Building Upon a Legacy

ANNUAL REPORT

a MESSAGE from the CEO

Since my family started First International Bank & Trust in 1910, we’ve put our focus on helping dreams come true, one customer at a time. The strength of that heritage and legacy is what we build upon to grow and expand our business and uphold our commitment to our customers. Our hard-working, service-minded approach to banking, coupled with our diversification across the upper Midwest and in Arizona, continues to support our reputation for strength and stability.

First International Bank & Trust is consistently recognized as a high performing bank in the top of our peer group with quality assets and high earnings. To achieve this standing, we’ve done a lot of things right for a long time. Through booms and busts, the great depression, and two world wars, we’ve stayed strong and continued to perform. Not to mention, we’ve done all this without the loss of a depositor’s dollar. That’s important to us as a family-owned community bank.

We place tremendous importance on remaining local, staying involved in our communities and caring for our customers. We also have the ability to focus on long-term solutions. We aren’t like the corporate or widely-held banks that concentrate only on short-term profits. We look at what’s most beneficial for us in the long run and understand strong strategies can take time to flourish. That’s why we started a Trust department in 1990, realizing that it would take time to gain traction. That’s why we invest in our communities by building significant facilities and hire local employees. It’s also why we devote time to our young employees, training them for future years.

ANNUAL REPORT 2016

Four generations of dedication to community banking.

Stephen L. Stenehjem

Odin Stenehjem

Leland Stenehjem

Peter Stenehjem Erik Stenehjem

I’m pleased to share this 2016 Annual Report which highlights our accomplishments in 2016. We focused on bringing additional conveniences to our customers, and continuing to be a one-stop-shop. This was a year that we opened a second branch in Watford City, N.D. and broke ground in two new markets (Bismarck and Rugby, N.D.). While building projects take time, we are open and are welcoming customers through temporary spaces. I’m excited to build new relationships and share our style of community banking.

In focusing on our one-stop-shop mentality, we also achieved great success with our mortgage division. In 2016, they tripled their net income from what they achieved in 2011, signifying our recognition of being a strong, trusted mortgage lender.

While we have experienced substantial growth in recent years, in comparison, 2016 was a stable year. The low commodity prices, notably with oil and agriculture, caused challenges for both our Bank and our customers. With North Dakota relying heavily on these commodity prices, and our oil activity steadying, our rapid growth plateaued.

As we move into a new year, I look forward with optimism. We will continue to be a financial partner for our customers; in the good times and the bad. We have many new initiatives in the works that will enhance our service offerings and help our customers earn more, save more and live first. We are confident that 2017 will be a good year for our customers and our company.

On behalf of the Stenehjem family, I want to say thank you to our work family—our employees, who dedicate themselves every day to care for our customers. Thank you to our Board of Directors, for the strategic guidance you provide for the direction of the Company.

And thank you, to our customers. For 107 years, we have been building upon a legacy, and we appreciate you continuing with us on this journey. Without you, we wouldn’t succeed.

Stephen L. Stenehjem CEO/Chairman

BUILDING for GROWTH

WATFORD CITY, N.D.

In March of 2016, we opened our doors to our second branch in Watford City at Fox Hills. Located in a new development, it is positioned next to the new high school and events center. In addition to the Bank, the building hosts a restaurant and coffee and ice cream shop, making it a popular destination for community members. Since our humble beginnings in 1910 in Arnegard, N.D., we’ve grown to 26 locations in three states. To better serve our customers and expand our North Dakota footprint, we opened a second branch in Watford City and broke ground in two new markets: Bismarck and Rugby.

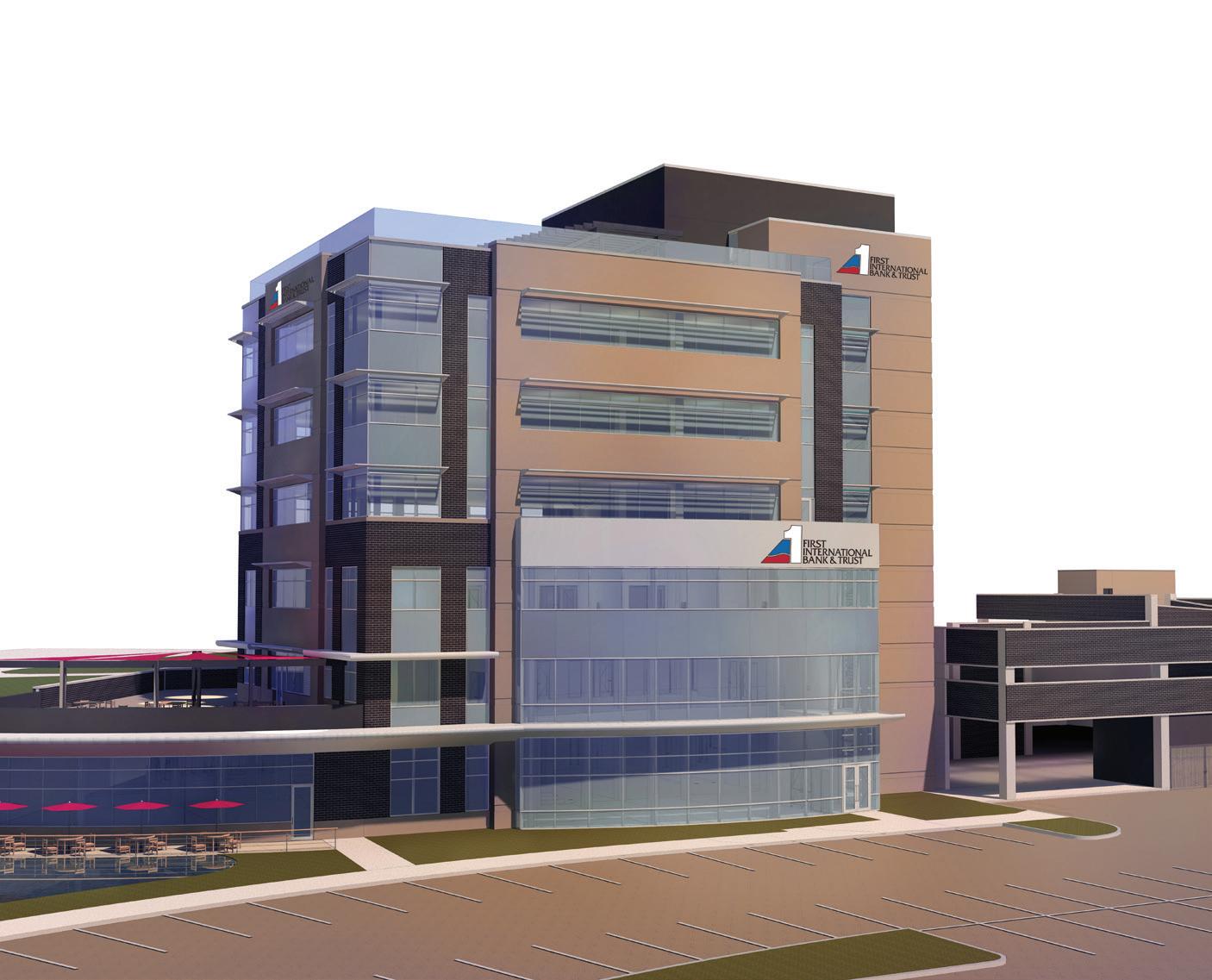

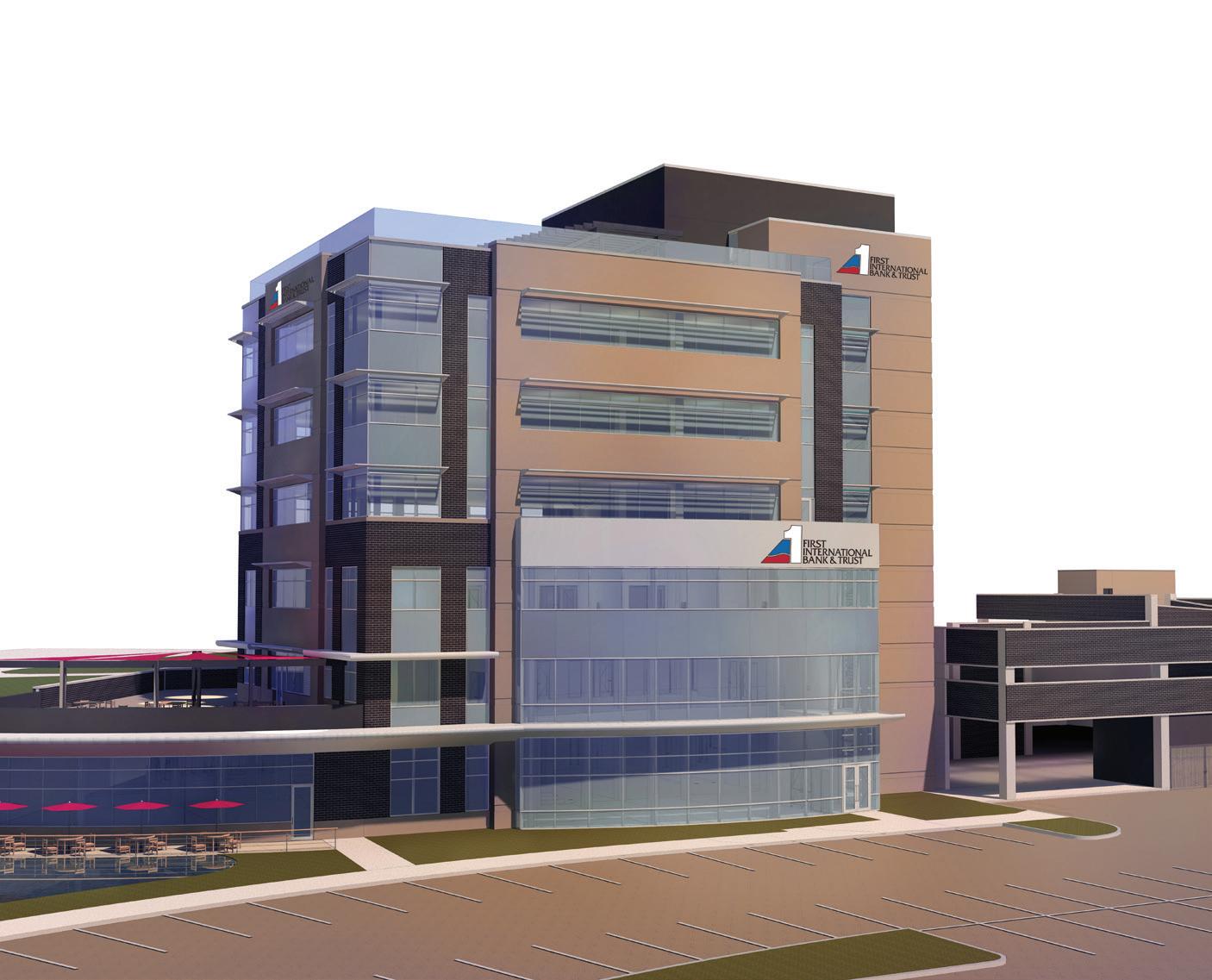

BISMARCK, N.D.

The city of Bismarck is the capitol of the state of North Dakota and is the second most populous city in the state. Years in the making, we were able to secure and revitalize a prominent location near the capitol building and invest in a $40 million flagship facility. It will have state-of-the-art technology and break the mold of the traditional bank branch. The building will rise over the skyline with six levels, feature a restaurant and offer business space for tenants. Solidifying our North Dakota presence, we held a groundbreaking in May. Today we serve our customers in a temporary space, on location. The opening is expected in the first quarter of 2018.

RUGBY, N.D.

Our entrance into Rugby makes perfect sense when you look at our locations across North Dakota. The centrally located Rugby branch is a great match to our demographic and customer base which we greatly enjoy working with. We purchased a landmark location and want to make the town and surrounding area proud of the corner on Highway 2. When we enter a new community, it’s more than just setting up shop for us. We want to be partners in the community. While serving customers out of a temporary location, we held a groundbreaking event for our new branch in June of 2016. The new building will have office space for tenants to rent, and is expected to be open the summer of 2017.

TRANSFORMING customer EXPERIENCES

Through enhancements in technology, we are able to empower our customers with the tools and conveniences they need to perform their banking. With an easy-to-navigate website, digitally-driven in-branch experience, full suite of cash management services and convenient personal banking features, we are able to meet the needs of our customers.

ENHANCED IN-BRANCH EXPERIENCE

Earlier this year, we deployed a fleet of iPads into our branches armed with resources for customers. With this new tool, our bankers can easily show new and current customers how to set up online banking and eStatements in a fun and interactive way that makes the process of opening new accounts easy and efficient.

EXPANDED MOBILE PAYMENT OPTIONS

In 2016, we were excited to announce a new way to pay using Apple Pay® with First International Bank & Trust debit and credit cards. Apple Pay changes the way you pay – it’s easy, secure and private, and it works at thousands of stores and within participating apps. As other mobile wallets expand, such as Samsung and Android solutions, we are committed to providing our customers with services that enhance their daily life.

STREAMLINED BUSINESS PROCESSES

We understand the demanding lifestyle of business leaders and the importance of being connected to make financial decisions. Therefore, we launched Business Mobile, the ultimate banking app that offers advancements in technology to take online business banking services beyond the office within a safe and secure environment.

DELIVERING on a PROMISE

At First International Bank & Trust, we offer more than just banking. Our suite of expanded services are what make us the full-service Bank that our customers can count on. From Wealth Management, to Mortgage and Insurance services, we have the financial solutions to fit the needs of our customers.

EARNING BUSINESS, GAINING TRUST

Our mortgage division has been making strides in positioning themselves as mortgage experts in the communities we serve and therefore, are building a customer base that continues to refer business to us. It comes from taking time with our customers, building trust and helping them enjoy what can often be a stressful journey.

95%

94% of our clients would recommend their mortgage loan officer to a friend or relative of our clients would describe the service they received as Excellent or Good

STRENGTH IN DIVERSIFICATION

We understand the importance of diversity and how it can affect our business. This past year was no different, and as the oil industry in North Dakota slowed, we relied on our diversification to keep our Bank strong.

There was a focus in 2016 to build upon our business client relationships that were established, as well as garner new relationships. The Fargo, Moorhead and West Fargo market increased deposits by over 50% and continue to expand commercial relationships; they also continue to expand their portfolio into different lines of business. In the Arizona metropolitan market, they pride themselves on catering to their business customers, and are growing their private banking sector, while focusing on providing excellent service.

We have long-standing strong roots and built our Company on the foundation of agriculture, particularly in our Western and Rural North Dakota markets. Our agriculture customers remain a meaningful segment of our customer base and we pride ourselves on having bankers that have extensive experience to successfully guide our customers through the seasons.

PARTNERING for SUCCESS

We’re diverse not only geographically, but also in the types of customers and industries we serve. We work hard to keep strong relationships with our customers, while earning new business each and every day.

RELATIONSHIP FOCUSED

Our relationships with our customers are top priority and our markets pride themselves on their personal and exceptional service. That sometimes comes in the form of visiting customers wherever is most convenient for them. We’ve closed many loans by signing documents on the hood of a pickup or at the kitchen table.

Up until recent years, many of the communities we serve were considered ‘rural’, thus our ‘small-town’ customer service still exists. Bankers concentrate on getting out of the office and meeting with their customers face-to-face to show our interest and commitment to their financial success.

Across the organization, our employees are diligent to find ways to expedite processes and increase service levels. We recognize customers have choices and we strive every day to earn their business.

INNOVATIVE SOLUTIONS

As a strong community bank, we pay attention to our communities and customers. We identify needs and economic factors that are influencing their lives and find solutions to overcome challenges. The wealth management* division launched their new Mineral & Land Services working interest product in 2016. They also introduced an improved financial planning tool, MoneyGuidePro®. These new additions nicely complement our current specialty offerings, which include Special Needs Trusts, Mineral & Land Services and Self-Directed IRAs.

Our insurance* division grew their oil and gas clients considerably in the Western North Dakota market and have become specialized in writing insurance for those industries.

* Not FDIC Or Any Federal Agency Insured No Bank Guarantee May Lose Value

RECOGNIZED in the COMMUNITY

We take pride in being recognized for our strong family values and customer-centric culture. In 2016, both our organization and its employees were honored to be recognized with numerous awards.

• Top 50 Best Places to Work by Prairie Business Magazine (third year in a row)

• Top 10 Places to Work by Bismarck Young Professionals Network

• Best Bank, Best Customer Service, Best Insurance and Best Mortgage Company by the Minot Daily News Reader’s Choice Awards

• Affiliate of the Year by the Minot Association of Builders

HONORED EMPLOYEES

Anita Quale, Chief Financial Officer was named as one of the Top 25 Women in Business by Prairie Business Magazine. Peter Stenehjem, President, and Dave Mason, Bismarck President, were named to the prestigious 40 Under 40 list by Prairie Business Magazine. Dave Mason was also named a Rising Star in Banking by Northwest Financial Review. Patti Helm, mortgage loan officer, received the North Dakota Housing Finance Agency Championship Award.

ODIN AWARD

Since its founding in 2012, we have awarded one employee each year with the Odin Award, an honor given to those who best exemplify the Mission, Vision and Values of First International Bank & Trust. Along with the award, recipients receive a $5,000 donation to a charity of their choice.

Named after Steve Stenehjem’s grandfather, this award is highly respected and sought-after. We recently named Shar Weltikol, AVP eServices Business Banking, the 2016 recipient of the Odin Award. Shar has been with our company for over 20 years.

Anita Quale

Shar Weltikol

Dave Mason

Peter Stenehjem

Patti Helm

Anita Quale

Shar Weltikol

Dave Mason

Peter Stenehjem

Patti Helm

STATEMENT OF CONDITION

GROWTH in NUMBERS

Year-after-year, First International Bank & Trust continues to be a high performing bank recognized in the top of our peer group with quality assets and high earnings.

ASSETS 1 Cash and Due From Banks $60,584,024 Federal Funds Sold $0 U.S. Government Bonds $150,503,763 State and Municipal Obligations $189,072,740 Other Securities $2,455,110 Quick Assets $402,615,637 Loans and Lease Financing Receivables $1,721,058,617 Less: Reserve for Possible Losses $17,156,992 Total Loans $1,703,901,625 Bank Premises & Equipment $93,914,457 Other Assets $61,571,154 Total Other Assets $155,485,611 Total Assets $2,262,002,873 LIABILITIES & CAPITAL 1 Demand Deposits $386,373,993 Time & Savings Deposits $1,599,061,702 Other Liabilities $75,754,565 Total Deposits & Other Liabilities $2,061,190,260 Common Stock $430,200 Surplus $61,594,945 Retained Earnings $138,787,469 Total Capital $200,812,613 Total Liabilities & Capital $2,262,002,873

Assets, Liabilities and Capital as of December 31, 2016.

1

GROWTH IN ASSETS

2012 2013 2014 2015 2016 YEAR-END TOTAL ASSETS $1.0 BILLION $1.5 BILLION $2.0 BILLION

BOARD

JIM

Jim Poolman Independent Consultant

POOLMAN CONSULTING Ty LeSueur President LESUEUR INVESTMENTS

TOLLEFSON’S

Mark Tollefson General Partner TNT REAL ESTATE & PRAIRIE HEIGHTS APTS CEO Retired

RETAIL GROUP

Nancy Slotten Executive Vice President/Treasurer BORDER STATES PAVING, INC.

OF DIRECTORS Directors

Dennis Walsh Chief Credit Officer

Michael Toy Chief Operating & Strategy Officer

Blaine DesLauriers Vice Chairman

Peter Stenehjem President

Anita Quale Chief Financial Officer

Erik Stenehjem VP/Business Development

Chairman of the Board

Minnesota Moorhead Motley Staples North Dakota Alexander Bismarck Bowdon Elgin Fargo | 3 locations Fessenden Harvey Killdeer Minot | 3 locations Rugby Watford City | 2 locations West Fargo Williston | 3 locations Arizona Gilbert Phoenix Scottsdale AZ ND 26 locations LOCATIONS

Stephen L. Stenehjem CEO/Chairman

Helping dreams come true, one customer at a time.

VISION

Be a growing, relationship driven bank providing complete financial solutions to our customers as a “one-stop-shop” and delivering those solutions in true community bank fashion.

Uphold our reputation for strength and stability achieved through more than 100 years of service.

Be a high-performing bank recognized in the top tier of our peer group with high quality assets and high earnings.

Be active in the communities we serve through ongoing community involvement helping our customers and communities grow.

firstintlbank.com MISSION

VALUES Respect • Customer Service • Excellence • Teamwork • Empowerment • Community 0326_03-17 Member FDIC

Anita Quale

Shar Weltikol

Dave Mason

Peter Stenehjem

Patti Helm

Anita Quale

Shar Weltikol

Dave Mason

Peter Stenehjem

Patti Helm