Support

One of Avatrade's biggest advantages lies in its rich educational ecosystem.

Avatrade: Offers video tutorials, eBooks, market analysis, and daily webinars.

Eightcap: Provides basic articles and market updates.

✅ Avatrade’s trader education platform is designed to help new traders become profitable faster.

📞 Customer Service

Avatrade: 24/5 multilingual support via live chat, phone, and email.

Eightcap: Also offers 24/5 support but with slightly slower response times during high traffic.

✅ Avatrade offers faster, more comprehensive support, especially for international users.

💼 Deposit & Withdrawal Methods

Both brokers offer similar payment methods: bank wire, credit cards, e-wallets (Skrill, Neteller), and crypto.

Avatrade: Processes most withdrawals within 24–48 hours.

Eightcap: Takes about 2–3 business days.

✅ Avatrade stands out for faster, hassle-free withdrawals—a huge plus for active traders.

🚀 Marketing Edge: Why Avatrade is the Better Choice in 2025

If you’re still asking Avatrade Vs Eightcap—who is better?, the answer leans heavily toward Avatrade for several strategic and performance reasons:

✅ More regulatory coverage = greater trust and fund security✅ More instruments = more trading opportunities✅ No commissions = beginner-friendly cost structure✅ Superior customer service and education = better trader support✅ Fast withdrawals = improved trading convenience

Open an account with Avatrade today and experience a platform built with trader success in mind. Whether you're looking for powerful tools, tight security, or simplified trading, Avatrade delivers on all fronts.

❓ FAQs about Avatrade Vs Eightcap

1. Which broker is better for beginners—Avatrade or Eightcap?Avatrade, thanks to its simplified pricing, educational content, and risk management tools.

2. Does Avatrade offer copy trading?Yes, via ZuluTrade and DupliTrade.

3. Can I trade crypto with Avatrade?Absolutely. Avatrade offers 24/7 crypto trading on various major pairs.

4. Which has better regulation?Avatrade, with Tier-1 oversight across multiple regions.

5. Is Eightcap good for scalping?Yes, due to its RAW account with tight spreads—but mind the commission fees.

6. Who offers more instruments?Avatrade with over 1,250 tradable assets.

7. How fast are withdrawals with Avatrade?Typically within 24–48 hours.

8. Can Muslim traders use Avatrade?Yes, Islamic accounts are available.

9. Is customer service better with Avatrade?Yes, it's more responsive and multilingual.

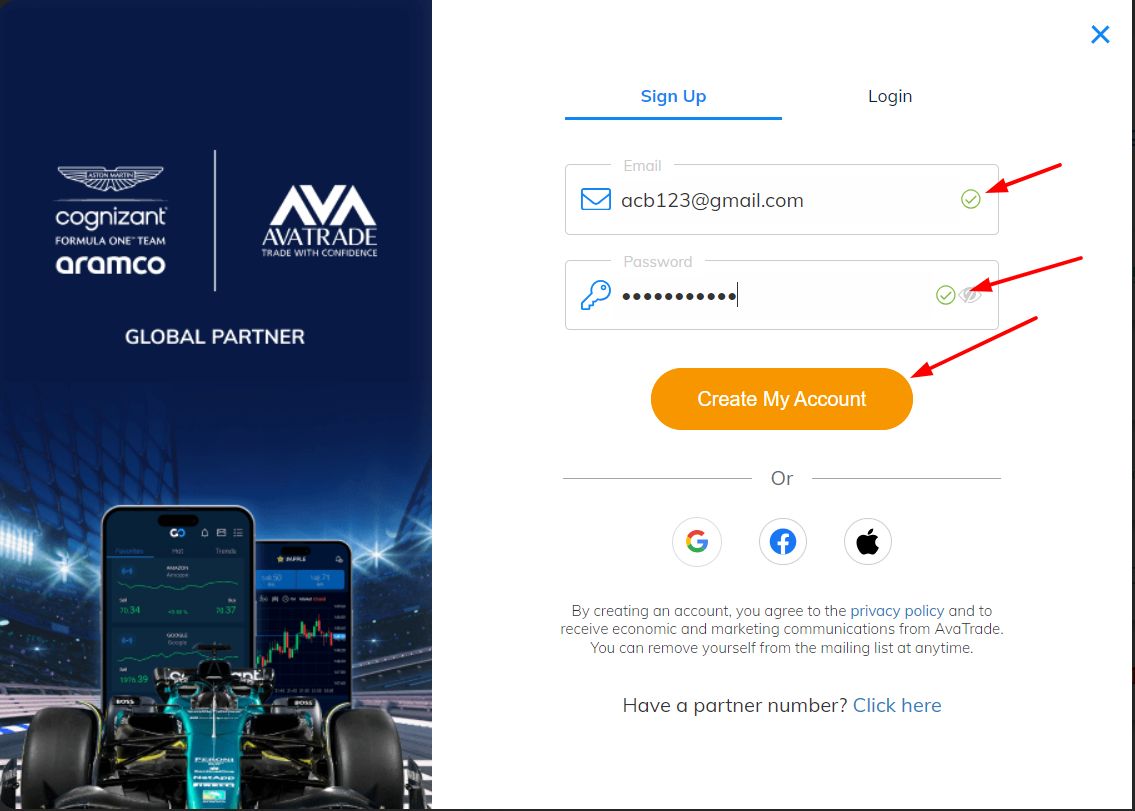

10. How do I start trading with Avatrade?Simply sign up, verify your identity, deposit funds, and start trading instantly. 👉 Open Avatrade Account Fast!

Final Verdict: If you’re serious about trading in 2025, Avatrade is your best bet. Don’t settle for less—choose a broker that grows with your goals.

💥 Read more:

Avatrade Vs Pepperstone 2025: Compared - which is better broker?

Avatrade Vs Interactive brokers 2025: Compared - which is better broker?