The dairy industry remains a cornerstone of global agriculture, contributing significantly to food security and economic stability. With a complex supply chain that spans farmers, cooperatives, processors, and retailers, the sector is continually evolving due to technological advancements and shifting market dynamics. As we launch the 3rd edition of Dairy Middle East & Africa Magazine, formerly Dairy Business Africa, we remain committed to keeping industry stakeholders informed, exploring key market developments, groundbreaking technologies, and critical challenges shaping the sector today.

A key focus of this edition is Saudi Arabia’s dairy market, where Almarai, one of the world’s largest vertically integrated dairy companies, continues to lead the industry. Through strategic investments in advanced dairy farming, processing, and distribution, Almarai has solidified its position as a powerhouse in the food industry. We delve into the company's impressive growth trajectory, market influence, and the strategies that have made it a benchmark for efficiency and sustainability in the region.

Shifting our focus to East Africa, we examine the transformation of Kenya’s informal milk distribution sector, where FRESH Networks Kenya is pioneering technologydriven solutions to enhance efficiency and safety. According to a 2020 report by the International Livestock Research Institute (ILRI), over 1.8 million smallholder farmers produce the majority of Kenya’s milk, yet only 20% is processed by formal dairies. FRESH Networks is addressing this gap with innovative milk dispensing solutions, creating a gamechanging approach to milk safety and accessibility.

Another emerging trend in Africa is the rising demand for probiotic dairy products, with consumers increasingly turning to fermented milks for their health benefits. Functional dairy products such as yogurt and kefir are gaining popularity due to their digestive and immune-boosting properties. In this issue, we explore the factors driving this trend and the opportunities it presents for dairy producers looking to tap into the growing health-conscious market.

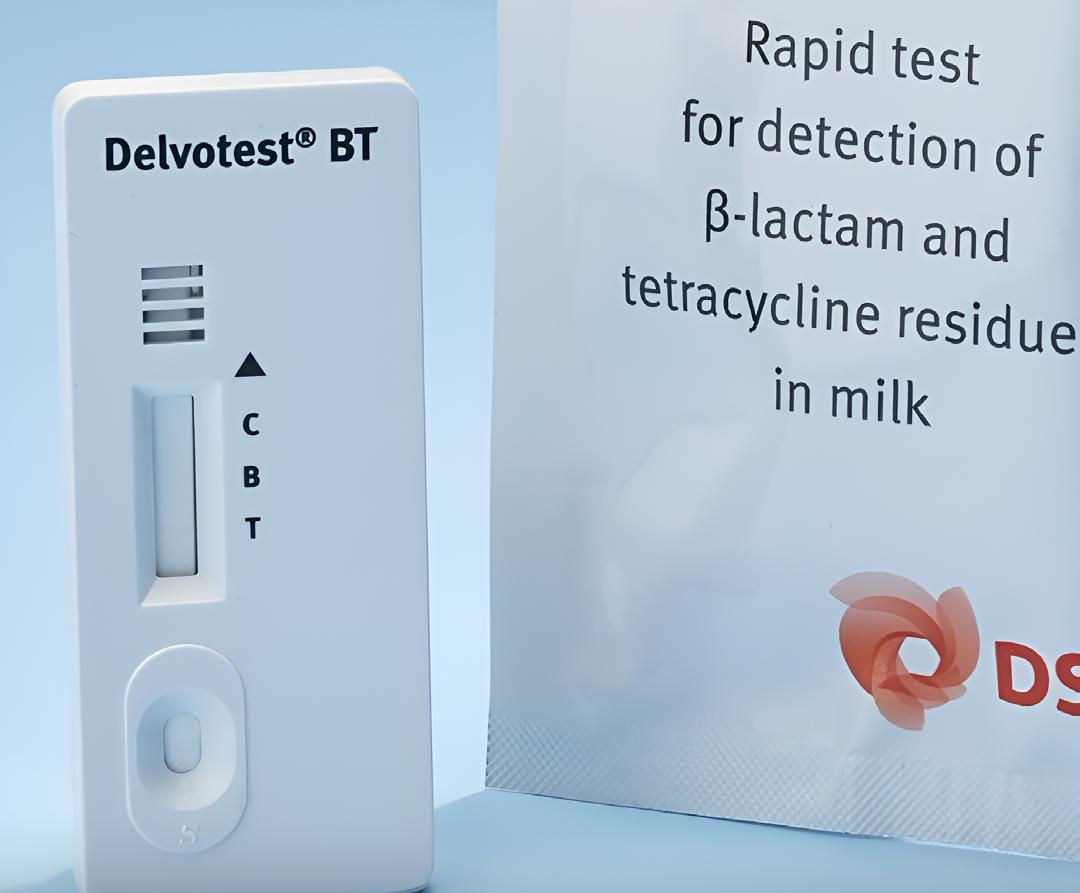

Despite these advancements, food safety remains a pressing concern, particularly the increasing presence of antibiotic residues in milk. This issue examines the risks associated with antibiotic contamination, its potential impact on consumer health, and the measures needed to mitigate these threats.

We also spotlight the critical role of women in the dairy

sector. Prof. Jolly M. Kabirizi of Valley University of Science and Technology shares her expert insights into the contributions of women in Uganda’s dairy industry. From production and processing to entrepreneurship and policy advocacy, women are instrumental in sustaining and advancing the dairy value chain.

Beyond these in-depth features, this issue delivers the latest industry news, market trends, and regulatory updates to keep you informed. From emerging technologies and investment opportunities to policy shifts and trade dynamics, we ensure that every player in the dairy sector is equipped with the knowledge needed to thrive.

We hope you find this edition insightful, engaging, and valuable in your journey within the dairy industry.

Martha Kuria Senior Editor, FW Africa

FOUNDER & PUBLISHER

Francis Juma

SENIOR EDITOR

Martha Kuria

EDITOR

Mary Wanjira

CONTRIBUTOR

Prof. Jolly Kabirizi

BUSINESS DEVELOPMENT DIRECTOR

Virginia Nyoro

BUSINESS DEVELOPMENT ASSOCIATE

Vivian Kebabe

HEAD OF DESIGN

Clare Ngode

DESIGN ASSOCIATE

Emmaculate Ouma

ACCOUNTS

Jonah Sambai

: FW Africa

P.O. Box 1874-00621, Nairobi Kenya

Tel: +254725 343932

Email: info@fwafrica.net

Company Website: www.fwafrica.net

www.dairybusinessafrica.com www.foodbusinessafrica.com www.millingmea.com

www.sustainabilitymea.com

Africa Dairy Summit 2025

Location: Argyle Grand Hotel, Nairobi, Kenya

(Dual format: in-person and virtual)

Date: 17-19 September 2025. www.africadairysummit.com

Dairy Livestock & Poultry Expo Africa

Location: Kenyatta International Convention Centre (KICC), Nairobi, Kenya

Date: June 11–13, 2025 www.dlpexpo.com

DairyTech Africa

Location: Nairobi, Kenya

Date: 29 - 31 July,2025 www.dairytechafrica.com

Africa Poultry & Animal Feed Expo

Location: Nairobi, Kenya

Date: 2-4 July, 2025(co-located with AFMASS Expo) www.africafarmtechexpo.com

IDF Regional Dairy Conference Africa

Location: Kigali Conference and Exhibition Village (KCEV) — Camp Kigali

Date: May 29 - 1 June 2025 www.africadairyconference.com

World Dairy Expo

Location: Madison, Wisconsin

Date: September 30 - 3 October, 2025 www.worlddairyexpo.com

International Cheese & Dairy Expo 2025

Location: Staffordshire Showground, UK

Date: June 25-26, 2025 www.internationalcheesedairyexpo.com

Dairy Industries Expo 2025

Location: NAEC Stoneleigh, UK

Date: 29-30 October, 2025

www.dairyindustriesexpo.com

LEBANON - Lebanon has partnered with the International Fund for Agricultural Development (IFAD) to launch a US$12 million initiative aimed at supporting smallholders dairy farmers hit hard by economic challenges and regional instability

The initiative focuses on improving cattle health, animal management, and dairy herd productivity.

A key objective is to reduce postharvest milk losses while enhancing the quality of dairy products.

Lebanese officials have praised the collaboration, with one noting, "This project will help our small farmers grow stronger and provide new opportunities for our youth."

The funding will be provided mainly by IFAD, with the Lebanese government committing US$1. 8 million.

Alongside Lebanon's contribution, Switzerland, through its Facility for Refugees, Migrants, Forced Displacement and Rural Stability (US$2.3 million), and the European Union’s Regional Trust Fund in Response to the Syrian Crisis (US$2.2 million) have pledged additional funding, while local beneficiaries will contribute US$0.2 million. This reflects a broad international commitment to Lebanon’s recovery.

This new project builds on IFAD's long-standing commitment to Lebanon, following its US$49 million investment in the country since 1992, which has

supported over 57,000 households.

This new initiative aligns with global sustainable development goals and promises to not only strengthen Lebanon's dairy sector but also build resilience in rural areas affected by inflation and trade disruptions.

Given the strain placed on Lebanon’s resources by the Syrian refugee crisis, initiatives like this are seen as vital for the nation’s recovery.

“This is about more than just dairy; it’s about building resilience,” noted an IFAD representative “The focus on youth employment, in particular, offers hope and stability to communities that have been severely impacted by regional instability and displacement.”

EGYPT - Danone Egypt has partnered with the WeCare Foundation to launch a program that trains individuals with disabilities in yogurt production, reinforcing its commitment to social impact.

The collaboration has led to the creation of a yogurt production lab at WeCare, supported by PET Egypt and Alasdekaa Dairies.

This facility provides hands-on training, enabling participants to learn every stage of yogurt-making, from production to sales. The yogurt cups produced are sold within the foundation, offering trainees an additional income source.

The program aims to go beyond nutrition, equipping participants with skills that enhance personal development, cognitive growth, and employment prospects while promoting independence.

Danone Egypt supports the effort by supplying fresh milk weekly from its Nubariya farm, ensuring the yogurt meets high nutritional standards.

This initiative reflects a growing trend of corporate investment in social responsibility projects that uplift marginalized communities.

The WeCare Foundation, known for empowering people with disabilities, views the partnership as a vital link

between training and economic opportunity. The program focuses on building practical abilities that allow participants to contribute to society and establish sustainable livelihoods.

PET Egypt contributes packaging materials, while Alasdekaa Dairies aids in the project’s development, strengthening its foundation. Danone Egypt has encouraged other companies to support similar efforts that promote inclusion and economic empowerment.

Aligning with Danone Egypt’s broader mission, the program seeks to positively impact the communities it serves by providing people with disabilities access to valuable training and work opportunities.

Through this effort, the initiative fosters skill development and economic participation, creating a model for combining corporate resources with social goals to drive meaningful change.

EGYPT - Arabian Food Industries Company (Domty) has reported impressive financial results for 2024, with consolidated net sales exceeding US$181 million.

The company’s latest figures show consolidated net profits after tax rising to US$10.023 million, a 10.29% increase from US$9.089 million in 2023, underscoring its robust standing in the dairy sector.

Consolidated net sales reached US$184.5 million, up from US$150.08 million the previous year, fueled by strong demand for its diverse products, including Tetra Pak cheese, plastic tube cheese, mozzarella, spread cheese, milk, and juices.

Earnings per share (EPS) improved to US$0.0288 in 2024 from US$0.026 in 2023, reflecting enhanced profitability. Domty’s board proposed a cash dividend of US$0.017 per share, demonstrating confidence in its financial stability and a commitment to shareholders.

However, standalone net profits after tax dipped to US$9.886 million from US$10.218 million in 2023, with standalone EPS slightly declining to US$0.0284 from US$0.0294. Despite this, the company’s overall consolidated performance highlights its resilience and strategic focus.

Domty specializes in a wide range of dairy and juice products, cementing its reputation as a household name in Egypt. The company’s success in 2024 reflects its ability to navigate a competitive market while meeting consumer needs.

Egypt’s food industry remains a cornerstone of the economy, and Domty continues to play a pivotal role with its innovative offerings and strong brand presence.

Looking ahead, Domty aims to maintain its growth trajectory by capitalizing on domestic and regional demand. The proposed dividends signal a balance between rewarding investors and reinvesting in operations.

With its solid foundation and adaptability, Domty is wellpositioned to further strengthen its leadership in the dairy and food sector in the coming years.

USA - Chobani LLC, a prominent yogurt producer, has revealed plans to invest US$500 million to upgrade its processing plant in Twin Falls, Idaho, marking its most significant financial commitment.

The expansion will increase the facility’s production capacity by 50% and enlarge its footprint by over 500,000 square feet, resulting in a total size of 1.6 million square feet.

Construction will start immediately, with the enhanced operations slated to begin in early 2026. Once completed, the plant will feature 24 production lines and employ more than 1,200 workers, including at least 160 new positions created by the project.

The Twin Falls facility is a cornerstone of Chobani’s operations, producing its well-known Greek yogurt, along with oatmilk and coffee creamers—products driving the company’s recent growth. This expansion will triple the plant’s milk usage to satisfy rising consumer demand.

Chobani’s long-term collaboration with Twin Falls and its Urban Renewal Agency, established in 2011, supports the project.

The city will improve its water and sewer infrastructure to accommodate the plant’s needs, while Chobani will fund upgrades to the local power substation and wastewater pretreatment systems. The agency will offset some of these expenses to reduce the company’s financial strain.

Beyond yogurt, Chobani has diversified with high-protein offerings, introduced Chobani Creations in 2023, and entered the oatmilk and creamer markets, expanding its consumer base.

This investment reflects a wider trend among industry leaders like PepsiCo, Nestlé, J.M. Smucker, and Ingredion, who are also pouring funds into facility upgrades to meet demand.

Based in New York, Chobani strengthens its Idaho hub, ensuring it remains competitive while honoring its Twin Falls roots.

GHANA - Fan Milk Plc, a leading brand in Ghana’s dairy sector, has announced a net profit of US$3.5 million for the 2024 fiscal year, more than doubling the US$1.56 million earned in 2023.

The financial update, released on the Ghana Stock Exchange, reflects a robust year despite an 18% drop in export performance.

The company credits its success to a 24% increase in turnover, reaching US$44.6 million, driven by higher product sales. Efforts to cut operational costs and boost profitability also paid off, with

the operating margin rising from 6% in 2023 to 12% in 2024.

A company report highlighted strategies like negotiating raw material prices, refining the product lineup, enhancing availability, and launching targeted promotions to widen its customer reach as key factors in improving the gross margin.

“These gains stem from productivity efforts, including better pricing on raw materials, an optimized product mix, improved access to our goods, and strategic promotions to grow our audience,” the report explained.

Despite the sales growth, expenses climbed significantly, with sales, distribution, administrative, and tax costs rising by 12.6%, 14.7%, 54.3%, and 57.7%, respectively, totaling over 641.6 million cedis US$41.9 million. Still, Fan Milk’s ability to balance rising costs with revenue growth has reinforced its standing in the market.

Ghana’s dairy industry is projected to reach $650 million in revenue by 2025, growing at an annual rate of 9.07% through 2029. Fan Milk views its 2024 results as a sign of its rising influence in this expanding sector.

“By prioritizing efficiency and innovation, we’ve set the stage for sustained growth.”

GLOBAL - The global dairy alternatives market is set for growth, with projections indicating it will reach a value of US$79.55 billion by 2032, up from US$28.55 billion in 2024, according to a recent Coherent Market Insights report.

This growth, reflecting a robust compound annual growth rate (CAGR) of 13.7% over the next eight years, is largely driven by increasing consumer preference for plant-based options such as almond, oat, and soy milk. Key factors fueling this shift include rising health consciousness, environmental concerns, and a growing adoption of vegan diets, particularly among younger demographics like millennials and Gen Z.

The surge in demand is bolstered by heightened awareness of lactose intolerance and the environmental advantages of plant-based milk, which requires fewer resources like water and land compared to traditional dairy farming. Major players like Whitewave Foods Company, SunOpta, and Hain Celestial are capitalizing on this trend by innovating with new flavors and nutrient-fortified products to appeal to a wider audience.

Regionally, North America and Europe currently dominate the market, though Asia-Pacific is gaining traction due to rising incomes and urban growth. The North American plantbased milk segment alone is forecasted to hit US$33.1 billion by 2031, per Persistence Market Research. Accessibility has

also improved, with dairy alternatives increasingly available in supermarkets and online, further driving market penetration.

Despite challenges such as competition from conventional dairy and nutritional critiques, industry experts remain confident. Innovations in taste, affordability, and product development are expected to overcome these hurdles, ensuring sustained growth. According to a report from Sarah Thompson in Coherent Market Insights, dairy alternatives are central to evolving consumer food perceptions, positioning the sector to transform the global food landscape by 2032.

Processing, packaging & supply chain excellence

Sustainable dairy production & circular economy

Nutrition, health & wellness

Dairy innovation & formulation

Dairy farming & development

Investments, financing & funding

Trade, market access & consumer engagement

Food safety, quality & compliance

ALGERIA - Baladna, Qatar’s top dairy firm, is pivoting its growth strategy toward high-protein dairy products and a landmark collaboration with Algeria after its Malaysian joint venture dissolved.

The company’s 2024 financials reported a record US$316 million in revenue, up 8% from the prior year, with net profit surging 69% to US$51 million, solidifying its dominance in Qatar’s dairy and juice sectors.

In Qatar, Baladna commands a 96.1% share of fresh milk and 92.5% of UHT milk, providing a strong base for expansion. To fuel growth, the company added 39 new products in 2024, including Greek yoghurt flavors, an expanded cheese range, and a refreshed Awafi line, targeting the plain dairy market. This

APPOINTMENTS

innovation aligns with a focus on highprotein milk and yoghurt, seen as highpotential segments.

Internationally, Baladna has secured a partnership with the Algerian National Investment Fund to build what it claims will be the world’s largest vertically integrated dairy farm. This follows the collapse of a US$986.4 million Malaysian venture, launched in 2020 with FGV Holdings and Touch Group Holdings. Aimed at producing 100 million liters of milk annually within three years, the project ended in December 2024 when FGV cited unmet conditions, prompting a mutual termination.

Undeterred, Baladna is deepening its Algerian ties, negotiating further agreements, including a memorandum

with the government to explore infant milk production. This shift leverages Baladna’s expertise in dairy self-sufficiency, honed in Qatar, where it supplies over 95% of fresh milk. With the Malaysian setback behind it, the company is channeling its 2025 ambitions into Algeria, aiming to replicate its domestic success on a global scale while meeting rising demand for specialized dairy products

SOUTH AFRICA - Danone Southern Africa has appointed Nyaladzi Moyo as its new commercial director, effective March 1, 2025. Known for its innovative food solutions, the dairy giant welcomes Moyo, affectionately nicknamed “Nyala,” for his extensive commercial expertise.

Moyo joins Danone from Beiersdorf Southern Africa, where he served as sales

director, leading a 48-member team.

His tenure there marked significant achievements, including boosting annual net sales and improving in-store execution, revenue growth management, and sales team skills. His leadership earned him a reputation as a dynamic professional.

Hendrik Born, general manager at Danone Southern Africa, views Moyo’s appointment as a strategic alignment with the company’s goals.

He believes Moyo’s experience will drive the firm’s commercial strategy and growth in South Africa’s competitive market.

Moyo’s academic background strengthens his profile, with an MBA from Warwick Business School (awarded with Merit) and a Bachelor of Commerce in Commercial Law and Management from Nelson Mandela University.

With over 13 years of experience, Moyo has honed his skills in market strategy and category sales, including

roles at Procter & Gamble in Canada and South Africa.

His appointment reflects Danone’s focus on sustainable growth and innovation. Moyo expressed enthusiasm for joining a team committed to impactful food solutions, aiming to leverage his expertise to enhance key growth initiatives and foster collaboration toward shared success.

Danone Southern Africa anticipates a bright future under Moyo’s leadership. His passion and ability to work collaboratively, combined with a skilled team, position the company for continued progress.

As Danone seeks to expand its regional presence, Moyo’s role is pivotal in advancing sustainable development and reinforcing the company’s standing in the food industry. This appointment underscores Danone’s dedication to blending expertise with purpose-driven goals.

NIGERIA - Nestlé Nigeria, partnering with the Federal Capital Territory Administration (FCTA), has set a goal to boost daily milk output to 30,000 litres by November 2027 through advanced cattle breeding and top dairy farming techniques.

The plan is part of the Nestlé Livestock Development Project, which focuses on Better Milk, Better Feed, and Resilient Communities.

At the unveiling of the Nestlé Dairy Demonstration Farm in Abuja, Wassim Elhusseini, Managing Director and CEO of Nestlé Nigeria PLC, highlighted the company’s commitment to livestock progress.

With an investment exceeding N1.8 billion, Nestlé currently gathers 6,000 litres of fresh milk daily from 1,600 dairy households, aiming to quintuple this by 2027.

Elhusseini noted that, with FCTA support, the project has formed 83 dairy cooperatives, aiding 3,000 producers and collecting over 1 million litres of raw milk, raising their monthly earnings from N70,000 to N250,000.

Additional gains include vaccinating 34,744 cattle, building 19 boreholes and 28 water troughs, and lowering milk rejection rates from 12% in 2021 to 5% in 2024.

Minister of Livestock Development, Muktar Maiha, praised Nestlé’s efforts in sustainable agriculture and backward integration, calling the farm a key step toward food security and economic growth.

He emphasized the government’s support for livestock as a driver of jobs and income, noting the project’s benefits like climate-smart practices, farmer training, and steady income via the Pakonkore milk hub. Maiha pledged to address industry hurdles like poor infrastructure and limited veterinary services.

FCTA’s Mandate Secretary for Agriculture, Lawan Geidam, lauded the public-private partnership, aligning it with President Tinubu’s Renewed Hope Agenda for economic development.

He urged Nestlé to use the farm as a training hub for smallholder farmers. Elhusseini underscored its role as a practical example of settled breeding methods, enhancing production and safety for cattle and owners alike.

MOROCCO - Moroccan conglomerate Dislog has bolstered its portfolio by acquiring Venezia Ice & Bakery and the MCDF food manufacturing plant.

Venezia, a prominent ice cream brand since 1999, founded by Sghir Bougrine, operates 45 stores across Morocco, known for its ice creams, sorbets, pastries, and artisanal bread.

This acquisition enhances Dislog’s presence in the food sector, aligning with its operations in hygiene and healthcare.

Dislog, a leader in Morocco’s fast-moving consumer goods (FMCG) market, distributes products for brands like P&G, Nestlé, Mars, Kellogg’s, Beiersdorf, and British American Tobacco, reaching about 72,000 outlets nationwide.

The company also manages a joint venture with Egypt’s Edita in baked goods, expanding its regional footprint.

This move follows a dynamic growth phase for Dislog. In March 2025, Sanlam Maroc invested MAD150 million (US$15.5 million) for a minority stake, funds earmarked for its healthcare division and international ambitions.

Earlier, in November 2024, Dislog acquired 75% of Megaflex, a medical device maker, and in September 2024, it secured 51% of cheese producer Fromagerie de l’Atlas.

Other 2024 acquisitions include Sanicroix from P&G in May and French distributor BBW / Chef Sam in January. In 2023, Dislog purchased France’s Cultures de France, CMB Plastique Maroc from Mutandis, and Africare, a medical products firm.

Industry sources note that the Venezia deal complements Dislog’s strategy to diversify and strengthen its offerings across sectors. The company’s aggressive expansion has caught the eye of investors and rivals, cementing its role as a dominant force in Morocco’s business scene.

With a growing portfolio spanning food, healthcare, and FMCG, and plans for further international growth, Dislog continues to reshape the market, showing no signs of pausing its ambitious trajectory.

EGYPT - Symrise, a chemicals company specializing in flavors and fragrances, has secured a 30,000 m² land plot in Giza, Egypt, through a contract with the Industrial Development Group (IDG).

The new facilities, set to be established at site e2 in the Industrial City of Giza by October 6th, aim to drive the company’s expansion across Africa and the Middle East.

This move will consolidate Symrise’s operations in Egypt, uniting its two production sites, innovation center, quality control lab, and sales offices into a single hub.

The consolidation is designed to streamline business operations, enhance communication, and foster collaboration among teams.

By centralizing its facilities, Symrise expects to support its consistent double-digit growth in Egypt while strengthening its service to over 22 markets in the Africa, Middle East, and Turkey (AMETCA) cluster.

The expanded production capacity will improve customer service and reinforce the company’s export capabilities, a cornerstone of its EAME Supply Chain Strategy.

Symrise’s growth is fueled by a diverse portfolio of taste, nutrition, and health ingredients, advanced production technologies, and a skilled workforce.

The new site will leverage the company’s global raw material sourcing network, ensuring a steady and secure supply chain. This strategic location enhances Symrise’s ability to serve regional markets efficiently while maintaining high standards.

The initiative also positions Symrise as a leader in Egypt’s food and beverage industry. By attracting top talent, deepening market insights, and localizing operations, the company aims to build an agile supply chain and establish itself as an employer of choice.

This development not only boosts production and innovation but also solidifies Symrise’s role as a market leader, delivering superior value to customers across Africa, the Middle East, and beyond.

SOUTH AFRICA - Libstar disclosed impairment charges exceeding US$27.6 million in its 2024 annual results, released March 18, resulting in a significant earnings per share (EPS) loss.

The largest hit, a US$22.1 million net-of-tax impairment, affected Finlar Fine Foods due to a key customer’s “supplier diversification” strategy, reducing beef volumes in the foodservice sector.

The Denny Mushrooms division faced a US$5.4 million netof-tax charge, while smaller impairments of US$0.58 million net-of-tax impacted Dickon Hall Foods and Cape Herb and Spice due to contract terminations.

These impairments led to a diluted loss per share of US$0.03, down from a US$0.02 profit in 2023. Normalised EPS, excluding one-off items, dropped to a US$0.018 loss from a US$0.021 profit. Revenue rose 3.1% to US$645.7 million, but sales volumes fell 3.2% amid weaker retail and foodservice demand. Normalised operating profit dipped 6.3% to US$34.8 million, with a 5.4% margin, while normalised EBITDA stayed flat at US$53.7 million.

Libstar is responding with a portfolio simplification strategy, anticipating ongoing consumer pressure. The company, owner of Lancewood, Denny, and Goldcrest, plans a shared-services model for its ambient products, consolidating Montagu Foods, Dickon Hall Foods, Retailer Brands, and Cecil Vinegar Works into one wet condiments framework while maintaining brand identities.

Further integration will merge Rialto, Ambassador Foods, and Cape Coastal Honey into a new ambient sub-category, aiming to boost growth and customer alignment.

The restructuring seeks to enhance leadership structure and technical capabilities. Despite 2024’s financial setbacks, Libstar’s leadership remains confident in the long-term plan.

Revenue growth amid tough conditions offers optimism, and the board is exploring options to unlock shareholder value, adapting to a challenging market with a focus on resilience and efficiency.

TANZANIA - Tanzania has introduced the Climate-Smart Smallholder Dairy Transformation Project (C-SDTP), a US$174.3 million effort to revolutionize its dairy industry and address climate change impacts.

Spanning ten years, the initiative targets 28 districts across Mainland Tanzania and Zanzibar, aiming to boost productivity and enhance livelihoods for smallholder dairy farmers.

The Ministry of Livestock and Fisheries announced the project, which was launched at an inception workshop in Dodoma. Permanent Secretary Prof Riziki Shemdoe emphasized accountability and diligence in its execution, calling it a pivotal move for the nation due to its substantial funding.

He highlighted two years of preparation to ensure a successful rollout, with a focus on transforming the dairy value chain while prioritizing women and

youth involvement.

Funding comes from the International Fund for Agricultural Development (IFAD), Heifer International, Agence Française de Développement (AFD), OPEC Fund, Green Climate Fund, and Tanzania Agricultural Development Bank (TADB).

IFAD Country Director Sakphouseth Mengi underscored its alignment with goals to mitigate climate change effects in agriculture, pledging technical support

and stakeholder engagement.

Project Coordinator Dr Lazaro Kapella outlined plans to distribute over 17,500 improved dairy cattle and train farmers in best practices, aiming to cut greenhouse gas emissions.

The Tanzania Dairy Board (TDB) reports annual milk production at 3.9 billion liters, but per capita consumption lags at 67.5 liters, far below the FAO’s 200-liter recommendation. TDB Registrar Prof George Msalya believes the project could significantly lift output.

Spanning regions like Arusha, Kilimanjaro, Pwani, Morogoro, Tanga, Iringa, Njombe, Mbeya, Unguja, and Pemba, the project involves key players such as the Tanzania Livestock Research Institute (TALIRI) and National Artificial Insemination Center (NAIC).

Targeting 40% women and 30% youth, it seeks to improve income, nutrition, and climate resilience for farmers.

ETHIOPIA - Ethiopia has secured a US$600 million investment from UKbased private-equity firm Asset Green to develop a large-scale dairy farming and processing initiative, reinforcing its commitment to agricultural modernization.

The agreement, signed in Addis Ababa in the presence of Ethiopian and UK government officials, will be executed in two phases under Ethiopian Investment Holdings (EIH), the country’s state investment arm.

The first phase focuses on establishing dairy farming and processing operations, supported by feed farming on 15,000 hectares to ensure a sustainable supply chain. The second phase will expand into cotton, oilseed, and rice farming, integrating advanced processing facilities to enhance productivity.

Ethiopia, where over 70% of the population relies on agriculture, views this investment as a strategic step in boosting food security, creating employment, and attracting foreign direct investment.

The project is expected to strengthen Ethiopia’s agricultural value chains by introducing advanced technology and modern farming techniques.

Asset Green describes the initiative as part of its broader strategy to develop vertically integrated agribusinesses that incorporate modern technology and best practices to improve efficiency and sustainability.

This investment aligns with Ethiopia’s ongoing efforts to enhance agricultural resilience. In December, the Climate Investment Funds (CIF) approved a US$37 million initiative to support rural communities against climate-related

shocks, with an additional US$492 million expected from partners including the World Bank and the African Development Bank.

Ethiopia continues to prioritize agricultural transformation as a key pillar of economic growth, with partnerships such as this seen as essential in advancing the sector’s modernization and long-term sustainability.

ETHIOPIA - Ethiopia’s dairy industry has seen extraordinary growth, with milk production nearly doubling to 12 billion liters in three years under the “Bounty of the Basket” (Yelemat Tirufat) initiative.

The Ministry of Agriculture attributes this rise to efforts aimed at improving food security, supporting smallholder farmers, and boosting agricultural productivity. A key driver is the eightfold increase in crossbred cattle, transforming the sector.

The initiative has improved access to affordable, high-quality animal feed across regions, vital for sustaining milk output and the expanding crossbred cattle population.

Enhanced crossbreeding programs and better farming practices in four major agricultural clusters have fueled dairy gains. Annual crossbreeding jumped from 500,000 animals preinitiative to 1.2 million in the first year, 2.4 million in the second, and 2 million of a targeted 3.8 million in the third.

Milk production climbed from 5.8 billion liters annually to a projected 12 billion, supported by better breeding, feed, and

farmer training.

Infrastructure investments include local liquid nitrogen production for artificial insemination and five new milk processing units, two of which are operational, with a goal of 10 by year-end. Local plants now produce yogurt, cheese, and butter, while larger facilities in Addis Ababa, Bahir Dar, and Awassa enhance distribution.

New plants in Gondar, Bahir Dar, and Jigjiga reduce transport costs and decentralize reliance on major hubs.

The program integrates farmers into cooperatives, strengthening their market presence. Increased dairy availability has improved household nutrition, reducing malnutrition and stunting. Foreign investment and farmer empowerment remain priorities, with cooperatives seen as key to sustained growth.

A workshop at ILRI in Addis Ababa today convened stakeholders to shape a national dairy strategy, with ILRI collaborating to elevate quality. The initiative lays a foundation for sustainable agriculture, positioning Ethiopia as an African agricultural leader.

BRAZIL – French dairy leader Lactalis has announced a US$55.3 million (326 million reais) investment to expand its production capabilities in Brazil’s Paraná state, marking a significant milestone as the company celebrates a decade of operations in the country.

The investment will fund the installation of a new UHT milk production line at the Londrina plant and an expansion of the Carambeí facility to increase output of yogurts, fermented milk, dairy beverages, and desserts.

These developments are part of a broader strategy to reinforce Lactalis' leadership in Brazil’s milk supply chain.

The announcement was formalized on March 18 during a ceremony in Curitiba, attended by Paraná Governor Ratinho Júnior and Lactalis Brazil CEO Roosevelt Junior.

Junior emphasized the company’s long-term commitment to the region, highlighting over 710 million reais invested in Paraná over the past ten years.

Lactalis operates three facilities in the state—its largest in Carambeí, employing 830 people, followed by Londrina with 280 employees and Pato Branco with 36.

This latest investment adds to a series of recent expansions. In November, Lactalis committed US$42.41m (250 million reais) to upgrade seven factories in Minas Gerais, and just weeks ago, it

pledged another US$16.96m (100 million reais) to improve five plants in Rio Grande do Sul.

Beyond production, the company maintains logistics operations in Contagem and administrative offices in Belo Horizonte, employing over 3,600 people nationwide.

Founded in 1933, Lactalis is known for its global brands such as Batavo, Président, and Elegê. Its expansion in South America includes a recent announcement to acquire Uruguay-based Granja Pocha, known for its Colonial brand cheese and yogurt.

With this latest investment, Lactalis reinforces its dedication to meeting rising dairy demand while deepening its footprint across Latin America.

UGANDA - Benni Foods, a prominent Ugandan dairy company, has opened a new processing factory in Kiruhura District to enhance milk production and support local farmers.

The facility, inaugurated by President Yoweri Kaguta Museveni, represents a major advancement for Uganda’s dairy sector, tackling excess milk production while generating jobs.

Located in a key dairy region, the plant can process 1 million litres daily, with plans to expand employment beyond its initial phase. It aligns with Uganda’s goal to raise dairy cattle yields from 6.2 to 30 litres per day, matching processing capacity to output.

The Dairy Development Authority notes that Western Uganda’s low farm gate prices make Kiruhura ideal for exportfocused production.

Benni Foods produces a wide range of items, including Lactose Pharma Grade, Whey Protein Concentrate, Butter Oil, Anhydrous Milk Fat, Skimmed Milk Powder, and Whole Full Cream Milk Powder.

It also specializes in infant nutrition, offering high-quality products for early childhood development, alongside specialized offerings like Sodium and Calcium Caseinates, Native Whey Protein, and Fat-Filled Milk Powder for local and global markets.

The factory is poised to benefit farmers by increasing raw milk demand, ensuring a stable market. A Benni Foods executive emphasized that the facility will not only boost production but also improve farmers’ livelihoods.

This comes as Uganda’s dairy exports surged from US$103.2 million in 2021/2022 to US$266.4 million in 2022/2023, reflecting the sector’s growing economic impact.

The launch underscores Benni Foods’ commitment to quality dairy derivatives and sustainable growth, positioning Uganda as a rising player in the international dairy market while uplifting rural communities through enhanced agricultural opportunities.

SAUDI ARABIA - Nestlé has solidified its expansion plans in Saudi Arabia by signing a contract to construct its first food factory in the Kingdom.

The facility, spanning 117,000 square meters in Jeddah’s Third Industrial City, will specialize in producing infant-nutrition products and is slated to commence operations in 2025 with an initial investment of US$72 million.

This move fulfills Nestlé’s earlier pledge in late 2022 to invest SAR7 billion (US$1.86bn) in Saudi Arabia over the next decade, reinforcing its long-standing presence in the region.

The factory aligns with Saudi Arabia’s Vision 2030, a national initiative to boost local food production and enhance food security.

With an anticipated annual output of 15,000 tons, the plant is expected to play a pivotal role in these efforts while attracting foreign investment.

The Saudi Authority for Industrial Cities and Technology Zones (MODON) estimates that the project will create hundreds of direct and indirect jobs in its initial phase, contributing to economic growth.

This development comes amid a 29.1% surge in foreign direct investment (FDI) inflows into Saudi Arabia, which rose from SAR6.2 billion to SAR7.99 billion in the third quarter of 2023, according to the Saudi Central Bank.

Meanwhile, Nestlé’s global strategy continues to evolve. The company recently sold its Cremora creamers business in South Africa to Lactalis SA, though production will persist at two Nestlé facilities in Babelegi and Potchefstroom, safeguarding jobs.

The sale is not expected to impact jobs at the South African production sites. Production in Zimbabwe, however, will halt post-sale.

Despite this divestment, Nestlé emphasized its ongoing commitment to sustainable economic development in Southern and Eastern Africa.

Pearl Dairy Farms Limited has introduced Lato Frutish, a new powdered flavored drink available in apple, mango, and strawberry.

Designed for convenience, it easily mixes with water, making it an ideal choice for both home and on-the-go consumption. With its vibrant flavors and high-quality formulation, Lato Frutish caters to a wide audience seeking a delicious and enjoyable beverage.

www.pearldairyfc.com

Dairyland has rolled out a vibrant new design for its ice cream tubs, combining modern aesthetics with the brand’s rich legacy of flavor and quality.

The refreshed packaging brings a bold, contemporary flair to retail shelves, with eye-catching colors, refined typography, and intuitive design elements that help consumers quickly identify their favorite flavors.

While the look may be new, Dairyland assures customers that the rich, creamy taste they’ve come to love remains unchanged.

www.dairyland.ke

Danone Southern Africa has launched the Nutriday Orange-Pine Dairy Drink, a refreshing fusion of orange and pineapple flavors blended with creamy dairy. Fortified with live cultures and 12 essential vitamins and mineral, including Vitamins A, D, E, B2, B6, B12, zinc, and calcium, this nutritious beverage supports immune function, growth, and gut health.

Available in a 1.5-liter pack, it provides a convenient and tasty option for families seeking a fortified dairy drink to complement their daily nutrition.

www.corporate.danone.co.za

JESA Farm Dairy has introduced JESA Lactose-Free Milk, a creamy and delicious alternative designed for individuals with lactose intolerance. This new offering retains all the essential nutrients of regular milk, such as calcium and protein, while ensuring easy digestion.

By providing a high-quality lactose-free option, JESA aims to bring milk back into the diets of consumers who have had to avoid it, reinforcing its commitment to innovation and consumer well-being.

www.jesa.co.ug

Kinangop Dairy Limited has launched Kinangop Gold Yoghurt, a premium range crafted to enhance indulgence and flavor. Available in pineapple, vanilla, strawberry, lemon biscuit, and chocolate flavors, the yoghurts offer a balance between indulgence and wholesomeness.

Designed to cater to diverse palates, they come in 400g familysized packs and 200g on-the-go optionsour drive to uphold top standards and deliver exceptional dairy products.” Kinangop solidifies its stature as a key industry player with this premium launch and accolade

www.kinangopdairy.co.ke

Fairfield Dairy has introduced a new range of smooth-flavored yogurts designed for younger consumers, featuring blueberry, strawberry, and litchi flavors

The launch aligns with the company’s commitment to delivering high-quality dairy products tailored to consumer preferences.

www.fairfielddairy.com

By Mary Wanjira

The Saudi Arabian dairy market is moderately consolidated, with both global and local players competing for market share. Large conglomerates and well-established dairy companies dominate the industry, alongside specialized entities making their mark. The presence of multinational corporations and local dairy producers creates a dynamic environment where brands compete on product quality, innovation, and distribution reach. Among the dairy giants in the Kingdom, Almarai stands out. According to Mordor Intelligence, Almarai is particularly dominant, leveraging its extensive product range and significant investments in production and distribution infrastructure, making it a cornerstone of the Kingdom’s dairy industry.

As one of the most recognized and trusted brands in Saudi Arabia, alongside competitors like Nadec, Almarai’s story resonates with both consumers and investors, solidifying its position as a standout name in the region’s food and beverage landscape.

Founded in 1977 by Irish brothers Alastair and Paddy McGuckian and Prince Sultan bin Mohammed bin Saud Al Kabeer, Almarai has grown into the leading food and beverage company in the Middle East, ranking as the world’s largest vertically integrated dairy company. Headquartered in Riyadh, Almarai’s transformation from a small-scale operation to a regional and global dairy powerhouse is a saga of innovation, scale, and ambition.

In 2024, Almarai ranked fourth among the world’s leading dairy processors, with a brand value of approximately 3.9 billion U.S. dollars. Its dairy brands—Almarai Fresh Milk, Almarai Long-Life Milk, Almarai Laban, Almarai Cheese, Almarai Cream, Almarai Yoghurt, Almarai Butter, Almarai Ghee, and Almarai Flavored Milk—have become synonymous with quality across the Gulf Cooperation Council (GCC) and beyond, transforming a desert nation into a dairy powerhouse.

PROJECTED MILK PRODUCTION BY 2030

Almarai’s dairy story took root in the late 1970s, a period when Saudi Arabia’s dairy industry was nascent, fragmented, and heavily dependent on imported powdered milk and limited local production. The founders identified a gap: the Kingdom lacked a robust, modern dairy infrastructure to meet the growing demand spurred by urbanization and a rising population. Importing 350 Holstein cows from Ireland, they established a small farm in Al Kharj, south of Riyadh, initially focusing on supplying fresh milk to a handful of local consumers. At the time, the operation processed just 300,000 liters of milk annually.

annually, according to industry estimates. Fresh milk became the cornerstone of Almarai’s identity, setting it apart in a region where refrigeration and logistics posed significant challenges.

- Ann Mwangi, Director, Meved Dairy Farm

The early years were about laying foundations. Almarai partnered with local farmers, providing training, equipment, and imported cattle to boost milk yields. By 1981, it had begun pasteurizing and packaging milk under its own brand, introducing Saudi consumers to fresh, locally produced dairy—a novelty in a market dominated by shelf-stable imports. Though production figures from this period are scarce, by 1985, Almarai’s output had grown to approximately 2 million liters

The 1990s marked a turning point in Almarai’s dairy growth, but its recent developments showcase even greater ambition. While the shift to vertical integration in the ‘90s saw its herd grow to 10,000 cows and production reach 100 million liters by 1997, Almarai has since focused on diversification, investments, and innovation. In 2022, it opened a SAR 1.2 billion (US$320 million) processing plant, increasing UHT milk capacity by 30%. In 2023, Almarai acquired PepsiCo’s 48% stake in their joint venture, International Dairy and Juice Limited (IDJ), consolidating control over dairy operations in Jordan and Egypt. New products, such as fortified milk lines and plant-based dairy alternatives introduced in 2024, reflect evolving consumer trends. The 2024 acquisition of Etmam Logistics for SAR 182 million (US$48.5 million) further bolstered its cold-chain logistics, ensuring

fresh dairy reaches wider markets efficiently.

Almarai’s growth accelerated dramatically in the 2000s, catalyzed by its 2005 initial public offering (IPO) on the Tadawul stock exchange. Floating 30% of its shares raised SAR 1.7 billion (US$453 million), providing capital to fuel its dairy ambitions. Investors, including the Savola Group, saw Almarai as a rare opportunity: a profitable, scalable agribusiness in a nation diversifying beyond oil. The IPO valued Almarai at US$2.27 billion, a figure that would multiply in the coming years. By 2010, its herd had swelled to 37,000 cows, and its milk production topped 800 million liters annually. Its six mega-farms supplied not only Saudi Arabia but also GCC neighbors, such as the UAE (where it holds a 40% dairy market share) and Kuwait (with exports of 50 million liters annually in 2023, per company reports). By 2014, Almarai held a 44% share of the Persian Gulf dairy market, cementing its regional dominance.

Almarai’s dairy growth wasn’t without hurdles. Water scarcity, a perennial issue in Saudi Arabia, threatened feed production, as alfalfa and corn—comprising 70% of dairy costs—required irrigation. Almarai tackled this by acquiring 14,000 acres in California in 2014 to grow alfalfa, securing a stable supply chain. Meanwhile, rising competition from Qatar’s Baladna, which emerged post-2017 GCC blockade, and UAE’s Al Rawabi tested its market share. Yet, Almarai’s scale and brand loyalty, bolstered by its “Quality you can trust” ethos, kept it ahead. By 2020, its dairy sales dwarfed rivals, with fresh milk alone generating billions in revenue.

Revenue growth reflected this dominance. In 2015, Almarai’s dairy segment contributed SAR 7.8 billion (US$2.08 billion) to its total revenue of SAR 13.6 billion. By 2023, dairy revenues had climbed to SAR 11 billion (US$2.93 billion) within a total of SAR 19.575 billion, despite inflationary pressures on feed costs. High-profile investors, including Saudi Arabia’s Public

Investment Fund (PIF), which raised its stake to 16.32% in 2017, saw Almarai’s valuation soar to US$15.74 billion by late 2024.

Technology has been Almarai’s growth engine. Its farms use AI-driven analytics to optimize breeding and feeding, while automated systems ensure hygiene and efficiency. In November 2024, a partnership with Google Cloud migrated its dairy operations to a scalable platform hosted in Saudi Arabia, aligning with Vision 2030’s data sovereignty goals. To support these goals, the company is leveraging SAP solutions like SAP S/4HANA, enabling a seamless transition to the cloud to streamline operations, boost agility and scalability, enhance decision-making, and grow geographically. Dr. Faisal Al-Nasser, Head of Enterprise Information Technology (EIT) at Almarai, stated, “Partnering with SAP and Google Cloud has equipped Almarai with the technological foundation critical for achieving sustainable growth and realizing our long-term vision. This collaboration ensures that we are well-prepared to navigate emerging opportunities while advancing our strategic objectives, seamlessly aligning with Saudi Arabia’s Vision 2030 and reinforcing our commitment to innovation and sustainability.” Andy Froemmel, Vice President and General Manager, Customer Services & Delivery for SAP MEA North, said that this implementation reaffirms Almarai’s commitment to operational excellence, sustainability, and digital innovation while strengthening its leadership in the global F&B industry, aligning with Saudi Vision 2030.

Almarai, widely recognized as the world’s largest vertically integrated dairy company, has strategically expanded beyond its core dairy operations to establish a strong presence in other

ALMARAI, WIDELY RECOGNIZED AS THE WORLD’S LARGEST VERTICALLY INTEGRATED DAIRY COMPANY, HAS MADE INROADS INTO JUICE, BAKERY, POULTRY, AND INFANT NUTRITION MARKETS.

key sectors. The company has made significant inroads into the juice, bakery, poultry, and infant nutrition markets, which have collectively contributed to its impressive financial performance and dominant market position across the Gulf Cooperation Council (GCC) region.

The juice division remains one of Almarai’s most successful non-dairy segments, with a broad portfolio under the Almarai Juice and Beyti brands. These products have gained a significant market share in the GCC, Egypt, and Jordan, offering over 30 flavors tailored to regional tastes. In Saudi Arabia, Almarai holds an 18% share of the total juice market and an impressive 42% share in the fresh juice segment. Despite the impact of regulatory changes, such as the introduction of a 50% sugar tax and an increase in VAT, the juice division recorded revenues of SAR 1.448 billion (approximately US$386 million) in 2020, reflecting steady growth.

Another critical segment in Almarai’s diversified portfolio is its bakery division, which was launched in 2007 and operates under the L’usine and 7DAYS brands. The company has solidified its leadership in the Saudi bakery market with a 54% share, far surpassing its closest competitors. With a product range that includes bread, pastries, and various snacks, this division has become an essential part of Almarai’s business, demonstrating the company’s ability to expand successfully into new food categories.

Poultry has also emerged as a major contributor to Almarai’s overall revenue, particularly through its Alyoum brand. The poultry segment generated SAR 2.3 billion (approximately US$613 million) in 2023, reflecting strong demand and operational efficiency. Currently, Almarai holds a 35% share of the Saudi poultry market, processing approximately 200 million birds annually. Looking ahead, the company has set ambitious expansion targets, planning to increase production capacity by 35% to process 270 million birds per year by 2027. This growth aligns with Almarai’s broader strategic vision and commitment to enhancing food security in the region.

Beyond poultry, Almarai has also entered the infant nutrition sector, offering high-quality products such as Nuralac. While specific revenue figures for this segment are not publicly disclosed, it represents a growing area of focus for the company,

as it seeks to cater to the increasing demand for premium infant formula in the Middle East. The company’s diversification efforts are further supported by its robust financial performance and strategic investments. In 2024, Almarai was ranked as the fourthlargest dairy processor globally, with a brand value estimated at US$3.9 billion. In alignment with Saudi Arabia’s Vision 2030, the company announced a five-year strategic plan in early 2024, committing more than SAR 18 billion (US$4.8 billion) to expansion and optimization efforts across its various sectors. A significant portion of this investment, approximately US$1.8 billion, has been allocated to increasing poultry production by 50% to 70% by 2026, with a goal of processing 450 million birds annually. Additionally, Almarai is actively constructing new domestic production plants for seafood, beef, and lamb, which are expected to become operational by 2027, further broadening its portfolio.

Market dominance remains a key strength for Almarai, with the company maintaining leading positions across several sectors in Saudi Arabia. It currently holds a 65% market share in dairy, 47% in juice, 54% in bakery, and 32% in poultry. The majority of Almarai’s revenue, approximately 66%, is derived from its operations in Saudi Arabia, with the remainder generated from its business activities across the wider GCC, Egypt, and Jordan.

Through strategic diversification, continued investment, and a commitment to quality, Almarai has reinforced its position as a dominant player in the Middle Eastern food and beverage industry. Almarai's vision is intertwined with Saudi Arabia's Vision 2030, which seeks to diversify the economy beyond oil, foster entrepreneurship, and attract foreign investment. By 2030, Almarai aims to increase its herd size to 100,000 cows, pushing milk production past 2 billion liters annually. DBA

By Mary Mithamo

Kenya’s dairy sector is a vital pillar of the nation’s agricultural economy, sustaining livelihoods and nutrition across the country. According to a 2023 report by the Food and Agriculture Organization (FAO), Kenya produces approximately 5.2 billion liters of milk annually, making it one of Africa’s top dairy producers. A 2022 report by the Kenya Dairy Board states that the country has the highest per capita milk consumption on the continent, averaging 110 liters per year. Yet, despite this strong production and demand, a significant challenge persists. According to a 2021 report by TechnoServe, an estimated 80% of milk is traded through informal channels. This informality often leads to quality inconsistencies, adulteration, and restricted access to safe, affordable milk for consumers.

FRESH Networks Kenya, a technologydriven solution provider is stepping in to tap into the informal milk distribution market with its innovative dispensing solutions. Rather than aiming to formalize the sector, FRESH Networks seeks to enhance its potential. In an exclusive interview, a team from Dairy Business Middle East & Africa Magazine sat down with Graham Benton, the visionary founder of FRESH Networks, to discuss his role in spearheading this initiative and the transformative impact it could have on Kenya’s dairy landscape.

THE INFORMAL DAIRY SECTOR IN KENYA: A MARKET RIPE FOR INNOVATION

Kenya’s informal dairy market is driven by small-scale farmers, brokers, and vendors who control the supply chain. According to a 2020 report by the International Livestock Research Institute (ILRI), over 1.8 million smallholder farmers produce the majority of the nation’s milk, yet only 20% is processed by formal dairies. The remaining 80% moves through unregulated channels, often sold in open containers or rudimentary dispensers like buckets and basic ATMs, making it highly susceptible to contamination and adulteration. A 2023 report by the Kenya Dairy Board

highlights that informal milk is sometimes diluted with water, antibiotics, or preservatives like hydrogen peroxide, posing serious health risks to consumers.

Unfortunately, most consumers of this milk are low-income earners, and formal dairies have struggled to offer safe milk at an affordable price to penetrate this expansive market. Benton identified this opportunity in 2021 while working with KOKO Networks, a company renowned for deploying thousands of smart ethanol fuel dispensers across East Africa. “I approached KOKO to explore how their technology could address the challenge of safe, affordable milk in Kenya,” Benton recalls. Following years of research and development, FRESH Networks has spun off as an independent entity, delivering a scalable, tech-powered solution that connects low-income consumers of informally traded milk with formal dairy players.

FRESH NETWORKS’ MILK DISPENSING TECHNOLOGY: A GAME-CHANGER

FRESH Networks’ milk dispensing system is a sophisticated blend of hardware, software, and logistics designed to guarantee milk safety, affordability, and accessibility. Unlike traditional dispensers that rely on open systems prone to contamination, FRESH Networks utilizes a fully closed, automated architecture to maintain milk integrity.

The process begins with rigorous quality assurance at the source, partnering exclusively with certified dairies that adhere to stringent chemical and microbial standards. These include maintaining acidity below 0.11%, butterfat content above 3.5%, and coliform counts under 10 CFU/mL. Though

exact thresholds for yeast, mold, and antibiotic residues like beta-lactams remain unspecified in current documentation, FRESH Networks ensures thorough testing.

Sharon Ooko, Head of Quality and Monitoring & Evaluation at FRESH Networks, explains: “Our process starts by partnering with dairies that conduct comprehensive quality tests, including acidity, butterfat content, total bacterial count, coliform presence, antibiotic residues, and aflatoxin levels. Once validated, results are uploaded into our system for verification and approval, ensuring only high-quality milk progresses through our supply chain.”

Milk is then packaged at the dairy in custom, tamper-proof containers maintained below 4°C, featuring security seals to prevent adulteration during transit. Temperature sensors monitor the milk at every stage—dairy, refrigerated trucks, micro-warehouses (MDCs), and dispensers— reporting data every five minutes to ensure compliance with the optimal 2-8°C storage range. The smart dispensers are equipped with automated injection systems, self-cleaning mechanisms, and machine-learning algorithms that verify container

seals and eliminate human contact with milk surfaces. AI-driven logistics optimize delivery by predicting demand patterns, ensuring fresh milk is always available without overstocking. The system operates on a cashless, token-based model via M-Pesa, featuring a simple three-step interface and

a foot pedal for universal accessibility.

FRESH Networks positions itself not as a dairy competitor but as a technology provider, enabling existing companies to expand into the informal market under their own brands. “We’re opening up 80% of the market that formal dairies couldn’t access before,” Benton asserts. By eliminating expensive packaging— often accounting for half the cost of processed milk—dairies can sell bulk milk at prices competitive with informal vendors, approximately 50% lower than packaged milk. Reduced marketing costs, thanks to partnerships with established shopkeepers, further enhance profitability.

The technology shortens payment cycles from 30 days to just a few days, allowing dairies to pay farmers weekly—a key demand in the informal sector. This attracts new suppliers and increases milk volumes. Additionally, dairies gain real-time analytics on consumer behavior, sales volumes, and pricing trends via customized dashboards, enabling targeted promotions and A/B testing. For farmers, the model encourages dairies to invest in extension services and stronger relationships, ensuring a steady supply of quality milk. “We collaborate with dairies that genuinely prioritize the well-being and success of their farmers,” Sharon emphasizes, highlighting FRESH Networks’ commitment to strengthening the entire dairy value chain—from farmers to consumers.

Two years of piloting in Kenya, beginning on March 7, 2023, with four to eight machines, have refined the technology through two hardware iterations and continuous software updates. Pilots in Rwanda and India further validate its adaptability. “We’ve pushed the limits to understand what works,” Benton says, expressing confidence in scaling to thousands of dispensers.

The primary challenge lies not in technology but in managing supply-side changes. Doubling a dairy’s throughput requires administrative and operational adjustments, from staffing to

equipment maintenance. FRESH Networks mitigates this by installing hardware at no upfront cost, recovering investment through a commission-based fee structure tied to sales. The closed system also addresses adulteration, a persistent issue in Kenya’s informal sector, ensuring traceability and safety from dairy to consumer.

FRESH Networks is collaborating with the Kenya Dairy Board to standardize milk dispensing regulations, leveraging its visibility and traceability to elevate industry standards. “They’re intrigued by our approach,” Sharon notes, highlighting ongoing discussions to shape policy.

Looking ahead, FRESH Networks envisions expanding beyond milk to other nutrient-rich products, capitalizing on its adaptable technology. “Milk is just the start; it’s critical for nutrition and income, but there’s a wide range of possibilities,” Benton says. This forward-thinking vision positions FRESH Networks as a potential leader in transforming not only Kenya’s dairy sector but also other agricultural markets across the region.

By Mary Wanjira

Zimbabwe’s dairy industry is on an upward trajectory, marked by a remarkable surge in domestic milk production and a steady push to reclaim its footing in the agricultural landscape. Historically a powerhouse in the sector, the country once boasted an annual milk output of 260 million litres during its agricultural peak. Today, while production levels haven’t yet returned to that zenith, recent gains signal a promising revival. Between January and September 2024, Zimbabwe produced 85 million litres of milk, a significant leap from the 71.9 million litres recorded in

the same period of 2023, reflecting an 18% year-on-year increase, according to the Zimbabwe National Statistics Agency.. September 2024 alone saw output climb to 9.8 million litres, up 10% from the previous year, underscoring the sector’s resilience despite persistent challenges like high production costs and limited technical capacity.

This growth has propelled Zimbabwe to 74% of its 2024 milk production target of 115 million litres, achieved three months ahead of schedule (Ministry of Lands, Agriculture, Fisheries, Water, and Rural Development, 2024). Yet, with national milk consumption hovering at 131 million litres annually, a gap

remains. The shortfall highlights both the progress made and the distance still to cover as Zimbabwe strives to meet domestic demand and reduce its reliance on imports.

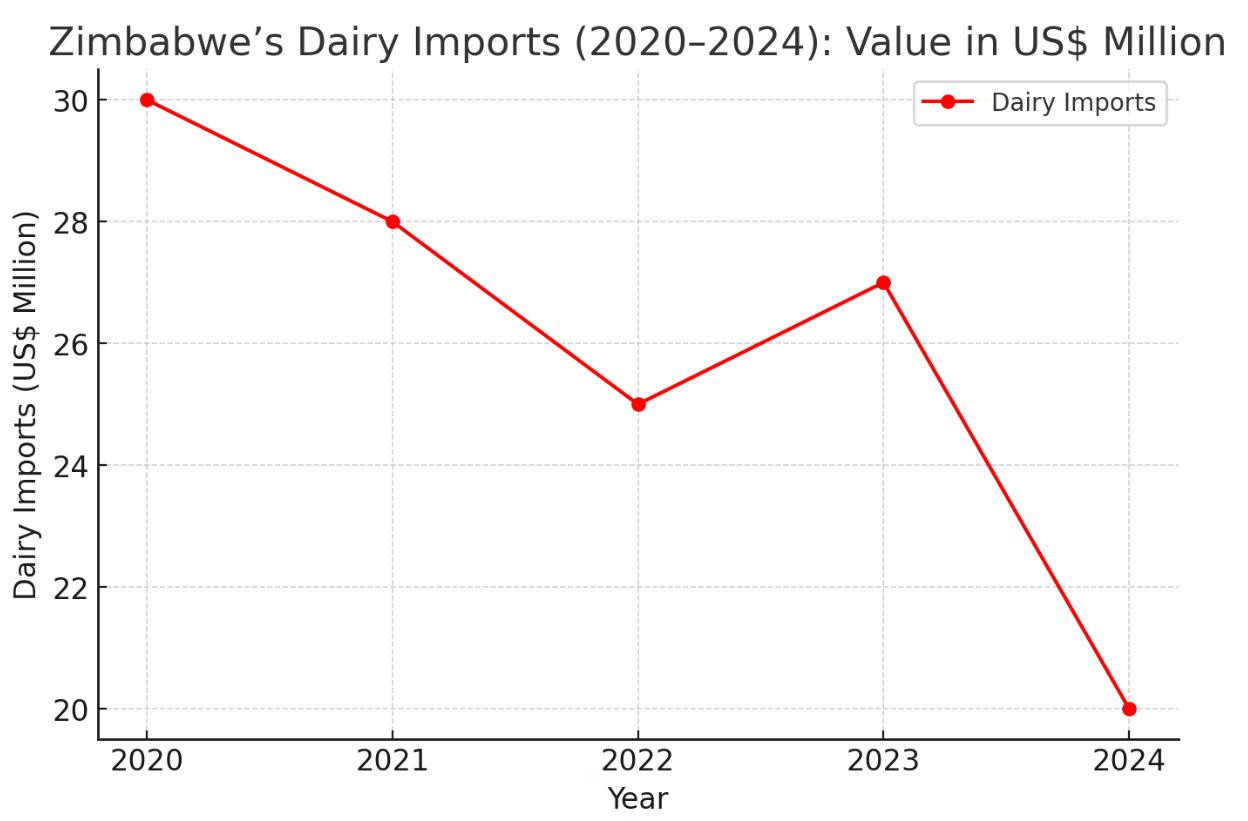

Zimbabwe’s reliance on imported dairy products has been steadily waning, a shift driven by growing local production and strategic interventions. In 2023, the country imported milk worth US$582,000, primarily from Mozambique (over 90% of the total value), positioning it as a minor player among global importers (Zimbabwe National Statistics Agency, 2023). More strikingly, the value of milk imports dropped by 23% from US$27 million in 2023 to US$20 million in 2024, with the volume of imported dairy products also declining (Zimbabwe National Statistics Agency, 2024). This reduction reflects a broader trend of import

substitution as local processors ramp up capacity.

Key players like Dairibord, Dendairy, and ProDairy have been instrumental in this shift. Dairibord, commanding a 39.1% market share, remains the dominant processor, while Dendairy, the second-largest processor and third-largest producer, contributes over 10% of the national milk intake. Dendairy’s output surged from 3 million litres per month in 2023 to 4 million litres in 2024, with plans to hit 5 million litres monthly by 2025 - a 25% increase (Dendairy Company Reports, 2024). ProDairy, holding a 20% market share, has also bolstered its processing capabilities. These companies, operating at 30 - 40% capacity, signal untapped potential to further close the import gap.

Beyond corporate efforts, the decline in imports stems from increased farmer participation and processing infrastructure. The number of registered dairy farmers has grown, supported by initiatives like the European Union-funded Transforming Zimbabwe’s Dairy Value Chain for the Future (TranZDVC) project, which has mobilised over 4,800 farmers since 2019 (ZAGP Report, 2022). This collective push has reduced the need for the 16 million litres of additional milk still required to meet the 2024 target of 115 million litres.

At the core of Zimbabwe’s dairy resurgence lies a powerful collaboration between the government, private sector, and development partners. The Livestock Recovery and Growth Plan (2021–2026), a cornerstone of this transformation, targets a dairy herd expansion and a production boost to achieve selfsufficiency by 2025. Introduced by the Ministry of Lands, Agriculture, Fisheries, Water, and Rural Development, the plan

PROJECTED MILK PRODUCTION IN ZIM IN 2025 IN NUMBERS

addresses systemic challenges, disease, genetics, and infrastructure through actionable policies and investments.

A pivotal move came in January 2022 with the imposition of a 5% levy on imported dairy products. Finance Minister Professor Mthuli Ncube framed this as a funding mechanism for the Dairy Revitalisation Fund, aimed at growing the national dairy herd and enhancing competitiveness. The levy’s proceeds have supported farmer training, herd expansion, and equipment upgrades, amplifying local production capacity. Dr. John Basera, Permanent Secretary of the Ministry, credited this policy alignment for revitalizing the sector, noting that the livestock industry’s value rose from US$1.1 billion in 2021 to US$1.5 billion in 2024, a 36% jump (Ministry Reports, 2024). Projections suggest it could reach US$3.4 billion by 2025 if momentum holds.

This trio of government, industry, and partners has sparked renewed farmer enthusiasm. The TranZDVC project, for instance, imported 500 incalf heifers from South Africa between 2020 and 2021, distributing them to 282 smallholder farmers. These high-yield Jersey and Friesian cows, capable of producing over 25 litres daily, have boosted yields significantly (ZAGP Report, 2022). Coupled with an artificial insemination program delivering 8,000 straws of semen, these efforts are enhancing herd quality and genetic diversity, key steps toward

Source: Zimbabwe National Statistics Agency

a sustainable dairy future.

Zimbabwe’s livestock sector, being a vital cog in the dairy machine, is charging toward a target of 6 million cattle by 2025, up from 5.6 million today (Ministry of Lands, Agriculture, Fisheries, Water, and Rural Development, 2024). Yet, this ambition has faced a formidable foe: tick-borne diseases, which have claimed nearly 500,000 cattle since 2016, especially during rainy seasons (Veterinary Services Report, 2023). The economic toll has been steep, threatening both dairy and beef production.

The Livestock Recovery and Growth Plan confronts this challenge head-on. Since 2021, the government has intensified disease control, building and refurbishing dip tanks, producing vaccines locally, and enhancing surveillance systems. These measures have curbed outbreaks, stabilising the herd and enabling dairy farmers to maintain productivity. Meanwhile, selective breeding via artificial insemination, supported by 300 trained extension officers, has introduced superior genetics, lifting milk yields and herd resilience.

This holistic approach extends beyond disease. By expanding veterinary services and promoting drought-tolerant forage crops, the plan ensures that

farmers have the tools to thrive. The result is a livestock sector poised to anchor Zimbabwe’s agricultural economy, supporting dairy growth and laying the groundwork for export revival.

Zimbabwe’s dairy industry is on an aggressive growth path, aiming to surpass 120 million liters of milk production in 2025, up from 114 million liters in 2024. With an annual national requirement of 130 million liters, stakeholders are intensifying efforts to bridge the supply gap through strategic investments, improved production techniques, and regional market expansion. The industry’s transformation is not only evident in policy frameworks but also in bold investments and grassroots initiatives that are driving its rapid recovery and positioning it as a key player in the Southern African dairy market. This growth trajectory is largely attributed to the expansion of major dairy processors such as Dendairy, Dairibord, and ProDairy, which have significantly scaled up their capacities to meet rising domestic and export demand.

According to industry data, Dendairy, for instance, has grown from processing 3 million liters per month in 2023 to a projected 5 million liters in 2025, reflecting an over 60% increase in output. However, the company is operating below half of its installed capacity, which provides room for further expansion. Similarly, Dairibord, Zimbabwe’s largest dairy processor, processed approximately 45 million liters in 2024 and aims to push this figure past 50 million liters in 2025. These processors are also making substantial investments in advanced processing facilities. For example, Dendairy has commissioned a new ultra-high temperature (UHT) processing plant, enabling the production of long-life milk suitable for export. Similarly, ProDairy has expanded its cold chain logistics to ensure efficient distribution across the region.

To support this growth, private sector players and government initiatives have pumped millions into the industry. The Transforming Zimbabwe’s Dairy Value Chain for the Future (TranZDVC) project, backed by the European Union (EU), We Effect, and the Zimbabwe Association of Dairy Farmers (ZADF), has facilitated investments in small-scale farmers, leading to the

registration of over 4,000 new dairy farmers since 2019. The introduction of nutrient-dense forages has also played a critical role in easing the burden of feed costs, which typically account for 70–80% of a dairy farmer’s expenses.

Investments in technology and sustainable dairy farming practices have significantly enhanced productivity in Zimbabwe's dairy sector. These technological advancements and sustainability initiatives are pivotal in driving the growth and competitiveness of Zimbabwe's dairy industry with the sector’s revenue projection expected to reach US$1.11 billion in 2025 and is expected annual growth rate of 11.01% from 2025 to 2030.

The heifer program, for instance, has been instrumental in increasing the national dairy herd from 19,000 in 2021 to 29,000 in 2022, contributing to a rise in raw milk production from 79.6 million liters in 2021 to 91.6 million liters in 2022, a 14.3% increase. Artificial insemination programs, on the other hand, have further bolstered genetic improvements, leading to higher milk yields per cow. These initiatives have been complemented by the importation of high-quality heifers and the adoption of modern dairy farming practices, significantly boosting productivity.

Despite these impressive gains, Zimbabwe’s dairy industry faces several challenges, including high feed costs, climate variability, and competition from imported dairy products such as specialized cheese and yogurts. However, industry players remain optimistic, banking on continued investments and government support to sustain growth.

Looking ahead, Zimbabwe’s dairy sector is set to play a significant role in regional trade, with industry leaders targeting a 10% increase in exports by 2026. The government’s push for selfsufficiency and reduced dairy imports is further strengthening the sector’s resilience. DBA

By Mary Wanjira

ut health has emerged as a critical concern across Africa, where lactose intolerance affects an estimated 60-95% of the population, according to the National Institutes of Health (NIH). This high prevalence, rooted in genetic adaptations to historically low dairy consumption, presents both a challenge and an opportunity for the continent’s dairy industry. As consumer awareness of digestive health grows, demand for lactose-free dairy and probiotic-enhanced products is surging, reshaping markets in Africa.

LACTOSE INTOLERANCE: A HIDDEN EPIDEMIC

Imagine living in a region where consuming milk could lead to discomfort or illness for most people. That’s the reality for millions across Africa. Lactose intolerance, a condition where the body lacks sufficient lactase enzyme to digest lactose (the sugar in milk), varies widely across the continent. In South Africa, 70-80% of adults are affected, according to NIH data, while in Nigeria, the American College of Gastroenterology estimates a staggering 90% prevalence. Kenya mirrors this trend, with studies from the Journal of Nutrition indicating 75-85% of adults struggle to digest lactose. This widespread intolerance has fueled a growing demand for digestible dairy alternatives, particularly in urbanizing regions where dietary habits are shifting.

Globally, the lactose-free dairy market was valued at US$11.45 billion in 2021 and is projected to reach US$24.36 billion by 2031, growing at a compound annual growth rate (CAGR) of 8%, according to Allied Market Research. Africa, however, is outpacing this global average in certain markets. South Africa’s lactose-free dairy segment, for instance, is expanding at a CAGR exceeding 10%, with estimates suggesting it could reach US$300-400 million by 2025, based on projections from Allied Market Research and Dairy SA. Nigeria and Kenya

are also experiencing rapid growth, driven by urbanization and rising disposable incomes, though their markets remain smaller. Nigeria’s lactosefree dairy sales are estimated at US$50-70 million in 2024 (FrieslandCampina internal estimates).

Fermented products like Kenya’s mursik (fermented milk) and South Africa’s amasi have long been staples, naturally reducing lactose content through fermentation while introducing beneficial bacteria. In parallel with the rise of lactose-free products, probiotics—live microorganisms that promote gut health—are gaining traction. Modern industry players are building on this tradition, incorporating scientifically validated strains like Bifidobacterium lactis and Lactobacillus acidophilus to meet contemporary health demands.

A MarketsandMarkets report forecasts the global probiotics market to reach US$105.7 billion by 2029, growing at a CAGR of 8.2%. In Africa, the demand for probiotic dairy, such as yogurt and fermented milk, has surged since 2020. The International Probiotics Association (IPA) notes that sales of these products in South Africa, Nigeria, and Kenya have increased by 10-15% annually

post-pandemic, reflecting a shift toward functional foods that support digestion and immunity.

Dairy companies across Africa and beyond are adapting to local needs with innovative products that address lactose intolerance and gut health trends. South Africa stands out as a leader in this dairy revolution. Between 2022 and 2024, sales of lactose-free milk and yogurt surged by 18%, with Clover and Danone dominating over 60% of the market. The lactose-free segment’s market share has doubled from 5% in 2020 to 10% in 2024, driven by a robust dairy industry and a growing appetite for healthier options. Danone’s Activia LactoseFree Yogurt, infused with Bifidobacterium lactis, has achieved a 12% annual sales rise since 2022 (company reports), appealing to health-focused urbanites, who are expected to make up 70% of the population by 2025 (Stats SA), with flavors like strawberry and vanilla.

Similarly,wwhas lifted its non-traditional dairy sales by 15% as of 2024 (Clover data), targeting younger consumers and solidifying its market lead alongside Danone.

While South Africa leads the way, PROJECTED GLOBAL PROBIOTIC MARKET BY 2029

Nigeria and Kenya are carving their own paths. In Nigeria, FrieslandCampina’s Peak Lactose-Free Milk, launched in 2023 for a 90% lactose-intolerant population, saw urban sales jump 20% in six months (company data), especially in Lagos, with its US$259 billion GDP (2025 estimate, Lagos State Government), highlighting untapped potential despite infrastructure hurdles.

In Kenya, a strong informal dairy sector coexists with a growing formal market for lactose-free products. With 4.5 billion liters of milk produced annually, the country has the raw materials to fuel its dairy revolution—but formal lactosefree offerings remain niche, catering mostly to urban elites. The COVID-19 pandemic, however, shifted consumer priorities toward immunity and preventive healthcare, accelerating demand for gut-friendly foods across Africa. Kenya’s Bio Food Products Ltd. taps into post-COVID immunity demands with probiotic yogurts featuring Lactobacillus acidophilus, growing sales 10% yearly since 2021 (internal estimates) amid a 75-85% lactoseintolerant populace (Journal of Nutrition) and an expanding middle class.