THE FIFTH DIMENSION SUMMER EDITION 2023

A Comprehensive Analysis of the Metro Vancouver Multifamily Market

Produced in Collaboration With:

Produced in Collaboration With:

Fifth Avenue is a proud partner of Peerage Realty Partners whose BC network includes Sotheby’s International Canada and Okanagan-based Epic Real Estate Solutions Inc. as well as strategic partnerships with Vancouver Island based DFH Real Estate and Island Realm Real Estate. Together we cover British Columbia’s ever changing and expanding new home market. As a service to our industry we provided a definitive guide on the new multifamily home market in Metro Vancouver each season of the year.

This summer edition is produced by Fifth Avenue Real Estate Marketing Limited, a leading full service, suburban market-focused residential real estate sales and development marketing organization and Central Vancouver based organization, BakerWest Real Estate Incorporated. The supporting data for this report is objectively collected and presented by renowned and renamed Zonda Urban, a leading provider of advisory services on the new Multifamily home market and a vital contributor to this report since 2010.

We start this summer edition of the Fifth Dimension grateful to those who courageously have been battling wildfires throughout BC and Canada. Our hearts ache for those who suffered a loss of home. Thank goodness there has been no loss of life in BC. We are also grateful that as of this week and based on discussions with our related Okanagan based company, EPIC Real Estate Solutions Inc., the situation is improving.

The dog days of summer are certainly upon us as consumers, realtors, and the industry as a whole continue to navigate the current rapids of one interest rate increase after another. Despite the expected rise in late summer, there is much discourse as to when this trend will begin to subside. At the same time, supply remains a recurrent theme falling on selectively muted ears. That being said, the Provincial Government has amped up an offence unveiling it’s ‘naughty’ cities list thereby adding heat at the municipal level of government with respect to the inadvertent constraint of housing. More specifically, BC’s leadership has spotlighted 47 cities, however, the specifics of the spotlighting remain a mystery. Such vagueness underscores the view that the overall

market roadmap is still strewn with uncertainties and challenges. It would appear that without advanced targeted action vs. policy, and given cost inflation, supply will remain restricted this fall and into 2024 compounding affordability challenges.

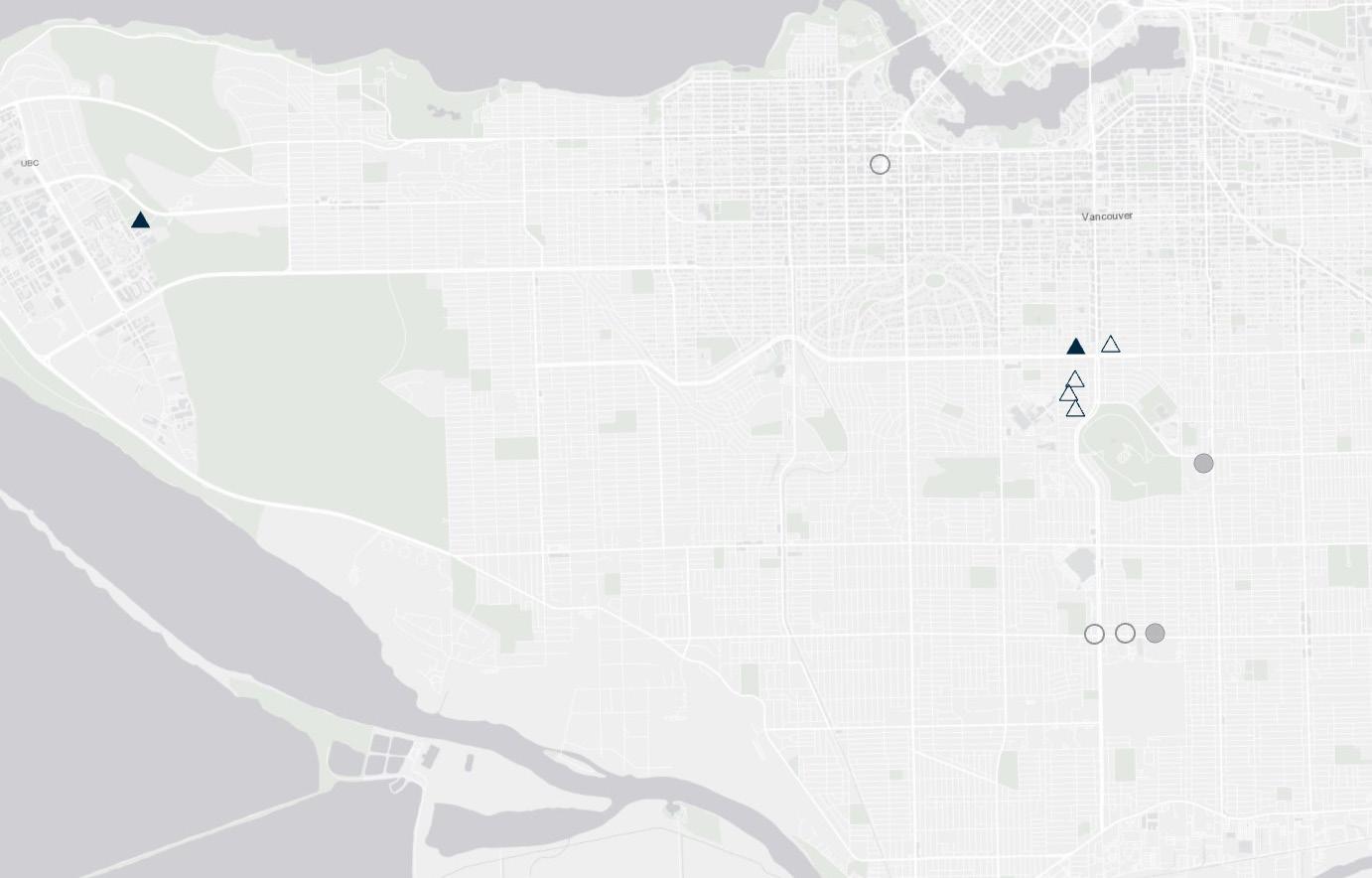

Amidst this backdrop, the remaining chapters of the 2023 market story will soon be revealed. While the market may have appeared to be more typical this summer, Vancouver Downtown pivoted from a cautionary “red light” in the First Quarter to an optimistic “green light” in the Second Quarter with a mere 17 new home sales in the first quarter being eclipsed by 124 new homes sold in the most recent quarter. This acceleration was marked by the introduction of Curv by Brivia Group and Henson Developments. Super prime real estate is certainly the focus and this singular statement in response to climate change in the form of housing is merely getting started while welcoming other market entrants this fall. This is a market to watch.

The dynamic overall market landscape included promising shifts within central markets including Vancouver East, Vancouver West, and Richmond all transitioning from a cautious “yellow lights” in First Quarter to encouraging “green lights” in the Second Quarter. Meanwhile further to the east the suburban and Fraser Valley market area are all a “green light” heading into the fall with one execption. Ridge Meadows has been upgrade from a “red light” to a “yellow light” largely due to a lack of supply.

Beneath these numbers lies a compelling narrative of affordability. Downtown Vancouver’s luxury market may have surged this quarter largely propelled by a singular development’s success and strategy. However, the heart of the Fraser Valley beats to a different rhythm. Here, the spotlight is on one product type. As Townhomes in the Fraser Valley approach the million-dollar average including GST, the Low Rise Condominium product market is most active. This sector represents the most accessible, and affordable new home offerings across all the markets.

In the 14 years we have been involved in this reporting exercise, the intricacies of these market shifts and the evolving definition of ‘affordability’ are noteworthy. It seems that affordability is at a cross road. The story seems less about what the average person can afford and how to deliver lower cost product. Instead, it is more increasingly about what added taxes and charges governments pile onto developers leaving the consumers facing added inflationary pressures across the province.

The specter of inflation casts a long shadow and as of this report, the recent rate hike has tempered inflation to 2.8 percent, a significant retreat from the 5 percent reported in our previous edition of the Fifth Dimension. The Bank of Canada (BOC) has it’s eyes set on a 2 percent inflation benchmark for 2024. Should they opt for another rate hike come September, this target might be within closer grasp than anticipated. By the close of the Fourth Quarter, we remain hopeful for a cessation in rate hikes and actual declines at some point in 2024.

As the summer passes and we head into the busy back to school season we wish everyone a healthy and happy conclusion to the year that is 2023.

Regards, and all the best.

Jamie Squires Jamie Squires President & Managing Broker Fifth Avenue Real Estate Marketing LTD.Jamie@fifthave.ca

In this Second edition of the Fifth Dimension for 2023, our data collection and analysis partner Zonda Urban shares its commentary on the most recent quarter, market performance year to date, and what to expect in the upcoming quarter with respect to Metro Vancouver’s multi-family residential real estate market.

In the pulsating heart of Metro Vancouver’s real estate landscape, the Second Quarter of 2023 emerged as a phoenix, signaling the hope of a robust recovery. This rejuvenation is particularly striking, given the backdrop of near-historic low sales that cast a large shadow over the closing months of 2022 and the dawn of 2023. The numbers speak volumes: a formidable 66 percent surge in sales compared to the preceding quarter.

This renewed vigor in the market, buoyed by heightened consumer confidence, has rekindled the spirits of developers. They’ve responded in kind, with the unveiling 37 ambitious new projects, translating to 3,654 units—a stark contrast to the 12 projects (1,415 units) that saw the light of day in First Quarter. The sales total for the Second Quarter stands at 3,554, reflecting the numbers from the Second Quarter of 2020, prior to the rapid market escalations of 2021.

Yet, the story doesn’t end here. As we closed the quarter, 8,027 units remained—both released and unsold. This marks an eight percent uptick from the First Quarter and a seven percent climb year-on-year. Furthermore, 1,010 completed yet unsold multi-family homes punctuated the end of the Second Quarter, showcasing a growth from both the previous quarter and a significant leap from the prior year.

In the towering realm of Metro Vancouver’s High Rise sector, the

Second Quarter of 2023 unfurled a narrative of growth, albeit with a touch of nostalgia. The Second Quarter witnessed 1,665 High Rise sales, marking a 29 percent ascent from the First Quarter. However, when juxtaposed against the same period last year, it’s a 26 percent descent. These High Rise transactions constituted a significant 47 percent of the Second Quarter’s new home sales.

As the curtain fell on the Second Quarter, a pool of 5,395 High Rise units—released yet unsold—awaited potential homeowners, reflecting a modest three percent growth from the First Quarter and a two percent year-on-year increase. The epicenter of this High Rise activity was unmistakably the Central Surrey/North Delta market area, commanding a robust 28 percent of all High Rise sales for the Second Quarter.

When we cast our gaze wider to include the Tri-Cities and Burnaby/ New Westminster market areas, a staggering 68 percent of High Rise sales come into focus, which translates to 32 percent of all new multi-family home sales for the period. The Second Quarter’s limelight was shared by a few standout projects, arranged from Vancouver Downtown to East: Lucent by Landa Group at UBC, Perla by Polygon in Metrotown, Wesgroup’s Harlin in River District, Intracorp’s inaugural tower of Gardena in Burquitlam, ML Emporio’s Sequoia, and Lucent by Landa Group in Surrey City Centre. The 1,203 new Low Rise Condominium sales recorded in the Second Quarter of 2023 were 125 percent higher than the previous quarter but 34 percent fewer than the number sold in the same quarter last year.

The increase in sales when compared to the previous quarter can be explained by an increase in project launches to the market; 15 new Low Rise projects were launched during the quarter which added 1,464 units to the market. This compares to the three new

project launches with 251 released units in the previous quarter. The 1,661 released and unsold units at the end of the Second Quarter represents a 37 percent increase from the previous quarter. The Central Surrey/North Delta and Tri-Cities market areas experienced the highest number of new Low Rise multi-family home sales in Metro Vancouver as they accounted for a combined total of 576 unit sales in the Second Quarter. Notable sales activity across Metro Vancouver’s Low Rise Condominium sector was observed at Westminster Plateau – Vista by Milkai Developments and Pacific Hills Developments (Mission), the first phase of Portwood by Edgar Development (St. Johns), the fourth and fifth building of Fleetwood Village II by Dawson + Sawyer (Fleetwood), Redekop Faye’s Jacob (Abbotsford), and Whitetail Homes’ Unity (Langley City).

A total of 685 new Townhome sales were recorded in the Second Quarter of 2023, which represents a 114 percent increase from the previous quarter and a 33 percent year-over-year increase. There were 971 released and unsold Townhome units at the end of the Second Quarter, which is three percent lower than last quarter but 18 percent higher than the same quarter last year. There were 15 new Townhome projects launched during the quarter which released 398 units into the market.

Significant sales activity was observed at The Loop by Gramercy Developments (Grandview Heights), the second phase of The Boroughs, Bexley by Streetside Developments (Grandview Heights), Kadium Properties’ Burqville (Burquiltam), the Parkside Collection of The Robinsons by Formwerks Boutique Properties (Burquitlam), and Zenterra’s Newbury (Yorkson).

A total of 3,430 newer multi-family homes were resold in the Second Quarter of 2023. This total is 66 percent higher than the previous quarter and 18 percent higher when compared to the same quarter in 2022. Comparing activity across product sectors, High Rise, Low Rise, and Townhome re-sales were 56, 80, and 66 percent higher, respectively when compared to the previous quarter and up 18, 26, and 19 percent, respectively when compared to the same quarter last year. Overall active listings increased by four percent when compared to the previous quarter but decreased by 20 percent relative to the same quarter last year. Active listings for High Rise products experienced no change while Low Rise, and Townhome

At the time of publication (July 2023), the Bank of Canada has increased its overnight lending rate as high as five percent and justified its measures as necessary to help bring down core inflation. While higher borrowing costs have challenged many households (especially those with variable rates), the continued substantial immigration and lack of housing to match demand has resulted in all-time high rental rates and a lack of affordable rental alternatives to homeownership in the region. As such, many households who were previously considering renting while waiting for prices to drop have reconsidered their approach.

While Zonda does not collect empirical evidence, it assumes that a notable amount of purchasing activity in the multi-family sector continues to be enabled by financial assistance from parents to children and investors seeking a presale opportunity with a longer closing time frame.

Approximately 1,400 more new home sales were achieved in Second Quarter 2023 when compared to the previous quarter. This increase in sales activity has given developers the confidence to proceed with their project launches. Although year-to-date sales year to date sales are half of what they were last year (thanks BOC), as the Second Quarter comes to a close, we have experienced a season of upward trends in sales absorptions providing us with a sense of tempered optimism with respect to the fall market and into 2024

Notable projects that could launch in the Third or Fourth Quarter of 2023 include: Vancouver Downtown – Anthem’s Park, Landa Global Properties’ 1400 Alberni; Vancouver West - Solterra’s Italia, Gryphon Developments’ Marco Polo, Sightline Properties’ Dahlia, Killarney Group’s Adore; Vancouver East - Wesgroup’s Ardea; Burnaby - Anthem’s Citizen, Shape Properties’ City of Lougheed Tower 3, Shokai’s Metro21, Concord’s Greenhouse, Symphony Homes’ Moonlight Sonata; North Shore - Polygon’s Elle, Fairborne’s Ashton; Tri-Cities - Foster Living’s The Grove, Enrich Developments’ Marlow, Townline’s Terrayne; Richmond/ South Delta – Polygon’s Tailstar; South Surrey/White RockStreetside Developments’ The Boroughs; Central Surrey/North Delta - Streetside Developments’ Juno, Westland’s Core; Langley/ Cloverdale – Mortise’s Unison, Zail Properties’ Aviva, Anxin Projects’ Vera; Abbotsford/Mission - Westcorp’s Cherryville, Heinrichs Developments’ Laurel on Mill Lake; Ridge-MeadowsFalcon Homes’ The North, Raicon’s Rydge, Epic Homes’ The Falls at Kanaka Spring.

2,954

1,738

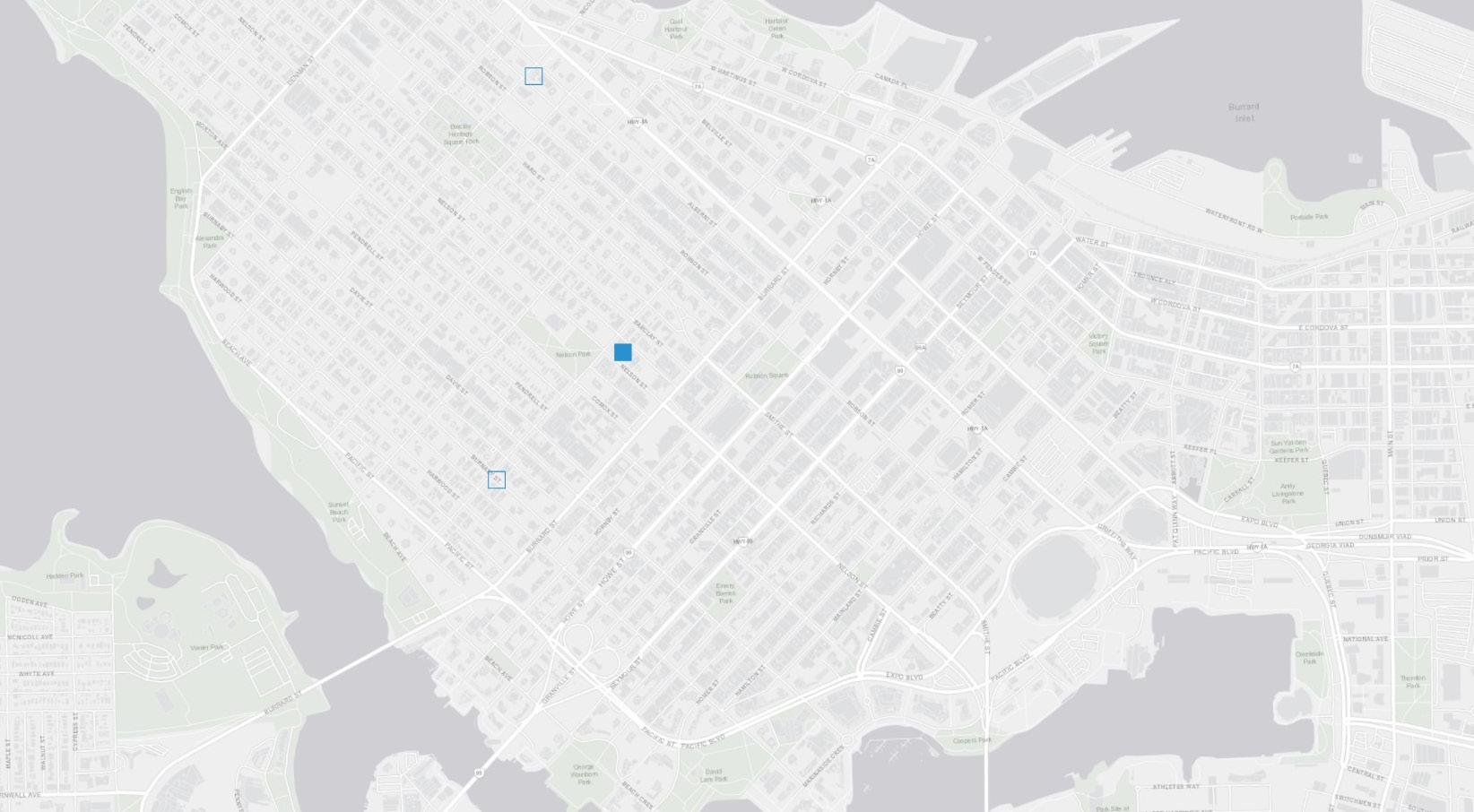

The Vancouver Downtown market area will be given a “Green Light” status for the Second Quarter of 2023, with 124 total sales recorded. The significant sales increase can be attributed to a new High Rise project, which recorded 100 sales, representing 80 percent of total sales in the market area. This project has since brought local end-users and international buyers back into the Downtown luxury market. The success of a new launch in the downtown market area highlights the demand for new products in the market area. Additionally, the market area experienced interest for finished move-in-ready properties, which provided realtor promotions, GST promotions, and credits up to five percent of the purchase price. With this new release of inventory, the Vancouver Downtown market area is expected to see above average sales volume throughout the second half of 2023.

Curv by Brivia Group and Henson Developments 60-unit High Rise started previews in late March and achieved 100 sales to date, at an overall blended price of $2,600 per square foot

8x On The Park by Brenhill, sold three units over the quarter, with just seven move-in ready units remaining

Onni’s High Rise, 1335 Howe, reported five sales throughout the quarter, with 69 remaining units that are now move in ready

Landmark on Robson – East Tower, Asia Standard America’s High Rise achieved five sales over the quarter. The project offered up to $650,000 in savings for first 5 homes sold

Marcon’s High Rise development, Mirabel, achieved six sales over the quarter, with just three units remaining

Westbank’s has two High Rise developments in the interior finishing stages of construction and are anticipated to have occupancy by the end of 2023

Average sales values per square foot have increased by $75 when compared with the Second Quarter of 2022 for High Rise product

The number of High Rise listings has decreased from 252 to 223 but High Rise resales increased by 28 when compared to the Second Quarter of 2022

For High Rise condominiums, the average per square foot values of one bedroom units increased by $112 while two bedroom units decreased by $1 since the Second Quarter of 2022

The months of supply for resales in the High Rise market has decreased from 9.4 months to 6.2 months when comparing to the same quarter last year

The sales range has increased by $60,000 on the lower end and by $535,000 on the higher-end over the past four quarters for High Rise product

The average time a unit is on the market has increased for High Rise by 50 days since the Second Quarter of 2022

For the Second Quarter of 2023, Vancouver West will remain classified as a “Green Light” market area. The market area experienced a 25 percent absorption rate in sales compared to the previous quarter, recording 14 percent. The sales were largely driven by the High Rise sector, which accounted for 80 percent of the total sales. New inventory continues to be limited in this market area as there was one new project launch. The new project achieved 60 percent of the total sales throughout the quarter, indicating high demand for new properties in the area. Many developments have paused sales as they finish construction. The Townhome sector witnessed a 96 percent increase in sales as opposed to the previous quarter, attributed to the implementation of attractive incentives and the introduction of three new projects. Expectations are high for upcoming project launches, which are expected to drive a surge in sales activity in the future.

Wordsworth, by Polygon was launched in late April and achieved 155 sales in its latest UBC High Rise with an overall price per square foot of $1,475

The Townhome portion of West Wind at Lelem by Polygon was released in early June and released 17 units out of a total of 58 units into the market area. The project sold 10 units at an overall blended price per square foot of $1,339

Tesoro, a 96-unit High Rise project by Concert, achieved nine sales at an overall blended price of $1,949 per square foot. Completion is targeted for 2024

Gryphon Development’s, Gryphon Nova, has only one unit remaining as the High Rise achieved 16 sales over the quarter

Listraor’s Townhome project, Boden, achieved 12 sales over the Second Quarter of 2023 at blended price of $1,294 per square foot

Thesis, by Alabaster, is anticipated to release a 69-unit Low Rise project in the Third Quarter of 2023

Total listings and resales have decreased by 46 and 12, respectively, when compared to the Second Quarter of 2022

The average time a unit is on the market has increased for High Rise and Low Rise by five and 19 days, respectively, but Townhomes decreased by eight days since the Second Quarter of 2022

Average price per square foot sales values for High Rise and Low Rise units have increased over the past four quarters by $10 and $40, respectively, while Townhomes decreased by $8

Two bedroom High Rise product saw a decrease of $20, in average price per square foot sales value while Low Rise product saw an increase of $25 when compared to four quarters ago

The sales range has decreased by $63,500 on the lower end and by $259,200 on the higher end since the Second Quarter of 2022 for High Rise product

The Townhomes sales range has increased by $194,500 on the lower end and decreased by $309,000 on the higher-end over the past four quarters

The Vancouver East market area will be upgraded to “Green Light” status for the Second Quarter of 2023, having recorded 143 sales, compared to 21 sales in the First Quarter of 2023. The significant sales increase can be attributed to new project launches across all three sectors. During the quarter, the total sales volume was mainly driven by five new projects, accounting for 75 percent of the overall sales. New inventory in the Low Rise sector increased the active price per square foot from $1,280 to $1,350 per foot. The absorption rates for High Rise, Low Rise, and Townhomes have increased to 24, 25, and 16 percent, respectively. Despite strong sales volume in newer projects there are 191 units that are standing inventory across the Vancouver East market area. Sales are expected to remain strong for the second half of 2023 as more projects are anticipated to be launched.

Harlin, a 334-unit High Rise in River District by Wesgroup, released in late-June and achieved 100 sales at an average price of $1,200 per square feet

Bailey, by StreetSide Developments, achieved 40 sales over the Second Quarter of 2023 after commencing its sales in mid May

Garden 11, by Aree Developments, recorded ten sales and is blending at an average price of $1,250 per square foot

2550 Garden Drive, by Bucci, has 44 move in ready units remaining as they sold ten units over the Second Quarter of 2023 and is blending at $1,290 per square foot

First Track Development’s Townhome project, Woodland Block, recorded 18 sales at an overall price per square foot of $1,225

The average time a unit is on the market has increased for High Rise, Low Rise, and Townhomes by 41, 15, and 12 days, respectively, since the Second Quarter of 2022

Average price per square foot sales values for High Rise and Townhome units decreased by $39 and $38, respectively, while Low Rise units increased by $46 when compared to the Second Quarter of 2022

The months of supply for resales in the Low Rise market has decreased from 4.2 months to 1.6 months when compared to the same quarter last year

The average price per square foot in a Low Rise for a one bedroom and two bedroom unit is down by $8 and $62, respectively, since the Second Quarter of 2022

Total resales have increased by 32 when compared to the Second Quarter of 2022, while total listings have decreased by 71 in that same time span

The average price per square foot for a two bedroom and three bedroom Townhome has decreased by $40 and $42, respectively, since the Second Quarter of 2022

The Richmond/South Delta market area will be upgraded to a “Green Light” status for the Second Quarter of 2023. Sales experienced a remarkable 136 percent increase compared to the previous quarter. Both the Low Rise and Townhome sectors showed robust activity, with the Low Rise sector saw four sales in the previous quarter to 106 sales this quarter. Similarly, Townhomes saw a 157 percent increase in sales compared to the First Quarter of 2023. This surge in activity can be attributed to the launch of four new projects releasing a total of 244 units onto the market and achieving a 42 percent absorption rate. Lower price points played a crucial role in driving buyer interest, exemplified by two new Low Rise projects. One project launched at $999 per square foot, achieved a 20 percent absorption rate, while another, launched at $800 per square foot, achieved a 63 percent absorption rate. Despite uncertainties in market conditions, there are still expectations of further project launches throughout the year, aiming to attract more buyer activity to the market area.

Luxe on Lansdowne by Townline and Canderel achieved 12 sales over Second Quarter 2023 and now has begun construction on site

The Boardwalk – Salt & Meadows 2, an Aquilini Development project sold out its remaining 20 units over the quarter after spending 12 months on the market. With the project selling out, Aquilini Development released the third and final building, Salt & Meadows 3, a 123-unit Low Rise development in mid-June and achieved 25 sales at an overall blended price of $999 per square foot Executive Group Developments released 84 units out of 127 units of the condominium portion of West Coast Estates in early-April and achieved 50 sales at an overall blended price of $800 per square foot

Onward, a 17-unit Townhome development by Kadium Properties launched in mid-May and achieved eight sales at an overall blended price of $1,076 per square foot

Aviary Living was released in early May, a 36-unit Townhome project by Tera Development and achieved 20 sales at an overall blended price of $998 per square foot

**Note: The greater variation in Active Sales Price Range is the result of the achievable sale value differential between comparable product in Richmond and South Delta

Total resales have decreased from 344 to 343 when comparing to the Second Quarter of 2022

The High Rise sales range has increased by $20,000 on the lower end and by $45,000 on the higher-end when compared to the same quarter in 2022

The sales range of Townhomes increased by $30,000 on the lower end and by $101,888 on the higher-end when compared to the Second Quarter of 2022

Average per square foot sales values of High Rise and Low Rise units increased by $17 and $3, respectively, while Townhomes increased by $12 when compared to four quarters ago

Price per square foot sales values for one bedroom High Rise and Low Rise units have increased by $35 and $7, respectively, over the past four quarters

The average sales price of a two bedroom Townhome decreased by $63,932 while a three bedroom Townhome increased by $64,498 since the Second Quarter of 2022

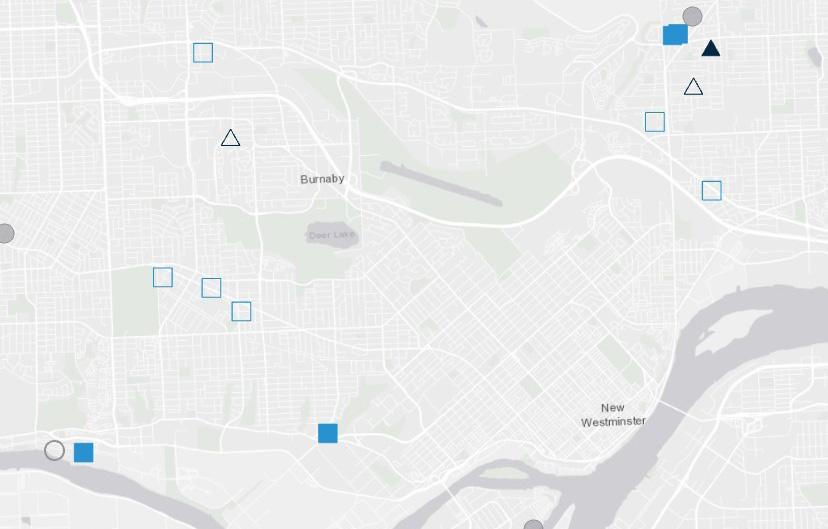

The Burnaby/New Westminster market area has been assigned a “Yellow Light” status for the Second Quarter of 2023. The market area witnessed a total of 331 sales during this period, representing a significant 43 percent decrease from the previous quarter. This decline in sales can primarily be attributed to the absence of new project launches in the area. While other market areas experienced numerous new launches, the Burnaby market area saw none, as developers adopted a cautious approach, waiting for improved market conditions. Within the market area, the High Rise sector continued to be the most sought-after by buyers, accounting for 79 percent of all sales. Developers proactively offered incentives to facilitate the movement of inventory from completed projects, leading to two High Rise projects being sold out successfully. Despite the recent slowdown, there is optimism for the upcoming quarter as several High Rise project launches have been announced. This is expected to drive an increase in buyer activity and potentially lead to a more favourable market performance in the Burnaby/New Westminster market area.

Thind’s three Lumina High Rise towers in Brentwood combined for 70 sales over the Second Quarter of 2023 with Lumina (Starling) and Lumina (Alpha) selling out its remaining move-in ready inventory

Perla, by Polygon recorded the most sales in the High Rise sector with 113 sales over the quarter Polygon’s Low Rise, Byrnepark led all sales in this sector with 32 sales and is now sold out after being in the market for nine months

Timber House by Aragon Properties released a cross-laminated timber (CLT) Low Rise over Second Quarter 2023 adding 87 units into the New Westminster market area and is blending at an average price of $925 per square foot

Portside by Anthem released its final 10 units over the quarter and achieved eight sales and only has two move-in ready homes remaining

Numerous High Rise developments are expected to release over Third Quarter 2023 which includes Metro21 by Shokai Developments, Citizen by Anthem, Greenhouse by Concord, and Lougheed Tower 3 by Shape Properties

Total resales have increased by 179 when compared to the Second Quarter of 2022, while total listings have decreased by 20 in that same time span

The average per square foot sales values of High Rise units and Townhomes increased by $53 and $9, respectively, while Low Rise units decreased by $10 when compared to the Second Quarter of 2022

The sales range of High Rise product increased by $22,000 on the lower end and by $69,000 on the higher-end when compared to the Second Quarter of 2022

Compared to the Second Quarter of 2022, the average price per square foot of one bedroom High Rise and Low Rise product has increased by $44 and $24, respectively

The average price per square foot of a two bedroom High Rise unit increased by $50 while it decreased by $16 for a two bedroom Low Rise unit over the past year

The average sales price of a two bedroom and three bedroom Townhome has decreased by $70,449 and $48,190, respectively, when compared to the Second Quarter of 2022

The North Shore market area will retain its “Green Light” status for the Second Quarter of 2023, maintaining a robust sales activity with only a minor nine percent decrease compared to the previous quarter. Notably, the Townhome sector has been driving sales, experiencing a significant increase from four to 33 sales. This growth can be attributed to the successful launch of two new Townhome projects, which introduced 41 units to the market and achieved a 76 percent absorption rate. The primary buyers in this market area have been end users, many of whom are looking to up size or return to the North Shore area. To further boost buyer activity for remaining units, developers have been offering incentives such as GST credits, reduced deposit structures, and assistance with lower mortgage payments. Overall, the North Shore market area achieved a 24 percent absorption rate, with 44 move-in ready units.

Polygon’s Low Rise in North Vancouver, Lennox, led all sales in the Low Rise sector with 20 sales over the Second Quarter of 2023 and now only has nine units remaining

Towns at Lynn, Mosaic’s masterplan community launched its Townhomes in early May and released 31 units out of 46 total units into the market area over the quarter. The project achieved 23 sales at an overall blended price of $1,080 per square foot

Anthem launched a completed Townhome project in North Vancouver called Eastwoods in early June. The project released 10 units out of 39 total units and achieved eight sales at an overall blended price of $1,000 per square foot

Apex at Seylynn Village by Denna Homes led all sales in the High Rise sector with 11 sales over the quarter as the project offered a 3 percent buyer incentive

Ashton by Fairborne homes is expected to release a 140-unit Low Rise development in Third Quarter2023 with homes starting from $599,90

*Note that the large sales range is due to the price differences observed in West and North Vancouver.

There were 152 total listings, a decrease by 22 when compared to the Second Quarter of 2022

Compared to the Second Quarter of 2022, the average time a unit is on the market has increased for High Rise and Low Rise units by eight and 11 days, respectively, while Townhome units decreased by one day

The average per square foot sales values for High Rise units and Townhomes decreased by $58 and $27, respectively, while Low Rise units increased by $42 when compared to the Second Quarter of 2022

The sales range increased by $5,000 on the lower-end and decreased by $60,100 on the upper-end for Low Rise product since four quarters ago

Two bedroom High Rise product decreased in per square foot sales value by $45 while no change was experienced in the Low Rise product when compared to the Second Quarter of 2022

The average sales price of a two bedroom Townhome decreased by $508,078 while it increased by $105,868 for a three bedroom Townhome when compared to the Second Quarter of 2022

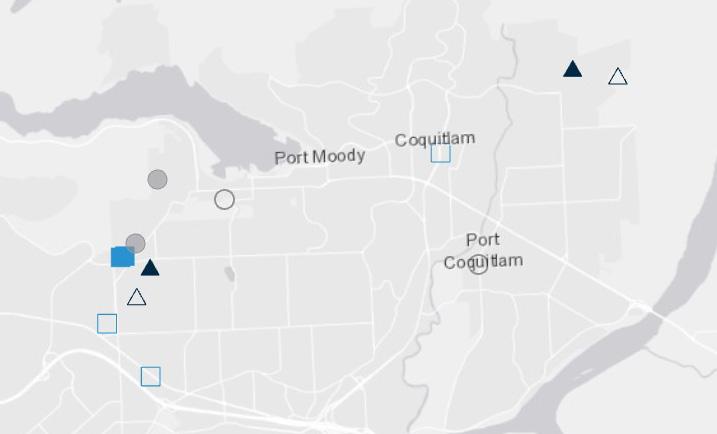

The Tri-Cities will maintain their “Green Light” status for the Second Quarter of 2023. Total sales experienced a 79 percent surge compared to the previous quarter. High Rise sales led all product types making up 51 percent of total sales with 404 sales. The Low Rise sector also exhibited strength with a 59 percent increase compared to the First Quarter of 2023. The most growth was seen in the Townhome sector, which saw from 15 sales in the previous quarter to 130 sales. All three sectors - Townhomes, Low Rises, and High Rises - demonstrated strong absorption rates of 52 percent, 45 percent, and 36 percent, respectively, indicating a healthy demand for properties across the Tri-Cities market area. During the quarter, six new projects were launched in the Tri-Cities releasing a combined total of 951 units into the market area. These new projects accounted for 62 percent of the total sales within the market area, emphasizing the importance of new developments in meeting the rising housing demand in the area.

Gardena, a 42-storey tower by Intracorp comprising of 526-units achieved 220 sales at a blended price per square foot of $1,137 after launching in early May

Aavand, A 79-unit mid rise by Canada West Group launched in early May and accounted for 31 sales blending at $971 per square foot

Edgar Development’s Phase 1 of Portwood, Umbra launched in mid-April releasing 219 units and achieved 115 sales at a blended price per square foot of $990

Strand’s Komo, a 355-unit 29-storey tower was launched in early June and accounted for 75 sales at a blended price per square foot of $1,125

Burqville by Kadium Properties started sales in late April and sold 40 of their 50 units at a blended price per square foot of $950

Tessera Homes & Annesley Homes’ Queenston brought 23 units to the market in early June, achieving nine sales at a blended price per square foot of $732

Compared to the Second Quarter of 2022, sales increased for Low Rise and Townhome products by 43 and 22 but it decreased by five for the High Rise product

Total listings have decreased by 37 when compared to the same period last year

The average sales value per square foot for High Rise, Low Rise, and Townhomes have increased by $27, $39, and $17, respectively, since the Second Quarter of 2022

The lower end sales range for High Rise, Low Rise, and Townhome products has decreased by $25,000, $19,990, and $25,000, respectively, since the same quarter last year

The average price per square foot of a one bedroom High Rise and Low Rise unit has increased by $40 and $4, respectively, when compared to the Second Quarter of 2022

The average sales price of a two and three bedroom Townhome increased by $82,296 and $47,528, respectively, when compared to the Second Quarter of 2022

During the Second Quarter of 2023, the Ridge Meadows market area has been assigned a “Yellow Light” status due to notable sales growth compared to the First Quarter of the same year. The market area witnessed a total of 62 sales, with two wood frame projects accounting for an impressive 94 percent of all transactions. This surge in sales activity can be primarily attributed to the introduction of a new project that released 111 units into the market area, indicating a clear demand for additional inventory to drive buyer interest in the area. Several ongoing projects that had previously paused sales due to construction are now progressing, and it is anticipated that the remaining unsold inventory will be released in late 2023 and early 2024. Consequently, the overall absorption rates have experienced a significant jump, increasing from 5 percent in the previous quarter to 25 percent in the current quarter. Looking ahead, the Townhome sector is expected to witness increased activity in the following quarter, as numerous developments are preparing for launch in Fall 2023.

Pacific Vision Development’s 111-unit Low Rise Condominium Project La Riviere launched in mid-May, achieving 32 sales at a blended price of $775 per square foot

Podium, by Whitetail Homes achieved 26 sales over the quarter at an average price per square foot of $698, leaving one unit remaining in the development

iFortune’s Fairview Gardens is expected to release the remaining four units when the project is slated to complete construction in September 2023

Pine Creek Estates 2, Dema Developments’ second phase of Townhomes sold four units over the quarter at an overall price per square foot of $549

Kennedy, Royale Properties’ 29-unit Townhome project is anticipated to release the remaining 10 units in late 2023 when construction is anticipated to complete

Total listings have decreased by 10 while resales have increased by 39 when compared to the Second Quarter of 2022

The average sales value per square foot for Low Rise units and Townhomes decreased by $7 and $28 since the same quarter last year

The average sales price of a one and two bedroom Low Rise unit decreased by $32,678 and $12,453, respectively, when compared to the Second Quarter of 2022

The lower bound of the sales range for Low Rise products decreased by $25,000 and the upper bound decreased by $5,000 compared to the same period last year

The sales range has increased by $50,000 on the lower end and decreased by $84,999 on the higher-end over the past four quarters for Townhomes

Three bedroom Townhome units saw a decrease in average price on sold units by $41,176 over the past year

The Surrey Central/North Delta market area will continue to maintain its “Green Light” status for the Second Quarter of 2023, after recording 868 sales - a 122 percent increase compared to the First Quarter of 2023. The Second Quarter of 2023 witnessed a strong demand in the market, as 40 percent of the available inventory was absorbed during that period. Throughout the quarter, there was one High Rise launch and four Low Rise launches. Over the last six months, there has been no new market activity in the Townhome sector. Nevertheless, the Townhome sector saw a 46 percent absorption rate and more inventory is anticipated to be released by the end of 2023. The introduction of new Low Rise inventory has led to a substantial sales boost, with 324 units sold in the Second Quarter of 2023, a significant increase compared to the 122 units sold in the previous quarter. Project representatives have reported strong interest from both inventors and end users.

Sequoia, a 386-unit High Rise by ML Emporio Properties launched in late-April and achieved 193 sales at an average price of $1,117 per square feet

Dawson + Sawyer released the fourth and fifth Condominium buildings of Fleetwood Village II in early April, releasing 231 units and reported 135 sales over the Second Quarter of 2023 with an overall price per square foot of $838

The second phase of Pura by Adera, a 112-unit Low Rise recorded 32 sales out of 77 released after commencing sales in mid-April and is blending at an average price of $940 per square foot Willow, the second building of Hartley by Porte Communities was launched in early April and released 56 units out of 74 total units. The project achieved 47 units at an overall blended price of $816 per square foot

Silva 3, the third and final building of Wanson Group’s Silva, is a 85-unit Low Rise that released in late May and achieved 40 sales at an overall blended price of $867 per square foot

Total listings decreased by 47 while resales increased by 115 when compared to the Second Quarter of 2022

The months of supply for resales in the Townhouse market has decreased from 5.2 months to 2.3 months when compared to the same quarter last year

The months of supply for resales for High Rise and Low Rise product has decreased by 0.7 and 1.0 months, respectively, when compared to the Second Quarter of 2022

The per square foot sales value has decreased for Low Rise units and Townhomes by $20 and $36, respectively, while High Rise units increased by $20 when compared to four quarters ago

One bedroom High Rise and Low Rise units saw a decrease in average price per square foot on sold units by $9 and $21 over the year

The average two and three bedroom Townhome unit have seen price decreases of $41,595 and $20,910, respectively, compared to the same period last year

The South Surrey/White Rock market area will retain its ‘Green Light’ status for the Second Quarter of 2023, after recording a 62 percent increase in total sales. This represents a significant increase compared to the minimal activity of 65 sales in the previous quarter. The large increase in sales activity was mainly driven by the Townhome sector absorbing 58 percent of the total sales of South Surrey/White Rock. The market area experienced 37 percent of total inventory absorbed during the Second Quarter of 2023, compared to 32 percent the previous quarter. The much-in-demand product type in South Surrey/ White Rock continues to favour the larger, ground-oriented product types, as the majority of purchasers are noted to be end-users. With the addition of new inventory, the High Rise sector is projected to experience a sales increase during the Third Quarter of 2023.

Gramercy Development’s, The Loop, led all sales in this market area as it recorded 31 sales over the quarter while increasing its pricing by $21 to an overall value of $667 per square foot

King + Crescent (Cedar), the final Low Rise building of King + Crescent by Zenterra, was launched in early June and recorded 12 sales over the quarter, blending at an overall average of $840 per square foot

Landmark Premiere Properties released their third tower of Foster Martin, a 128-unit High Rise called The Landmark in late June with an overall price per square foot of $1,234

The Boroughs (Phase 2) – Bexley, by Streetside Developments, achieved 27 sales over the quarter with a price per square foot of $709

Park Ridge Homes third Low Rise building in their Low Rise development, Southaven recorded 17 sales blending at an overall value of $864 per square foot

When compared to the same quarter last year, the total number of listings decreased by 51 while resales increased by 16

The months of supply for resales for Low Rise and Townhome product has decreased by 1.5 and 1.1 months, respectively, while High Rise project increased by 2.6 when compared to the Second Quarter of 2022

Average per square foot sale values for High Rise and Low Rise units decreased by $101 and $36, respectively, when compared to the Second Quarter of 2022

High Rise products have seen an increase in average days spent on the market, averaging 76 more days on the market while Low Rise products saw a decrease averaging one less day when compared to the Second Quarter of 2022

One and two bedroom Low Rise units saw a decrease in average price per square foot on sold units by $2 and $13, respectively, over the past year

Two and three bedroom Townhome product saw a decrease in average sales price by $28,819 and $59,763, respectively, compared to the same quarter last year

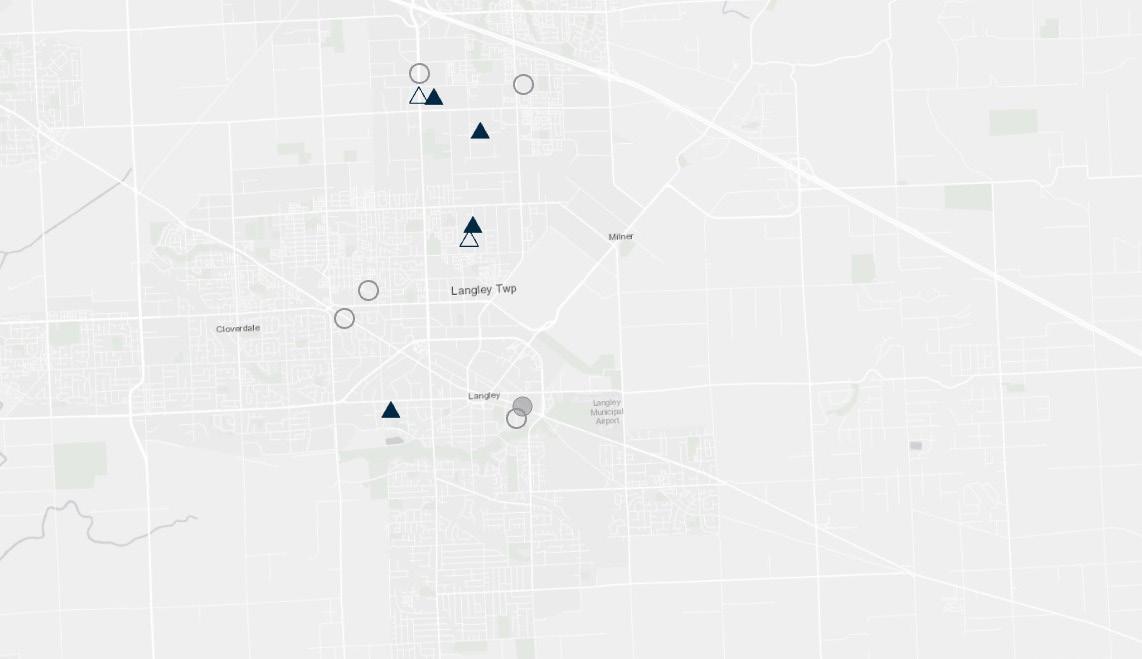

The Langley/Cloverdale market area has been upgraded to a ‘Green Light’ status for the Second Quarter of 2023, with a total of 274 sales recorded, compared to 93 sales from the previous quarter. The sales activity in the Low Rise sector increased significantly with 65 percent of the overall sales coming from Low Rise projects. Meanwhile, the Townhome sector constituted 35 percent of the total sales recorded in the quarter. Demand for Townhomes increased towards the end of the quarter, and it has been anecdotally reported that the demand for this product type under one million dollars is strong. The Langley/Cloverdale market has also seen the continued launch of additional phases of existing projects, indicative of the stability in demand for this product type.

Oakley, a 30-unit Townhome development by Warwickshire Homes, sold out during the quarter after being on the market for four months with an overall price per square foot of $581

Icon, a new 98-unit Low Rise development by Whitetail Homes, sold 30 units throughout the quarter with an average price of $789 per square foot

Hayer Builders Group’s Low Rise development called, Hayer Town Centre (Building 3 + 4), achieved 53 sales, with just two unsold units remaining

Unity, a new Low Rise development by Whitetail Homes, sold 78 units in the Second Quarter of 2023, with an average unit price of $511,110 after starting sales in late June

Zenterra’s Townhome development, Newbury, sold an additional 33 units in the Second Quarter of 2023 at an average price of $691 per square foot

Resales for Low Rise and Townhome products increased by 74 and 23, respectively, when compared to the Second Quarter of 2022

Total listings decreased by 174 when compared to the same quarter last year

The sales range decreased by $1,000 on the lower-end and by $34,900 on the upper-end for Townhome product since four quarters ago

Average price per square foot sales values decreased for Low Rise condominiums and Townhomes by $7 and $26 when compared to this quarter last year

The average price per square foot sales value for one bedroom Low Rise unit decreased by $14, while it increased by $2 for a two bedroom Low Rise unit when compared to the Second Quarter of 2022

Since the Second Quarter of 2022, the months of supply for Townhome product has decreased from 3.0 months to 1.1 months

The Abbotsford/Mission market area will retain its “Green Light” status for the Second Quarter of 2023. The market area experienced a 29 percent increase in total sales. Buyer activity primarily occurred in the Low Rise sector, accounting for 116 total sales. This marked a 63 percent increase from the previous Quarter and accounted for 74 percent of total sales this quarter. One project launched over the Second Quarter of 2023, releasing 48 units into the market and achieved an 85 percent absorption rate. The Townhome sector maintained a steady buyer’s activity with 40 total sales. The Low Rise and Townhome sectors experienced strong absorptions at 72 and 69 percent respectively. The low-entry price points have attracted many first-time home buyers and end users migrating from the Tri-Cities, Surrey, & Langley. Buyer interest is expected to remain robust with numerous upcoming project launches and the subsequent release of additional inventory into the market.

Vista, the condominiums at Westminster Plateau is a 48-unit Low Rise building by Milkai Developments & Pacific Hills Developments in Mission launched in early May and sold 41 units at an overall blended price per square foot of $673

Infinity Properties has begun launching their Low Rise buildings at Rail District with The Mason, a 93-unit Low Rise which launched with a very limited release of units in late June and is expected to officially launch their sales campaign in September 2023

Townhomes at Rail District by Infinity Properties saw continued absorptions with 18 sales over the quarter at a blended per square foot price of $517

AB Wall’s Highstreet Village Townhomes sold 14 units this quarter before pausing sales with an expected relaunch in September 2023

Milkai Developments & Pacific Hills Developments’ Westminster Plateau – Vantage released 10 additional units to the market and achieved 7 sales over the quarter

Total listings decreased by eight while total resales increased by 26 when compared to the Second Quarter of 2022

Over the past four quarters, the lower bound of the sales range for Low Rise product has decreased by $12,900 and the upper bound of the sales range also decreased by $10,000

Price per square foot sales values for Low Rise Condominiums and Townhomes are down by $62 and $32, respectively, from the Second Quarter of 2022

The average days spent on market for Low Rise units and Townhomes has increased by 34 and 3 days, respectively, when compared to the same quarter last year

The average Low Rise price per square foot for one and two bedroom Condominiums has decreased by $59 and $48, respectively, when compared to the same quarter in 2022

The average price per square foot for two bedroom and three bedroom Townhome has decreased by $6 and $35, respectively, when compared to the Second Quarter of 2022

As the second quarter comes to a close, we have experienced a season filled with changes, and the good news is that sales absorptions have continued to steadily increase, providing us with a sense of optimism about the ongoing market stabilization that has been noticeable since late 2022 in Metro Vancouver.

In the last issue, we discussed the stabilization of interest rates over the previous two consecutive periods, while Canada’s inflation rate was at 5.2 percent. As predicted, there has been at least one more rate hike, which has resulted in lowering inflation to 2.8 percent. The surprise is the significant effect and change in inflation, which has come down by a whopping 2.4 percent from the previous quarter.

In addition, we made predictions that various municipalities across the Lower Mainland would implement new policies to accelerate their development and building permit approval processes. We were, and still are, hopeful that these measures will lead to significant time and cost savings for our industry. It seems that this is happening quietly as the 47 cities prepare to meet their approval targets, which are yet to be announced by the Provincial Government.

As predicted, the federal ban on foreign buyer ownership across Canada does not seem to have had any impact on the market so far. With less than 1.5 percent of the hottest market in Canada already being affected by foreign buyers during the pandemic, an outright ban was not expected to make a significant difference. As our market has continued to improve over the first two quarters, it is evident that the two-year ban was merely a vote-buying tactic, lacking substantial effects. The exemptions announced in Second Quarter have been helpful in ensuring that the supply of development land is not limited, and this can be seen as the main positive outcome from all these potentially misguided actions by our Canadian leaders.

Being part of the development industry, it is highly beneficial to be involved with the Urban Development Institute (UDI). These organizations provide the most up-to-date information on policy changes and act as strong advocates for our industry, maintaining close communication with each city. They keep their members informed about new policies, often before they are implemented. It allows us all the opportunity to provide industry input in the design and implementation of new policies that directly affect us. Fifth Avenue is a proud member of UDI and actively participates in the UDI Fraser Valley Committee for over 20 years.

As we look forward to the third quarter and the latter half of 2023, there is great anticipation regarding the targets that the Provincial Government will announce for each of the 47 named cities. For detailed information on these cities, you can refer to this article: https://fifthave.ca/b-c-government-documentsexpose-47-municipalities-mandate-to-boost-housing/. We are eager to see how each city strategize to meet their respective targets and anticipate new policy announcements from most, if not all, of them.

One area of interest is whether public hearings on lands already zoned per neighbourhood concept plans, where public input has already been incorporated, will be eliminated in any of these communities. We predict that many cities might take this approach, as it seems redundant to repeat the public input process for development permit applications that are already conforming to the established plan and zoning guidelines. The public’s input was already considered when the neighbourhood concept plan (NCP) was adopted, making it unnecessary to go through the same process again for conforming applications. Eliminating this duplication would save valuable time and resources, including taxpayers’ funds.

Of course, public input remains crucial and should still be sought for applications that deviate from approved and adopted plans (i.e., nonconforming applications). However, for conforming applications, the double process appears inefficient and unnecessary. Instead, these communities could focus on other strategies to expedite the muchneeded supply of housing to their markets.

How do you think the market will do for the final half of 2023?

• What changes we will see with respect to accelerating the development approval process? Who will lead? Who will lag?

• Will consumer confidence remain renewed or be dissipated again by the BOC’s next action? Will there be another in September?

• Do you think your participation in the industry through groups such as UDI is important? Why or why not?

Being part of the development industry, it is highly beneficial to be involved with the Urban Development Institute (UDI). These organizations provide the most up-to-date information on policy changes and act as strong advocates for our industry, maintaining close communication with each city. They keep their members informed about new policies, often before they are implemented. It allows us all the opportunity to provide industry input in the design and implementation of new policies that directly affect us. Fifth Avenue is a proud member of UDI and actively participates in the UDI Fraser Valley Committee for over 20 years.

If you have a view you would like to share and/or questions you would like to discuss please contact Jamie Squires at Jamie@fifthave.ca.

Zonda Urban is Metropolitan Vancouver’s leading source for analytical interpretation of relevant real estate market data, trends and strategic recommendations.

Zonda Urban (formerly Urban Analytics) has been retained by Fifth Avenue Real Estate Marketing Ltd. To provide aggregate data on the Multi-family residential real estate market in the Vancouver Metropolitan. The methodology used to collect the data was as follows:

General Parameters

Metropolitan Vancouver refers to the area from West Vancouver to Abbotsford. The focus of this study is limited to the Multi-family market.

The primary method used to collect information is a personal visit to each project being actively marketed. In addition to collecting current sales information, Zonda Urban representatives engage onsite sales staff to determine additional relevant information such as incentive offerings, traffic trends and active buyer profiles. In all instances, active sales range quoted in tables is defined as “The per square foot sales range in which 75 percent of sales of this product type occurred”

For the purposes of this publication, Zonda Urban contacts various municipal planning departments along with developers (and/or their representatives) of proposed new developments to determine the anticipated timing of their approval and marketing launch.

The resale market provides an important barometer from which to assess demand and determine pricing for new home projects. Accordingly, Zonda Urban closely monitors the resale market for Multifamily homes in order to identify trends that are relevant to the new home sector. However, the breadth and depth of product for sale can create findings that are less than helpful to the new home developer

As a result, Zonda Urban recommends studying only product that is aged ten years or newer and valued at less than $1.2 million. While it could be argued that limiting the analysis to newer product (i.e. five years or newer) would be more relevant to the new home sector, we believe this would limit the sample size and potentially skew the data towards a specific type of product available in a small number of specific buildings/projects. In all instances active sales range quoted in tables is defined as “The active sales range in which 75 percent of sales of this product type occurred”.

Zonda Urban (Formerly Urban Analytics) been monitoring the new Multi-family home market in Metro Vancouver and beyond since 1994. In addition to providing clients with the most current and accurate information on actively selling and contemplated new condominium and Townhome projects in Vancouver, Toronto, Ottawa, Calgary, Edmonton and Victoria on the market-leading NHSLive data product at nhslive.ca, Zonda Urban is also the leading provider of advisory services on the new Multi-family home market in these markets.

Zonda Urban also monitors the purpose-built rental apartment market, residential land transactions, and commercial property transaction data. Contact sales@zondaurban.com and/or advisory@zondaurban.com to learn more about these products and services.

Zonda

NHSLive

Zonda

For over 25 years, and prior to its transition to Zonda Urban, Urban Analytics provided clarity on what’s selling, who’s buying and what that means for our clients at every stage of their project.

President & Managing Broker Jamie Squires

Address #313 - 14928 56th Avenue, Surrey, BC V3S 2N5

Phone Number 604.583.2212

Email Jamie@fifthave.ca

Website fifthave.ca

President Jacky Chan

Address 1480-1500 West Georgia Vancouver, BC V6G 2Z6

Email jacky@bakerwest.com

Website bakerwest.com

This document has been prepared by Fifth Avenue Real Estate Marketing Ltd. And BakerWest Real Estate Incorporated with data provided by Zonda Urban for advertising and general information only. Fifth Avenue, BakerWest, and Zonda Urban make no guarantees, representations or warranties of any kind, express or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. E.&.O.E. Metropolitan Vancouver: West Vancouver to Aldergrove. Excludes Chilliwack, and Mission. Resale Data: MLS sold for attached product (High Rise, Low Rise, and Townhomes) built within the last ten years for units valued less than $1.2 million. Single family sales are excluded from the report. This publication is the copyrighted property of Fifth Avenue Real Estate Marketing Ltd. © 2023. All rights reserved.