THE FIFTH DIMENSION

A Comprehensive Analysis of the Metro Vancouver Multifamily Market

A Comprehensive Analysis of the Metro Vancouver Multifamily Market

With the Third Quarter of 2024 fully wrapped up we reflect here on changes affecting our local market, including the results of recent provincial election, interest rate drops, the US federal election and the our own upcoming federal election.

Despite all the policy change from our Provincial Government being made counteractive to itself the people of British Columbia have elected another NDP Government. However, ended very close with the Conservatives showing our leaders they need to be careful as they have barely maintained their position in last month’s election. The only reason this happened was due to two reasons, there were a lot of independents skewing votes in many areas allowing the NDP to scrape in as well as the let’s call them wealthier ridings voting with their hearts as finances don’t affect them electing the Green Party. Without these 2 factors, the NDP could not have won this election as they did with some ridings winning by under 100 votes! This means we can expect some more of the same, some good policies that could help supply, followed by bad policies that makes it so the new supply cannot come to fruition as required. However, more will be brought to light as more closely monitored by our newly elected conservative MLA’s. We will watch closely.

We saw two interest rate drops over the Third Quarter and a fourth early in the final quarter so far of 2024. Major banks across Canada are projecting further drops with various articles quoting they anticipate the Bank of Canada (BOC) to continue dropping rates to as low as 3% by In

May 2025, the public takes notice, and anticipation builds. While traffic has increased at many presentation centers across the Lower Mainland, sales absorptions have declined compared to the previous quarter. Potential buyers are exploring their numerous options and waiting for lower rates expected next spring. Based on this, we anticipate at least a slight surge in absorptions for Q2 2025, with minimal change expected until then due to a simple public fact. This outlook could shift if the economy changes, though no such changes are currently projected.

Our neighbours south of our border had their federal election in recent weeks, and somehow surprisingly, or maybe not (depending on your outlook), it was a massive majority win for the Republican party led by Donald Trump. What does this mean for Canada, and BC in particular? Only time will tell. The US has elected a leader that has promised to put its people first, meaning potentially higher tariffs/ costs for other countries that do business with the US, such as us. Leading into our own upcoming federal election, as Canadians we will need to elect a leader that will be strong enough to stand up for Canadians and what Canada requires to succeed. Someone that will stand a chance negotiating with leaders such as Trump. Based on our current Federal Government’s track record to date, I personally highly doubt they would be able to do this, as seen previously.

The bottom line is costs are up, market absorptions are down, majority of new builds require about 75% firm presales for banks to even fund

construction to commence excavation for future homes. Homes cannot be more affordable due to rising costs from Government policy and if they cannot sell or pre-sell to the point the construction can commence, they simply will not be built until this can happen. Population is rising with record immigration, and we do not have enough homes for everyone today, and with the current NDP and Federal Liberal ‘suck and blow’ policies we will not have this tomorrow or anytime in the near future our supply and affordability issue will only continue to worsen. When rates do go low enough there will be another frenzy from the pent-up demand pushing prices even higher as the supply will have dwindled down that should increase to keep costs and prices more affordable. Regards, and all the best.

Jamie Squires

President & Managing Broker

Fifth Avenue Real Estate Marketing LTD. Jamie@fifthave.ca

In this third edition of the Fifth Dimension for 2024, our data collection and analysis partner Zonda Urban shares its commentary on the most recent quarter, market performance year to date, and what to expect in the upcoming quarter with respect to Metro Vancouver’s multi-family residential real estate market.

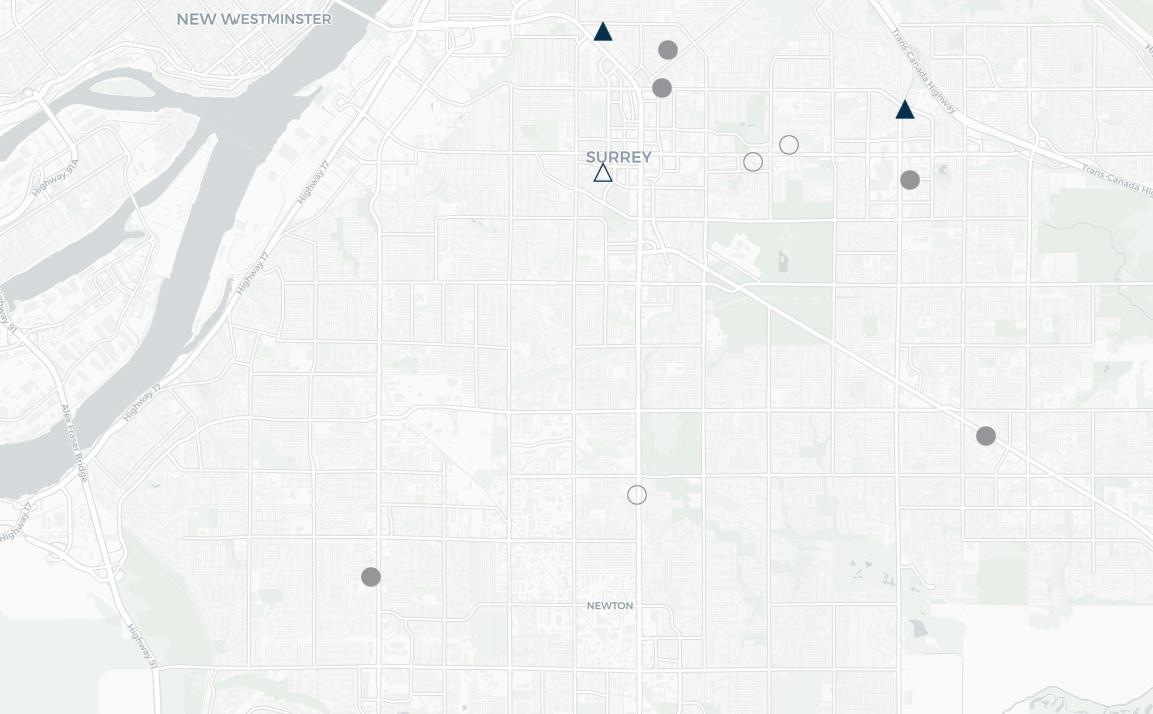

Metro Vancouver’s new home market officially entered “buyers” territory in the Third Quarter of 2024 as it experienced two consecutive quarters with reasonable project launch activity met with subdued demand. The spread between total released inventory and quarterly new home sales at the end of the Third Quarter (12,170) was up 31 percent from last quarter and was the highest on record since Zonda Urban began tracking this metric in 2010. Overall sales activity in the Third Quarter continued to be affordability and price point driven and like the previous quarter was primarily focused in the Central Surrey/North Delta, Langley/ Cloverdale, and Tri-Cities market areas.

A total of 23 new projects representing 2,863 units were introduced during the quarter, a significant decrease from the 46 new projects consisting of 4,545 units released in the Second Quarter of 2024. A total of 1,926 new home sales were recorded during the Third Quarter of 2024, which is a 38 percent decrease compared to the same quarter last year and also down 45 percent from the long term average. There were 14,096 released and unsold units remaining at the end of the Third Quarter. This reflects a fourteen percent increase from the previous quarter and a 75 percent increase from the same quarter last year. Additionally, there were 1,784 completed unsold new multi-family homes available at the end of the Third Quarter, marking a 10 percent increase from the previous quarter

and a 55 percent increase from the same quarter last year.

A total of 465 High Rise sales were recorded in the Third Quarter of 2024: a 48 percent decrease from the previous quarter and 68 percent lower than the same quarter last year. High Rise sales accounted for 24 percent of new home sales during the quarter. There were 8,460 released and unsold High Rise units available at the end of the Third Quarter, a 12 percent increase from the previous quarter and a 70 percent increase year-over-year. The majority of High Rise sales occurred in the Tri-Cities (123 sales), Burnaby/New Westminster (118 sales), and the Surrey/North Delta (87 sales), market areas, as they combined for 71 percent of all High Rise sales during the quarter. Over the quarter, three new High Rise project launches were launched, releasing 818 units into the market. Notable sales activity occurred at Vivere by Solterra Group of Companies (Surrey City Centre), Bassano by Boffo Developments (Brentwood), and Burquitlam Park District by Intergulf Development Corp (Burquitlam).

The 1,106 new Low Rise condominium sales recorded in the Third Quarter of 2024 were 35 percent lower than the previous quarter but 33 percent higher than the number sold in the same quarter last year. Low Rise sales constituted for 57 percent of all new homes sales this quarter. During this period, 15 new projects launched, adding a total of 1,627 units to the market, which is lower than the 19 new project launches in the previous quarter, releasing 2,078 units. The 3,894 released and unsold Low Rise units at the end of the Third Quarter represents a 27 percent increase from the previous quarter. The highest number of new Low Rise sales occurred in the Surrey/North Delta (371 sales), Tri-Cities (303 sales), Abbotsford/Mission (125 sales), and Langley/Cloverdale (125 sales)

market areas, combining for 84 percent of all Low Rise sales over the quarter. Notable sales activity across Metro Vancouver’s Low Rise condominium sector was observed at Level by Jayen Properties (Burquitlam), Aria by Diverse Properties (Abbotsford), Whitetail Homes’ Elijah, Scott + 77 by Realco Properties (North Delta), and Fleetwood Village II – Building 7 by Dawson + Sawyer (Surrey).

A total of 355 new Townhome sales were recorded in the Third Quarter of 2024, marking a 31 percent decrease from the previous quarter and a nine percent year-over-year decrease. Townhome sales accounted for 18 percent of all new home sales over the quarter. There were 1,742 released and unsold Townhome units at the end of the Third Quarter which was down by less than a percent from the previous quarter but was 64 percent higher compared to the same quarter last year. During the quarter, five new Townhome project launches that added 114 new units to the market were observed. This marks a significant decrease from the previous quarter, where 22 projects were launched. Positive sales activity was observed at Aviva by Zail Properties (Yorkson), Heartwood by StreetSide Developments (Coquitlam), The Falls at Kanaka Springs by Epic Homes (Maple Ridge), Polygon Homes’ Westhampton at Hampton Cove (Ladner), Woodward by Mosaic Homes (Surrey), and Latimer Walk by Zenterra (Yorkson).

A total of 2,157 newer multi-family homes were resold in the Third Quarter of 2024. This total is 17 percent lower than the previous quarter and a 14 percent decrease compared to the same quarter in 2023. When comparing activity across product sectors, High Rise, Low Rise, and Townhome re-sales were 13, 18, and 21 percent lower, respectively, when compared to the previous quarter. Year over year, the High Rise, Low Rise, and Townhome sectors experienced decreases of 15, 17, and 10 percent, respectively. Overall, active listings decreased by one percent when compared to the previous quarter but increased by 27 percent when compared to the same quarter last year. Active listings for High Rise, Low Rise, and Townhome products each experienced an increase of 22, 40, and 27 percent, respectively, when compared to the Third Quarter of 2023.

Softer conditions for new home builders persisted as only 26 percent of the newly launched product in the Third Quarter was absorbed, further expanding the spread between active listings and sales. The 22 months of supply of new home inventory recorded at the end of the Third Quarter was the highest on record. One of the more challenging aspects of current market conditions is the rising cost of development, which renders it unfeasible for many projects to substantially decrease pricing to attract new home buyers.

Projects offering lower deposit structures, mortgage payment buydowns and select incentive offerings have experienced some degree of success in the market, although it should be noted that most successful projects that offered this also were predominantly in Low Rise buildings that also featured lower and attractive price points. While the recent 50 basis point cut implemented by the Bank of Canada in October hasn’t yet resulted in any increase in sales, it is likely that future reductions could potentially be the

final catalyst needed to spark demand as mortgage payments of a new home become more attractive relative to rents. This shift could occur in early 2025 and would be welcomed by development industry stakeholders.

Notable projects that could launch in the Third or Fourth Quarter of 2024 include: Vancouver Downtown – Prima Properties Ltd.’s Monogram; Vancouver West – Grosvenor’s Mayfair West, Pennyfarthing Homes Slate and Ash, Transca Developments’ Latitude on Cambie, Novara Properties’ Ashlyn, Tavanco Corp’s Wren; Vancouver East – Hana Ventures’ Solid and Trillium Projects’ Hendry; North Shore – Citimark & Peterson Group’s Emerald; Burnaby/New Westminster – Mosaic Homes’ Symposia, Beedie Living’s Koen; Tri-Cities – Wesgroup’s Inlet District Phase 1, Rize’s Olo, Strand’s Kora, Adera’s Kestrel, Placemaker Communities Inc.’s Mary Anne’s Place; Richmond/South Delta – Bramor Developments’ Skye; South Surrey/White Rock – Cressey’s Rockford; Central Surrey/North Delta – Northwest Development’s Spera, Matte Homes’ Zenith, Tangerine Developments’ Fellow; Langley/Cloverdale – Westmont Homes’ The Merchant, Westmont Homes’ Saxon Park, Jayen Properties’ Phase 2 of Park and Maven Condos; Abbotsford/Mission – Imperial Blue Developments Uptown Cedar, Whitetail Homes’ Caleb; Ridge-Meadows – Platinum Group’s Phase 3 of Inspire

Sales Comparison Totals Q3-2024

Resale Market Totals Q3-2024

465

1,106

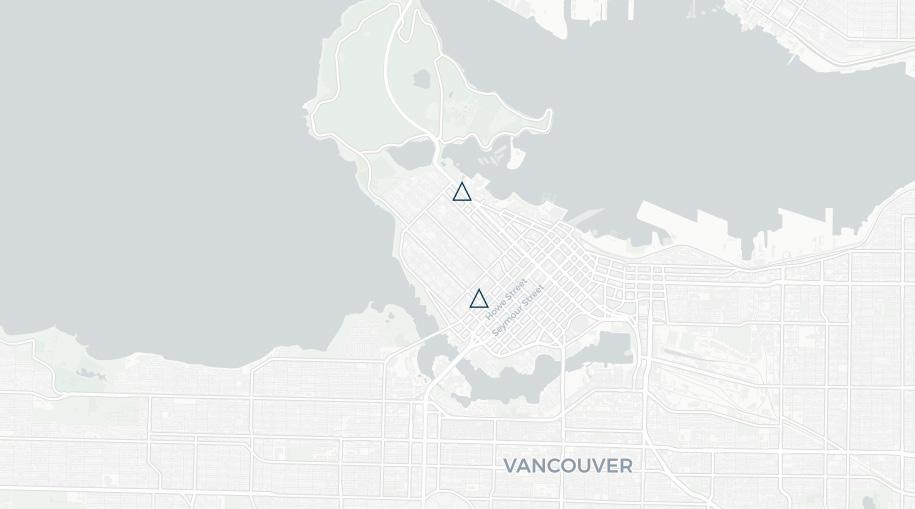

The Downtown Vancouver market area posted another weak quarter, maintaining a “Red Light” status due to slow sales and limited buyer activity. Total sales declined by 44 percent, dropping from 16 units in the previous quarter to just 9 units in the third quarter. All sales were within the High Rise sector, which saw its inventory decrease slightly from 440 to 432 units. Despite this slight dip in inventory, the absorption rate remained low at just 2 percent, indicating a sluggish market. The luxury-oriented price range has likely deterred potential buyers, especially in an environment with higher interest rates and economic uncertainty. Additionally, no new project launches, or significant incentives were introduced during the quarter, further reducing demand and buyer interest. Without a change in market dynamics or more competitive pricing strategies, the market may continue to see lackluster performance moving forward.

Monogram by Prima Properties consisting of 261 condos and 50 rental units is anticipated to launch in the Fourth Quarter of 2024

The Pacific by Grosvenor sold two units this quarter at a blended price of $2,119 per square foot with one final unit remaining

1335 Howe by Onni led the market area in sales with seven total sales this quarter at an average price of $1,903 per square foot

**Note: The greater variation in active Sales Price Range is the result of the achievable sale

Average sales values per square foot have decreased by $73 when compared with the Third Quarter of 2023 for High Rise product

The number of High Rise listings decreased by 22 while High Rise resales decreased by 21 when compared to the Third Quarter of 2023

For High Rise condominiums, the average per square foot sales values of one bedroom units decreased by $120 while two bedroom units increased by $126, when compared to the Third Quarter of 2023

The months of supply for resales in the High Rise market has increased from 10.3 months to 13.2 months when comparing to the same quarter last year

The sales range has increased by $10,000 on the lower-end and decreased by $20,000 on the higher-end, over the past four quarters for High Rise product

The average time a unit is on the market has increased for High Rise by 30 days when compared to the Third Quarter of 2023

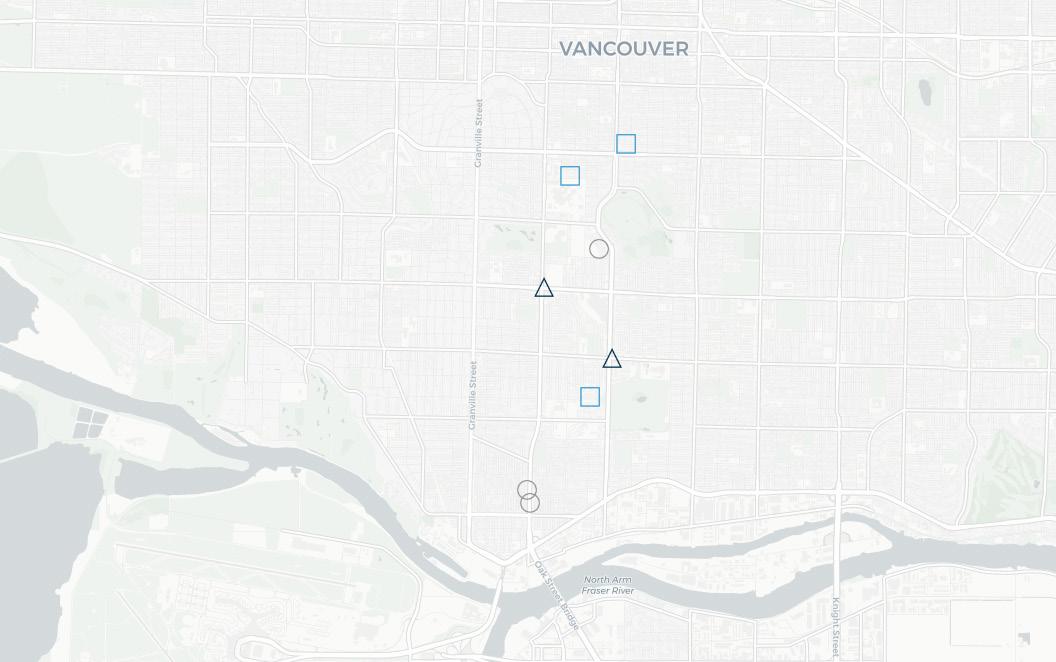

In the third quarter of 2024, Vancouver West retained its “Yellow Light” status. Sales across all product types declined from the previous quarter, with total transactions falling by 55 percent, down to 56 sales from 125. The High Rise sector faced the most significant impact, with sales dropping sharply to 13 from 57 in the second quarter. While the Townhome sector continued to lead with 37 transactions, it experienced a 36 percent decrease from the previous quarter’s 58 sales. Low Rise sales also slowed, recording six sales compared to 10 in the prior quarter. Unsold inventory decreased in the High Rise and Townhome sectors, while Low Rise inventory rose to 72 units from 64. The overall absorption rate remained modest at six percent for the third quarter. Despite the slowdown, sales activity is expected to increase toward year-end as delayed projects reach completion.

New Market Highlights

No projects launched in the Third Quarter as developers were preparing to launch over the fourth quarter in anticipation of rate cuts

West Wind at Lelem Townhomes by Polygon Homes led Townhome sales and achieved six sales at a blended price per square foot of $1,339

Pure, by Lavern Developments achieved three sales at a blended price per square foot of $1,403

Cambie Gardens Phase 1 (East Tower), by Onni achieved four sales at a blended price per square foot of $1,623

Total listings increased by 66 while total resales decreased by 58 when compared to the Third Quarter of 2023

The average time a unit is on the market has increased for High Rise, Low Rise, and Townhome product by 44, 6, and 12 days, respectively, when compared to the Third Quarter of 2023

Average price per square foot sales values for High Rise and Townhome units have decreased by $45 and $3, respectively, while Low Rise units increased by $59 over the past four quarters

Two bedroom High Rise product saw a decrease of $55 while two bedroom Low Rise product saw an increase of $76, in average price per square foot sales value when compared to four quarters ago

The sales range has increased by $60,000 on the lower end and increased by $28,000 on the higher end when compared to the Third Quarter of 2023 for High Rise product

The Townhome sales range has decreased by $110,000 on the lower end and increased by $68,000 on the higher-end over the past four quarters

In the third quarter of 2024, the Vancouver East market area sustained its “Yellow Light” status. A total of 34 sales were recorded, marking a 61 percent decline from the previous quarter. The overall absorption rate dropped to 4 percent this quarter. The High Rise sector stood out with 14 sales, representing 41 percent of total transactions. A new High Rise project launched at the end of the quarter, setting a record as the highest-priced active project based on price per square foot. In contrast, the Low Rise condominium sector saw a 75 percent decline in sales, largely due to limited new inventory. Elevated price points continue to limit buyer interest, especially among those looking to enter the housing market. To retain its “Yellow Light” status, the market area will need to achieve higher sales in the coming quarter.

Market Highlights

Frame by Peterson Group, a 217-unit High Rise project lead all High Rise projects in sales this quarter and achieved 10 new sales at a blended price per square foot of $1,325

The Jim Pattison Group launched, M6, a 76-unit High Rise in mid September at an overall price per square foot of $1,628

Ace on the Drive, by Wesgroup achieved two sales, over the Third Quarter of 2024

The second phase of The Cut by Fabric Living and Ergas Group sold 6 units this quarter at a blended price per square foot of $ 1,198

2550 Garden Drive by Bucci sold four units this quarter at a blended price per square foot of $ 1,290

The average time a unit is on the market has increased for High Rise, Low Rise, and Townhome units by 15, 20 and 25 days, respectively, when compared to the Third Quarter of 2023

Average price per square foot sales values for Low Rise and Townhome units increased by $23 and $28, respectively, while High Rise units decreased by $25 when compared to the same quarter last year

The months of supply for resales in the High Rise market has increased from 4.1 months to 5.3 months when compared to the same quarter last year

The average price per square foot in a Low Rise decreased for a one bedroom unit by $17 and increased for a two bedroom unit by $26 when compared to the Third Quarter of 2023

Total listings have increased by 47 while resales saw a decrease of 11 when compared to the Third Quarter of 2023

The average price per square foot for a two bedroom Townhome increased by $29 while a three bedroom Townhome increased by $30 since the Third Quarter of 2023

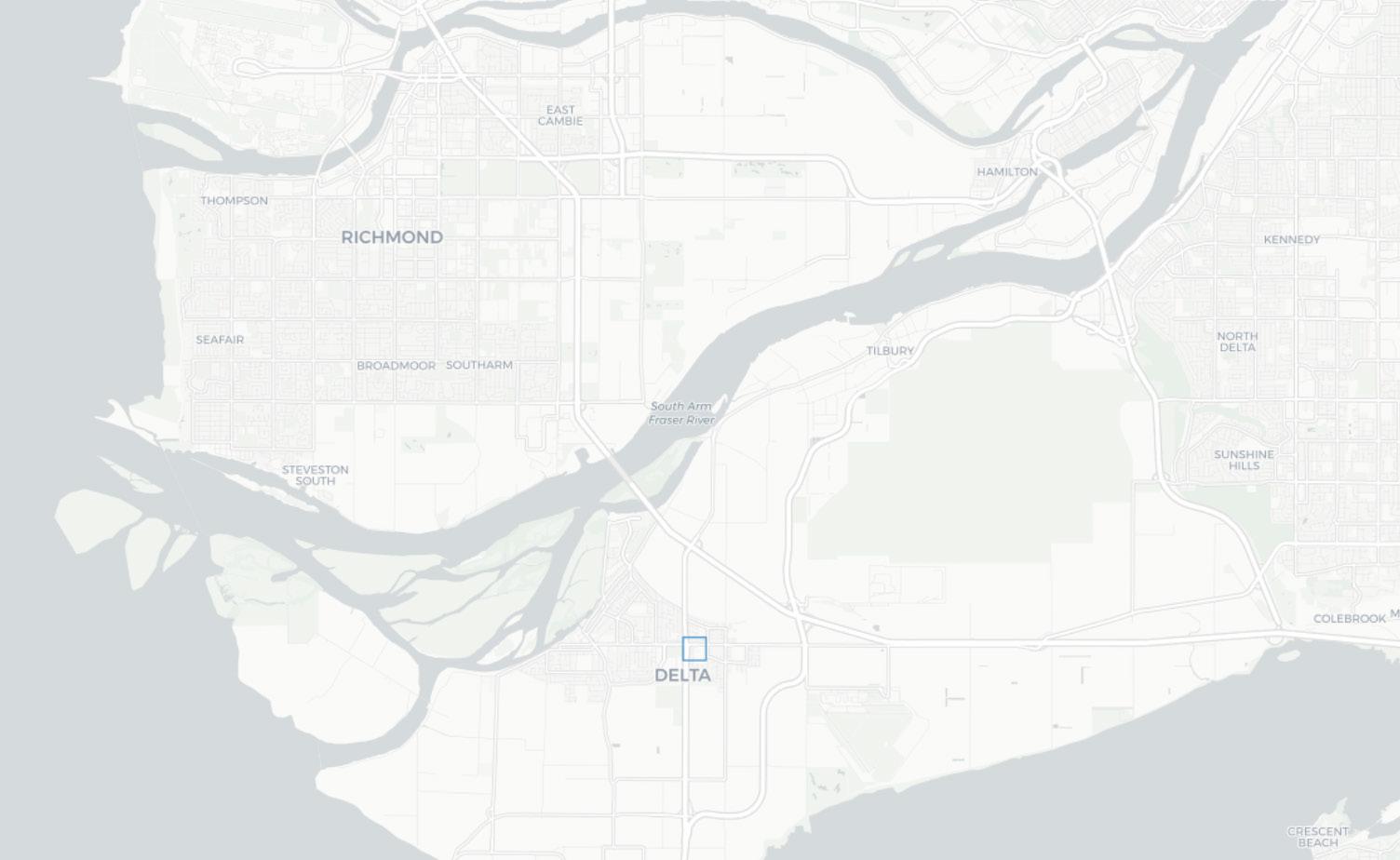

Richmond and South Delta will maintain its “Yellow Light” status in the third quarter of 2024. Total sales increased by 27 percent from the previous quarter, rising from 97 to 123 units, with notable growth in the Low Rise sector, where sales climbed by 46 percent. Despite a 20 percent increase in High Rise sales, unsold inventory remains elevated at 694 units, a slight decrease from 753 units in the prior quarter. While some developers have introduced incentives to encourage sales, the ongoing slowdown in High Rise absorption continues to be a concern. Although unsold inventory has decreased, it remains high, and absorption rates for High Rise projects continue to lag. While the Richmond and South Delta market area shows positive momentum, it requires careful monitoring in the coming quarters.

Talistar - Aurora (Phase 1) by Polygon Homes had three sales this quarter, with a blended price per square foot of $1,255, as it advances in the framing stage.

View Star (Bldg J and A) saw increased absorption with five sales this quarter, reaching an average price of $1,044 per square foot

Prima by Anderson Square achieved six sales this quarter at a blended price of $1,184 per square foot

Galleria – Picasso by Concord Pacific has only one unit remaining this quarter and led all product types this quarter with 38 sales

Bridge and Elliott by Headwater Projects in Ladner was the leading low-rise development with 30 sales this quarter at an overall price of $980 per square foot

**Note: The greater variation in Active Sales Price Range is the result of the achievable sale value differential between comparable product in Richmond and South Delta

Total resales have decreased from 297 to 219 when compared to the Third Quarter of 2023

The High Rise sales range has decreased by $15,000 on the lower end and decreased by $40,000 on the higher-end when compared to the same quarter in 2023

The sales range of Townhomes increased by $15,100 on the lower end and decreased $40,000 on the higher-end when compared to the Third Quarter of 2023

Average per square foot sales values of High Rise and Townhome units decreased by $33 and $32, respectively, while Low Rise units increased by $4 when compared to four quarters ago

Price per square foot sales values for one bedroom High Rise and Low Rise units decreased by $38 and $51, respectively, over the past four quarters

The average sales price of a two bedroom and three bedroom Townhome decreased by $91,4423 and $56,184, respectively, when compared to the Third Quarter of 2023

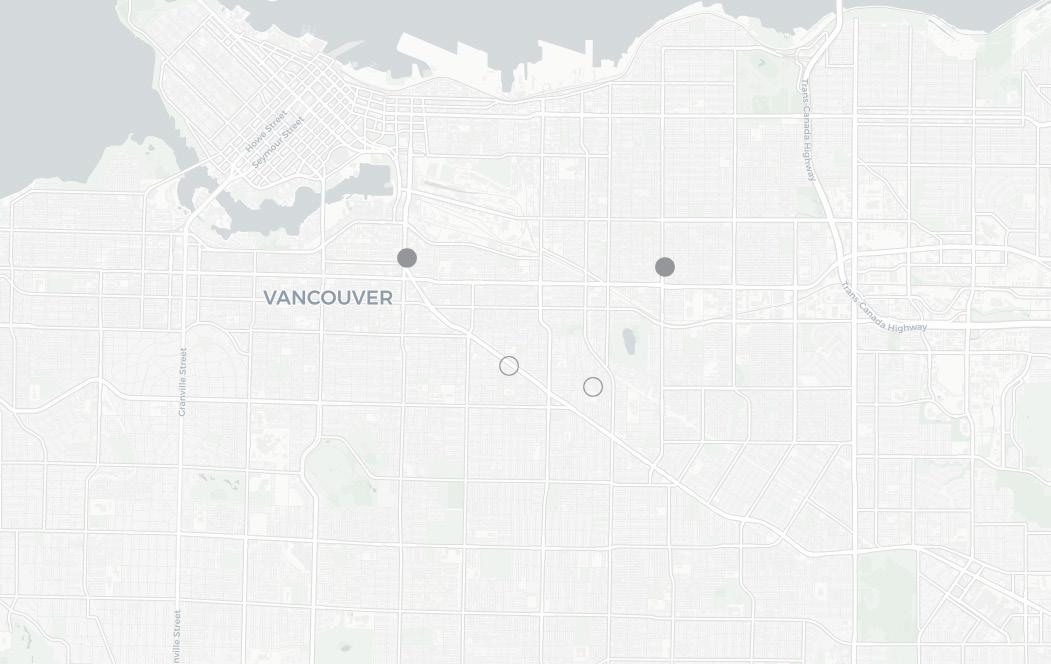

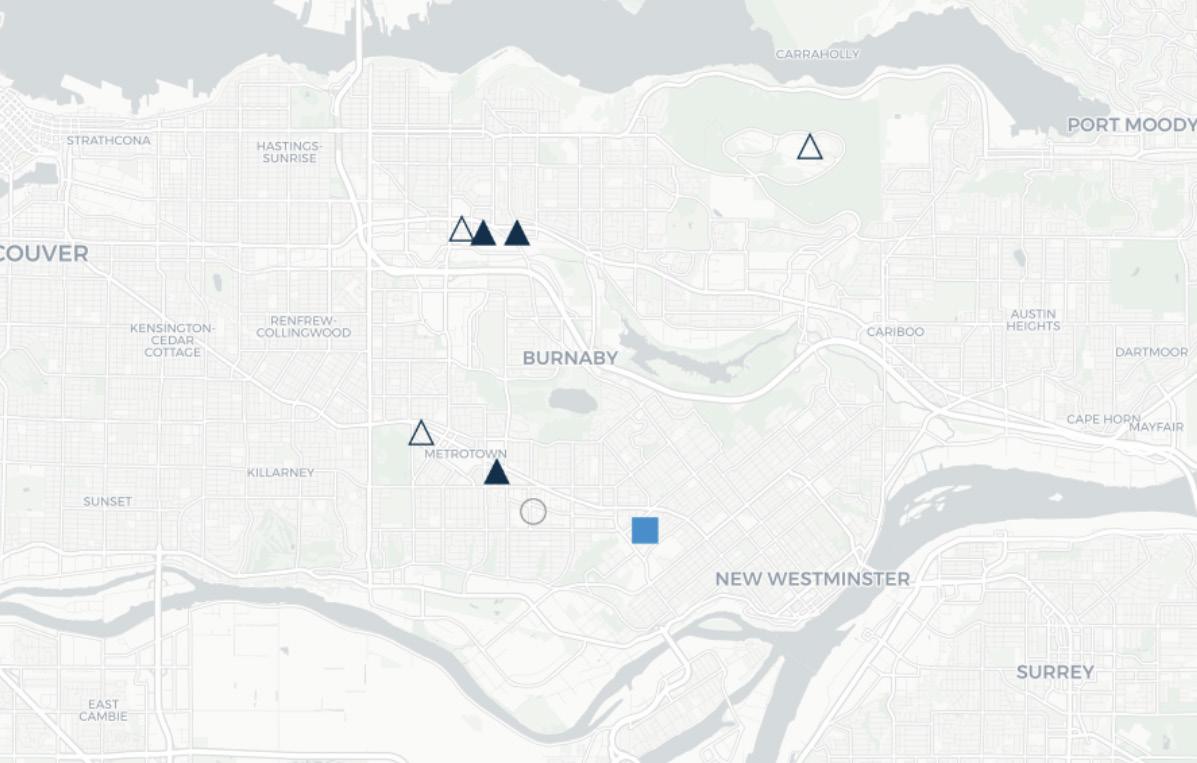

The Burnaby/New Westminster market area is projected to retain its “Yellow Light” status for the Third Quarter of 2024, reporting 169 sales - a 36 percent drop from the previous quarter. The High Rise sector led in activity with 118 sales, down 51 percent from the second quarter and accounting for 70 percent of total sales. Townhomes represented 30 percent of sales with 16 units sold, reflecting a 33 percent increase, while the Low Rise segment saw a notable 218 percent surge as previously withheld inventory was reintroduced and rapidly absorbed. Buyer activity remained modest, with only two new projects entering the market this quarter. High Rise absorption rates declined to 4 percent, largely due to limited new inventory releases. Projects with longer completion timelines continued to show stronger performance compared to near-completion or move-in-ready units. Sales volume is expected to rise as multiple High Rise projects launch early in the fourth quarter.

Boffo Development’s Bassano – Tower 1 launched and achieved 40 sales at a blended price per square foot of $1,325

Element 2, a 27-unit Townhome project by Square Nine Development launched late in the third quarter at a blended price per square foot of $1,089

Solhouse 6035, a 411-unit 50-storey high rise by Bosa Properties achieved 20 sales over the quarter at an average price per square foot of $1,450 for a total of 145 sales

Anthem’s Ethos, a 218-unit 34-storey project achieved 112 total sales at a blended price per square foot of $1,320 with 29 total sales over the quarter

Arbour (Condos) by Intergulf Development Group relaunched into the market achieving 30 sales over the quarter and 125 sales overall at a blended price per square foot of $867

The first phase of Brentwood Block, a master plan community by Grosvenor launched early in the third quarter of 2024

Total listings have increased by 197 but total resales have decreased by 12 when compared to the Third Quarter of 2023

The average per square foot sales values of High Rise and Low Rise units have decreased by $7 and $15, respectively, but increased by $32 for Townhome units when compared to the Third Quarter of 2023

The sales range of High Rise product decreased by $6,200 on the lower end and decreased by $46,000 on the higher-end when compared to the Third Quarter of 2023

Compared to the Third Quarter of 2023, the average price per square foot of one bedroom High Rise and Low Rise unit have increased by $11 and $2, respectively

The average sales price per square foot of a two bedroom High Rise and Low Rise unit decreased by $13 and $46 , respectively, over the past year

The average sales price of a two bedroom Townhome decreased by $55,000 while it increased by $17,516 for a three bedroom Townhome when compared to the Third Quarter of 2023

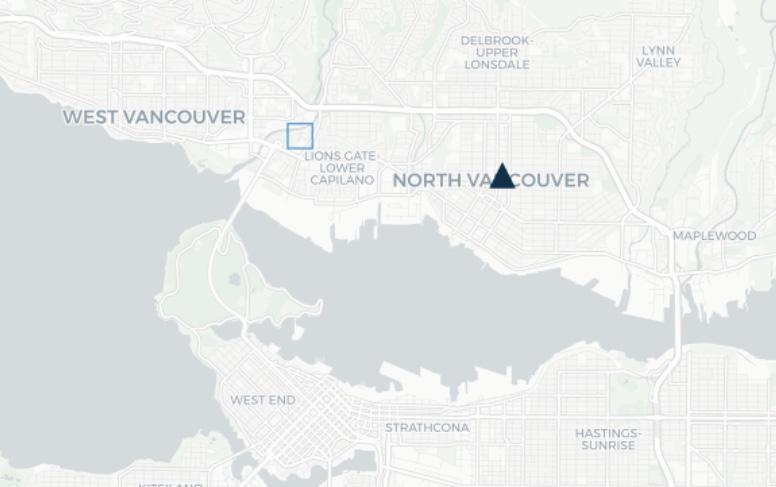

In the third quarter of 2024, the North Shore market area retained its “Yellow Light” status amid a notable decline in overall sales. Total sales dropped by 52 percent from the previous quarter, decreasing from 94 in the second quarter to just 45. This contraction was largely driven by a complete halt in Low Rise sales, which recorded zero transactions compared to 32 in the previous quarter. High Rise sales, however, increased by 28 percent, reaching 41 transactions and comprising 91 percent of total market sales. Despite this uptick, unsold High Rise inventory rose to 384 units from 258, indicating potential market saturation. Townhome sales also declined sharply, down 87 percent to just four transactions.

Persistent challenges in the market are attributed to limited new supply and high price points, which continue to dampen buyer demand across most property types.

One20 by Three Shores Development achieved 15 sales at a blended price of $1,415 per square foot as it launched this quarter

Elle by Darwin, which started construction this quarter, posted 8 sales at a blended price of $1,515 per square foot

Emerald by Woodbridge and Citimark, situated near the Capilano River is a 41-unit Townhome development expected to launch in the fourth quarter of 2024

Apex - Seylynn Village saw improved activity with 9 sales over the quarter at an average price per square foot of $1,142

*Note that the large sales range is due to the price differences observed in West and North Vancouver.

There were 210 total listings, an increase of 48 when compared to the Third Quarter of 2023

Compared to the Third Quarter of 2023, the average time a unit is on the market has increased for High Rise, Low Rise, and Townhome units by 44, 33, and 47 days, respectively

The average per square foot sales values for High Rise units increased by $32 but decreased by $11 and $41 respectively, for Low Rise and Townhome units when compared to the Third Quarter of 2023

The sales range decreased by $80,000 and $121,000 on the lower-end and upper-end, respectively, for Low Rise product since four quarters ago

Two bedroom High Rise product decreased in per square foot sales value by $41 while two bedroom Low Rise units increased by $18 per square foot when compared to the Third Quarter of 2023

The average sales price of a two bedroom Townhome increased by $72,669 and for a three bedroom Townhome, it decreased by $91,164 when compared to the Third Quarter of 2023

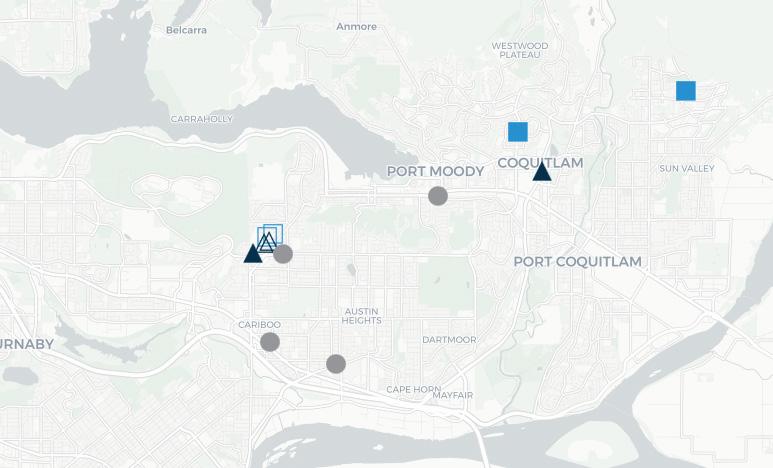

In the Third Quarter of 2024, the Tri-Cities market received a “Yellow Light” rating, with total sales declining to 481 - a 10 percent decrease from the previous quarter. The Low Rise sector accounted for 63 percent of total sales, followed by the High Rise sector at 26 percent and the Townhome sector at 11 percent. Six new projects launched this quarter, including four Low Rise and two Townhome projects, generating robust sales of newly released units. Sales growth is anticipated to persist in the coming months, with buyers showing a strong preference for Low Rise units, largely due to their more competitive pricing compared to similar High Rise options. Absorption rates were moderate, led by the Low Rise sector at 23 percent, followed by Townhomes at 20 percent and the High Rise sector at 10 percent, resulting in an overall absorption rate of 17 percent. Additional Low Rise projects are anticipated to launch in the coming months, as their pre-sale requirements are currently more achievable than those of High Rise projects, given current market dynamics.

Level, a 6-storey 178-unit low rise project by Jayen Properties launched in early July, achieving 155 sales at a blended price per square foot of $992

Marcon’s Soenhaus, a 165-unit low rise project achieved 50 sales over the quarter at an overall price per square foot of $1,095

Heartwood, an 81-unit Townhome project by Streetside Developments achieved 21 sales over the quarter at a blended price per square foot of $766

Paulsun Development’s 74-unit wood frame building Ravir, launched in late September, achieving 10 sales at an overall price per square foot of $960

Two Shaughnessy by Kutak Development relaunched in early September, achieving 3 sales at a blended price per square foot of $880

Trillium Project’s 24-unit Townhome project Westview, launched in mid July and achieved 13 total sales at a blended price per square foot of $880

Compared to the Third Quarter of 2023, sales decreased for High Rise, Low Rise, and Townhome units by 19, 17, and 5, respectively

Total listings have increased by 52 when compared to the same period last year

The average sales value per square foot for High Rise units decreased by $8 while Low Rise and Townhome units increased by $13 and $9, respectively, when compared to the Third Quarter of 2023

The lower end sales range for High Rise and Townhome units have decreased by $26,000 and $30,000, respectively, while it increased for Low Rise units by $15,000, when compared to the same quarter last year

The average sales price per square foot of a one bedroom High Rise decreased by $42 while a one bed Low Rise increased by $6, when compared to the Third Quarter of 2023

The average sales price of a two bedroom Townhome increased by $7,650 while a three bedroom Townhome decreased by $14,593, when compared to the Third Quarter of 2023

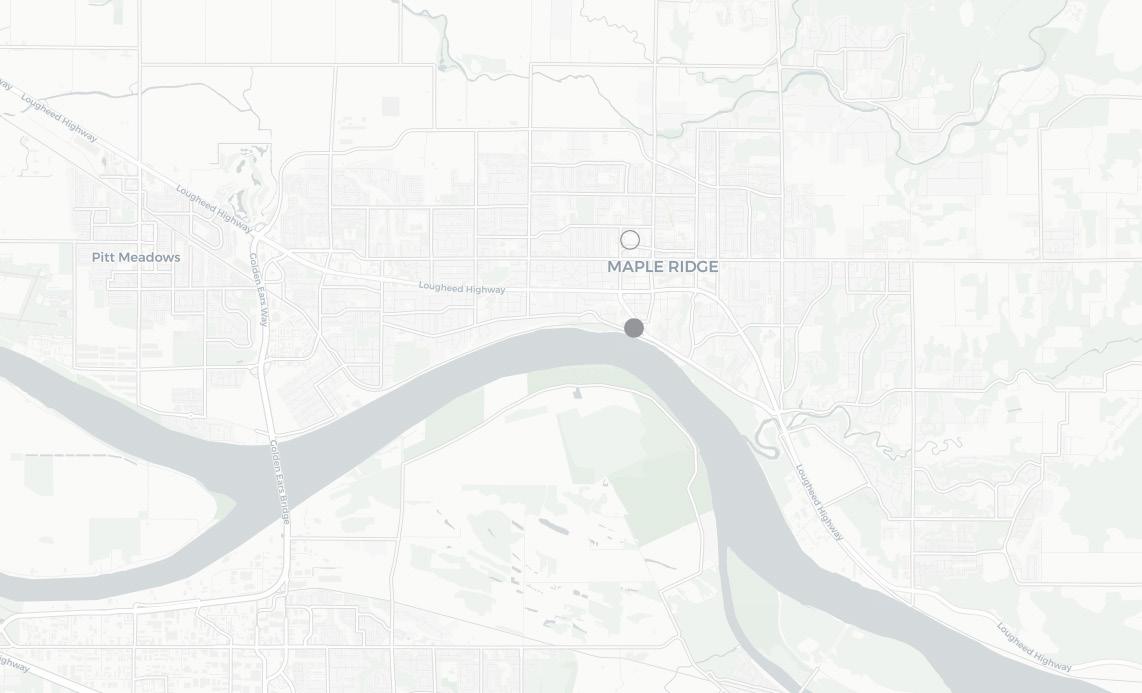

The Ridge Meadows market area will retain its “Yellow Light” status for the Third Quarter of 2024. Total sales rose slightly by 2 percent, reaching 46 transactions for the quarter. In the Low Rise sector, a new project launched, achieving 5 percent sales of its total inventory. The Townhome sector, despite a 7 percent decline in sales, still comprised 85 percent of total sales volume. This quarter saw an overall absorption rate of 12 percent across available inventory. No new Townhome projects were introduced, with many existing projects pausing sales to await completion before releasing the remaining units. While the market continues to face certain challenges, upcoming project completions may drive improvements in both sales and absorption rates.

Market Highlights

Portal by Western Canada Monthly Income Fund is a 36-unit Low Rise project launched in mid July and achieved two sales throughout the quarter.

The Falls – Kanaka Springs by Epic Homes is a 165-unit Townhome project and achieved 18 sales throughout the quarter at a blended price per square foot of $600

Rydge by Raicon, a 61-unit Townhome project, achieved eight total sales throughout the quarter

The North at Port Haney by Falcon Homes is a 67-unit Low Rise project that achieved 33 total sales to date at a blended price per square foot of $783

Nature’s Walk by Onni achieved 187 sales out of 220 total units to date at an average price per square foot of $525 with 5 sales over the quarter

Total listings increased by 16 and total resales decreased by 2, respectively, when compared to the Third Quarter of 2023

The average sales value per square foot for Low Rise units decreased by $13 and Townhomes increased by $3 since the same quarter last year

The average sales price of a one bedroom Low Rise unit decreased by $24,901 and it decreased by $958 for a two bedroom Low Rise unit when compared to the same quarter last year

The lower end of the sales range for Low Rise products decreased by $51,900 and the upper end increased by $99,900 compared to the same period last year

The sales range has decreased by $14,900 on the lower end and decreased by $45,000 on the higher-end over the past four quarters for Townhomes

Three bedroom Townhome units saw a decrease in average price on sold units by $23,983 over the past year

The Central Surrey and North Delta market area retained its “Green Light” status in the third quarter of 2024, despite a significant 42 percent decrease in total sales, from 882 to 475 transactions. This decline is largely attributed to the 14 project launches in the previous quarter, compared to only six new launches in the third quarter of 2024. Buyer interest remains strong in new projects that offer competitive pricing and low deposit requirements, driving transaction volumes and facilitating entry for first-time home buyers. The market area achieved an overall absorption rate of 14 percent for the quarter. The Low Rise sector saw the highest level of activity, with 347 sales, accounting for 73 percent of total transactions. Competitive pricing, extended deposit structures, longer completion timelines, and the promise of community amenities have fueled significant investor interest.

Vivere, a 20-storey 175-unit High Rise by Solterra launched over the third quarter and achieved 44 total sales

Realco Properties’, Scott + 77 - Phase 2, sold 40 units over the quarter and sold out of its Phase 1, achieving a blended price per square foot of $964 for second phase

BridgeCity (Phase 1), Ovideo Properties’ High Rise in Surrey City Centre achieved 30 sales over the quarter

Dawson + Sawyer launched Fleetwood Village II (Condo Building 7), a 116-unit Low Rise project and achieved 45 sales at an overall average price per square foot of $939

Mosaic Homes’ Townhome development Woodward, sold 17 units over the quarter at an overall price per square foot of $660

Tangerine Developments will be launching Fellow, a 152-unit Low Rise building in the Fourth Quarter

Total listings increased by 189 and total resales decreased by 70 when compared to the Third Quarter of 2023

The months of supply for resales in the Townhome market has increased from 4.7 months to 8.5 months when compared to the same quarter last year

The months of supply for resales in the High Rise and Low Rise market increased by 5.0 and 2.2 months, respectively, when compared to the Third Quarter of 2023

The per square foot sales value have increased for Low Rise and Townhome units by $35 and $6, respectively, while High Rise units have decreased by $51 when compared to four quarters ago

One bedroom High Rise units saw a decrease in average price per square foot on sold units by $60 and one bedroom Low Rise units saw an increase of $20, over the year

The average two bedroom Townhome saw an average sales price decrease of $38,800 and a decrease for three bedroom Townhome units of $68,277 when compared to the same period last year

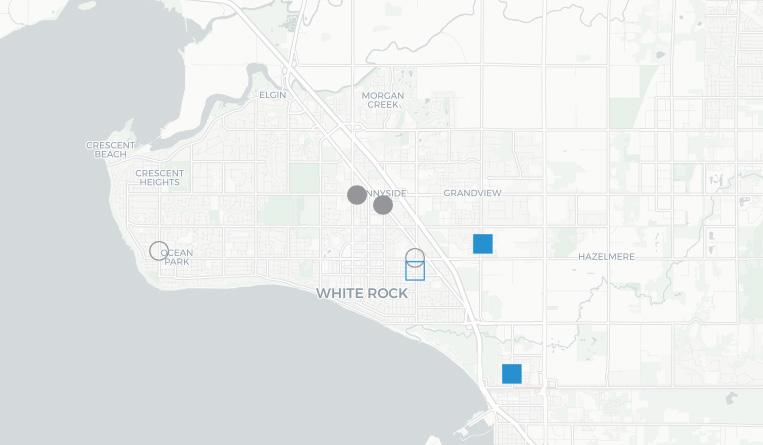

The South Surrey/White Rock market area has maintained its “Yellow Light” status for the Third Quarter of 2024. This market area saw a total of 72 sales, reflecting a 38 percent increase from the previous quarter. The Townhome and Low Rise sectors dominated the sales, representing 53 percent and 46 percent, respectively, of the market area’s total sales. Low Rise sales saw a notable 230 percent increase compared to the second quarter, driven primarily by the launch of a new project, which accounted for 85 percent of all Low Rise sales in the market area. Absorption rates in both the Low Rise and Townhome sectors remain steady, with rates at 21 percent and 22 percent, respectively. Sales within the Townhome sector held consistent at 38 total sales, the same as the previous quarter. Existing Townhome projects continued to perform strongly, with two projects achieving 10 sales each over the course of the quarter.

Halo, a 204-unit project consisting of two 6-storey wood frame buildings launched in late September and achieved 28 sales at an overall price per square foot of $875

MetroVan’s Finestra achieved 10 sales over the quarter for a total of 32 sales

The Cedar Building in Zenterra’s King + Crescent project achieved 5 sales over the quarter at an overall price per square foot of $840

Hive Development’s Elisa, a 31-unit Townhome project accounted for 5 sales over the third quarter

Glenmont, a 50-unit Townhome project by PCC Homes achieved 10 sales over the quarter at a blended price per square foot of $688

When compared to the same quarter last year, the total number of listings increased by 64 while resales decreased by 21

The months of supply for resales for High Rise, Low Rise and Townhome product has increased by 0.3, 4.6 and 2.1 months, respectively when compared to the Third Quarter of 2023

Average per square foot sale values for High Rise, Low Rise, and Townhome units increased by $99, $47, and $6, respectively, when compared to the Third Quarter of 2023

Low Rise and High Rise product increased in average days spent on the market, averaging 1 and 22 more days, respectively, on the market when compared to the Third Quarter of 2023

One bedroom Low Rise units saw an increase in average price per square foot on sold units by $17 and two bedroom High Rise units increased by $157 over the past year

Two bedroom Townhomes saw an increase in average sales price by $92,641 and three bedroom Townhomes increased by $20,602 when compared to the same quarter last year

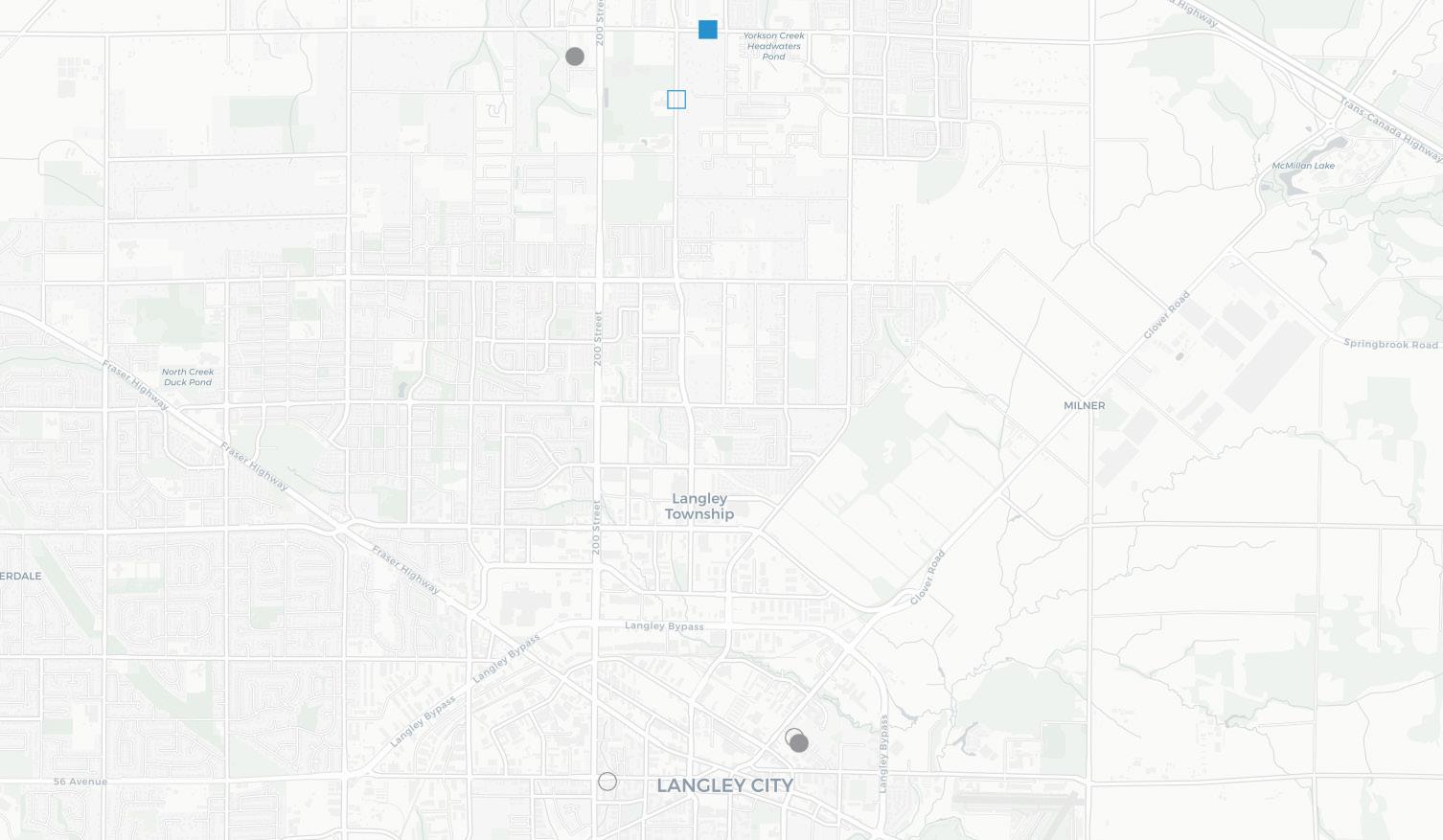

The Langley/Cloverdale market area retained its “Yellow Light” status in the third quarter of 2024, despite a significant 70 percent decline in total sales, from 652 to 195 transactions. The high sales volume in the previous quarter was largely driven by two new Low Rise developments, which accounted for 62 percent of sales. Sales activity in the third quarter remained steady, with one new Low Rise development contributing to 36 percent of total sales. Successful projects typically offer competitive entry prices and flexible deposit terms, making them attractive to both first-time buyers and investors. Sales momentum is expected to increase as developers release additional inventory into the market.

Elijah, Whitetail Homes’ 180-unit Low Rise building launched in early July 2024 and achieved 72 total sales at a blended price per square foot of $820

The first phase of Jericho Park by Essence Properties achieved a total of 160 sales, accounting for 24 sales over the Third Quarter of 2024

The Commons by Zenterra achieved 13 sales over the quarter while offering incentives such as a reduced deposit structure of five percent

Zail Properties’ Townhome project, Aviva, led all Townhome sales in this market area with 23 sales over the quarter

Streetside Development’s 231-unit Townhome project, Cascadia, sold 14 units this quarter at an overall price per square foot of $660

The Merchant by Westmont, a Low Rise building comprised of 136 total units, is anticipated to launch in the Fourth Quarter of 2024

Resale price per square foot on Low Rise product decreased by $11 and Townhome product decreased by $1 when compared to the Third Quarter of 2023

Total listings increased by 104 when compared to the same quarter last year

The sales range increased by $22,000 on the lower-end and increased by $82,100 on the upper-end for Townhome product since four quarters ago

Average price per square foot sales values decreased for Low Rise condominiums and Townhomes by $11 and $1, respectively, when compared to this quarter last year

The average price per square foot sales value for a one bedroom Low Rise unit decreased by $8 and a two bedroom Low Rise unit decreased by $13 when compared to the Third Quarter of 2023

Since the Third Quarter of 2023, the months of supply for Townhome product has increased from 1.8 months to 2.1 months

The Abbotsford/Mission market area maintained its “Green Light” status for the third quarter of 2024, highlighting its strong performance and increased buyer activity. With 135 sales this quarter, the market area saw a 58 percent drop from the previous quarter. Despite this decline, new projects and successful launches have supported the market area in retaining its “Green Light” status. Absorption rates remained strong, with Low Rise and Townhome product achieving rates of 33 percent and 13 percent respectively, resulting in an overall absorption rate of 30 percent. The Low Rise sector dominated sales, accounting for 93 percent of total sales. Standing inventory levels remain low, with just 76 Low Rise units and 9 Townhome units on the market. The region’s strong sales performance can be attributed to affordable and competitive entry-level prices compared to nearby market areas. Looking ahead, the market is expected to remain resilient as new projects launch within several master-planned communities, bringing additional supply.

Phase one of Sage by Diverse Properties achieved 175 sales in 2 buildings at a blended price per square foot of $760, selling out the first phase of the 5-build ing master plan project

The Mason – Rail District Flats by Infinity Properties sold out, achieving an average price of $690 per square foot as the final 12 units sold

Scout, a 99-unit six-storey wood frame project by Heinrichs Developments launched over the quarter at a blended price per square foot of $750

Diverse Properties launched their second master-planned community in the market area with Aria, successfully selling out the first building with 78 units at an average price of $799 per square foot.

Montvue – Building 2 by Parcel7 achieved 40 total sales at a blended price per square foot of $747 with 15 new sales over the quarter

Heinrichs Developments’ Laurel on Mill Lake achieved 23 total sales at an overall price per square foot of $750

Total listings increased by 45 while resales decreased by 15, when compared to the Third Quarter of 2023

Over the past four quarters, the lower bound of the sales range for Low Rise product has decreased by $17,500 and increased by $27,700 on the upper bound

Price per square foot sales values for Low Rise condominiums and Townhomes are down by $18 and $10, respectively, from the Third Quarter of 2023

The average days spent on market for Low Rise and Townhome units increased by 28 and 9 days, respectively, when compared to the same quarter last year

The average sales price per square foot for Low Rise one bedroom condominiums increased by $86 while two bedroom Low Rise condominiums decreased by $32 when compared to the same quarter in 2023

The average sales price per square foot for two bedroom and three bedroom Townhome units decreased by $17 and $26, respectively, when compared to the Third Quarter of 2023

As we wrap up this Third Quarter of the 2024 Fifth Dimension, we urge everyone in our industry to rest and reflect on the past quarter, year and 4 years and really think about how we as an industry can adapt and make homes that can be both affordable, meet all the new costly criteria coming at us from the province and municipalities, that will benefit homeowners in BC and naturally our industry by delivering to our customers a product that works.

The Third Quarter saw drops in sales absorptions across all areas of the Lower Mainland, despite further interest rate drops, and many incentives to choose from in any given market. Looking back over this quarter the previous quarter and even year this is the longest real estate lull we have experienced in well over two maybe even three decades. Our market re-bounded from the global crash of 2008 much faster than it is from our current recession, most likely prolonged by

our provincial and municipal leadership’s costly policies. Perhaps driving out the investor that allows large multifamily developments to be funded was not such a great thing after all as it also means limited new supply for everyone else as well.

As we work through the final quarter of this year, we see market absorptions dipping further as they typically do this time of year, when the public is focused on other things from black Friday to cyberMonday to holiday shopping.

In anticipation of further rate drops in December and through to around May, we do not anticipate a surge in sales absorptions until at least May possibly June 2025 or later. That said, this means we are at

the bottom and any good deals to be had are out there today as most prepare for a better market at some point in 2025 when mortgages will be more attainable for more potential buyers, and we will all know/ feel how our new government is functioning and its effects on our daily lives, in particular our pocket books.

If you have a view you would like to share and/or questions you would like to discuss please contact Jamie Squires at Jamie@fifthave.ca.

Zonda Urban is Metropolitan Vancouver’s leading source for analytical interpretation of relevant real estate market data, trends and strategic recommendations.

Zonda Urban (formerly Urban Analytics) has been retained by Fifth Avenue Real Estate Marketing Ltd. To provide aggregate data on the Multi-family residential real estate market in the Vancouver Metropolitan. The methodology used to collect the data was as follows:

Metropolitan Vancouver refers to the area from West Vancouver to Abbotsford. The focus of this study is limited to the Multi-family market.

The primary method used to collect information is a personal visit to each project being actively marketed. In addition to collecting current sales information, Zonda Urban representatives engage onsite sales staff to determine additional relevant information such as incentive offerings, traffic trends and active buyer profiles. In all instances, active sales range quoted in tables is defined as “The per square foot sales range in which 75 percent of sales of this product type occurred”

For the purposes of this publication, Zonda Urban contacts various municipal planning departments along with developers (and/or their representatives) of proposed new developments to determine the anticipated timing of their approval and marketing launch.

The resale market provides an important barometer from which to assess demand and determine pricing for new home projects. Accordingly, Zonda Urban closely monitors the resale market for Multifamily homes in order to identify trends that are relevant to the new home sector. However, the breadth and depth of product for sale can create findings that are less than helpful to the new home developer

As a result, Zonda Urban recommends studying only product that is aged ten years or newer and valued at less than $1.2 million. While it could be argued that limiting the analysis to newer product (i.e. five years or newer) would be more relevant to the new home sector, we believe this would limit the sample size and potentially skew the data towards a specific type of product available in a small number of specific buildings/projects. In all instances active sales range quoted in tables is defined as “The active sales range in which 75 percent of sales of this product type occurred”.

For over 25 years, and prior to its transition to Zonda Urban, Urban Analytics provided clarity on what’s selling, who’s buying and what that means for our clients at every stage of their project.

Zonda Urban (Formerly Urban Analytics) been monitoring the new Multi-family home market in Metro Vancouver and beyond since 1994. In addition to providing clients with the most current and accurate information on actively selling and contemplated new Condominium and Townhome projects in Vancouver, Toronto, Ottawa, Calgary, Edmonton and Victoria on the market-leading NHSLive data product at nhslive.ca, Zonda Urban is also the leading provider of advisory services on the new Multi-family home market in these markets.

Zonda Urban also monitors the purpose-built rental apartment market, residential land transactions, and commercial property transaction data. Contact sales@zondaurban.com and/or advisory@zondaurban.com to learn more about these products and services.

Zonda Urban and NHSLive provides the confidence and knowledge to make better decisions.

Zonda Urban (Formerly Urban Analytics) (604) 569-3535 zondaurban.com

President & Managing Broker Jamie Squires

Address #313 - 14928 56th Avenue, Surrey, BC V3S 2N5

Phone Number 604.583.2212

Email Jamie@fifthave.ca

Website fifthave.ca

President Jacky Chan

Address 1480-1500 West Georgia Vancouver, BC V6G 2Z6

Email jacky@bakerwest.com

Website bakerwest.com

This document has been prepared by Fifth Avenue Real Estate Marketing Ltd. And BakerWest Real Estate Incorporated with data provided by Zonda Urban for advertising and general information only. Fifth Avenue, BakerWest, and Zonda Urban make no guarantees, representations or warranties of any kind, express or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. E.&.O.E. Metropolitan Vancouver: West Vancouver to Aldergrove. Excludes Chilliwack, and Mission. Resale Data: MLS sold for attached product (High Rise, Low Rise, and Townhomes) built within the last ten years for units valued less than $1.2 million. Single family sales are excluded from the report. This publication is the copyrighted property of Fifth Avenue Real Estate Marketing Ltd. © 2023. All rights reserved.