By Joe Lam

| ACCOUNTANT

COPYWRITER / ACRREDITED EDITOR

Are you our next Copywriter? ?

Are you our next Wedding Planner? ? ?

Are you our next Life Coach?

Are you our next Bookkeeper?

By Warren Strybosch

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written

By Joe Lam

Like it or not, you or someone you know is going to need aged care advice. That is why we believe every adviser should be knowledgeable about aged care advice. There are three great reasons we incorporate aged care advice into your service offering.

1. The critical third phase: By breaking retirement into three distinct phases, (active, quiet, and frailty years) we help our clients understand and plan for their future.

2. Growing demand: There are now more than half a million Australians who are aged 85 and over and at age 65, a person’s chance of needing aged care during their lifetime is also high. Aged care is complicated, and great advice can make a big difference.

3. Meeting the Code of Ethics: The Code of Ethics, while initially causing stress, aims to strengthen the advice profession by prioritizing clients. Given the high probability of clients experiencing frailty, aged care planning is crucial.

“Ready to get the right aged care advice? Get in touch with us today to learn how we can help you get things right when it comes to your Aged Care needs.

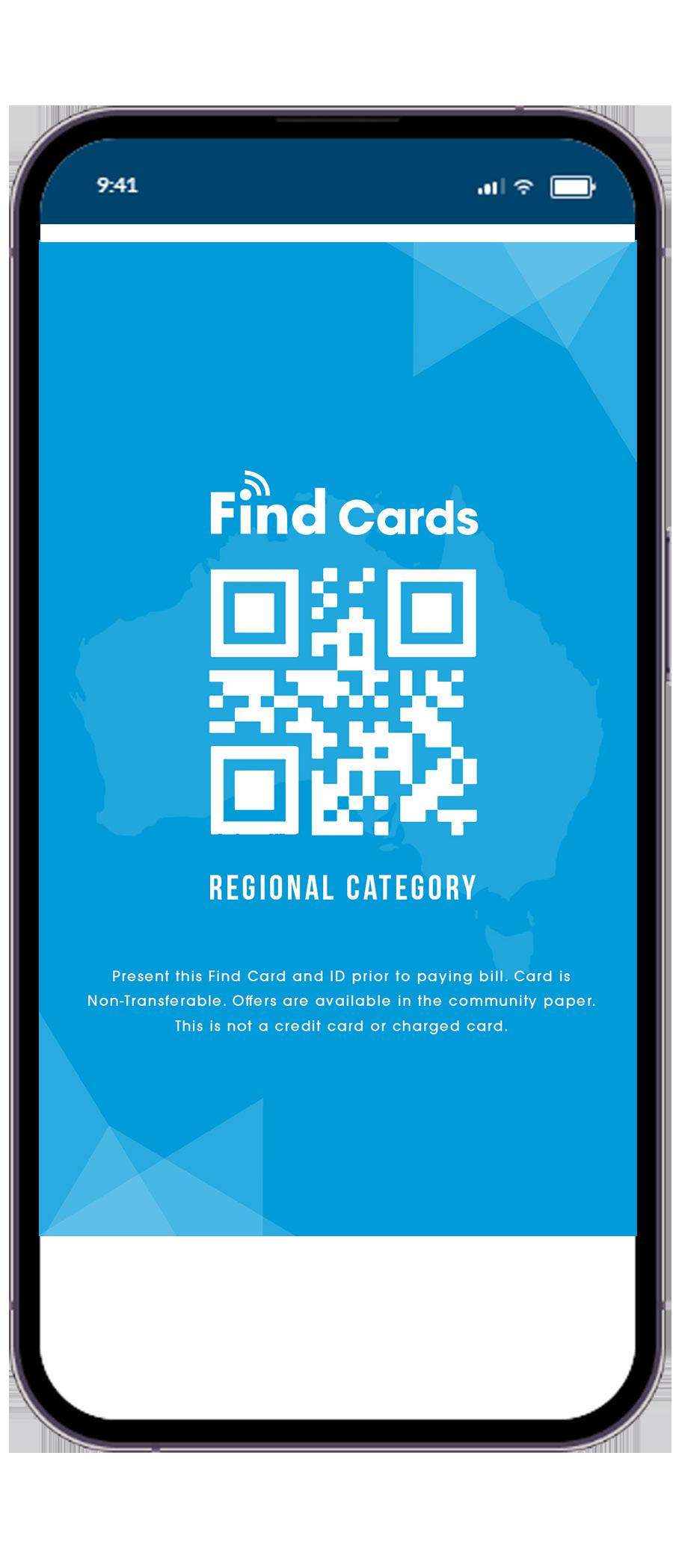

Find Cards is a fundraising initiative set up by Warren Strybosch who wanted to help as many Charities, Not-For-Profits, Schools, Sporting Clubs and other organisations in his local community and other regions throughout Victoria.

The revenue generated from the Find Cards will support the above organisations as well as provide the necessary funding to support the Find Foundation, a Not-ForProfit organisation that is setting up and operating community papers across Victoria.

The community papers provide a place where those above organisations can tell their story via the ‘NFP of the Month’, and enables those organisations to promote themselves for Free, let the community know what services they provide, and when they will be holding fundraising events in the future.

With the Find Cards, everyone wins. Become a Find Card Member today for less than a coffee($4.99) a month and help everyone win. Businesses gain more business through offers. Members save money and can access giveaways. NFPs, clubs, schools, and charities receive revenue. Local community papers provide information and benefit the community.

For more details go to www.findcards.com. au and check out how to register and become a member,

Ensure Your National Disability Insurance Scheme (NDIS) Plan Management Remains Compliant - Partner with Experts You can Trust.

With the changes that occurred in April 2025, the NDIS now requires Plan Management to be conducted by qualified and currently practicing accountants and/or bookkeepers. For those currently providing Plan Management services who are not practicing

accountants and/or bookkeepers, it is highly likely that after the business' next audit, which occurs annually, those Plan Management providers will be required to become practicing accountants/bookkeepers otherwise they will have their authorities by the NDIS to operate in this space revoked.

At Find Wellbeing, we’re already ahead of the changes. As qualified and practising accountants and bookkeepers - and with our founder, Warren Strybosch, an award-winning accountant and financial advisor - you can trust that your Plan Management is in expert hands. We’re also on track to becoming a registered NDIS Provider, ensuring full compliance now and into the future.

Book a time with Find Wellbeing today and secure your Plan Management with professionals who meet the NDIS’s new standards.

At Find Group, we’re committed to creating services that empower individuals, support communities, and provide peace of mind at every stage of life. Whether planning for aged care, supporting local causes through Find Cards, or ensuring NDIS compliance with Find Wellbeing, we're here to make a meaningful difference. Get in touch with us today to learn how our solutions can help you and your community thrive.

By Warren Strybosch

More people are becoming homeless as the cost of living continues to go up. For those living in Victoria it is even worse given taxpayers are forking out over $22 million in interest repayments per day due.

With increasing financial stress being felt by many the Labour government, in its drive to try and find ways to increase revenue, has decided to disallow a tax deduction for interest incurred on ATO debt.

From 1 July 2025, Australian businesses and individuals will no longer be able to claim tax deductions for interest charges imposed by the Australian Taxation Office (ATO). This includes the General Interest Charge (GIC) and Shortfall Interest Charge (SIC), which are applied to unpaid tax liabilities and amended assessments, respectively.

The government announced this change in the 2023–24 Mid-Year Economic and Fiscal Outlook, aiming to encourage timely tax

compliance and reduce reliance on the ATO for financing but we know the real reason is to reduce government costs and increase revenue. For businesses, particularly base rate entities with turnovers under $50 million, this means an additional 25% cost on outstanding tax debts.

This is bad timing for people and business owners who are already struggling with cashflow and keeping their businesses afloat.

Thankfully, the RBA reduced rates which will help a little.

Even so, taxpayers should prepare by reviewing their tax obligations and considering strategies to manage cash flow and avoid penalties. For those running a business who owe money to the ATO, it might be wise to speak to a mortgage broker and consider refinancing the debt so that the interest can continue to be tax deductible.

By Liz Sanzaro

Never heard of a hand fish?

Well, you are not alone. The CSIRO has been funding research into a precious colony of these strange fish from a small area in the Derwent River in Tasmania. In conjunction with the University of Tasmania, a successful breeding program has been realised with the birth of 21 new babies.

Here is a mum guarding her very precious eggs on day 14 of incubation.

The world has some amazing creatures, many still as yet undiscovered, which is why we need to protect our environment on land and at sea. Many creatures look cute or just plain funny, so we sometimes amuse ourselves and destress by watching funny cat and dog videos. There are so many more fascinating species, to entertain our curiosity and allow us to learn about the world, which can be strange and surprising.

Sir David Attenborough who has just celebrated his 90th Birthday, has been a guiding light for the Environment and through his work he has allowed us to join in amazing experiences through his

videos and films. Every species is amazing in some way, from frogs and lizards in our own back yard to flying with geese, one of Davids most spectacular pieces of work.

During the recent election, the Australian Conservation Foundation collected over 20,000 pledges for Climate and Nature, not really a surprise since many of us know that something needs to be done.

As Earth inhabitants, we cannot just complain and feel stressed, it achieves nothing and is unhealthy. The best way to combat a feeling of helplessness, is to become involved and this has happened right across the nation. If you did display a sign, be proud of what has been seen and acknowledged.

If you displayed an ACF sign leading up to the election, you were one of 3,000 to do so, thank you.

Enjoy the benefits of living in Maroondah with our plentiful supply of wildlife. If you are a cat owner, please keep your cat in a cat-run to allow tiny birds to survive. A recent analysis of bird life shows the tiny birds are scarcer than they used to be, we now rarely see Pardalotes, Fairy Wrens, and Silvereyes, or tiny Wrens.

Bunnings image of an outdoor cat enclosure for daytime use.

Croydon Conservation Society is a group member of ACF, as well as Environment Victoria.

By Reece Droscher

The Federal election has been run and won, so what does it mean for aspiring homeowners looking to buy property in 2025? Here are the key takeaways that could impact you.

The Government is expanding its Help to Buy scheme, increasing both income and property price caps. Under this scheme, eligible buyers may receive an equity contribution of up to 40% from the Federal Government—making it easier to buy with a smaller deposit and lower mortgage.

Key updates:

• Income caps: Raised from $90,000 to $100,000 for individuals and from $120,000 to $160,000 for joint applicants and single parents.

• Budget allocation: $800 million to support this expansion, aimed at helping around 40,000 Australians enter the market.

The re-elected Government has promised $17.1 billion for national infrastructure projects—developments that could influence housing supply and boost surrounding property values.

Notable investments:

• $7.2 billion for Bruce Highway safety upgrades (QLD)

• $2.3 billion+ for Western Sydney infrastructure (NSW)

• $465 million for regional NSW upgrades, including:

º $250 million for Mona Vale Road

º $115 million for Terrigal Drive

$2 billion to upgrade Sunshine Station (VIC)

• $350 million for the Westport–Kwinana Freeway Upgrades (WA)

From 1 April 2025 to 31 March 2027, foreign individuals and companies

will be banned from purchasing established dwellings in Australia (exceptions apply). This measure aims to increase housing availability for local buyers. The Government also plans to crack down on land banking.

To accelerate home building, Labor will:

• Invest $54 million in the prefabricated and modular housing sector.

• Allocate $120 million via the National Productivity Fund to reduce red tape around modern construction methods.

These homes are built off-site and assembled quickly, cutting build times in half compared to traditional methods. There may be some restrictions on these types of properties though with some lender policies, so speaking with a broker first to work through who can assist in financing these projects would be your best option.

To address workforce shortages, a new Housing Construction Apprenticeship stream will be introduced. Eligible apprentices in housing trades can receive up to $10,000 in financial incentives— helping increase construction capacity and housing supply.

A re-elected Labor Government has committed to:

• Expanding access to 5% deposit home loans without Lenders Mortgage Insurance (LMI).

• Building 100,000 new homes exclusively for first home buyers, backed by a $10 billion investment.

• Introducing a $1,000 instant tax deduction starting in 2026–27.

There’s a lot to digest from the Federal election result, with a lot of promises made that are geared towards increasing housing supply and making it easier for first home buyers to enter the market. We’re here to help navigate you through all of what is available. If you have questions about how these changes could affect your current or future property plans, feel free to reach out. We’d be happy to walk you through your options.

Please call Reece Droscher on 0478 021 757 to discuss all of your Home Loan needs.

reece@shlfinance.com.au

www.shlfinance.com.au

In the fast-paced digital world, it's easy to believe that marketing is all about visibility. The more eyes on your cause, the better. More traffic means more awareness, which leads to more donations, more volunteers, and ultimately, more impact.

Right?

Not quite.

At first glance, this logic seems sound. Many not-for-profits throw themselves headfirst into the world of social media, email campaigns, Google Ads, and influencer shoutouts, trying to be everywhere at once. They post regularly, pay for visibility, and tick every box on the "best practices" list.

But despite their efforts, many still feel like they’re spinning their wheels. Campaigns underperform. Donations plateau. Engagement stays lukewarm.

Why?

Because visibility without clarity is just noise.

At Good Cause, we've had the privilege of working with passionate organisations that care deeply about their mission. These are groups doing important work in communities across Australia.

But we kept seeing the same issue arise: they were being seen, but not heard.

Their messaging was unclear. And in marketing, clarity is everything. You can’t move someone to act if they don’t know exactly what you want them to do, why it matters, and how it connects to a story they care about. When organisations fail to answer those questions, their marketing falls flat, no matter how many people it reaches.

The truth is, a clear message is more powerful than a big audience.

We’ve seen it firsthand. When we sat down with these non-profits and helped them refine their message, who they were speaking to, what they wanted people to do, and how that action linked to realworld impact, something shifted.

Suddenly, their campaigns started converting. Donors leaned in, not just because they saw another appeal, but because they understood why it mattered and how they could be part of the change. Volunteers showed up because they resonated with the story being told. The mission didn’t just exist, it came to life.

Take, for example, one organisation we worked with that had been investing heavily in Google Ads and Facebook campaigns. They were driving plenty of traffic to their site, but very few people were signing up or donating. Once we reworked their homepage messaging

and clarified their call-to-action, replacing vague statements with specific impact-driven language, the same ads began performing 3–4x better. Nothing changed in the budget. Everything changed in the clarity.

It’s not rocket science. But it is a shift in mindset.

In an age where everyone is competing for attention, clarity wins. It's what cuts through the noise. It's what inspires action. And most importantly for not-forprofits, it’s what fuels real impact.

So if you’re a charity leader or marketer feeling disheartened because your reach isn’t translating into results, pause before you pour more into ads or post another reel.

Ask yourself:

• What exactly do I want people to do?

• Why should they care?

• How does this connect to the transformation or hope we’re offering?

Once you’re crystal clear on those answers, then turn up the volume.

Because when your message is clear, marketing becomes more than just reach, it becomes momentum.

And momentum is what changes the world.

By: Kendall Reilly

WarranwoodPrimarySchoolcommunity comes together for a sold-out night of dancing, fun, and appreciation of mum and special persons.

Laughter, music, and the shimmer of disco lights filled the venue on the evening of Friday, May 2nd, as families gathered for the Mother’s and Special Person’s Disco. The event gave students the opportunity to share the dance floor with their mums, carers, grandparents, and other important figures in their lives, creating a night filled with fun, connection, and heartfelt appreciation.

Now in its second year, the event— organised by the Friends of Warranwood— has quickly become a cherished tradition. Its popularity continues to soar, with this year’s disco selling out within a fortnight, setting a new record. Beth Strachan, a member of Friends of Warranwood, shared the importance of celebrating and organising these special events: "At Friends of Warranwood, we love bringing our school community together and fostering a strong sense of belonging. Our Mother’s and Special Person Disco is a chance for families, friends, and staff to come together, share special moments, and strengthen the bonds that make our school such a warm and supportive community.”

Guests were welcomed with disco ball necklaces and glow sticks to set the tone for a fun-filled evening. Throughout the evening the atmosphere was electric, with a photo booth capturing special memories, lively games, energetic dancing, and a fun scavenger hunt to keep everyone entertained. The evening wrapped up with a raffle, featuring incredible prizes generously donated by local businesses, rounding off the celebration with a sense of community spirit.

A heartfelt thank you goes to the Friends of Warranwood for their incredible organisation, and to all the mums, special friends, and students who joined in the fun, helping make the evening such a memorable success.

Financial Planner

By Erryn Langley

As the end of the 2024–2025 financial year approaches, you may be looking to boost your retirement savings while taking advantage of tax-effective strategies. One of the most common and beneficial ways to do this is through concessional contributions to superannuation.

This article explains what concessional contributions are, the limits for the 2024–2025 financial year, key strategies to consider before 30 June 2025, and how to avoid potential pitfalls.

Concessional contributions are before-tax contributions made to your superannuation fund. These include:

• Employer Superannuation Guarantee (SG) contributions

• Salary sacrifice contributions

• Personal contributions claimed as a tax deduction

These contributions are generally taxed at 15% within the super fund, which is often lower than most people’s marginal tax rate, making them a tax-effective way to save for retirement

It is important to ensure your total concessional contributions (including employer contributions) do not exceed the cap, or you may incur extra tax and charges.

The annual concessional contributions cap for the 2024–2025 financial year is $30,000

However, you may be able to contribute more using the carry-forward rule if your total super balance was less than $500,000 on 30 June 2024. This rule allows you to use unused cap amounts from the previous five financial years, starting from 2018–2019.

To ensure your contributions are counted for the 2024–2025 financial year, your super fund must receive the payment by 30 June 2025.

Tip: Superannuation contributions can take several days to process, especially if made via payroll or BPAY. Aim to make any voluntary contributions by mid-June 2025 to allow processing time.

Concessional contributions are taxed at 15% in your super fund, which can be significantly lower than your personal marginal tax rate. For example:

• If you're on a marginal tax rate of 34.5% (including Medicare levy), you could save up to 19.5% in tax by making concessional contributions.

Additionally, deductible personal contributions can reduce your taxable income, potentially increasing your tax refund or reducing your tax liability.

Concessional contributions can be a powerful strategy for building retirement wealth and reducing taxable income, but they must be planned carefully. A qualified financial adviser or tax agent can help you determine:

• How much you can contribute

• Whether carry-forward rules apply

• The most tax-effective way to make contributions

With the 30 June 2025 deadline fast approaching, now is the time to review your super contributions and take full advantage of the concessional cap. Whether through salary sacrifice, deductible personal contributions, or catch-up contributions, you could significantly boost your retirement savings while reducing your tax bill.

Don’t leave it to the last minute — check your contribution history, speak to your super fund and act well before EOFY to make the most of your super.

If your circumstances have changed in the year for example, you have sold a significant asset such as an investment property or your principal residence, or you are intending to, it might be a great time to seek financial advice. At Cherry Wealth are always happy to offer an initial obligation free chat to determine how we can help you.

Director and Financial Adviser - GradDipFinPlan

Authorised Representative No 1269525

T:1300 557 144 Email: erryn@cherrywealth.com.au

Website: www.cherrywealth.com.au

Office Address: Suite 4 / 4 - 6 Croydon Road, Croydon 3136

Postal Address: PO Box 657, Croydon VIC 3136

Financial Planning is offered via Cherry Wealth Pty Ltd Ltd ABN 14 653 375 458

Cherry Wealth is a Corporate Authorised Representative (No. 1314769) of Alliance Wealth Pty Ltd

ABN 93 161 647 007 (AFSL No. 449221). Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider any relevant Product Disclosure Statements (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

By Jodie Moore

Accurate expense reconciliation is a critical component of sound financial management in any business. It involves comparing internal financial records with external documents— such as bank statements, receipts, or supplier invoices—to ensure that every recorded transaction is accurate and accounted for. While it may seem like an insignificant back-office task, proper reconciliation has far-reaching implications for the health and sustainability of a business.

At its core, expense reconciliation helps maintain financial accuracy. Discrepancies between internal records and actual expenditures can lead to errors in financial statements, tax filings, and budget forecasts. Over time, these inaccuracies can accumulate, distorting a company’s understanding of its financial position. By reconciling expenses regularly, businesses can catch and correct mistakes early, ensuring their books reflect true financial activity.

Moreover, reconciliation plays a key role in detecting and preventing fraud. Inconsistent or unauthorised expenses can signal misuse

of company funds, either through employee misconduct or external threats such as cyber fraud. Timely reconciliation enables businesses to flag unusual transactions and investigate them before the damage escalates. For example, identifying duplicate payments or inflated vendor charges can help recover funds and tighten internal controls to prevent future issues.

Proper expense reconciliation also supports regulatory compliance. Companies are required by law to maintain accurate records for tax reporting and audits. If a business fails to reconcile its expenses properly, it may face legal penalties, interest charges, or damage to its reputation. Especially in regulated industries like finance or healthcare, the stakes are even higher, making meticulous reconciliation not just a best practice but a legal necessity.

In addition to compliance and fraud prevention, reconciliation provides a clearer picture of cash flow. Knowing exactly how much has been spent, when, and on what helps business leaders make informed decisions. It enables better budget management, improves forecasting accuracy, and ensures that working capital is allocated effectively. This level of insight is especially crucial for

small and medium-sized businesses operating with tighter margins and fewer resources.

Automating the reconciliation process can further enhance its effectiveness. With the help of accounting software such as Xero and digital expense management tools, businesses can streamline the process, reduce human error, and free up staff time for more strategic tasks. Automation also provides audit trails and real-time tracking, making it easier to monitor financial activity continuously rather than relying on periodic reviews.

Ultimately, reconciling expenses correctly isn’t just a matter of good accounting—it’s a strategic safeguard that underpins operational integrity, financial transparency, and business resilience. Companies that prioritise regular, thorough reconciliation are better equipped to grow sustainably, manage risks proactively, and build trust with stakeholders.

In a rapidly evolving economic landscape, the ability to track and verify every dollar spent is not optional—it’s essential. Businesses that neglect this responsibility do so at their own peril, while those that invest in strong reconciliation practices position themselves for long-term success.

By Kathryn Messenger

When you’re feeling stressed or anxious and especially if you’re feeling stuck in that state, it can be really helpful to have some tools that you can use, to move out of it, into your calm, rational mind.

Your autonomic nervous system has 2 modes: sympathetic nervous system (fight or flight), and parasympathetic nervous system (rest and digest). Don’t worry too much about the names of these 2 modes, they were given hundreds of years ago and the original theories around what they did, turned out to be untrue.

To balance your autonomic nervous system in the long term, you want to make sure your life includes activities that you find fun or relaxing: exercise, time in nature, and time with friends (especially if that includes a good laugh).

In the short term, breathing exercises can be an amazing way to calm your mind. Every health guru will have their special breathing technique, but the basic formula is the same: breathe out for longer than you breathe in. They must

be done through the nose and without taking in more air than you normally would, sometimes they include holding your breath.

For me, I’m someone who has had asthma, and still do from time to time, so I find breath holds more difficult. But what I do find is that breathing exercises not only calm my mind but improve my asthma. If you want breathing exercises specifically for asthma, look into the ‘Buteyko breathing technique’.

Ideally, these exercises would be done for around 15 minutes twice a day, in a place with no distractions or conversation. You need to be straight, so that your diaphragm and whole lungs are used: sitting, standing or lying down. I often use them when I’m lying in bed and can’t relax to fall asleep, I rarely get to the 15 minutes before I’ve drifted off.

The way I like to do it is to breathe in for 4 counts, then out for 5 counts, the length of the counts should be just a little slower than your normal breath in. It shouldn’t feel difficult, but an easy flow to get into.

I sometimes find it a little difficult to get into the rhythm at first, especially if I haven’t done it for a while, or if I’m

particularly stressed. Some signs that you’re doing this correctly are: increased saliva in your mouth (after all, it is called rest and digest), and increased blood flow - if you’re someone with cold feet, you will find that the increased blood flow should warm your extremities. For me once I’ve been breathing like this for 5 minutes, my mind starts to feel amazing. I would describe it as a calm with joy.

If you need any further support to calm your mind, I have many natural products that can make a massive difference with this.

During May through to July, Wyreena’s Arts Lounge will feature two new exhibitions from Nicole Tomlinson and Robyn Gunther.

Tomlinson presents evocative sculptural works that explore masking, identity and the duality of our inner and outer worlds; while Gunther’s acrylic and mixed media ‘mindscapes’ play with the abstract form, referencing the real world, whilst more concerned with what lies beneath.

About the artists

Nicole Tomlinson

Masking and Identity - Facades We Adopt and Truths

We Conceal In this series of ceramic sculptures, Tomlinson explores the delicate and complex terrain between who we are, who we think we should be, and what we hide in the name of survival. Each mini collection dives into a different layer of identity, protection and vulnerability.

In Collection One: The Protagonist and Her Masks, lies the chaos of constructed identity. The curated quirks we show the world, the traits we cling to, in order to feel unique. Some masks are chosen. Some are assigned. Some we barely notice we've put on. This work challenges the idea of a fi xed self. Identity here is seen as fragile, often laughable, sometimes sacred—a collection of chance, defense, and deep yearning.

Collection Two: “I’ll Give You Something to Cry About”, refl ects the duality of memory and survival. A mother losing

touch with her inner child. Children who know how to fi ght back in the only way they can—through make-believe.

In this exhibition Gunther, an abstract artist, poet and photographer, displays paintings representing alternate depictions of reality. Gunther communicates her concepts of landscape by combining her love of colour, form, line, gestural markings and design without completely abandoning representation. With acrylic as Gunther’s principal medium of choice, she applies many layers of paint and other mediums using various brushes and markmaking tools, as she travels within the works. Gunther’s landscapes emanate from her imagination, with references to the real world, but unrestrained by it.

Gunther starts a painting with the open mindedness of an explorer. “For me, there are moments in the making of my works which are like a veil lifting and everything becomes clearer. I can see a path and, even though it may meander, it becomes well defined.”

“There’s always poetry in these ever-changing paintings and it shapes how I navigate all my works. After all, the word ‘poem’ comes from the Greek word for ‘create’.” Gunther likes to present possibilities of what may lie beneath the strata no geologist has minded, or beyond reality - travelling without boundaries.

Many people are relying more on the convenience of prepared meals and packaged foods, which often come wrapped in plastic. With stores open around the clock, it’s easy to pop in for a quick top-up, but this convenience can lead to increased waste.

Join podcaster Mardi Lee from ReNewy Living for this free webinar to learn tips and tricks to reduce food and plastic waste in your household. We’ll help you take the time to plan your meals each week, make the most of your pantry staples, and use leftovers creatively—all while learning how to best store food to maximise freshness. By planning and cooking with intention, you’ll feel good about reducing your environmental footprint by cutting down on food and plastic waste in your everyday life.

Our goal is for you to feel confi dent and relaxed about using the ingredients you already have, and embracing the simplicity and satisfaction of smart meal planning. You'll leave with practical tools and strategies to plan your meals, reduce food waste, and minimise plastic use.

Come along and meet like-minded people and help us enhance the natural environment in Croydon Hills.

Join the Friends of Candlebark Walk Reserve for a day of planting. Take this opportunity to contribute to the preservation and enhancement of Maroondah's natural environment by reintroducing indigenous plants back into our parks and reserves.

Working bee details

• Date: Sunday 15 June

• Time: 11am to 1pm

• Meeting point: At the rear of 55 Croydon Hills Drive, Croydon Hills

• Please wear sturdy shoes, long pants, and a long-sleeved shirt , as well as weather appropriate clothing (hat, sunglasses, warm jacket etc.)

Please bring:

• gardening gloves

• gardening tools if you have them (i.e. small spade)

• drinking water

• snacks

• sunscreen

• any medication you might need (such as an epi-pen)

When you turn 18, you should be ecstatic and full of newfound freedom. However, leaving the out-of-home-care system can feel like being tossed off a cliff for many young people— isolated, unprepared, and unsupported.

This inevitably leads to already disadvantaged young people experiencing homelessness, mental health issues, and other social challenges.

That’s where Anchor’s MyLife comes into play.

Anchor offers a specialised support program called MyLife that is designed to help young people transition out of care. It provides them with the necessary life skills, emotional support, and continuous motivation to face adulthood with confidence and hope.

This is all about helping young people to forge their own pathway and create a brighter future.

Meet Ella.

Ella is eighteen. She has had years of trauma as a result of her father's abuse, as well as an intellectual disability. After experiencing severe sexual assault and having a mother who was unable to defend her due to her own disability, Ella was removed from her home by Child Protection Services at the age of 16 and placed in residential care.

She also had trouble handling her money and was frequently the victim of internet fraud, losing money to strangers after inadvertently disclosing her personal information. Anchor provided her with advice on how to spot scammers, protect her identity, and use the internet safely.

Ella is a happy Year 12 graduate today. The day she broke the news, her case manager broke down in tears. Anchor is currently helping Ella with résumé writing, job applications, and interview preparation. She is financially astute, adept with technology, and independent of others to manage her life.

Ella's story is only one of many that demonstrate how important MyLife is in changing people's lives. Giving young people the resources they need to live with dignity, safety, and purpose is more important than simply finding them a place to reside when they transition from care to self-sufficiency.

Moving forward for young people who have suffered from extreme trauma, like Ella, requires ongoing, tailored assistance that ignites their self-belief, confidence and motivation.

The journey hasn’t always been straightforward; Ella constantly encounters issues. However, she becomes more confident in her ability to handle life's uncertainties with every stride she takes forward. In addition to meeting a need, MyLife gives young people leaving the care system a way to achieve a future that was unreachable before.

Her removal caused her to be separated from the only family she had ever known, even if it was necessary for her safety. The two years that followed were characterised by instability, including living in an unreliable place, enduring constant bullying, and lacking emotional stability.

Nevertheless, she hoped for a better future in spite of the trauma she had experienced. The sad truth? She didn't yet have the life skills needed to support herself.

At first, Ella experienced anxiety, depression, and a strong mistrust of adults. But Anchor never gave up on her. Her case managers steadily won her trust with their support, kindness and reliability. Ella started to open up, asking for assistance and sharing her goals.

One of the first things she learned was cooking skills. Anchor helped Ella with every step, including meal planning, grocery shopping, recipe reading, and stove safety training. These days, one of Ella's favourite things to do is cook. She looks forward to cooking on her own every day and takes joy in it.

Education presented yet another formidable obstacle.

was only attending school sporadically before joining MyLife. By offering transportation, help with her schoolwork, and constant support. Anchor made sure she showed up there every

In a system where many people fall through the cracks at the age of 18, these young people can not only survive but thrive with the right kind of help, tenacity, and empathy.

Ella's bravery and Anchor's steadfast support show what can happen when no one is left behind.

You can help Ella build a thriving life, against all the odds and the horrors in her past.

Anchor’s mid year appeal is asking people to donate to help change the lives of young people like Ella.

Head to our website to read Ella’s story. Make a donation to become part of the solution to youth homelessness today:

https://anchor.org.au/eofy2025/

Candlebark Community Nursery Inc Sausage Sizzle Fundraiser

Saturday 28th June

9.30 am – 3.30 pm

Lilydale Bunnings

(Corner John and Hutchinson St, Lilydale) Sausages $3.50 (+ bread and onions)

Cold drinks $2

Supporting the Environment Has Never Tasted So Good!

Candlebark Community Nursery, a not-for-profit run by dedicated volunteers, is hosting its monthly fundraising sausage sizzle at Bunnings. We are raising funds to support the nursery’s ongoing work: growing indigenous plants, sharing gardening expertise, and creating a more sustainable future.

While you're there, chat with Team Candlebark for gardening advice and learn about the nursery’s exciting projects planned for 2025 — including site renovations, expanded educational programs, and new ways to connect with the community.

Whether you’re a seasoned green thumb or just after a snack, it’s a perfect reason to visit Bunnings, support local, and be part of something that’s growing.

Candlebark Community Nursery Incorporated

308 Hull Road, Mooroolbark 3138

Open to the public: Tuesdays, Wednesdays, Thursdays, Fridays and Sundays between 9:00 am and 3:00 pm.

Email: info@candlebark.org.au

Phone: (03) 9727 0594 or 0494 088 804

Learn Scottish Country dances

• Learn the basic steps & formations

• Increase your fitness

• Add more fun to your life

• No previous experience necessary

• No partner required

Kilsyth Scottish Country Dance Group Inc

Invite you to our

Unlike Highland Dancing Scottish Country Dancing is known as the Ballroom Dancing of Scotland and includes Reels, jigs and the slower, graceful strathspeys

Croydon Senior Citizens Hall, Unit 1, 7 Civic Square, Croydon (Adjacent to the Library)

Door unattended, please ring bell on far right for entry

Contact: Ruth 0414 752 432 Lori 0407 501 089

By Warren Strybosch

As an accountant who looks after SMSF returns and as a financial advisor with SMSF qualifications, I often get asked if people should have a SMSF or not and what would be reasons for setting up a SMSF.

Let me get straight to the point. The only time I believe someone should set up a SMSF is if they want to purchase a commercial property for which their business is going to reside in or the commercial property is being purchased to help a family member to run their business from. Otherwise, I cannot see the value in setting up a SMSF.

I know, you get told you have more control, it is transparent, and you can invest in all types of weird and wonderful things. Yes, SMSF allow you to invest in different things e.g., Crypto and/or derivatives, but for most people who do this, they tend to lose their money when investing in these more speculative investments. When it comes to control and transparency, this is now lesser of an issue and one should not be encouraged to set up a SMSF based on these factors any longer.

If we look at the March 2025 quarterly statistical report on the self-managed super fund (SMSF) sector that the ATO produces it highlights the following;

• There are 646,168 SMSFs.

• There are 1,197,293 members of SMSFs.

• The total estimated assets of SMSFs are $1.01 trillion.

• The top asset types held by SMSFs (by value) are:

- listed shares (26% of total estimated SMSF assets)

- cash and term deposits (16%).

• 53% of SMSF members are male and 47% are female.

• 85% of SMSF members are 45 years or older.

What is interesting to note is that approximately 40% of Trustees have investments sitting in either listed shares or cash.

Given that Industry funds now offer access to listed shares and the cash account can be paying higher than term deposit rates, one has to question the viability and costs of establishing and/or continuing with a SMSF.

Also, age is something to consider as well. If we look at the age of members, we can see that over 50% of trustees are over the age of 60 (refer Table 1: Member demographics – age and gender).

This table contains the age distribution of individuals who were members of SMSFs as at the end of June 2024.

The data is an estimate based on Australian Business Register (ABR) data.

The data was extracted on 17 September 2024 and is updated annually.

Table 6: Members, by gender and age range

(Source: https://data.gov.au/)

We are now seeing more people over the age of 70 starting to wind down their SMSF. In part, this is because one of the partners would not want to operate the SMSF when their partner passes away, and due to the increasing costs, compliance, and legal burdens being placed on trustees.

These tables show:

• the proportion of funds by their size (based on asset range)

• the proportion of total assets that are held by SMSFs of different sizes (based on their asset range).

These figures are estimates based on SMSF annual return data for the 2019 to 2023 financial years.

The data was extracted on 12 August 2024 and is updated annually.

(Source: https://data.gov.au/)

Of the roughly 620,000 SMSF that are establish, over 65% have assets held in the SMSF worth more than $1,000,000 and approximately 30% of SMSF have assets over $5,000,000.

With the introduction of Div 296, trustees are going to have to consider the value of holding assets in a SMSF given anything over $3,000,000 is likely to be taxed at 30% (Note: Div 296 has not yet been legislated but is very likely to come into play).

With the increasing costs of running a SMSF and the extra legislative and compliance requirements associated with managing a SMSF, trustees should consider whether they should continue to operate one or close them down.

If you are not sure whether to retain or close down your SMSF, consider speaking to Warren at Find Accountant for a free noobligation discussion.

Warren Strybosch

•

We have made it cheaper and easier for you to get your returns completed & you can do it all from the comfort of your own

Here are the steps involved:

1. Email to info@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address

2. A Tax engagement letter will be emailed to you for signing via your mobile (no printing or scanning required).

3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes.

4. We will then require you to upload your documents to our secure portal.

5. Once we have received all your documentation, we will complete the return.

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf.

•

•

We specialise in the following:

• Biz Pack Insurance

• Landlord Insurance

• Public Liability Insurance

• Professional Indemnity Insurance.

DO NOT provide advice or quotes for the following (you need to go direct and save):

• Car Insurance

• Home & Contents

• Caravan

• eBikes We work with only the most reputable insurers to bring you a range of insurance options for you to choose from:

At Find we can help you find the ‘right’ personal insurance. Our aim is to help you obtain and retain the personal insurances that are appropriate for you and at cost that you can afford.

• Income Protection (IP)

• Total and Permanent Disability (TPD) Personal Insurances Include:

When your insurance are in place, our services do not stop there. We will provide you with an after care service that includes policy notifications, insurance report, help desk, reviews and help at claim time. We provide ourselves in providing honest advice that you can rely on.

warren@findinsurance.com.au

www.findinsurance.com.au

•

•

•

•

•

•

•

•

•

Osteopathy in Australia is a government registered, allied health profession. Osteopaths focus on improving the function of the neuro-musculoskeletal system (bones, muscles, nerves and connective tissues) to optimise health and well-being.

Joanna is highly qualified and experienced in the osteopathic assessment and treatment of babies and infants.

She can assist with the following assessments:

• Gross motor development (milestones)

• Primitive reflexes

•

•

IBCLC lactation consultants are recognised around the world as the experts in lactation care. They provide evidencebased knowledge to assist mothers to establish and maintain breastfeeding. As professionals, they are charged with promoting, protecting and supporting breastfeeding.

Joanna can help with a broad range of lactation consulting services, including:

• Teaching a new mum how to hold and position her baby to breastfeed

• Assess the suck, swallow and breathing of an infant

• Assess for tongue function and determine any evidence of restriction (tongue tie)

• Pre and post-frenectomy breastfeeding support

• Help increase or decrease milk supply

Receive Your All About Almond Collection For $49 When You Spend $60. Indulge in the comforting scent of Almond with our All About Almond Discovery Collection.

Spend $60 or more and receive this exclusive kit for just $49. This collection offers a decadent body care ritual, featuring our most loved Almond favourites. Wrap your skin in nourishment and enjoy the deliciously addictive aroma of warm almonds! T&Cs

Get ready to glow and save big! For a limited time, enjoy up to 70% off your MySkin favourites in our EOFY Sale.

Stock up on personalised skincare solutions, top-rated treatments and must-have products at unbeatable prices. Don't miss your chance to treat your skin (and your wallet). Hurry- these offers won't last forever!

Discover more

30% off selected endota New Age skincare*

Shop 30% off selected endota New Age skincare products in spa and online.

Enriched with powerful vitamins and antioxidants, endota New Age™ skincare is clinically tested to deliver agedefying results for a radiant complexion. Speak with our expert therapists for advice on the products best suited to your skin concerns. Sale ends 30 June, get in quick!

Dental - Veneer package offer Take advantage of our limited-time veneer package offer

Our expertly curated veneer packages combine advanced technology, personalised care, and artistry all at transparent, upfront pricing.

In-Kind Sponsorship with Find Maroondah Community Paper

We invite a representative from each sporting club to submit team selections, results and any interesting stories relating to your club/sports.

For more information contact: Warren on 1300 88 38 30 or Email: editor@findmaroondah.com.au

Friday 5th July | 7PM | Norwood Clubrooms

Beyond the Wood is Norwood’s very own winter celebration of music, mates, and immersive vibes.

Inspired by the energy of outdoor festivals, Beyond the Wood brings the party indoors for one unforgettable night. Expect festival-style lighting, high-energy DJ sets, and a crowd full of good vibes. The lineup features some of our favourite local talent, including Norwood’s very own Joel Richards behind the decks. This event is all about community, connection, and cutting loose. Whether you’re owning the dancefloor or soaking up the atmosphere, you’ll be part of something truly special. Early bird tickets: $15 (available until 25th May) General tickets: $20 (from 26th May onwards)

Secure your spot, bring your crew, and get ready to go Beyond the Wood https://www.trybooking.com/DCGEG

Congratulations to Abbey Chapman, yesterday’s Hoyt Eastland Best on Ground award winner in Norwood Football Netball Club Senior Women’s Match of the Round victory! Five goals for Abbey yesterday at Templestowe Reserve!

Coaching Announcement!

Eastfield is excited to announce that Ben Anderson has re-committed to the club as the senior coach for 2025/26 as well as the First XI Captain.

Ben has shown great leadership in the 2 seasons he has been at Eastfield and has been able to demonstrate incredible player development throughout the entire cricket club.

Ben is excited for the future at Eastfield and the possibilities ahead of us. We couldn’t be prouder to have Ben on board at Eastfield.

Stay tuned for more player announcements in the coming weeks.

The announcement we have been waiting for!

We are so thrilled to announce Lachlan Clarke will be returning to Eastfield for 2025/26.

After a great first season impacting with bat, ball and in the field, Clarko has also had a huge impact off the field at training and in junior program.

An energetic cricketer who impacts all 3 phases of the game, we are excited to see what Clarko can do this season at the nest.

Join us in welcoming Clarko back for this season and keep an eye for another signing real soon.

Player Announcement

We are excited to announce that Cody Andrews will be joining the Eastfield family in 2025/26.

An exciting opening bowler that compliments our current bowling stocks and brings a difference with experience, bowling in Meehan Shield, Newey Plate and the Trollope Shield in the past 2 years.

84

Please join us in welcoming Cody to the nest for this season!

Simply upload your ad at www.findmaroondah.com.au/nfp-free-advertising or you can email the ad to the editor@findmaroondah.com.au and we will do the rest for you.

Senior

Karen

NextGen

Worship

Transform

Community

Children's

Youth