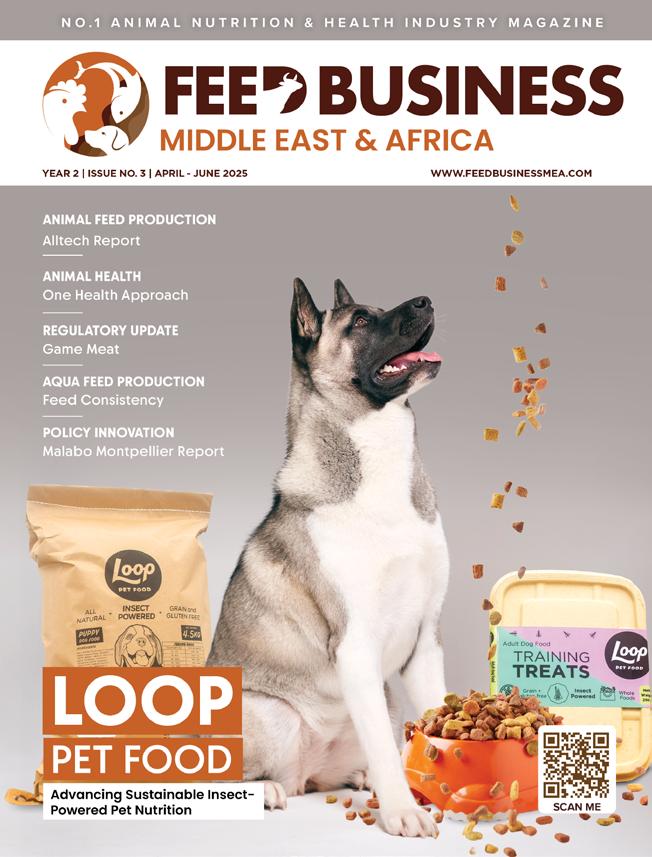

LOOP PET FOOD

When the Story Writes Itself…

One of the quiet joys of working in publishing is the way a magazine issue evolves; slowly, unpredictably, and always slightly differently than you imagined. When we wrapped up our last issue, we already had a rough idea of what the next one might look like: a feature or two, some industry updates, maybe a policy deep dive or a country focus. But two to three months is a long time in this industry. Between one issue and the next, reports are released, policies shift, events are held, and entirely new conversations begin to shape the narrative.

And that, I’ve come to realise, is one of the most fulfilling parts of the process: the not knowing. The openness to being surprised by what matters most now, not just what seemed urgent a few weeks ago. This issue is a perfect reflection of that journey.

For instance, it features insights from the recently released 2025 Alltech Agri-Food Outlook, an article inspired by the CGIAR Science Week that Martha Kuria and I attended, a recent EFSA update that Ms. Khasoa flagged, and even a report I first heard about through a reflection by a LinkedIn connection.

It also includes a guest technical article on achieving uniformity in extruded fish feed, contributed by Jan Jonkers, an expert I had the pleasure of meeting during an aquaculture roundtable hosted by Bühler Group. That event brought together aquaculture experts from around the world, serving as a reminder of just how collaborative and knowledge-rich this industry is.

Speaking of collaboration, this issue wouldn’t exist without it. It has benefited from the voices and ideas of multiple writers and partners, including an opinion piece by Daouda Ngom, Senegal’s Minister of Environment and Ecological Transition, whose thoughts on Africa's Pastoralism are timely and thought-provoking.

COMING FULL CIRCLE

Our cover story this time brings us back to Loop Pet Food Kenya. After Laura Stanford, the CEO of Loop Pet Food, gave readers expert insights on pet nutrition in our previous issue, her company now takes centre stage in a beautifully written profile by Fridah Chepkoech. It's a delight to trace their growth and innovation in the pet food space.

At its core, this issue reminds me that the best stories often weren’t part of the original plan. They emerge, surprise us, and make the output stronger, deeper, and more relevant than we hoped. And when we listen, when we let the evolving conversation lead the way, something powerful happens.

Thank you, as always, for turning these pages with us. We hope you find this issue as insightful and engaging to read as it was to create.

Warmly,

Wangari Kamau Editor - Feed Business MEA

Year 2 | Issue No.3 | APR-JUN 2025

FOUNDER & PUBLISHER

Francis Juma

SENIOR EDITOR

Martha Kuria

EDITOR

Wangari Kamau

Fridah Chepkoech

Lydia Khasoa

CONTRIBUTOR

Jan Jonkers

BUSINESS DEVELOPMENT DIRECTOR

Virginia Nyoro

BUSINESS DEVELOPMENT ASSOCIATE

Vivian Kebabe

HEAD OF DESIGN

Clare Ngode

DESIGN

Monica Wachio

ACCOUNTS

Jonah Sambai

PUBLISHED BY: FW Africa

P.O. Box 1874-00621, Nairobi Kenya

Tel: +254 725 34 39 32

Email: info@fwafrica.net

Company Website: www.fwafrica.net

We publish some of the most influential magazines and websites in Africa & the Middle East regions. Please visit the websites below for more information about our publications

Feed Business Middle East & Africa (ISSN 2307-3535) is published 4 times a year by FW Africa. Reproduction of the whole or any part of the contents without written permission from the editor is prohibited. All information is published in good faith. While care is taken to prevent inaccuracies, the publishers accept no liability for any errors or omissions or for the consequences of any action taken on the basis of information published.

EVENTS CALENDAR

World Aquaculture Safari 2025

June 24 – 27, 2025

Speke Resort, Kampala, Uganda

www.was.org/meeting/code/afraq25

Africa Poultry and Animal Feed Expo 2025 – Kenya and Eastern Africa Edition

July 2 – 4, 2025

Sarit Expo Centre, Nairobi, Kenya www.afmass.com

Livestock Malaysia 2025

August 25 – 29, 2025

Kuala Lumpur Convention Centre, Kuala Lumpur, Malaysia

www.livestockmalaysia.com

Pet Fair Asia 2025

August 20 – 24, 2025

Shanghai New International Expo Centre, Shanghai, China www.en.petfairasia.com

VIV China 2025

September 10 – 12, 2025

Nanjing International Expo Center, Nanjing, China

www.vivchina.nl

Agra Middle East 2025

October 6 – 7, 2025

Dubai World Trade Centre, Dubai, UAE

www.informaconnect.com/agra-middle-east

Vietstock Expo and Forum 2025

October 8 – 10, 2025

Saigon Exhibition and Convention Center, Ho Chi Minh City, Vietnam

www.vietstock.org

VIV MEA 2025

November 25 – 27, 2025

Abu Dhabi National Exhibition Centre (ADNEC), Abu Dhabi, UAE

www.viv.net

35th Annual IAOM MEA Conference & Expo 2025

December 1 – 4, 2025

Jeddah Hilton (Hilton Hall), Jeddah, Saudi Arabia

www.iaom-mea.com/Jeddah-2025

Ridley sells South Australia feed mill to Baiada for US$14M

AUSTRALIA - Ridley Corporation, a major player in Australia's animal feed industry, has agreed to sell its Wasleys feed mill in South Australia to poultry processor Baiada Group for AUD22 million (US$14 million), with the deal expected to close by June 30, 2025.

The move comes as part of Ridley’s broader business reset strategy. The Wasleys' facility, which generated AUD3.5 million (US$2.24 million) in EBITDA over the past year, sold more than 90% of its output to Baiada.

The sale is expected to deliver a net gain of AUD4 million (US$2.55 million) in fiscal 2025 EBITDA after transaction

and restructuring costs. From fiscal 2026, the reset plan is projected to yield AUD 5 million (approximately US$3.19 million) in annual cost savings.

“We understand Baiada’s desire to own the feed mill as part of their expansion plans,” said Ridley Managing Director and CEO Quinton Hildebrand. “The sale represents a fair price and supports our growth ambitions.”

Baiada, a major player in Australia’s poultry industry with a market share of over 20%, operates a fully integrated supply chain. The privately owned company employs about 2,200 people and continues to invest in long-term food security.

“To meet Australia’s insatiable appetite for poultry… Baiada continues to look forward and invest to ensure we can continue to provide quality poultry for future generations – sustainably,” the company said in a statement.

Ridley, with 70 years in the industry, remains a key national feed producer. It operates 20 feed mills across Australia and produced 2 million metric tons of feed in 2023 for the dairy, poultry, swine, aquaculture, beef, and pet food sectors.

In related news, Baiada Poultry is constructing a broiler processing facility in Tamworth, New South Wales, with operations expected to begin in 2026. The new facility is expected to handle up to 3 million chickens every week once fully operational.

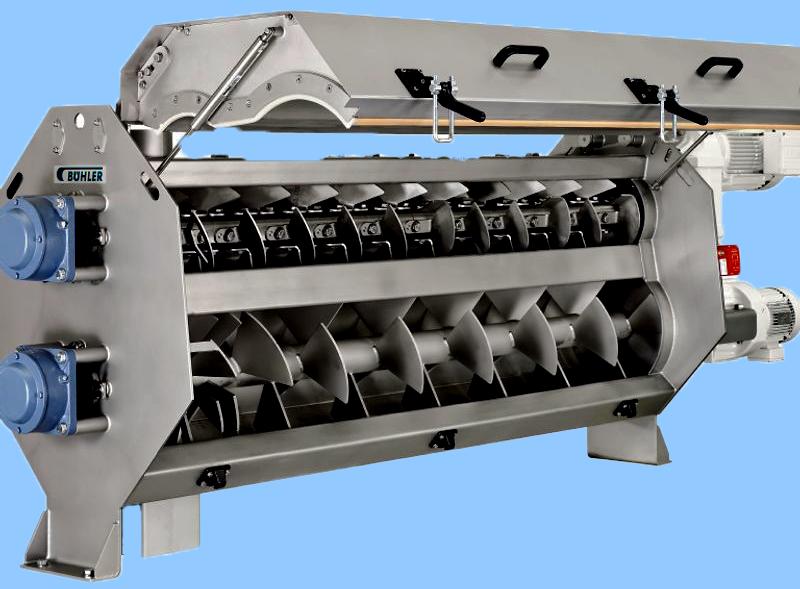

Bühler launches inaugural extrusion workshop in Nairobi, opens new academy in Switzerland

KENYA - Swiss food tech giant Bühler will host its first-ever Food Extrusion Workshop in Nairobi from July 15 to 18, 2025, marking a milestone in its commitment to building technical capacity in food and feed processing across Africa.

Set to take place at the African Milling School and Bühler’s local customer site, the four-day workshop is tailored for operations supervisors, engineers, and R&D professionals. It offers a robust blend of in-depth theoretical instruction and practical, hands-on training using Bühler’s high-performance twin-screw extruder.

Participants will explore key principles of extrusion, including screw design, mechanical and thermal input, and product configuration. Advanced modules will delve into steam addition, preconditioning, vacuum degassing, coextrusion, remote-cut technology, colouring, coating, drying, and toasting.

Demonstrations will feature a wide range of extruded products, such as ready-to-eat cereals, snacks, texturised plant-based proteins, and fortified rice. Analytical methods will also be covered to assess ingredient transformation during

extrusion cooking.

Attendance costs US$900, excluding VAT. The fee includes meals, training materials, a networking dinner, and transport between the hotel and venue. Participants are required to bring their own safety shoes and glasses.

The workshop underscores Bühler’s broader agenda to drive sustainability and innovation in global food systems.

In related news, Bühler has opened a new Milling Academy at its Uzwil headquarters. Spanning 1,800 square metres, the centre features a fully automated 24-tpd school mill, labs, classrooms, and access to the Grain Innovation Centre.

“With the opening of our new, state-of-the-art Milling Academy, we are empowering the next generation of milling professionals by offering advanced training, hands-on experience, and access to the latest technologies,” said Stefan Birrer, Head of Business Area Milling Solutions at Bühler Group.

Offering over 100 courses annually in seven languages, the Academy now includes the School of Feed Technology and serves more than 750 professionals worldwide.

CHINA 10-12 Septermber

48,000m2 Exhibition Area

500+ Exhibitors

18,000+ Visitors

Mr. Matthew Yu

Tel: +86 158 0083 0669

E-mail: matthew.yu@globusevents.com

Mr.Philippe Verstuyft (based in Europe) Tel: +31 6 1517 3564

E-mail: philippe@vnueurope.com

Ms.Chanitprapa Menasuta (based in Thailand) Tel: +66 (0) 8 1801 7464

E-mail: chanitprapa@vnuasiapacific.com

E-mail: viv.service@globusevents.com

Saudi’s Fourth Milling Co. announces US$71M expansion to boost flour, feed output

SAUDI ARABIA – Fourth Milling Co. (MC4), one of Saudi Arabia’s top flour and animal feed producers, has announced a significant expansion initiative valued at SAR 265 million(US$71 million), with plans to construct a new flour mill and feed plant at its Al-Kharj site in Riyadh.

Approved by the company’s board on April 30, the project will raise the site’s total flour capacity to 1,350 tons per day with an additional 750 tons/day from the new mill.

The feed plant will contribute 240 tons/day, significantly enhancing MC4’s role in strengthening the Kingdom’s food and feed supply chains.

This strategic investment aims to meet the surging demand from bakeries, food processors, and livestock producers nationwide, aligning with Saudi Arabia’s broader food security objectives.

The project has received approval from the General Food Security Authority (GFSA), reinforcing the government’s commitment to supporting investments that secure national food reserves and promote sustainable exports.

Financing for the development will be secured through a mix of Shariah-compliant bank facilities and internal funds.

Construction is set to begin in Q2 2025, subject to final regulatory approvals. The feed mill is expected to become operational by the second half of 2026, followed by the flour mill in the second half of 2027.

According to the company, trial production runs will precede full-scale operations, with financial gains projected from the respective go-live dates.

MC4 currently operates strategically located facilities in Dammam, Madinah, and Al-Kharj, serving more than 80% of the Kingdom’s population. Its existing operations boast a daily flour milling capacity of 3,150 tons and feed output of 450 tons.

The investment plans follow the company's recent announcement of its highest-ever annual revenue of approximately US$170 million (SAR 629 million) for the full year ended December 31, 2024 (FY 2024), representing a 12.7% year-over-year increase.

Cairo Poultry to produce French animal feed brands for Egypt and the GCC

EGYPT - Cairo Poultry Company (CPC) has signed a strategic franchising agreement with French agribusiness giant Avril Group and its subsidiaries, MiXscience and Sanders Nutrition Animale, marking a significant step toward elevating animal nutrition standards in Egypt and the Gulf region.

Signed this May in Rennes, France, the deal grants CPC and its affiliate, Cairo Feed Company, exclusive rights to manufacture, market, and distribute Sanders and Golden Horse-branded animal feed in Egypt and across GCC countries.

The Sanders brand, a staple in French animal nutrition, will now be locally produced in Egypt under CPC’s stewardship, using premixes supplied exclusively by MiXscience. The agreement also includes technical support, audits, quality control, and tailored training to ensure consistency and quality.

“This agreement enables the local production of highquality animal feed formulas by leveraging Avril’s nutritional expertise and CPC’s industrial capabilities,” said Mr. Sayed Fouad, Head of the Egyptian Commercial Office in France.

The initiative is expected to bolster food security, sustainability, and economic growth, with CPC aiming to double sales and position Egypt as a regional hub for premium animal nutrition products.

Dignitaries from the Egyptian Embassy in France, including Fouad and Third Secretary Mr. Ahmed El-Shafie, attended the signing ceremony, highlighting the growing Egypt–France relationship.

“It’s about connecting Egypt and France, vision and opportunity, today’s ambitions and tomorrow’s successes,” the partners declared.

“I invite French companies to enter into strategic partnerships with their Egyptian counterparts… to benefit from the large Egyptian market and to take Egypt as a regional hub to increase French exports,” Fouad added.

Meanwhile, in its financial disclosure for the period ending March 31, CPC reported revenues of approximately US$85.6 million (EGP 4.2 billion), marking a 22% increase from the US$69.9 million (EGP 3.4 billion) recorded in Q1 of 2024.

Reinartz joins Kahl Group to strengthen feed and biomass innovation ACQUISITION

GERMANY - Germany’s Reinartz GmbH & Co. KG has officially joined the Kahl Group, marking a strategic acquisition aimed at accelerating innovation in sustainable food, feed, and biomass processing.

Reinartz, a global specialist in mechanical extraction technologies with 170 years of experience, will continue to operate independently under its own name. Its 50-employee team and production site in Neuss will remain unchanged.

The move strengthens synergies between Reinartz and other Kahl subsidiaries, including Amandus Kahl (feed pelleting), Schule Mühlenbau (grain milling), and Neuhaus Neotec (food processing). Together, the companies aim to enhance ingredient processing, expand innovation in alternative proteins, and speed up entry into new markets.

“With this merger, we want to boost our innovative power and market presence in the long term,” said Niklas Stadermann, who will co-lead Reinartz alongside Artur Kühl. “Together with the Kahl Group, we want to develop new strategic partnerships, expand distribution channels, and enter new markets.”

Reinartz’s screw presses and separation systems are already widely used to process insect larvae into protein-rich cakes, extract vegetable oils, and convert biowaste into energy, supporting circular and sustainable systems globally.

described Reinartz as a cultural and strategic fit: “Like all companies in our group, Reinartz is committed to reliability, trust, and a long-term perspective. These values are the foundation of a successful partnership.”

The integration also brings a leadership change. Longtime managing director Michael Moll is stepping down but will remain as a consultant and advisory board member.

The Kahl Group now comprises seven companies and offers a broad portfolio across feed, food, and biomass engineering.

Novonesis takes full ownership of Feed Enzymes Alliance in

US$1.56B deal

DENMARK - Novonesis has acquired complete control of the Feed Enzymes Alliance from dsm-firmenich in a €1.5 billion (US$1.56 billion) deal, ending a 25-year partnership between DSM-Firmenich and Novozymes.

The transaction, completed in early June, brings approximately €1.4 billion (US$1.45 billion) in net cash to dsmfirmenich after costs. It enables Novonesis to fully integrate the alliance’s innovation, production, and sales operations, thereby strengthening its position in the animal biosolutions sector.

Founded through the 2023 merger of Novozymes and Chr. Hansen, Novonesis has until now primarily focused on probiotics. The acquisition significantly expands its product portfolio, enabling the company to offer enzymes alongside probiotics to a shared customer base, particularly in North America.

“We are better positioned to deliver innovative, sustainable, and value-adding bio-solutions,” said Novonesis CEO Ester Baiget. Executive VP Tina Sejersgård Fanø added, “We can now increase our market reach and offer a more comprehensive

product range to our customers.”

The feed enzymes business generated around €300 million (US$324 million) in annual net sales in 2024 and was part of dsm-firmenich’s Animal Nutrition & Health division. The sale marks the beginning of dsm-firmenich’s planned exit from that business.

“The alliance has been a great success, establishing a global leadership position in feed enzymes. I am confident that this business will continue to thrive under Novonesis’ leadership,” said dsm-firmenich CEO Dimitri de Vreeze.

Novonesis assured all dsm-firmenich or Novonesis customers, partners or distributors that the acquisition will have little to no effect on your day-to-day operations.

“Contracts with the Feed Enzyme Alliance are still valid and contact persons will remain the same wherever possible,” Novonesis says on its website.

Although the formal partnership has ended, the two companies will maintain commercial ties, with Novonesis using dsm-firmenich’s premix network to distribute enzymes.

Kahl Group CEO Uwe Wehrmann

De Heus builds new feed mill in South Africa, acquires Voeders Huys in Europe

SOUTH AFRICA

- De Heus South Africa has broken ground on a new feed mill in Middelburg, Eastern Cape, marking a major step in its expansion strategy across the country. The facility, set to open in August 2026, will produce up to 15,000 tons of ruminant feed per month.

Located in the heart of the Karoo, a region known for sheep, beef, and dairy farming, the plant aims to provide farmers with easier access to high-quality livestock nutrition. The project is expected to enhance regional productivity and bring new employment opportunities.

“We’re excited to bring top-notch animal nutrition to this region to develop agriculture and support local communities,” said Co de Heus, Chairman of the Board of Royal De Heus. “Based on the strong performance of our South African team, we’re confident this new facility will be a success.”

The Middelburg mill will complement De Heus’ existing operations in Mkhambathini, Klerksdorp, Kleinberg, and Modimolle, ensuring a reliable supply nationwide across the poultry, swine, and ruminant sectors.

De Heus South Africa also recently invested in a solar park in Modimolle aimed at cutting greenhouse gas emissions and improving operational resilience.

This initiative, which provides renewable energy to one of its production facilities, highlights De Heus’s dedication to ecofriendly feed production.

Meanwhile, De Heus has also expanded its European footprint with the acquisition of Belgian compound feed producer Voeders Huys. The deal includes two production facilities, one in Bruges, Belgium, and another in Northern France, adding 250,000 tons of annual feed capacity.

“This acquisition marks a new chapter in our long-term growth strategy,” said Gabor Fluit, CEO of De Heus Animal Nutrition. “It enables us to grow with our farmers and supply chain partners while reducing our carbon footprint.”

Founded in 1938, Voeders Huys brings deep regional roots and a legacy in grain trading dating back to 1865.

Imas completes one of Kazakhstan’s largest feed mills for Nurym Group

KAZAKHSTAN - Turkish milling equipment manufacturer Imas has cemented its reputation as a global feed technology leader with the completion of a major turnkey project for Nurym Group in Shymkent, Kazakhstan.

The newly commissioned feed mill is now among the largest and most advanced in the country and the surrounding region, boasting a production capacity of 20 tons per hour and a daily output of approximately 480 tons of compound feed.

The facility runs three shifts around the clock to produce high-quality feed for cattle, poultry, and small ruminants. It was delivered as a full-scope project by Imas, which handled everything from design and engineering to machinery manufacturing, installation, commissioning, and staff training.

“Our team also delivered comprehensive training on machine performance and on operating the feed laboratory equipment at the facility,” Imas noted.

Imas’ Viteral machinery series anchors the plant. The Viteral pellet press (VPP) can reach up to 30 tons per hour and is equipped with a touchscreen for precise control of time and temperature.

The Viteral paddle mixer (VMX), praised in lab tests for its mixing homogeneity, ensures efficient blending. Meanwhile, the Viteral hammer mill (VHM) features a fixed-hammer design and a pre-crushing blade system, allowing it to process up to 50 tons per hour with durability and power.

The mill is automated end-to-end. A central system continuously monitors equipment performance, raw material input, and output data in real-time. The system also allows Imas’ after-sales team to access the plant remotely for troubleshooting and support.

This facility adds to Imas’ track record of over 500 completed projects in more than 100 countries. Founded in 1989, the company has consistently provided scalable feed and grain milling technologies tailored to meet the needs of clients across five continents.

CPF Philippines to lease new US$20M feed mill in Isabela

PHILIPPINES - Charoen Pokphand Foods Philippines (CPF Philippines), a subsidiary of Thailand’s Charoen Pokphand Foods (CPF), will lease a new feed mill under construction in Isabela province, enhancing its integrated poultry and livestock operations across Luzon.

The 15-hectare Isabela Feed Mill Complex is being developed by Sagittarian Agricultural Philippines, Inc. (SAPI), with financing from the Land Bank of the Philippines. Landbank is providing a PHP 1.2 billion (US$21.3 million) loan for construction, along with a US$1.77 million working capital credit line.

The facility is expected to strengthen CPF’s feed supply for its fully integrated value chain, from feed manufacturing to food distribution, while boosting local corn demand. Isabela, the country’s top corn-producing province, accounts for about 20% of the Philippines’ total output.

“With this investment, Landbank reaffirms its commitment to modernising the agricultural sector, empowering local farmers, and strengthening the country’s food security,” said Landbank President and CEO Lynette V. Ortiz during the

agreement signing on April 23 2025.

In a separate announcement, CPF said it will acquire Itochu Corporation’s 23.8% stake in C.P. Pokphand for US$1.1 billion, becoming the sole owner of the Bermuda-based company.

The acquisition is expected to improve CPF’s management flexibility in China and Vietnam, where C.P. Pokphand operates major animal farming and food businesses. Itochu forecasts a net profit impact of US$888.1 million in fiscal 2026 from the sale.

Additionally, CPF Group recently enhanced its animal feed operations in Bangkok, Thailand, with the successful commissioning of a state-of-the-art storage and unloading system supplied by French bulk handling specialist Morillon Systems.

The advanced setup features a 10-meter-diameter, 32-meter-tall silo, designed for storing soybean meal, an essential component in animal feed.

The commissioning was carried out in partnership with local engineering firm Kasetphand Industry Co., Ltd. Morillon praised the collaboration, citing the technical team’s efficiency and commitment to excellence.

Manuchar secures exclusive MetAMINO distribution rights in Pakistan

PAKISTAN - Manuchar Pakistan has been appointed the exclusive distributor of MetAMINO®, Evonik’s branded DLmethionine, an essential amino acid for livestock, reinforcing its role as a significant force in the country’s growing animal nutrition sector.

The partnership with German chemicals firm Evonik gives the Karachi-headquartered distributor exclusive rights to supply MetAMINO® across Pakistan. The agreement is set to expand Manuchar’s footprint in a key emerging market where protein demand is surging alongside population growth and rising consumer awareness.

“We’re thrilled to partner with Evonik as their exclusive distributor for Methionine in Pakistan. This agreement is a key milestone for us, unlocking new opportunities for growth and innovation,” said Aaqib Munawer Hussain, Country Manager for Manuchar Pakistan. “It strengthens our position in the market and paves the way for long-term success, allowing us to deliver high-quality solutions to meet the growing demand in Pakistan.”

Manuchar, a global distribution specialist with operations in over 35 countries, brings established logistics networks, deep market insight, and a strong commitment to ESG and regulatory standards.

“This partnership strengthens Manuchar’s feed additives portfolio in emerging markets, offering top-quality products, continuous availability, and competitive pricing to keep our customers’ production running – anytime, anywhere,” said Tim Lemeer, Global Director for Animal Nutrition at Manuchar.

Evonik’s Regional Head of Animal Nutrition for Asia Pacific, Madeline Tan, noted: “This partnership marks a step forward in our efforts to serve customers in emerging markets. With its growing animal nutrition sector, Pakistan offers substantial potential for our premium product MetAMINO.”

In other news, Manuchar will be exhibiting its solutions at the upcoming Africa Poultry and Animal Feed Expo at the Sarit Expo Centre in Nairobi, Kenya, from July 2-4, 2025.

Louis Dreyfus deepens feed ingredient footprint in China with speciality lecithin line

CHINA – Louis Dreyfus Company (LDC) recently inaugurated a new state-of-the-art automated production line for speciality feed lecithin at its oilseeds crushing facility in Tianjin, China.

The new facility, which operates entirely on renewable electricity, is part of LDC’s strategy to capture rising global demand for high-performance lecithin products and expand into value-added animal nutrition solutions.

The investment comes as the global lecithin market, valued at an estimated US$1.08 billion in 2025, is projected to grow to US$1.46 billion by 2030, at a compound annual growth rate (CAGR) of 6.15%.

Developed in collaboration with LDC’s R&D centre in Shanghai, the line will manufacture enzymatically treated lecithin and low-viscosity lecithin, two functional ingredients that enhance nutrient absorption and processing efficiency in animal feed.

Enzymatically treated lecithin boosts the bioavailability of fat-soluble vitamins and nutrients, leading to improved feed efficiency and lower production costs for livestock farmers. Low-viscosity lecithin, on the other hand, can be blended directly into feed without requiring high heat or expensive storage solutions.

“Leveraging LDC’s processing and innovation capabilities, our new production line will enable us to offer customised solutions tailored to feed industry requirements,” said James Zhou, Global Head of Food & Feed Solutions at LDC.

The growth of the lecithin market is being primarily driven by increasing demand from the animal nutrition sector, particularly in high-consumption regions such as China, the world’s largest pork producer and a key consumer of poultry and aquaculture products.

Lecithin, primarily derived from soybeans, is widely used as an emulsifier and stabiliser in compound feeds. Its costefficiency and functional versatility make it a preferred choice for large-scale feed operations.

“Our new automated production line for speciality feed lecithin reflects our commitment to leveraging innovation and processing infrastructure to meet the evolving needs of China’s farming industry,” added Shengshu Huang, Chief Technology Officer at LDC.

ILRI named first WOAH collaborating centre for One Health

KENYA – The World Organisation for Animal Health (WOAH) has designated the International Livestock Research Institute (ILRI) as its first-ever Collaborating Centre for One Health.

The announcement was made during the closing session of WOAH’s 92nd General Session, held in Paris, France, from 25 to 29 May 2025.

The designation marks a significant milestone in the integration of animal, human, and environmental health efforts worldwide.

With this recognition, ILRI becomes the inaugural institution globally entrusted by WOAH to lead the advancement of the One Health agenda.

“We are honoured by WOAH’s designation of ILRI as a Collaborating Centre for One Health. ILRI will continue to work with partners to provide the One Health solutions that improve animal health management, drive innovations, mitigate emerging global threats and build sustainable resilience in food systems globally,” said ILRI Director General Appolinaire Djikeng.

As a WOAH Collaborating Centre, ILRI will focus on several strategic areas critical to global health. These include disease

prevention, particularly zoonotic and emerging pathogens, through improved surveillance and early warning systems.

It will also involve enhancing biosecurity and value chain practices to reduce disease risks, as well as applying epidemiological modelling and socio-economic impact analysis to inform policy.

Additionally, ILRI will support climate-smart strategies to manage health vulnerabilities driven by environmental changes.

ILRI’s designation builds on decades of experience in using the One Health approach in low- and middle-income countries.

As a CGIAR research centre operating 14 offices across Africa and Asia, ILRI has established a broad, interdisciplinary network that connects science, policy, and practice to solve complex health challenges at the animal-human-environment interface.

WOAH Director General Emmanuelle Soubeyran welcomed the collaboration, stating: “ILRI’s interdisciplinary approach aligns with WOAH’s vision for One Health. We look forward to working closely with ILRI to advance the One Health agenda”

SIGN UP FOR FEED BUSINESS MIDDLE

Africa's Pastoralists Hold The Key To Sustainable Livestock And Environmental Balance

By Daouda Ngom, Minister of Environment and Ecological Transition for Senegal

Across Africa, pastoralists and livestock keepers sustain herding systems that are closely tied to their landscapes and are crucial to national food security, economic growth, and ecological balance. In my country, Senegal, almost 70 % of our land is used to graze livestock.

And yet, I hear it often argued that, if we want a sustainable future, we must choose between hooves and habitats because livestock is an “environmental liability”.

But this point of view is misunderstood. Across Africa, innovative technologies are being piloted to allow livestock and a healthy environment to coexist. What we need now is more investment and collaboration to scale these breakthroughs.

Despite being home to more than 85% of the world’s pastoralists and livestock keepers, sub-Saharan Africa produces just 2.8% of global meat and milk. As a result, one in five Africans lacks adequate access to nutritious foods. Fixing this can be simple: a single egg, a cup of milk, or a small piece of meat can make all the difference in combating malnutrition.

UNPRECEDENTED POPULATION GROWTH CATAPULTS MEAT CONSUMPTION

Meanwhile, populations are growing and urbanising faster here than anywhere else in the world. Demand for meat and dairy products is forecast to rise 300% by 2050. Thankfully, evidence already exists that proves we don’t need to sacrifice a healthy environment to meet this demand.

Pastoralists in Senegal, for example, strategically move their animals to mimic natural grazing patterns, taking into account rainfall to prevent overgrazing. This not only improves biodiversity and soil quality, but also reduces dry vegetation and the growing threat of wildfires. To support, the Senegalese government has been providing our pastoralists with detailed weather data and forecasts to help them optimise grazing and manage their livestock more efficiently. Working with communities in this way has been shown to reduce conflicts over land and water resources.

Elsewhere in Africa, animal health interventions are demonstrating that better, not necessarily fewer, livestock is the answer to sustainability in the sector. East Coast fever

vaccination programmes have reduced calf mortality up to 95% in some countries. More than 400,000 cattle have been saved in the past 25 years, reducing emissions up to 40%.

Moreover, new thermotolerant vaccines for the highly contagious viral disease peste des petits ruminants (PPR), as demonstrated already in Mali, offer a promising way to curb the US$147 million in annual losses suffered by sheep and goat keepers across Africa. Boosting productivity among these climate-resilient animals will be nourish Africa’s rapidly growing population as climate change intensifies.

However, despite these successes, a significant challenge remains. I have seen firsthand that many pastoralists, smallholders and subsistence farmers lack the knowledge and resources needed to access and implement these innovations. These groups account for the majority of Africa’s livestock keepers and must be reached for these innovations to realise their benefits at scale.

COLLABORATION AND INVESTMENT TO BRIDGE GAPS

Two things are needed to bridge this gap. First, greater collaboration between policymakers, researchers, farmers, and businesses can help us better understand the challenges that livestock farmers face and enable them to produce more, without compromising our environment.

For example, collaborative initiatives like the Livestock and Climate Solutions Hub, launched by the International Livestock Research Institute, showcase practical ways for farmers to reduce their herds’ impact on the environment.

The second element is investment. For decades, despite the clear potential of high returns on investment, the livestock sector has suffered from a vast investment gap, receiving as little as 0.25% of overall overseas development assistance as of 2017. It must be made financially viable for livestock keepers to invest in technologies and approaches that raise productivity sustainably, or else this mission will not even get off the ground.

The 2025 World Bank Spring Meetings, where funding for development initiatives was determined, present a timely opportunity to kickstart this paradigm shift so that livestock is recognised within green financing frameworks.

African countries, in turn, must do their part by incorporating livestock into their national economic development plans and their climate action plans. This will help encourage funding streams from global investors and climate financing mechanisms, ultimately catalysing a multiplier effect of billions in livestock sustainability investment.

The solutions are within reach. What is needed now is the will to act decisively and unlock the continent’s unparalleled natural resource potential to build a future where prosperity and sustainability go hand in hand. FBMEA

June 24-27, 2025

International Conference and Exposition of

June 24-27, 2025

International Conference and Exposition of

World Aquaculture Societ y and African Chapter, WAS (AFR AQ2025)

Speke Resor t, Munyonyo, Entebbe, Uganda

World Aquaculture Societ y and African Chapter, WAS (AFR AQ2025)

Speke Resor t, Munyonyo, Entebbe, Uganda

For details: w w w.was.org

For details: w w w.was.org Register now WORLD AQUACULTURE SAFARI 2025

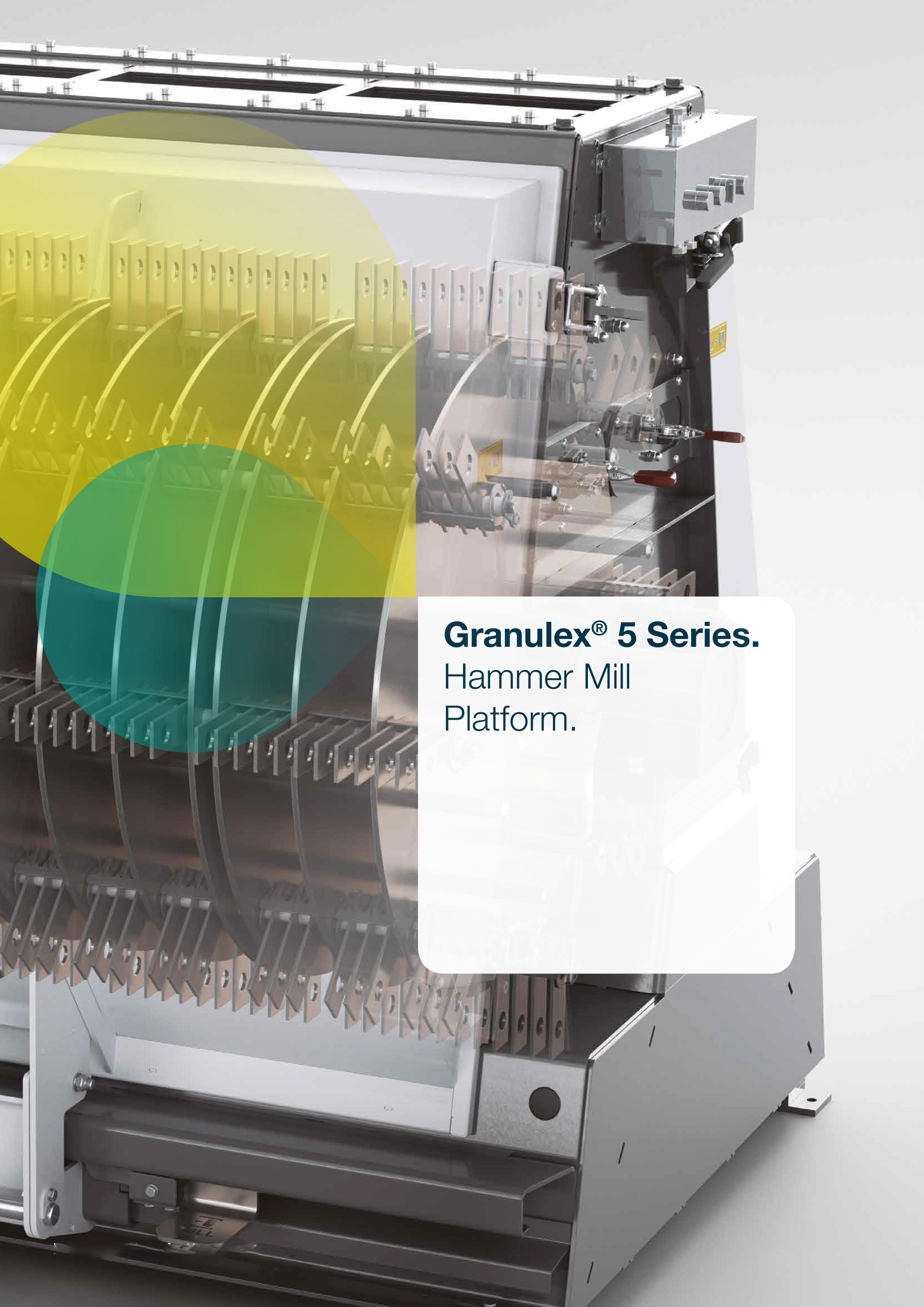

LOOP PET FOOD:

How a Kenyan Startup is Pioneering Sustainable Insect-Powered Pet Nutrition

BY FRIDAH CHEPKOECH

The first thing you notice when you step into Loop Pet Food’s establishment, located in an industrial centre just off Nairobi’s Waiyaki Way, is the cold. Not the kind that bites. The kind that comes from an intentionally conditioned, well-sealed space. At the far end of the waiting room, a waist-high display shelf sits beneath a photo frame stamped #LOOPLOVE. It holds four clearly labelled glass jars: Ground BSF, Peas, Brewer’s Yeast, and Dried BSFL. The earthy powder colours catch your attention. Looks more like sampled ingredients from a bakery than from a conventional dog food manufacturing facility.

But Loop is anything but a conventional kibble plant. It is one of the few companies in Africa building a local, circular supply chain in a pet food market valued at U$2.94 billion in 2025, and growing fast. According to UN Comtrade, Africa remains a net importer, with pet food imports nearly doubling from U$101.6 million in 2012 to U$200.2 million in 2021. Euromonitor further projects that market volume will reach 2.23 billion kilograms by 2030.

CEO and co-founder Laura Stanford greets us warmly upon arrival, ready to turn what could have been a simple facility tour into a crash course on how insects, smallholder farmers, and Kenyan ingenuity could reshape global pet nutrition.

WHY TWO FOUNDERS BET ON BUGS

You don’t usually expect pet nutrition to begin with waste streams, but that’s exactly where Loop Pet Food started.

Laura Stanford, an insect enthusiast, and Amit Grabovski, her co-founder, launched Loop in 2022 after realising pet food options in Kenya were either unaffordable imports or risky local blends following repeated aflatoxin alerts. “There was no safe, affordable middle ground,” Laura tells Feed Business Middle East & Africa Magazine.

Both founders were already familiar with the black soldier fly larva (BSFL). Farmers across East Africa had begun trialling it as a replacement for soy and fishmeal in poultry rations, thanks to an FAO study backed by multiple other studies showing the insect’s feed conversion ratio (1.4–2.0) outclassed that of chicken (2.5) and beef (6). What no one had tried at scale was putting BSFL into complete, shelf-stable dog food.

480 MT IN NUMBERS

They had a compelling and aligned premise to kick start the project: If Nairobi’s markets generate thousands of tonnes of organic waste each week. (A reality backed by a recent Dutch-funded study that found that Nairobi’s markets generate nearly 7,000 tonnes of organic waste annually, much of it ending up in rivers or landfills.) And larvae thrive on those scraps, converting them into a protein that contains all ten essential amino acids dogs need. Then Loop could complete a dog food recipe by securing clean vegetable “seconds” from smallholder farmers, and rescuing nonaesthetically pleasing produce often left unsold in retailers, yet nutritionally perfect. A circular recipe almost naturally wrote itself: cassava flour for starch, peas and other vegetables for fibre, brewer’s yeast for B vitamins, bentonite clay for minerals, and dried BSFL as the sole animal protein, all 100% locally sourced.

“It was important to us from the beginning that everything be sourced as locally as possible,” Laura says. “There’s just so much value in the system already, we’re not importing anything if there’s a farmer down the road who has exactly what we need.”

Loop officially incorporated in March 2023

after 6 months of initial R&D, and rented a workshop in Nairobi’s industrial belt, “honestly no bigger than a single parking spot,” Laura laughs. One tabletop mixer, one converted oven and a hand-crank extruder produced their first 50 kilogram batch. Friends with Labradors and rescued street dogs became beta testers. Within three months, vets reported shinier coats and calmer stomachs, especially in animals previously intolerant to chicken or beef. It was an early sign that Loop’s insect-based formula was both sustainable and effective.

Interestingly, in a guest contribution to Issue 2 of Feed Business Middle East & Africa Magazine, Laura explored this very topic. In the article “Tailored Nutrition: Meeting the Unique Nutritional Needs of Dogs and Cats,” she explained how dogs have evolved into omnivores over thousands of years of domestication, capable of digesting a variety of proteins. Cats, on the other hand, are strict carnivores, nutritional purists in a sense, hence require a diet closer to that of their wild cousins, lions.

This science-backed positioning, along with promising early trials, quickly drew attention from local retailers. GreenSpoon, Kenya’s farm-

The newly installed processing plant, dubbed "Tiny"

to-door e-grocery platform, was among the first to stock Loop Pet Food, soon followed by a few Naivas branches. Demand quickly outran capacity. And while this necessitated scaling, financing this significant growth posed a classic SME dilemma: local banks quoted 25% interest on equipment loans, a rate that could easily cripple a young firm. Instead, Laura and Amit raised a modest friends and family equity round, commissioning a twin screw extruder and multilayer dryer that went live in January 2025 and was officially commissioned in March 2025. The upgrade lifted monthly capacity from 4 to 40 metric tonnes, enough to look beyond Kenya’s borders. Which they since have.

But rather than chasing scale for scale’s sake, Loop’s next moves are deliberate. “Our focus was first on getting this facility up and running,” Amit explains. “Once we have all the right certifications, that will unlock additional regions.”

So far, the numbers suggest that Loop could sell every bag it produces within Kenya alone. But that hasn’t stopped the team from exploring wider opportunities. Their sights are set on Uganda and Rwanda, two countries where, as Laura points out, “100% of pet food is imported, which is crazy.”

They’ve already made inroads into Rwanda, working with Pride Farms, an online grocery platform akin to Kenya’s Greenspoon. A 2024 Euromonitor snapshot estimates 90% of packaged pet food in East Africa is imported , so Loop’s principal competitor is the shipping container, not a local rival.

A CIRCULAR ECONOMY PLANT IN MOTION

On the day of our visit, production is minimal, so we skip the full sanitation gear and pass through a translucent swing door

IT WAS IMPORTANT TO US THAT EVERYTHING BE SOURCED LOCALLY. THERE’S SO MUCH VALUE IN THE SYSTEM ALREADY, WE’RE NOT IMPORTING ANYTHING UNLESS WE ABSOLUTELY NEED TO.

into the heart of operations. The machines are mostly idle. Production had wrapped the previous day, Laura tells us. We pass by rows of stacked bins. Further in, sealed blue barrels contain the real star – the main character: dried black soldier fly larvae. “This batch came in from one of our farmer clusters in Kiambu,” Laura says, tapping a lid. Through partnerships, Loop collaborates with over 300 farmers in peri-urban areas of Nairobi, Nakuru, and Machakos, utilising aggregators.

Each raw ingredient is cleaned, weighed, and prepared in small, measured quantities. “It’s a bit like baking,” Laura says. Ingredients are then mixed, pressure-cooked, and shaped into pellets using an extruder, and subsequently dried to a moisture content of less than 10%.

When asked about energy and water use, Laura responds that Kenya’s 90% renewable energy grid is a significant advantage.

LAURA STANFORD - CEO LOOP PET FOOD

“Just by using KPLC, I’m using renewable energy sources, which is so cool. Additionally, a lot of our moisture comes from the vegetables in our recipes. The only water we use is for cleaning.”

Every operational choice is filtered through that lens, including packaging. “At the moment, we’ve got our paper bags, and where we’re looking to go is towards recyclable plastic.” She adds that their neighbour is a recycler: “People can return the bags to us, and we’ll make sure they go to recycling.”

Loop’s model is structured to reduce waste at every turn. “We always make sure the decisions we make are coming back to closing that loop, because I don’t think we have excuses not to anymore.”

PRICE, ADOPTION & THE COST OF MONEY

Loop's product may be radically local and circular, but price remains its most crucial entry point.

Laura frames the company’s priorities in a strict order:

1. Nutrition: Formulated to AAFCO and FEDIAF standards; every batch is aflatoxin tested.

2. Affordability: Price within 10% of mid-tier imports, with an economy line in R&D.

3. Sustainability: The company diverts five kilograms of organic waste and avoids 17 kg CO₂e for every

Co-founders Laura Stanford and Amit Grabowski at the launch of their new plant

Mark, an employee at Loop Pet Food, dispaying a bag of premium dog food

kilogram of kibble sold.

“If we don’t win on the first two, no one sticks around to care about the third,” she says.

“You can build the most sustainable thing in the world,” Laura adds, “but if people can’t afford it, or don’t see why they should switch, you won’t move the market.”

Their kibble currently retails at a mid-premium price point, slightly below imported brands like Pedigree and Hill’s Science Diet, but higher than generic maize-meal blends that dominate Kenya’s lower-income segment. For Laura and co-founder Amit Grabovski, finding that sweet spot between affordability and value was always part of the challenge.

Furthermore, insects carry a cultural “ick factor”, a visceral resistance shaped by years of conditioning, especially among urban dwellers who associate larvae with waste and decay, not wellness. To address this, Loop uses vet partnerships, social media, and WhatsApp videos to normalise insectbased nutrition for customer education. It also helps that some communities in Kenya and the broader Eastern Africa associate insects with food.

In Laura’s view, Kenya has proven to be fertile ground for entrepreneurs willing to think differently. “In Kenya, your idea can be very big or very small, but you can start with basic machinery to test it. You don’t need to wait for perfect conditions. There’s so much opportunity because industrialisation is still young. We can build a beautiful industrial Kenya, one small company at a time,” she adds.

WHAT’S NEXT FOR LOOP PET FOOD?

Loop Pet Food is developing a new cat food line. “Cats are

YOU CAN BUILD THE MOST SUSTAINABLE THING IN THE WORLD, BUT IF PEOPLE CAN’T AFFORD IT, OR DON’T SEE WHY THEY SHOULD SWITCH, YOU WON’T MOVE THE MARKET.

obligate carnivores,” says Laura. “They should eat like lions in the Maasai Mara, meat only.” Yet dry pet food, by nature, requires more than just meat. The team is working to create a dry formula that respects this dietary need while staying ethical, sustainable, and complete. They won’t launch until the product meets their standards for nutritional integrity.

At the same time, Loop is expanding into feeds for backyard animals like chickens and rabbits. Many Kenyan households that keep pets also raise small livestock; therefore, the company aims to offer products that cater to this broader need.

The team handles research and development in-house, supported by an international feed formulator with experience in insect-based nutrition. Together, they are updating all recipes to meet AAFCO (US) and FEDIAF (EU/UK) standards. Loop also plans to earn HACCP and ISO 22000 certifications in the coming months, aligning its safety standards with those of human food production.

Loop is building an economy line to reach more households. The team aims to expand its retail footprint, increase its presence on more shelves, and enhance price competitiveness through scale. They’re also expanding their partnerships with vets, joining more events, and strengthening community engagement.

As part of its mission, Loop continues to support the Kenya Society for the Protection and Care of Animals (KSPCA), Kibera Youth for Stray Animals (KYSA), and Paws for a Cause – organisations that rescue and care for abandoned animals.

CLOSING THE LOOP

We return to the waiting room. The chill is gone, or we've stopped noticing. The jars still catch the light, but the room now holds a quiet familiarity. A few copies of recent Feed Business Middle East & Africa issues are passed around. Laura flips through the one where she contributed a piece on pet nutrition, chuckles, and jokes about sending it to her extended family. We pose for a few photos. Mostly of us, the visiting editorial team, with Laura slipping into a few frames between scenes.

We select the neatly packed samples that are displayed neatly by the product, which we get to take home. Just as we wrap up, the rain starts. Softly at first, then steadily. “Is that rain?” Laura tilts her head, listening, “Oh, it’s rain. I love it.”

FBMEA

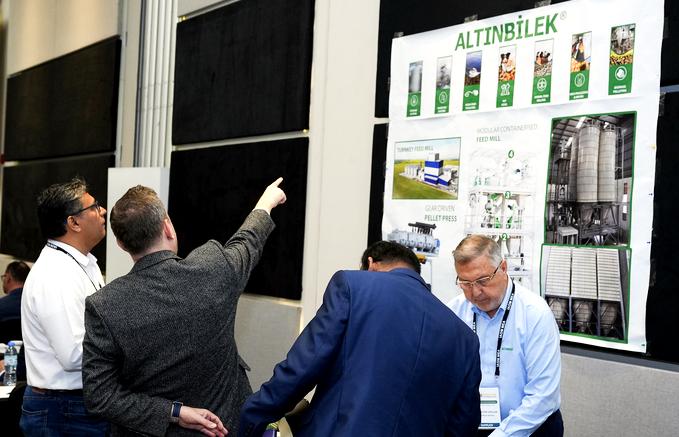

IAOM MEA’s Inaugural Feed Milling Forum Elevates Animal Nutrition Dialogue in MEA

From May 6 to 8, 2025, the International Association of Operative Millers Middle East and Africa Region (IAOM MEA) hosted its inaugural Feed Milling Forum in Dubai, launching a focused platform for the animal nutrition and feed production industry under the banner “Where Animal Nutrition Meets Excellence.”

Set against the backdrop of a feed industry on the rise, with the regional market projected to exceed US$32.96 billion by 2029, the forum offered participants a rich blend of scientific insights, engineering advances, and practical tools designed to help them meet the demands of a sector under increasing pressure to deliver quality, efficiency, and sustainability.

The three-day programme featured a compelling roster of speakers and topics. Dr. Zahid Aslam delivered a keynote address that explored the critical intersections between feed formulation and production in the face of industry shifts. Priscilla Bakalian from Bühler’s African Milling School delivered two insightful presentations, one of them on strategies to secure the safety of the feed supply chain. Martin Schlauri, chairman of the IAOM MEA Education Committee, provided practical guidance on safe grain storage, while Wim Delameilleure of SCE discussed the return on investment of square silo infrastructure.

On the technology front, Alex Ammann of Bühler addressed the importance of moisture control and homogeneity in feed processing. Ivan Harjacek from Andritz highlighted the potential of AI in transforming feed mill operations. Presentations by Hamid Farahmand showcased expander and pelleting technologies, while Zeki Demirtasoglu of Bastak Group unpacked advanced quality control strategies.

Automation also featured prominently, with Abdul Raouf Mahmoudi of ASM Process Automation offering insights on plant-wide digitisation, and Stanko Milutinov from IFFCO detailing the precision required in micro-nutrient systems. Mansour Al Suwaiyeh shared developments in Saudi Arabia’s barley flaking industry, adding a regional layer to the forum’s global perspective.

Throughout the event, delegates explored exhibitions by some of the most respected names in process technology, including Alapala, Altınbilek, Bühler, IMAS, KAHL, ASM, Bastak, SCE, STATEC BINDER, and TANIS Milling Technologies. Looking ahead, the broader milling industry is now preparing for the 35th IAOM MEA Conference & Expo, scheduled to take place for the first time in Saudi Arabia from December 1 to 4, 2025, at the Jeddah Hilton. FBMEA

Why Africa Matters Now:

Mr. Faisal Baig, the newly appointed

SubRegional Director for Africa at ANDRITZ Feed & Biofuel on the company's strategy for Africa

BY FRANCIS JUMA

Please tell us a bit about your journey to heading the ANDRITZ office in Dubai and your new role covering Sub-Saharan Africa.

MR. FAISAL BAIG: Since joining ANDRITZ in 2021, my journey has been both diverse and fulfilling. I’ve held several roles that have deepened my understanding of the feed and biofuel sectors, and I’m honoured to take on now the role of leading our operations across Sub-Saharan Africa.

We recently restructured our focus by separating the former Middle East and Africa portfolio into three distinct regions: Africa, the Middle East, and Turkey, each with dedicated leadership. I now oversee the Africa region, which is entering a defining moment in its industrial development.

The demand for animal proteins, from poultry and livestock to aquaculture, is rising, and Africa is increasingly investing in infrastructure to meet this demand. Our technologies are wellsuited for this growth, especially as the market shifts toward more efficient, digitised, and sustainable solutions.

To ensure we remain close to our customers, we’ve established regional teams in Northwest Africa, East Africa, and South Africa. These teams engage directly with clients on the ground, listening, advising, and co-creating tailored solutions that meet local needs.

What excites you most about the feed and biofuels sector in Africa, and what is your vision for driving ANDRITZ’s growth on the continent?

MR. FAISAL BAIG: Africa is at an inflection point. With rapid urbanisation, a rising middle class, and growing protein demand, we are witnessing an unprecedented opportunity to build integrated feed systems and scalable biofuel solutions. What excites me is the chance to create circular, resilient supply chains that empower local producers.

We’re also seeing a shift: multinational companies are no longer just exporting to Africa, they’re setting up manufacturing bases and making acquisitions on the continent. Additionally, small, family-run feed mills are scaling into large commercial operations. These players need modern, energy-

efficient, and digitally enabled solutions, and that’s precisely where ANDRITZ comes in.

Our vision is to create localised, inclusive ecosystems anchored in sustainable raw material sourcing, smart manufacturing, and strong distribution networks. We aim to be a partner of choice, through technology, and by investing in long-term capacity building and value chain integration.

Which trends and regions are shaping your growth strategy in Africa?

MR. FAISAL BAIG: We're seeing strong momentum in four areas: commercial poultry and aquaculture feed demand, industrial-scale feed mill development, decentralised biomass solutions, and interest in second-generation biofuels. These trends reflect a broader shift toward digitalised advanced manufacturing and green energy transition.

East Africa and Southern Africa are leading in infrastructure readiness, private investment, and agro-industrial capacity. West Africa, notably Nigeria and Ghana, is rapidly emerging due to population-driven demand. Additionally, Africa’s advantage lies in its abundance of arable land, underutilised agricultural residues, and a youthful, adaptable workforce. With ANDRITZ technology and policy support, Africa can become a net exporter of sustainable feed and biomass.

We aim to offer scalable, modular, and regionally adapted feed solutions, and support investments in decentralised biofuel projects that can serve both on- and off-grid needs. We’re prioritising technologies that reduce setup costs, improve nutrient efficiency, and promote energy efficiency.

How is ANDRITZ integrating digital technologies, and circular economy principles into its African operations?

MR. FAISAL BAIG: Our portfolio includes energy-efficient feed technologies such as advanced hammer and pellet mills, coupled with automation systems that optimise energy use, improve throughput, and lower operational costs. We're also leading in bio-waste conversion and offer dedicated technology for black soldier fly processing, a promising local alternative to traditional fishmeal and soy-based ingredients.

On the digital front, our Metris automation platform enables real-time monitoring, remote and centralised plant control, and predictive maintenance, all of which streamline operations, reduce unplanned downtime, and improve consistency in output quality. Its predictive maintenance function supports fewer breakdowns and better control of operational expenses. These capabilities are a game-changer for feed producers looking to scale efficiently.

We’re also advancing circular economy models by offering solutions that convert plastics, wood, and industrial waste into clean energy. For instance, we help reprocess wood waste into biomass pellets used for clean cooking or steam generation.

How are you navigating Africa’s fragmented markets and aligning with regional initiatives like AfCFTA to streamline operations?

MR. FAISAL BAIG: We take a decentralised approach, focusing on local regulatory engagement, risk-sharing partnerships, and policy advocacy. This allows us to operate with agility and influence reforms in collaboration with national and regional stakeholders.

AfCFTA offers a unique opportunity to harmonise standards, reduce cross-border trade costs, and scale manufacturing. Most standards are already internationally derived, so this does not significantly impact our technology; however, it presents an opportunity for Africa to adopt higherquality feed and biofuel processing across the board.

How is ANDRITZ working with partners like DFIs, governments, and local innovators to scale impact across Africa?

MR. FAISAL BAIG: Public-private partnerships are vital for de-risking capital, accelerating infrastructure, and scaling industry mechanisation. We’re actively engaging with governments, NGOs, and development finance institutions (DFIs), particularly in areas such as feed production zones and biofuel corridors. DFIs offer concessional finance, technical support, and risk guarantees. They are co-creators of inclusive, commercially viable solutions.

We treat cooperatives as strategic partners. We co-create business models that enhance their margins, support them with training, and link them to finance and inputs. We’re also exploring African innovations with global potential, such as banana pulp as a feed ingredient, an example of how local ingenuity can be scaled through co-development.

What leadership principles guide you as you manage diverse teams across Africa?

MR. FAISAL BAIG: Empathy, agility, passion, and accountability. I believe in empowering local teams, fostering inter-country collaboration, and creating space for innovation and cultural intelligence to thrive.

Success in my first year in this office will mean laying the foundation: establishing anchor projects in at least three countries, deepening association and DFI engagement, and building a capable, empowered regional team.

What’s your message to local industry players looking to grow alongside your division?

MR. FAISAL BAIG: This is the time to scale. Africa's feed and biofuels sector is ripe with opportunity, and we’re looking for partners who are committed to sustainability, innovation, and long-term value creation. Let’s build it together. FBMEA

Defying the Odds: Africa and the Middle East Lead the Way in Feed Sector Recovery

BY WANGARI KAMAU

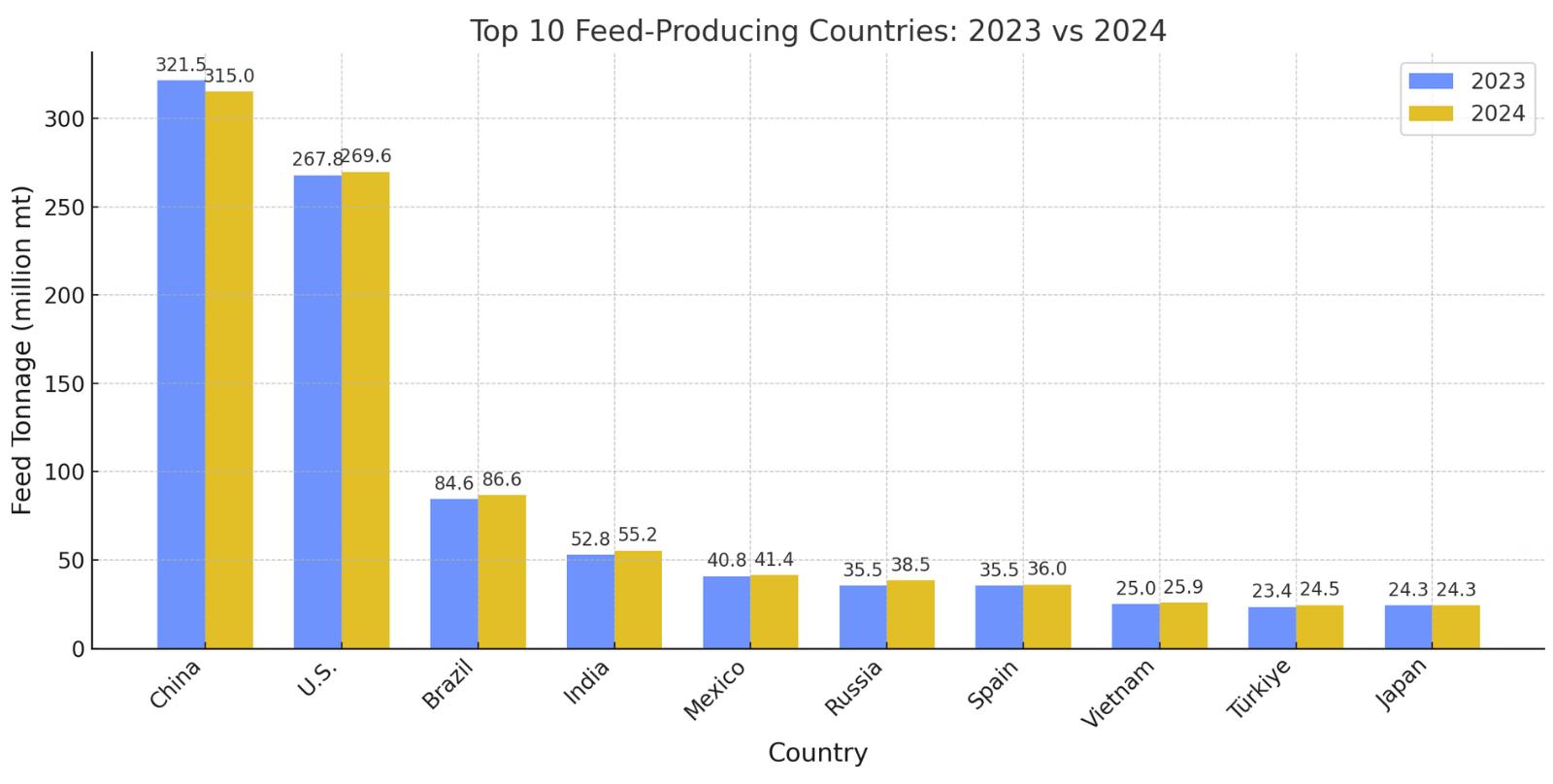

In a world still reeling from economic shocks, climate whiplash, and the persistent shadow of animal disease outbreaks, one would expect the global feed industry to stall, or even shrink. Yet, against the odds, it not only endured but inched forward. And leading that charge were Africa and the Middle East. According to the 2025 Alltech Agri-Food Outlook, these regions recorded the highest percentage growth in feed production globally in 2024, with output surging by 5.4% to reach 95.5 million metric tonnes. Africa alone posted a 7.2% increase, the strongest of any region, while the Middle East managed a respectable 2.8% rise, despite long-standing structural constraints.

This momentum speaks to more than numbers. It’s a signal of more profound shifts: a region steadily transitioning from subsistence to commercial systems, new players entering the market (think pet food and aquafeed), and a quiet resilience rewriting Africa and the Middle East’s place in the global livestock economy. Poultry and dairy rebounded. Pet food skyrocketed. And aquaculture, though still small in scale, began showing signs of strategic intent.

The gains come at a time when the rest of the world fought hard just to maintain their footing. Global feed production grew by a modest 1.2%, rising from 1.380 to 1.396 billion metric

tonnes, as supply chains stabilised and demand gradually recovered from a stagnant 2023. Even so, the Asia-Pacific region posted a decline, and several top producers, such as China, saw sharp drops in specific sectors.

REGIONAL SPOTLIGHT: AFRICA AND THE MIDDLE EAST

In 2024, Africa’s total feed output rose from 53.9 million to 57.8 million metric tonnes, and the Middle East followed suit with an increase from 36.7 to 37.7 million tonnes; a modest gain, but one that speaks volumes given the region’s enduring structural constraints.

Traditionally characterised by smallholder, low-input systems, Africa’s feed landscape is evolving fast. Countries across the continent are shifting toward more intensive and commercialised models, especially in dairy, beef, poultry, and aquaculture. The results are striking: dairy feed production surged by 25.7%, the highest percentage increase of any region worldwide, driven by the rise of urbanised, commerciallyoriented smallholder farms and improved cold-chain infrastructure. Beef feed tonnage jumped 32.2%, reflecting both growing urban appetite for red meat and a shift toward feedlot systems in drought-prone areas with poor pasture

quality.

The poultry sector, still the dominant feed consumer, also showed signs of recovery and resilience. Broiler feed grew 2.6% in Africa and 9.2% in the Middle East, as producers bounced back from 2023’s HPAI disruptions and responded to rising demand for affordable protein. Layer feed grew modestly in Africa (+1.7%), but fell 1.1% in the Middle East, constrained by volatile egg prices and persistent supply chain instability.

Meanwhile, aquaculture feed defied global trends. While global aquafeed production declined by 1.1%, Africa recorded a 9.1% increase, fueled by expanding inland fish farms and a shift toward formulated feeds. Although volumes remain relatively low, this growth indicates aquaculture’s increasing strategic importance as a tool for food security and economic development. In contrast, aquafeed in the Middle East dipped by 0.6%, though long-term prospects remain positive, especially in the UAE, where investment in recirculating aquaculture systems (RAS) is gaining momentum.

The most explosive growth came from the pet food industry. Africa led the world with a 60.3% year-on-year increase, as urbanisation, rising disposable incomes, and changing cultural attitudes toward companion animals sparked demand for premium pet nutrition. The Middle East also posted positive gains (+0.95%), mirroring this shift, albeit more gradually.

All of this progress unfolded despite formidable headwinds: conflict in Sudan, ongoing geopolitical instability, currency volatility, water scarcity, and spiralling input costs. Yet feed producers across both regions adapted by expanding mill capacity, reformulating rations, and leveraging regional policy support where possible. What emerged was not just growth, but a signal that Africa and the Middle East are rapidly maturing into serious players on the global agri-feed stage.

COMPARED WITH GLOBAL FEED TRENDS

While Africa and the Middle East led the world in percentage growth, the broader global picture, outlined in the 2025 Alltech Agri-Food Outlook, reveals a feed industry in cautious recovery. The year 2024 saw global feed production experience a modest yet meaningful rebound after a nearly flat 2023, where feed production rose by only 0.2%, primarily thanks to the Russo-Ukrainian war. The growth in 2024 occurred despite persistent headwinds, including economic instability, disease outbreaks, high input costs, and the deepening effects of climate change.

We have already established that Africa and the Middle East emerged as clear growth leaders, with a combined 5.4% increase, driven mainly by a shift toward commercial production systems, expanding urban demand, and greater feed mill investment.

Elsewhere:

• Latin America posted a solid 3.6% rise, buoyed by robust demand for poultry and pork, and strong export momentum, particularly from Brazil and Mexico.

• Europe grew 2.7%, with improvements in pig and aquaculture feed production. However, evolving

BROILER FEED ROSE 1.8%, SUPPORTED BY INCREASING DEMAND WHILE LAYER FEED REMAINED ESSENTIALLY FLAT, IMPACTED BY EGG OVERSUPPLY AND DISEASES IN KEY MARKETS.

sustainability mandates and emission-reduction policies may temper future expansion.

• North America inched up 0.6%, restrained by lingering HPAI impacts, stagnant aquaculture, and tighter consumer spending in an inflationary environment.

• In contrast, Asia-Pacific, historically the largest feed-producing region, experienced a 0.8% decline, primarily due to sharp reductions in China’s pig and beef feed output.

From a species perspective, poultry feed continues to dominate globally, accounting for 42.7% of all feed volume. However, its growth has slowed. Broiler feed rose 1.8%, supported by affordability and increasing export demand. In contrast, layer feed remained essentially flat, as it was impacted by egg oversupply and disease challenges in key markets, such as North America and Asia.

The dairy sector was a surprise bright spot, with a 3.2% global increase. Stronger milk prices fueled this, intensified production models, and rising consumer demand, especially in Africa, Europe, and parts of the Asia-Pacific region. The numbers confirm dairy’s steady resurgence as a key driver of feed demand.

Aquaculture, by contrast, recorded a 1.1% global decline, marking its second consecutive year of contraction. While demand for fish protein remains strong, the sector was hampered by disease outbreaks, high feed costs, and erratic weather patterns, particularly in Asia and Latin America. Still, growth in regions like Africa and Europe offered a glimmer of resilience and longer-term potential.

Pet food stood out as the fastest-growing category globally, expanding by 4.5%. Emerging markets led this surge, where rising incomes and shifting cultural norms have sparked a boom in pet ownership. Africa’s 60.3% increase is the most dramatic, but similar upswings are visible in Asia and Latin America. The result is a growing appetite for premium, functional, and human-grade formulations, transforming a once-niche segment into a major driver of growth.

WHAT’S DRIVING THE TRENDS?

Beneath the growth figures are several intertwined forces shaping both production and consumption patterns globally. Economic pressures remain one of the strongest

influencers. Rising input costs, inflation, and changing disposable incomes have altered consumer choices, tilting preferences toward cheaper proteins like poultry and eggs. This shift has amplified demand for certain feeds while depressing others, such as beef or aquafeed, in regions facing affordability challenges.

Disease outbreaks, particularly highly pathogenic avian influenza (HPAI) and African swine fever (ASF), continue to reshape supply chains and consumer demand. From massive flock culls to market volatility, disease management has been as much about economic survival as it is about animal health. Countries that implemented aggressive biosecurity and vaccination protocols, such as France and Brazil, have fared better in stabilising production.

Climate change has also forced producers to rethink feed strategies. In drought-hit regions like North America, Latin America, and parts of Africa, reliance on commercial feeds has grown as pastures shrink and grain yields become unpredictable. This has pushed up feed costs, but also accelerated innovation.

Pet humanisation is another major driver. Across continents, pets are increasingly seen as family, not animals. That emotional bond has translated into higher spending on tailored, functional nutrition—from joint-supporting kibble to probiotic-laced treats—fueling sectorwide growth.

Finally, technology adoption, sustainability mandates, and regional policy integration are

influencing feed formulation, sourcing, and milling. Countries prioritising innovation and environmental accountability, like Norway with its 2034 Sustainable Feed Mandate, are setting a new global benchmark for what the future of feed must look like: smarter, leaner, and far more circular.

WHAT DOES THE FUTURE HOLD?

Looking ahead to 2025, the global feed and agrifood sectors are expected to experience modest growth, shaped by regional dynamics and speciesspecific challenges. The Alltech report opines that optimism remains strong for the poultry and pet food industries, while aquaculture, dairy, and beef are cautiously optimistic sectors navigating cost, disease, and regulatory pressures. The pig industry remains divided in sentiment due to the lingering effects of African Swine Fever (ASF).

Innovation will play a critical role in driving both efficiency and sustainability, with technologies such as advanced nutrition, genetics, biosecurity, and renewable energy gaining traction. Disease management and economic volatility, including rising input costs and geopolitical instability, will continue to pose risks. Regions that emphasise biosecurity, cost control, and sustainable production practices will be better positioned to weather these challenges. Overall, 2025 will demand adaptability and collaboration across the value chain to ensure continued resilience and progress. FBMEA

Soybean Producers in the Middle East and Africa – 2024/2025 Marketing Year

Soybeans are prized for their high protein content, making them a vital component in animal feed production. As demand for poultry, livestock, and aquaculture feed rises across the region, driven by increasing consumption of animal protein, soybean cultivation has become increasingly important. The Middle East and Africa region, however, collectively accounts for less than 1% of global soybean output. Based on USDA/FAS estimates for the 2024/25 marketing year, these are the region’s top 10 producers.

1 SOUTH AFRICA – 2,330,000 METRIC TONS

South Africa remains the region’s top soybean producer, driven by advanced farming systems and expansive cultivation. Output rose from 1,840,000 tons in 2023/24, a season hit by prolonged drought, and is projected to reach 2,470,000 tons in 2025/26, driven by expanded acreage.

NIGERIA – 1,400,000 METRIC TONS

Nigeria continues to play a key role in the continent’s soybean sector. The country has steadily expanded its cultivation area to meet rising demand from the growing domestic and regional feed industries. Output is forecast to rise to 1,500,000 tons in 2025/26, as hectarage increases from 1,350,000 to 1,400,000 hectares.

ZAMBIA – 770,000 METRIC TONS

Soybean production in Zambia has surged, with acreage growing from 375,000 hectares in 2022/23 to 604,000 hectares in 2023/24, lifting output from 475,000 to 760,000 tons. Production is expected to hold at 770,000 tons in 2025/26.

BENIN – 652,000 METRIC TONS

Benin has recorded remarkable growth in soybean production, up from 521,000 tons in 2023/24. Improved access to certified seed and farmer training has bolstered output. With increased government support, production is projected to rise to 700,000 tons in the next season.

2 3 4 5 6 7 8 9 `10

GHANA – 358,000 METRIC TONS

Soybean production in Ghana continues to benefit from strong demand from the poultry sector. Output is expected to edge up to 360,000 tons in 2025/26 as more land is cultivated. This is a notable jump from the five-year average of 280,000 tons.

ETHIOPIA – 250,000 METRIC TONS

Ethiopia’s soybean industry is on a steady growth path, with production set to rise from 250,000 to 260,000 tons in 2025/26. This reflects a notable improvement from the fiveyear average of 225,000 tons, driven by expanded cultivation and the broader adoption of improved seed varieties.

IRAN – 170,000 METRIC TONS

Iran remains one of the few Middle Eastern countries with substantial soybean production, maintaining output at 170,000 tons. No change is expected in 2025/26, as priority is given to wheat, rice, and barley.

UGANDA – 150,000 METRIC TONS

Uganda’s output remains steady at 150,000 tons, underpinned by consistent demand from processors and regional buyers, and stable acreage. Production is expected to stay flat in the coming year. Yields, however, remain low at under 1 ton per hectare.

TURKEY – 150,000 METRIC TONS

Production in Turkey increased from 140,000 tons in 2023/24 to 150,000 tons, driven by expanded acreage. Output is expected to remain unchanged in 2025/26. The country still relies heavily on imports to meet its nearly two million-ton demand.

EGYPT – 85,000 METRIC TONS

Egypt closes the list with 85,000 tons of soybean production, matching its 2023/24 output, which had risen from 56,000 tons following an increase in cultivated area from 20,000 to 30,000 hectares. Production is expected to remain stable in the coming season.

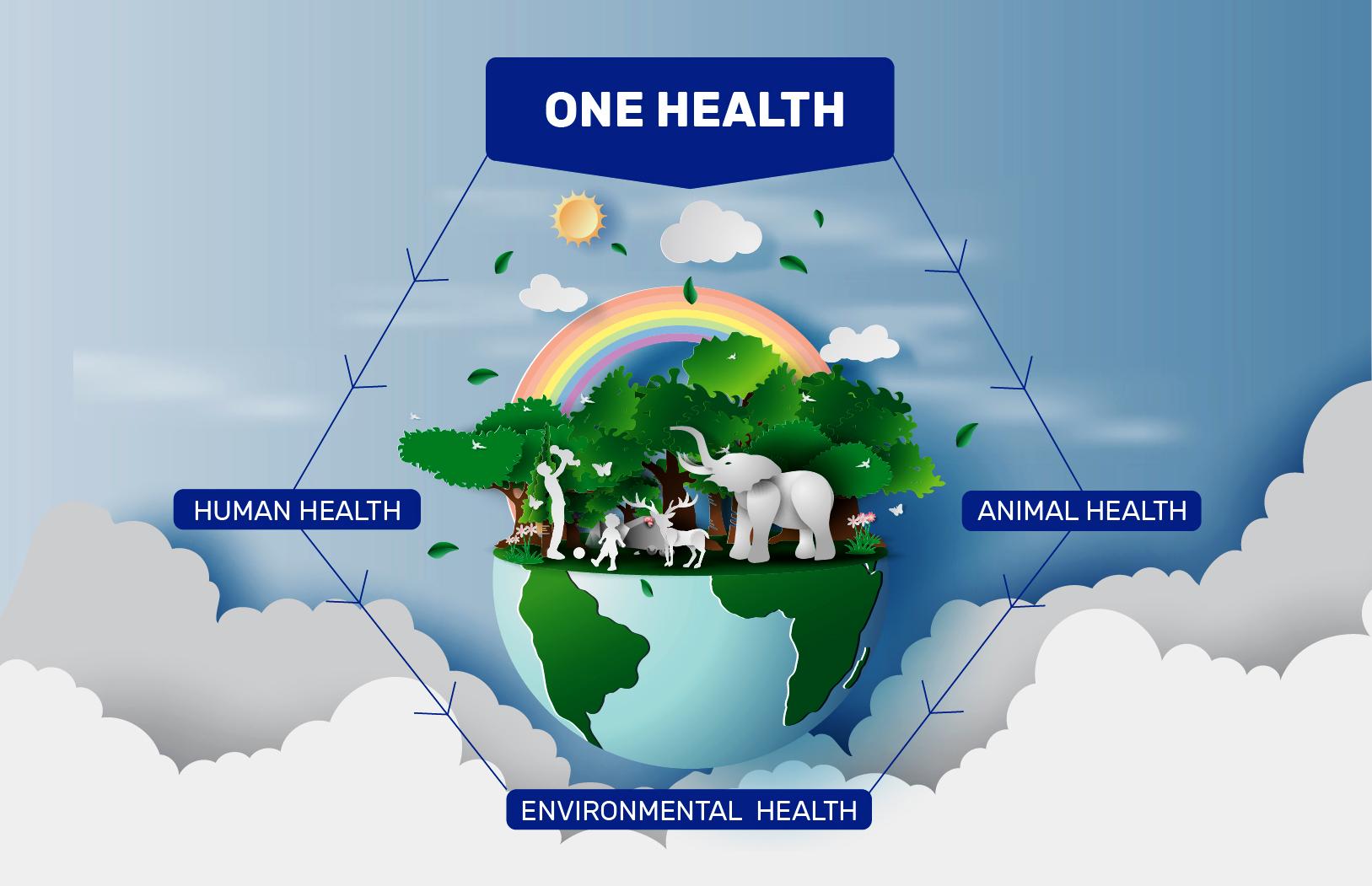

One Health: A Holistic Pathway to Africa’s Health and Food Security

BY MARTHA KURIA

By 2050, the global population is projected to reach approximately 10 billion, posing a significant challenge to ensuring equitable access to healthy and sustainable diets. Small-scale producers, responsible for over 70% of Africa’s and Asia’s livestock-derived foods, and contributing 66% and 47%, respectively, to the regions' total fish catch, are central to meeting this demand. Yet they are increasingly burdened by rising input costs, fragmented policies, limited access to finance and technology, and the escalating impacts of climate change. Worse still, three billion people lack access to healthy and sustainable food, a problem particularly severe in Africa, where one in five people suffered from hunger in 2023.

Meeting these challenges requires not only innovation and investment but also a systems-level approach, such as One Health, a concept increasingly championed by researchers, policymakers, and development agencies for its ability to address health, food security, and environmental sustainability in an integrated manner.

At the 2025 CGIAR Science Week in Nairobi, where over 10,000 delegates convened to share solutions for sustainable

food systems, participants emphasised the urgency of adopting the One Health approach. This approach is especially critical as animal and aquatic food systems, which supply nutrition and livelihoods to millions, are under unprecedented pressure, as underscored by Dr. Rodrigue Yossa, Interim Director of the SAAF Program.

“The demand for animal-source foods is expected to rise by 30% by 2050, primarily driven by low- and middle-income countries. This growth must be managed sustainably to avoid further environmental degradation,” Yossa explained during the event.

THE ONE HEALTH IMPERATIVE

One Health is a collaborative, multisectoral, and transdisciplinary approach that recognises the intrinsic connection between people, animals, plants, and their shared environment. Officially launched in 2004 during a conference by the Wildlife Conservation Society in the United States, the concept was further formalised in 2010 through a strategic partnership between the World Health Organization (WHO), the Food and Agriculture Organization (FAO), and the World

Organisation for Animal Health (WOAH), who recognised their shared responsibility in addressing health risks at the humananimal-environment interface.

In Africa and the Middle East, regions characterised by high levels of interaction between humans, animals, and ecosystems due to agriculture, wildlife trade, and rapid urbanisation, this approach is especially vital. Rooted in collaboration across disciplines and sectors, the One Health concept seeks to mitigate pandemic risks, enhance public health outcomes, and promote global health resilience. It promotes long-term, preventative strategies rather than reactive measures.

INSTITUTIONALISING ONE HEALTH IN AFRICA

Given the complexity and interconnectedness of human, animal, and environmental health, multi-stakeholder coordination is essential, especially in resource-constrained African contexts. Preventing zoonotic diseases is not only more effective than responding to outbreaks but also cost-efficient: prevention costs are estimated to be less than 1/20th of the economic value of lives lost annually due to zoonoses.

The African Union (AU), comprising 55 Member States, recognises the need for integrated action to achieve the continent's Pan-African vision of an integrated, prosperous, and peaceful Africa, as outlined in Agenda 2063. One Health is central to this vision, enhancing the capacity to prevent, detect, and respond to health threats at the human–animal–environment interface.

AU Member States have made notable progress in institutionalising One Health mechanisms for zoonotic disease

THE DEMAND FOR ANIMAL-SOURCE FOODS IS EXPECTED TO RISE BY 30% BY 2050, DRIVEN BY LOW- AND MIDDLE-INCOME COUNTRIES AND THIS GROWTH MUST BE MANAGED SUSTAINABLY.

surveillance, control, and prevention. Practical implementation involves joint planning and execution of policies, legislation, programs, and research across health sectors.

WHY THE ONE HEALTH APPROACH IS CRITICAL IN THE ANIMAL AND LIVESTOCK SECTOR