THE FIFTH DIMENSION SUMMER

A Comprehensive Analysis of the Metro Vancouver Multifamily Market

A Comprehensive Analysis of the Metro Vancouver Multifamily Market

With the second quarter of 2024 now behind us we should all reflect not just on the market, but on what our government, both provincial and federal have actually accomplished to help the growing housing crisis our province has been faced with over the last decade.

There have been a lot of policy changes put in place with the promise that they would help increase supply and lower costs for buyers. After over two full terms in office, the current provincial policies have worsened our situation by removing personal rights from ordinary citizens and increasing the cost of living for essential needs like housing, food, and transportation.

All during a time when the market was already correcting itself prior to any unnecessary government intervention that has only made life harder for everyone.

As mentioned in the last issue, the Fraser Valley has long been a sought after region for real estate investment and homeownership due to its stunning landscapes, thriving economy, and proximity to Vancouver. With 2 interest rate cuts in 2024 so far amid rising costs, taxes and red tape, the market has yet to see significant improvement. Most likely in light of all the uncertainty created by our government at all three levels.

On a positive note we can say that activity has picked up across the

Fraser Valley in terms of viewings and traffic to projects actively marketing. With the prediction of yet another rate drop this September and possibly more this year the market could change swiftly as pentup demand increases and the cost to borrow decreases. Many banks predicting this to happen this fall or early 2025.

The bottom has hit months ago and we are on a gentle slope up, though the slope is barely noticeable now it will have a sharp increase in the coming months based on the stats we are seeing today compared to previous markets. The time to “buy low and sell high” as they say, has come and is slowly coming to an end. This summer and early fall may be the last opportunity for deal seekers to get in certain neighbourhoods. Especially if considering a pre-sale.

As we approach the election this October, remember to have your say in provincial policy with your vote. Remember all the promises made as a result of these policies that are having the opposite effect hoped and promoted. The current Marxist approach is not working and is having the expected affect as seen in British Columbia in the 1990’s, a time of desperation for most.

Regards, and all the best.

Jamie Squires

President & Managing Broker Fifth

In this second edition of the Fifth Dimension for 2024, our data collection and analysis partner Zonda Urban shares its commentary on the most recent quarter, market performance year to date, and what to expect in the upcoming quarter with respect to Metro Vancouver’s multi-family residential real estate market.

While there were some signs of positivity in the market throughout the Second Quarter as a higher number of project launches resulted in more sales relative to the previous quarter, the absorption rate of new inventory was underwhelming relative to the optimistic expectations set for the market in early 2024. The spread between total released inventory and quarterly new home sales at the end of the Second Quarter (9,296) was the highest total on record since Zonda Urban began tracking this metric in 2010. Despite the lack of widespread market strength, the Central Surrey/North Delta, Langley/Cloverdale, the Tri-Cities and Abbotsford market areas reported strong sales and were the primary drivers of the market in the Second Quarter.

A total of 46 new projects representing 4,545 units were introduced during the quarter, a substantial increase from the 21 new projects consisting of 1,937 units released in the First Quarter of 2024. A total of 3,101 new home sales were recorded during the Second Quarter of 2024, which is a 15 percent decrease in sales volume when compared to the same quarter of 2023. There were 12,397 released and unsold units remaining at the end of the Second Quarter. This reflects a thirteen percent increase from the previous quarter and a 54 percent increase from the same quarter last year. Additionally, there were 1,622 completed unsold new multi-family homes available at the end of the Second Quarter, marking a

five percent increase from the previous quarter and a 61 percent increase from the same quarter last year.

A total of 892 High Rise sales were recorded in the First Quarter of 2024: a 31 percent decrease from the previous quarter and 46 percent lower than the same quarter last year. High Rise sales accounted for 29 percent of new home sales during the quarter. There were 7,575 released and unsold High Rise units available at the end of the First Quarter, an eight percent increase from the previous quarter and a 40 percent increase year-over-year. The majority of High Rise sales occurred in Central Surrey/North Delta (270 sales), Burnaby/New Westminster (242 sales), and the Tri-Cities (195 sales), market areas, as they combined for 79 percent of all High Rise sales during the quarter. Over the quarter, seven new High Rise project launches were launched, releasing 1,899 units into the market. Notable sales activity occurred at Bosa Properties’ Parkway 2 - Intersect (Surrey City Centre), Ironwood by QualexLandmark (Burquitlam), and Ethos by Anthem (Metrotown).

The 1,691 new Low Rise condominium sales recorded in the Second Quarter of 2024 were 110 percent higher than the previous quarter and 41 percent higher than the number sold in the same quarter last year. Low Rise sales constituted for 55 percent of all new homes sales this quarter. During this period, 19 new projects launched, adding a total of 2,078 units to the market, which contrasts with the three new project launches in the previous quarter, releasing 419 units. The 3,076 released and unsold units at the end of the Second Quarter represents a 23 percent increase from the previous quarter. The Langley/Cloverdale and Central Surrey/North Delta submarkets experienced the highest number of new Low Rise home sales in Metro Vancouver as they accounted for 545 and 490 sales

respectively in the Second Quarter. Notable sales activity across Metro Vancouver’s Low Rise condominium sector was observed at Azure Grove by ML Emporio Properties (Yorkson), Sage by Diverse (Abbotsford East), Scott + 77 by Realco Properties (North Delta), Jericho – Jericho Park (Phase 1) by Essence Properties (Yorkson), Building 6 of Fleetwood Village 2 by Dawson + Sawyer (Fleetwood), Porthaven by NorthStar Developments (Port Coquitlam South of Lougheed), Beedie’s Chapter (Fraser Mills), and Zenterra’s City Corners (Surrey City Centre).

A total of 518 new Townhome sales were recorded in the Second Quarter of 2024, marking a 13 percent decrease from the previous quarter and a 24 percent year-over-year decrease. There were 1,746 released and unsold Townhome units at the end of the Second Quarter, a 22 percent increase from the previous quarter and 80 percent higher than the same quarter last year. During the quarter, 22 new Townhome project launches were observed contributing 631 units to the market. This marks an increase from the previous quarter, where 14 projects were launched, releasing a total of 40 units. Positive sales activity was observed at Aviva by Zail Properties (Yorkson), Whitford by Citimark and Grosvenor (Oak Corridor), Latimer Walk by Zenterra (Yorkson), Platinum Group’s Liberty Encore (Fleetwood), and Mercer Village by Domus Homes (Queensborough).

A total of 2,599 newer multi-family homes were resold in the Second Quarter of 2024. This total is 20 percent higher than the previous quarter and a 24 percent decrease compared to the same quarter in 2023. When comparing activity across product sectors, High Rise, Low Rise, and Townhome re-sales were 21, 22, and 16 percent higher, respectively, when compared to the previous quarter. Year over year, the High Rise, Low Rise, and Townhome sectors experienced decreases of 23, 30, and 20 percent, respectively. Overall, active listings increased by five percent when compared to the previous quarter and increased by 58 percent when compared to the same quarter last year. Active listings for High Rise and Townhome products each experienced an increase of 12 and four percent, respectively, while the Low Rise market decreased by eight percent when compared to the Fourth Quarter of 2023.

Contrary to the prediction of many real estate experts (including us), the interest rate cuts implemented by the Bank of Canada in May and June of this year did not have a meaningful impact on spurring purchasing activity in June and July. As such, this encourages the Bank of Canada to implement further rate cuts into the remainder of 2024 and may create more affordable purchasing opportunities for new home purchasers in the coming quarters.

Despite the softer overall conditions, there are still areas that are experiencing modest to strong levels of success in the market. Most notably in the Second Quarter of 2024; there were 47 percent more new home sales recorded in South of the Fraser relative to North of the Fraser. For context, the 10-year average of quarterly North of the Fraser sales have been twice that of South of the Fraser. If more proportional sales South of the Fraser persist, it suggests a trend towards locations that offer more affordable home ownership

opportunities and should be monitored closely among industry stakeholders.

Notable projects that could launch in the Third or Fourth Quarter of 2024 include: Vancouver Downtown – Prima Properties Ltd.’s Monogram; Vancouver West – Icona Properties Ortus, Enrich Developments Frank, Pennyfarthing Homes Slate and Ash, Transca Developments Latitude on Cambie; Vancouver East –The Jim Pattison Group’s M6, Hana Ventures Solid; Burnaby/ New Westminster – Tower 1-Boffo Properties Bassano, Polygon Homes Onyx, Mosaic Homes Symposia, Grosvenor’s Brentwood Block; North Shore – Three Shores Development One20; Tri-Cities – Wesgroup’s Inlet District Phase 1, Onni Group’s Pine & Glen, Strand’s Kora, Marcon’s Soenhaus, Trillium Projects Westview, Adera ‘s Kestrel; South Surrey/White Rock – Mortise Group of Companies Pinnacle, Cressey‘s Rockford; Central Surrey/North Delta –Northwest Development’s Spera, Matte Homes Zenith, Tangerine Developments Fellow, ML Emporio Properties The Manhattan; Langley/Cloverdale – Westmount’s The Merchant, Jayen Properties Park and Maven Condos (Phase 2), Wesmont Homes Saxon Park, Castlehill Homes Renfrew; Abbotsford/Mission – Imperial Blue Developments Uptown Cedar, Au Milan Group’s Auctus; RidgeMeadows – Western Canada Monthly Income Fund’s Portal

Comparison Totals Q2-2024

Resale Market Totals Q2-2024

892

1,691

518

SALES

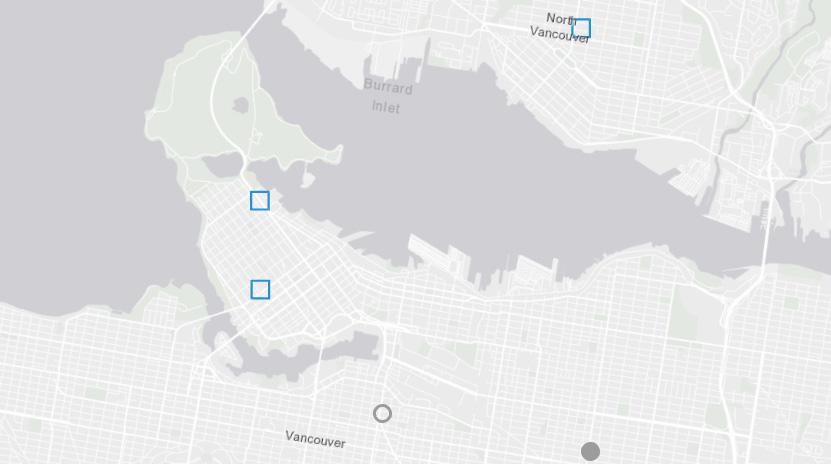

The Vancouver Downtown market area has been classified as “Red Light” for the second quarter of 2024. Sales volume declined by 50%, falling from 32 to 16 transactions quarter over quarter. The High Rise sector dominated, accounting for all 16 transactions. This decline is attributed to low demand due to steep price points compared to nearby market areas. The overall absorption rate dropped from 7% to 4% over the quarter, with 40 units of standing inventory currently available. Developers are offering various incentives, including large purchaser credits, realtor bonuses, and increased commission structures. Sales activity in the Downtown market area is expected to remain subdued as interest rates continue to drop. Once conditions improve and on-hold projects become economically viable, new inventory is anticipated to spark sales activity. With no new launches expected until 2025, the Downtown market area is expected to remain consistent over the third quarter of 2024.

1335 Howe, by Onni led the market area in sales with 9 total sales over the quarter

Marcon’s Mirabel has one unit remaining, a 2,117 square foot penthouse which is move-in ready

The Pacific, by Grosvenor accounted for the remaining 7 units sold over the second quarter Anthem’s High Rise condominium Park is anticipated to launch in early 2025

Average sales values per square foot have decreased by $105 when compared with the Second Quarter of 2023 for High Rise product

The number of High Rise listings increased by one while High Rise resales decreased by 38 when compared to the Second Quarter of 2023

For High Rise condominiums, the average per square foot sales values of one and two bedroom units decreased by $123 and $154, respectively, when compared to the Second Quarter of 2023

The months of supply for resales in the High Rise market has increased from 6.2 months to 11.1 months when comparing to the same quarter last year

The sales range has decreased on the lower-end and higher-end by $53,500 and $690,000, respectively, over the past four quarters for High Rise product

The average time a unit is on the market has decreased for High Rise by 8 days when compared to the Second Quarter of 2023

For the second quarter of 2024, Vancouver West will maintain its “Yellow Light” status. During this period, the market area recorded 125 total sales, representing a 44 percent increase from the previous quarter. The Townhome and High Rise sectors were the primary drivers, recording 58 and 57 sales, respectively, while the Low Rise sector lagged with just 10 sales. This uptick in sales is largely attributable to the launch of four new Townhome projects, which contributed 30 of the 58 total Townhome sales for the quarter. Despite the increase in sales, absorption rates remained modest, with an overall rate of 12 percent for the second quarter of 2024. High Rise sales showed significant growth, increasing from 31 to 57 total sales, an 84 percent quarter-over-quarter increase. As numerous projects are expected to reach completion in late 2024, it is anticipated that many sales campaigns will relaunch, likely leading to a further surge in market activity.

Kinsley, by Intergulf Development Group was released in early April and achieved eight sales at a blended price per square foot of $1,481

Careston Properties released Enzo, a 20-unit Townhome project in late May and reported one sale at a blended price per square foot of $1,540

Killarney Group’s Adore 49th sold eight homes over the quarter at a blended price per square foot of $1,410

Voyce by FOREFIELD Development Group sold out at an overall price per square foot of $1,550 after selling their remaining seven units throughout the quarter

Whitford by Citimark & Grosvenor commenced sales in mid May and reported 21 total sales at a blended price per square foot of $1,450

Revive, a 93-unit Townhome project by Belford Properties, relaunched their sales campaign with eight new sales at an overall price per square foot of $1,369

Total listings increased by 112 while total resales decreased by 47 when compared to the Second Quarter of 2023

The average time a unit is on the market has increased for High Rise and Townhome product by 22 and 62 days, respectively, while Low Rise product remained the same at 41 days when compared to the Second Quarter of 2023

Average price per square foot sales values for High Rise and Low Rise units have decreased by $59 and $43, respectively, while Townhomes increased by $13 over the past four quarters

Two bedroom High Rise and Low Rise product each saw a decrease of $42 in average price per square foot sales value when compared to four quarters ago

The sales range has increased by $16,500 on the lower end and increased by $115,200 on the higher end when compared to the Second Quarter of 2023 for High Rise product

The Townhomes sales range has decreased by $116,096 on the lower end and decreased by $237,100 on the higher-end over the past four quarters

For the Second Quarter of 2024, the Vancouver East market area maintained its “Yellow Light” status. The market area recorded a total of 88 sales, representing a 19 percent decrease from the previous quarter. The overall absorption rate has remained still at 11 percent this quarter. Notably, the Low Rise sector stood out with 44 sales, accounting to 50 percent of sales. These sales were largely driven by the launch of Naimo by Hudson. Conversely, the High Rise condominium sector saw a 47 percent decline in sales due to a lack of new inventory. High price points continue to prevail, reducing interest from potential buyers looking to enter the housing market.

Market Highlights

Naimo by Hudson, a 38-unit Low Rise project launched this quarter and achieved 22 total sales at a blended price per square foot of $1,325

Wesgroup’s Harlin, a 204-unit High Rise project in the River District masterplan led all High Rise projects with 10 total sales; the blended price per square foot has decreased to $1,180 from $1,200

Ardea & MODE, part of Wesgroup’s River District Masterplan accounted for eight and four sales, respectively, over the Second Quarter of 2024

The second phase of The Cut by Fabric Living and Ergas Group sold 11 units this quarter at a blended price per square foot of $ 1,198

2550 Garden Drive by Bucci sold 16 units this quarter at a blended price per square foot of $1,290

The average time a unit is on the market has decreased for High Rise and Townhome units by 18 and 20 days, respectively, while Low Rise units increased by six days when compared to the Second Quarter of 2023

Average price per square foot sales values for Low Rise and Townhome units decreased by nine and $38, respectively, while High Rise units increased by $22 when compared to the same quarter last year

The months of supply for resales in the High Rise market has increased from 2.3 months to 4.8 months when compared to the same quarter last year

The average price per square foot in a Low Rise decreased for a one bedroom unit by $62 and increased for a two bedroom unit by $38 when compared to the Second Quarter of 2023

Total listings have increased by 112 while resales saw a decrease of 53 when compared to the Second Quarter of 2023

The average price per square foot for a two bedroom Townhome decreased by $101 while a three bedroom Townhome has decreased by $15 since the Second Quarter of 2023

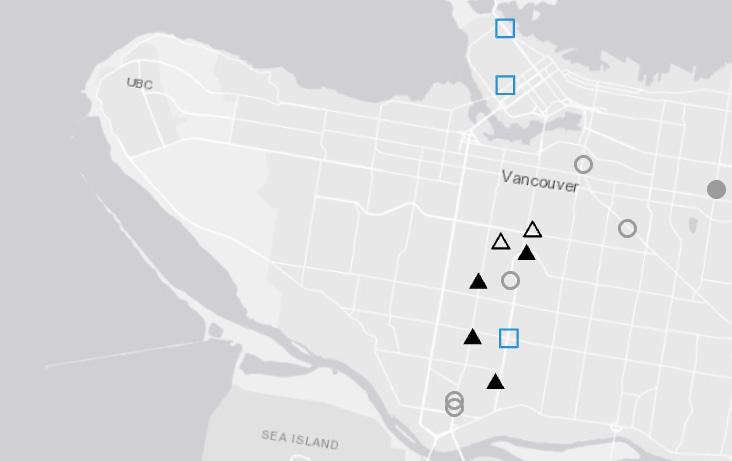

The Richmond/South Delta market area will maintain it’s “Yellow Light” status for the Second Quarter of 2024. The market area saw a slight downturn in purchaser activity, with 97 sales, marking a 27 percent decrease from the previous quarter. New project launches slowed, with only two reported, adding 159 units to the market area. Sales in this region have been predominantly fueled by the High Rise sector, accounting for 49 sales and constituting 51 percent of total sales in the market area. Meanwhile, Low Rise and Townhome units continue to face challenges, with absorption rates of 27 percent and 23 percent, respectively. 596 unsold move-in ready units were reported by the quarter’s end, largely due to high interest rates impeding the movement of move-in ready inventory. Developers have responded by offering specialized incentives aimed at alleviating mortgage payments to stimulate buyer activity.

TopStream Group released 8899 Spires, a 28-unit Townhome development in late April and is blending at an overall price of $1,036 per square foot with four total sales

Bridge and Elliott by Headwater Projects led all Low Rise sales in the market area with 20 sales over the second quarter of 2024 at an overall blended price of $980 per square foot

Enrich developments 20-unit Townhome development in Richmond, Gladwyn, sold out after selling the remaining two units over the Second Quarter

Aspac Development’s Hollybridge at River Green Low Rise building, achieved 19 sales during the Second Quarter of 2024

Polygon’s Westhampton at Hampton Cove achieved 7 sales at an overall blended price of $684 per square foot

Total resales have decreased from 343 to 265 when compared to the Second Quarter of 2023

The High Rise sales range has decreased by $10,000 on the lower end and decreased by $19,000 on the higher-end when compared to the same quarter in 2023

The sales range of Townhomes decreased by $42,000 on the lower end and $116,888 on the higher-end when compared to the Second Quarter of 2023

Average per square foot sales values of High Rise and Low Rise units increased by four and $10, respectively, while Townhome units decreased by $52 when compared to four quarters ago

Price per square foot sales values for one bedroom High Rise units decreased by $14 while Low Rise units increased by $10 over the past four quarters

The average sales price of a two bedroom and three bedroom Townhome decreased by $155,433 and $82,282, respectively, when compared to the Second Quarter of 2023

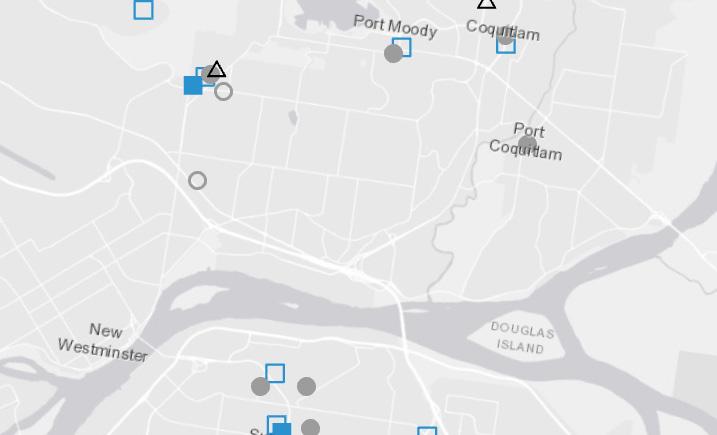

The Burnaby/New Westminster market area will retain its “Yellow Light” status for the first quarter of 2024, with 265 sales, representing a 24 percent decrease from the previous quarter. The High Rise sector dominated, with 242 sales, accounting for 91 percent of all transactions. The remaining nine percent consisted of the Low Rise and Townhome sectors, with 11 and 12 sales respectively. Buyer activity has remained steady, with four new projects releasing 460 units of inventory into the market. Absorption rates were modest at eight percent for the quarter. Projects with longer completion timelines continue to experience stronger absorption rates compared to those with shorter timelines or move-in-ready units. Sales volume is expected to remain steady, with several High Rise projects scheduled to launch in the third quarter of 2024. Previews have begun for multiple previously on-hold projects as interest rate drops have created optimism in the market.

Market Highlights

Ethos, by Anthem launched in late April and achieved 83 total sales at a blended price of $1,320 per square foot

Shokai Canada released Metro21, a 22-storey 132-unit High Rise to the market at an overall price of $1,292 per square foot

Nido, a 90-unit 6-storey wood frame building by Wanson Group was released in late April and achieved 10 sales at a blended price per square foot of $1,152

Domus homes released the first phase of 23 units for Mercer Village, a 146-unit Townhome project in the Queensborough area of New Westminster and sold 12 units at a blended price per square foot of $771

Wesgroup’s Reign – North Tower, a 38-storey 357-unit High Rise condominium led all projects in sales with 94 total units sold over the quarter

Bassano Tower 1 by Boffo Developments has started previewing and is slated to launch over the third quarter of 2024

Total listings have increased by 341 but total resales have decreased by 180 when compared to the Second Quarter of 2023

The average per square foot sales values of Low Rise and Townhome units have increased by one and $4, respectively, but decreased by $51 for High Rise units when compared to the Second Quarter of 2023

The sales range of High Rise product decreased by $10,000 on the lower end and decreased by $84,000 on the higher-end when compared to the Second Quarter of 2023

Compared to the Second Quarter of 2023, the average price per square foot of one bedroom High Rise and Low Rise unit have decreased by $38 and $20, respectively

The average sales price per square foot of a two bedroom High Rise unit decreased by $45 but increased by $11 for a Low Rise unit over the past year

The average sales price of a two bedroom Townhome increased by $70,275 while it increased by $79,112 for a three bedroom Townhome when compared to the Second Quarter of 2023

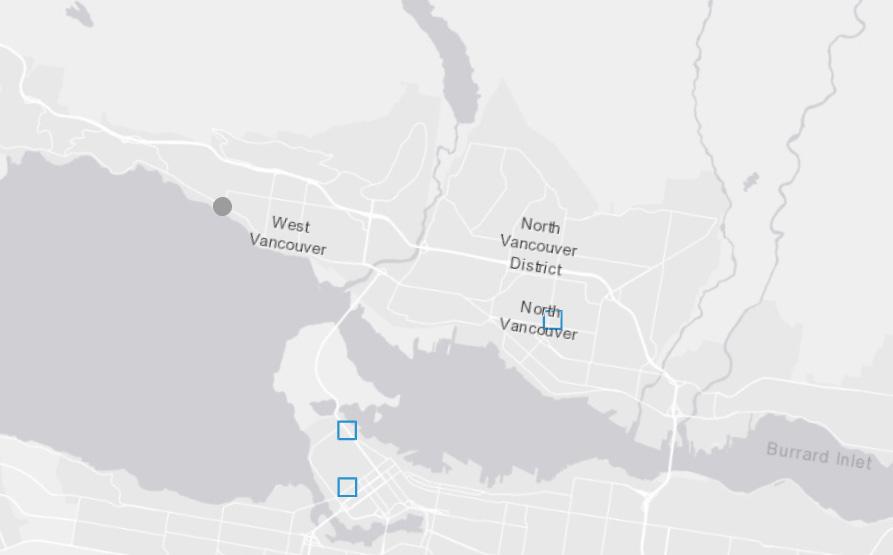

The North Shore market will maintain its “Yellow Light” status for the first quarter of 2024, recording 94 sales, a 12 percent increase from the previous quarter. Both the High Rise and Low Rise sectors led the market with 32 transactions each, while the Townhome sector followed closely with 30 transactions. The High Rise and Low Rise sectors saw sales increases of 28 percent and 23 percent, respectively, whereas Townhome sales declined by 9 percent over the quarter. Absorption rates remained stable, rising slightly from 17 percent to 18 percent quarter over quarter. With no new project launches in the second quarter, sales remained modest due to the lack of additional inventory. This stagnation can be attributed to high price points and many active projects being temporarily halted during construction. Despite the modest transaction numbers this quarter, sales activity is expected to increase with several new launches anticipated in the third quarter.

Pierwell, by SwissReal Group and Brimming Development achieved 12 sales at a blended price of $2,450 per square foot

Weston Place by Darwin and Citimark continued their sales campaign with eight sales over the quarter at an overall blended price per square foot of $1,800

The Trails Phase 1B by Wall Financial Corporation sold 19 homes over the quarter at a blended price per square foot of $1,052

One20, a 21-storey 164-unit High Rise by Three Shores Development started previewing late in the second quarter of 2024

Fairborne Homes’ Ashton continued their strong sales campaign with 32 sales over the quarter at a blended price per square foot of $1,115

*Note that the large sales range is due to the price differences observed in West and North Vancouver.

There were 234 total listings, an increase of 82 when compared to the Second Quarter of 2023

Compared to the Second Quarter of 2023, the average time a unit is on the market has increased for High Rise, Low Rise, and Townhome units by 19, nine, and four days, respectively

The average per square foot sales values for High Rise units increased by $87 but decreased by $71 and one dollar for Low Rise and Townhome units, respectively, when compared to the Second Quarter of 2023

The sales range increased by $24,000 on the lower-end but decreased by $127,900 on the upper-end for Low Rise product since four quarters ago

Two bedroom High Rise product increased in per square foot sales value by $105 while two bedroom Low Rise units decreased by $37 per square foot when compared to the Second Quarter of 2023

The average sales price of a two bedroom Townhome increased by $170,047 and for a three bedroom Townhome, it decreased by $259,927 when compared to the Second Quarter of 2023

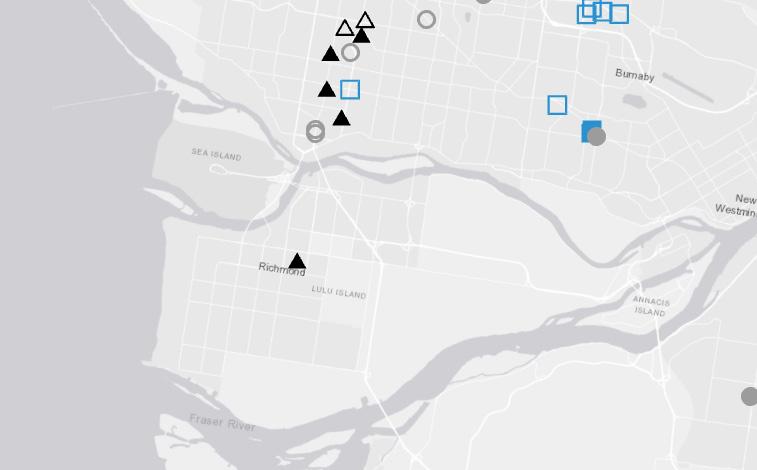

For the Second Quarter of 2024, the Tri-Cities market area is set to maintain its “Green Light” status, despite a decrease in total sales to 536, representing a 20 percent drop compared to the previous quarter. Buyer activity remains strong, particularly in projects offering new and competitively priced inventory. The Low Rise sector experienced increased buyer activity with a 72 percent increase in sales from the previous quarter. This surge can be attributed to an increase in supply, with developers launching projects that were previously on hold. The market area saw five new Low Rise projects come to market over the second quarter of 2024. Sales growth is anticipated to continue in the coming months. Developers are slated to release additional product into the market, with multiple project anticipated to launch in the third quarter of 2024.

Beedie’s Fraser Mills masterplan continued with the launch of Chapter, a 173-unit Low Rise building, achieving 53 total sales at a blended price per square foot of $937

Ironwood by Qualex-Landmark achieved 100 sales over the Second Quarter of 2024 at a blended price per square foot of $1,159

Anthem released additional inventory in SOCO Two and achieved 36 sales over the quarter

Partington Creek by Polygon Homes, a 148-unit Townhome community in Burke Mountain, released 64 units in February and achieved 23 sales at a blended price per square foot of $690

Porthaven, a 108-unit Low Rise building by NorthStar Developments achieved 54 sales at an overall blended price of $960 per square foot

Compared to the Second Quarter of 2023, sales decreased for High Rise, Low Rise, and Townhome units by 31, 42, and 14, respectively

Total listings have increased by 116 when compared to the same period last year

The average sales value per square foot for High Rise, Low Rise, and Townhome units decreased by two, four, and $30, respectively, when compared to the Second Quarter of 2023

The lower end sales range for High Rise, Low Rise, and Townhome units have increased by $13,500, $10,000 and $51,000, respectively, when compared to the same quarter last year

The average sales price per square foot of a one bedroom High Rise decreased by $19 while a one bed Low Rise increased by $35, when compared to the Second Quarter of 2023

The average sales price of a two and three bedroom Townhome decreased by $65,257 and $18,605, respectively, when compared to the Second Quarter of 2023

The Ridge Meadows market area will maintain its “Yellow Light” status for the Second Quarter of 2024. Total sales in this market area decreased by 21 percent to 45 transactions over the quarter. Furthermore, the Low Rise sector experienced a significant decline, with sales decreasing by 77 percent, resulting in only three transactions. The Townhome sector saw a five percent decrease in sales and accounted for 93 percent of total sales. 12 percent of all inventory was absorbed this quarter. No new woodframe projects were released over the quarter. Many developers have paused project sales temporarily, as they wait for the projects to near completion before releasing the remaining inventory. Upcoming project completions are anticipated to improve sales and absorption rates, introducing a substantial amount of unreleased inventory into the market..

The Warwick by Bolt Construction Ltd. is a 31-unit Townhome project launched in early April and achieved one total sale to date at a blended price per square foot of $639

Everwood by Woodlock Developments is a 35-unit Townhome project launched in early May and achieved five total sales at a blended price per square foot of $643

City and Laurel by Atterra Development Group closed their presentation centre after a successful sales campaign with 75 sales of 100 units over the previous three quarters

Portal by Western Canada Monthly Income Fund is a 36-unit Low Rise project directly across from Port Haney Station is anticipated to launch in the Third Quarter of 2024

Total listings increased by 130 and total resales decreased by 47, respectively, when compared to the Second Quarter of 2023

The average sales value per square foot for Low Rise units and Townhomes increased by six and five dollars since the same quarter last year

The average sales price of a one bedroom Low Rise unit increased by $12,277 and it increased by $12,508 for a two bedroom Low Rise unit when compared to the same quarter last year

The lower end of the sales range for Low Rise products remained the same and the upper end increased by $85,000 compared to the same period last year

The sales range has decreased by $3,000 on the lower end and increased by $25,000 on the higher-end over the past four quarters for Townhomes

Three bedroom Townhome units saw a decrease in average price on sold units by $2,655 over the past year

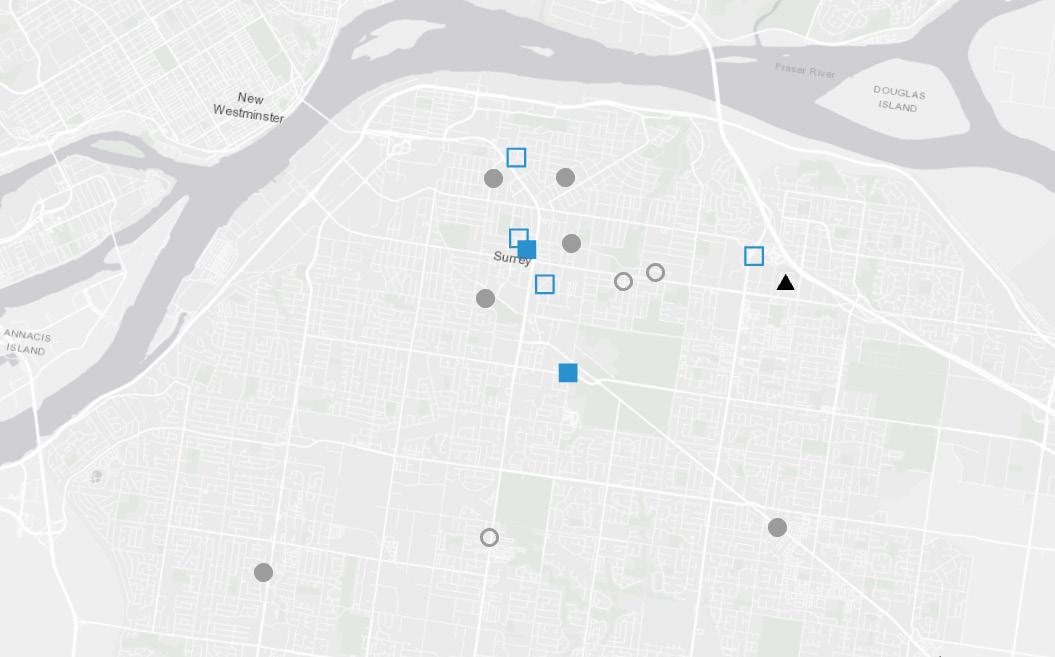

The Central Surrey and North Delta market area retained its “Green Light” status for the Second Quarter of 2024, witnessing a notable 21 percent increase in total sales, rising from 681 to 822 sales. This drove heightened transaction volume, allowing entry into the market for first-time homebuyers. 14 total project launches were observed during the quarter, introducing 1,703 new units to the market. The market area saw a total absorption rate of 28 percent throughout the quarter. The Low Rise sector saw the largest amount of sales activity with 490 total sales, accounting for 60 percent of total sales. Competitive pricing, extended completion timeline, low deposit structures, and plentiful amenities have especially sparked purchaser engagement when compared to projects situated north of the Fraser River.

Market Highlights

Parkway 2, a 52-storey 396-unit High Rise by Bosa Properties launched in the second quarter of 2024 and achieved 150 total sales

Realco Properties’, Scott + 77, sold 149 units over the quarter, selling out of it’s initial release, achieving a blended price per square foot of $930

Georgetown Two, Anthem’s High Rise in Surrey City Centre achieved 37 sales over the quarter

Quadra Homes launched Ledgeview II, a 319-unit Low Rise project across two buildings. The project achieved 95 sales at an overall average price per square foot of $890

Mosaic Homes Townhome project Woodward, sold 16 units over the quarter at an overall price per square foot of $660

Solterra will be launching Vivere, a 20-storey, 175-unit High Rise building early in the Third Quarter of 2024

Total listings and resales increased by 237 and 43, respectively, when compared to the First Quarter of 2023

The months of supply for resales in the Townhouse market has increased from 3.3 months to 5.6 months when compared to the same quarter last year

The months of supply for resales in the High Rise and Low Rise market increased by 2.1 and 0.6 months, respectively, when compared to the First Quarter of 2023

The per square foot sales value have increased for High Rise, Low Rise, and Townhome units by $23, $25 and $42, respectively, when compared to four quarters ago

One bedroom High Rise and Low Rise units saw an increase in average price per square foot on sold units by $37 and $13, respectively, over the year

The average two bedroom Townhome saw an average sales price decrease of $13,557 while it increased for a three bedroom Townhome by $53,415 when compared to the same period last year

The South Surrey/White Rock market area has been given a “Yellow Light” status for the Second Quarter of 2024. With a total of 52 sales, the market area experienced a 51 percent decrease from the preceding quarter. The Townhome sector has been significantly more active compared to other product types, representing 73 percent of total sales in the market area. This surge can be attributed to four Townhome projects launching over the quarter, adding 102 new units to the market. Increased supply and competitive pricing, especially for units with a price point under one million, have facilitated increased buyer activity. High Rise and Low Rise condominiums saw decreases in sales by 87 and 50 percent respectively. These sharp drops in sales can be attributed to a lack of new inventory being introduced into the market. The market achieved an overall absorption rate of 19 percent, down from 32 percent in the previous quarter.

Chelsea, Streetside Development’s final phase of their South Surrey Townhome masterplan, The Boroughs, was released in early 2024. The project achieved 9 sales over the second quarter of 2024 at an overall blended price of $651 per square foot

PCC Homes released their 50-unit Townhome development in South Surrey, Glenmont, in March 2024. The project achieved seven sales to date with an average blended price of $682 per square foot

Fox and Aikins South, Park Ridge Homes’ second release of Fox and Aikins, launched their sales campaign in March, releasing 43 Townhomes and achieving seven sales at an overall blended price of $690 per square foot

Elisa, a 31-unit Townhome project, by Hive Development launched in mid April and achieved 5 sales over the second quarter of 2024

The Loop, Gramercy Development’s Townhome development in South Surrey achieved 14 sales over the Second Quarter of 2024

Zenterra’s Low Rise development, King + Crescent, led all Low Rise sales over the quarter as it achieved nine sales across its four Low Rise buildings

When compared to the same quarter last year, the total number of listings increased by 84 while resales decreased by 45

The months of supply for resales of Low Rise and Townhome product has increased by 2.5 and 3.5 months, respectively, while High Rise product has decreased by 1.1 months when compared to the Second Quarter of 2023

Average per square foot sale values for High Rise and Townhome units increased by $102 and $12, respectively, while Low Rise units decreased by six when compared to the Second Quarter of 2023

Low Rise product increased in average days spent on the market, averaging 18 more days on the market while High Rise products saw a decrease of 29 days when compared to the Second Quarter of 2023

One bedroom Low Rise units saw a decrease in average price per square foot on sold units by $28 while two bedroom High Rise units increased by $5 over the past year

Two bedroom Townhomes saw a decrease in average sales price by $26,695 and three bedroom Townhomes increased by $52,164 when compared to the same quarter last year

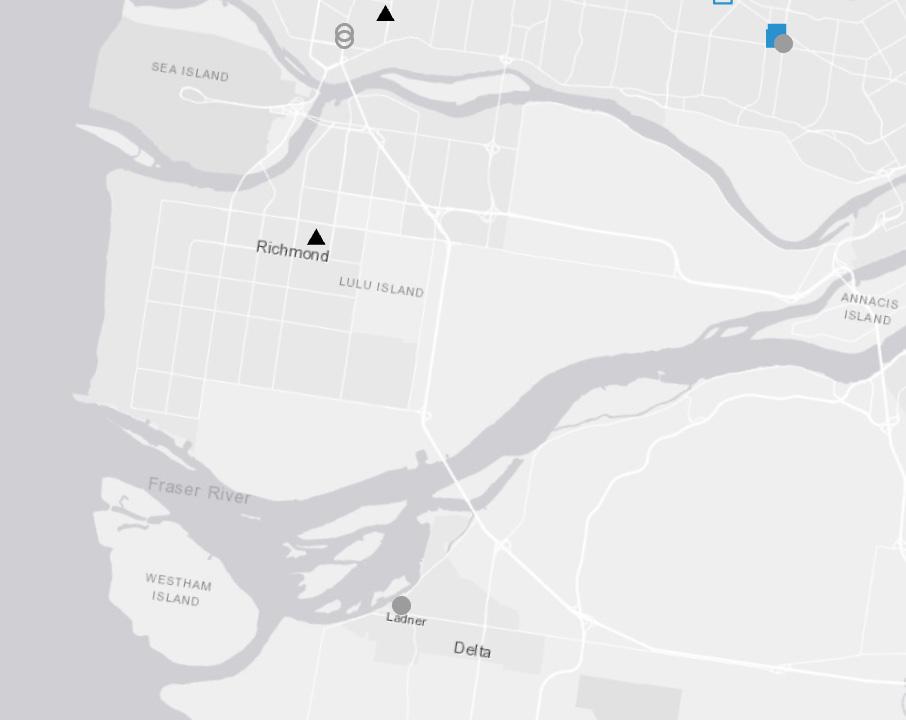

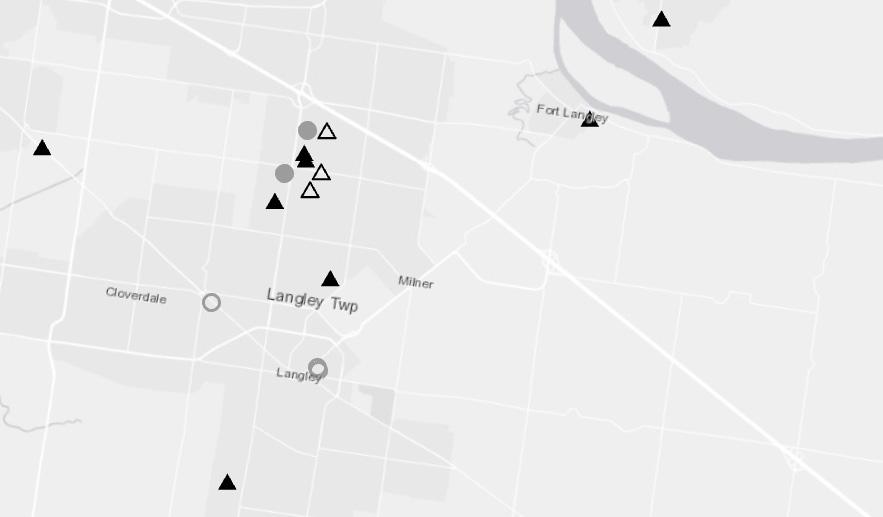

The Langley/Cloverdale market area has been upgraded to “Green Light” status in the Second Quarter of 2024, with a 152 percent increase in overall sales from 259 to 652 transactions. Sales activity has been steadily rising as developers continue to introduce inventory in the Low Rise and Townhome sectors. Nine new project launches were observed during the quarter. Even with 1,332 units this quarter 49 percent were absorbed. The Low Rise sector saw the most significant surge in sales, with a 199 percent increase and a 52 percent absorption rate for the quarter. Low Rise projects accounted for 84 percent of sales this quarter, driven by the release of numerous projects and strong demand for affordable entry points. Successful projects often have low entry price points and reduced deposit structures, making them more accessible to first-time homebuyers and investors.

Azure Grove by ML Emporio Properties launched over the second quarter of 2024 and sold out of all 273 units at a blended price per square foot of $935

Phase one of Jericho by Essence, a 371-unit woodframe building launched this quarter and sold 136 units at a blended price per square foot of $910

Aviva, a 68-unit Townhome project by Zail Properties was released this quarter, achieving 28 sales at a blended price per square foot of $640

Zenterra’s Townhome project, Newbury, sold out this quarter at a blended price per square foot of $691 after selling the remaining three units

Scale, a 75-unit woodframe building by Scale Projects launched this quarter and sold 37 units at a blended price per square foot of $860

Elijah, a 180-unit woodframe project by Whitetail Homes is anticipated to launch early in the third quarter of 2024

Resales for Low Rise product decreased by $71 and Townhome product decreased by $24 when compared to the Second Quarter of 2023

Total listings increased by 100 when compared to the same quarter last year

The sales range decreased by $19,000 on the lower-end and increased by $34,900 on the upper-end for Townhome product since four quarters ago

Average price per square foot sales values decreased for Low Rise condominiums and Townhomes by $71 and $24, respectively, when compared to this quarter last year

The average price per square foot sales value for a one bedroom Low Rise unit decreased by $4 and a two bedroom Low Rise unit increased by $3 when compared to the Second Quarter of 2023h

Since the Second Quarter of 2023, the months of supply for Townhome product has increased from 1.1 months to 2.1 months

The Abbotsford/Mission market area has retained its “Green Light” status for the Second Quarter of 2024, reflecting strong performance and increased buyer activity. This quarter, the market area recorded 322 sales, marking a remarkable 127 percent rise from the previous quarter. Additionally, the absorption rate climbed from 35 percent in the first quarter to 55 percent, signaling heightened buyer engagement. The region continues to stand out for its affordability and competitive entry price points compared to nearby market areas. Low Rise condominiums remain particularly popular, making up 81 percent of total sales. Looking ahead, buyer interest is anticipated to stay robust, bolstered by new project launches and a growing inventory within master-planned communities. This approach is designed to supply inventory for a diverse buyer pool and support continued market vitality.

Phase one of Sage by Diverse Properties achieved 172 sales at a blended price per square foot of $760, leaving only three units remaining in the first phase of the project

Montgomery by Redekop Faye, a 85-unit Low Rise project sold 36 units in the first release at an overall price per square foot of $728

Montvue building two launched over the Second Quarter of 2024 and has sold 25 units at an overall price per square foot of $747

Skyview, a 99-unit Townhome project by Bianco Development released 33 units and sold four homes at an overall price per square foot of $500

Scout, a 99-unit six storey woodframe project by Heinrichs Developments is anticipated to launch in July 2024

Total listings and resales increased by 18 and 25, respectively, when compared to the Second Quarter of 2023

Over the past four quarters, the lower bound of the sales range for Low Rise product has decreased by $22,300 and increased by $7,350 on the upper bound

Price per square foot sales values for Low Rise condominiums and Townhomes are up by $25 and $7, respectively, from the Second Quarter of 2023

The average days spent on market for Low Rise units decreased by 17 days while it increased by six days for Townhomes when compared to the same quarter last year

The average sales price per square foot for Low Rise one bedroom condominiums increased by $42 while two bedroom Low Rise condominiums decreased by $3 when compared to the same quarter in 2023

The average sales price per square foot for two bedroom and three bedroom Townhome units decreased by $4 and $3, respectively, when compared to the Second Quarter of 2023

As we wrap up the second quarter of 2024 the Fifth Dimension, we urge everyone in our industry to look ahead and think how we can all adapt to our current landscape or affect a change that will benefit the majority of homeowners in British Columbia.

The second quarter definitely moved slower than hoped. Especially when we saw the first and second cut in interest rates in over 5 years. This quarter is the first quarter people are really feeling the effects of our current communist style policies from our provincial leaders. While stating that we need more homes and are in crisis, they continue to push policies that have only made homeownership more expensive and reduced the number of homes that can actually be built. This approach has lowered supply instead of increasing it, keeping prices and costs high despite lower sales numbers. It is very obvious our current government at all levels municipal, provincial and national have zero financial or budgeting skills, no ability or even a basic comprehension of economics and clearly do not understand how homes are built.

Who is going to buy the pre-sales necessary to fund construction of all the new homes our government wants built, when no one wants to buy

because the policies they themselves have implemented on these very sales? If the sales do not happen the construction loan is not funded, and the units are not built, thus no meaningful new supply is added as required to lower prices. Projects are already being put on hold in the Okanagan and now the Lower Mainland which is in fact lowering or removing inventory from the market when the purpose of all this change was to gain more supply and bring prices down.

As we enter the third quarter of 2024 we are expecting further relief from the Bank of Canada with more interest rate cuts and continue to hope for our government’s to perhaps start consulting with industry experts to come up with new policies that may actually help all citizens instead of working to the detriment of the majority of they have been pushing forward with little to no input from industry experts with their current policies and perhaps why they have not been working.

We will wait and see the results of the election this October to see if the people of BC have noticed their rights being removed and if they

vote for change this fall. Or will they follow the example of Russia under Marxism where it was promised that the workers would rise, destroy capitalism, and create a socialist society under the leadership of the Communist Party of the Soviet Union where these types of policies ended up killing over 5 million people in the long run? Will we realize those that forget are doomed to repeat and change the path we are now headed towards? Will the people vote to break free and give themselves the autonomy required to succeed?

If you have a view you would like to share and/or questions you would like to discuss please contact Jamie Squires at Jamie@fifthave.ca.

Zonda Urban is Metropolitan Vancouver’s leading source for analytical interpretation of relevant real estate market data, trends and strategic recommendations.

Zonda Urban (formerly Urban Analytics) has been retained by Fifth Avenue Real Estate Marketing Ltd. To provide aggregate data on the Multi-family residential real estate market in the Vancouver Metropolitan. The methodology used to collect the data was as follows:

Metropolitan Vancouver refers to the area from West Vancouver to Abbotsford. The focus of this study is limited to the Multi-family market.

The primary method used to collect information is a personal visit to each project being actively marketed. In addition to collecting current sales information, Zonda Urban representatives engage onsite sales staff to determine additional relevant information such as incentive offerings, traffic trends and active buyer profiles. In all instances, active sales range quoted in tables is defined as “The per square foot sales range in which 75 percent of sales of this product type occurred”

For the purposes of this publication, Zonda Urban contacts various municipal planning departments along with developers (and/or their representatives) of proposed new developments to determine the anticipated timing of their approval and marketing launch.

The resale market provides an important barometer from which to assess demand and determine pricing for new home projects. Accordingly, Zonda Urban closely monitors the resale market for Multifamily homes in order to identify trends that are relevant to the new home sector. However, the breadth and depth of product for sale can create findings that are less than helpful to the new home developer

As a result, Zonda Urban recommends studying only product that is aged ten years or newer and valued at less than $1.2 million. While it could be argued that limiting the analysis to newer product (i.e. five years or newer) would be more relevant to the new home sector, we believe this would limit the sample size and potentially skew the data towards a specific type of product available in a small number of specific buildings/projects. In all instances active sales range quoted in tables is defined as “The active sales range in which 75 percent of sales of this product type occurred”.

For over 25 years, and prior to its transition to Zonda Urban, Urban Analytics provided clarity on what’s selling, who’s buying and what that means for our clients at every stage of their project.

Zonda Urban (Formerly Urban Analytics) been monitoring the new Multi-family home market in Metro Vancouver and beyond since 1994. In addition to providing clients with the most current and accurate information on actively selling and contemplated new Condominium and Townhome projects in Vancouver, Toronto, Ottawa, Calgary, Edmonton and Victoria on the market-leading NHSLive data product at nhslive.ca, Zonda Urban is also the leading provider of advisory services on the new Multi-family home market in these markets.

Zonda Urban also monitors the purpose-built rental apartment market, residential land transactions, and commercial property transaction data. Contact sales@zondaurban.com and/or advisory@zondaurban.com to learn more about these products and services.

Zonda Urban and NHSLive provides the confidence and knowledge to make better decisions.

Zonda Urban (Formerly Urban Analytics) (604) 569-3535 zondaurban.com

President & Managing Broker Jamie Squires

Address #313 - 14928 56th Avenue, Surrey, BC V3S 2N5

Phone Number 604.583.2212

Email Jamie@fifthave.ca

Website fifthave.ca

President Jacky Chan

Address 1480-1500 West Georgia Vancouver, BC V6G 2Z6

Email jacky@bakerwest.com

Website bakerwest.com

This document has been prepared by Fifth Avenue Real Estate Marketing Ltd. And BakerWest Real Estate Incorporated with data provided by Zonda Urban for advertising and general information only. Fifth Avenue, BakerWest, and Zonda Urban make no guarantees, representations or warranties of any kind, express or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. E.&.O.E. Metropolitan Vancouver: West Vancouver to Aldergrove. Excludes Chilliwack, and Mission. Resale Data: MLS sold for attached product (High Rise, Low Rise, and Townhomes) built within the last ten years for units valued less than $1.2 million. Single family sales are excluded from the report. This publication is the copyrighted property of Fifth Avenue Real Estate Marketing Ltd. © 2023. All rights reserved.