Austin Cuka AustinCuka@SpotlightMediaFargo.com

Matt Purpur Matt@SpotlightMediaFargo.com

ClientRelations@SpotlightMediaFargo.com

Jessica Ventzke Tyler Duclos

Missy Roberts John Stuber

Austin Cuka AustinCuka@SpotlightMediaFargo.com

Matt Purpur Matt@SpotlightMediaFargo.com

ClientRelations@SpotlightMediaFargo.com

Jessica Ventzke Tyler Duclos

Missy Roberts John Stuber

here’s something special about Fargo that’s hard to put into words—though, as a writer and editor, I’ll give it my best shot.

I grew up here. I’ve watched this city grow, stretch, and shine in new ways over the years—but through all the change, what’s remained is a sense of community that’s impossible to replicate. It’s in the way neighbors show up for each other. It’s in the energy of a packed downtown on a Friday night, the buzz of conversation over a shared

plate, the spark of a mural you weren’t expecting to find.

For a while now, I’ve been focused on our company’s business magazine Fargo INC!— an incredible experience, full of stories about leadership, growth, and grit. But stepping back into Meet Fargo feels like coming home. This magazine has always been about connection to place, to culture, and to each other.

I’m thrilled to be back.

Meet Fargo is a celebration of creativity, flavor, style, and soul. This magazine is a love letter to Fargo in all its forms.

Whether you’re new to the area or a lifelong local like me, I hope you find something in these pages that makes you smile, think, or fall in love with Fargo all over again. Because this is a place worth

celebrating—and I’m so proud to be part of telling its story.

See you around town.

Brady Drake Meet Fargo Editor

For over four decades, Twin City Garage Door Co. has been a trusted name in garage door services, serving homeowners, businesses, and contractors across the Midwest. Throughout that time, Twin City Garage Door has continued to achieve by focusing on expertise, certified service, and customer-first values.

OOne thing that sets Twin City Garage Door apart is its status as the only accredited door dealer in the state of North Dakota. The company also proudly boasts two Master Certified Technicians, accredited through the Institute of Door Dealer Education and Accreditation (IDEA) currently the only technicians in the state to achieve this certification. These credentials represent national-level proficiency in a range of specialties, including rolling fire doors, sectional steel doors, and both commercial and residential installations.

With additional team members nearing master certification, Twin City Garage Door is investing in raising the bar not just for itself but for the entire industry in the region.

BOOK YOUR SERVICE APPOINTMENT TODAY WITH TWIN CITY GARAGE DOOR'S NEW ONLINE BOOKING SYSTEM!

At the core of Twin City Garage Door’s reputation is its exceptional team. With 35 employees collectively bringing over 300 years of industry experience, the company has an amazing depth of knowledge and dedication within its ranks.

• Kevin Gustman, Commercial Project Manager –39 years of service

• Ray Boehme, Assistant Branch Manager – 29 years

• Jamie Ordahl, Service Technician – 21 years

• Craig Goldader, Service Technician – 21 years

Twin City Garage Door Co. offers a comprehensive range of services, including:

• Garage door installations

• Periodic maintenance programs

• Garage door opener installations

• Fire door drop testing

• Dock equipment services

The company believes heavily in the importance of proactive maintenance to help customers avoid costly breakdowns while extending the lifespan of their equipment.

While Twin City Garage Door’s expertise is at the heart of its operations, their partnership with West Fargobased Midland Garage Door makes them even better. Midland Garage Door, a respected manufacturer with a 45-year heritage, supports Twin City Garage Door by providing customizable, high-quality doors with fast turnaround times—a benefit Twin City Garage Door customers appreciate when timelines are tight.

Whether your facility or home operates a single door or dozens, routine garage door maintenance is one of the smartest ways to protect your investment, minimize downtime, and ensure safety. Twin City Garage Door recommends biannual maintenance for commercial properties, and quarterly checkups for high-use doors like those in warehouses or fire stations. Their services include inspecting critical components like springs and cables, checking alignment, lubricating moving parts, testing safety sensors, and checking weather seals for energy efficiency.

Proactive maintenance can extend the life of your door, reduce the risk of costly emergency repairs, and ensure compliance with safety standards. Neglecting these services, on the other hand, can lead to dangerous breakdowns, operational disruptions, and higher long-term costs.

10% DISCOUNT ON PARTS FOR CURRENT AND FORMER MILITARY MEMBERS!

Part of a larger family of branches across the Midwest, Twin City Garage Door’s reach extends from western North Dakota through the lakes region, with sister locations in Bismarck, Burnsville, Nisswa, Waite Park, White Bear Lake, New Hope and Chippewa Valley. This expansive footprint allows them to serve a wide geographic area while still delivering the personalized, local service customers have come to trust.

• Joints

• IV Infusions

• Microneedling

• Hair Restoration

• Inflammatory Disorders

Everest Regenerative Medicine is preparing to bring the future of medicine into the present under the direction of Chief Medical Officer Dr. Arden Beachy by launching an advanced adipose-derived stem cell (ADSC) program—one of the most promising and accessible forms of regenerative therapy available

it’s incredibly powerful.” Unlike other stem cell sources, which may degrade within days of injection, adiposederived mesenchymal stem cells survive for weeks—even months—within the body. This gives them a longer window to integrate, adapt, and regenerate damaged tissue.

“These cells aren’t burdened with your lifestyle history. They’re clean slates,” Dr. Beachy said.

Once extracted, the fat is sent to an FDA-compliant lab where it’s processed and converted into tens of millions of living, personalized stem cells. These are then cryopreserved, stored in stateof-the-art facilities, and ready to be shipped back to the clinic within 24 hours for future therapeutic use.

The collection process is as unintrusive as it is innovative.

“You are not put under. There are no large incisions," Dr. Beachy said. "We use a small amount of numbing agent, same as for the aesthetic body sculpting. Then, we make one small incision and extract 20 milliliters of adipose tissue. That's it."

The extraction takes less than half an hour. Most patients return to work the same day with little more than a small stitch and a bruise—if that.

Once processed, the resulting stem cell line belongs to the patient—and potentially their family. Thanks to HLA matching, first-degree relatives can often use the same stem cells without rejection.

"A 21-year-old patient can bank stem cells that their parents and even their siblings may one day benefit from," Dr. Beachy said.

While stem cell injections into knees, hips, and shoulders are the most immediate application, Everest offers options beyond orthopedic care.

The same stem cells can be infused via IV for systemic regeneration or applied topically for cosmetic procedures such as microneedling and hair restoration. And they can be cryopreserved indefinitely for future use.

“This is about creating a bio-asset that you can draw on for the rest of your

life,” Dr. Beachy said. “We’re seeing people who are choosing to bank now, not because they’re injured, but because they’re planning ahead.”

Dr. Beachy’s decision to lead with fat-derived stem cells was shaped by both clinical observation and global best practices.

“I've followed the research and have been interacting with several pioneers in this area of medicine,” he said. “And the longevity and adaptability of adipose-derived cells—it’s unmatched.”

Adipose-derived stem cells have a better tolerance to oxidative stress and other factors that influence stem cell survivability.

"Adipose-derived stem cells can differentiate into new stem cell types four times faster than umbilical cord stem cells," Dr. Beachy said.

The young adipose-derived stem cells are locked away in a kind of collagen time capsule and they can demonstrate very little signs of aging, if any, at retrievel.

Unlike “washed” bone marrow or amniotic cells that often degrade quickly and yield inconsistent outcomes, Everest’s method produces unadulterated, genetically-matched, and lab-expanded stem cells with high viability.

“We’re not mixing and guessing,” Dr. Beachy said. “We’re replicating and restoring.”

The team at Everest has begun performing the procedure, and they brought in a national trainer to oversee the first round of patient harvests—a move Dr. Beachy sees as more about excellence than necessity.

"Even the best regenerative physicians do this training," he said. "It's about getting certified, checking every box, and doing it right from day one."

Stem cell therapy may once have sounded like the stuff of sci-fi, but at Everest Regenerative Medicine it's a simple outpatient procedure with lifelong implications.

“This isn’t hype,” Dr. Beachy said. “This is biology at its best—pure, unmodified, and working in your favor.”

| everestregenerative.com

| Search "Everest Regenerative Medicine" | @everestregenerativemedicine

By Brady Drake

by Jeremy Albright

Constructed in 2024 and conveniently located right off I-29 and 52nd Ave, Premiere Storage was built with the customer in mind—combining security, cleanliness, and convenience under one climate-controlled roof. Whether you're decluttering your home, relocating for work, or need extra space for your business inventory, Premiere Storage delivers a first-class storage experience unlike anything else in town.

Premiere Storage offers a range of unit sizes designed to fit a variety of personal and business storage needs, including:

5’x5’

10’x5’ 10’x10’

10’x12’ 10’x15’ 10’x20’

"You can’t store anything with a motor in here," CoOwner Jon Kungel said. "Our units are strictly for personal items, business records, seasonal things like Christmas decorations, lawn furniture, trade show materials, or just the things you don’t want cluttering your home or office."

From regulated temperature and humidity to 24/7 access, the facility is designed to make self storage easy, secure, and flexible. Plus, month-to-month rental agreements allow you to store stress-free without long-term commitments.

*Conditions apply

One convenient aspect of the Premiere Storage experience is the indoor loading area.

In the growing city of Fargo, the demand for modern, secure, and accessible storage is greater than ever, and Premiere Storage, a locallyowned, state-of-the-art facility is exactly what this area needs.

"What really sets us apart is the experience," Kungel said. "We’ve got an indoor loading area—which nobody else in town offers with 24/7 access. Other places might have drive-up units, but you sacrifice security and climate control."

At Premiere Storage, every corridor is equipped with cameras—there isn’t a blind spot in the entire building. App-based access means no keys, no hassle. Customers can rent a unit at midnight, receive immediate access to the app, and walk straight into their storage space without talking to anyone.

ENJOY 24/7 ACCESS WITH THE PREMIERE STORAGE APP!

Two freight elevators, along with carts and other tools, make moving items in and out seamless, even from the third floor.

Two freight elevators, along with carts and other tools, make moving items in and out seamless, even from the third floor.

It's not hard to see that this space was designed to rival premium storage operations in markets like Phoenix, Florida, and Texas, where land is expensive and expectations are high.

"That’s why we went with a three-story facility; we wanted to maximize the space but still give people Class A access and experience."

CLEANLINESS, AND COMMUNITY AT THE CORE

Beyond being clean and secure, Premiere Storage is also proud to partner with the Fargo Police Department by allowing law enforcement K9 units to train on the premises to add an extra layer of security for both employees and customers.

"We take pride in our facility," Kungel said. "It’s a really clean, well-run facility. Even our office is as nice as most offices in Fargo."

• 100% climate-controlled, secure units

• Indoor loading area & 24/7 app-based access

• Cameras in every corridor

• Two freight elevators

• Located off I-29 & 52nd Ave—easy for residents and businesses alike

• Month-to-month rentals with competitive rates

• Moving supplies and local moving partners available

• Clean, modern facility opened in 2024

Premiere Storage also sells moving supplies on-site and works closely with local moving companies to offer customers the convenience of having their belongings picked up, stored, and ready whenever they need them— perfect for those building a new home or relocating to Fargo.

If you’re looking for self storage in Fargo that puts your needs first, Premiere Storage is the clear choice.

By Brady Drake

South Fargo has a new residential gem—and it’s quickly capturing the attention of homebuyers looking to build something special.

Selkirk Place is a thoughtfully designed neighborhood just off 64th Avenue South and I-29 that offers a rare blend of generous lot sizes, scenic amenities, and unmatched location—all without the heavy burden of typical special assessments.

Backed by the same trusted landowner behind Rose Creek and Marten's Way, Selkirk Place has quietly become one of the most sought-after residential developments in the region. And now, with over half of its 42 premium lots already sold, the opportunity to join this growing community is slipping away.

Lots starting at $99,500 NEARLY NO SPECIALS OVER 50% SOLD

"This 5,400-square-foot modern craftsman rambler, complete with a finished basement, is a true showcase of elegance and functionality. Valued at $1.2 million, the home will be nestled in the sought-after Selkirk Place neighborhood—just minutes from South Fargo’s premier shopping, dining, I-29 access, and the new Fargo Parks building. The east-facing backyard overlooking the serene pond was a major draw for the homeowners, who love starting their mornings with sunrise views and quiet reflections in nature."

- Adam Klein, President, Klein Custom Homes

"This home is a fully finished, nice, and open two-story with six bedrooms and a bonus room above the garage. We tend to show our clients this area because it is such a good location with low specials and nice lot sizes. Our clients choose us to build because of our hands-on, open communication, smooth, streamlined build process we offer. All of our plans have many upgrades included in the process, such as seamless steel siding, heated garages, custom cabinets, and generous allowances so our clients can get good products in their homes. We offer many different plans, but also do a fair share of from-scratch plans."

-Angie Kuznia, Owner, Titan Homes

Unlike many new developments, Selkirk Place doesn’t box homeowners into a handful of pre-designed floor plans. This development allows custom homes to flourish.

Builders like Titan Homes have already broken ground, with one home complete and more in the works.

In a market where special assessments can balloon to $50,000 or more, Selkirk Place is different. Thanks to the developer’s decision to pay for infrastructure upfront, most lots here come with $10,000 or less in specials. That’s a game-changer for families building their forever home—or for anyone planning a long-term investment in South Fargo.

And the lots themselves are spacious, generous, and beautiful.

Selkirk Place is nestled on the east side of I-29, just beyond the overpass on 64th Avenue South.

Residents can easily spot the Sanford Sports Complex from their front porches, and enjoy quick access to I-29, Davies High School, Shanley High School, and Bennett Elementary—all just blocks away, and all excellent schools!

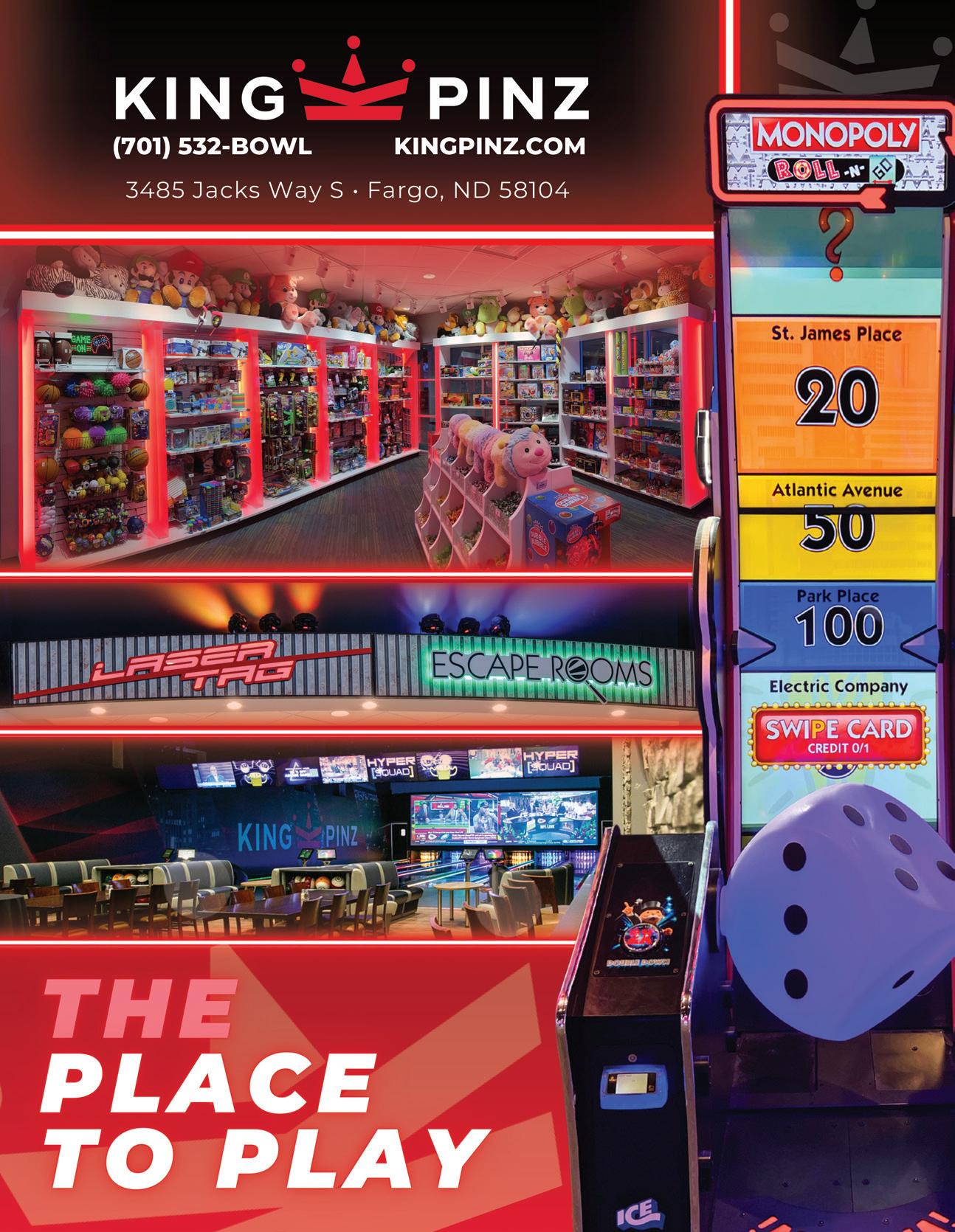

The surrounding area is buzzing with growth. There is Suite Shots, King Pinz, Plaza Aztec, and so much more!

And a future city park—Hector Memorial Park—is already in the works for this new neighborhood!

"Carpenter Homes is pleased to display another custom-built dream home. This 4,500 sq. ft. European meets traditional styled home with 5 bedrooms and 4 ½ bathrooms offers an abundance of natural light. The main floor presents open concept living with a well-appointed kitchen and a large butler’s pantry. Upstairs will feature a primary suite and three additional bedrooms. The basement features a large family room for entertaining and plenty of room to play in the large sport court! Conveniently located in Selkirk Place, this home is close to many great amenities and suits a family on the go."

-Jason Carpenter, Owner, Carpenter Homes

If you’re considering building in South Fargo, Selkirk Place is the moment. With lots starting at $99,500 and the majority already spoken for, the window is narrowing. You don’t have to build right away—but you do have to act fast.

To view available lots and see the development for yourself, visit selkirkplacefargo.com. Explore the map, check availability, and discover what’s already underway.

BY BRADY DRAKE

Under the visionary leadership of President and CEO Tyrone Leslie and the expertise of Vice President of Operations Troy Mattern, SunSet Valley is the latest chapter in Heritage Homes’ 30-year legacy of excellence and customer-first craftsmanship.

When Heritage Homes set out to create SunSet Valley, the goal was to totally reinvent what a development in the Fargo-Moorhead-West Fargo metro looked like. To do this, they drew inspiration from the many successful community style projects they have completed within their 30 years, and most recently The Ranch at The Wilds project in West Fargo. They have been able to envision a community that would blend adults thriving in their golden years with vibrant, family-friendly living.

"We wanted something not just slightly different, but truly 100% unique. A boutique development that would cater to our clientele like no other homebuilder in North Dakota ever has," Leslie said.

The result? Two distinct yet harmoniously connected neighborhoods within 50 acres, each offering world-class amenities, exceptional design, and a lifestyle experience unrivaled in the region.

1. Heritage at SunSet Valley (Family-Friendly Living)

For families, newlyweds, or those looking for a unique neighborhood lifestyle, Heritage at SunSet Valley offers a vibrant, amenity-rich environment.

Key amenities include:

• 79 homesites featuring two-story and rambler home plans, distinctive driveway setbacks and meandering streets.

• Gather together at the pool house, spacious heated pool and splash pad.

• Outdoor pavilion with fire pits and seating area.

• Community dog park, zen garden to unwind in, and playground for the kids.

• Beautifully lit pathways and scenic pond view with fountain features.

• Optional lawn care and snow maintenance available.

• LOW SPECIALS!

2. The Ranch at SunSet Valley (Popular Among 55+ Adults)

Tailored for homeowners rightsizing as they enter a new chapter in life, The Ranch at SunSet Valley allows those residents to lock their doors and travel without sacrificing comfort, security, or community amenities.

Key amenities include:

• 56 meticulously designed premium main level living courtyard homes.

• Exclusive clubhouse with gourmet kitchen and social spaces.

• Full fitness center and golf simulator.

• Private heated pool with sitting areas and fire pits, over looking the pond.

• Lit walking pathways that are beautifully landscaped.

• Lawn and snow care is all maintained for you.

• Enjoy the nation's fastest growing game with two pickleball courts available.

• LOW SPECIALS!

At SunSet Valley, Heritage Homes defies the mold of traditional developments. Instead of rigid grid patterns, SunSet Valley boasts meandering streets, custom setbacks, and artfully arranged homes that create a neighborhood bursting with charm and uniqueness.

"People don’t want to build a house—they want to build a home... That sense of belonging, that intimate exclusivity—that’s exactly what this community offers," Mattern said.

Every detail of SunSet Valley encourages connection, relaxation, and a sense of place—from the lit walking paths to the private, residents-only amenities that no other community in the region can offer.

Located just off the new arterial 66th Street S in Horace, SunSet Valley offers easy access to Sheyenne Street, from 64th ave south and soon to be 45th street, making commutes seamless and efficient. Add to that the proximity to the future grocery store, upcoming amenities, and some of the state's top-rated schools, and it's easy to see why Horace is North Dakota’s next sought-after hotspot.

"There’s just something about a sunset that brings people together. It brings warmth, connection, and beauty. That’s the feeling we wanted to capture in every part of SunSet Valley," Leslie said.

Open 5 days a week, step into the Welcome Center, your first stop on the path to building your dream home with Heritage Homes. Whether you are looking to build in SunSet Valley or within 60 miles around the region, here, you’ll sit down with one of their New Home Specialists to explore your options, ask questions, and start shaping the vision of your future home.

Located at 6841 Sunrise Point in Horace, your fun and easy homebuilding journey begins today!

In North Dakota, homes bear the brunt of every season's fury. So, you need to make sure you have a roof that can withstand those forces. Vita Roofing can help you with this. In fact, in Latin, vita means "lifetime."

What sets Vita Roofing apart, according to Founder Clay Blair, is the level of service their company offers.

"We’re a newer company in the area, and we do things a little differently. We’re not just selling a product—we’re offering value,” Blair said

And "value" at Vita Roofing means more than just high-performance materials and warranties—it means thorough due diligence.

Every project begins with a conversation.

"We explain who we are as a company, who we are as individuals, and we take the time to walk clients through the products, the process, and the long-term savings,” Blair said. "We complete a full attic inspection followed by a detailed walkthrough of the entire roofing

system. We do this because the problems that matter most often hide beneath the surface."

“You can’t know what the decking looks like unless you actually get up in the attic,” Blair said. “Ventilation issues, mold, rot, bad decking— these are things we diagnose before a project starts. Otherwise, you risk hitting the homeowner with a $6,000 surprise mid-job.”

According to Blair, most roofers skip this step entirely.

“We hear it all the time—‘You’re the only ones who asked to go up there.’ And half the time, we find stuff no other company would’ve caught,” Blair said.

This is how Vita avoids bait-andswitch change orders, and how they ensure clients know exactly what they’re getting into.

Vita Roofing’s warranties aren’t just ink on paper. With upgraded underlayments and an in-house roofing system, they offer a 50-

warranty, ideal for homeowners seeking reliable protection without breaking the bank.

• Class Roofing System: A 50year no-leak system, with optional upgrades like Class 4 shingles for insurance discounts and added durability.

Still, the company offers flexible financing options, making premium roofs accessible to middle-income clients, not just luxury buyers.

CONTINUED>

“When we show clients the long-term value, they realize it’s worth financing. You pay it off in 20 years, and still get 30 years of protection,” Blair said.

Blair's path to roofing started in high school construction jobs, followed by launching his own seamless gutter business before

even finishing his first semester of college. From there, he hustled his way into the roofing business in Dallas, before returning to Fargo to build what is now Vita Roofing.

The company rebranded three years ago from MinDak Roofing & Exteriors.

“We like the name Vita,” he said. “It means ‘lifetime.’ And we think it fits our brand perfectly.”

• Be Careful Who You Trust - “The quality of installs in Fargo has gone downhill. It’s not just laziness—it’s a mix of unskilled work and corner-cutting.”

• Hidden Costs - "Too many contractors are offering rock-bottom prices without explaining the hidden costs. We’ve replaced roofs that were under 15 years old. Only two were even close to being warranty-worthy, and only one of those claims went through.”

• Low Bids Often Mean Low Quality - “Shingles that used to cost $15 a bundle are now up to $50+. Contractors can’t cut material costs—so they cut corners elsewhere.”

• If We Get Quarter Sized Hail, Call a Roofer - “Nickel-sized hail might not cause damage, but quarter-sized? That’s your cue to call a roofer."

• Get Biannual Inspections - Get your roof checked in the spring and fall to catch potential damage early. Not only does this protect your investment, but it ensures you don’t miss the 12-month insurance window for filing storm-related claims."

• Don't Walk on Your Roof in the Winter - "This causes damage. We only recommend walking on them if absolutely necessary."

• Make Sure Your Roofer Spends Time - “Ask questions. Make sure your sales rep actually spends time with you. Are they getting in the attic? On the roof? Or just taking photos from the driveway?”

Bill isn’t just another Scottsdale realtor— he’s a Midwest transplant who understands exactly what you’re looking for because he’s been in your shoes. From Fargo’s rinks and golf courses to the sun-drenched fairways of Arizona, Bill’s personal journey makes him uniquely suited to guide Red River Valley buyers.

Though Bill has called Scottsdale home since 2014, his ties to the Red River Valley run deep:

• 10 years as a Fargo resident.

• Father to two daughters born in Fargo.

• Formally active in Fargo’s country club and hockey communities.

• Maintains strong, lasting connections in the area through friendships and former clients.

This connection allows Bill to quickly identify what matters most to Midwest buyers seeking a place in Arizona whether it’s escaping the cold, access to golf, shopping, or familyfriendly amenities.

Bill isn’t confined to one neighborhood or zip code:

• Licensed to sell throughout Arizona, and specializes in the Phoenix Metro, Scottsdale, and the Eastern Mountains (Pinetop, Payson, Strawberry, etc.)

• Helps clients navigate entry-level golf communities to high-end Scottsdale luxury properties.

Bill keeps a close watch on emerging hotspots that balance value and lifestyle.

• 5th largest U.S. market, yet still more affordable than other top 10 cities.

• Steady appreciation over the last decade—homes have doubled in value.

• Continuous migration of businesses and residents ensuring sustained growth.

• Less volatile compared to other "boom" markets like Florida, Texas, and Colorado.

• New, clean developments, especially in North Scottsdale.

• Less congestion than Southern California, but still with big-city amenities.

• Seasonal bursts of activity during spring training and events like the Waste Management Open.

• Year-round access to outdoor recreation, golf, and culture without the oppressive Midwest winters.

realtor you should call!

When Magnifi Financial opens a new branch, the company plants roots.

So, don't be surprised if you see the friendly faces at the new 5161 Charles Way South, Fargo location making an impact around town!

For Magnifi, a member-owned credit union with origins in central Minnesota, expansion isn’t about transactions or territories—it’s about deepening human connections, helping locals achieve dreams, and showing up when and where it matters most.

Before the Fargo branch opened, Magnifi, which already had a branch location in Moorhead, did something rare—they listened.

They sat down with local leaders, nonprofits, educators, and families. They walked the streets, volunteered, asked questions: What does the community need? How do we support the work that is already being done?

By Brady Drake

In fact, their arrival in the FargoMoorhead metro is already proving to be more than a logo on a building as they're working towards becoming a trusted hand when it comes to community events, shelters, and parks where neighbors gather.

One of the answers they heard again and again was Churches United, a cornerstone organization providing emergency shelter, food, and hope to hundreds across the region. Magnifi’s Fargo-Moorhead team responded by rolling up their sleeves.

Through CU Forward Day (A MN state-wide credit union initiative to demonstrate our commitment to members and the community by volunteering across the organization), Magnifi employees worked side by side with Churches

MAGNIFI FINANCIAL'S TEAM MEMBERS ARE HEAVILY INVOLVED WITH CHURCHES UNITED.

"We’re grateful for partners like Magnifi who help us raise awareness about food insecurity, homelessness, and build stronger communities."

-Churches United

Churches United offers hope for individuals, families and veterans experiencing homelessness and food insecurity in the Fargo-Moorhead area. Founded on the belief that everyone deserves dignity, shelter, and a path forward, Churches United operates multiple shelters, supportive housing programs, and food pantries that serve people with compassion and respect. Through partnerships with local organizations, faith communities, and volunteers, Churches United not only meets immediate needs for food and shelter but also walks alongside individuals as they work toward stability, healing, and long-term independence. Their mission is to provide safe shelter, stable food, and a caring community to all who seek it.

United staff, assembling care kits, stocking shelves, and offering time, compassion, and dignity to those seeking support. For Magnifi, these moments are more than volunteer hours. They are expressions of their belief that financial wellbeing can only thrive when basic human needs are met first—with respect, with care, and with community.

LOOKOUT FOR MAGNIFI FINANCIAL AT LOCAL PARADES!

• 255 nights of shelter donated through 3 Essentials program

• Care kits assembled by Magnifi volunteers: hundreds

• Food shelf support: Ongoing

• CU Forward Day participation: Full staff engagement

• $10,000 investment

• 13,000 children gaining access to yearround sports and recreation

• 20+ organizations served

• Participation in Fargo parades and festivals

• Volunteering at Salvation Army North, FargoPack with Feed My Starving Children and Giving Hearts Day.

• Volunteering at “Farmer and the Dell”

• CU Forward Day outreach across multiple Fargo-Moorhead sites

ANOTHER PLACE THAT MAGNIFI FINANCIAL FREQUENTLY VOLUNTEERS AT IS FARM IN THE DELL!

Farm in the Dell of the Red River Valley is a place where individuals with disabilities cultivate independence, purpose, and belonging through meaningful agricultural work. Located in Moorhead, this working farm provides life-enriching employment opportunities that empower adults with disabilities to grow, harvest, and sell fresh produce while building skills, confidence, and community connections.

Magnifi Financial also recognized that Fargo-Moorhead is a city on the rise, bursting with young families, athletes, and dreamers. But they also saw the need for more accessible, inclusive spaces for these dreams to take flight—regardless of income, background, or ability.

That's why Magifi donated to the Fargo Parks Sports Center, a indoor sports and recreation venue designed to serve over 13,000 children and more than 20 community organizations.

Magnifi proudly invested $10,000 into this landmark project, supporting a vision that includes:

• State-of-the-art hardwood courts

• Year-round ice rinks

• Pickleball courts

• An indoor playground

• Free walking tracks and multi-purpose community rooms

Through all of these efforts, Magnifi Financial is working to help every person in Fargo-Moorhead feel seen, supported, and empowered to thrive.

It’s hot if it’s in demand. This will be the neighborhoods with the lowest inventory. Right now, that tends to be established neighborhoods with low special assessments. A couple of other locations include neighborhoods with one-level living homes, as we don’t have a lot in this area, and newer developments centered around parks and schools.

We asked local real estate agents to spill the secrets , dish on the market’s seasonal quirks, and share the smartest moves you can make in this region’s housing market.

Right now, neighborhoods like Rivers Bend, Rocking Horse Farm, and Shadow Creek are on fire. Those areas blend lifestyle, amenities, and smart long-term equity plays.

-Tyler Bretz, Raboin Realty

Bluemont Lakes Area has some amazing views and homes that are ready for a second owner—these are strong choices for lasting home value in Fargo–Moorhead–West Fargo. With a little updating, you can get an amazing value in an established community.

Summer is speed. Listings fly. Buyers come out in full force. Winter has less competition, motivated sellers, and better deals if you play it smart.

-Tyler Bretz, Raboin Realty

The market typically heats up significantly in spring and summer with higher inventory and quicker sales, while winter sees less inventory and slower activity, though serious buyers remain active. Some of the best deals are in the winter, and who wants to sweat to death moving in the humid summer?

-Kyle Olson, Keller Williams Inspire Realty Fargo

We are not like the South or drier climates, so it’s no surprise that our housing market is cyclical like our seasons. The spring market kicks off when we get those first few thaw days in February/March, and when buyers see what they’ll get back on their tax returns. That money can be used towards a down payment or closing costs. Once the ground is thawed, the new construction takes off, and there is typically more inventory. It’s not uncommon for July to be slow with peak summer vacations, and again in late August when kids go back to school. As we get closer to winter, there will be another big rush before the holidays and inclement weather. It can get slower because people are spending more money around the holidays, and certain parts of houses can’t be seen or tested depending on how cold it is and how much snow is on the ground.

-Alicia Graves, Green Team Realty

Don’t just shop the interest rate, shop the lender and their programs, too. This will be one of your bigger purchases in life, and you want someone who is going to educate you along the way with your financial interests at heart.

-Alicia Graves, Green Team Realty

Buy with vision. Don’t just look at square footage, look at lifestyle. Can you see yourself thriving there? And don’t wait for the perfect time—timing the market is a myth. Instead, time in the market should be the focus. Buy when it’s right for you, and the value follows.

-Tyler Bretz, Raboin Realty

Think long-term and act fast—homes here average just 28 days on the market during peak season. Always, always get pre-approved and never skip the home inspection—it’s your safety net in our tough winters.

-Kyle Olson, Keller Williams Inspire Realty Fargo

You get one shot at a first impression, therefore, anything you can do to make your home stand out and get buyers in the door is key. It starts with professional photography. Marketing is key.

-Tyler Bretz, Raboin Realty

Preparing your house for sale is as important as the listing price. People first see your house online to determine whether a physical showing is worth their time. As the saying goes, 'A picture is worth a thousand words.' Start by decluttering, cleaning, and packing now. You’ll thank yourself later when moving day comes. Little touches can have the biggest impact, from paint and minor repairs to servicing utilities and a deep clean.

-Alicia Graves, Green Team Realty

Make your home irresistible— price right from the start, stage like it's your final act, and hire a photographer who makes your property shine brighter than your neighbors’.

-Kyle Olson, Keller Williams Inspire Realty Fargo

Going for 'good enough'—never underestimate the importance of inspections, especially when winters here can freeze and thaw your budget overnight.

-Kyle Olson, Keller Williams Inspire Realty Fargo

Overthinking. Getting stuck in what-ifs while someone else writes the offer. You’ve got to move with purpose and clarity. When this happens, analysis paralysis kicks in and opportunities are missed.

-Tyler Bretz, Raboin Realty

There are professionals who make the process easier and smoother. It’s important for home buyers to trust their realtor, their mortgage lender, and others to help in their decisions along the way. Even those who have bought and sold before may not know all the changes and nuances that take place in the real estate world, continually. These professionals stay in tune with local, state, and national information to keep consumers in the know. If buying a house is a healthy, financial decision for you, then go for it. Learn as much as you can during the process while having reasonable expectations.

-Alicia Graves, Green Team Realty

Not putting in the effort to prepare their house for sale and wanting to price it higher than the market allows. No one wants their house to sit on the market for a long time and be perceived as stale by prospective buyers. Obviously, there are moments when the market is slower, or niche housing takes more time, but if all the houses around you are selling and you’re not, then you may need to consider adjusting the price or changing something in the house.

-Alicia Graves, Green Team Realty

Overpricing. There are certain times when that works, aka during COVID. In a high-interest market when affordability is tough, you end up netting less on your home with all the reductions vs. pricing it right from the start for multiple offers. The first two weeks on the market are crucial.

-Tyler Bretz, Raboin Realty

Setting prices based on dreams rather than market reality. Homes priced correctly from day one sell nearly twice as fast.

Areas with strong school districts, newer infrastructure, and lifestyle-driven amenities, like South Fargo and parts of Horace, tend to weather downturns better. When lifestyle and demand intersect, value holds.

-Tyler Bretz, Raboin Realty

The timeless charm of neighborhoods like Hawthorne and South Fargo or the stability of Charleswood helps them weather economic storms better than most.

-Kyle Olson, Keller Williams Inspire Realty Fargo

Yes, the lower to mid-range houses in established or historic neighborhoods tend to withstand the ups and downs of the housing market.

-Alicia Graves, Green Team Realty

The sweet spot? Homes priced between $250K-$350K with stylish interiors, energy-efficient features, and no need for a to-do list. These sell almost 30% faster.

-Kyle Olson, Keller Williams Inspire Realty Fargo

Right now, it’s your average first-time home buyer houses that are $300,000 or less.

-Alicia Graves, Green Team Realty

Good homes that are well kept and around the $300k price point tend to sell the fastest due to affordability and speaking to a very large buyer pool. 3 bed 2 bath homes with a good school district.

-Tyler Bretz, Raboin Realty

ARE

NDHFA’s FirstHome program, MN’s Start Up program, and even some local lender grants. The key is getting connected to the right lender early. A good lender is key to know your options.

-Tyler Bretz, Raboin Realty

ND Housing Finance Agency programs and Minnesota’s Start Up Loan program can put thousands toward your down payment or closing costs. These programs are hidden gems— use them!

-Kyle Olson, Keller Williams Inspire Realty Fargo

Yes, both MN and ND have great options. Minnesota has the Deferred Payment Loan program and Monthly Payment Loan program. They also have First Generation Homebuyer program with up to $32,000 in downpayment and closing cost assistance. Each program works a little differently, so you’ll want to consult with a lender to see if you qualify or check out the Minnesota Housing website for additional information. North Dakota has a First Time Homebuyer Loan, a Home Access Loan, and the ND Roots Loan. All of them have income and purchase price limits as well as access to downpayment and closing cost assistance. You can review these at ndhfa.org and consult with a lender to see if you qualify.

-Alicia Graves, Green Team Realty

Q: ARE THERE ANY LOCAL BUILDERS KNOWN FOR BETTER ENERGY EFFICIENCY OR COLD-WEATHER PERFORMANCE?

A lot of builders can do a custom build to include energy efficient options in your future home, but one builder that stands out would be Cornerstone Custom Homes. They’ve been in business since 1998, and it’s been their standard practice to improve energy efficiency in their houses, helping reduce costs and increase comfort.

-Alicia Graves, Green Team Realty

Plecity Kowalski and Heritage Homes are ones that consistently lead with quality and cold-weathersmart builds. We’re talking upgraded insulation, and systems built for the winters.

-Tyler Bretz, Raboin Realty

Hawthorne Custom Homes isn't just building houses—they’re crafting homes designed to stand tall against the Fargo cold while saving you money on energy bills.

-Kyle Olson, Keller Williams Inspire Realty Fargo

Expect a fight—especially for homes under $350K. Be prepared to act decisively and strategically. If/when rates go down, we will see even more buyers on the market.

-Kyle Olson, Keller Williams Inspire Realty Fargo

If it’s clean, updated, and priced right, we can expect bidding wars, especially under that $400k price point.

-Tyler Bretz, Raboin Realty

Inventory is lower, so if the house or the location of the house is desirable, then you will run into multiple offer situations. I tend to see multiple bids with new hot listings, price drops, and interest rate drops. I know some individuals are waiting for interest rates to lower before buying. However, this can mean writing an offer way above list price to compete with more buyers. Waiting isn’t always ideal. Discuss with your realtor the pace of the market in your price range so you know what to expect when making offers.

-Alicia Graves, Green Team Realty

Specials (those can be big), and the cost of inspections in older homes (the home plus sewer lines). That’s why I walk every client through a cost breakdown before they fall in love. No surprises.

-Tyler Bretz, Raboin Realty

Overall, it’s going to be special assessments: specials attached to the property, specials that are pending and proposed for future city work, or specials not yet assessed by the city. It never hurts to contact the city or county directly. If someone doesn’t live on the Minnesota side or it’s their first time buying a house, then it could be the deed tax. Typically, the seller is liable, but it doesn’t prohibit the seller from assigning it to the buyer in a private contract.

-Alicia Graves, Green Team Realty

Watch out for property taxes and special assessments—often a shock to newcomers. Asking about them early can save you unexpected financial stress.

-Kyle Olson, Keller Williams Inspire Realty Fargo

IS THERE ANYTHING ELSE YOU WOULD LIKE TO SAY TO OUR READERS?

Join us at Fargo’s Longest Open House this June 20 - 22, a 66-hour charitable marathon event supporting the Alzheimer's Association. Experience fun, community, and homes for a cause! Find out more about the mission at longestopenhouse.com

-Kyle Olson, Keller Williams Inspire Realty Fargo

It’s a big transaction. It should be a fun process, and you should always use a professional to navigate the waters. I’m bullish on the real estate market in the FM area—we tend to do well even in economic downturns. You can’t go wrong elevating your lifestyle and treating it as a nice investment for the future.

-Tyler

Bretz, Raboin Realty

Buying and selling a house can be overwhelming, but doesn’t have to be. You have to connect yourself with the right trusted professionals, learning along the way. Remember, it’s not every day you buy or sell a house. Real estate laws and documents are ever evolving. Don’t hesitate to ask questions when you’re investing in yourself and your future. Your concerns are important, so stay curious and informed.

-Alicia Graves, Green Team Realty

BY BRADY DRAKE

PHOTO SUBMITTED BY NORDIC HOME INSPECTION

When it comes to purchasing a home—arguably the biggest investment most people will ever make—knowledge truly is power. That’s the driving philosophy behind Nordic Home Inspection, a Fargo-based company that has built its reputation on transparency and comprehensive service.

With thousands of five-star reviews and a full-service inspection model that goes well beyond the basics, Nordic is educating homeowners and protecting investments.

We sat down with Home Inspect Dan Appel to learn more about the company and what advice they have for homebuyers/homeowners.

• Get a radon test—especially if you have a basement or children.

• Always inspect a home before purchase even if it’s not legally required.

• For foundation issues, get a second opinion before signing with a contractor.

• Mold and air quality matter, particularly in homes with water damage.

• Don’t skip warranty inspections for new builds—get documentation before the warranty ends.

• Educate yourself. Attend a homebuyer class or consult with your inspector on maintenance tips.

• Choose inspectors with strong reviews and full-service options.

“I realized I can’t sit in an office all day,” Dan said. “I need to be in a different place every day, encountering something new. This job gives me that. Pretty much every day, I see something that makes me stop and think, ‘What is that?’ And it pushes me to dig in, figure it out, and grow my expertise.”

Now settled in Fargo to be closer to family, Dan helps push Nordic Home Inspection forward with that same curiosity and drive—balancing field work with client consultations, report writing, and ongoing education.

THE UPPER MIDWEST, INCLUDING NORTH DAKOTA AND MINNESOTA, HAS SOME OF THE HIGHEST RADON LEVELS IN THE COUNTRY. THIS IS DUE TO THE UNIQUE GEOLOGY OF THE REGION—PARTICULARLY THE GLACIAL AND SEDIMENTARY SOILS LEFT BEHIND BY ANCIENT LAKE AGASSIZ. THESE SOIL TYPES ARE KNOWN TO CONTAIN HIGHER LEVELS OF URANIUM, WHICH LEADS TO MORE RADON PRODUCTION.

RADON ENTERS HOMES THROUGH:

• CRACKS IN FOUNDATION WALLS OR FLOORS

• GAPS AROUND PIPES AND DRAINS

• SUMP PITS AND CRAWL SPACES

• EXPOSED SOIL IN BASEMENTS

Nordic Home Inspections offers far more than the standard home inspection. While their bread and butter remains pre-purchase assessments, their services extend to a comprehensive list of critical home evaluations, including:

Why this is important: Underground sewer lines are hidden and expensive to repair—replacements can cost upwards of $15,000. A sewer scope can reveal blockages, root intrusions, breaks, or sagging pipes before they cause catastrophic backups or require emergency excavation. This is especially vital in older homes where sewer infrastructure may be deteriorating.

Why this is important: Radon is a radioactive gas that naturally seeps up from the soil and can accumulate in homes—especially in basements. It's the second leading cause of lung cancer in the U.S., according to the EPA. Testing ensures your home is safe, and mitigation systems reduce risk when radon levels are high. Even homes with existing systems need periodic checks to confirm they're working properly.

Why this is important: Mold exposure can cause or aggravate respiratory issues, allergies, and other health problems—especially in children and individuals with weakened immune systems. Mold often hides behind walls or under flooring, especially after water damage. Air sampling helps detect harmful spores that aren’t visible, and ensures indoor air quality is safe.

Why this is important: Homes in the Fargo-Moorhead region are built on clay-rich soils that shift dramatically with moisture and freezethaw cycles. This can cause foundation walls to crack, bow, or settle unevenly. Elevation surveys identify early signs of structural movement so homeowners can address issues before they lead to major repairs—or evaluate whether a contractor’s repair recommendation is truly necessary.

Why this is important: New homes often come with one- or two-year builder warranties. While buyers may assume everything in a new house is flawless, construction mistakes and overlooked issues are common. A thorough inspection near the end of the warranty period gives homeowners documented proof of defects they can ask the builder to fix—potentially saving thousands in future repairs.

“We’re a one-stop shop. Not many inspectors around here are certified for radon testing or have sewer scopes. With us, you get it all in one go,” Dan said.

This approach not only saves clients time and money, but also ensures peace of mind—especially for first-time buyers navigating unfamiliar territory.

“We go beyond just pointing out deficiencies—we help people understand how their home works, and how to keep small issues from turning into big, expensive problems,” Dan said.

This philosophy will soon take shape in a new offering: homebuyer education classes, hosted in partnership with local realtors and lenders. Both in-person and online, these sessions will walk first-time buyers through everything from mortgages to maintenance—and may even help them qualify for better rates.

Dan offers practical tips for selecting a reliable inspector:

• Read reviews.

• Understand what services are offered. Not all inspectors offer sewer scopes, radon testing, or mold analysis.

• Look for certifications. Especially for radon and mold testing.

• Be wary of agent preferences. While agents often suggest inspectors, they might prioritize speed over thoroughness. “We’ve found deal-killers,” Dan said. “Not every agent loves that—but we’re doing our job.”

Whether you're buying or selling a home in the Fargo-Moorhead area, choosing the right real estate company can make all the difference. Here is a comprehensive guide to the most reputable residential real estate brokerages in the region—ranked by a combination of their Google review rating and total number of reviews. All companies listed have physical offices in Fargo, West Fargo, or Moorhead, and focus on home buying and selling (not rental property management).

BBuying your first home is an exciting milestone, but navigating the process can feel overwhelming, especially in a unique market like FargoMoorhead-West Fargo. So, you'll want to make sure you're well prepared and this guide will help!

Begin by thoroughly assessing your finances. Review your credit score, savings, monthly income, and debts. Lenders typically look for a credit score of 620 or higher, but better scores can secure more favorable rates. Calculate your debt-to-income ratio—ideally, your monthly housing payments shouldn't exceed 28-30% of your gross monthly income.

Fargo-Moorhead-West Fargo has numerous local banks, credit unions, and mortgage brokers ready to assist first-time homebuyers. Programs like the North Dakota Housing Finance Agency (NDHFA) FirstHome Program and Minnesota Housing Mortgage Loans Start Up Program offer competitive interest rates and down payment assistance.

Explore various mortgage types

• Conventional Mortgages: Typically require higher credit scores and down payments but offer competitive interest rates.

• FHA Loans: Require lower down payments (as low as 3.5%) and accommodate lower credit scores.

• VA Loans: For eligible veterans and active-duty service members, these offer zero down payment options.

• USDA Loans: Available in eligible rural areas around Fargo-Moorhead, offering low-interest rates and minimal down payment options.

Partnering with a trusted local realtor can dramatically simplify your first-time home buying experience. They understand neighborhood nuances, local market trends, and negotiation strategies unique to Fargo-MoorheadWest Fargo. Consider choosing an agent who specializes in working with first-time buyers, as they'll be adept at guiding you through the complexities of your initial purchase.

The Fargo-Moorhead-West Fargo area offers diverse neighborhoods with unique characteristics:

• Downtown Fargo: Ideal for young professionals, with proximity to nightlife, restaurants, and cultural events.

• West Fargo: Popular with young families, offering newer developments, parks, and quality schools.

• Moorhead: Known for its strong community vibe, affordability, and excellent educational opportunities.

Visit these areas at different times of the day to get a genuine feel for daily life, commute times, and community atmosphere.

Never skip a home inspection. Fargo-Moorhead-West Fargo experiences a range of weather conditions—from heavy snowfall to summer thunderstorms—making structural integrity, insulation, roofing, drainage, heating, and cooling systems critical factors. A thorough inspection can identify potential issues early, potentially saving you thousands in unexpected repairs.

Beyond the purchase price, be prepared for additional expenses, such as:

• Home inspections and appraisals

• Closing costs (typically 2-5% of the home's purchase price)

• Property taxes (varying by city)

• Home insurance premiums

• Immediate repairs or upgrades

• Moving costs

• Utility setup and transfer fees

Work closely with your realtor to craft a competitive yet reasonable offer based on comparable home sales. The FargoMoorhead-West Fargo market has seen steady growth, meaning strategic negotiation and timely decisions are essential.

Closing involves significant paperwork, legal processes, and final financial transactions. Make sure you're prepared with all necessary documentation, identification, and certified checks for closing costs. Your realtor and lender will guide you through this final stage.

Once you've closed, prioritize regular home maintenance and budget for unexpected repairs or emergencies. Consider setting aside a small monthly amount dedicated specifically to home-related costs to avoid financial stress later.

NORTH DAKOTA HOUSING FINANCE AGENCY (NDHFA)

MINNESOTA HOUSING MORTGAGE LOANS START UP PROGRAM

FARGO-MOORHEAD AREA ASSOCIATION OF REALTORS

BUILDING INDUSTRY ASSOCIATION OF THE RED RIVER VALLEY

By thoroughly preparing and utilizing local resources, your first-time home-buying experience in Fargo-Moorhead-West Fargo can be both successful and enjoyable.

THESE FIRST-TIME HOME BUYER AND FINANCIAL LITERACY CLASSES CAN HELP!

NORDIC INSPECTIONS' FIRST TIME HOMEBUYERS CLASSES

UPCOMING SCHEDULE

May 24

Fargo First Time Homebuyer Class (IN PERSON)

3312 39th St S Fargo

June 13

Fargo First Time Homebuyer Class (VIRTUAL)

June 28

Fargo First Time Homebuyer Class (IN PERSON)

3312 39th St S Fargo

DOORSTEPS HOMEBUYER CLASS

UPCOMING SCHEDULE

May 19-20

June 17-18

July 15-16

August 19-20

FINANCIAL LITERACY CLASS

MOORHEAD COMMUNITY EDUCATION PERSONAL FINANCE

*Note: This course is offered as either a 3-month self-guided experience or as a 6-week course.

SSelling a home is more than just sticking a “For Sale” sign in the yard. In Fargo-MoorheadWest Fargo, it’s about understanding the local market, preparing your home to shine, and making strategic decisions every step of the way. Whether you’re upgrading, downsizing, or relocating, this guide will walk you through a smart, efficient homeselling journey.

Before listing, get familiar with the trends unique to the Red River Valley:

• Fargo boasts a steady market fueled by healthcare, education, and tech sector growth.

• West Fargo continues to be a hotspot for new builds and family-friendly developments.

• Moorhead offers affordability and Minnesota-specific incentives, such as homestead tax credits.

Spring and early summer are peak selling times, but strong demand for well-maintained homes means opportunities exist year-round.

Tip: Check local comps (comparable sales) within the past 3-6 months for pricing guidance.

A seasoned local agent is your best asset. Look for someone who:

• Knows neighborhood-by-neighborhood trends (like how Hawthorne differs from Osgood).

• Has a proven marketing strategy, including virtual tours, professional photos, and a strong MLS presence.

Tip: Ask potential agents for a detailed CMA (Comparative Market Analysis) and their average Days on Market (DOM) for recent listings.

• Exterior: Clear snow in winter or tidy landscaping in spring/summer. Address any hail or wind damage on siding and roofing.

• Interior: Neutralize colors, declutter, depersonalize, and deep clean. Highlight finished basements and mudrooms, which are a big plus in our climate.

• Repairs: Fix cracked driveways, leaky faucets, or outdated fixtures that could raise red flags during inspection.

Tip: Consider pre-listing inspections, especially for older homes in North Fargo or central Moorhead.

Overpricing is the #1 reason homes sit unsold. Lean on your agent’s expertise and local data. Remember:

• Homes in West Fargo's new developments might sell faster, but face more competition.

• Moorhead homes may need to account for Minnesota’s different property tax structure.

• Pricing just below a major threshold (e.g., $299,900 instead of $305,000) can increase interest.

Tip: Strategic pricing can spark bidding wars, especially in low-inventory markets like South Fargo.

Be flexible and ready to leave at a moment’s notice. Staged homes that feel open and neutral tend to perform better. Provide:

• Fresh scents (but nothing overwhelming)

• Light refreshments during open houses

• Easy-to-read flyers with home features and neighborhood highlights

Once under contract, the buyer’s lender will send an appraiser. Ensure:

• All mechanical systems are working

• Your home is clean and clutter-free

• You’ve documented recent upgrades or maintenance (HVAC service, new roof, etc.)

Modern buyers expect an online-first experience:

• Photos: Invest in professional photography with bright lighting and wide-angle shots.

• Video tours: Showcase your layout and highlight upgrades like new HVAC systems or triple-pane windows.

• Listing platforms: Your home should appear on Zillow, Realtor.com, the FM Area MLS, and social media.

You may receive multiple offers, especially during spring and summer. Evaluate not just price, but:

• Contingencies (home sale, inspection, appraisal)

• Buyer financing (cash vs. FHA/VA loan)

• Timeline (are they flexible with your moveout date?)

Expect to:

• Sign documents at a title company (commonly in Fargo or Moorhead)

• Provide a property disclosure statement

• Transfer utilities and hand off keys

North Dakota and Minnesota have slightly different closing customs, so work with your agent or title company to stay aligned.

By understanding the market, preparing thoroughly, and partnering with local experts, you can sell your Fargo-Moorhead-West Fargo home with confidence and success.

WWith nearly 30 years in the mortgage industry, Dan Van Winkle offers expert insight into the FargoMoorhead mortgage market. From starting First Class Mortgage with his business partner, Greg Dean, back in 2003, Dan has navigated every type of market—low rates, high rates, and everything in between. He’s passionate about helping buyers make smart, informed decisions and understands the unique factors that make this region a solid investment. In this Q&A, Dan shares his perspective on the current market trends, mortgage myths, budgeting tips, and what buyers need to know to succeed in today’s housing landscape.

"The current housing market has been doing quite well, especially when taking into consideration how rates have increased since mid-2022. Inventory levels are on the rise in the area, which is good news for all buyers."

"Not in particular—what we're seeing here in North Dakota is pretty in line with what’s happening across the country. Mortgage rates had started to trend down a bit, but recently we’ve seen them tick back up again. Factors, like ongoing tariff discussions, can definitely influence those shifts. So while the market might feel local, it’s often reacting to national and even global trends."

"I think these tariff wars will eventually get resolved, and rates will start to improve. But, I don’t see them getting super low anytime soon. I think it’ll be 2026 before we see a refinance boom again."

"One of the biggest misconceptions first-time home buyers have about buying a home is that some think they need 20% down. However, there are programs out there that allow first-time home buyers to get into a home with as little as $500 down. Some buyers think they can’t afford to buy a home. I like to remind them that they can’t afford not to buy a home. When you take what you’d spend on

rent over a 10-year period compared to what you’d have in market appreciation over that same 10-year period, the numbers speak for themselves, and it really puts things into perspective. Even with increased interest rates and the market cooling from the highs of 2020 and 2021, real estate is still a great investment."

"I think the biggest thing is just making sure people really understand their finances— know what you have, know your credit score. Start saving as early as possible, and if your credit score isn’t where it needs to be, work on improving it before you start the homebuying process. It’s also important to work with someone who’s knowledgeable and someone you feel comfortable with and trust. There are a lot of agents and lenders out there, so take the time to find someone you really feel confident working with."

With nearly three decades of experience in the mortgage and finance industry, Dan brings a wealth of knowledge to every client interaction. He and his business partner, Greg Dean, have owned and operated First Class Mortgage for the past 22+ years, giving him a deep understanding of market cycles. He’s experienced the market crash of 2008-09, the historically low interest rates from 2020 through mid-2022, and the sharp increases that followed mid-2022 into 2023. Dan believes that owning a home in the FargoMoorhead area is one of the smartest financial moves you can make when approached thoughtfully. He advises buyers to do their homework, understand the process, ask questions, and to work with a local trusted and experienced lender.

A native of Devils Lake, Dan has witnessed firsthand the explosive growth of the FargoMoorhead region. He points to the constant expansion of schools, health care facilities, and infrastructure, making the area a thriving hub. Even when the real estate market is slow, Fargo-Moorhead tends to stabilize rather than decline sharply, offering buyers solid longterm value. No matter the interest rates or economic conditions, Dan sees one constant: people are still eager to buy here. With his guidance, they can do it confidently.

"The first thing I would tell everyone is to find a local and reputable lender. That way, if you ever have questions, you can always go in and visit with them face to face. Your lender should be knowledgeable in all programs, from conventional, FHA, VA, USDA, and First Time Home Buyer loans. They should be responsive to your calls, emails, or text messages. Also, when you’re shopping lenders, always make sure you ask for a loan estimate or a fee sheet so you can see all the terms and fees for that particular loan. Lastly, I always like to encourage my borrowers to ask questions and really try to get them to understand their options so they can make an informed decision. People are so busy these days that they don’t always take the time to understand their finances, so we’re here to help them with that."

"The first step is sitting down and going through your income

and expenses. Once you know what you have for income and expenses, putting the budget together is quick and easy. I always like to ask borrowers what they think they can afford vs. what the underwriting engines tell them they can afford. Once I know what the borrower can afford from a monthly payment standpoint, then we can work backwards into a house price that fits their budgets. Additionally, borrowers should also think about things such as closing costs, which generally run around 3%, moving expenses, and possible repairs."

"For a conventional loan, you will need at least a 620 credit score. FHA allows lower credit scores, but ideally, you’ll want a credit score above 620. As your score improves, your rates improve, and your mortgage insurance, when required, gets cheaper, so it’s always best to work to improve and maintain a high credit score."

SHOULD PEOPLE HAVE READY FOR STARTING THE

"The main thing we need to get someone pre-qualified is their most recent 30 days of pay stubs, their last 2 years’ W2s, and their last 2 months' checking/savings/ investment statements. That gives us everything we need to get someone pre-qualified. By having accurate information upfront, it ensures that we can provide the borrowers with an accurate approval."

"Where we live, most people are very conservative, so most borrowers are looking for a fixedrate product. They like the stability and peace of mind that a fixedrate product allows."

USDA LOAN ELIGIBILITY, PROPERTIES MUST BE LOCATED IN AREAS DESIGNATED AS RURAL BY THE USDA. THESE AREAS TYPICALLY HAVE A POPULATION OF 20,000 OR FEWER INHABITANTS AND ARE NOT LOCATED IN METROPOLITAN STATISTICAL AREAS. HOWEVER, SOME SUBURBAN AREAS MAY STILL QUALIFY. TO DETERMINE IF A SPECIFIC PROPERTY IS ELIGIBLE, YOU CAN USE THE USDA'S ELIGIBILITY MAP.

"Some people aren’t aware of the first-time home buyer products that are available through the North Dakota Housing and Finance Agency. They have many great programs and products to help first time home buyers, single parents, the elderly, and the disabled. Also, for those who are Veterans, I always like to encourage them to take advantage of a VA loan, as that program is an outstanding program for our Veterans. If the borrowers are looking to purchase in a smaller community, there is also a USDA rural housing loan that allows up to 100% financing. The idea behind that is to encourage people to stay in smaller communities, as many are leaving."

WHAT ARE SOME OF THE BIGGEST MISTAKES YOU SEE BUYERS MAKE DURING THE MORTGAGE PROCESS?

“Yeah, I’d say really slow down and take the time to understand what you’re getting into. It’s a big commitment—it’s a 30-year decision—so you want to make sure you understand what you’re signing."

IS THERE ANYTHING IN PARTICULAR PEOPLE SHOULD KNOW ABOUT DOWN PAYMENT ASSISTANCE OPTIONS? ARE THERE ANY OTHER PROGRAMS OR OPTIONS OUT THERE THAT WE HAVEN’T TOUCHED ON YET?

"The down payment program through the North Dakota Housing and Finance Agency requires no monthly payment, and it is forgiven after the 96th payment. However, if you sell or refinance prior to the 96th payment, the borrower is required to repay that loan."

ARE THERE ANY LOCAL WORKSHOPS, EDUCATION COURSES, OR OTHER RESOURCES LIKE THAT YOU’D RECOMMEND?

There are first-time homebuyer workshops available through North Dakota Housing and Finance. Also, many lenders offer local first-time homebuyer classes, so people can

check with their local lender or give us a call, and we can help them find those resources.

"I think home ownership in the FM area is a great investment for all. We live in a community that continues to grow, that continues to add and attract new businesses, and continues to prove to be a very stable economy."

BY BRADY DRAKE

PHOTOS PROVIDED BY KIPP HARRIS

Kipp Harris isn't like most other people involved with real estate. He's not transactional, he's personal and unconventional. He doesn't dress like most real estate people. He doesn't talk like most real estate people. However, don't let those things fool you. He's learned a lot over the last 18 years. And you can learn a few things as well by reading this article.

Kipp's journey to real estate wasn't born from childhood dreams or a generational legacy. It came after ten whirlwind years in corporate America that included relocations from Omaha to Minneapolis, Kansas City to California and a series of frustrating real estate transactions.

"Every time I moved, I’d hire a real estate agent. But after signing, I’d get passed off to an assistant I’d never met," he said. "It never felt like how it should be."

When Kipp returned to North Dakota, he decided to pivot careers and committed to doing things differently.

"We do real estate differently—not because I’m just a nonconformist (which I am), but because I want to fix the things I think are wrong with the real estate experience.”

Two areas Kipp sees as lacking in the modern real estate experience are transparency and thoroughness. To address this, he calculates estimated monthly payments for every property, down to special assessments that many agents overlook.

KIPP HARRIS AND MOST OTHER REAL ESTATE EXPERTS WE TALK TO STRONGLY WARN AGAINST USING ONE AGENT ON BOTH SIDES OF A TRANSACTION!

“Two homes can list at $150,000, but one might have $40,000 in specials hidden. I don’t let people get blindsided.”

He also believes in leveraging modern technology in people's experiences. One example of this is the ability to book an appointment with him directly through his website.

“Nobody should have to wait for a callback just to see a house. We’re all busy. This way, it just works.”

Behind Kipp's process is a customized transaction management system with over 293 steps. That number didn’t appear overnight—it evolved from hard-earned lessons. One pivotal moment came early in his career when a client unknowingly violated neighborhood covenants. Kipp took full responsibility, even covering costs.

“That taught me that it’s my job to know the rules and make sure my clients do too... Now, from the first meeting to closing, I don’t rely on memory. I rely on that checklist. Because it protects the client and it protects me."

Kipp isn't a real estate agent—he's a broker who was a licensed real estate salesperson in 2007. He received his broker license in 2012 and worked as a broker associate at Keller Williams until starting his own ccompany in 2014. At one point he oversaw 10 agents at his own company, but, in 2019, he chose a different path.

“I wasn’t having fun anymore. And I’ve had cancer three times. I can’t do something just to do it.”

He dissolved the team, kept only his mother on staff, and after her passing in 2022, he continued alone.

“I don’t practice dual agency. Ever. That’s like hiring the same divorce lawyer for both sides. My clients deserve full representation, period.”

While some agents chase numbers—closing 60, 70, even 80 deals a year—Kipp is content with two transactions a month. That slower pace is deliberate.

“I want to know my clients. I think it’s fun and interesting to help someone find the right home—even if it takes months. Or in one case, 8 years.”

For Kipp, the process is deeply human. He has had clients who have challenged his assumptions and expanded his worldview. He has made friends and longstanding relationships.

“When you meet people and truly get to know them, your judgments change. Every time I forget that, real estate brings someone into my life to remind me.”

Kipp is also passionate about educating buyers. His revamped first-time homebuyer class condenses essential information into one practical, three-and-a-half-hour session. Topics include the offer process, inspections, lending basics, and critical red flags.

One key differentiator? An attorney who teaches the credit section—an expert who sues credit bureaus and helps buyers repair their profiles before applying for a loan.

“Our class strips away the fluff. We focus on what first-time buyers really need to know.”

ARE YOU A FIRST TIME HOME BUYER? SCAN THE QR CODE AND SIGN UP FOR THE CLASS!

THIS BOOK EXPLORES THE IDEA THAT JOY EXISTS SIMULTANEOUSLY WITH ALL THE DIFFICULT THINGS THAT HAPPEN IN OUR WORLD . BECAUSE WE SPEND SO MUCH TIME FOCUSING ON THE PAINFUL AND DIFFICULT, WE DEPRIVE OURSELVES OF JOY THAT COEXISTS. THROUGH PERSONAL STORIES, KIPP TELLS OF MOMENTS WHEN THE ACT OF BEING INTENTIONAL LED TO LIFE-CHANGING EXPERIENCES. HE WILL GET YOU TO BELIEVE THAT YOU, TOO, HAVE THE ABILITY TO CHANGE NOT ONLY YOUR OWN LIFE—BUT THE LIVES OF OTHERS—ALL THROUGH A SIMPLE MIND SHIFT!"

Kipp’s career is only part of his story. Diagnosed with cancer three times between 2004 and 2007, he underwent multiple 13.5-hour surgeries and endured chemo both during and after each. At his lowest, he weighed just 89 pounds.

Yet, he never let bitterness take root.

“Mostly, I just live with gratitude,” he said. "During that time, I did feel sorry for myself before one friend bluntly said to me, 'Nobody said life was fair. Nobody said it was easy.' That moment shifted my outlook and I made an intention to find joy in the worst moments ahead. And I did. Every time.”

In remission since 2007, Kipp lives in Minnesota, walks his dog, mountain bikes, snowshoes, and enjoys quiet fires in the backyard. His favorite restaurant is India Palace on 13th Avenue in Fargo.

“We all have an incredible ability to touch and change people’s lives every day—and most of the time, we don’t even know it. That’s what I want people to remember.”

TThe son of two industry veterans—his father, Bruce Johnson, a 40-year real estate agent, and his mother Vikki Johnson, a seasoned mortgage lender— Jayce grew up with real estate swirling around the dinner table. Terms like “escrow,” “pre-approval,” and “appraisal gap” peppered his childhood without ever registering as part of his future.

“Honestly, I had zero interest,” he said.

His sights were locked on something else entirely. Jayce majored in biology at Concordia College and he eventually took on internships in physical therapy, planning to pursue a career in either medicine or rehabilitation.

Jayce’s pivot began in the sky. After college, he traded textbooks for flight school, spending two years learning to pilot helicopters for the Army. It was during that time—while his peers trudged through the grueling years of graduate education—that he made some observations.

“All my friends in PT or med school were in that ‘my life is miserable’ phase,” he said. “They kept saying, ‘It’ll be worth it eventually,’ but in the moment, they were just beat down. That didn’t sound very enticing—to come out of one school just to start again.”

That’s when real estate started whispering from the background.

BY BRADY DRAKE

PHOTO PROVIDED BY JAYCE JOHNSON

Jayce Johnson never set out to be a real estate agent. If anything, he ran from it.

“It started in Montana, during my time out there with the Army,” Jayce said. “I wanted something I could mold around my flight career, especially as I transitioned to part-time with the Army National Guard. And real estate? It started checking all the boxes.”

Yet Jayce wasn’t naive. He didn’t want rose-colored advice from someone emotionally invested. So he called the one person who knew the game better than most: his dad.

“I said, ‘Tell me what you’ve got for me. The good, the bad—I want to make an informed decision,’” Jayce said.

Bruce did him one better: “He said, ‘Next month we’ve got the RE/MAX R4 event in Vegas. Why don’t you come with me?’”

Jayce jumped at the chance.

What followed was a crash course in real estate immersion. At the R4 convention—a weeklong gathering of agents from across the country—he absorbed more than classroom tips and sales scripts. He dove headfirst into real-world conversations. “I told myself I was going to talk to as many people as possible. People crushing it, people miserable—I wanted both perspectives.”

It’s one thing to feel inspired by a conference in Las Vegas. It’s another to turn inspiration into action. Jayce

returned to Montana, linked up with RE/MAX of Helena, and despite not yet having a license, made a strong impression. “They said, ‘If you decide to get your license, we’ve got an office space ready for you.’” That vote of confidence lit the fire. Within weeks, Jayce pounded through 90 hours of online coursework, passed the state and national exams, and was officially licensed.

“I literally did nothing else for three weeks—Army, eat, study, repeat. I just wanted to get it done and get started.”

When he finally walked into his office on day one as a full-fledged agent, like most new agents, Jayce found himself staring into the unknown. There was no roadmap. No clients. No income. Just an open calendar and the gnawing truth of independent contracting: if you don’t hustle, you don’t eat.