GEREMEW TASSEWCOUNTRY PROGRAM MANAGER OF AINFP

SUGAR REDUCTION

PRIORITIZING WORKPLACE SAFETY

CIDER IN AFRICA

COCOA SHORTAGE

Food Africa Business AFRICA’S NO.1 FOOD MANUFACTURING & RETAIL INDUSTRY MAGAZINE WWW.FOODBUSINESSAFRICA.COM YEAR 11 | ISSUE NO. 61 MAR/APR 2024 SABS Acting CEO Lungelo Ntobongwana on SABS’ approach to standardization

SCAN ME

THE CEO SUMMIT ON THE FUTURE OF SUSTAINABLE FOOD SYSTEMS IN AFRICA AFRICA FUTURE FOOD SUMMIT Nairobi, Kenya OCTOBER 24-25, 2024 info@fwafrica.net +254 725 343 932 www.africafuturefoodsummit.com INVESTING IN & FUNDING FOOD ENTERPRISES FOOD INNOVATION FOOD NUTRITION & SUSTAINABILITY FOOD MARKETS, TRADE & LOGISTICS FOOD TECHNOLOGY KEY AGENDA ISSUES WELCOME TO REGENERATIVE AGRICULTURE SCAN ME

CONTENTS

REGULARS

4 Editorial

6 Events Calendar

10 News Update

30 Appointments Update

68 Supplier News & Innovations

32 New Product Innovations: African Originals Ltd: Mara Gin | Premier Nut: Value-added macadamia products | Starbucks: Salted Caramel Cream Cold Brew | Crown Beverages: 7UP soda | Macallan: The Reach | Delta Corporation: Chibuku Pineapple and Ginger

BEVERAGE TECH AFRICA

47 Cider in Africa: the next big opportunity for growth

YEAR 10 | ISSUE NO. 61 MAR/APR 2024

FOOD INGREDIENTS AFRICA

53 Sugar Reduction: Sweetness’ Role in Health, the Environment, and Taste

TOPICAL FOCUS

59 Prioritizing Workplace Safety: The Significance of Hazard Identification and Risk Assessment

INDUSTRY REPORT

63 Cocoa shortage and rising prices continue to challenge chocolatiers worldwide

FOODBUSINESSAFRICA.COM MAR/APR 2024 | FOOD BUSINESS AFRICA 1

My Company Profile: SABS

Executive Interview: Geremew Tassew - Country Program Manager of AINFP

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 2 CONTENTS

YEAR 10 | ISSUE NO. 61 MAR/APR 2024

34 42 South African Bureau of standards’ non-regulatory role unveiled ON THE COVER - Lungelo Ntobongwana, CEO, SABS

PERFECT SOLUTIONS

DO NOT STOP US FROM CONTINUING TO WORK ON OUR IDEAS.

As a leading innovator, we have one prime characteristic: We are never satisfied.

At KHS, we are thus always proud of what we have achieved – but we also immediately start to question it and think ahead. With the aim of constantly advancing and always improving – and of providing our customers with new, intelligent systems time and again. Which we then, of course, develop further. khs.com/products

Booth B070 C089 Hall 5.1,

Food Africa Business

Year 11 | Issue No.61 • ISSN2307-3535

FOUNDER & PUBLISHER

Francis Juma

SENIOR EDITOR

Catherine Odhiambo

EDITOR

Francis Watari

Nicholas Ng'ang'a

BUSINESS DEVELOPMENT DIRECTOR

Virginia Nyoro

BUSINESS DEVELOPMENT ASSOCIATE

Vivian Kebabe

HEAD OF DESIGN

Clare Ngode

ACCOUNTS

Jonah Sambai

PUBLISHED BY: FW Africa

P.O. Box 1874-00621, Nairobi Kenya

Tel: +254 20 8155022, +254725 343932

Email: info@fwafrica.net

Company Website: www.fwafrica.net

Navigating turbulent waters in the snacks and confectionery sector

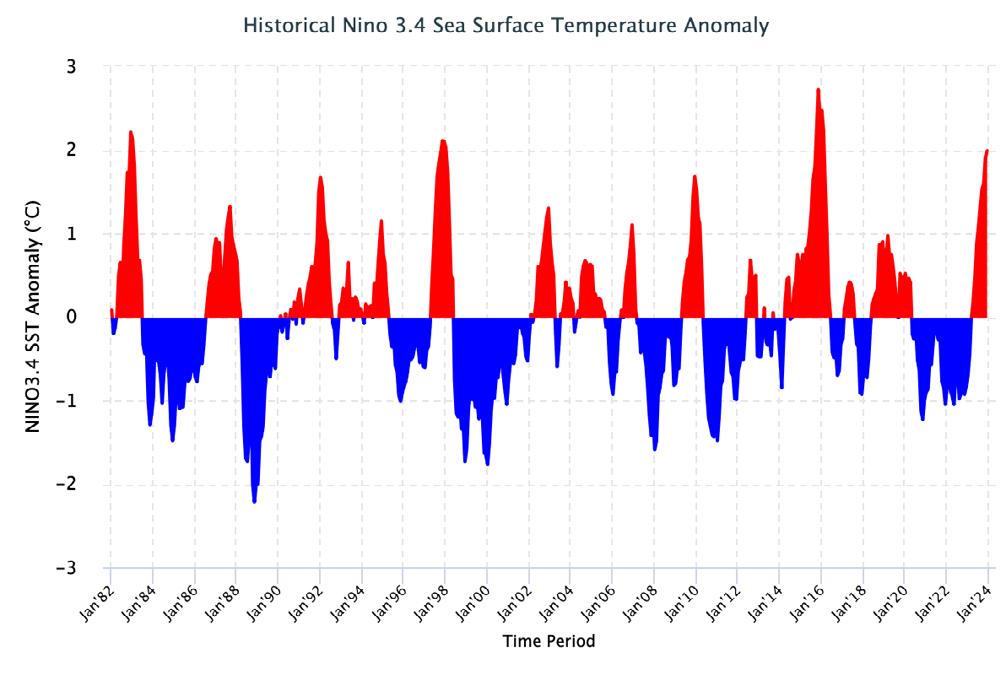

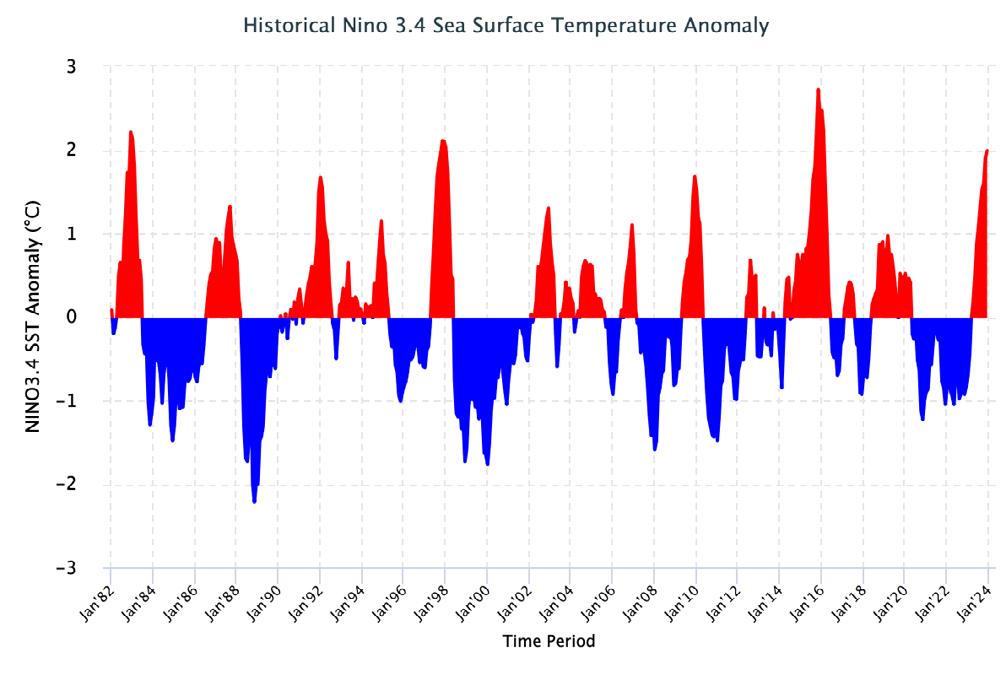

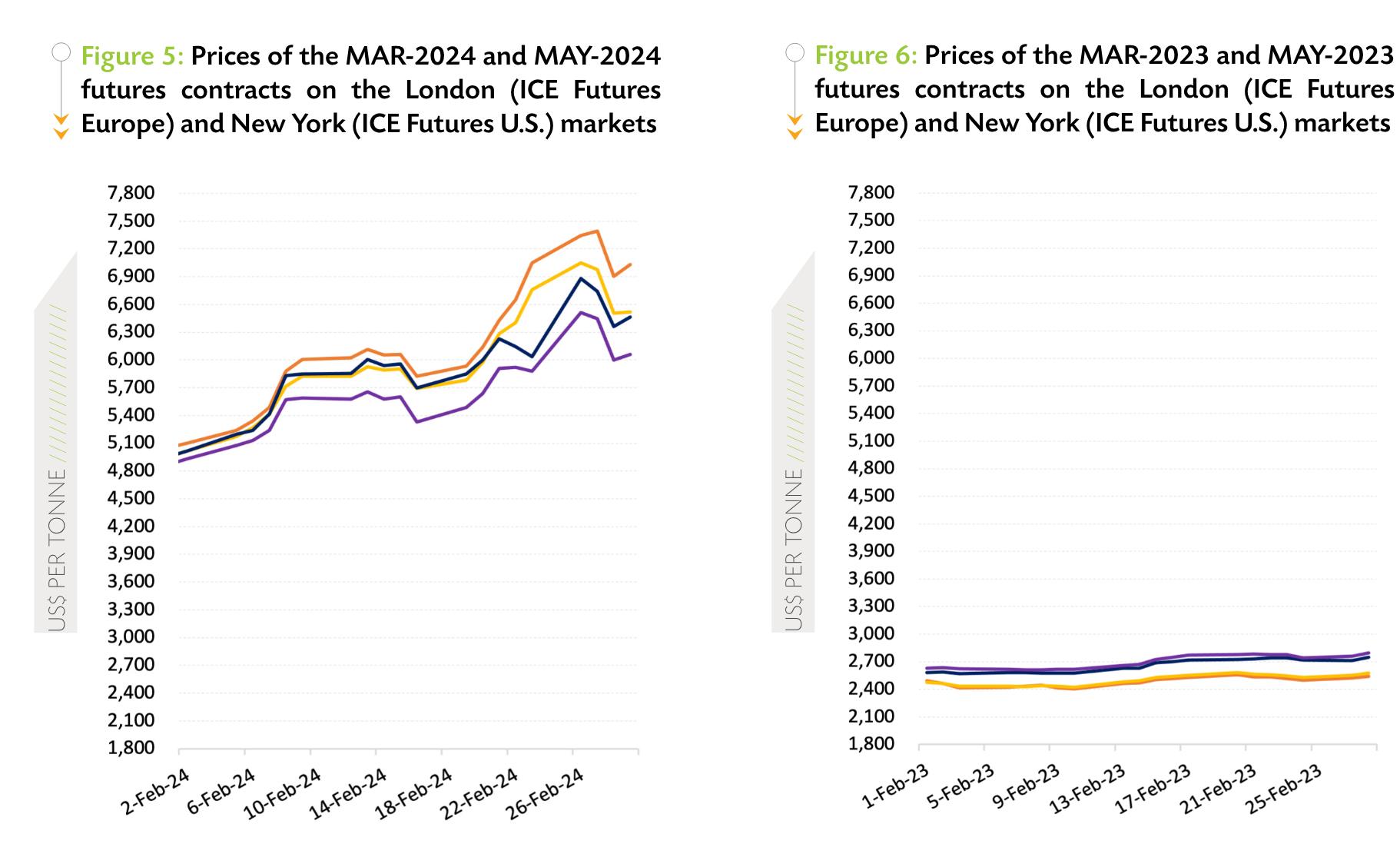

As we explore the 61st edition of Food Business Africa Magazine, we find ourselves amid challenging times in the food industry, particularly in the snacks and confectionery sector. The sector, recognized as the largest in the food market with a market volume of US$204.10 billion in 2024, is currently grappling with the repercussions of soaring cocoa and sugar prices.

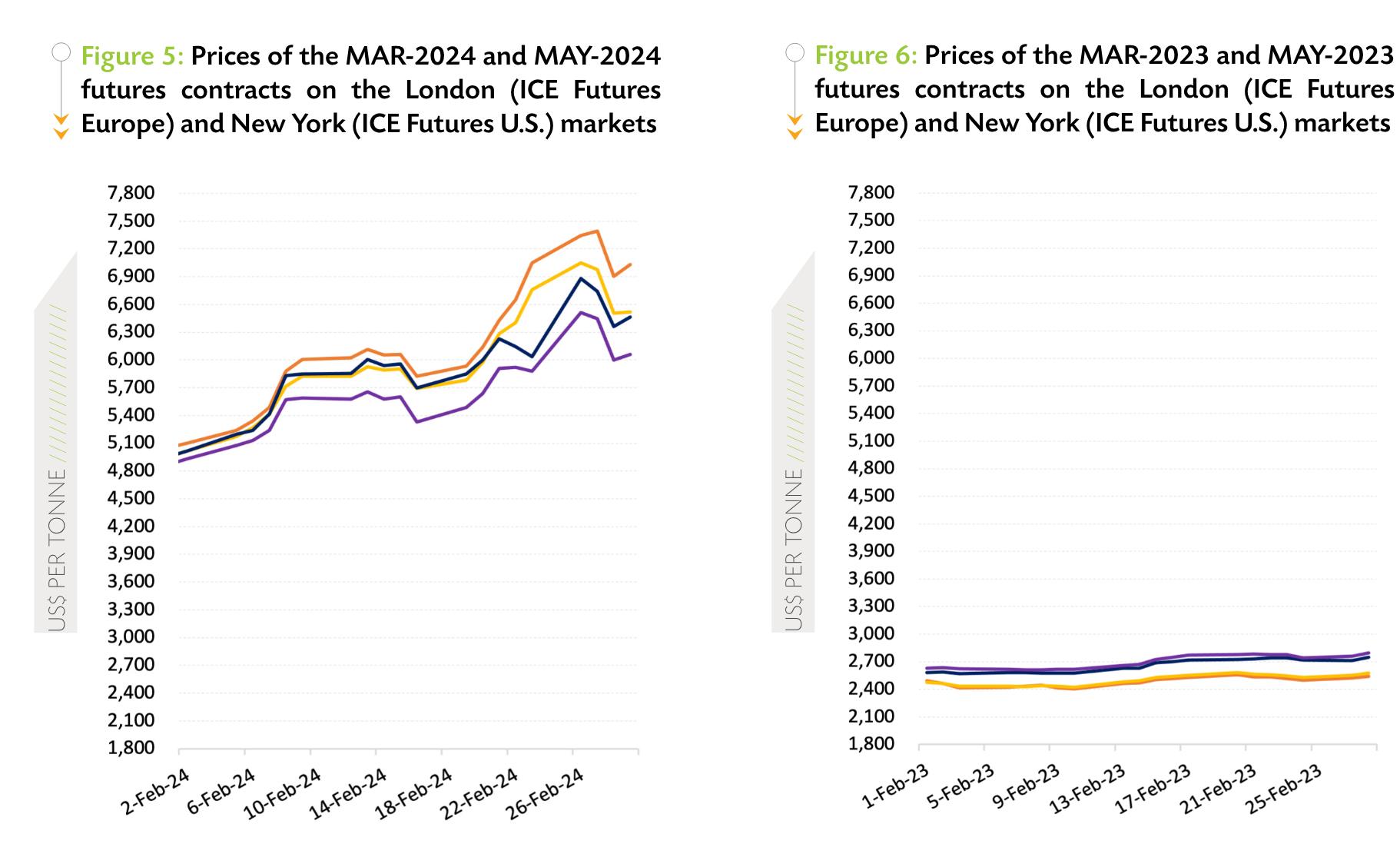

According to Statista, cocoa prices have surged nearly 65% in the past year, reaching a 46-year high in New York futures prices. This unprecedented increase threatens to disrupt the delicate balance of supply and demand within the snacks and confectionery segment. While consumer demand remains robust, the inevitable rise in retail prices is poised to impact volume sales and potentially impede category growth throughout much of 2024.

In this edition, we explore the ramifications of the cocoa shortage and rising prices on chocolatiers worldwide. Our comprehensive coverage delves into the strategies adopted by industry players to navigate these turbulent waters and maintain their competitive edge in an increasingly challenging landscape.

segment.

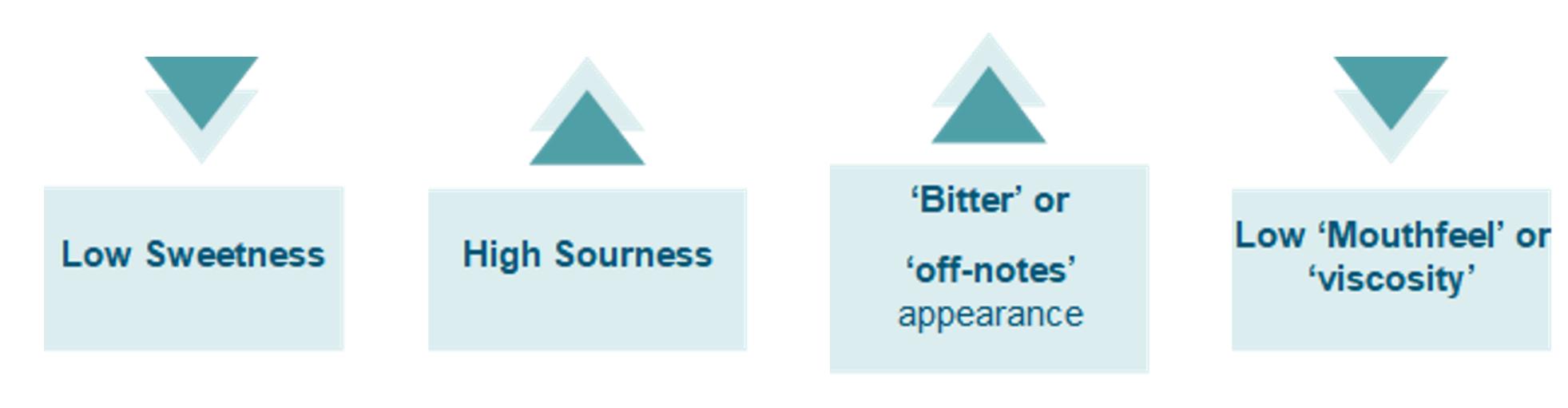

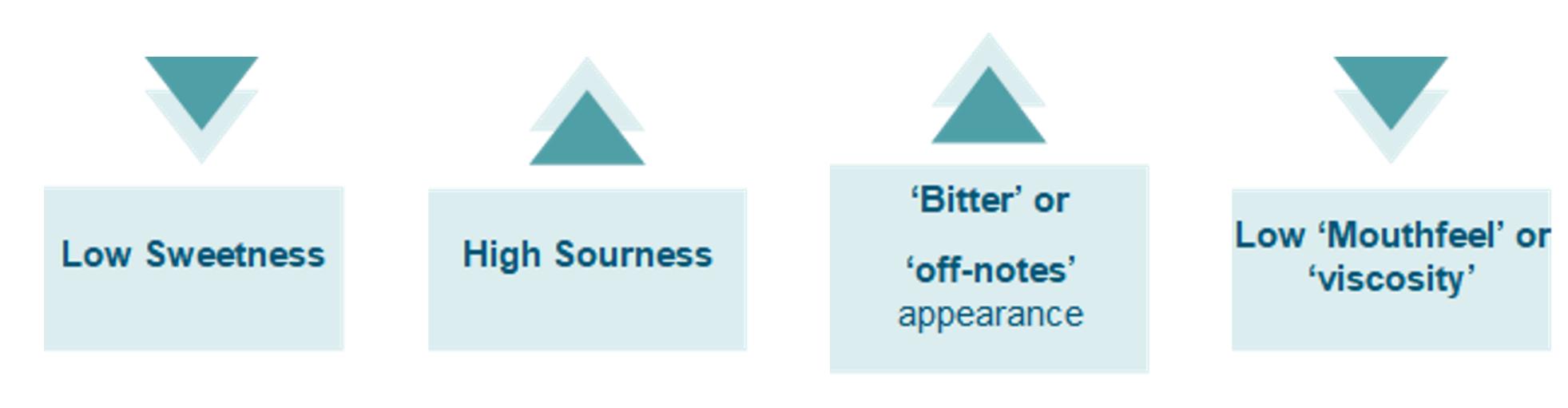

Furthermore, we address the pressing issue of sugar reduction, examining its multifaceted impact on health, the environment, and taste. As regulatory scrutiny intensifies and consumer awareness grows, we examine the strategies employed by manufacturers to meet the evolving demands of today's health-conscious consumers without compromising on flavor or quality.

In a noteworthy development, we announce the merger of Food Safety Africa Magazine with Food Business Africa Magazine. This strategic consolidation aims to provide our readers with a more comprehensive and integrated platform for industry insights and information. In this issue, we feature essential food safety elements, including an in-depth look at the South African Bureau of Standards and expert perspectives on prioritizing workplace safety.

As the leading source of information for investors, managers, and professionals in the food, beverage, and milling industry in Africa, Food Business Africa Magazine remains committed to empowering industry stakeholders with timely, relevant, and insightful content.

Food Business Africa (ISSN 2307-3535) is published 6 times a year by FW Africa. Reproduction of the whole or any part of the contents without written permission from the editor is prohibited. All information is published in good faith. While care is taken to prevent inaccuracies, the publishers accept no liability for any errors or omissions or for the consequences of any action taken on the basis of information published.

But the challenges faced by the food industry extend beyond cocoa and sugar. With our commitment to providing holistic coverage of the sector, we shine a spotlight on the burgeoning opportunity presented by cider in Africa. As consumer preferences evolve and diversify, we explore the potential for growth and innovation in this market

Thank you for your continued support and trust in Food Business Africa Magazine. We look forward to embarking on this journey of exploration and discovery with you.

Catherine Odhiambo, Lead Editor Food Business Africa

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 4

EDITORIAL

OUR PUBLICATIONS WWW.FWAFRICA.NET MILLING MIDDLE EAST & AFRICA Food Africa Business HealthCare MIDDLE EAST & AFRICA www.foodsafetyafrica.net www.healthcaremea.com www.ceobusinessafrica.com www.freshproducemea.com www.dairybusinessafrica.com www.foodbusinessafrica.com www.millingmea.com www.sustainabilitymea.com Packag ng AFRICA SUSTAINABLE

East Africa Food & Beverage Exhibition 2024

East Africa Food and Beverage Exhibition event is designed to create substantial value by reaching target markets in East Africa and fostering connections with discerning industry buyers.

02 - 04 May 2024

The Sarit Expo Centre, Nairobi, Kenya

www.eastafricafoodshow.com

Halal Trade, Logistics & Manufacturing Expo 2024

Africa's number 1 gateway for halal businesses bringing together a wide swarm of industry professionals from Trade commissions and the Islamic Chamber of Commerce, Certification, Regulatory bodies, and halal trade services, buyers and sellers.

06 - 08 May 2024

Gallagher Convention Centre, Johannesburg, South Africa

www.halaltradeafrica.co.za

Middle East Poultry Expo 2024

The Middle East Poultry Expo is the largest exhibition specialized in the poultry industry organized in the Kingdom of Saudi Arabia, which is the largest poultry producer in the Middle East and Africa and the third global consumer of meat and poultry products

13 - 15 May 2024

Riyadh International Convention & Exhibition Center, Riyadh, Saudi Arabia

www.mep-expo.com

Agrofood Ethiopia 2024

Agrofood Ethiopia is Ethiopia's leading trade show & conference on agriculture, food & beverage technology, food ingredients and food.

16 - 18 May 2024

Millennium Hall, Addis Ababa, Ethiopia

www.agrofood-ethiopia.com

International Foodpack East Africa 2024 serves as a platform for networking, business development, market research, and knowledge exchange within the food industry.

16 - 18 May 2024

Uganda Manufacurers Association Main Exhibition Hall, Kampala, Uganda

www.mxmexhibitions.com/ foodpackUganda

The Saudi Food Show 2024

The Saudi Food Show is the world's biggest food show, making its debut in one of the world's fastest-growing and most exciting economies. This oneof-a-kind inaugural event will act as a powerful sourcing hub, a springboard for F&B trends, and a platform from which to inspire world-leading, industry-wide transformation.

21 - 23 May 2024

Riyadh front expo, Riyadh, Saudi Arabia

www.thesaudifoodshow.com

EVENTS CALENDAR

FoodPack East Africa 2024

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 6

Replacing Sugar- Naturally

Cape Food Ingredients (CFI) has launched its fourth generation advance in sugar replacement technology. CFI has worked with reformulating food and beverages to lower sugar use since 1986, giving it one of the longest track records in the application technology of sweetness.

Using its formulation expertise with flavours and natural sweeteners, CFI can now replace up to 60g of sugar per litre of final product without the use of artificial sweeteners.

The most recent advance is part of the best-selling Sugar Enhance range. Sugar Enhance IV products, when used at the recommended dosage, have a clean sweetness with sugary after-notes, giving high consumer appeal.

Sectors in which sugar reduction is well-established include beverages, dairy products including ice creams, sauces and vegan products.

Examples include the reduction of sugar in yoghurts by about 35g/litre, the reduction of sugar in carbonated soft drinks by up to 60g/litre and 100% replacement of sugar in mayonnaise and many other sauces.

In unsweetened vegan milks (soya, oat, rice, almond etc), the sweetness value of Sugar Enhance IV (Dairy) reaches even

120 times the sweetness of sugar and simultaneously greatly improves the beany or cereal notes of such products.

The sugary notes of the products also make Sugar Enhance flavours the perfect complement for the use of artificial sweeteners, another area where CFI excels in formulation work.

Sugar Enhance masks the chemical notes and off-tastes sometimes found with artificial sweeteners and so achieves the end goal of all products, consumer preference.

In terms of cost in use, Sugar Enhance flavours are significantly cheaper than using sugar.

Sugar Enhance flavours come in a variety of formats designed to improve the overall flavour of the end products. For example Sugar Enhance IV (Dairy) which brings out the rich, creamy notes of dairy products and Sugar Enhance IV (Beverages & Confectionery) which besides sweetness also boosts overall flavour impact.

Contact the CFI New Product Development and Application labs in Nairobi (for East Africa), Accra (West Africa) or Cape Town for more information about your specific products, and for samples.

FOODBUSINESSAFRICA.COM MAR/APR 2024 | FOOD BUSINESS AFRICA 7 SPONSORED CONTENT

Fi Africa is Africa's top food and beverage exhibition, offering a comprehensive platform for sourcing cutting-edge ingredients, packaging, processing, and logistics solutions.

26 - 28 May 2024

Egypt International Exhibition Center, Cairo, Egypt

www.figlobal.com/africa

Cocoa,

The annual Cocoa, Coffee & Tea Fair helps the value chain players to explore the growth opportunities in the African market and learn about value addition, entrepreneurship, and technological advancements in the industry.

07 - 09 Jun 2024

Kenyatta International Convention Centre, Nairobi, Kenya

www.cct.gwijiafrica.com

Africa's Big 7 2024

Africa's Big 7 is the continent's largest annual meeting place for the food and beverage industry. It provides opportunities to connect with buyers from across Africa, source products, and make export and import deals.

11 - 13 Jun 2024

Sandton Convention Centre, Johannesburg, South Africa

www.africabig7.com

AFMASS Food Expo Eastern Africa 2024

AFMASS Food Expo Eastern Africa trade show is the longest-running trade show that covers the entire scope of the food industry in the region, enabling industry stakeholders from across Eastern Africa and beyond to discover the latest opportunities and trends in the food, beverage, dairy, meat, and milling industry.

12 - 14 Jun 2024

The Sarit Expo Centre, Nairobi, Kenya

www.afmass.com

Africa Agri Tech 2024

The Africa Agri Tech Conference and Exhibition focuses on the intersection between agriculture, science and technology connecting the Southern African agricultural, scientific and technology communities at one event staged over three days.

25 - 27 Jun 2024

CSIR International Convention Centre, Pretoria, South Africa

www.africa-agri.co.za

CONNECT WITH US!

EVENTS CALENDAR Fi

Follow Us Foodbizafrica Follow Us Foodbizafrica Like Food Business Africa Magazine Connect with us Food Business Africa Magazine

Africa 2024

Coffee and Tea Africa Fair & Summit 2024

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 8

AFMASS FOOD EXPO

EASTERN AFRICA 2024

Connecting the Food Industry across Africa

June 12-14 2024

Ever wondered where in Africa to get food industry suppliers, manufacturers, and key decision-makers under one roof? Ever thought of having packaging industries and retailers together? Or having financial service providers and commercial-scale farmers under one roof?

Look no farther, as the AFMASS Food Expo Eastern Africa 2024 brings them all! This year’s edition comes equipped with all that the African region and far abroad have to offer.

WHO WILL YOU MEET AT AFMASS FOOD EXPO EASTERN AFRICA 2024?

Technology Suppliers

Can you think of a place where you can meet your equipment, ingredients, packaging, milling and other technology suppliers - all in one place? We at AFMASS Food Expo provide a platform where suppliers and innovators meet users of their equipment. This platform allows equipment providers to get to know the specific needs of manufacturers without much stress.

Food processing and packaging industries

AFMASS Food Expo Eastern Africa 2024 offers opportunities for all players in grains and legumes; meat, fish, and poultry; fresh produce; tea, coffee, and cocoa; bakery, confectionary, and snacks; animal feed and aquaculture; soft and alcoholic beverages; dairy products, among many more, to showcase their products and new technologies.

Commercial-scale farmers and agribusiness players

Is your interest in commercial-scale farming? This expo offers fast knowledge and an opportunity to meet key decisionmakers in Agricultural practices in Africa and beyond. In addition, AFMASS Food Expo Eastern Africa 2024 brings manufacturers of equipment used in the sector, networking opportunities, and deal rooms.

Government ministries and agencies

Meet representatives from various ministries and agencies for one-on-one discussions with industry players. It's a unique opportunity to present your ideas, innovations, and receive instant feedback from those who regulate the industry in Africa.

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 10

www.afmass.com Sarit Expo Centre, Nairobi Kenya

Retail and Distributors

With many players, including retailers, distributors, importers and exporters coming together into this year’s edition, you are assured of new buyers and users. AFMASS Food Expo Eastern Africa 2024 edition incorporates all players in the food and agriculture value chains, from exporters to importers of fresh produce and other agricultural products.

Hotel, Restaurants and Catering (HORECA)

Is this your specialty? Worry no more! The 2024 edition has a platform for you to shine. Come and showcase your products as you also learn about new technologies in the industry that can amplify your offering.

Logistics and mobility services

Are you in this sector and still stuck on how to expand your reach? Well, worry less as AFMASS Food Expo Eastern Africa 2024 has got you covered. The Expo brings together players in the food and consumer goods value chain, who work together to ensure that products are delivered to the right place at the right time - at the right temperature!

University and research institutions

Working on that project or innovation that will improve the industry? Why not showcase it to stakeholders who need it the most. Come and find out more about what is happening in the food industry in Africa and beyond. Get equipped with knowledge on new technologies, equipment, and products that have changed the face of the industry. At AFMASS Food Expo 2024, as a researcher or student, you are assured of gaining more knowledge and experience than ever before.

NGOs and Development organizations

Looking for opportunities to partner with manufacturers

AFMASS Food Expo Eastern Africa 2024 is your chance to connect directly with industry leaders, explore new products and technologies, and forge valuable partnerships that can drive growth and innovation in the food and agriculture sectors.

Dairy AFRICA MANUFACTURING EXPO AFRICA EXPO INGREDIENTS AFRICA EXPO P ULTRY MEAT & PACK AGI NG EXPO AFRICA AFRICA EXPO Fresh Produce EXPO AFRICA MILLING & BAKING Africa Expo BEVERAGES FOOD MARKET AFRICA 8-1N-1 TRADE SHOWS

NEWS UPDATES

Kenya’s tea sector receives major boost as Mombasa Auction prices surge by 29.1%

KENYA – Kenya’s tea sector has received a major boost as tea prices at the Mombasa auction surged 29.1 percent to Kes443 (US$3.41) per kilogram in February.

The increase in prices has been attributed to an increase in global demand for the beverage marking a major boost for the green leaf which fetched US$2.64 during the same period in 2023.

The Central Bank of Kenya (CBK) has since tipped Kenya to increase the quantity of tea exports revealing that traditional importers such as Europe and North America have increased their demand for the country’s major export.

The higher tea prices recorded come on the heels of a stellar performance by the tea sector in 2023, with exports for the green leaf recording a 16 percent rise to 522.92 kilograms.

Egypt set to import 250,000 tons of sugar amid shortage crisis

EGYPT – In a bid to alleviate the ongoing sugar crisis, the Egyptian Ministry of Supply and Internal Trade, through the General Authority for Supply Commodities (GASC), has inked a contract to import 250,000 tons of raw sugar.

This move comes in the wake of

Louis

the cabinet’s approval to import one million tons of sugar, aiming to address the severe shortage that has plagued the nation in recent months.

According to a statement from the ministry, the sugar shipments, part of the newly signed contract, are scheduled to commence arriving next month.

Egypt has been grappling with soaring sugar prices, surpassing EGP 50 per kg in recent months. GASC had previously issued an international tender to procure 50,000 tons of raw sugar cane, open to any origin, as part of the approved import plan.

Dreyfus strengthens soluble coffee business with Cacique acquisition

BRAZIL – Louis Dreyfus Company (LDC), a leading merchant and processor of agricultural goods, has signed a binding agreement with Companhia Cacique de Café Solúvel (Cacique), Brazil’s largest independent producer, processor and exporter of soluble coffee, to acquire 100% of Cacique shares.

“This development is aligned with

LDC’s strategy to diversify revenue streams through value-added product lines – in this case, by accelerating the scale-up of LDC’s soluble coffee business,” remarked Michael Gelchie, LDC’s Chief Executive Officer.

With the acquisition LDC aims to position itself among the world’s largest soluble coffee producers.

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 12

by www.FoodBusinessAfrica.com ACQUISITION TRADE

FOOD Afmass EXPO

JUNE 12-14, 2024

Sarit Expo Centre, Nairobi, Kenya

www.afmass.com

Trade Shows

AFMASS FOOD EXPO UGANDA

Kampala, Uganda - September 3-5, 2024

CONFIRMED SPONSORS:

AFMASS FOOD EXPO WESTERN AFRICA

Lagos, Nigeria - September 17-19, 2024

8-IN-1 TRADE SHOWS

5000+ ATTENDEES FREE ENTRY

Food

Retail

Industry

Easstern Africa’s Largest

Manufacturing,

& HORECA

Transforming Africa’s Food Systems

Ghana implements 58.26% increase in cocoa producer price amid industry challenges

GHANA – The government of Ghana, under the Ghana Cocoa Board (COCOBOD), has announced a 58.26% rise in cocoa producer price as the country aims to increase farmer income.

This board, responsible for setting cocoa buying prices, increased price for the 2023-2024 crop year rises to 33,120 Ghana cedis (US$ 2,499) per ton, up

DIVESTMENT Daybreak Foods plans

US$13M debt deal

to stabilize operations, optimize balance sheet

SOUTH AFRICA – Daybreak Foods Pty Ltd, a leading South African poultry producer, has announced a debt deal worth R250 million (US$13 million) to stabilize its operations and optimize its balance sheet.

According to the company, the move comes on the heels of recent successful restructuring efforts and the appointment of a new executive team.

Under the leadership of Richard Manzini, Daybreak Farms underwent a comprehensive restructuring process in 2023.

In addition, the company recently announced a new C-suite team to support its ongoing growth plans.

The restructuring of the company’s balance sheet could pave the way for additional investment rounds to further advance its strategic direction as a protein foods business.

from 20,926 cedis (US$ 1,578) per ton set last September.

According to the statement signed by COCOBOD’s CEO Joseph Boahen Aidoo, the price increase aims to improve the welfare of farmers in response to the escalating cocoa prices on the global market.

As the backbone of Ghana’s economy, in 2022, the sector was expected to contribute more than 3.4 billion GHS (454 million U.S. dollars) to Ghana’s GDP, with a projected annual growth rate of 12.1 percent at the national level.

James Finlay receives US$23.6M from sale of Kenya tea business

KENYA – James Finlay, a private limited company specializing in processing and supply of tea, received KES3.1 billion (US$23.6M) from the sale of its Kenyan tea business..

The sale of the tea business to Sri Lanka’s LOLC Holdings, the Browns Investments PLC, was officially finalized in November 2023, but the value of the deal was not disclosed.

The sale saw LOLC Holdings acquire an 85 percent stake in James Finlay Kenya, with a 15 percent stake allocated to the local community through the Kipsigis Highlands Multipurpose Co-operative Society.

The deal will see LOLC Holdings take over James Finlay’s tea plantation, covering 10,300 hectares, including 5,200 hectares of tea fields across nine tea estates.

As part of the transition, the UK multinational will retain its tea extraction business which will be supplied by LOLC’s local operations that will be rebranded from James Finlay Kenya to Browns Plantations Kenya to reflect the change in ownership.

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 14 NEWS UPDATES

TRADE

JUNE 12-14, 2024

Sarit Expo Centre, Nairobi, Kenya

Lagos,

AFRICA EXPO MEAT

&

AFRICA’S BIGGEST MEAT, POULTRY, FISH & SEAFOOD INDUSTRY TRADE SHOWS www.africameatpoultryexpo.com AFRICA MEAT & POULTRY EXPO UGANDA AFRICA MEAT & POULTRY EXPO WESTERN AFRICA

Nigeria - September

Uganda - September

17-19, 2024 Kampala,

3-5, 2024

Suntory trials world-first hydrogen-fueled whisky distillation

JAPAN – Suntory Holdings, a Japanese drinks giant, has successfully trialled the use of hydrogen as a fuel source in the distillation of whisky, a significant step in its quest to decarbonize whisky production.

The trial took place at Suntory’s Yamazaki distillery in Osaka, where the company successfully demonstrated the feasibility of using hydrogen as a fuel source in the distillation process.

Utilizing hydrogen in the “direct firing” of the still allowed for higher temperatures compared to indirect

heating methods using steam coils.

According to Suntory Holdings, this direct-firing technique can enhance the quality and depth of character of the spirit, although transitioning from gas to hydrogen presented technical challenges in the decarbonization effort.

The trial at the Yamazaki distillery is part of Suntory’s broader initiative dubbed ‘WhiskHy’, which focuses on decarbonization technology leveraging ‘green’ hydrogen.

Kenya issues ultimatum to alcohol manufacturers

KENYA – Kenya has issued a stern warning to 24 alcohol manufacturers, including prominent industry players like Keroche Breweries and London Distillers, threatening to revoke their licenses if they fail to comply with government guidelines within 21 days.

Interior CS Kithure Kindiki announced that only three out of 29 manufacturers and distillers of secondgeneration alcohol have been allowed to resume production.

KWAL, Savanna Brands Company

Limited, Patiala Distillers Kenya Limited, Kenya Nut Company Limited, and UDV are the only entities permitted to operate, having met the specific requirements outlined by the authorities.

In March, the government suspended licenses of secondgeneration alcohol manufacturers and distillers pending fresh vetting amid the increasing menace of illicit brews in the country.

illicit brews, drug abuse, and substance abuse, the government shut down a total of 18,650 liquor joints and 14 distilleries in the ongoing national crackdwon according to Kenya’s Interior Cabinet Secretary.

Kindiki also revealed plans to table new legislations in the fight against illicit brews in the parliament. He stated, “New stringent laws to combat illicit drugs and substance abuse will be submitted to Parliament next month.”

ONLY THREE OUT OF 29 MANUFACTURERS AND DISTILLERS OF SECONDGENERATION ALCOHOL HAVE BEEN ALLOWED TO RESUME PRODUCTION.

Additionally, in efforts to combat

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 16

REGULATORY

NEWS UPDATES

JUNE 12-14, 2024

Sarit Expo Centre, Nairobi, Kenya

DAIRY MANUFACTURING AFRICA EXPO UGANDA

Kampala, UgandaSeptember 3-5, 2024

DAIRY MANUFACTURING AFRICA EXPO WESTERN AFRICA

Lagos, NigeriaSeptember 17-19, 2024

Africa Dairy 2.0 - Taking Africa's Dairy Industry into the Next Level through Innovation & Sustainability

Dairy AFRICA MANUFACTURING EXPO

SCAN ME

www.dairymanufacturingafrica.com

AFRICA’S NO.1 DAIRY INDUSTRY TRADE SHOW & CONFERENCE

TO ATTEND , SPONSOR & EHIBIT

SIGN UP

Nigeria inaugurates second largest tomato processing factory

NIGERIA – Nigeria’s President, Bola Tinubu, has officially unveiled a 20 billion Naira (US$14.2 million) tomato farm, as well as the second largest processing facility in Nigeria.

Plans to construct the facility date back to 2016, after negotiations with GB Foods Africa, a Spanish multinational company- they agreed on establishing a tomato plantation and processing facility expected to provide employment for 1,000 individuals.

By 2020, GB Foods Africa had already announced the operational status of its factory, initiating tomato harvesting and concentrate production.

Opening this facility is a part of a bold initiative by the government of Nigeria in strengthening its agricultural sector and reducing dependence on imported tomato paste.

PepsiCo,Carrefour resolve pricing dispute

FRANCE – PepsiCo and Carrefour have reached a resolution in a pricing dispute that caused the French retailer to remove PepsiCo’s food and beverage brands from its shelves across Europe earlier this year.

According to Carrefour, PepsiCo snacks and beverages are currently being restocked at Carrefour stores in France.

Earlier this year, Carrefour delisted PepsiCo food and beverage brands from its stores in France subsequently extending to other stores in Spain, Italy, Belgium, and Poland.The retailer ceased selling PepsiCo products such as Lay’s and Doritos crisps, as well as 7Up drinks and Lipton tea in France due to what it deemed as “unacceptable price increases”.

Cadbury Nigeria suffers US$14.7M loss

NIGERIA – Cadbury Nigeria Plc is facing significant setback as shareholders brace for a dividend-less year due to a staggering loss of N19.09 billion (US$14.7 Million) after tax for the financial year 2023.

The company’s annual report for the year ended December 2023 marks a drastic decline from the previous year’s profit of N583.11 million (US$ 453,000).

This comes despite a noteworthy 46% revenue surge to N80.38 billion (US$ 62.5 million) from N55.21 billion (US$ 42.8 million) in the preceding year.

In light of this adverse financial outcome, the company’s directors have refrained from recommending any dividends for the year, a sharp contrast to the N751.28 million (US$0.6 million) final dividend payout in 2022.

The company is looking to take proactive measures through debt structuring. This will include efforts to convert a US$7.7 million debt owed to the principal shareholder, Cadbury Schweppes Overseas Limited, into equity. The move will augment Cadbury Schweppes Overseas Limited’s shareholding in Cadbury Nigeria to 79.39%.

Heineken’s Bralirwa Plc expands production capacity with new line

RWANDA – Bralirwa Plc, a subsidiary of the Heineken Company, has inaugurated a new production line at its brewery in Rubavu District.

Bralirwa invested over €30 million (US$32M) in the expansion project which included the installation of its inaugurated packaging line.

This is in line with the company’s commitment to developing the Rwandan beer market for sustainable growth and proactively investing in digital technology and innovation to improve its operations.

With sustainability at the forefront of its agenda, the new production line will operate with reduced energy and water consumption, aligning with Heineken’s ambitious goal of achieving net zero across all production sites by 2030.

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 18 NEWS UPDATES

FINANCIALS INVESTMENT

EXPO

AFRICA MILLING & BAKING EXPO

EASTERN AFRICA

Nairobi, Kenya - June 12-14, 2024

AFRICA MILLING & BAKING EXPO

UGANDA

Kampala, UgandaSeptember 3-5, 2024

AFRICA MILLING & BAKING EXPO

WESTERN AFRICA

Lagos, Nigeria - September 17-19, 2024

www.africamillingbakingexpo.com No.1 Trade Shows For Latest Technologies To Africa’s Milling, Baking, Animal Feed & Snacks Industries info@fwafrica.net +254 725 34 39 32

SIGN UP TO ATTEND , SPONSOR & EHIBIT

AFRICA MILLING & BAKING

Plukon Food Group acquires Polish poultry business Algas

POLAND – Netherlands based poultry company, Plukon Food Group, is currently in the process of acquiring the assets of its Polish counterpart, Algas SP.

While financial specifics of the acquisition remain undisclosed, Plukon will be assuming control of Algas’s slaughterhouse and processing facilities located near Katowice, Poland.

However, the Szatan family, who own Algas, will retain a

stake in the business operations of its slaughterhouse and processing factory.

Plukon, presently positioned as the fourth largest poultry company in Europe and the 19th largest globally, sees this acquisition as a strategic move to fortify its presence in the Polish market and reinforce its commitment to growth and leadership in the European poultry sector.

Refresco completes acquisition of VBC Bottling Company

US – Refresco, a prominent independent beverage solutions provider, has finalized its acquisition of VBC Bottling Company, a contract manufacturer of premium beverages based in the United States.

The move marks a significant step for Refresco in expanding its presence

and capabilities in North America, enabling the company to offer enhanced beverage solutions to its customers.

The facility boasts over 600,000 square feet of manufacturing and warehouse space, equipped with advanced capabilities for large-scale production, including cold-filled

canning, post-pasteurization, and robotic variety packing.

This acquisition follows Refresco’s earlier expansion efforts, including the acquisition of Avandis, a manufacturer of alcoholic beverages in the Netherlands, expanding its product offerings in the alcohol category.

Brown-Forman launches own distribution business in Japan

JAPAN – Brown-Forman Corporation, a leading American-owned spirits company, has announced the launch of its own distribution business in Japan.

The move signifies a departure from relying on external distributors, a practice upheld since the company’s entry into the Japanese market in the 1970s.

The newly established Brown-Forman Japan office, situated in the heart of Tokyo, has been operational since the end of 2023.

Aaron Martin, VP and General Manager of Brown-Forman Japan, said: “With our dedicated team in place and our new and inspiring headquarters in the heart of Tokyo, we are ideally set up to further the growth of our brands in Japan across all channels.”

The company’s expansion into Japan follows its successful direct sales operations in key global markets like Taiwan, Thailand, and South Korea within the Asian region.

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 20 NEWS UPDATES

INVESTMENT ACQUISITION

AFRICA Food Safety SUMMIT

Eastern Africa Edition

Kampala, Uganda

September 3-5, 2024

AFRICA Food Safety SUMMIT

Western Africa Edition

Lagos, Nigeria

September 17-19, 2024

AFRICA Food Safety SUMMIT

Southern Africa Edition

Date and Location to be confirmed

Africa’s No.1 food safety and quality conferences and trade shows

Be inspired by an unprecedented lineup of food safety and nutrition experts and opinion shapers from across Africa and the World. Meet and network with some of the most influential key decision makers from the private and public sectors, NGOs and more across various disciplines and countries from Africa and beyond of career-changing exchanges and innovative ideas. info@fwafrica.net +254 725 343 932 www.summit.foodsafetyafrica.net Sign up to Sponsor, Attend & Speak AFRICA Food Safety SUMMIT

REASONS TO ATTEND THE SUMMIT

South Africa court overturns planned seizure of plant-based meat alternatives

SOUTH AFRICA – The Johannesburg High Court recently overturned the

Tiger Brands launches peanut butter plant in Johannesburg

SOUTH AFRICA – Tiger Brands has strengthened operations with the inauguration of a R300 million (US$15,940,243) Peanut Butter plant in Chamdor, South Africa.

This cutting-edge manufacturing facility serves as the new operational hub for South Africa’s beloved peanut butter brand, Black Cat.

This bold move underscores the vast potential within the peanut butter category, promising sustainable returns for the future.

The state-of-the-art plant is equipped with advanced technologies and streamlined processes enabling Tiger Brands to uphold its commitment to excellence while meeting market needs.

Tjaart Kruger, CEO of Tiger Brands, said: “This new facility will introduce flexibility, improved efficiencies, and reduced costs.”

planned seizure of plant-based meat alternatives that are marketed using “meat-like” terms in South Africa.

These products are set to remain permanently available on supermarket shelves all over the country.

In June 2022, South Africa’s Department of Agriculture, Land Reform and Rural Development (DALRRD) banned the use of meatlike terms on plant-based product labels, asserting that it was misleading to consumers.

This included banning items that had a naming resemblance to processed

FOOD SERVICE

meat products like ‘nuggets’, ‘burgers’, ‘patty’, and ‘sausage’.

In response to this, plantbased advocates took the case to the Johannesburg High Court, successfully arguing that plant-based meat alternatives were not covered by legislation related to the classification and labeling of processed meats.

After thorough review of the case which had seen the planned seizure halted several times, the court has now completely overturned the seizure concluding that it was not legally enforceable.

Carrefour opens 23rd outlet in Kenya

KENYA – Carrefour has inaugurated its latest addition, a sprawling 600sqm supermarket situated in the Global Trade Centre in the heart of Westland, Nairobi.

This flagship establishment marks the 23rd venture in Kenya and the 14th across the nation, embodying a commitment to serving the local community with tailored offerings.

According to Alexandre Cerqueira, Carrefour Kenya’s District Manager Supermarkets, this new Carrefour outlet embraces a contemporary aesthetic and a thoughtfully curated array of products designed to cater to the diverse preferences of its clientele.

The grand opening ceremony welcomed esteemed guests, including H.E. James Njoroge Muchiri, Deputy Governor, and H.E. UAE Ambassador in Kenya, Dr. Salim Ibrahim Binahmed Mohammed Alnaqbi, alongside notable figures like Wambui Mbarire, CEO

of Retrak, and Christophe Orcet, Regional Director East Africa.

Looking ahead, Carrefour GTC teased an exciting journey ahead in 2024, hinting at a series of forthcoming openings that promise to further enrich the retail landscape.

MAR/APR 2024 | FOOD BUSINESS AFRICA 22 NEWS UPDATES

REGULATORY

Sarit Expo Centre, Nairobi, Kenya

AFRICA INGREDIENTS EXPO UGANDA

Kampala, Uganda - September 3-5, 2024

AFRICA INGREDIENTS EXPO WESTERN AFRICA

Lagos, Nigeria - September 17-19, 2024

EXPO INGREDIENTS

AFRICA

SCAN ME

Premier Food, Personal Care & Pharma Industry Ingredients Solutions Trade Shows

Africa’s

FAO, WHO launch 2024 World Food Safety Day campaign theme

GLOBAL — The Food and Agriculture Organization of the United Nations (FAO) and the World Health Organization (WHO) have kicked off the joint World Food Safety Day campaign for 2024, unveiling the theme “Food safety — prepare for the unexpected.”

This year’s campaign, leading up to World Food Safety Day on June 7, aims to shed light on the significance of

FDA announces elimination of PFAS in food packaging to protect public health

U.S — To reduce dietary exposure to per- and polyfluoroalkyl substances (PFAS) from food packaging, the U.S. Food and Drug Administration (FDA) has banned the sale of grease-proofing materials containing PFAS in food packaging within the United States.

This move directly addresses concerns regarding major sources of dietary PFAS exposure, including fastfood wrappers, microwave popcorn bags, take-out paperboard containers, and pet food bags.

The FDA’s announcement signifies the successful completion of a voluntary initiative by manufacturers to eliminate the sale of food contact substances containing certain PFAS used as greaseproofing agents in the U.S.

anticipating and addressing unforeseen food safety challenges.

The campaign delves into various unexpected food safety incidents that can transpire despite diligent efforts to maintain food safety.

From everyday occurrences like power outages impacting food storage at home to international food safety alerts due to contamination within the food supply chain, the focus is on

Potential african swine fever vaccine offers hope amidst pandemic

AFRICA — The International Livestock Research Institute (ILRI) researchers are on the brink of a groundbreaking scientific achievement—a potential ASF vaccine already showing remarkable efficacy in controlled experiments.

Leveraging CRISPR/Cas9 genome editing technology, the team has developed a vaccine candidate demonstrating 100% effectiveness in controlled experiments—an achievement poised to transform the trajectory of ASF control efforts.

CRISPR/Cas9 technology offers unprecedented precision in genome editing, enabling scientists to target specific genes within the ASF virus with unparalleled accuracy. Unlike traditional methods, this revolutionary approach allows for the swift identification and deletion of genes crucial for viral replication and pathogenesis.

“We’ve shown that with CRISPR/ Cas9, within two months you can generate multiple vaccine candidates in parallel,” says Hussein Abkallo, a scientist at ILRI.

understanding and preparing for a range of potential scenarios.

INVESTMENTS

FS4Africa project launches to elevate food safety standards across African

NIGERIA — The “FoodSafety4Africa” (FS4Africa) project, designed to address and mitigate critical food safety issues threatening the continent, recently inaugurated its journey with a landmark kick-off meeting in Ibadan, Nigeria.

FS4Africa is led by a consortium of leading partners from both African and European nations.

Its goal is to tackle a wide array of food safety concerns that have long afflicted the continent, from the dangers of mycotoxin contamination to the risks posed by pathogens like Escherichia coli and the widespread problem of food adulteration.

Focusing primarily on the informal sector, which is crucial for food security and local economies yet is often beset by safety challenges, the project aims to uplift local markets.

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 24

EVENT REGULATORY

NEWS UPDATES

Dutch-based De Heus to construct US$26M feed factory in Kenya

KENYA – De Heus Animal Nutrition, a Dutch multinational, has initiated the construction of a KES 3 billion (US$26M) feed factory in Athi River, Kenya. The company estimates that the project will be completed in late 2025. The factory aims to produce 200,000 metric tonnes of animal feed, boosting regional agriculture and creating around 1000 jobs.

The move is seen as a positive disruption to Kenya's animal feed industry, plagued by high production costs. Officials at the launch ceremony praised the investment as a vote of confidence in Kenya's economy and agriculture sector, anticipating benefits like agricultural innovation and job creation.

PARTNERSHIP

Nestlé to invest over US$500M in Italian petfood facility

ITALY – Nestlé, a global food and beverage leader, plans to invest around US$507 million in constructing a new pet-food manufacturing facility in Mantua's Valdaro industrial area, Italy. The facility will focus on producing wet pet food to meet regional demand. Spanning 180,000 square meters, the project is expected to create 300 job opportunities by 2027.

Marco Travaglia, Nestlé Italy's President and CEO, praised the support from the government, emphasizing Italy's importance in the evolving pet food sector. Minister Urso hailed Nestlé's decision as a vote of confidence in Italy's resurgence as an investment destination, acknowledging the Ministry of Business and Made in Italy's support in advancing the project.

REGULATORY

Mandela Millers acquires ISO 22000 certification

UGANDA – Mandela Millers, a subsidiary of the Mandela Group of Companies in Uganda, has obtained ISO 22000 Food Safety Management System Certification from the Uganda National Bureau of Standards (UNBS), making it Uganda's sole flour manufacturer with this distinction. The certification underscores Mandela Millers' dedication to customer safety.

Patricia Bageine Ejalu of UNBS emphasized the rigorous control measures implemented by Mandela Millers across its production processes. This internationally accredited certification not only ensures the safety of products for Ugandans but also for global consumers. Samuel Musyoka, Quality Assurance Manager at Mandela Millers, highlighted the company's meticulous monitoring of its entire food processing chain to mitigate safety hazards.

ANDRITZ teams up with Microsoft to revolutionize manufacturing industry

AUSTRIA — ANDRITZ has unveiled a strategic partnership with Microsoft to establish fully autonomous factories and a robust data ecosystem. The collaboration signifies a significant leap in digital transformation, focusing on efficiency and customer satisfaction.

ANDRITZ's President & CEO, Joachim Schönbeck, sees this as a pivotal moment in the company's digital evolution, aiming to optimize their Metris

solutions.

Central to the collaboration is the ANDRITZ Metris platform, with the Copilot solution leveraging Microsoft Azure OpenAI Service for anomaly detection and operator-machine communication, enhancing decisionmaking and process optimization. The partnership also aims to digitize internal processes, enabling employees to focus on strategic tasks and deliver better customer experiences.

FOODBUSINESSAFRICA.COM MAR/APR 2024 | FOOD BUSINESS AFRICA 25

INVESTMENTS

digital platform with Microsoft's

Nampak, Woodland Dairy introduce tethered cap carton to combat plastic pollution

SOUTH

Coca-Cola Company’s Smartwater introduces canned water for convenience

USA — The Coca-Cola Company’s Glacéau smartwater brand is launching 12-oz. aluminium cans adorned with a fresh visual design, aiming to resonate with consumers' growing environmental consciousness while offering convenient hydration options for the spring and summer seasons.

The redesigned cans boast a sleek and elegant aesthetic, mirroring the brand's signature bottle packaging with a consistent color palette and silver drop motifs.

Each variety is distinguished by a distinct background color – royal blue for the original smartwater and black for the alkaline variant with antioxidant properties.

By embracing aluminium cans, the brand seeks to align with the escalating consumer preference for non-plastic, sustainability-oriented packaging solutions without compromising on ease of use.

Woodlands Dairy, has introduced South Africa's inaugural tethered cap carton, marking a significant stride in combating plastic pollution.

This innovative design prevents the separation of the cap from the carton during post-consumer recycling, aligning with the growing demand for sustainable packaging solutions.

Raymond Dube from Nampak

BIDCO eliminates security cap seal on planet aqua water, removing 1MT of plastic

KENYA — BIDCO, a prominent consumer goods company in Kenya, has taken a substantial stride towards reducing plastic waste by removing the security cap seal from its Planet Aqua Water bottles, effectively eliminating approximately 1 metric tonne of unnecessary plastic from their packaging.

By simplifying the bottle design and reducing plastic usage, BIDCO is actively contributing to environmental conservation efforts and reducing its carbon footprint.

This initiative aligns perfectly with the global movement towards minimizing single-use plastic and promoting more sustainable packaging solutions.

BIDCO's actions exemplify corporate responsibility and demonstrate a proactive approach towards addressing plastic waste challenges within the consumer goods industry.

Liquid Cartons emphasizes the importance of sustainability in product packaging, highlighting its positive impact on both the environment and consumer perception.

Woodlands Dairy emerges as the pioneer in adopting this environmentally friendly packaging solution, showcasing its commitment to sustainability and consumer preferences.

ACQUISITION

Ishida Europe completes acquisition of National Packaging Systems

SOUTH AFRICA — Ishida Europe has expanded its presence in Africa through the recent acquisition of National Packaging Systems (NPS), a leading packaging equipment manufacturer based in South Africa.

Established in 1983, NPS is renowned for its high-performance vertical form, fill, and seal machines catering to diverse packaging needs.

They also specialize in volumetric fillers, auger fillers, and feed systems, serving industries ranging from food (including sugar, rice, and snacks) to non-food applications like firelighters and automotive components.

The acquisition represents a strategic move aimed at combining technical expertise, extensive applications experience, and market knowledge.

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 26

AFRICA — Nampak Liquid Cartons, in collaboration with

SUSTAINABILITY SUSTAINABILITY

NEWS UPDATES

WorldVeg commissions new Vegetable Genebank to Eswatini’s MoA

ESWATINI — Supported by Taiwan, WorldVeg has inaugurated Eswatini's new Vegetable Genebank, aiding climate resilience.

Dr. Shakuntala Thilsted hailed it as vital for preserving regional vegetable diversity. Simultaneously, Africa's first Vegetable Genebank was opened in Arusha, Tanzania, championing biodiversity conservation.

Dr. Gabriel Rugalema lauded the long-term commitment to agricultural heritage preservation. Mr. Gerald Mweli pledged support for African vegetable biodiversity conservation.

Dignitaries, including Ambassadors de Boer and Lou, commended WorldVeg's contributions to healthier lives through improved vegetable varieties.

European supermarket chains implement AI fruit ripeness scanners

EUROPE – European supermarket chains have implemented AI fruit ripeness scanners.

Dozens of devices have been deployed in major chains like Jumbo and Migros, with German retailers initiating pilot projects.

Plans to introduce the technology in the UK are underway. Initially calibrated for avocados, the scanners will expand to assess mangoes, melons, and kiwifruits.

Despite initial skepticism, the positive reception affirms the innovation's legitimacy. Developed by Dutch company OneThird, the scanners address retailers' concerns about manual inspections damaging avocados.

Following successful trials, demand surged, prompting inquiries about extending the scanner's capabilities. Time-intensive data collection is underway for assessing other fruits.

Spinneys expands presence in Egypt with launch of new store in October City

EGYPT – Spinneys has expanded its presence in Egypt with the launch of a new store in October City.

The store, situated on Waslet Dahshour road, was flagged off on March 24, marking a milestone in its expansion strategy.

CEO Mohanad Adly highlighted its significance amidst economic challenges, planning six more openings by June.

Since 2006, Spinneys has grown to 25 stores nationwide, employing 2500 individuals. Adly reaffirmed the growth plan despite challenges, aiming for more stores annually for the next three years.

The 750 m2 supermarket expansion is part of Spinneys' 2023/2024 fiscal year plan, demonstrating commitment to Egyptian consumers.

Nigeria inaugurates second largest tomato processing factory

NIGERIA — Nigeria has inaugurated its second-largest tomato processing factory, led by President Bola Tinubu, unveiling a 20 billion Naira (USD14.2) facility.

The Minister of Agriculture and Food Security, Senator Abubakar Kyari, represented the President at the event, emphasizing the government's commitment to food security.

Initiated in 2016 with GB Foods Africa, the factory commenced

operations by 2020, bolstering Nigeria's agricultural sector and reducing reliance on imported tomato paste.

Located in Gafara, Kebbi State, the facility spans 1,500 hectares and employs 2,000 workers, capable of producing 650 tons of concentrate daily.

Nigeria's agricultural advancements, spearheaded by Minister Abubakar Bagudu, also include cassava cultivation and bee farming promotion.

FOODBUSINESSAFRICA.COM MAR/APR 2024 | FOOD BUSINESS AFRICA 27

TRADE & MARKET UPDATE RETAIL TRADE & MARKET UPDATE

Kenya Nutritionist and Dietitian Institute endorses Brookside Plus range

KENYA – Brookside Dairy Limited’s “Brookside Plus” range has become the first dairy brand to receive endorsement from the Kenya Nutritionist and Dietitian Institute. The endorsed products include lactose-free milk, lowfat milk, probiotic yoghurt, vitamin A and D-fortified milk, and vitamin A and fibre-enriched products.

According to Reza Cheboko, a Marketing Director from the company, the endorsement was done after the company underwent active review and analysis process to monitor the alignment with Section 36-2 of the law.

REGULATORY

FDA grants GRAS status to Superbrewed Food’s postbiotic cultured protein

USA – The Food and Drug Administration (FDA) has approved Superbrewed Food’s bacteria biomass protein, granting it Generally Recognized as Safe (GRAS) status. The approved ingredient, labelled as Postbiotic Cultured Protein, is seen as the “first-ever” FDA-notified, bacteriaderived biomass ingredient and it shares similarities with nutritional fungal proteins and aligns with consumer acceptance trends of probiotics and prebiotics.

According to Bryan Tracy, CEO and co-founder of Superbrewed Food, the approval opens doors for adoption by Food & Beverage (F&B) brands in the United States, especially in dairy and alternative dairy applications.

APPOINTMENT

Arla Foods appoints first Ghanaian Managing Director to lead Ghana business

NIGERIA – Arla Foods, renowned producers of Dano milk variants, has appointed Paul Dowuona as the Managing Director to lead its Ghana business, effective from August 1, 2024. Dowuona who will become the first Ghanaian to head the company’s operations in Ghana brings over 14 years of sales experience in his role.

His appointment after serving as head of West Africa Distributor Sales (Export Sales) follows the departure of Vytautas Petronis, who has been appointed Head of Arla Foods’ operations in Indonesia.

Canada Royal Milk receives regulatory approval to launch infant formula in domestic market

CANADA – Canada Royal Milk, a subsidiary of China’s Feihe Milk, introduces infant formula to the Canadian market following regulatory approval from the Canadian Food Inspection Agency (CFIA).

The Ontario-based company, established in 2019, has primarily focused on producing powdered milk for food manufacturers but now plans to diversify its product range to include

infant

formula.

According to a statement from the company, the necessary approvals from Health Canada and CFIA were obtained after nearly two years of regulatory processes. The company’s more than 150 skilled professionals at its Kingston facility are now preparing to initiate production of the first batch of infant formula, with retail distribution anticipated nationwide soon.

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 28 NEWS UPDATES

REGULATORY

BUSINESS SUMMIT AFRICA

SEPTEMBER 10-12, 2024 | Safari Park Hotel, Nairobi, Kenya

THE AFRICA CEO LEADERSHIP & SUSTAINABILITY FORUM

The Africa Business Summit is the ground-breaking executive level conference and expo on the future of strategic leadership, entrepreneurship, sustainability & african transformation

The program at the 3-day Summit comprises of a number of premium sessions such as Leadership Dialogues, CEO Roundtables, Plenary and Panel Discussions and a B2B Deal Connect Service as well as presentations by influential people and change makers who are making waves – and inspiring the next generation of leaders in Africa

Co-located with:

* *

Digitalisation & Tech Innovation Sustainable Business & ESG Strategic Leadership Pan-African & Global Trade Financing, Investing & Financial Inclusion Industrialisation & Infrastructure Development Supply Chain & Logistics Transformation Human Capital Development KEY AGENDA www.africabizsummit.com SCAN ME

The Africa CEO Leadership & Sustainability Forum Events

Anne Joy Michira appointed as Marketing and Innovations Director for Diageo’s SWC region

KENYA – Diageo, a global alcoholic beverage, has appointed Anne Joy Michira as the Marketing and Innovations Director for the South, West, and Central Africa (SWC) region.

Michira is currently serving the same role, but at Diageo’s Kenya subsidiary, East African Breweries Ltd (EABL). She will be transitioning into this new position in London at the start of April, bringing with her nearly twenty years of experience in fast-moving consumer goods.

Michira's journey at Diageo began in 2015 at EABL, where she held various roles before her current position. Her impact on EABL's performance is notable, especially in rejuvenating iconic beer brands like Tusker and Pilsner.

Michira will be heading a region which was formed back in November 2023, covers Southern Africa, the Indian Ocean, West Africa, and Central Africa, including key markets like Nigeria and South Africa.

Jackie Tahakanizibwa to chair Uganda Alcoholic Industry Association

UGANDA – Jackie Tahakanizibwa, Corporate Relations, Public Policy, and Regulatory Affairs Manager at Uganda Breweries Limited, has been appointed to chair the Uganda Alcoholic Industry Association (UAIA) for a three-year term.

This association, which serves as an umbrella organization for registered and regulated producers of alcoholic beverages in Uganda, has appointed her aiming to align their interests and promote responsible drinking since its establishment in 2006.

Jackie, who has been serving in the association as secretary general, comes in to replace Onapito Ekomoloit, who will be assuming the association’s inaugural patron position.

She will be deputized by Emmanuel Njuki, who is currently the Legal and Corporate Affairs Head at Nile Breweries Limited (NBL).

During the association’s 2024 Annual General Meeting (AGM), Tahakanizibwa emphasized her commitment to collaborating with the government and stakeholders to foster sectoral growth and advocate for members' interests.

Ayo Awosika to serve as general manager for UAC Foods Limited

NIGERIA – Ayo Awosika has been named as the new general manager of UAC Foods Limited, a Nigerian Food and Beverage company.

In addition to holding a B.Sc. in economics and an MBA in Strategic Management, Awosika brings over thirteen years of expertise in Strategy, Sales, and Business Development. He has showcased his proficiency in different departments, including Strategy Design and Implementation, Route-To-Market Design, and P&L Management.

This change in leadership comes after s UAC Nigeria Plc's outstanding financial performance in fiscal year 2023, recording a pre-tax profit of approximately US$9.14 million. This marked a significant rebound from the previous year.

Additionally, its revenue grew by 9%, propelled by increased sales across various segments such as Paints (+24%) and Packaged Food and Beverages (+23%).

APPOINTMENTS Update MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 30

Mandla Nkomo appointed as Partners in Food Solutions’ new CEO

SOUTH AFRICA – Zimbabwe's Mandla Nkomo has been appointed as the new CEO for Partners in Food Solutions (PFS), a US based nonprofit.

Nkomo is taking over from the stepping down co-founder Jeff Dykstra, marking the first time an African will lead the organization. He will be joining the company’s leadership position after serving as the chief growth officer for Consultative Group on International Agricultural Research (CGIAR), one of the largest publicly funded agricultural research organizations.

With over two decades of diverse experience spanning public and private sectors, PFS has expressed confidence in his appointment. In a statement, Ken Powell, PFS’s board chair, cited his agricultural science background and extensive experience in the sector as his biggest stronghold.

Since its inception in 2008, PFS has linked African food processors with volunteers from major agri-food corporations like General Mills and Cargill, aiding in addressing business challenges.

Coca-Cola Beverages Africa appoints Sunil Gupta as new CEO

AFRICA – Sunil Gupta is set to assume the role of CEO at Coca-Cola Beverages Africa (CCBA), Africa's Coca-Cola bottling partner, succeeding Jacques Vermeulen, effective April 1, 2024. Vermeulen will be taking a well-deserved retirement after concluding his illustrious 28-year tenure within the Coca-Cola company.

Gupta, who is the current Chief Financial Officer for The Coca-Cola Company’s Bottling Investments Group (BIG), brings a wealth of experience spanning 25 years within the Coca-Cola company. He held various pivotal roles in India and the Philippines too.

Bruno Pietracci, Chairman of CCBA's Board, extended his heartfelt appreciation to Vermeulen for his remarkable contributions to the company, particularly his contribution in managing CCBA through the complexities of a global pandemic and orchestrating a quick and effective recovery.

Norton Kingwill, CCBA's esteemed Chief Finance Officer, will serve as acting CEO during the transition phase. Gupta will take over a company that already a dominant market share across 15 nations and a workforce of around 18,000 individuals.

Sam Ngumeni to appointed CEO of Woolworths Foods

SOUTH AFRICA – Sam Ngumeni, Woolworths Group’s Chief Operating Officer with 26 years of experience, has been appointed as the new CEO of Woolworths Foods, effective July, 1.

Ngumeni’s extensive background in financial services and retail credit, along with his successful track record within the organization, makes him an ideal replacement for the role. His leadership has been marked by milestones such as overseeing joint ventures and serving on the WHL Board since 2014.

Ngumeni will be taking over from Zyda Rylands, who has been the

company’s CEO for 9 years. She is retiring after an illustrious 29-year career with Woolworths Group, leaving behind a legacy of growth and innovation in every position she served. Despite earlier plans to step down in 2021, Rylands extended her tenure until August 2024, showcasing her dedication.

At the onset of his leadership, Ngumeni will take over a thriving food business within the group, evidenced by an impressive 8.4% growth in turnover and a 7.2% increase in concession sales on a comparable store basis during H1 FY2024.

FOODBUSINESSAFRICA.COM MAR/APR 2024 | FOOD BUSINESS AFRICA 31

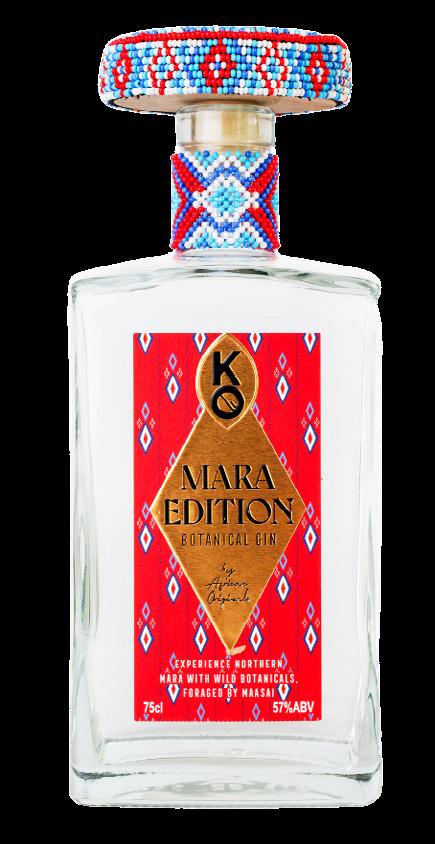

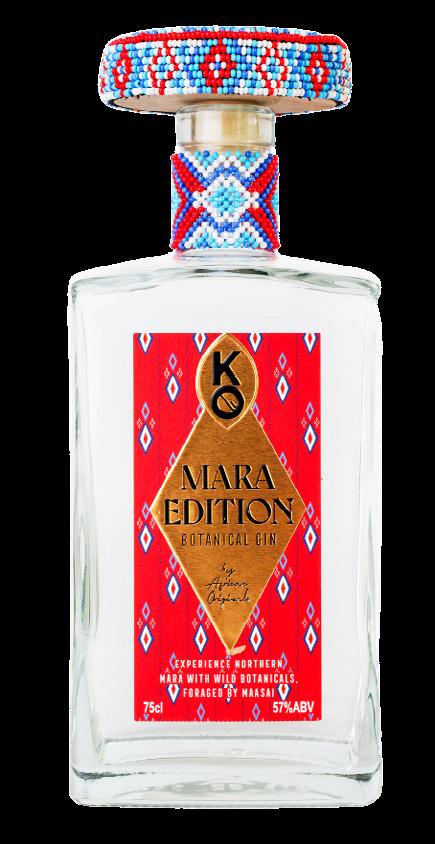

AFRICAN ORIGINALS LTD

Mara Gin

African Originals Ltd (AOL), the creators of the well-known Kenyan Original (KO) brand of ciders, has introduced its latest addition, the Mara Edition Gin, as part of a strategic initiative to reinforce its position in the beverage market.

Each bottle is adorned with a beaded top crafted by Maasai women, adding a touch of cultural heritage and artistry to the product.

www.africanoriginals.com

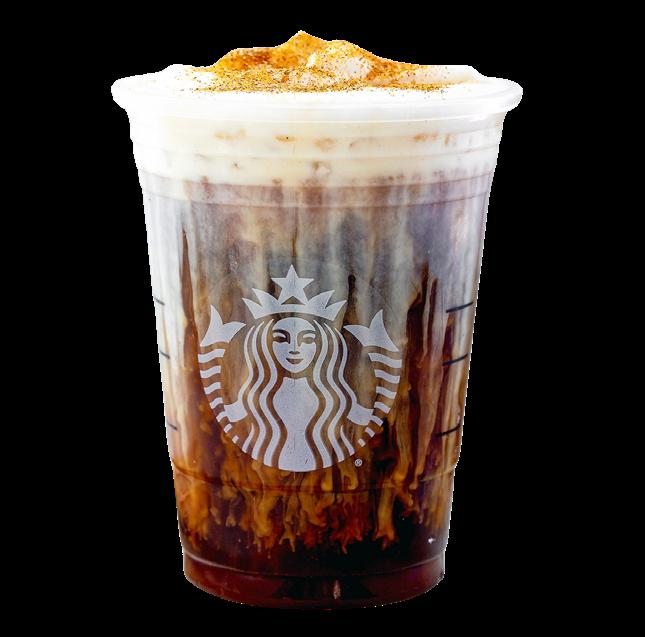

STARBUCKS

Salted Caramel Cream Cold Brew

Starbucks South Africa has introduced into the market the limited edition Salted Caramel Cold brew as it celebrates the arrival of the second half of the country’s summer season.

The super-smooth cold brew is sweetened with a touch of caramel and topped with a salted, rich cold foam.

www.starbucks.co.za

PREMIER NUT

Value-added macadamia products

Premier Nut, South Africa’s long standing macadamia producer, has unveiled a series of innovative value-added macadamia products: Sutton Pressed, MacaPaste, and Snackadamia.

www.premiernut.co.za

NEW FOOD PRODUCT INNOVATIONS

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 32

CROWN BEVERAGES

7UP soda

Crown Beverages Limited (CBL), Uganda’s oldest beverages company, and PepsiCo bottler, has officially launched the popular 7UP carbonated soft drink in the Ugandan beverage market.

7UP is now available in Uganda in 300ml and 500ml PET bottles.

pepsi-cola.co.ug

DELTA CORPORATION

Chibuku

Pineapple and Ginger

Delta Corporation has introduced two new flavors, pineapple and ginger, to its Chibuku Super beer brand under the sorghum segment, marking an expansion of its product offering.

The new Pineapple and Ginger flavours are now available for purchase in stores nationwide.

www.delta.co.zw

MACALLAN The Reach

The Macallan, a distinguished single malt Scotch whisky distillery, has introduced “The Reach,” an exceptional single malt whisky that pays homage to the brand’s rich legacy and enduring spirit over 200 years in Nigeria.

Aged for 81 years, The Reach is a rare single malt, making it the oldest whisky ever released by The Macallan.

www.themacallan.com

FOODBUSINESSAFRICA.COM MAR/APR 2024 | FOOD BUSINESS AFRICA 33

SABS' Head office in Groenkloof, Pretoria

SABS' Head office in Groenkloof, Pretoria

NO GAVEL, Just Standards

South African Bureau of standards’ non-regulatory role unveiled

By Catherine Odhiambo

In the convoluted world of standardization, where regulations reign supreme and oversight is paramount, there exists a unique entity that defies convention. Unlike most of its counterparts in other nations, the South African Bureau of Standards (SABS) stands apart as a model of neutrality, devoid of regulatory authority. It is a curious anomaly in an arena where regulation and standardization often go hand in hand.

But what sets the SABS apart from its regulatory brethren? How does this distinctive approach shape its role in ensuring safety and quality standards in South Africa's food and agriculture sector? To unravel this enigma, let's embark on a journey into the heart of the SABS, guided by none other than Lungelo Ntobongwana, the Acting CEO of this remarkable organization. Join us as we explore the inner workings of the SABS and uncover the secrets behind its unconventional yet profoundly impactful approach to standardization.

THE GENESIS OF STANDARDIZATION

In the crucible of post-war reconstruction, amidst the clamor for progress and

innovation, the South African Bureau of Standards emerged as a vanguard of industrial transformation. Established in 1945 through the Standards Act, the SABS became a pillar in developing and introducing standards, aligned to global developments in standardization.

Amidst the backdrop of global alignment towards technical standards, the establishment of national standards bodies became common among nations seeking to fortify their industrial foundations. Cognizant of the imperative to chart its own path to progress, South Africa seized upon this momentum, laying the groundwork for forming the SABS.

"At its core, the SABS was founded on the principles of innovation, quality, and sustainability," remarks Lungelo Ntobongwana, Acting CEO of the SABS.

Indeed, the establishment of national standards was not merely a bureaucratic exercise but a strategic imperative aimed at fostering human, animal, and environmental sustainability. As the custodian of national standards, the SABS is responsible for developing guidelines that shape the contours of industry and trade, through

MAR/APR 2024 | FOOD BUSINESS AFRICA 35

standards development.

“Standards are not merely technical specifications; they are the bedrock upon which modern civilization is built,” reflects Ntobongwana.

“In a world profoundly reliant on product standards, the SABS played a pivotal role in shaping the economic landscape, ensuring the quality and safety of products that permeate our daily lives.”

MANDATE AND ROLE OF SABS

Mandated by the Standard Act No.8 of 2008, the SABS assumes a multifaceted role in standardization, charged with the development, promotion, and maintenance of South African national standards (SANS).

“At the heart of our mandate lies a commitment to excellence and innovation,” asserts the Acting CEO.

“As thebearer of national standards, we are tasked with fostering a culture of quality and safety, ensuring that South African products meet the highest international benchmarks.”

Indeed, the SABS's mandate transcends mere standardsetting, encompassing a myriad of activities aimed at fortifying the nation's industrial infrastructure. From providing training services to conducting conformity assessments and certification, the SABS serves as a linchpin of quality assurance in the South African economy.

“Our certification services, symbolized by the iconic SABS mark, serve as a badge of honor, signifying adherence to the highest standards of quality and safety,” remarks

Ntobongwana.

“Moreover, our inspection and verification services play a pivotal role in safeguarding consumer interests, ensuring that products meet the stringent requirements of national standards.”

SABS also plays a pivotal role in mitigating risks and

MY COMPANY PROFILE: SABS

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 36

On the left, CEO recognizing laboratory team for outstanding performance

OUR CERTIFICATION SERVICES, SYMBOLIZED BY THE ICONIC SABS MARK, SERVE AS A BADGE OF HONOR, SIGNIFYING ADHERENCE TO THE HIGHEST STANDARDS OF QUALITY AND SAFETY

safeguarding the integrity of the food industry. By collaborating with regulators and stakeholders, SABS identifies and addresses potential risks, ensuring the safety, quality, and compliance of food products.

Whether appointed as a certification authority or testing entity, the SABS remains steadfast in its commitment to promoting industrial excellence and consumer protection.

FROM CONCEPTION TO CULMINATION: THE STANDARDIZATION JOURNEY

But how do these standards come to be?

Central to the SABS's modus operandi is the consensusbased approach to standard development—a hallmark of its commitment to inclusivity and transparency. Through a rigorous process of public consultation and stakeholder engagement, the SABS endeavors to craft standards that reflect the collective wisdom of industry experts, policymakers, and consumers alike.

“Our Technical Committees serve as crucibles of innovation, bringing together a diverse array of stakeholders to shape the industry’s future,” explains Ntobongwana.

"From government agencies to industry experts, each stakeholder brings a unique perspective to the table, enriching the standard-setting process with invaluable insights and expertise.”

The journey of a SANS begins with the drafting process, where industry-specific nuances and best practices are distilled into a comprehensive framework. Draft standards undergo

rigorous scrutiny and are subjected to public inquiry, inviting feedback from stakeholders and the wider community.

“Transparency and inclusivity lie at the core of our standardization efforts,” asserts Ntobongwana. “By soliciting public input, we ensure that our standards reflect the collective wisdom and aspirations of society, fostering a sense of ownership and buy-in.”

A FEAST OF STANDARDS: ACCESSIBLE AND ADAPTABLE

Among the myriad standards promulgated by the SABS, these are the more recent examples:

1. SANS 22000: Food Safety Management Systems

This cornerstone standard lays the foundation for a robust food safety management system, applicable to organizations across the food chain. From feed producers to retailers, SANS 22000 delineates comprehensive requirements to ensure the integrity and safety of food products at every stage of production and distribution.

2. SANS 2235: Raw Pet Food Nutritional and Manufacturing Requirements

In an era marked by a burgeoning pet food industry, SANS 2235 emerges as a vital source of guidance for manufacturers. This standard outlines nutritional requirements and manufacturing protocols for raw pet food, ensuring the wellbeing of our beloved canine and feline companions.

3. SANS 587: Canned Fish, Canned Marine Molluscs, and Canned Crustaceans

SANS 587 serves as a bulwark against contamination and spoilage in the realm of canned seafood products. By stipulating stringent manufacturing, processing, and treatment protocols,

FOODBUSINESSAFRICA.COM MAR/APR 2024 | FOOD BUSINESS AFRICA 37

Lungelo Ntobongwana, Acting CEO, SABS

this standard safeguards the quality and integrity of canned marine delicacies, enriching culinary experiences across the nation.

4. SANS 1647: Approved Market Names for South African Fish and Seafood Species

In the bustling marketplace of seafood commerce, clarity and transparency are paramount. SANS 1647 provides a definitive guide to market names for South African fish and seafood species, ensuring consistency and accuracy in labeling practices, and empowering consumers to make informed choices.

5. SANS 3091: Chilled Finfish, Marine Molluscs, and Crustaceans

With the rise of chilled seafood consumption, SANS 3091 emerges as an essential standard for guaranteeing the quality and safety of products. This standard guarantees consumer trust in chilled fish products by defining strict guidelines for handling, processing, and storage, paving the way for culinary delight.

6. SANS 885: Processed Meat Products

From biltong to boerewors, processed meat products hold a cherished place in South African culinary traditions. SANS

QUALITY IS NOT JUST A METRIC; IT'S A WAY OF LIFE. THROUGH OUR STRINGENT TESTING AND CERTIFICATION PROCESSES, WE STRIVE TO ELEVATE INDUSTRY STANDARDS AND CULTIVATE A CULTURE OF EXCELLENCE THAT PERMEATES THE FOOD INDUSTRY

885 sets forth comprehensive guidelines for the handling, processing, and storage of these delectable treats, ensuring adherence to microbiological safety standards and preserving their flavor and quality.

THE SABS SEAL OF APPROVAL

When it comes to ensuring top-notch quality in the food

MAR/APR 2024 | FOOD BUSINESS AFRICA FOODBUSINESSAFRICA.COM 38 MY COMPANY PROFILE: SABS

Lungelo Ntobongwana, Acting CEO, SABS

Secretary General of ARSO, Hermogene Nsengimana gracing SABS' Luncheon

industry, the South African Bureau of Standards stands as a guiding light. The coveted SABS Approved Mark of Approval is more than just a symbol – it's a stamp of excellence that resonates with consumers and businesses alike. With its rigorous testing and certification process, SABS ensures that products bearing its mark meet stringent quality criteria, providing consumers with peace of mind and confidence in their purchases.

However, SABS's influence extends beyond consumer confidence. Regulators and manufacturers frequently request the expertise of SABS to conduct testing, inspections, and studies on various products and facilities. This acknowledgment underscores SABS's reputation as a trusted authority in ensuring safety and quality standards are met across the board.

“Quality is not just a metric; it's a way of life. Through our stringent testing and certification processes, we strive to elevate industry standards and cultivate a culture of excellence that permeates the food industry value chain,” asserts Ntobongwana.

Moreover, SABS doesn't just rest on its laurels. Through strategic marketing and engagement initiatives, the organization actively promotes its services to businesses, ensuring that the industry is well-informed about the benefits of seeking SABS certification.

EMPOWERING THROUGH CERTIFICATION

While SABS may not wield regulatory authority, its impact

on ensuring food safety and quality standards is indisputable. Through its voluntary conformity assessment and certification services, SABS empowers organizations across the food supply chain to uphold the highest standards of safety and quality.

At the center of SABS's efforts lies the certification of organizations under SANS 22000 Food safety management systems. By obtaining this certification, organizations, including farmers, manufacturers, and retailers, demonstrate their commitment to maintaining rigorous food safety protocols. This certification not only enhances consumer trust but also elevates the reputation of businesses within the industry.

SABS's accreditation by the South African National Accreditation System (SANAS) locally and internationally by Raad Voor Accreditatie (RvA) and FSSC further solidifies its position as a credible authority in food safety certification. This accreditation accentuates SABS's adherence to internationally recognized standards, assuring stakeholders both domestically and globally.

Moreover, SABS's status as an authorized body for testing and certification ensures that organizations meet the quality criteria outlined in national standards (SANS). With meticulous attention to detail, SABS delivers on these requirements, offering a stamp of approval that signifies adherence to stringent quality and safety standards.

It's essential to note that SABS's commitment to excellence extends beyond its clients to its own operations. The organization obtains certification and authorization to

FOODBUSINESSAFRICA.COM MAR/APR 2024 | FOOD BUSINESS AFRICA 39

SABS and ZABS signing a Memorandum of Understanding (MoU).

perform testing and certification services, ensuring that its processes meet the same rigorous standards it upholds for others.

FORGING PARTNERSHIPS

The South African Bureau of Standards recognizes that collaboration is key to driving innovation and ensuring the relevance of standards. As such, it actively engages with various organizations to enhance practices and standards in the food industry.

Internationally, SABS collaborates with renowned organizations such as the International Organization for Standardization (ISO), which sets global standards for various industries. Serving as a founding member of ISO, SABS has earned global recognition as a highly esteemed contributor to international standardization, establishing itself as the foremost standardization authority in Africa. Here, the Bureau represents South Africa on prestigious platforms such as ISO/TC 34, Food products. This ISO technical committee plays a crucial role in developing standards that govern food production, ensuring safety, quality, and fairness

in international food trade.