Dear Friend of the Foundation,

It’s estimated that only one-third of American adults have a will or estate plan. The Community Foundation often works with those in our community who are interested in including charitable organizations or causes in their estate plans, and we know just how important it is to have a plan to ensure your family and assets are secure and your wishes are fulfilled. As we head into spring, this fresh start is a great reminder to start your planning or review and refresh of any plans you have.

Take this opportunity to schedule an appointment with your team of advisors to consider any changes or confirm your plan is set the way you’d like. Additionally, ask your team about the best way to include charitable giving in your plan. Not only will this establish a legacy for you forever, but it might also have tax advantages for you and any heirs.

There is no shortage of critical nonprofit organizations doing important work in our community. You can make a charitable gift, now and through your estate, to any fund through the Foundation. If you’d like to support a cause more broadly, consider a Field of Interest Fund for any area, like education, health, and many more. In this magazine, you’ll read stories of four local philanthropists and how they’ve planned to support the causes they care about.

For more than 30 years The Community Foundation has been facilitating planned gifts to honor donors’ intent for generations after they’re gone. So far in those 30 years, we’ve awarded more than $85 million because of the generous people in our community. Regardless of the intent of your planned gift, know that we are here to partner with you to generate Funding Forever to improve the quality of life for all in Hancock County.

Thank you for another year of support!

Sincerely,

BRIAN P. TREECE, ED.D. PRESIDENT & CEO

Through The Community Foundation, you can support your 4-H Club, FFA Chapter, scholarships and more…forever.

Gifts of Grain can help reduce your taxable income and save money with your harvest. Transfer a portion of unsold crop to The Community Foundation and your gift can be used to create a fund of your own or given to an established fund for a cause or organization you care about. Learn more at community-foundation.com/grain.

Commodity harvested

Transfer at elevator

Sale proceeds to The Community Foundation

Support your cause or organization forever!

Giving through The Community Foundation is easier and more accessible than ever. By giving to the Acorn Fund, you’re doing good as you build your own fund on your own time. You can make donations of any amount to accumulate a giving history to eventually create your own endowed fund. As the Acorn Fund grows, it will award grants to meet the community’s most pressing needs.

• When giving to the fund, the Foundation will track your giving history.

• You will be notified when your donations reach the minimum fund balance.

• Once it reaches the minimum fund balance, you may transfer the total sum of your gifts to create a new endowed fund at the Foundation.

• The annual fund distribution will be used for responsive grants, approved by the Foundation board, to meet the community’s needs.

• An annual update will be shared, detailing your giving history and any grants awarded by the fund.

Contact Tasha Dimling, Rachel Gerber or Andrea Reinhart at the Foundation for more information on either of these opportunities.

Planned giving is a way to make a lasting impact on the causes you care about. It is a thoughtful, long-term approach to philanthropy that allows you to achieve your charitable goals while also meeting your financial needs. The Community Foundation works with with individuals, families, organizations, corporations and professional advisors to make your goals a reality.

"Knowing that an organization like the Foundation will carry out your wishes once you’re gone is a great feeling."

Jeff Wobser grew up on the north side of Findlay and was no stranger to the pool deck during his youth. He swam competitively, which eventually gave him the chance to go to college to swim. He met his first wife, Jane, who was a diver at the University of Tennessee. Jeff and Jane never had children, and after she passed, Jeff decided to put a plan in place for the money they’d saved together.

“With our shared love of swimming and diving, it just made sense,” said Jeff. “My plan is to put remaining funds after I pass into a fund at The Community Foundation to support a thriving competitive swimming community here in Hancock County. Competitive swimming and diving gave Jane and me great life experiences and opportunities. We want to do what we can to ensure those opportunities continue here.”

Jeff is working with donor engagement staff at the Foundation, as well as his attorney, to put his plan in place to solidify his legacy.

“It’s not an easy conversation with yourself or your family,” he said. “But once you get past that hurdle, you can look at what you might do with your legacy and your remaining wealth. Knowing that an organization like the Foundation will carry out your wishes once you’re gone is a great feeling.”

Becky Stooksbury heard about The Community Foundation through friends. After talking to her attorney, she decided the Foundation was “a very worthwhile organization and something to pay forward with.”

Working with her attorney, she named The Community Foundation the beneficiary of her IRA. Additionally, Becky is co-owner of a house on Lake Erie. After her lifetime when the house is sold, the proceeds will also add to her funds at the Foundation. Becky’s goals are to support autism programs and the Humane Society in Hancock County.

“I want to put my money to good use,” Stooksbury said. “That’s all I want in a nutshell. And to encourage people to think about your situation down the road. You can always start small, but that small amount will grow. And every little bit helps.”

Becky was inspired to support these two causes in vastly different ways. She has extended family members who have autism, and she believes there’s an increased need locally for services. The inspiration for supporting the Humane Society was two-fold.

One afternoon she was dropping off items to donate at the Humane Society where she saw a large dog caged and shaking. Becky was raised by two animalloving parents and has a dog herself. Seeing the dog pulled at her heart strings.

“My heart just broke for that dog. I decided right then and there I would split my gift between autism and animals.”

Later, Becky was traveling and saw a dog park with sculptures, water features, benches, shade and other enrichment opportunities for dogs. As a pet parent of a small Yorkie, Becky knows the value of a safe space for dogs to be off leash. The sale of the lake house will support the Riverbend Dog Park.

“If you’re planning your estate and are thinking about a cause or organization, call The Community Foundation and tell them that's what you're thinking about,” said Stooksbury. “They’re there to help you be successful.”

“I want to put my money to good use and to encourage people to think about your situation down the road. You can always start small, but that small amount will grow.”

William and Eveline Stitt had deep roots in Hancock County.

Born and raised in Findlay, Bill graduated in the Findlay High School Class of 1956. Eveline was born in Paris, France, where she met Bill during his Army service. Following their marriage and completion of school, Bill practiced internal medicine in Oxford, Ohio, where they raised their two daughters. After retirement, Bill and Eveline returned to Findlay, actively volunteering as tutors in the schools and with the Blanchard River Watershed Project.

During their lifetimes, Bill and Eveline worked closely with the local team of professional advisors to create an estate plan to include the causes and organizations they were passionate about.

Bill and classmates Jane O'Neil, Bob Walland, and Dee Walland established the Findlay High School Class of 1956 Scholarship for their class’s 50th

reunion. The scholarship benefits FHS graduates pursuing a degree in education. Bill and Eveline included the class’s scholarship fund in their estate plans to ensure the fund would continue to grow and award for many generations. Today, more than $250,000 has been awarded.

Bill and Eveline were champions of education and wanted to support literacy in the community as well. Through their estate plans, they created the Bill and Eveline Stitt Fund to support early literacy intervention using mentors. The intervention program is designed for K-2 students and is targeted toward the most at-risk local students. Nearly $1.5 million has been awarded to support students so far.

The Community Foundation has supported donors in their planned giving for more than 30 years.

With a proven track record of fulfilling donor intent and growing funds to support the community, our staff is happy to work with you and your team of advisors to make your charitable goals a reality. Find more planned giving stories and resources at community-foundation.com/legacy.

Because of the seeds you plant with your gift, Hancock County will have

Through the power of endowment, both the Stitt Fund and the Class of 1965 Scholarship will continue to grow while awarding to worthy students and schools in our community. Funding Forever.

The latest funds established by generous philanthropists and organizations in the community.

• Officer Douglas T. Akers Memorial Scholarship

• Arcadia Local Schools Growth Fund

• Jim and Nancy Firth Donor Advised Fund

• George G. Fletcher Memorial Scholarship

• Heacock Family Scholarship

In 2023, The Community Foundation partnered with the Lilly Family School of Philanthropy to bring the IUPUI Fund Raising School to Findlay. Several Community Foundation staff members have traveled to Indianapolis to attend Fund Raising School classes in the past, and suggested offering them locally to nonprofit organizations who may not have the time or resources to attend out-of-state.

In 2023, 35 participants representing 23 organizations attended the first of four classes in the Fundraising Management Series. The Principles & Techniques of Fundraising was a four-day workshop to teach the triedand-true practical skills of effective fundraising. Brooke Nissen, executive director of FOCUS Recovery and Wellness Community, attended the class. “As someone who had limited experience in fundraising, participating in Principles and Techniques of Fundraising course made fundraising not seem like such an intimidating concept,” said Nissen. “The learning opportunities this course provided helped me see fundraising is a different way for meaningful engagement to happen in our community. The course also helped me identify some action steps I needed to take to be successful in implementing the principles and

• James Rettig, Jr. Memorial Scholarship

• David C. Rinebolt Memorial – Be Good to One Another Scholarship

• Andrew Walker Memorial Scholarship

Visit community-foundation.com to read about these funds and many others.

techniques to fundraising. I want to give a sincere thank you to The Community Foundation for being awesome and providing this opportunity.”

The investment to bring this class to Findlay saved these organizations a total of $92,960, or $2,650 per participant. Additionally, it gives participants the opportunity to step outside of their offices for four days of professional development.

In 2024, we are offering two more IUPUI Fund Raising School classes: Major Gifts and an Introduction to Digital Fundraising. Those who complete all four Fund Raising School classes will receive a Certificate in Fundraising Management.

2023 Lilly School Class Graduates

Foundation President & CEO Brian Treece presents Brooke Nissen with her certificate of achievement.

2023 Lilly School Class Graduates

Foundation President & CEO Brian Treece presents Brooke Nissen with her certificate of achievement.

When you signed up for your first retirement plan, you were likely presented with a “beneficiary designation” form. You examined your life circumstances at that moment in time, and determined who was the most suitable beneficiary. Perhaps you listed your spouse, child, sibling, or friend. Maybe you even listed a “contingent beneficiary” (someone who would receive the benefit if the primary beneficiary died). You filled out additional “beneficiary designation” forms when you signed up for life insurance policies and when you started a new job with retirement benefits or a health savings account.

But did you update those forms when your life circumstances changed? Perhaps you got married or divorced, a loved one died, you had or adopted (more) children or grandchildren, or a trusted friend or loved one fell out of your life by choice or circumstance. If you did not update those forms, your loved ones may be in for an unwelcome surprise. So, let this serve as a reminder to make those updates now.

If you have failed to review and update your beneficiary designations, you are not alone. In one recent Ohio case, a deceased husband’s and father’s retirement benefits were paid over to his parents because he failed to update the form after marriage and fatherhood. Though you might anticipate that the parents would use the funds to benefit their son’s widow and children, there are several legal hurdles: (1) the parents will be personally subject to tax rules and penalties; (2) the transfer into or out of the parents’ names may affect the parents’ eligibility for disability or nursing home benefits; and (3) the parents are not legally obligated to use the funds for the widow and children. So, let’s not rely on the listed beneficiaries to graciously fix your omission.

State law has attempted to “cure” some of the most common omissions. For example, Ohio has a rule that a divorce or dissolution will automatically revoke a designation of the ex-spouse as a beneficiary, but there are several exceptions to when and how this rule is applied. Likewise, there is a law that will add an “after-born” child to your will, but that law does not apply to life insurance policies and retirement accounts. So, let’s not rely on the “law” to fix your omission.

Your beneficiary designations should complement (work together with) your will, trust, and other estate planning documents, and should be reviewed and updated regularly. Ask your lawyer or financial advisor whether and how to update your beneficiary designations for all of your financial assets.

The Foundation is pleased to welcome Rachel to the Foundation team. Rachel will serve as Donor Engagement Officer. In this role, she will work with donors to grow their involvement with the Foundation and leading outreach efforts. Rachel previously worked for the Foundation from 2013-2015, and we are glad to have her back on our team!

Contact Rachel at rgerber@community-foundation.com or (419) 425-1100.

Charitable University is a learning platform developed by the Ohio Attorney General’s Office to provide tools on some of the most important elements for leading a charitable organization, including governance, governmental filings, financial operations and fundraising.

We are proud to announce that The Findlay-Hancock County Community Foundation is the first community foundation in Ohio to have all staff, board and committee members complete the training requirements and receive completion certificates.

This certification demonstrates our commitment to our donors and community.

At the February meeting, the Foundation Board awarded grants totaling $888,484. Responsive grants were awarded to:

• Arlington Local Schools

• Awakening Minds Art

• Children’s Museum of Findlay

• City of Findlay

• Crime Prevention Association of Findlay-Hancock County

• Findlay Hope House for the Homeless

• FOCUS Recovery and Wellness Community

• Habitat for Humanity of Findlay/Hancock County

• Hancock County Veterans Services

• Hancock Properties Foundation

• Hancock Public Health

• Lima Symphony Orchestra

• St. Andrew’s Church

• University of Findlay’s Mazza Museum

• Village of Jenera

The Foundation offered a special grant opportunity for activities and education related to the upcoming total solar eclipse on April 8. The Board approved grants totaling $81,803 to following organizations:

• Arlington Local Schools

• Black Swamp Area Council, Boy Scouts of America

• Findlay-Hancock County Public Library

• Hancock County Educational Service Center

• Hancock Public Health

• Imagination Station

• Ohio Department of Natural Resources

• Riverdale Local Schools

• University of Findlay

• Vanlue Local Schools

Visit community-foundation.com to read more about these grants and the others awarded.

Habitat for Humanity is a global nonprofit housing organization working in nearly 1,400 communities across the United States and in approximately 70 countries around the world. Habitat’s vision is of a world where everyone has a decent place to live. Habitat works toward its vision by building strength, stability and self-reliance in partnership with people and families in need of a decent and affordable home. The Foundation supported Habitat projects including: the Financial Opportunity Center, Critical Home Repair Program, homeowner education series, and more. Consider the following fund on community-foundation.com to help to advance their mission to build homes, communities and hope.

Your support of their work is appreciated!

In January 2023, The Community Foundation launched Fun for All. The goal of this program is to provide affordable, family friendly activities in Hancock County, which we’ve repeatedly heard is a challenge. Last year, more than 10,000 people attended these events, and we’re thrilled to continue these offerings in 2024. Visit community-foundation.com/fun for the schedule, which we add to regularly!

Our 2023 events included:

• Movie nights at MCPA

• Saturday events at 50 North

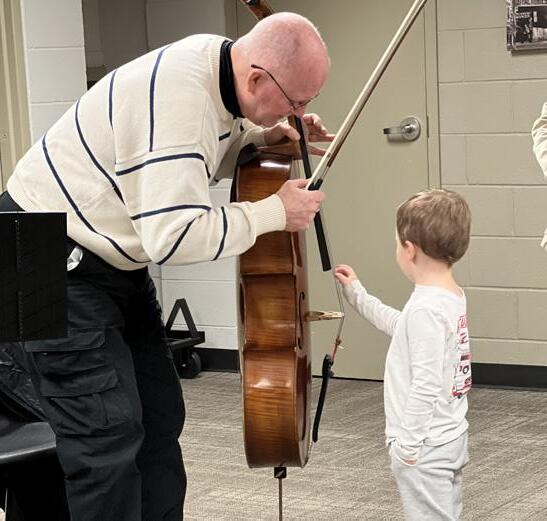

• Symphony Storytimes at the library

• Free skating days at the Cube

• Free play days at the Children's Museum

• Live@Armes performance

• Book launch event with Mazza Museum

• Free admission days at all Hancock County public pools

• Free boat and kayak rentals at the Hancock Park District

• A family series performance at the MCPA

• A Fort Findlay Playhouse performance