NEW RELATIONSHIPS

DEDICATE

COMMITMENT

AS AN ORGANIZATION AND AS INDIVIDUALS, WE THRIVE ON CONNECTION, WITH ONE ANOTHER AND WITH OUR CUSTOMERS. FINDING NEW WAYS TO MAINTAIN AND ENRICH THOSE CONNECTIONS WAS THE BIGGEST YET MOST REWARDING CHALLENGE WE FACED IN 2020. MAINTAINING QUALITY INTERACTION AND POSITIVE WORKING RELATIONSHIPS REQUIRED ALL OF OUR EMPLOYEES TO GET CREATIVE AND DEDICATE TIME TO MAINTAIN AND GROW THOSE RELATIONSHIPS. WHILE MANY THINGS HAD TO CHANGE, SOME THINGS REMAINED CONSTANT: OUR COMMITMENT TO BEING OPEN FOR YOUR BUSINESS AND A POSITIVE PRESENCE AND INFLUENCE IN OUR COMMUNITIES. OUR ABILITY TO ADAPT AND RISE TO THE CALL OF OUR CUSTOMERS REFLECTS A DEDICATION TO

LEAVING OUR COMMUNITIES IN A BETTER PLACE.

CONNECTION ENRICH

ADAPT 2020 ANNUAL REPORT

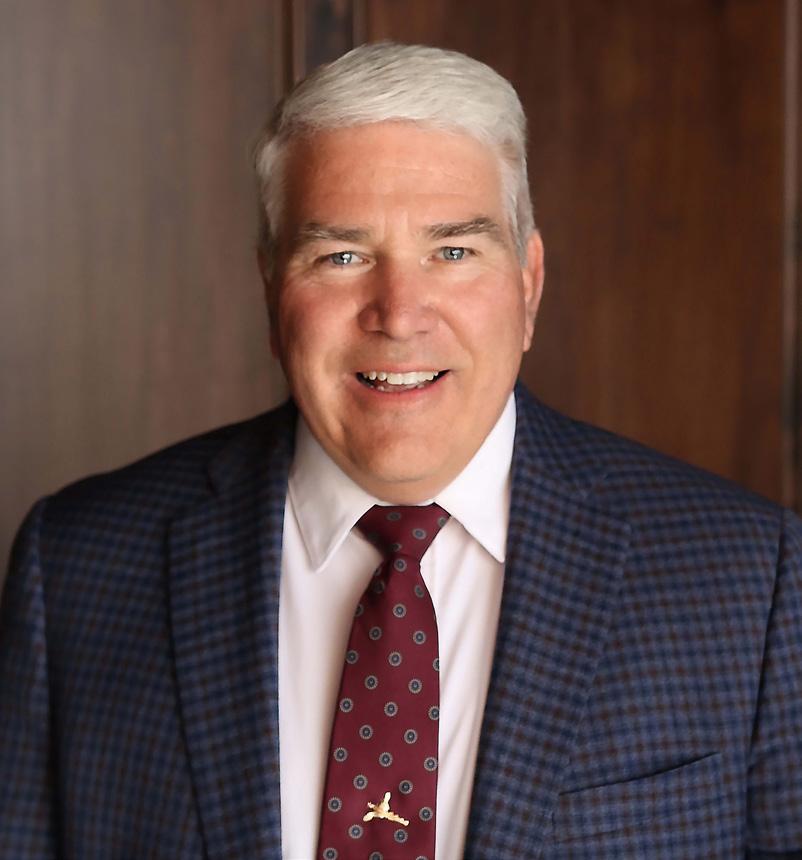

A MESSAGE FROM THE CEO

Unprecedented was a word we heard many times in 2020. The scale of disruption triggered by the coronavirus left us at a loss… for words, of normalcy, of commerce, and of life. This past year undoubtedly posed unprecedented challenges for many individuals and businesses across our footprint. Unfortunately, some did not survive or will be recovering from economic harm done by the pandemic for quite some time. As the scale of losses and hardships is yet to be realized, my deepest empathy extends to all those harmed financially and physically. However, the challenges of 2020 also triggered innovation, responsiveness, and cooperation, the likes of which many organizations had not experienced before. First International Bank & Trust was no exception.

UNPRECEDENTED ACTION

As an organization and as individuals, we thrive on connection, with one another and with our customers. Finding new ways to maintain and enrich those connections was the biggest, yet most rewarding challenge we faced in 2020. Mere weeks after it became clear COVID-19 was a valid concern in our markets, our IT Department was able to transition a significant number of our employees, in 28 locations across three states, to remote work.

Maintaining quality interaction and positive working relationships required all of our employees to get creative and dedicate time to maintain and grow those relationships. The Paycheck Protection Program was rolled-out in

early spring, creating a high volume of work for our commercial lenders and loan processors. Our Mortgage Department was also dealing with a refinancing frenzy as homeowners sought to take advantage of historically low rates. Even as our staff navigated the pressures of an increased workload, our managers and employees maintained and enriched relationships with one another and our clients. Zoom meetings, drive-through closings, and the occasional virtual happy hour were among the tools used to support employee and client relationships.

UNWAVERING COMMITMENT

While many things had to change, some things remained constant: our commitment to being open for your business and a positive presence and influence in our communities.

Throughout the pandemic, our branches continued to offer drive-through and by-appointment service. We implemented protocol for positive cases, practiced social distancing, placed physical barriers, and enhanced our cleaning services to ensure the safety of our customers and employees who remained working in our locations.

When the government rolled out its Paycheck Protection Program, FIBT was among the first banks to approve the loans. Our legal and lending teams took a proactive approach, enabling us to extend a lifeline to thousands of businesses across our footprint, as many of our larger competitors stood on the sidelines. The distribution of those dollars helped ensure small businesses could continue making payroll, in turn bringing countless families some amount of financial surety during uncertain times.

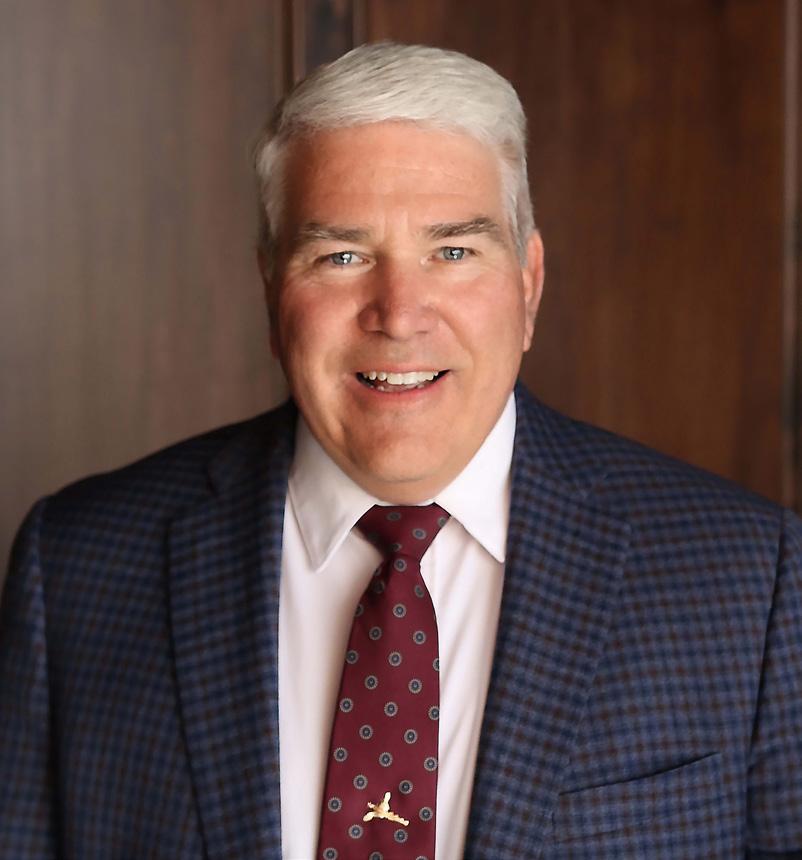

STEPHEN L. STENEHJEM CEO/Chairman

Our ability to adapt and rise to the call of our customers reflects a dedication to leaving our communities in a better place. It’s this purpose-focused mindset that drives us to achieve our full potential. With all the heartache experienced, as an organization we also achieved great things in 2020, which you will read more about in the following pages.

UNPARALLELED INSPIRATION

Personally and professionally, the pandemic has forced us to examine our attitudes and our practices. As I consider how I’ll choose to remember 2020, what strikes me most is the relentless resiliency exhibited by leaders and entrepreneurs in our communities. It was remarkable, but not surprising, to see many businesses pivot and find success in alternative spaces or new services and products.

It’s with that sense of hope and in that entrepreneurial spirit that we forge our future. The year ahead holds great promise. We continue to expand into new markets, offer enhanced products to our customers, and invest in our communities.

I would like to thank our leadership team for their continued pursuit of excellence throughout the last financial year. All of our employees deserve recognition. Across all departments and on all levels, they rose to the challenge, providing empathy for one another and great service for our customers.

I am also grateful for the continued support of our customers. Thank you for trusting us with your financial needs. We approach 2021 from a position of strength, with a growing customer base and diversified products. Our commitment to earn and preserve the trust of those we serve will guide the way forward.

THANK YOU

First International Bank & Trust celebrated 110 years in 2020. Our foundation has been built on the bond between our employees and our customers. On behalf of the Stenehjem family, thank you for your continued support. We remain committed to those relationships that we’ve worked so hard to build and to our values.

OUR MISSION

To be nationally recognized as a community bank whose innovation and drive for excellence is propelled by the best financial experts with heart.

OUR VISION

Our customers leave feeling like family.

OUR VALUES

Own the Choices You Make Speak Up Respectfully Make Decisions with Integrity

Take Pride in Your Work

Act Like Your Ride is Waiting

Learn from Yesterday, Rush for Mastery

Leave Your Mark on Our Communities

Seek the Sunshine Every Day

3

PROVIDING SUPPORT

Paycheck Protection Program

The success of First International Bank & Trust depends on the success of our communities and neighbors. If they are healthy and thriving, so are we. With our clients and community members going through a worldwide health crisis, it was important for us to prioritize safety while also being more present than ever to support our clients and communities as they navigated hardships created by the pandemic. One of the many ways we were able to do that was through our support of the Small Business Administration’s Paycheck Protection Program (PPP). We were able to help more than 2,100 businesses and approve over $300 million in PPP loans. In addition to PPP, we also were able to assist a number of small North Dakota businesses through the Small Employer Loan Fund (SELF) and COVID-19 PACE Recovery Programs.

In many cases, such as that of Base Pizzeria in Phoenix, Arizona, we were able to process applications in record time. “It means we’ll keep people employed. Keep them looking after their families, and enable us as well, and keep us getting those pizzas out the door,” the owner of Base Pizzeria, Michael Sands, told a local news station. “To do this kind of stuff in a week or two weeks is just incredible.”

$261,541,447

FIRST DRAW FIRST ROUND PPP LOANS

FUNDED THROUGH APRIL 24, 2020

1,239 BUSINESSES HELPED

$48,772,766

FIRST DRAW SECOND ROUND PPP LOANS FUNDED THROUGH AUGUST 8, 2020

887 BUSINESSES HELPED

$310,314,213

TOTAL PPP LOANS FUNDED THROUGH 2020

2,126 BUSINESSES HELPED

- Dennis Walsh Chief Credit Officer

4

“ “

“I want to extend a heartfelt thank you to our team members for caring for our customers, being proactive, prompt, and going above and beyond to extend lifelines. We were able to build new relationships due to our fast action and counsel during these tough times.”

Words of Gratitude from PPP Recipients:

The PPP Loan was designed to help small businesses keep their doors open during a time of social distancing and mandatory business closures. However, many large banks struggled with the approval process, leading to lengthy delays for their customers. Our lenders and support team worked tirelessly to get these loans approved. Hard work that was appreciated by our clients.

“At a time and in a world where you could have easily said, ‘No, thank you,’ and helped other customers that you have bigger relationships with, you stepped in to help us. We know things will be tough until we get back to normal. But we also know that working with a local bank means all the difference in the world. Without exaggeration, for the rest of my life, I won’t forget how you helped us when we were feeling so helpless.”

-An Unnamed Paycheck Protection Loan Recipient and FIBT Customer Treasury Management

While 2020 presented unforeseen challenges, the importance of running your business effectively and efficiently became increasingly clear. FIBT Treasury Management services implemented a more robust business account analysis service. This service allows our qualifying customers the ability to easily reconcile bank services utilized, track transaction volume, and detail service charges accrued on commercial deposit accounts, while applying an earnings credit rate to offset bank fees.

5

“The year posed so many challenges. I’m proud that our team which spans 28 offices in three states, was able to pull together to work hard, post amazing results and serve more customers than ever before.”

- Mike Mulwani, Director of Mortgage

159% 409% 1,961

Low Rates, High Volume

Interest rates fell in 2020, partly in response to the COVID-19 recession. The magnitude of the drop boosted the amount that home buyers could borrow and created a frenzy to refinance existing home loans. Fueled by record-low rates, and a team driven to create a great experience for our customers, First International Bank & Trust’s Mortgage Division had its strongest year ever.

This was achieved while maintaining the same level of staffing on our Mortgage Operations Team. Rather than increasing staff, our team increased efficiencies while maintaining the same level of responsive service and responsible decision making. With rates expected to remain favorable for the foreseeable future, we continue to expect great things from our Mortgage Division.

New Credit Cards: Designed With Our Customers in Mind

In 2020, we launched four new consumer credit cards designed with the end user in mind. Each card has unique offerings that match individual needs and purchase behaviors. Extensive research into what consumers value most in various life stages drove the final product offerings. From first-time card holders to mass-affluent executives, we believe we have very competitive products that rival the big banks while keeping local servicing and support available.

INCREASE INCREASE LOANS CLOSED Record Closing Volume Record Net Income 160+ Per Month Average

“ “

MORTGAGE

Our electronic payments solution provider, Kotapay, experienced record growth in 2020. Enhanced underwriting and fraud detection systems, along with the diligence of the Kotapay team, allowed for a year with zero fraud losses. December of 2020 was a record-breaking month with over five million transactions, including a record high single day dollars processed amount of over one billion dollars.

$83 BILLION 55 MILLION

PROCESSED IN 2020 TRANSACTIONS IN 2020

Up from $69 Billion in 2019 Up from 46 Million in 2019

INSURANCE

“Insurance had a record year all around: total revenue, new business, and net income. We accomplished this during a year that easily could have made us lose focus on our clients. The opposite happened. Everyone stepped up to the plate and we were able to serve more people. I believe we have the best producers and support staff around and could not be more proud of the team.”

- Daniel Toy Director of Insurance

First International Insurance continued to grow in 2020. Our independent insurance agents will find the best policy to suit your needs and budget, giving you access to a wide portfolio of insurance products from over 35 companies we represent. We offer personal, commercial and agribusiness insurance offerings.

145% 10%

INCREASE INCREASE

Net Income Gross Revenue

7 ®

* Not FDIC Or Any Federal Agency Insured | No Bank Guarantee | May Lose Value

KOTAPAY

“ “

*

WEALTH MANAGEMENT

The Wealth Management Division of First International Bank & Trust (FIBT) continues to provide custom-built solutions tailored specifically to you. We offer a wide variety of investment, trust & fiduciary, and private banking options to align your wants, needs, and dreams.

Enterprise Retirement Solutions

Benefits and retirement savings options can seem overwhelming, but they don’t have to be. FIBT has you covered from your initial consultation through paying out benefits to long-time employees. Whether you’re working towards personal financial security, offering a savings plan to attract employees, or creating an employee stock ownership plan to retain your valued leaders, we can create options to help you reach your goals.

Mineral & Land Services

For more than 100 years, First International Bank & Trust has been based in Western North Dakota, home of the Bakken and Three Forks Formation, the second-largest producer of oil in the United States. Throughout 2020, FIBT’s Mineral & Land Services Division continued to establish its identity as a single clearing-house for all issues facing mineral rights owners, and a trusted liaison to act in their best interest in managing relationships with oil companies. From a family with two acres to an entire oil company, anyone with a mineral interest can come to FIBT for assistance.

With the purchase of Krown Energy Group in July of 2020, the proprietor of leading mineral management software MineralTracker, and the addition of co-founder Joel Brown to our FIBT Mineral & Land Services Team, this division has stepped further into its role as one of the most comprehensive mineral service providers in the country. MineralTracker provides an easy-to-use platform for mineral owners to organize, map, and track wells, audit royalty income, and forecast future revenue and production. It is the only mineral management software allowing owners to project royalty income based on well performance and a proprietary Bakken-specific reservoir model built by petroleum engineers.

We also welcomed Jeff Skaare as Mineral & Land Services Landman and Business Development Lead. Jeff is a North Dakota licensed attorney who has dedicated his career to oil and gas development, bringing more than 15 years of impressive industry experience to his role at FIBT.

The additions of Jeff and Joel allowed us to provide a number of new or enhanced services, such as self-service mineral management through MineralTracker, mineral appraisal, oil and gas asset sale, consulting and reserve-based lending, in addition to what we already offer in terms of mineral and land management.

JEFF SKAARE

JOEL BROWN

MINERAL & LAND SERVICES DIRECTOR LANDMAN/BUSINESS DEVELOPMENT MINERAL SERVICES MANAGER

8

CATHRINE GRIMSRUD

*

““Our goal is to provide unparalleled service to our mineral owners through diligent management, innovative technology and goal-oriented strategies. We are here whether you want a simple question answered, or you want us to fully manage your mineral interests.”

Donor Advised Funds

“When it comes to charitable giving, it’s clear every dollar counts. “Not only do your donations make the world a better place, they come with financial benefits. Being strategic in your giving can lead to a win-win situation for you and your favorite causes,” says Teresa Harland, FIBT Wealth Advisor Team Lead. A Donor Advised Fund (DAF) is a vehicle for giving, utilizing an irrevocable charitable investment account sponsored by a public charity. It allows donors the ability to make grants to IRS qualified public charities and receive immediate tax benefits the year they contribute to their DAF. First International Bank & Trust partners with

American Endowment Foundation (AEF) as its public charity. AEF is the nation’s leading independent non-profit sponsor of Donor Advised Funds.

We’re pleased to share one of our first donor advised funds was the Steve Stenehjem Family/ First International Bank & Trust Donor-Advised Fund. Steve and his family plan to make grant recommendations from the DAF account that support both personal and bank philanthropic interests. The DAF will grow over time allowing the Stenehjems to make significant grants supporting the communities within our bank footprint.

9

Peter, Stacey, Evelyn, & James Stenehjem

- Cathrine Grimsrud Mineral and Land Services Director

Steve & Gretchen Stenehjem

Erik, Jessica & Charlie Stenehjem

Dr. Kristen Stenehjem & Dr. Grant Edland

Kira & Gregory Noll

* Not FDIC Or Any Federal Agency Insured | No Bank Guarantee | May Lose Value

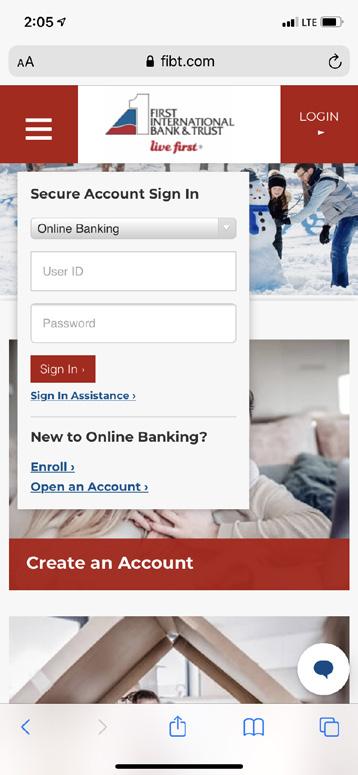

DIGITAL INNOVATION

FIBT.com: Relaunched, Reimagined

In April of 2020, First International Bank & Trust unveiled a redesigned FIBT.com. The website was reimagined to better serve our customers. In an addition to a brand-new layout with a sleek, modern design, the site was also enhanced with:

• Improved navigation and easy to find content to help you get to the resources you need, quickly

• A new “Live First” section, offering industry insights, and information about FIBT news and culture

• Additional and improved experience with our online applications for new accounts

Technology With a Personal Touch

It’s our mission and promise to provide personal attention, whether a customer is coming into one of our branches or applying online for a new account. For those who prefer handling their banking online, we have a Digital Universal Banker who receives applications and further engages with those customers who want the speed and ease of doing it themselves, with the personal touch they love and expect from a community bank.

We also upgraded our chat service to be able to offer co-browsing where we can assist clients with questions about online banking or hard to find areas of the website by sharing screens. In 2021, this will be developing even further to add a video component to our chat system to continue providing excellent service to our customers.

“We have some really exciting digital enhancements coming in 2021 that will offer so much to our commercial and personal banking customers. More access, more insight, and more tools to help you be successful and financially confident.”

- Justin Walseth Chief Growth Officer

10

“

“

COMMUNITY GIVING

Considering the uncertainty that came at the beginning of the year, we felt it was best to focus first on the issues at hand. Many of our non-profit organizations that support our communities were assessing how to respond to the new restrictions and putting new procedures in place to move forward. In an effort to be mindful of the strain on their resources, we decided to delay our normal Community Giving Campaign, and instead donated more than $25,000 to schools and other organizations providing meals for children facing food uncertainty because of the pandemic.

A record-breaking 134 community organizations applied for our Sixth Annual Live First Community Giving Campaign, which launched in September. Voting for the organizations and causes garnered more than 100,000 social media interactions. Due to the overwhelming response and quality of nominations, we decided to award two Grand Prize grants of $10,000. The big winners were Jessy’s Toy Box out of Fargo, ND and Ryan House out of Phoenix, AZ. Overall, we gave away $32,000 through the campaign.

Thank you to the FIBT team members who made a commitment to better their communities in 2020.

$10,000 Grand Prize Award –Jessy’s Toy Box, Fargo, ND

Jessy’s Toy Box is a non-profit that collects new toys, games, blankets, and gift cards. Through monetary donations, they provide children, who are in the hospital or staying away from home, activities, iPads, and other items to help make their stay a little easier. Jessy’s Toy Box is bringing smiles to children who need them most, one toy at a time.

$10,000 Grand Prize Award –Ryan House, Phoenix, AZ

In addition, FIBT is sponsoring the Volunteer Activation Center in the new United Way building in Fargo, North Dakota. Over five years, the bank is donating a total of $250,000 to support United Way as they host community meetings, corporate meetings, trainings and other events in the new 2,000 square foot space.

Whether it’s a significant donation, or spending a few hours helping at a community project, we believe in giving without expectation. We challenge our employees to leave their mark on their communities. They continually rise to the challenge, and amaze bank and community leaders with their dedication to service.

Ryan House embraces all children and their families as they navigate life-limiting or end-of-life journeys. Their goal is to provide coordinated care and improve the quality of life for medically fragile children and their families in Arizona. Ryan House serves families of all cultures, income levels, and family sizes each year. All services at Ryan House are provided at no cost to families.

11

AWARDS & HONORS

RECIPIENT

Named after Odin Stenehjem, who founded our bank in 1910, this award is given annually to the employee who best exemplifies FIBT’s Mission, Vision, and Values. It recognizes those who execute service at its highest level, and inspires those around them.

HONORED EMPLOYEES

Peter Stenehjem was recognized on The Independent Community Bankers of America’s list of “40 Under 40 Emerging Community Bank Leaders.”

He was also recognized with the University of North Dakota’s “2020 Young Alumni Achievement Award.”

GREG

PRESIDENT WEST FARGO, ND

Greg Mastrud, our 2020 Odin Award recipient, is the President of FIBT’s West Fargo branch. He has been with FIBT for over 17 years and has nearly 30 years of experience in the financial industry. He is active in his community currently serving in the following capacities: West Fargo Area Scholarship Fund President and Greater Fargo-Moorhead Economic Development GIF Board Member.

PETER STENEHJEM

PRESIDENT | FARGO, ND

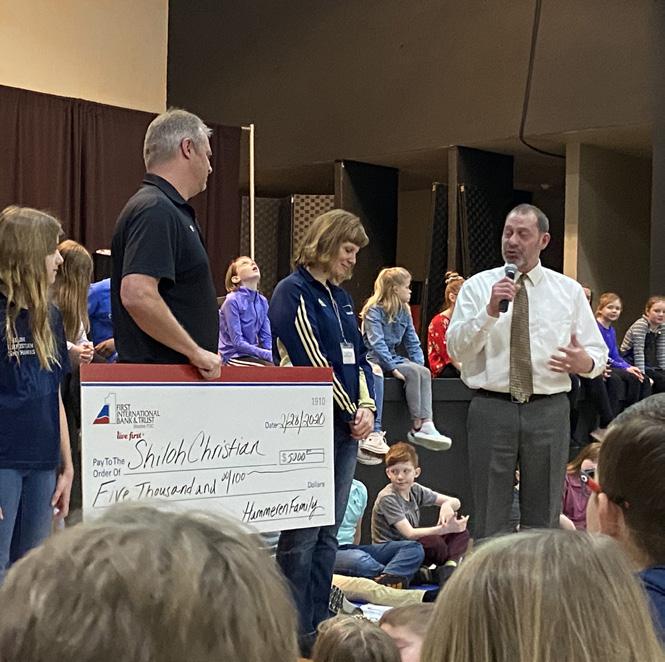

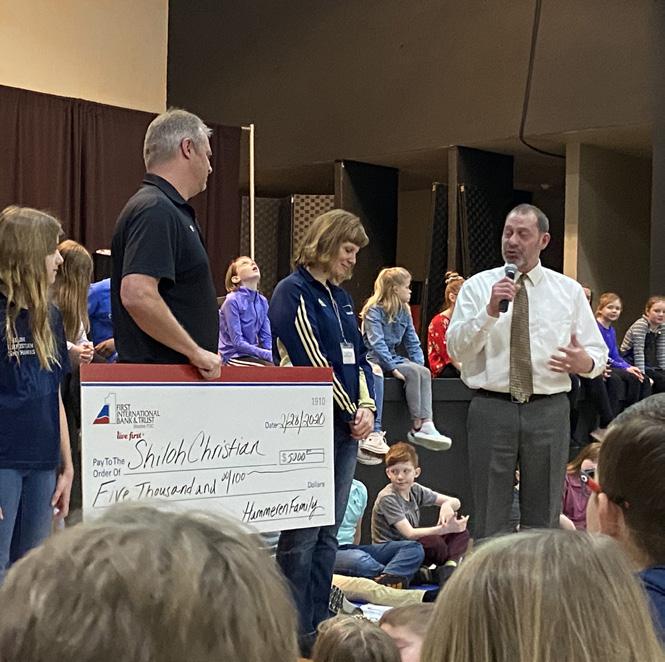

Last year’s Odin Award recipient Shannon Hammeren, Director of Information Technology, decided to surprise Bismarck’s Shiloh Christian School by matching FIBT’s $5,000 donation with $5,000 of his own money. Shannon’s generous gift was well-appreciated and is a shining example of the qualities which earned him the award.

Top 40 Business Professionals Under 40

- Prairie Business Magazine

SEAN ELSNER

BRANCH PRESIDENT MOORHEAD, MN

Top 25 Women in Business

- Prairie Business Magazine

RENEE DAFFINRUD

REGIONAL PRIVATE BANKING MANAGER BISMARCK, ND

2020 Business Partner of the Year

- Minot Board of Realtors

JESSI ERDMANN

MORTGAGE LOAN OFFICER MINOT, ND

Best Loan Officer

- Bismarck Tribune’s 2020 Best of the Best

JON LEET

MORTGAGE LOAN OFFICER BISMARCK, ND

12

MASTRUD

2020 ODIN AWARD

2019 ODIN AWARD UPDATE

BANK HONORS

Named to Prairie Business magazine’s list of the Top 50 Best Places to Work for seven consecutive years.

Voted Best Bank / Financial Institution by the Scottsdale Airpark News.

READERS CHOICE AWARDS2020

Voted Best Bank, Best Place to Work, Best Customer Service, Best Insurance Agency, and Best Mortgage Company by the Minot Daily News Reader’s Choice Awards.

LOOKING FORWARD TO 2021

Named to ICBA’s list of “Highest Rated Agriculture Lenders” in Asset Class.

Awarded the “Good Scouting Award for Corporate Philanthropy in the Community” by the Northern Lights Council Boy Scouts of America.

ALEXANDER BRANCH SODAK HOME LOANS

In February 2021, First International Bank & Trust welcomed customers to its completely rebuilt location in Alexander, ND. Proudly sporting the town’s first ever drive-through, the remodeled Alexander branch includes a brand-new interior that mixes modern design with the town’s historic roots. Plans are in the works for an official grand reopening event happening later in the year.

First International Bank & Trust recently acquired the assets of Sodak Home Loans, a Sioux Falls-based full-service mortgage brokerage company. This acquisition marks FIBT’s first office in South Dakota. Additionally, FIBT purchased land at the northwest corner of 69th Street and Minnesota Avenue in Sioux Falls. No specific construction plans have been announced, but the land would be a logical place for future expansion to serve more customers and attract top financial services talent.

“A Sioux Falls location will be advantageous for our customers geographically, and for us as an organization in attracting top financial services talent to serve customers locally and throughout our footprint.” - Peter Stenehjem, FIBT President

13

BOARD OF DIRECTORS

CHAIRMAN OF THE BOARD

Stephen L. Stenehjem, CEO/Chairman

DIRECTORS

Blaine DesLauriers, Vice Chairman

Dennis Walsh, Chief Credit Officer

Erik Stenehjem, President, Phoenix

Michael Toy, Chief Operating & Strategy Officer

Peter Stenehjem, President

Jim Poolman, Independent Consultant, Jim Poolman Consulting

Mark Tollefson, General Partner, TNT Real Estate & Prairie Heights Apts., CEO Retired Tollefson’s Retail Group

Michelle Kommer, Founder and Owner, HighRoad Partners, LLC

Nancy Slotten, Executive Vice President, Treasurer, Border States Paving, Inc.

Ty LeSueur, President, LeSueur Investments

After 39 years of service, Chief Financial Officer Anita Quale retired from First International Bank & Trust. Anita began her career at FIBT in September of 1981 in Bookkeeping and has since worked in many different areas of the bank, including Director of Accounting and Finance. She accumulated a wealth of institutional knowledge over her career and played a prominent role in numerous initiatives, such as converting the bank from cash to accrual accounting and the acquisition of six of the Midwest Federal Offices. Anita has the honor of being the first female to hold a C-level position at the bank and be on the Board of Directors.

Congratulations to Anita on her well-deserved retirement! We wish her the best in the next stage of her life and thank her for her years of service.

Jason Johnson was named Chief Financial Officer in August of 2020. Having served as FIBT’s Controller since 2018, Jason has an extensive background in bank finance, reporting, strategic planning, and budgeting, and a deep appreciation for FIBT’s commitment to serving its customers .

First International Bank & Trust welcomed Michelle Kommer to its Board of Directors in December of 2020. Prior to the launch of her HR solutions business, HighRoad Partners, LLC, Michelle served as North Dakota’s Commissioner of Labor, Commissioner of Commerce, and Executive Director of Job Service.

14

ANITA QUALE

Chief Financial Officer (Retired)

Chief Financial Officer

Founder & Owner HighRoad Partners, LLC

JASON JOHNSON MICHELLE KOMMER

STATEMENT OF CONDITION

GROWTH BY NUMBERS YEAR OVER YEAR

33.7%

INCREASE

Total

Efficiency

(BILLION) 0 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 2016 2017 2018 2019 2020

15

Income

Net

Assets

INCREASE IMPROVEMENT ASSETS 1 2020 2019 Cash and Due From Banks $506,890,610 $300,009,537 Federal Funds Sold $0 $0 U.S. Government Bonds $290,823,637 $194,937,047 State and Municipal Obligations $285,463,286 $194,937,047 Other Securities $18,276,148 $13,214,114 Quick Assets $1,101,453,681 $738,954,702 Loans and Lease Financing Receivables $2,870,826,767 $2,520,483,641 Reserve for Possible Losses ($27,963,787) ($23,845,858) Total Loans $2,842,862,980 $2,496,637,783 Bank Premises & Equipment $154,703,950 $158,324,338 Other Assets $64,704,302 $66,622,522 Total Other Assets $219,408,252 $224,946,860 Total Assets $4,163,724,913 $3,460,539,345 LIABILITIES & CAPITAL 1 2020 2019 Demand Deposits $2,115,391,602 $1,646,039,149 Time & Savings Deposits $1,506,509,768 $1,407,155,030 Other Liabilities $174,437,001 $88,645,739 Total Deposits & Other Liabilities $3,796,338,371 $3,141,839,918 Common Stock $430,200 $430,200 Surplus $101,394,945 $101,394,945 Retained Earnings $265,561,397 $216,874,282 Total Capital $367,386,542 $318,699,427 Total Liabilities & Capital $4,163,724,913 $3,460,539,345 Assets, Liabilities and Capital as of December 31, 2020.

20.3% 6.8%

YEAR-END TOTAL ASSETS

AS AN ORGANIZATION AND AS INDIVIDUALS, WE THRIVE ON CONNECTION, WITH ONE ANOTHER AND WITH OUR CUSTOMERS. FINDING NEW WAYS TO MAINTAIN AND ENRICH THOSE CONNECTIONS WAS THE BIGGEST YET MOST REWARDING CHALLENGE WE FACED IN 2020. MAINTAINING QUALITY INTERACTION AND POSITIVE WORKING RELATIONSHIPS REQUIRED ALL OF OUR EMPLOYEES TO GET CREATIVE AND DEDICATE TIME TO MAINTAIN AND GROW THOSE RELATIONSHIPS. WHILE MANY THINGS HAD TO CHANGE, SOME THINGS REMAINED CONSTANT: OUR COMMITMENT TO BEING OPEN FOR YOUR BUSINESS AND A POSITIVE PRESENCE AND INFLUENCE IN OUR COMMUNITIES. OUR ABILITY TO ADAPT AND RISE TO THE CALL OF OUR CUSTOMERS REFLECTS A DEDICATION TO

16

LEAVING OUR COMMUNITIES IN A BETTER PLACE.