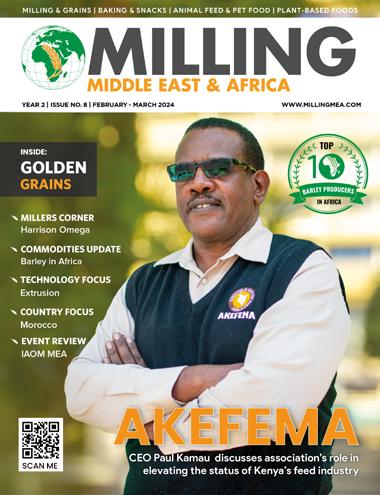

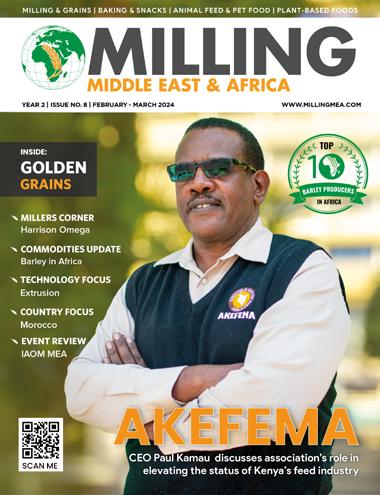

INSIDE: GOLDEN GRAINS

MIDDLE EAST & AFRICA

MILLERS CORNER

Harrison Omega

COMMODITIES UPDATE

Barley in Africa

TECHNOLOGY FOCUS

Extrusion

COUNTRY FOCUS

Morocco

EVENT REVIEW

IAOM MEA

Regional Forum

MILLING

MILLING & GRAINS | BAKING & SNACKS | ANIMAL FEED & PET FOOD | PLANT-BASED FOODS YEAR 2 | ISSUE NO. 8 | FEBRUARY - MARCH 2024 WWW.MILLINGMEA.COM

CEO Paul Kamau discusses association’s role in elevating the status of Kenya’s feed industry

TOP IN AFRICA

BARLEY PRODUCERS

SCAN ME

THE CEO SUMMIT ON THE FUTURE OF SUSTAINABLE FOOD SYSTEMS IN AFRICA AFRICA FUTURE FOOD SUMMIT Safari Park Hotel, Nairobi, Kenya SEPTEMBER 10-12, 2024 info@fwafrica.net +254 725 343 932 www.africafuturefoodsummit.com INVESTING IN & FUNDING FOOD ENTERPRISES FOOD INNOVATION FOOD NUTRITION & SUSTAINABILITY FOOD MARKETS, TRADE & LOGISTICS FOOD TECHNOLOGY KEY AGENDA ISSUES WELCOME TO REGENERATIVE AGRICULTURE SCAN ME Events

24

FEATURE

30

EXECUTIVE INTERVIEW - MARK LYONS, MD, GOLDEN GRAIN GROUP INTERNATIONAL

Golden Grain Discusses Flour Milling Expertise for Africa

33

MILLERS CORNER - HARRISON OMEGA

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 1 CONTENTS YEAR 2 | ISSUE NO. 8 | FEB-MARCH 2024

(AKEFEMA)

- ASSOCIATION OF KENYA FEED MANUFACTURERS

Empowering millers, feeding a nation

on the do's

of

milling ON THE COVER - Paul Kamau, CEO, Association of Kenya Feed Manufacturers

Harrison Omega

and dont's

feed

•

•

• Bunge introduces plant-based alternative to butter in the

• Selu Limited to invest US$80M at Galana Kulalu after successful pilot phase

• DSM-Firmenich to separate Animal Nutrition & Health division amid vitamin market downturn

• Ethiopia launches Jigjiga flour and bread factory in Somali Region

• Tunga Nutrition Uganda launches a new plant in Kampala

• Kitui Flour Mills to acquire 100% stake in Rafiki Millers

• Cameroon allocates US$698M to wheat import

with

• Puratos unveils sourdough made with regeneratively farmed flour

• Bühler eyes emerging rice processing opportunities in Saudi

• Kemin Industries introduces new blend to enhance freshness of dry bakery products

• GoodMills Innovation unveils Slow Milling ingredients for artisanal baking

• Omas Industries expands into UK and northern Europe

successfully concludes sale of South Korean business

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 2 Supplier News & Innovations:

acquisition

Dawn Foods expands bakery solutions portfolio

Royal Steensma

Arabia

6 52 CONTENTS YEAR 2 | ISSUE NO. 8 | FEB-MARCH 2024 Persistent drought threatens food security prospects Extrusion, the decades old technology driving new product development in thee 21st century 42 36 30 50 46 Editorial News Update:

Ingredion

4

East

Middle

substitution program TECHNOLOGY FOCUS - EXTRUSION COUNTRY FOCUS - MOROCCO

10 - BARLEY PRODUCERS IN AFRICA COMMODITIES UPDATE - BARLEY IN AFRICA 42 46 36

REVIEW

IAOM MEA REGIONAL FORUM 2024

TOP

EVENT

-

Your Team for Great Flour

The Flourists, Part 5: Baking Technology

Protecting Baking Traditions through Innovative Ideas.

Baking industry demand for suitable ours is rising globally, and we’re supplying highly speci c answers. Developers of individual our treatment concepts: The Flourists, an interdisciplinary, worldwide networked team of experts who put their all into adapting our characteristics to the requirements of local baking applications. Thanks to our regional Technology Centers, customers get unique our additives developed locally, that are designed specifically for local baking traditions and varying grain qualities. The result: Diversity in baking culture and consistently good baking quality in ours, for professional and home use.

#the

ourists muehlenchemie.com

MILLING

MIDDLE EAST & AFRICA

Year 2 | Issue No.8 | Feb-March 2024

FOUNDER & PUBLISHER

Francis Juma

SENIOR EDITOR

Paul Ongeto

EDITORS

Martha Kuria | Wangari Kamau

BUSINESS DEVELOPMENT DIRECTOR

Virginia Nyoro

BUSINESS DEVELOPMENT ASSOCIATE

Vivian Kebabe

HEAD OF DESIGN

Clare Ngode

CINEMATOGRAPHER

Newton Lemein

ACCOUNTS

Jonah Sambai

Published By: FW Africa

P.O. Box 1874-00621, Nairobi Kenya

Tel: +254725 343932

Email: info@fwafrica.net

Company Website: www.fwafrica.net

Quality Feeds for Quality Animals

Welcome to the eighth edition of Milling Middle East and Africa Magazine.

Kenya's animal feed market is experiencing significant growth, driven by rising protein demand, a larger livestock population, and informed farmers seeking quality feed to maximize livestock returns.

As the industry expands, stakeholders have revitalized the previously inactive Association of Kenya Feed Manufacturers (AKEFEMA) with a singular mission: fostering a conducive environment for feed businesses and promoting profitable livestock farming through the production of high-quality animal feed.

One year into his tenure, CEO Paul Kamau expresses pride in the association's achievements under his leadership. Operational structures are now established, and dedicated committees address specific industry challenges, including technical expertise, trade, and public relations.

With these structures in place, the association is now tackling a pressing "triple threat": the availability of raw materials, feed quality, and cost, which are currently the Kenyan feed industry's biggest challenges.

how the country is navigating this challenge and others impacting the grain and milling industry.

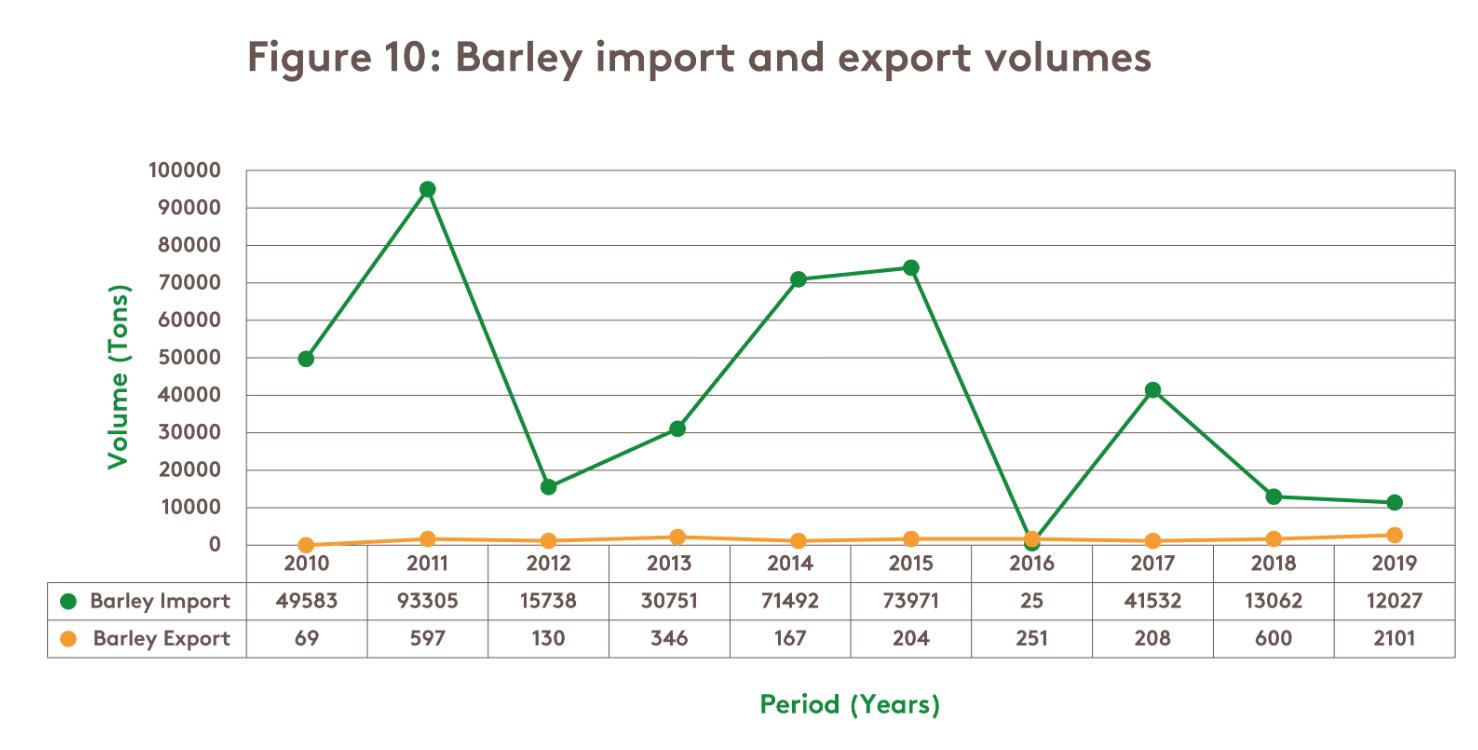

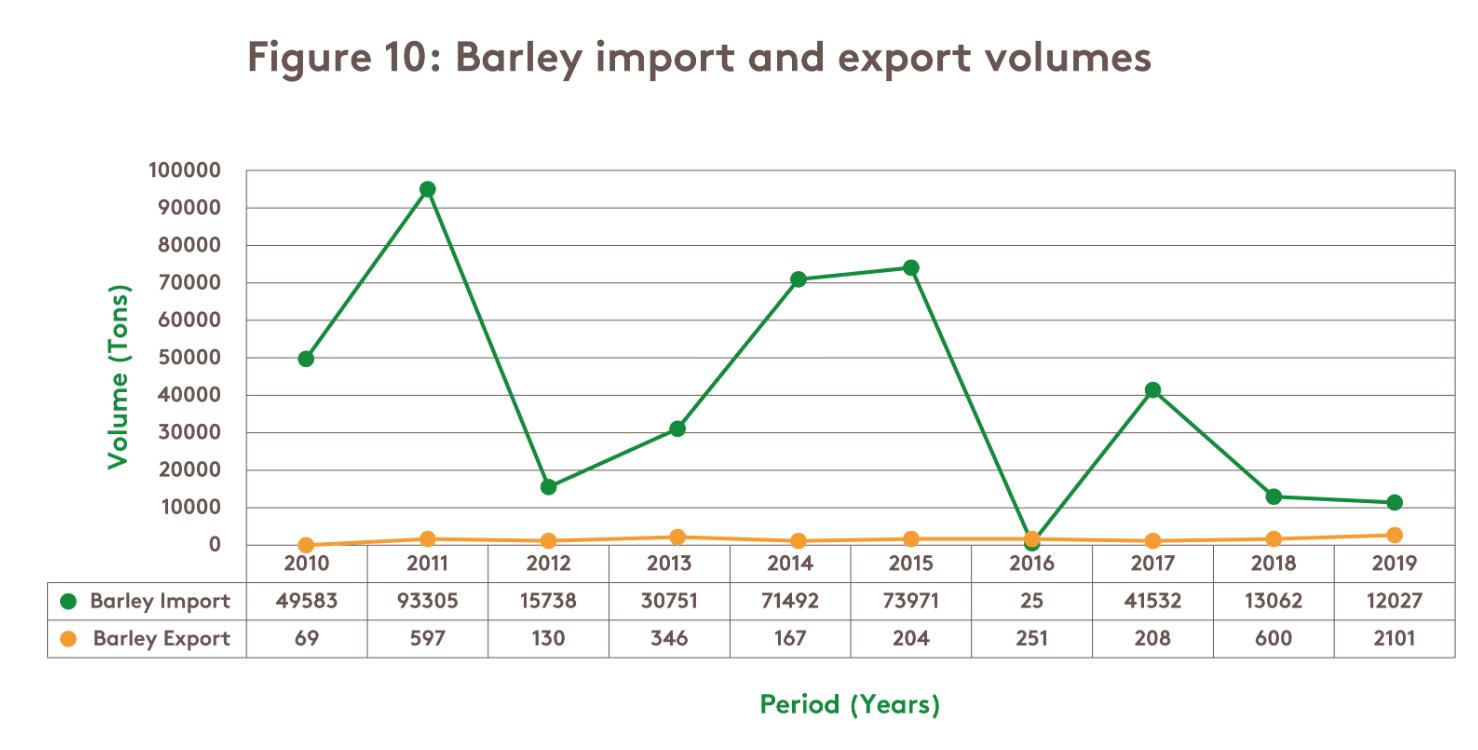

Barley, essential for feed for Moroccan and North African livestock farmers, is not widely produced in Africa. We analyze production forecasts for the 2023/24 season in our "Commodity Update," focusing on the handful of producers – Ethiopia, Morocco, Algeria, and South Africa –that account for over 80% of Africa's production.

Milling Middle East & Africa is published 4 times a year by FW Africa. Reproduction of the whole or any part of the contents without written permission from the editor is prohibited. All information is published in good faith. While care is taken to prevent inaccuracies, the publishers accept no liability for any errors or omissions or for the consequences of any action taken on the basis of information published.

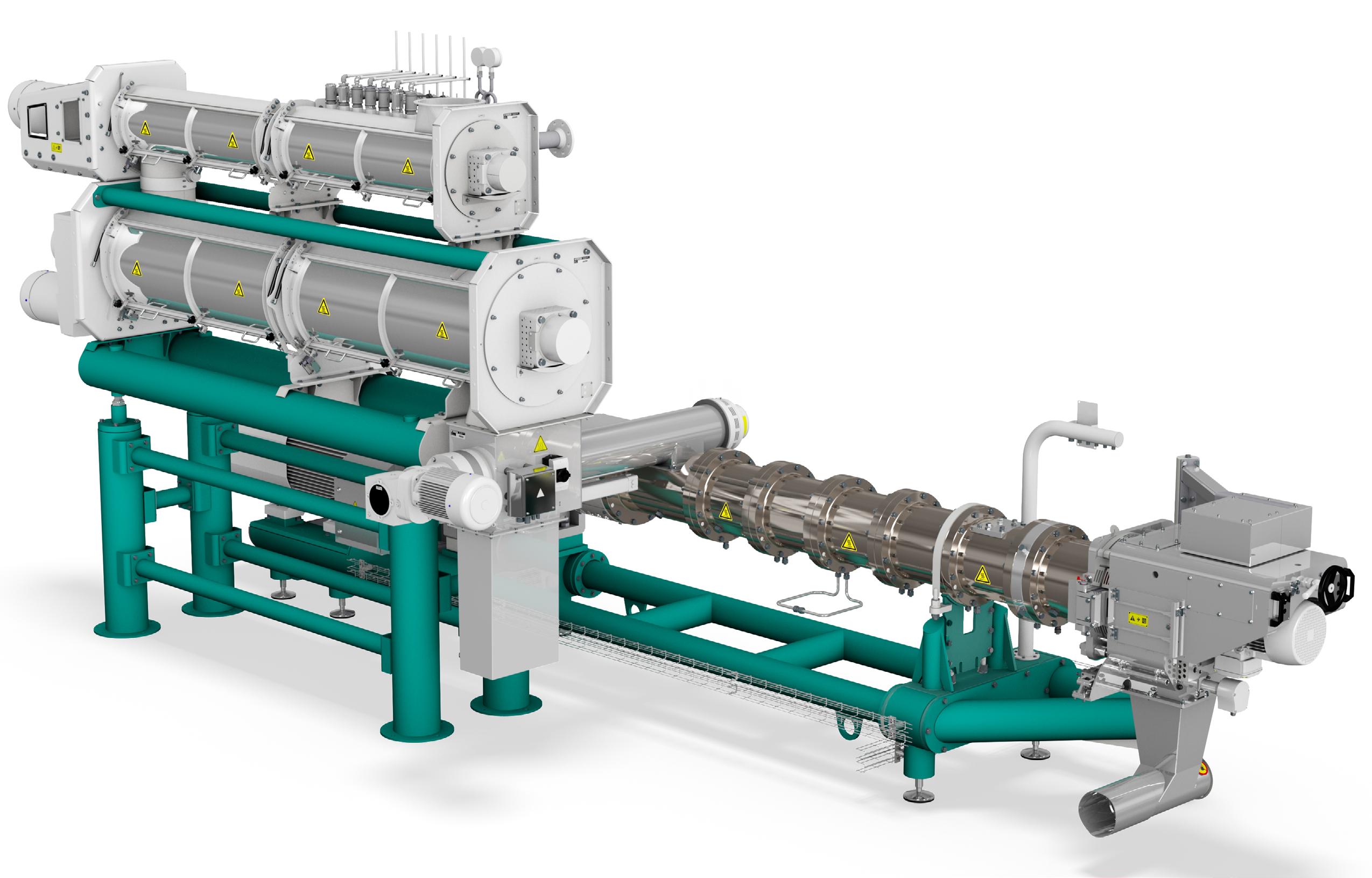

Harrison Omega, Process Supervisor - Feed Mill and Soy Extrusion Plant at Unga Group Limited, acknowledges the valuable role AKEFEMA plays in the industry. In our "Millers' Corner," he shares essential insights on animal feed milling best practices.

Morocco's feed industry faces a shortage of its primary raw material: barley. Our "Country Focus" examines

This issue also explores extrusion technology, the top 10 barley producers in Africa, and the latest news from Africa, the Middle East, and the world.

We hope that you enjoy your read.

Paul Ongeto Senior Editor

FW Africa

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 4

EDITORIAL

OUR PUBLICATIONS WWW.FWAFRICA.NET MILLING MIDDLE EAST & AFRICA Food Africa Business HealthCare MIDDLE EAST & AFRICA www.foodsafetyafrica.net www.healthcaremea.com www.ceobusinessafrica.com www.freshproducemea.com www.dairybusinessafrica.com www.foodbusinessafrica.com www.millingmea.com www.sustainabilitymea.com Packag ng AFRICA SUSTAINABLE

COMPLETE PLANT SOLUTION PARTNER

UNDERSTANDING YOU. STANDING BY YOU.

As leaders in our industry, we understand the intricacies and challenges involved in running an efficient feed and biofuel plant.

That’s why we have dedicated ourselves to being your go-to-partner, offering complete plant solutions, tailored to your exact specifications and needs.

Leveraging our extensive processing expertise and experience, we ensure the lowest possible total cost of ownership. But we don‘t stop there. With meticulous attention to detail and unwavering dedication, we guide you through every phase – from delivery to commissioning and tackle any challenge, ensuring the success of your project.

Choose ANDRITZ Complete Plant Solutions for a secure, consistent, and end-to-end experience that takes you from PLAN to PLANT, whether it‘s a green or brown field. Trust in our expertise, reliability, and commitment to delivering excellence.

Find out how our complete plant solutions can serve your business at andritz.com/ft.

A/S T: +971 (04) 214 6546

Andritz.com/ft

ANDRITZ FEED & BIOFUEL

/ Email: andritz-fb.uae@andritz.com

FEED & BIOFUEL

BY WWW.MILLINGMEA.COM

Bunge introduces plant-based alternative to butter in the Middle East

MEA – Bunge, a global leader in food and agribusiness, has announced the launch of Beleaf™ PlantBetter in the Middle East and Africa region.

This innovative plant-based alternative to butter, celebrated for its exceptional taste, texture, and versatility comparable to dairy butter, follows the successful launch of Eleplant, the retail version of Beleaf PlantBetter, in Europe last November.

Beleaf PlantBetter is poised to address the growing demand for highquality, environmentally responsible

FOOD SECURITY

butter substitutes.

Bunge will introduce this groundbreaking plant-based innovation at the Gulfood expo in Dubai from February 19 to 23, 2024, at booth Z1-F3 in Za’abeel Hall 1.

As the demand for dairy alternatives continues to soar, Beleaf PlantBetter emerges as the solution to the challenges faced by food manufacturers and bakers seeking plant-based alternatives that replicate the sensory qualities and functional versatility of traditional dairy butter.

TARI launches five-year project to boost drought-tolerant rice farming

TANZANIA – The Mbeya-based Tanzania Agricultural Research Institute (TARI) Uyole Centre has launched a-five-year drought-tolerant rice growing project geared to support Tanzania’s efforts towards becoming an African food basket.

Launching the project, coordinator from TARI, Dr Dennis Tippe said that the

FOOD SECURITY

efforts were as a result of collaboration between agricultural researchers and experts from at least 17 countries.

Sponsored by International Rice Research Institute (IRRI), the project is aimed at enhancing production in the country, according to Dr Tippe.

“This is very possible as the project is mostly characterized by modern farming technologies. It is implemented

in the southern highlands zone, the area that provides over 40 percent of the rice in the country.

“We will have demonstration farms to sharpen extensions officers and rice farmers’ knowledge, including an application of modern technologies, hence, phasing out all tra- ditional farming methods,” he said.

Kenya to revive stalled US$122M Soin-Koru dam in a bid to boost rice production

KENYA – In a fresh attempt to revive the stalled KES 19.9 billion (US$122M) Soin-Koru dam project, the government has started negotiation with contractors to resume work in a bid to bolster rice production in Ahero irrigation scheme.

This comes six months after the contractor, China Jianxi International Kenya Limited and China Jianxi International Economic and Cooperation Company Limited, suspended operations citing non-payment.

Speaking during a tour of the project,

Zachariah Njeru, Water and Irrigation Cabinet Secretary has assured the public that the Government was committed to ensure that the project located on the border of Kisumu and Kericho counties, takes-off to boost rice production in Ahero.

The project fully funded by the Government of Kenya, started on 27th August 2022 after nearly three decades of planning. The contractor was demanding KES 846.5 million (US$5M) before resuming excavation works.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 6

INNOVATION

NEWS UPDATES

JBS invests US$117M in 3 new Brazilian feed factories to boost Seara’s production capacity

BRAZIL – JBS, a leading global food company, is finalizing investments totaling 570 million reais (approximately US$117 million) for constructing three new feed factories in Southern Brazil to align input supply with the expanding production capacity of Seara Foods.

The new facilities, located in Seberi (RS), Santo Inácio (PR), and Itaiópolis (SC), aim to enhance feed production by over 1 million tonnes per year, further solidifying JBS’s commitment to bolstering Seara’s presence in the poultry and swine segments.

“The new factories are equipped with the latest automation and feature the highest available technology for

input production. These investments demonstrate our continuous effort to expand our production capacity,” stated João Campos, President of Seara.

“By reinforcing our presence in these cities, we strengthen our commitment to the socio-economic development of the regions where we operate.”

The investments underline JBS’s commitment to leveraging the latest automation and technology for input production, ensuring enhanced control over the quality of the final products. The expansion is anticipated to strengthen Seara’s production capacity and contribute to the socio-economic development of the regions involved.

COMMODITY TRADING

DSM-Firmenich to separate Animal Nutrition & Health division amid vitamin market downturn

NETHERLANDS – DSM-Firmenich has announced plans to separate its Animal Nutrition & Health (ANH) division from the broader group.

This move is aimed at insulating the division from the volatile vitamins market, a decision prompted by the division's substantial performance challenges.

The company believes that unlocking the full potential of the ANH business requires a different ownership structure. As such, DSM-Firmenich is exploring various separation options and anticipates completing the process by 2025.

The decision to separate follows a tumultuous year in 2023, marked by persistent low prices in the vitamins market.

In its full-year 2023 earnings forecast, DSM-Firmenich estimated an

adverse impact of approximately €500 million from vitamin price fluctuations, along with a further negative effect of around €90 million due to foreign exchange dynamics.

To address these challenges, DSMFirmenich unveiled comprehensive restructuring plans for its vitamins business in its Q2 2023 trading update.

These plans include the closure of a second vitamin production facility in China and extended shutdowns of Swiss vitamin plants.

These restructuring efforts are expected to yield annual savings of approximately €200 million (US$215.59m) and are projected to contribute €100 million (US$108m) to adjusted EBITDA in 2024, with the full €200 million (US$215.59m) contribution expected in 2025.

New high yielding, stress tolerant maize variety making breakthrough in Somalia’s agriculture

SOMALIA – Maize farmers in Somalia have hailed a new hybrid maize variety, already registering a staggering 30 to 50% increase in yield potential as compared to local varieties since its introduction late last year.

Dubbed Siman, the high-yielding variety has been termed as a significant breakthrough for Somalia’s agriculture.

The new variety was officially registered in October 2023, heralding a new era for variety release in the country and it is a testament to the power of collaboration and innovation in agriculture.

According to experts, the hybrid not only exhibits uniformity in the field but also matures a week earlier than local varieties and performs better under moisture and nutrient stress.

It owes its origins to CIMMYT’s Stress Tolerant Maize for Africa (STMA) program, generously supported by the Bill and Melinda Gates Foundation (BMGF) and USAID.

The milestone is the hard work of Filsan Seed Company in partnership with the International Maize and Wheat Improvement Center (CIMMYT) aimed at boosting maize production in Somalia.

The variety has been greatly embraced by farmers, reporting impressive harvests.

According to Farhia Mohamud Mohamed, leader of Deeq Agriculture Cooperative, a 5-ha plot yielded a harvest of 136 bags of Siman grain each weighing 100 kg, compared to a mere 120 kg from the local variety on 25 ha.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 8 NEWS UPDATES

FOOD SECURITY STRATEGY

SARIT EXPO CENTRE, NAIROBI, KENYA JUNE 12-14, 2024 Dairy AFRICA MANUFACTURING EXPO www.dairymanufacturingafrica.com SCAN ME Africa Dairy 2.0 - Taking Africa's Dairy Industry into the Next Level through Innovation & Sustainability AFRICA’S NO.1 DAIRY INDUSTRY TRADE SHOW & CONFERENCE SIGN UP TO ATTEND , SPONSOR & EHIBIT Events

Nairobi Flour Mills puts business on sale

KENYA – The Nairobi Flour Mills, renown for Jimbi maize and wheat brands, have put up the business for sale at an asking price of KES400 million (US$2.5M).

Prospective buyers of Nairobi Flour Mills will take over its assets including equipment, Godowns, offices and two plots measuring 1.124 acres in Nairobi’s Industrial Area.

“The sale price is Sh400 million, negotiable. The owners closed down the milling plant. They are too old to manage it and this is why they are putting it up for sale,” a source familiar with the matter told Business Daily.

With a production capacity of 255 tonnes per day, the plant has two lines for producing two-kilogram packets of flour and one line for processing onekilogram packets of flour.

Interested buyers were advised that the facility is ideal for an agricultural cooperative society dealing in maize value addition.

Kenya targets 80M bags of maize in 2024, opens aflatoxin testing center in Meru

KENYA – Kenya aims to produce 80 million bags of maize, its staple crop, in 2024 to enhance self-reliance in food production.

Agriculture Cabinet Secretary Mithika Linturi disclosed that farmers yielded 61 million bags of maize in 2023, emphasizing the need for proper storage to ensure food security.

Speaking at the inauguration of a

new aflatoxin testing laboratory at the National Cereals and Produce Board (NCPB) depot in North Imenti, Meru County, Linturi highlighted the dangers of aflatoxins, which are highly toxic substances affecting grains and posing health risks to animals and humans, including cancer.

The establishment of the aflatoxin testing laboratory aims to safeguard the safety of consumed food, especially in regions like Meru, which has a high prevalence of cancer. Linturi underscored the importance of producing safe food to combat health issues.

Expressing optimism, Linturi mentioned the government's intensified distribution of fertilizer to farmers and its target of producing 80 million bags of maize in the current year, surpassing the national consumption average.

He highlighted the distribution of mobile maize dryers to assist farmers in drying their crops properly, emphasizing the government's efforts to mitigate post-harvest losses.

INVESTMENT

Ethiopia launches Jigjiga flour and bread factory in Somali Region

ETHIOPIA – Abiy Ahmed, Prime Minister of the Federal Democratic Republic of Ethiopia has presided over the inauguration of Jigjiga Flour and Bread Factory in Somali Region.

The PM was accompanied by First Lady Zinash Tayachew during Somali Regional State visit where they oversaw different development projects on February 13.

According to Abiy, the project is one of the many pro-poor initiatives led by the Office of the First Lady and marks the eighth out of twelve factories being built across the country.

This is “a step forward in our journey towards sustainable development and support for our communities,” he noted.

In Ethiopia, wheat is the second cereal cultivated after corn. While production in the country is one of the highest on the continent, the processing segment is still struggling to meet domestic demand.

By 2020, the Ethiopian Milling Association (EMA) reported that its affiliate members were operating at only 20% to 30% of their installed capacities because of wheat shortages, with the average national milling capacity estimated at 50%.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 10 NEWS UPDATES

MARKET UPDATE MARKET UPDATE

Africa’s Largest Food Manufacturing, Retail & HORECA Industry Trade Shows FOOD Afmass EXPO Transforming Africa’s Food Systems SIX PAVILLIONS THAT COVER THE FOOD INDUSTRY FROM A-Z +254 725 343932 www.afmass.com info@fwafrica.net SCAN ME KENYA NIGERIA SEPTEMBER 17-19, 2024 Afmass NIGERIA EXPO FOOD Afmass UGANDA EXPO FOOD SEPTEMBER 3-5, 2024 FOOD Afmass EXPO Eastern Africa JUNE 12-14, 2024 UGANDA TEA, COFFEE C COA AFRICA EXPO & Events

Egypt seeks US$145M to establish six wheat silos in 2024

Mondelez to close biscuit factory in France putting 61 jobs at stake

FRANCE – Mondelez International has announced closure of its biscuit plant in France by the end of 2025 to “safeguard its competitiveness.”

The move would lead to loss of 61 jobs at the plant by mid-2026.

According to the company, production at the Château-Thierry site in Aisne, northern France will be phased out over the next two years.

In a statement, Mondelez stated that the Château-Thierry site has no capacity for new production lines and its current production rate is lagging behind its other sites.

“Despite the measures taken in recent years to optimise production, production at Château-Thierry costs on average twice as much as other Mondelez International sites in the rest of Europe, with no prospect of improvement,” a statement read.

EGYPT – Egyptian authorities plans to establish six wheat silos in 2024 at an investment cost of US$145.6 million, Zawya has reported.

The French Development Agency (AFD) will finance the project with US$61.5 million, with the country to provide the remaining sum of US$84.1 million, according to sources.

The move aims to shore up the country’s storage capacity of wheat silos by 420,000 tonnes to reach a total capacity of 4.620 million tonnes, representing about 10% of the country’s current total capacity,

The sources pointed out that the

ACQUISITION

government is targeting to increase the storage capacity of state-owned wheat silos by at least 2.5 to 3 million tonnes within three to four years to reach a capacity ranging between 6.4 and 7 million tonnes.

The announcement comes after Egypt’s state grains buyer, the General Authority for Supply Commodities (GASC) revealed that it plans to purchase more than 5 million tonnes (MT) of wheat in 2024 through international tenders.

This objective is an increase of 500,000 tonnes compared to imports made in 2023.

Petsource by Scoular completes US$75 million expansion

USA – Petsource, an indirect subsidiary of Scoular known for its efficient production of freeze-dried pet food, has announced the completion of its US$75 million expansion project, aimed at supporting the burgeoning demand for freeze-dried pet food products.

This significant investment not only triples the company’s production capacity but also paves the way for welcoming new customers into its stateof-the-art facility.

The expansion, which adds an impressive 70,000 square feet of manufacturing space dedicated to freeze-dried pet food ingredients, comes as a response to the exponential growth observed in this segment of the pet food industry.

Freeze-dried products have witnessed a surge in popularity, and Petsource’s enhanced capabilities position it as a leader in meeting this escalating demand.

Moreover, this expansion has led to the creation of 75 new jobs, with

plans for further hiring in the pipeline. With a current workforce of over 150 employees, Petsource now stands as one of the top 10 largest employers in Seward County, reinforcing its commitment to driving economic growth in the region.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 12 NEWS UPDATES

FOOD SECURITY

DIVESTMENT

Sarit Expo Centre, Nairobi, Kenya

AFRICA’S BIGGEST MEAT, POULTRY, FISH & SEAFOOD INDUSTRY TRADE SHOWS

Discover innovative products and the latest technologies and market trends in the meat, poultry, fish and seafood industry in Africa and globally.

AFRICA EXPO MEAT & JUNE

12-14, 2024

www.africameatpoultryexpo.com Events

Nestle to discontinue two biscuit brands due to decline in sales

UK – Nestlé UK has announced that it is discontinuing making two of its popular chocolate biscuit bars Breakaway and Yorkie, to make way for investment across its wider portfolio of products.

The company is known for a range of products including KitKat, Smarties, Quality Street, Haagen-Dazs and Cheerios.

According to the company, the chocolate-coated biscuits will no longer be produced from March with remaining stocks sold by Sainsbury’s over the next couple of months.

Nestle says this decision has been taken due to a decline in sales, and in an effort to “make way for investment and innovation” across the company’s wider portfolio of products.

First manufactured all the way back in 1970, Breakaway, the chocolate digestive biscuit bars have made their way into many a school lunchbox or stuffed into pockets for an on-the-go sweet treat.

Speaking on the reason behind Breakaways being discontinued, a spokesperson for Nestlé UK & Ireland expressed concern about fans being disappointed to see it go, but he maintained that the decision was critical for the business.

“We have seen a decline in sales over the past few years, and unfortunately, we had to make the difficult decision to discontinue it,” added the spokesperson.

Tunga Nutrition Uganda launches new plant in Kampala

Minister of Agriculture, Animal Industry & Fisheries.

future by ensuring people in Uganda and the East African region at large have equitable access to nutritious food by supporting farmers in producing animal protein (eggs, meat, milk) optimally and sustainably.

He also expanded on the range of products and services that Tunga offers ranging from concentrates, complete feed and minerals, adding that this feed mill investment means a lot for distributors, farmers and suppliers.

Tunga Nutrition is a joint-venture animal nutrition business of Nutreco International BV & Unga Holdings Plc renowned for producing and distributing both the Hendrix Concentrate and the Fugo complete animal feed.

The launching ceremony was presided by Frank Tumwebaze, the

Speaking during the launch, Tumwebaze said the government is pushing for manufacturers like Tunga Nutrition who produce results backed by innovation and science because it makes it easier for Ugandans, young and old, to continue being a part of agriculture.

On his part, Toochukwu Chido, Tunga’s General Manager said that Tunga Nutrition’s purpose is to feed the

TUNGA NUTRITION IS A JOINT VENTURE ANIMAL NUTRITION BUSINESS OF NUTRECO INTERNATIONAL AND UNGA GROUP HOLDINGS

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 14

UGANDA – Tunga Nutrition Uganda, a leading animal feeds manufacturer in Uganda, has launched its ultra-modern feeds mill in Ntinda, Kampala.

NEWS UPDATES

INVESTMENT

STRATEGY

PLC.

Africa's No.1 food safety and quality conferences and trade shows +254 725 343932 www.africafoodsafetysummit.com info@fwafrica.net SCAN ME AFRICA Food Safety SUMMIT NIGERIA Western Africa Edition | Lagos, Nigeria AFRICA Food Safety SUMMIT Eastern Africa Edition | Kampala, Uganda AFRICA Food Safety SUMMIT SEPTEMBER 17-19, 2024 SEPTEMBER 3-5, 2024 Events

IGC forecasts record global grain output in 2023-24

GLOBAL – At its 59th council session held in New Orleans on Jan. 24, the International Grains Council (IGC) announced that global grain production is set to achieve a record high of 2.307

billion tonnes in the 2023-24 season, largely attributed to a robust recovery in corn output.

Chaired by Anita Katial, the USDA’s Agricultural Counselor for the United Kingdom and Republic of Ireland, the meeting highlighted a projected 2% year-over-year increase in both grain production and consumption, reaching 2.307 billion tonnes and 2.314 billion tonnes, respectively.

Global inventories are expected to contract by 1%, reaching 590 million tonnes, marking the seventh consecutive drawdown.

Meanwhile, world trade is anticipated to decrease by 3%, totaling 415 million tonnes, with reduced shipments of wheat, corn, and barley.

The IGC noted a potential 1% decline in global wheat harvested area for 202425 due to lower prices and suboptimal sowing weather in certain regions. While rapeseed/canola plantings may contract, they are projected to remain above average.

Soybean production is forecasted to reach a record 392 million tonnes, marking a 6% year-over-year gain, mainly tied to expectations of a rebound in Argentina. Consumption is predicted to peak, and aggregate inventories are set to climb for the second consecutive year, including accumulation in key exporting countries.

WORLD TRADE IS ANTICIPATED TO DECREASE BY 3%, TOTALING 415 MILLION TONNES, WITH REDUCED SHIPMENTS OF WHEAT, CORN, AND BARLEY.

Kitui Flour Mills to acquire 100% stake in Rafiki Millers

KENYA – Kenyan-based Kitui Flour Mills, the maker of the ‘Unga wa Dola’ wheat and maize flour brand, is set to acquire a 100 percent stake in Rafiki Millers Limited.

The proposed acquisition has been given a nod by the Competition Authority of Kenya ruling, which stated that the transaction is unlikely to negatively impact competition in the market for wheat milling, nor elicit negative public interest concerns.

“The analysis considers the impact that the proposed transaction will have on public interest which includes the extent to which a proposed merger would impact employment opportunities, competitiveness of SMEs,

particular industries/sectors, and the ability of national industries to compete in international markets,” said the Authority.

After the merger, the assets of Kitui Flour Mills are set to cross the KES 1 billion (US$6M).

Founded in 1982, Kitui Flour Mills is among Kenya’s producers of home products such as Premium Maize Flour, Dola Wheat Flour, Dola Chapati Flour, Atta Flour, and Baba Lao Maize Flour, among others.

CAK noted that the manufacturer commands 13% of the wheat milling market and is the third largest firm behind Mombasa Maize Millers (22%) and Grain Industries Limited (15%).

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 16 NEWS UPDATES

MARKET UPDATE

ACQUISITION

AFRICA EXPO Fresh Produce AFRICA’S NO.1 FRESH PRODUCE INDUSTRY TRADE SHOW Fresh Produce Market Logistics & Mobility Machinery & Technology Agro-Inputs & Chemicals Services & More WHAT’S ON SHOW AT THE EXPO

Africa Fresh Produce Expo will consist of the following Sections: Events CO-LOCATED WITH: JUNE 12-14, 2024 – Sarit Expo Centre, Nairobi, Kenya www.africafreshproduceexpo.com FOOD Afmass EXPO Transforming Africa’s Food Systems

The

Egypt

intends to purchase 5M tonnes of wheat, short grain rice in international tender in 2024

EGYPT – Egypt’s state grains buyer, the General Authority for Supply Commodities (GASC) plans to purchase more than 5 million tonnes (MT) of wheat in 2024 through international tenders, according to the Ministry of Supply and Domestic Trade.

This objective is an increase of 500,000 tonnes compared to imports made in 2023.

According to Nassr Nomani, the adviser to the head of the ministry, the domestic consumption of the grain crop currently exceeds 20 million tonnes per year.

At the same time, he noted, the total production is just over 9million tonnes, hence, the government and the private sector supplements the deficiency by

importing 11 million tonnes.

In 2023, Egypt purchased about 4.5 million tonnes of wheat through GASC tenders, including almost 3 million tonnes from Russia, 780,000 tonnes from Romania, 360,000 tonnes from France, 270, 000 tonnes from Bulgaria

and 120,000 tonnes from Ukraine.

Overall, wheat purchases reached 10.8 million tonnes in 2023, representing a 14.7% jump from 2022, according to data from traders relayed by Reuters.

Reuters linked this rebound in imports to the overall drop in world wheat prices.

Innscor Africa to boost capex with up to US$60M investment in 2024

ZIMBABWE – INNSCOR Africa

Limited, a diversified consumer staple manufacturer in Zimbabwe intends to spend between US$50 million and US$60 million on capital programs in the 2024 financial year, as the conglomerate continues to consolidate its local and regional market share.

The intended capital expenditure follows a cumulative US$125 million

that was deployed in capital investments across the Innscor business units in the past two years.

Mr Addington Chinake the Innscor’s board chairperson, revealed this while presenting the 2023 annual report.

According to Mr. Chinake, the group’s business models continue to undergo constant refinement to ensure that the group remains adaptive and relevant in a dynamic and complex

operating environment.

“This investment program has allowed for the establishment of new business units and products enabled the expansion and modernizing of existing manufacturing lines, extended existing product categories, and will ultimately enhance the overall manufacturing efficiencies and capabilities of the Group as critical mass is reached,” the statement read.

The company said the investments would span its subsidiaries including the beverages, milling, baking, protein, and packaging segments all scheduled for completion in the 2024 financial year.

In the bakeries division, the investments will be directed at the Harare plant automation initiatives and recapitalization of Baker’s Inn delivery fleet.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 18 NEWS UPDATES

INVESTMENT MARKET UPDATE

The Africa Business Summit is the ground-breaking executive level conference and expo on the future of strategic leadership, entrepreneurship, sustainability & african transformation

The program at the 3-day Summit comprises of a number of premium sessions such as Leadership Dialogues, CEO Roundtables, Plenary and Panel Discussions and a B2B Deal Connect Service as well as presentations by influential people and change makers who are making waves – and inspiring the next generation of leaders in Africa

Co-located with:

SEPTEMBER 10-12, 2024 |

Nairobi,

Safari Park Hotel,

Kenya

* *

SUSTAINABILITY FORUM Digitalisation & Tech Innovation Sustainable Business & ESG Strategic Leadership Pan-African & Global Trade Financing, Investing & Financial Inclusion Industrialisation & Infrastructure Development Supply Chain & Logistics Transformation Human Capital Development KEY AGENDA

SCAN ME BUSINESS SUMMIT AFRICA

THE AFRICA CEO LEADERSHIP &

www.africabizsummit.com

& Sustainability

Events

The Africa CEO Leadership

Forum

Selu Limited to invest US$80M at Galana Kulalu after successful pilot phase

KENYA – Selu Limited has announced a significant investment of US$80 million (KES13 billion) in the Galana-Kulalu, a

national food security project, over the next three years following a successful pilot phase last year.

Selu Limited is a Special Purpose Vehicle, a partnership consisting of various companies, including Campos, a farm management company with vast experience overseeing extensive farmland in Latin America with a climate similar to Kenya, and AgCo, a global leader in precision agriculture technology based in the United States.

For Selu, this move aims to expand the company’s operations to over 20,000 acres within the Galana-Kulalu irrigation project.

Selu has revealed that it has concluded the initial development phase

FOOD SECURITY

Tanzania to build US$1.4B modern industrial park, fostering economic growth

TANZANIA – Tanzania has commenced building a modern industrial park project located at Disunyara and Kikongo, Mlandizi District of Kibaha in the coast region, set to revitalize the country’s economy.

At a projected cost of 3.5 trillion (US$1.4B) until completion, the project is an investment of the Kakama Company Limited of Dar es Salaam in collaboration with the Government of Tanzania.

Dr. Ashatu Kijaji, the Minister of Industry and Trade, while visiting the project noted that Tanzania decided not to be left behind by the fourth revolution hence the focus on industrial development to build the country in various fields.

The park covers 1077 acres and is expected to establish 202 factories providing direct employment to about 30,000 local youths.

of 500 acres, which involved a feasibility assessment to evaluate the viability of large-scale commercial maize farming in the 1.75-million-acre governmentowned ranch..

The firm says the project implementation was undertaken in partnership with a consortium, consisting of LEAF Africa, CampoBrazil and BrazAfric Group that provided expertise on large-scale tropical commercial farm management.

The firm said the investment would be channelled towards rolling out full irrigation, smart agriculture and introducing renewable energy solutions in the race towards achieving carbonneutral food production.

Cameroon allocates US$698M to wheat import substitution program

CAMEROON – The government of Cameroon and its financial partners have earmarked 417 billion F (US$698M) for the production and processing of wheat in the next five years.

According to Gabriel Mbaïrobe, the Minister of Agriculture and Rural Development, this plan aims to reduce imports of this cereal by 35% and produce nearly 350,000 tonnes of marketable wheat by 2028.

Cameroon produces less than onefourth of the 1.6 million tonnes of wheat it needs each year, forcing it to depend on imports to meet the local demand.

In 2022, wheat shortage worsened following Russia’s war on Ukraine which led to a 40 percent increase in the price of bread in the country.

However, the Cameroonian government is confident that the county has a strong potential for the production and transformation of the wheat sector under the earmarked five-year initiative.

According to the executives, around thirty departments across the country are conducive to the development of this culture.

Additionally, the country has enough primary processing, with nine out of 12 milling companies operational with a capacity of more than one million tonnes per year for a demand of nearly 600,000 tonnes, according to Minader statistics.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 20 NEWS UPDATES

INVESTMENT

INVESTMENT

TAP INTO MIDDLE EAST & AFRICA'S GROWING GRAINS INDUSTRY

ADVERTISE IN MILLING MIDDLE EAST & AFRICA - REGION'S ONLY GRAINS INDUSTRY MAGAZINE

WHY ADVERTISE IN THIS MAGAZINE?

• Reach the key decision makers in Africa & Middle East grains, milling, bakery, animal feed, snacks and pet food industry with one magazine

• Milling Middle East & Africa is the only magazine focused on the grains industry in the region

• The magazine is available in both print and digital format, providing our advertisers with a regional and worldwide audience

• We offer more than just the magazine - we also offer digital advertising, organise industry events and webinars

MORE INFO: WWW.MILLINGMEA.COM

ASSOCIATION OF KENYAN Feed

Manufacturers

Empowering millers, feeding a nation

BY WANGARI KAMAU

BY WANGARI KAMAU

Asilent revolution fueled by a growing demand for protein, a rising livestock population, and a relentless pursuit of quality and efficiency, is unfolding within the Kenyan feed industry. At the forefront of this transformation stands the Association of Kenya Feed Manufacturers (AKEFEMA), a revitalized organization under the leadership of CEO Paul Kamau.

AKEFEMA is not only empowering its members but also navigating the industry through a complex and ever-changing landscape, paving the way for a future where "quality feed for quality animals" isn't just a slogan, but a reality

for countless Kenyan livestock farmers.

REKINDLING THE FLAME

Established in 2004, AKEFEMA experienced a period of relative dormancy until its recent revival under Mr. Kamau's leadership in 2023. This revival has been marked by several noteworthy accomplishments. One of the most significant has been the establishment of a well-organized and functional organizational structure.

Dedicated committees, each tackling specific industry challenges like technical expertise, trade, and publicity, now form the backbone of the association. These committees, coupled with continuous training programs for members and partners, have laid a solid foundation for future growth.

NAVIGATING THE CHALLENGES OF RAW MATERIALS, QUALITY, AND COST

Despite the recent positive developments, the Kenyan feed industry is currently grappling with a formidable "triple threat": availability of raw materials, feed quality, and cost. Mr. Kamau highlights the industry's current dependence on imported ingredients, with a staggering 80% of

COMPANY FEATURE: AKEFEMA FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 24

raw materials originating from outside Kenya’s borders. This dependence has been further exacerbated by the ongoing war in Ukraine, creating a supply chain crisis and driving up costs.

To address this challenge, Mr. Kamau emphasizes the urgency of increasing domestic production of key ingredients like maize and soya. "If we could produce all our maize and soya, which are major feed ingredients and comprise almost 60 and 85% (depending on the feed), costs would significantly decrease," he explains. This strategy would not only lessen reliance on volatile imports but also stabilize costs and create a more sustainable supply chain.

EXPLORING ALTERNATIVE RAW MATERIALS AND SUSTAINABLE SOLUTIONS

AKEFEMA, recognizing the need to diversify and mitigate risks associated with imported raw materials, is actively exploring alternative solutions.

One such avenue involves distiller's dried grains with solubles (DDGS), a by-product of the ethanol production process. AKEFEMA is working closely with research institutions like the Kenya Agricultural and Livestock Research

Organization (KARLO) to assess the viability of DDGS as a potential alternative feed ingredient. This collaboration ensures that any new solutions meet stringent quality standards and contribute to the overall health and well-being of livestock. While other options like Black Soldier Fly larvae (BSFL) hold promise,

Mr. Kamau acknowledges the need for largescale production before BSFL can be widely adopted. "We are slowly bringing to our members raw material alternatives but it is gradual. For DDGS, we are working with one of the leading millers in the country and Kenya Agricultural and Livestock Research Organization (KARLO to determine whether it fits the standards that we want or not." he explains.

UNTAPPED POTENTIAL BECKONS

Mr. Kamau reveals a compelling statistic that paints a vivid picture of the immense potential for growth within the Kenyan feed industry: currently, Kenya feeds only 15% of its livestock population. This signifies a vast untapped market, particularly in the arid and semi-arid lands (ASALs) regions, where livestock rearing is the primary source of income for many families. AKEFEMA envisions empowering these

AKEFEMA IS WORKING CLOSELY WITH KALRO TO ASSESS THE VIABILITY OF DDGS AS A POTENTIAL ALTERNATIVE FEED INGREDIENT.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 25

OUR MAJOR VISION FOR THE INDUSTRY IS TO ENCOURAGE FARMERS TO COMMERCIALIZE THEIR LIVESTOCK PRODUCTION, USING THE RIGHT FEED AND ANIMAL BREEDS TO GET MORE RETURNS FROM THEIR VENTURES.

communities by enabling commercial livestock production through the use of high-quality, accessible feed.

This vision, if realized, has the potential to not only improve livelihoods but also contribute to food security and economic development in these often-marginalized regions. "Our major vision for the industry is... to encourage these families to commercialize their livestock production, using the right feed and the right animal breeds, to get more returns from their ventures," Mr. Kamau emphasizes.

HUNT FOR A MILLER FRIENDLY BANK

Recognizing the need for financial muscle to support the industry's growth, AKEFEMA is

COMPANY FEATURE: AKEFEMA

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 26

actively seeking partnerships with financial institutions. Mr. Kamau emphasizes the importance of securing "feed millerfriendly" financial institution to help local millers acquire state of the art technologies that will enable them to compete with the anticipated influx of foreign companies. "That is a key role that we seek to play for our members. We are looking for a feed miller-friendly bank... If we can negotiate special AKEFEMA rates of loans for our members, they will be assured to survive and maintain their market share in the face of stiff competition," he explains.

Kamau discloses that the supply side of the equation has already been solved. He assures that suppliers of milling technologies are eager to facilitate essential mill upgrades and capacity expansion. These suppliers are also willing to provide training to the millers on how to apply these technologies. “However, the primary obstacle to these upgrades is financing,” he stresses. Therefore, finding a financially supportive partner would be a game-changer since there is a huge demand for feed as we move towards commercial livestock production, and it presents an opportunity for financial partners to benefit.

ENHANCING FEED SAFETY

AKEFEMA acknowledges that a sustainable future for the Kenyan feed industry hinges not only on efficient production but also on responsible practices and consumer education. The association is working towards establishing an AKEFEMA quality mark to guarantee farmers access to safe and effective feed. "We prioritize the adherence of our millers to the proper standards as their products ultimately go into human food," Mr. Kamau highlights. This initiative, coupled with government efforts to improve storage facilities and minimize post-harvest losses, will create a more robust and sustainable feed industry ecosystem. Such an ecosystem will not only ensure the well-

being of livestock but also safeguard the health and safety of consumers throughout the food chain.

THE AKEFEMA LIVESTOCK EXHIBITION AND CONFERENCE

The upcoming AKEFEMA Livestock Exhibition and Conference, scheduled for July 2024, serves as a testament to the association's dedication to knowledge sharing and fostering innovation.

With a theme of "Resilience and Innovation in an EverChanging Industry Landscape," the conference will bring together a diverse range of stakeholders, including industry experts, farmers, suppliers of raw materials and additives, equipment and service providers, regulators, government departments, universities, and other affiliated institutions. This platform will foster knowledge exchange, facilitates collaboration, and encourages the exploration of innovative solutions to address the industry's pressing challenges.

The conference agenda will encompass technical presentations covering a range of subtopics. Experts will explore the latest advancements in animal nutrition and health, as well as innovation and technology in feeds and feed processing. Given the imperative of sustainability in the feed industry's future, a dedicated session will address topics such as responsible sourcing of raw materials, minimizing environmental impact, and promoting the utilization of renewable energy sources.

Acknowledging milling as a business endeavour, AKEFEMA has organized a session on Financial Vehicles and Opportunities in the market. Financial experts will elucidate various financing options available to feed millers, aiming to bolster the expansion of their enterprises.

The conference will also feature exhibition booths, providing a platform for suppliers to showcase their products and attendees to explore the latest advancements in feed technology, equipment, and services. AKEFEMA hopes that this interactive environment fosters networking opportunities and facilitates the exchange of ideas between various stakeholders within the industry.

A CATALYST FOR TRANSFORMATION

The Kenyan feed industry holds immense growth potential as only 15 percent of livestock in the country utilizes commercial feed. A rejuvenated AKEFEMA is however here to change that narrative.

From fostering commercial livestock production in marginalized regions to creating a more sustainable and efficient feed industry, AKEFEMA's vision extends far beyond the simple act of feeding animals. It encompasses the potential to empower communities, drive economic growth, and contribute to a brighter future for Kenya. The upcoming AKEFEMA Livestock Exhibition and Conference stands as a testament to this vision, bringing together the diverse players within the industry to collectively chart a course for a thriving and transformative future.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 27

GOLDEN GRAIN Discusses Flour Milling EXPERTISE FOR AFRICA

Golden Grain Group International (GGI), a flour mill engineering and technology company, is setting its sights on the African market, leveraging its experience in Southeast Asia to offer expertise and equipment to regional millers. We speak with Mark Lyons, a third-generation miller and Managing Director of Golden Grain Group International (GGI).

BY MARTHA KURIA

Thank you for joining us today. Can you tell us a bit about Golden Grain Group International (GGI) and its experience in the flour milling industry?

Absolutely. GGI is a flour mill engineering and technology company with a proven track record. We have a factory in China, a headquarters in Hong Kong, and representatives across the globe. For over 15 years, we've been actively involved in building new flour mills in Southeast Asia, particularly focusing on larger facilities in countries like Indonesia, Philippines, Vietnam, and Thailand.

That's impressive. What prompted GGI's decision to expand into the African market?

We see tremendous potential in Africa's growing economies and a rising demand for higher quality flour. Our experience in Asia has shown a strong link between economic development and the need for better flour. We believe we can offer African millers the expertise and technology to meet this evolving demand.

You mentioned your extensive experience in Asia. Can you elaborate on your personal background in flour milling?

Flour milling is practically in my blood. My grandfather and father were both millers, and I've spent over 30 years in Asia working with millers and engineering firms. This experience has given me a deep understanding of the industry's technical aspects and the specific needs of different regions.

Drawing from your experience in Asia, how do you believe the lessons learned there could benefit the African milling industry?

Over the years, Asia has witnessed a significant evolution in flour quality and milling practices driven by changing consumer demands and international standards. Africa stands to benefit from these experiences, particularly in enhancing food quality, adapting to market needs, and ensuring food

safety standards.

You mentioned partnering with millers. What services does GGI offer in Africa?

We provide a comprehensive range of services, from initial consultation and design to equipment supply, installation, and after-sales support. We want to be a one-stop shop for African millers looking to upgrade their operations or build new facilities.

The rise of fast-food chains in Africa is noticeable. How does GGI address the specific requirements of these international brands?

The growing presence of companies like KFC and Pizza Hut presents an interesting challenge. These brands have stringent quality specifications for their flour. We understand these requirements and can help African millers adapt their processes to meet these standards, ensuring consistent highquality flour production.

How does GGI ensure long-term success for its partnerships with African millers?

Building trust and strong relationships is paramount. We go beyond just selling equipment. We offer technical support, training programs, and ongoing service to ensure our partners have the knowledge and resources they need to thrive. Our goal is to be a valuable asset in Africa's journey towards flour milling excellence.

What is your message to potential clients in Africa who might be considering GGI for their flour milling needs?

We encourage you to reach out to us. No matter the size or complexity of your project, we are here to help. We have the experience, expertise, and commitment to provide you with the solutions you need to achieve your flour milling goals. We are confident that together, we can contribute to a brighter future for Africa's flour milling industry.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 29

IAOM MEA ZAMBIA REGIONAL FORUM

The International Association of Operative Millers Middle East and Africa Region (IAOM MEA) brought together technical millers from across sub-Saharan Africa for its recent Regional Forums program held in Lusaka, Zambia.

Under the banner of "Milling Operation for Ultimate Efficiency," the forum fostered a space for professional connection and knowledge exchange. Participants delved into the latest advancements and solutions showcased by leading international suppliers in the milling industry.

Among the noteworthy participants were Swiss technology giants Buhler, their Turkish counterparts Alapala, and flour improvement specialists Mühlenchemie.

The resounding success of the Zambia event has set the stage for the highly anticipated IAOM MEA 2024 Conference and Expo, scheduled for November 10-13 in Dubai, UAE.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 30

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 31

- 29 FEBRUARY

LUSAKA, ZAMBIA

27

2024,

MILLERS Corner

HARRISON OMEGA on the do's and dont's of FEED MILLING

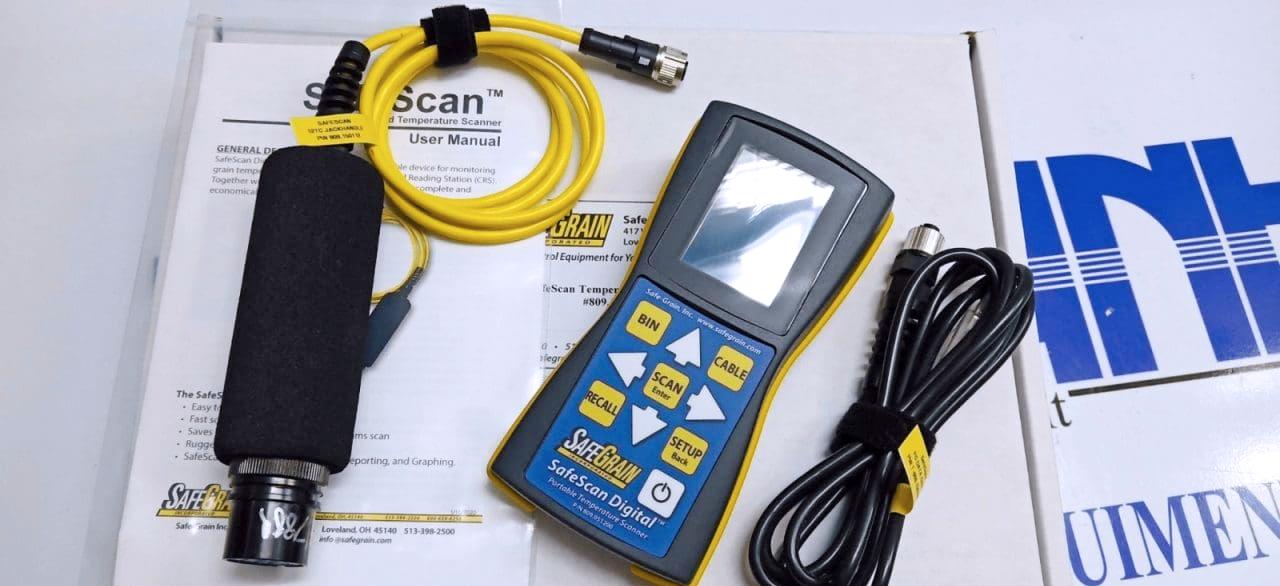

MILLING MEA magazine sat down with Harrison Omega, a seasoned professional with nearly a decade of experience in feed milling. Currently serving as Process Supervisor - Feed Mill and Soy Extrusion Plant at Unga Group Limited, Omega shares his career journey, industry knowledge, and valuable advice for aspiring feed millers.

Could you briefly introduce yourself and share your experience in animal feed milling?

I'm a manufacturing production professional with close to ten years of hands-on experience overseeing production. I have a strong passion for animal nutrition and am enthusiastic about management and process control. My educational background includes a Bachelor of Science in Food Science and Technology, along with a Diploma in Purchasing and Supplies Management. Additionally, I've received training in Animal Nutrition and Feed Milling Technology from esteemed institutions like Penn State University, Buhler, and Cargill.

What initially drew you to the field of feed milling, and how did you develop your expertise?

My career began at Kenchic Co. Ltd., a chicken processing company. While there, I became curious about the feeding and handling of the broiler birds, particularly their diet and feed composition. This sparked a deep interest in working within the feed milling industry, leading me to pursue this career path.

Looking back, what would you consider the

most significant achievement or highlight of your career in feed milling?

I'm particularly proud of my time at Pioneer Feeds, where I joined the strategic team and contributed to a remarkable increase in production capacity. We went from producing 1,260 tons to 3,150 tons of feed per month. It was a journey filled with experimentation, challenges, and ultimately, rewarding successes. I was honored to support the company through various stages of growth.

In your current role at Unga Group Ltd., how do you ensure the smooth and efficient operation of the feed milling and soy extrusion process?

At Unga, we prioritize both food safety and customer focus. We're ISO-certified for Food Safety Management Systems (FSMS), and our team is deeply committed to exceeding customer expectations. Additionally,

BY WANGARI KAMAU

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 33

we utilize several methodologies to optimize operations, including TPM (Total Productive Maintenance), KANBAN, and KAIZEN, which promote continuous improvement.

You mentioned the importance of a well-trained team. What specific measures do you take to ensure your team is prepared and empowered?

Investing in our people is crucial. Right from the start, our employees receive ongoing training in various areas, including production processes, health, safety, and environment (HSE) practices, quality control, and machine maintenance. Effective planning also plays a critical role. We meticulously plan for raw materials, manpower, machinery, and all other necessary inputs to ensure a smooth production run.

Finally, how do you foster a collaborative and supportive work environment at Unga?

We believe in open communication and continuous learning. Unga offers comprehensive training programs to equip our workforce with the necessary skills and knowledge to excel in their roles. I also encourage my team members to actively participate in the process by sharing their ideas for improvement and voicing any concerns they may have. This fosters a collaborative and supportive environment where

everyone feels valued and empowered to contribute.

Shifting gears, what are some of the biggest challenges facing the Kenyan feed milling industry currently?

Shortages of essential raw materials are a significant challenge. Kenya relies heavily on imports from neighboring countries, making the industry vulnerable to geopolitical situations and government policy changes. Additionally, fluctuating prices of commodities and high energy costs contribute to increased production costs and expensive final products.

How are these challenges being addressed?

The Kenya Feed Manufacturers Association (AKEFEMA) has lobbied the government for measures such as allowing the importation of key inputs like maize, albeit with certain restrictions. The government, through the Ministry of Agriculture, has also attempted to boost crop production through subsidies for farm inputs.

Looking ahead, what emerging trends or innovations do you see shaping the future of animal feed milling?

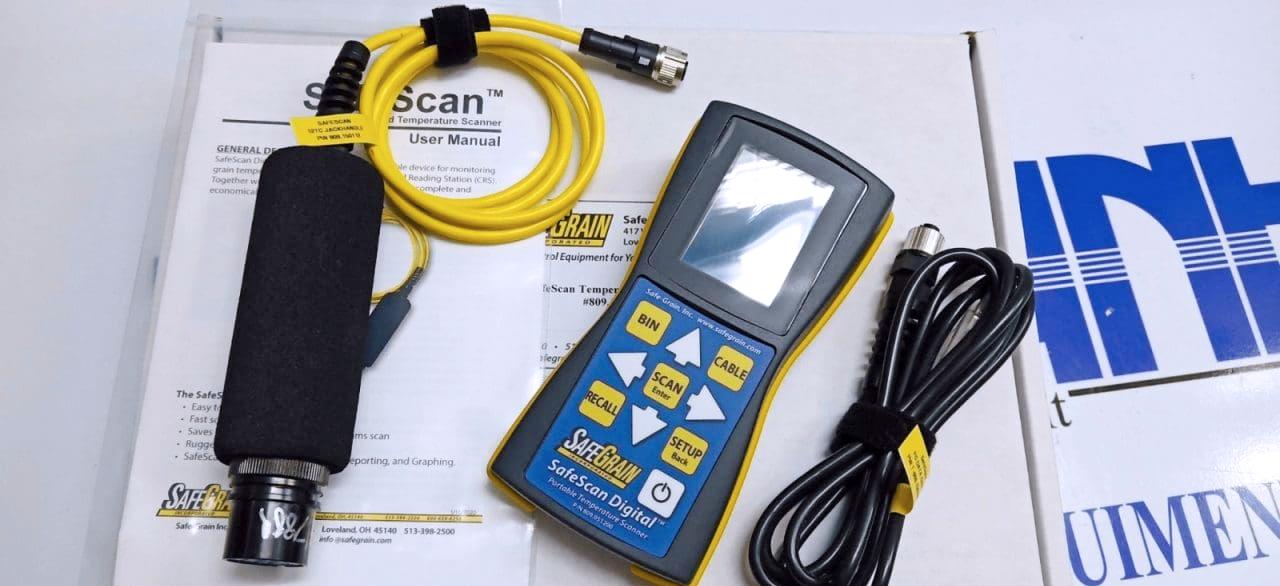

Process automation is becoming increasingly popular in Kenya, with feed millers embracing new technologies to enhance efficiency and product quality. We're also seeing faster methods like NIR (near infrared) and online quality testing equipment being adopted for raw materials and finished products.

How does Africa compare to the rest of the world when it comes to advancements in feed milling technology?

Europe, America, and some Asian countries are significantly ahead of Africa in milling technology. However, Africa is catching up by adopting existing technologies and knowledge from these regions. Government support for research and development, coupled with improved access to high-quality raw materials, is crucial for Africa to bridge the gap.

MMEA: With the growing global population and advancements in technology, how do you envision the future of the feed milling industry?

The future looks promising for the feed milling industry worldwide, driven by population growth and the constant evolution of knowledge and

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 34 MILLERS CORNER: HARRISON OMEGA

technology. We anticipate increased production in every country as the demand for animal feed continues to rise.

In the face of climate change, how can the animal feed industry contribute to a sustainable future?

Embracing renewable energy sources like wind, solar, and geothermal power can significantly reduce production costs and environmental impact for feed producers in Kenya and Africa. Additionally, industry bodies like AKEFEMA can implement policies that encourage companies to undertake Corporate Social Responsibility (CSR) projects focused on environmental preservation, such as tree planting initiatives.

Looking back on your career, have you faced any setbacks or failures that ultimately proved to be valuable learning experiences?

While not necessarily setbacks, my career has been filled with learning opportunities. I've gained a deep understanding of the essential systems and components that ensure a profitable feed mill operation. The importance of appreciating customer feedback and taking prompt action to address concerns has also been an invaluable lesson. Through these experiences, I've learned the essential "dos and don'ts" of the feed milling industry.

As you look towards the future of your career, what are your aspirations, and what potential opportunities or challenges do you foresee in the animal feed industry?

The feed milling industry offers numerous exciting opportunities worldwide, including roles in research,

TO SUCCEED IN FEED MILLING, PRIORITIZING QUALITY AND CONSISTENCY IS PARAMOUNT. ADDITIONALLY, FEED MILLERS MUST BE PREPARED TO CONTINUOUSLY LEARN AND ADAPT TO STAY AHEAD OF COMPETITION.

nutrition, and technical management. My aspiration is to one day become a Feed Mill Plant Manager, either domestically or internationally. In this role, I would be responsible for overseeing daily operations, managing challenges, and staying updated on the ever-evolving technological landscape of the industry.

Finally, what advice would you offer aspiring feed milling professionals looking to make their mark in the industry? To succeed in feed milling, prioritizing quality and consistency is paramount. Customers value consistency in product quality, and remember, quality starts from the moment you source raw materials and continues until the final product is fed to the animals, yielding the desired results. Additionally, feed millers must be prepared to continuously learn and adapt to stay ahead of the competition.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 35

BY MARTHA KURIA

BY MARTHA KURIA

MOROCCO

Persistent drought threatens food security prospects

The Kingdom of Morocco, known as the Maghreb or the “Arab West”, boasts a rich culture with Arab, Berber, European, and African influences. It is located in North Western Africa. The country borders Algeria to the East and South-East and Mauritania to the South-West. As in many other developing countries, the agricultural sector is a key economic engine within the country and is highly dependent on often-limited rainfall.

Agricultural lands span across 8.7 million hectares in our region. Approximately 43% of arable land is dedicated to cereals, with 7% allocated to plantation crops such as olives,

almonds, citrus fruits, grapes, and dates. Among cereals, common wheat comprises nearly 47% of the gross value, followed by durum wheat (27%), barley (23%), maize (2%), and other cereals like sorghum and rice (1%).

Notably, 90% of cereal acreage is situated in rainfed areas. Thus their output is highly variable year-on-year depending on rainfall amounts and distribution. Out of the past five agricultural seasons, four were affected by drought with different degrees of intensity. This has had an outsized impact on Morocco’s grain and feed industry which has had to rely on imports to meet local demand. As far as imports and trade is concerned, The European Union is

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 36

COUNTRY FOCUS: MOROCCO

Morocco’s primary trading partner, accounting for about 60% of Morocco’s agricultural exports.

WHEAT OCCUPIES A CENTRAL ROLE IN MOROCCAN DIETS

Wheat is an important cereal crop in Morocco, contributing significantly to the livelihoods of farming communities and the national economy. Wheat stands as a crucial food staple in the Moroccan diet. According to the "Fédération Nationale de la Minoterie" (FNM), the average per capita wheat consumption in Morocco is 200 kg, which is three times higher than the global average.

Soft wheat is the most important cereal grown in Morocco, accounting for 45-47% of the total cereal growing area. When combined with durum wheat, wheat is by far the country’s most important crop, covering 2.9 million hectares (65 percent of the total cereal growing area). According to estimates from Government of Morocco, the country produced 2.98 MMT of common wheat, 1.18 MMT of durum wheat in 2023.

The government supports wheat production through the establishment of a reference price for purchasing local production. The government achieves this by applying tariffs on wheat imports to protect local producers from international competition and revising the duties periodically depending on the domestic supply and demand situation. Usually, import duties are set at the highest levels at harvest time. The government also provides a storage premium to farmers who decide to store wheat grain in licensed facilities.

In Morocco, wheat, flour, and bread prices are tightly regulated. The country entrusts the National Inter-Professional Office for Cereals and Legumes (ONICL) with the responsibility

of overseeing prices. Their mandate includes maintaining bread wheat prices within the range of US$260/MT to $280/ MT.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 37

6934 5116 2731 7091 7342 4025 2870 7540 3800 2700 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 9000 8000 7000 6000 5000 4000 3000 2000 1000 0 Year Production (1000MT) MOROCCO WHEAT PRODUCTION BY YEAR (2013-2023)

Wheat is the most planted cereal in Morocco covering 2.9M hectares

IN NUMBERS

153

NUMBER

ONICL subsidizes common wheat flour, “National Flour,” to preserve the purchasing power of low-income consumers. The 2020 edition of the annual report on the flour milling sector published by Fédération Nationale de la Minoterie (FNM), Morocco’s milling industry association, puts the number of industrial mills processing soft wheat in the country at 125, with a further 20 milling durum and eight producing barley flour.

At the end of 2019, the country had 11 million metric tonnes (MMT) of grain processing capacity, 85% of which was used for soft wheat. The amounts processed in 2019 were 4.4 MMT of soft wheat, 900,000 tonnes of durum and 830,000 tonnes of barley.

Due to the excess milling capacity in the country and the goodwill from the government, some quantities of wheat flour, couscous and pasta are exported to neighboring countries.

DEVASTATING WEATHER CONDITIONS

DROVE MOROCCO’S WHEAT IMPORT TO A RECORD HIGH

Wheat constitutes about 60 percent of the cereal imports in Morocco. The country ranks as is one of the top global wheat importers and Africa’s third-largest wheat importer, averaging imports

of 3 million tonnes of soft wheat a year for the last 10 years. In 2022, the country endured its most severe drought in decades, resulting in a 60% decline in cereal production compared to the previous year and a 45% decrease from the preceding five-year average. According to USDA data, production plummeted from 7.54 MMT in 2021/2022 to 2.7 MMT in 2022/2023, marking a staggering 64% drop.

The decline in grain production has triggered a sharp rise in imports. Official USDA data reveals that Moroccan wheat imports surged from 4.726 MMT in 2021/2022 to 6.5 MMT in 2022/2023. Although production in MY2023/24 is anticipated to rebound to 3.8 MMT, it remains considerably below pre-2022/2023 drought levels. Consequently, the USDA forecasts wheat imports to escalate to 7.5 MMT in 2024.

To address local demand, Morocco initiated an import program for the 2023/24 season, covering up to 2.5 million tons from July to September, followed by a second phase permitting up to 2 million tons from October to December. Phase 3 to support imports of 2.5 million MT of common wheat was rolled out in December. This initiative aims to support importers by covering the difference between the cost of wheat and the reference import price of 270 MAD ≈ $263 per

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 38

OF FLOUR MILLING COMPANIES IN MOROCCO.

COUNTRY FOCUS: MOROCCO

MT. According to USDA, the program will mainly benefit Moroccan importers looking to source wheat from, Germany, Argentina, France and the United States and is valid from January 1st, 2024, until April 30th, 2024.

Morocco’s import support program is intended to maintain low bread prices in the local market and encourage stock building, according to the USDA. Overall, FAS estimates MY 2023/24 consumption at 10.65 MMT, equivalent to 288 kg per capita based on a population of 36.3 million.

MOROCCO SHIFTS TO THE EU FOR WHEAT

Ukraine and Russia have traditionally accounted for 20% and 7% respectively of Morocco's wheat supply in recent years. However, supply disruptions from these countries in 2022 led to imports from these countries falling to below 1% of total exports. This coincided with the worst drought season in three decades, exerting immense pressure on Morocco’s wheat supply, and prompting the country to boost imports from partners such as France.

According to the European Commission's 2023 report, Morocco remains the largest importer of wheat from the EU for the 2022/2023 agricultural campaign. The report highlights that during the first four months of

2023, Morocco imported over 4 MMT of wheat, a significant increase from 1.4 MMT the previous year.

Data from Gro Intelligence reveals that between June 2022 and January 2023, Morocco imported 3.2 MMT of soft wheat alone. Of these imports, nearly 70%, totaling 9.16 MMT, originated from France, followed by Romania with 3.49 MMT, Germany with 3.12 MMT, Poland with 2.54 MMT, and Lithuania with 2.26 MMT.

MOROCCO DETHRONED AS THE MAJOR BARLEY PRODUCER IN AFRICA

For decades, Morocco has maintained its position as the top barley producer in Africa. In the 2021/2022 marketing year, Morocco emerged as the largest barley producer, harvesting 2,780,000 metric tons across 1,490,000 hectares of planted area.

Changing weather patterns have however devastated the sector, leading a downward trend in production. In the 2022/23 marketing year, production plummeted to only 700,000 metric tons, marking a 78% decrease from 202122 levels. This decline in production relegated Morocco from its leading position to third place, behind Ethiopia (2.18 million metric tons) and Algeria (1.6 million metric tons), in barley

MOROCCO IS FORECAST TO CONSUME 10.65MMT OF WHEAT IN MY2023/24, EQUIVALENT TO 288KG PER CAPITA BASED ON A POPULATION OF 36.3 MILLION.

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 39

production.

2.3MMT

MOROCCO CORN IMPORT ESTMATES FOR 2023.

Production is primarily directed towards animal feed, with a smaller portion allocated for human consumption. According to USDA, the utilization rates for human food and animal feed vary based on local availability and pasture conditions. Consumption peaks during dry years and declines during seasons with ample rainfall, when wheat becomes more predominant, notes the US agricultural agency. For MY 2023/24, USDA forecasts total barley consumption at 1.7 MMT.

Most of the local demand will be satisfied by domestic production, estimated by USDA at 1.1 MMT from approximately 1.2 million hectares of land. The country is also expected to import around 700,000 tonnes of barley to address the

shortfall, primarily from the EU27 region, which accounts for over half of Morocco’s imports. Ukraine and Russia serve as the other two major barley exporters to Morocco.

POULTRY DRIVES CORN IMPORT MARKET

Morocco is not a major producer of corn. According to the most recent USDA data, Morocco produced about 115,000 tons of maize in 2022, reflecting a 4% decline compared to the previous year. Nonetheless, the country maintains a substantial demand for corn, primarily driven by its animal feed sector. The poultry and dairy industries stand as the primary consumers of imported corn.

In 2023, the country is estimated to have imported approximately 2.3 million metric tons (MMT) of corn. Argentinean and Brazilian corn imports dominated the market, capturing a 90% share, as reported by the USDA. US corn held the third position with a 7% market share. However, the US emerges as the leading supplier of corn co-products to Morocco, commanding an 83% market share, followed by Argentina at 13%, and the Netherlands at 6%.

The US Grain Council anticipates a future increase in corn imports as the poultry industry, the largest single consumer of corn, rebounds in response to the recovering economy.

A FIRSTHAND EXPERIENCE WITH CLIMATE CHANGE

As reiterated earlier, climate change poses the most significant threat to Morocco's agriculture and the nation's food security aspirations. In December of last year, Morocco's Minister of Equipment and Water, Nizar Baraka, disclosed that the Kingdom is bracing for its sixth consecutive year of drought due to decreased rainfall in recent months.

During that period, rainfall dwindled by 67% in the three months spanning October to December compared to a year considered normal. With rainfall scarce, the North African country's reservoirs are presently only 23.5% full, a stark contrast to the 31% recorded at the same juncture last year, a situation Mr. Baraka deemed "very dangerous."

The diminished rainfall accounts for the country's reduced agricultural output, jeopardizing the livelihoods of a third of the working-age population reliant on agriculture.

In response to escalating water stress, authorities are pinning hopes on seawater desalination projects, including one slated to

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 40

IN NUMBERS

COUNTRY FOCUS: MOROCCO

Morocco produced 115,000 tons of maize in 2022.

MT) for grain traders and Moroccan agricultural cooperatives. This premium is provided to facilitate the storage of wheat at facilities licensed by the Moroccan Cereals Office (ONICL).

On May 31, 2023, the Moroccan government ceased its common wheat import support program as global prices decreased with the emergence of the new world wheat crop (ranging between $227-$251 per MT), coupled with other diminishing inflationary pressures. Furthermore, the government of Morocco maintained wheat and barley import duties at zero until December 31, 2023, in a bid to encourage

One of the most ambitious initiatives is the launch of a US$1 billion plan in June 2023 to mitigate the impacts of drought on the agricultural sector. This comprehensive plan includes support for livestock, horticultural production, and the enhancement of agricultural financing systems. Of the total funds, $500 million will be allocated to a subsidy program for imported barley and dairy cattle feed, $400 million will be utilized to facilitate the purchase and distribution of inputs such as seeds and fertilizers, while the remaining $100 million will be dedicated to supporting Credit Agricole and improving

SIGN UP FOR MILLING MIDDLE EAST & AFRICA EMAIL NEWSLETTERS! www.millingmea.com/signup

EXTRUSION

Extrusion, the decades old technology driving new product development in thee 21st century

BY MARTHA KURIA

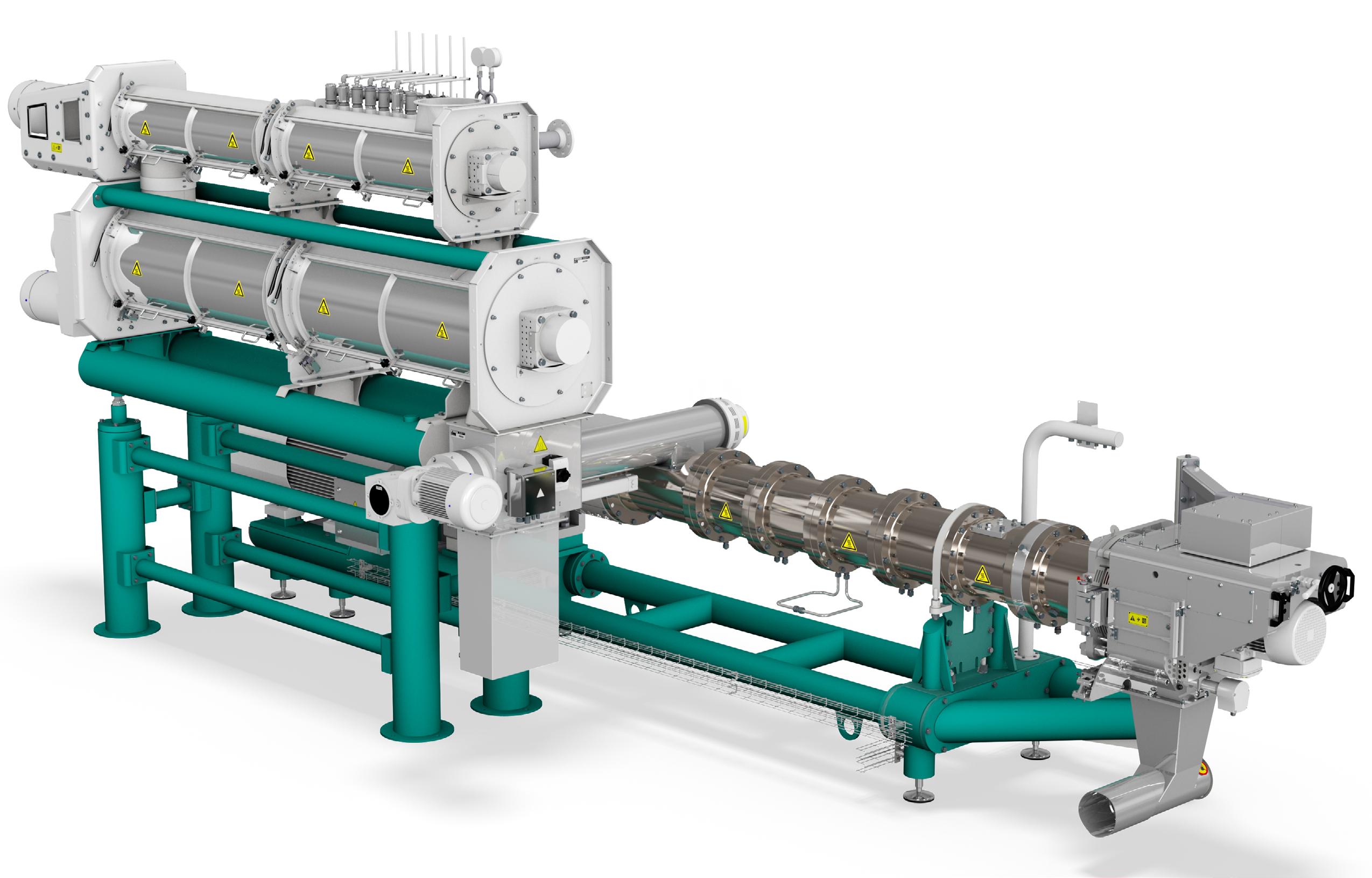

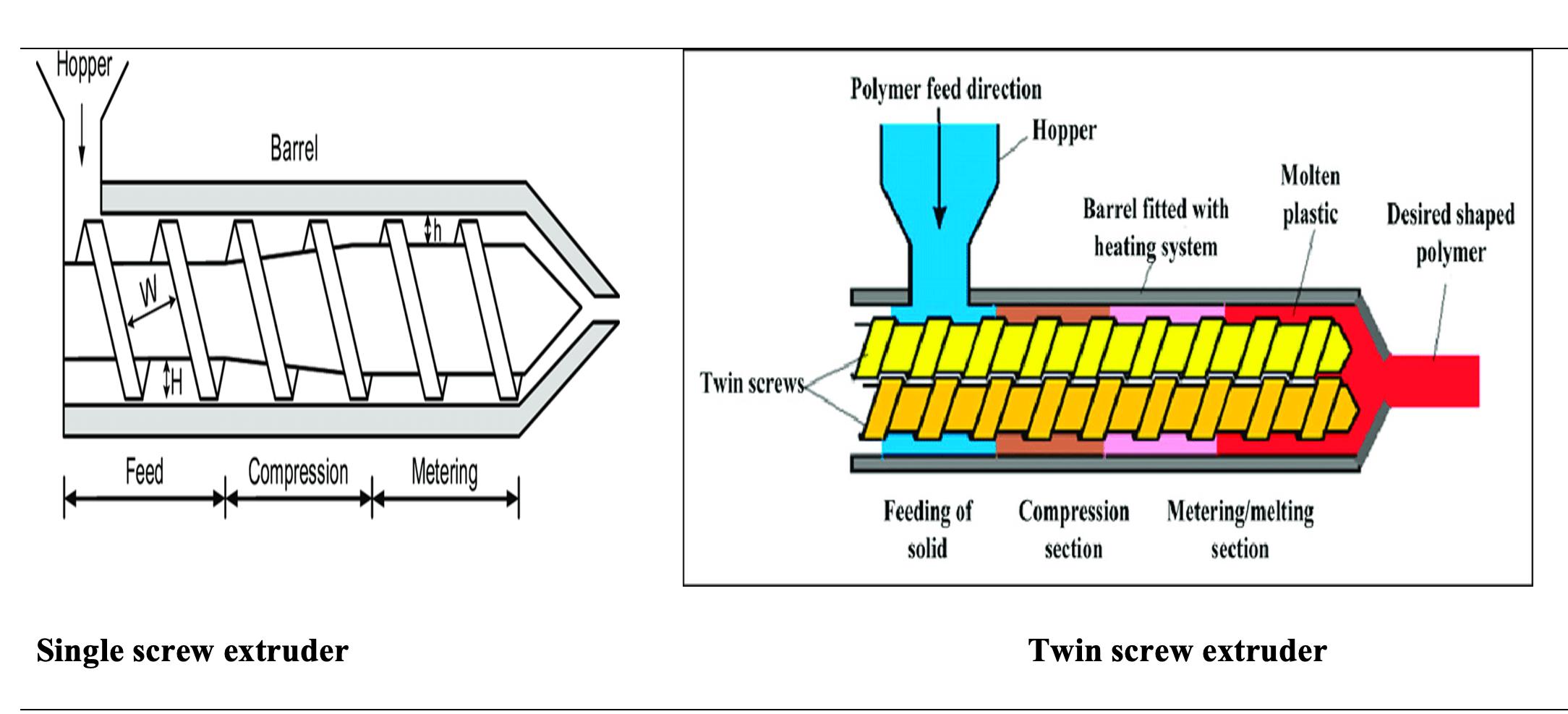

Over the past 80 years, the application of continuous extrusion, which was initially limited to mixing and forming macaroni and ready-to-eat cereal pellets is now considered a high temperature-short time bioreactor that transforms raw ingredients into modified intermediate and finished products. The technology has been developed as an alternative method for texturization, mixing, forming, reacting, and cooking of food.

According to Market Research Future, extruded snacks market size was valued at US$

44.3 billion in 2022 and is projected to grow from US$ 47.4 Billion in 2023 to US$ 72.0 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 7.20% during the forecast period (2023 - 2030). The rapidly evolving snacks industry has created new opportunities for manufacturers to innovate their processing and preservation technologies, as well as their modern product offerings. The extruded category has entered the mainstream, and the market is experiencing a variety of trends, from pasta, breakfast cereals, bread crumbs, biscuits, crackers, croutons, baby foods, snack foods, confectionery items, chewing

FEB/MARCH 2024 | MILLING MIDDLE EAST & AFRICA WWW.MILLINGMEA.COM 42 TECHNOLOGY FOCUS: EXTRUSION

gum, texturized vegetable protein, modified starch, pet foods, dried soups, and dry beverage mixes.

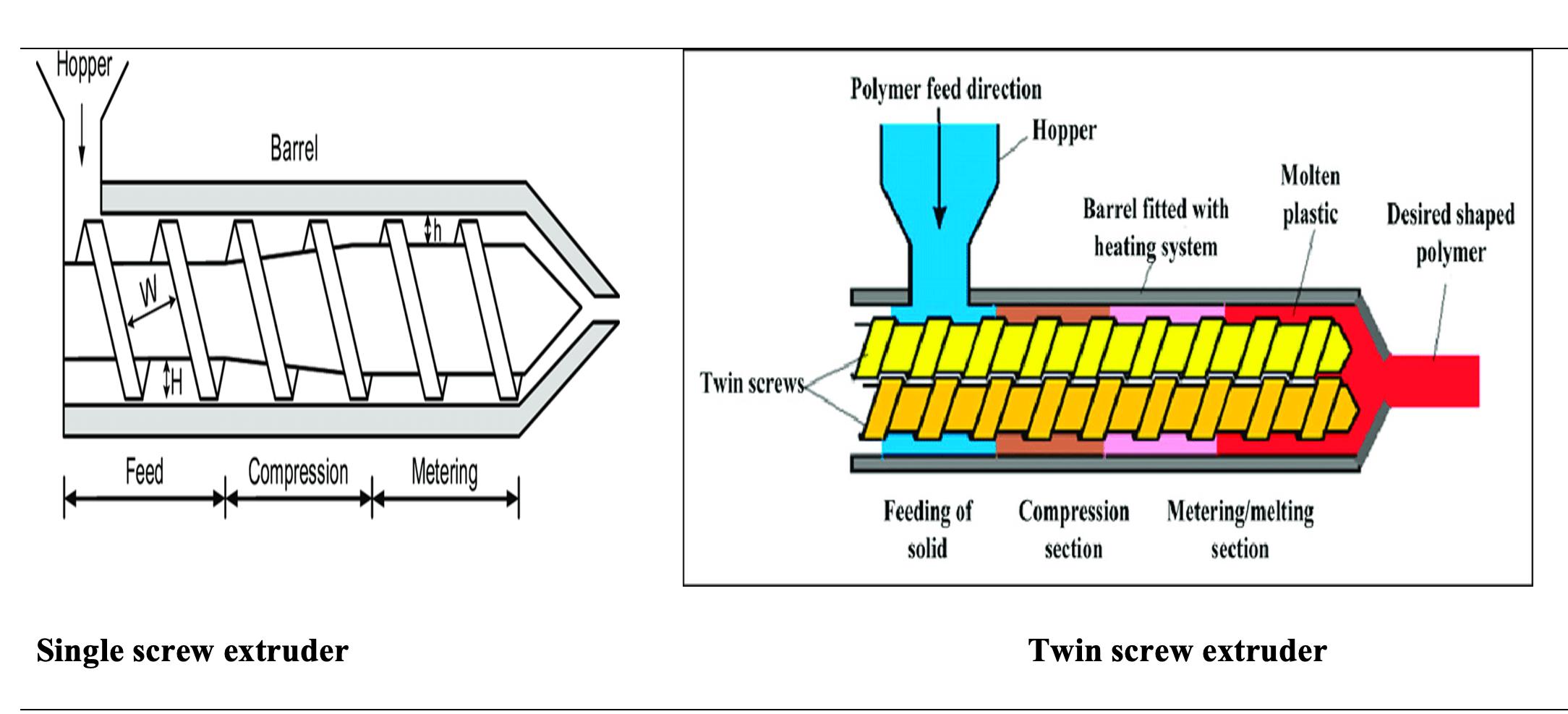

BASIC PRINCIPLE OF EXTRUSION PROCESS

Extrusion is a high-temperature–short-time (HTST) cooking process in which heat transfer, mass transfer, pressure changes, and shear are combined to achieve structural, chemical, and nutritional transformations.

During extrusion, raw materials are forced to flow under controlled conditions along the length of the extruder barrel and through a shaped opening (called die assembly) at a defined throughput. First, raw materials are commonly ground to the preferred particle size. While food is being forced through the extruder, foods are cooked in the high-pressure, high-shear, and high-temperature environment created by the screws, encased in the barrel.