6 minute read

Avatrade Copy Trading Review 2025: Pros & Cons A Comprehensive Review

from Avatrade Review

by ForexMakets

Avatrade Copy Trading Review 2025: Pros & Cons A Comprehensive Review

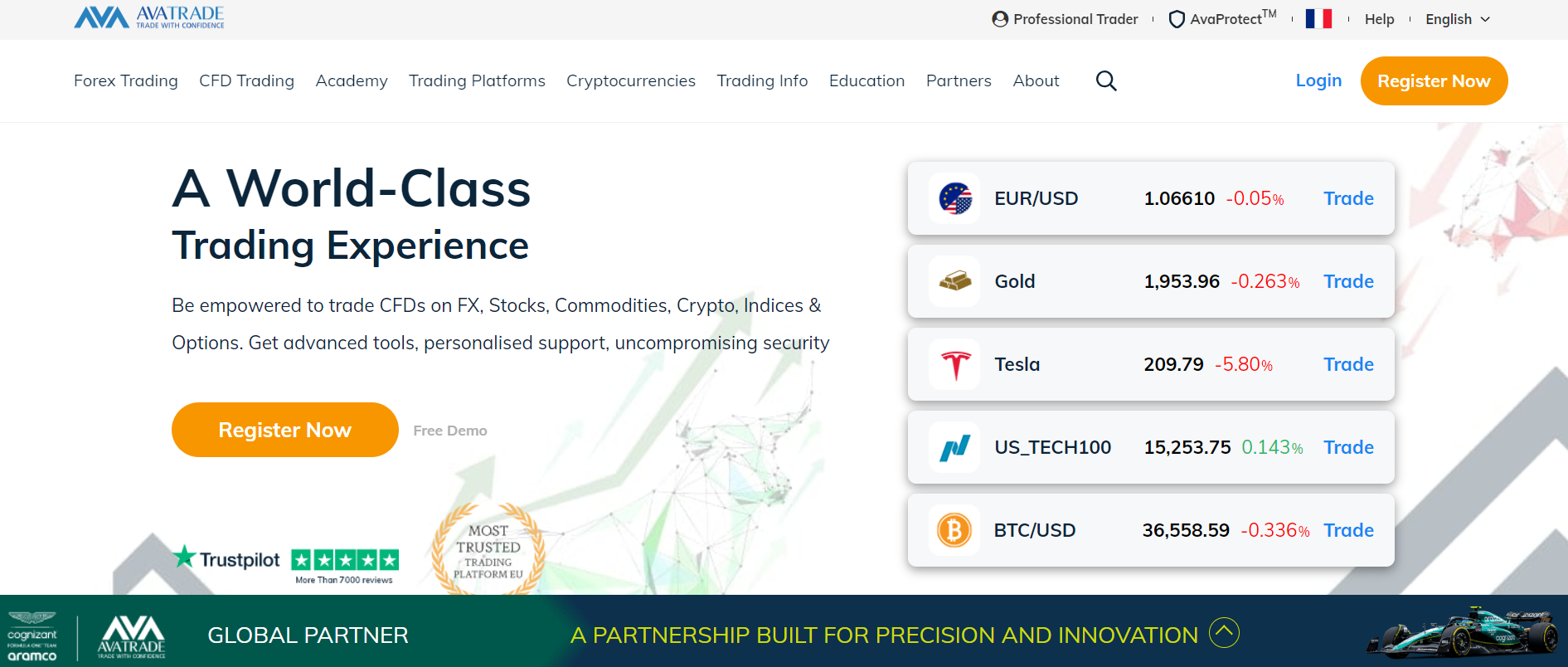

In the ever-evolving world of forex trading, finding a platform that is not only reliable but also user-friendly is crucial to success. Avatrade, a globally recognized broker, has made significant waves in the industry with its copy trading feature. As we dive into 2025, traders—both new and experienced—are exploring whether Avatrade Copy Trading is the game-changer they need.

This in-depth review unpacks every aspect of the platform to help you make an informed decision, without the confusion and clutter. ✅

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. Introduction to Avatrade Copy Trading

Avatrade, founded in 2006, has grown into one of the most reputable forex brokers globally. With regulation in multiple jurisdictions and a commitment to secure trading, Avatrade provides a robust platform for forex, CFD, and now—copy trading.

Copy trading is the process of automatically replicating the trades of seasoned investors, which enables beginners to enter the forex market with lower risk and less stress. In 2025, this method is rapidly gaining traction due to its accessibility and potential for passive income.

2. What is Copy Trading and How It Works

Copy trading allows users to mirror the actions of professional traders in real-time. When a trader opens or closes a position, that same action is replicated in your account proportionally.

The core mechanism involves:

Choosing a signal provider (professional trader)

Allocating funds for copying

Automatic execution of trades

Monitoring performance and making adjustments

Unlike traditional trading, copy trading reduces the need for deep market analysis and allows newcomers to leverage the expertise of others.

3. Why Avatrade Stands Out in 2025

In 2025, many platforms offer copy trading, but Avatrade excels due to several key differentiators:

Regulation by top-tier authorities (Central Bank of Ireland, ASIC, FSCA)

Integration with top copy trading software like DupliTrade and ZuluTrade

Fast execution speed and low latency ✅

Intuitive mobile and desktop platforms

Extensive educational support for new traders

4. Key Features of Avatrade Copy Trading

Some of the most valuable features in Avatrade’s ecosystem include:

Multi-platform support: Compatible with MetaTrader 4/5, DupliTrade, and ZuluTrade

Diverse asset selection: Forex, commodities, indices, crypto, and more

Trader analytics: Performance history, risk level, strategy type

Adjustable risk settings: Control over lot size and maximum loss

5. Pros of Using Avatrade for Copy Trading

✅ Beginner-friendly: No deep market knowledge required

✅ Diverse trading opportunities: Follow traders in various markets

✅ Secure environment: Strict regulations and fund segregation

✅ Educational content: Webinars, eBooks, trading guides

✅ Risk management tools: Stop-loss, copy trading limits

6. Cons and Limitations ❌

❌ Limited manual control: Traders relying heavily on automation might overlook risk factors

❌ Performance variance: Past performance does not guarantee future returns

❌ Requires ongoing monitoring: Copying trades is not a “set and forget” strategy

❌ Minimum deposit: May be higher depending on platform (e.g., ZuluTrade)

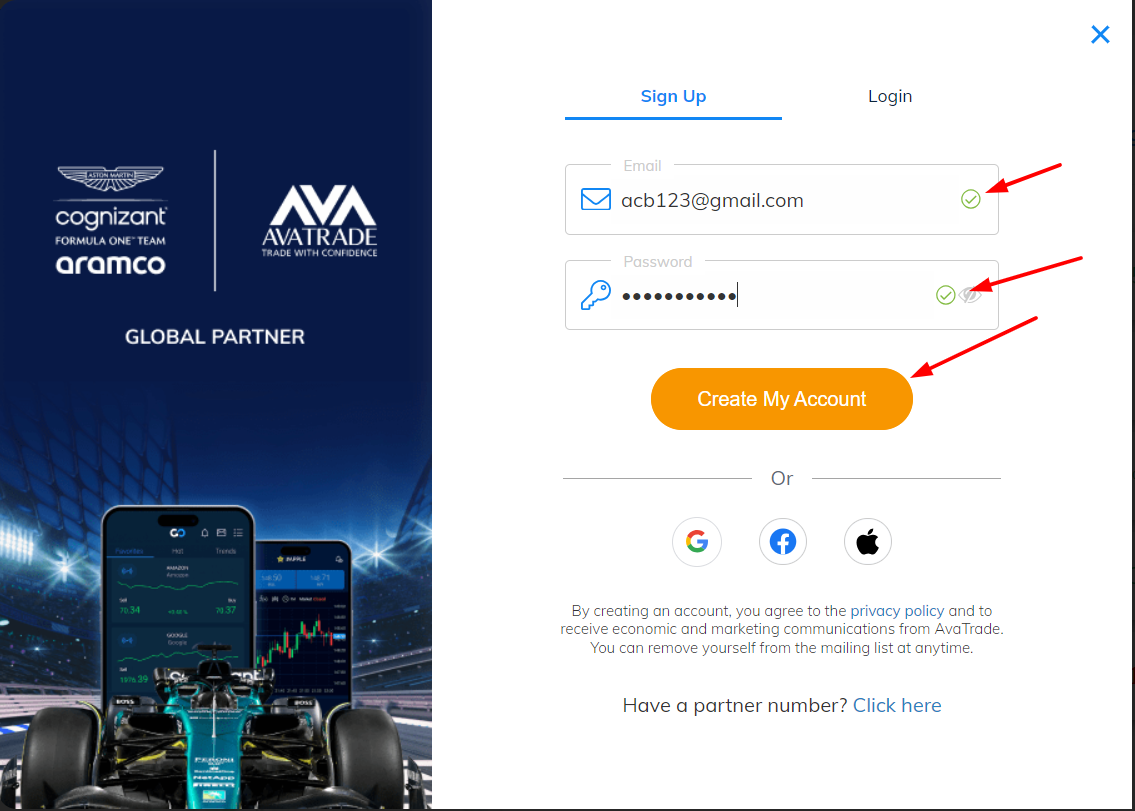

7. Step-by-Step: How to Start Copy Trading on Avatrade

Verify your identity to comply with KYC regulations

Choose a copy trading platform: ZuluTrade or DupliTrade

Browse available traders and evaluate their performance

Allocate funds and adjust risk settings

Start copying and monitor trades regularly ✅

8. Best Strategies When Using Avatrade Copy Trading

To maximize success:

Diversify among multiple traders

Choose traders with consistent monthly gains rather than occasional spikes

Monitor risk scores and drawdown statistics

Reassess and adjust your portfolio monthly

Avoid emotional decisions based on short-term loss

9. Copy Trading vs. Traditional Forex Trading

Here’s how they differ:

Copy Trading: Automated, relies on expert’s decisions, great for beginners

Traditional Trading: Manual, requires deep analysis, more control

Copy Trading: Lower time commitment

Traditional Trading: Higher learning curve

10. Is Avatrade Safe and Regulated?

Yes. ✅ Avatrade is fully regulated in several countries:

Europe: Central Bank of Ireland

Australia: ASIC

South Africa: FSCA

Japan: FSA

They also implement negative balance protection, SSL encryption, and segregated accounts to protect client funds.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

11. Mobile Experience and Platform Interface

Avatrade’s mobile app offers:

Rime trade execution

Easy switching between manual and copy trading

Notifications and trade summaries

Intuitive UI for beginner users

It integrates with ZuluTrade’s mobile platform for seamless copy trading.

12. Fees and Minimum Deposit

No commission on most trades

Spreads starting from 0.9 pips

Minimum deposit typically around $200 (may vary with platform)

No deposit or withdrawal fees ✅

13. Tips for Choosing the Right Trader to Copy

Look for low drawdown and high consistency

Prefer those with verified accounts

Study their strategy description

Avoid traders with sudden high returns over short periods

Follow traders with at least 1 year of history

14. Marketing Bonuses and Promotions ✅

In 2025, Avatrade offers:

Welcome bonus up to $10,000 (terms apply)

Referral bonuses when inviting friends

Seasonal contests with cash prizes

Loyalty rewards for high-volume traders

These promotions make opening an account not just rewarding—but exciting.

15. Real User Experiences and Feedback

Many users highlight:

Ease of use for new traders

Reliable support team

Transparent trader performance metrics

Some suggest adding more advanced filtering options

Overall sentiment is highly positive, especially among passive investors.

16. Frequently Asked Questions

Q1: Can I lose money with copy trading?A1: Yes. While risk is reduced, it is never eliminated.

Q2: How do I stop copying a trader?A2: You can stop anytime via the copy trading dashboard.

Q3: Is Avatrade good for beginners?A3: Absolutely. It’s designed with educational tools and simple interfaces.

Q4: Can I copy multiple traders at once?A4: Yes. Diversification is encouraged.

Q5: How often can I change traders?A5: As frequently as you wish, instantly.

Q6: What happens if the trader I copy stops trading?A6: You will stop receiving trades. You can switch to another trader.

Q7: Are there hidden fees?A7: No. All costs are transparent and clearly outlined.

Q8: Is copy trading passive income?A8: It can be. But like all investments, monitoring is important.

Q9: Is my capital safe?A9: Avatrade uses top-tier protections, but forex always carries risk.

Q10: Can I withdraw my funds anytime?A10: Yes. There are no restrictions on withdrawals.

17. Final Verdict: Should You Join Avatrade Copy Trading in 2025?

If you're a trader looking for a simplified entry into the forex world, or a passive investor aiming for steady returns, Avatrade’s copy trading platform is a powerful tool to have in your arsenal.

✅ Regulated, intuitive, and rich in features—it’s tailor-made for modern traders.

Don’t just trade. Trade smarter.

Ready to start? Open your Avatrade account today and copy your way to success.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker