Proposed Site Master Plan for Data Centers at Doubs/Adamstown

Proposed Site Master Plan for Data Centers at Doubs/Adamstown

Data centers have increasingly developed into an integral part of our daily lives, affecting matters ranging from national security to how we operate smart appliances in our homes. Every industry and every service we use now has a digital footprint in a data center and utilizes their cloud storage in order to function efficiently and effectively. In fact, the “cloud” consists entirely of these buildings and the fiber that connects them. This allows us to take advantage of economies of scale that not only increase our efficiency and lower our costs, but also reduce our carbon footprint in comparison to the older and more widely dispersed data centers we previously employed.

Data centers have become a crucial component of modern society, providing the infrastructure necessary for our increasingly digital world. They enable us to access and utilize information in real-time, while also promoting sustainability through their efficient use of resources. As technology continues to advance, it is likely that data centers will play an even greater role in shaping our lives and the world around us.

Over the last two years, the general public has witnessed unprecedented technological transformations related to how we work, play, and communicate. As expected for 2021, the cloud migration that began in 2020 continued to transform businesses and data centers, 5G rollouts accelerated, IoT powered the trend to make nearly everything “smart,” AI went from experimental to essential, and remote work became a way of life for many.

These trends have proven so important to how businesses, communities, and families are adapting to change that they will continue unabated in 2023 and beyond. In addition, the accelerating adoption of single-mode fiber for faster processing of more data and automated infrastructure management (AIM) for increased system interoperability will have a significant impact on data centers. Here’s how these trends are expected to evolve:

Scalability and cost continue to drive companies to the cloud. In late 2021, HPE reported that year-over-year (YoY) orders for its GreenLake cloud platform increased by 46%, and AWS reported YoY growth of around 40%. Renting infrastructure and scaling it within days instead of waiting for a multiyear build is just too compelling. Both public and private cloud infrastructure will grow. Large enterprises will use a hybrid model, while smaller companies will use the public cloud alone. The only real inhibitor of this growth is concern around data security and compliance restrictions, such as privacy and compliance regulations that require protecting individual health care information or keeping some data within a country or on-premises.

According to Statista, the number of IoT devices worldwide will reach more than 25.4 billion in 2030, tripling from the 8.74 billion devices in 2020. However, this is still just the beginning, as businesses are starting to understand how they can optimize operations, such as shipping and logistics, by collecting and analyzing data from sensors. Once again, the impact on data centers will be enormous, as all that data needs to be stored and processed somewhere, which is increasingly in the cloud.

Consider the number of data points required for a package tracking application: where a package originated, where it is, where it’s going, estimated time of arrival, environmental conditions (including temperature, humidity, altitude, pressure, etc.), delivery company, driver, vehicle status and history, etc. Now multiply the data for one package by hundreds of thousands or even millions of packages.

In the past few years, most companies have still been figuring out their AI strategy. In 2023, AI will be essential to understanding all the data companies are collecting; big data analytics just can’t be done manually. From facial recognition and contact tracing to supply chain and logistics analytics, AI is the key to process optimization and business competitiveness.

Over the next year, building AI capabilities and capacity will be a major initiative for most enterprises, even as we begin a long-term trend toward increased reliance on Augmented Reality (AR). While AR will initially be adopted for gaming and personal interaction, it will begin to play an increasing business role in marketing, sales, training, and other service applications. For instance, field technicians already use AR to connect with a call center via a smartphone to get answers to questions pertaining to their installations and repairs.

Remote work was a trend before the pandemic, and for vast numbers of workers and companies, it will become the standard way of doing business. It offers a better work-life balance for employees as well as lower operating costs and increased productivity for employers. Of course, this trend will have a significant impact on the need for high-speed internet access at home to support videoconferencing, not just for work but also for remote learning and entertainment. Once again, data center storage and performance requirements must increase to support high-quality video streaming, recording, and storage.

Local governments will need to invest in digital infrastructure to support the expansion of these new technologies and online services for their constituents. This includes providing reliable internet access to rural and underserved areas as well as ensuring the security of online transactions and data. Additionally, the shift towards remote work will likely lead to changes in urban planning, as people may no longer need to live in close proximity to their workplaces. This could result in a decentralization of urban centers and a greater emphasis on suburban and rural areas.

In 2020, the Maryland General Assembly passed SB 397, which created a sales and use tax exemption program for data centers. The passage of SB 397 was an attempt to bring Maryland in line with the 31 other states that offer incentives for data centers in order to attract the unrivaled amounts of investment and tax revenue that they generate. The list of Tier 1 counties in the bill, while an excellent beginning, does show how challenging it is to create legislation that takes into account the technical and commercial aspects of these operations. The list notably omits Frederick County, the first and most critical location for us to develop in order to compete with Virginia or any of the other major markets.

The example showcases the challenge for governments in adopting legislation that supports the growth of digital infrastructure, as seen in Maryland’s exclusion of critical areas such as Frederick County from its data center exemption program. This highlights the need for comprehensive and inclusive policies that consider not only technical and business factors but also regional disparities and public needs. Nevertheless, interest in Maryland as a potential market was generated for the first time since the collapse of the 2019 Amazon Web Services deal in Frederick County, which denied Maryland approximately 35 billion USD in investment and instead went to Virginia.

Overall, while there have been efforts in Maryland to incentivize the growth of data centers, the exclusion of critical areas like Frederick County highlights the challenges of creating legislation that considers all factors. However, there is renewed interest in Maryland as a potential market for data centers following the collapse of the Amazon Web Services deal in 2019. Going forward, it will be important for policymakers to adopt comprehensive and inclusive policies that take into account regional disparities and public needs in order to support the growth of digital infrastructure.

Stafford County has been working to become part of the data center building boom in Virginia. A new proposal for a 5.5 million square foot campus featuring 25 data centers could add a new hub for NoVA cloud storage...

After the completion of its $11 billion acquisition by DigitalBridge and IFM, Switch is poised to shift into building mode in an industry facing capacity constraints in key markets.

Dec. 7, 2022

Google has completed the latest phase of construction at its data center in Council Bluffs, Iowa, bringing its total investment in its Iowa campus to $5 billion. The milestone.

Feb. 7, 2022

Investment giants KKR and Global Infrastructure Partners will acquire data center developer CyrusOne for $15 billion, taking the company private in the largest M&A deal in the.

Nov. 15, 2021

Meta currently has 47 data centers under construction, the company said this week, reflecting the extraordinary scope of the ongoing expansion of world’s digital infrastructure

Nov. 10, 2021

Vantage Data Centers has raised $1.25 billion in equity funding from its current investors, led by Digital Colony. The funding reinforces the value proposition of building wholesale..

Nov. 19, 2021

In order to facilitate long-term sustainable growth and position Maryland as the most important element of our national fiber backbone, we intend to develop a multiple redundancy network throughout the state, beginning in Frederick County given its proximity to the Northern Virginia Network Access Point (NAP) in Loudoun County. It is impossible to overstate the significance of proximity to the Loudoun County Network access point. Reason why, as we are witnessing, the first large-scale hyperscale data centers are being constructed in Frederick County. Second, the access to power and land that Fredrick County can provide is a unique characteristic of the county that other counties will find difficult to replicate because they have a higher population density and projects will take longer to initiate.

When the data center market in Frederick County opens, the focus should shift to Prince George’s County. As Northern Virginia connects its counties (Loudoun and Prince William), it forms a crescent that will connect Prince George County in the east to Frederick County in the west, forming a semicircle around Washington, D.C., and into Maryland. This expansion of the data center market into Prince George’s County is a natural progression as the demand for cloud computing and big data analytics continues to grow. With its proximity to Washington, D.C., and major transportation hubs, Prince George’s County is poised to become a major player in the data center industry.

The loop’s final phase will connect Anne Arundel County, Baltimore County, and Baltimore City. Aside from Baltimore City, the greatest difficulty will be locating land suitable for data centers in high-density areas that meets the requirements of these data centers. Frederick County and Prince George’s County would become a major hub for federal data traffic and storage with the establishment of our Fort Washington Loop, thereby enhancing the viability of a Baltimore-to-Philadelphia Internet Exchange (IEX).

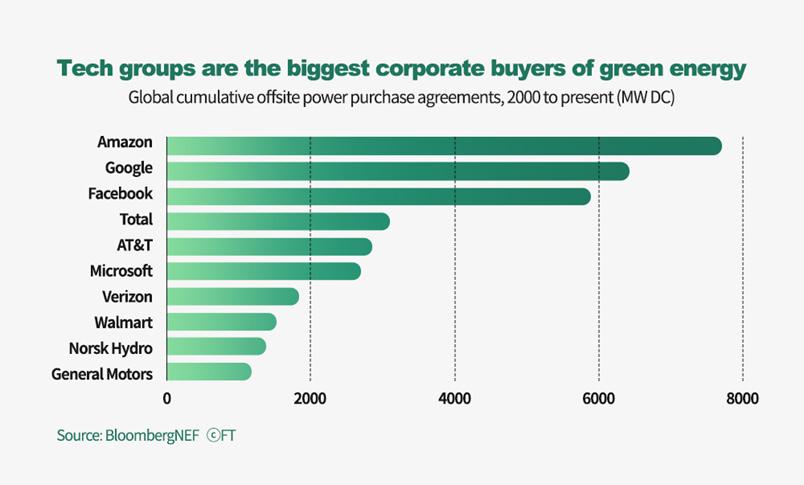

The largest driver of hyperscale site development is their resource efficiency when compared to multiple smaller sites totaling a similar capacity. Advances in cooling have led to drastically reduced water usage, and commonsense steps such as utilizing non-potable water and renewable energy such as solar have led to some of our first zero-carbon emission sites in the last two years. The development of utility-scale renewable energy has been heavily promoted and financed by the data center industry, with sites in some regions sourcing 100 percent of their power needs from renewable energy sources. Our own experience with solar energy has enabled our first major data center facility in the Middle East to operate with over 99% uptime in an environment that does not yet have a stable energy grid by leveraging our ability to install utility-scale solar fields adjacent to our site.

“When working with suppliers, data centers have begun adding multiple sustainability-related requirements into their RFPs and RFIs, asking for information pertaining to carbon usage in the supply chain, the level of reuse and recycling programs in place, and the energy efficiency of infrastructure components.

Every new infrastructure purchase evaluation should take sustainability-related factors into account, but it’s important to keep in mind that the industry is still developing in terms of its capacity to precisely measure and track such metrics, particularly outside of their own organizations (e.g., across the supply chain). However, decision-makers in the data center should continue to press for information because doing so will encourage the necessary increase in maturity. However, in the short term, they might want to concentrate primarily on the criteria that infrastructure vendors can precisely measure, namely energy efficiency and, more specifically, energy efficiency per infrastructure capability, or, more simply put, power consumption per usable capacity at the required performance level.”

AWS Eyes New Strategies to Meet Energy Goals for its $15 Billion Oregon Cloud Region

Amazon Web Services has invested $15 billion in its cloud cluster in Oregon, and is pursuing new approaches to energy - including on-site generation - to create a path to sustainable.

May 1. 2023

(“The Era of the Sustainable Data Center | TechTarget”)

(Based on March 2020 Potential Impact on Large Data Center Development Study )

Maryland has a once-in-a-lifetime opportunity to become the epicenter of US tech innovation and generate enormous wealth for the state over the next several years. This opportunity arose as a result of Virginia’s population growth and inability to meet demand, prompting companies like Microsoft and Amazon Web Services to consider Maryland as an alternative solution for the first time.

The construction and operation of data centers in Maryland would have far-reaching consequences for the state’s economy. To empirically assess the statewide and regional economic impact of the data, a widely used regional input-output model and the characteristics of a hypothetical large data center project were employed. The regional input-output model quantifies the ripple effects of an expenditure as it moves through the economy. For this report, spending by the data center industry in Maryland would have a direct economic impact on the state economy in terms of people hired as data center employees, employee pay and benefits, and economic activity in the region for utilities, construction, and equipment. That direct spending by the data centers creates the first ripple of economic activity.

As data center employees and businesses (like construction contractors for data centers, power companies that supply data centers, and data center equipment suppliers) spend the money that they were paid by data center companies, they create another indirect ripple of economic activity that is part of the secondround effects of the data center industry.

In addition to the economic effects on the Maryland state and local economies of data center-to-other business transactions, there are also the second-round economic effects associated with data center employee-to-business transactions that ripple through local economies. These effects occur when data center employees buy groceries, pay rent, go out for dinner, entertainment, or other recreation, pay for schooling in Maryland, or make other local purchases. Additionally, there are the second-round economic effects of business-to-business transactions between the direct vendors of data centers and their suppliers.

Between 2001 and 2020, the average private sector data center employee saw their gross income increase 70% faster than the average. Wages paid in the data center industry are not only higher on average than other industries but also increase at a much faster rate. Because of this, the increase in tax revenue for Maryland would not only be derived from the tax revenue generated by the data centers themselves but also from the workforce they employ. The higher wages earned by these employees enable more spending within the local economy and help to bolster a variety of industries across the state while also enhancing capabilities to expand programs and improve essential services. Loudoun County, on average, spends approximately twice as much per capita on public safety, fire, and EMS services as does Frederick County, while also spending approximately two and a half times as much per student in their public school system. Our project will not only enable Frederick County to make up that ground but also spread the benefits throughout the state.

Data centers create positive, long-lasting effects on local communities. Building new data centers creates more demand for expanding and upgrading local roads, power, water, and sewage. Data centers also spend their own resources to train local workers. These assets remain in the community and benefit other local businesses and residents. With these improvements, data centers attract other data centers and businesses to communities. Like other industries, data centers tend to group together geographically and follow others, as seen in Colorado Springs. Raleigh, Des Moines, and other places across the country. Data center often make charitable contributions, partner with local educational institutions, and support local organizations to build stronger communities.

The development of large data centers tends to happen in stages, with ongoing investment in construction to increase capacity. As a result, local economies have additional inflow investments and pipeline projects that promote economic growth. For example, in 2016 Google acquired another 74 acres in The Dalles, Oregon, to expand its first corporate data center that was built a decade earlier. The new expansion is estimated to cost approximately $600 million, bringing its total investment in data centers in the area to $1.8 billion. Similarly, the Apple and Facebook data centers in Prineville, Oregon, have brought over $1 billion in new investments, which helped the county’s economy transition from its dependence on the wood products industry. These projects have created thousands of construction jobs that helped Prineville reduce unemployment from 20% during the Great Recession to 8%. The diversification of businesses helps lessen local economies’ dependence on a particular sector.

The availability of related skilled labor, such as engineers and construction workers, is crucial for high-end and largescale data centers. The pool of skilled workers in the data center industry, such as building architects and engineers, IT engineers and technicians, and computer system designers, creates advantages for local communities to attract other data centers and other industries, as seen in Ohio, Central Washington, and Virginia. Workers trained by Apple and Facebook in Prineville, Oregon; by Google in The Dalles; and by Dell, Intuit, Microsoft, and Yahoo in Central Washington are valuable assets for these regions.

Many data center developments are located in rural areas where public infrastructure is limited. The building of data centers in underdeveloped areas creates a high demand for expansion and the upgrade of public roads, power, water, and sewer systems. In some cases, data centers directly collaborate with local companies to find innovative solutions. These public infrastructure improvements are long-lasting and benefit all local businesses and residents.

Data centers contribute to local communities in different ways, including cash donations, local sponsorships, community grants, STEM education, computer donations, and community assistance. In addition to monetary donations, corporate employees are active volunteers who provide assistance to communities. For example, Google each year works with local organizations to sponsor community events such as Storm the Citadel to promote STEM education, Googlefest to help local teachers, nonprofit leaders, and small business owners use the Internet more effectively, and other seminars to help business owners set up and run successful websites. Google has awarded $1.9 million in grants to South Carolina nonprofits and schools. Similarly, Facebook awarded more than $2 million to schools and qualified nonprofits to support STEM education and technological and economic development in communities in which it operates data centers. Facebook entered into a partnership with Isothermal Community College in North Carolina to develop the curriculum for its Datacenter Institute and launched a pilot program with the Town of Forest City, North Carolina, and Rutherford County Schools to provide free Wi-Fi access to 75–100 students’ homes.

Innovation:

Power is the largest component of data center operating expenditures. Companies are constantly evaluating the source and cost of power for data centers. Over the past decades, data center owners have been actively involved in clean and renewable energy development by working with local utilities and renewable energy companies to develop and purchase power from local wind, solar, and micro-hydro resources. For example, Apple employs an innovative cooling system that reuses water 35 times, resulting in a 20% reduction in overall water consumption in its data center. The data center also uses a rainwater-supplied system for on-site landscape irrigation, further reducing overall water consumption. The Apple campus in Maiden, North Carolina, is supported by renewable energy from two separate 100-acre solar arrays that each produce 42 million kilowatt-hours (kWh) of energy annually. Google has signed many agreements to purchase renewable energy, including the agreement to purchase 407 megawatts of wind-sourced power from MidAmerican Energy Company to supply its data center in Council Bluffs, Iowa. Google sets a goal of powering all its operations with 100% renewable energy. In addition to powering its last seven data centers with renewable energy, Facebook has also begun working with local energy utilities to help create renewable energy tariffs to cover 100% of the anticipated energy consumption for new data centers in Los Lunas, New Mexico, and Papillion, Nebraska. These tariffs are accessible to all companies, and Yahoo recently announced the tariff would enable its Nebraska facility to go 100% renewable as well. Inspired by the model of open source software, the Open Compute Project was launched in 2011 with a mission to share the innovations of IT hardware designs. Since then, the Open Compute Project has become a collaborative community of hundreds of IT and non-IT companies to share specifications and best practices for creating the most energy-efficient and economical data centers.

The Maryland Commission on Innovation and Excellence in Education, frequently referred to as the Kirwan Commission, was created in 2016 and tasked with developing major reforms to improve the quality of Maryland’s public education system. In October of 2019, the Commission voted on and submitted its recommendations. Those recommendations addressed five major policy areas: 1) early childhood education; 2) high-quality and diverse teachers and leaders; 3) college and career readiness; 4) more resources for students that need them, and 5) accountability.

The Commission estimated the additional funding required to implement those recommendations in fiscal year 2030 alone would be $3.8 billion, with approximately $1.1 billion of that total coming from local governments. However, as HB 1300, the primary legislative vehicle for the proposed reforms, has moved through the 2020 Maryland General Assembly, it has been heavily amended. And a March 16 estimate by the Maryland Department of Legislative Services pegged the FY 2030 local funding required by HB 1300 with Senate amendments at $601.1 million. But even that reduced estimate indicates that heavy additional fiscal burdens would be placed on certain localities. For example, the City of Baltimore would be required to provide $152.2 million in additional local funding in FY 2030; Montgomery County would provide 147.9 million; Prince George’s County would provide $141.9 million; and Baltimore County would provide $63.2 million.

With the motto “good land, good living, good people,” Shelby County, KY is home to data centers owned by Eaton Corporation, EON Energy, and Humana Insurance.

The county attracts data centers due to its proximity to major metro areas, the low cost of utilities, and the mild climate that is not prone to flooding, earthquakes, or storms, according to Shelby County Judge Executive Rob Rothenburger. In the event of a storm, the companies have several backup systems to keep data safe.

In 2011, Eaton Corporation spent $80 million to build a 55,000 square foot data center in Shelby County’s town of Simpsonville, KY. An additional $80 million went toward an identical data center in Louisville, KY.

Shelby County offered Eaton Corporation several incentives, including an industrial revenue bond, to build in the area. The company also receives tax benefits through the Kentucky Enterprise Initiative Act, which allows it to recover state sales and use tax on construction costs, building fixtures, and research and development materials.

While Eaton’s Simpsonville data center has only created about 15 jobs for local residents, these jobs are high paying, Rothenburger said. “They want to attract the brightest individuals from the local community, but they also brought in some internal personnel, especially at the start,” Rothenburger said. As people are trained, and the internal people cycle to other areas, more jobs will open up, he added.

Despite the lack of new jobs, Eaton Corporation does make payments to local schools as part of its local assessment. In some ways, this is more beneficial, because the schools have more funds to improve without the student population growth that would occur if more jobs were offered in the area, Rothenburger said. The company also partnered with the city of Simpsonville to rebuild a community park and baseball field.

“Their contribution to schools has been a tremendous asset to our community,” Rothenburger said. “If we could attract more data centers, we would at this point.”

by Alison DeNisco Rayome in Data Centers on September 19, 2016, 4:00 AM PDTTypically, the largest source of local revenue for a county is property taxes, while the largest source of local expenditures is education. As a result, because the data centers need more equipment than they need employees, they provide a high benefit-to-cost ratio to localities in terms of the tax revenue they generate relative to the government services that they and their employees require. Data centers pay millions of dollars in state and local taxes, even in states that have sales and use tax exemptions on some data center equipment.

All data centers pay state employer withholding taxes and corporate income taxes. At the local level, they also pay real estate taxes, tangible personal property taxes, business license taxes, and industrial utility taxes.

In addition to the taxes that data centers pay directly, the economic activity that they generate also results in additional tax collections. Employees and business suppliers that are paid directly by the data centers also pay taxes, and, additionally, the people and businesses that are paid by the employees and suppliers of the data centers also pay taxes. All of these sources of tax revenue are included in the tax revenue estimates described in this report.

The construction of state-of-the-art and energy-friendly data centers has gained momentum around the world, the idea of reusing excess heat has been largely overlooked. But it shouldn’t be. Capturing and recirculating excess heat could make a vital contribution to smart and fossil fuel–free urbanization. It

By using pumps to capture and repurpose heat, SDP aims to supply 10 percent of Stockholm’s total heating demand. Three contracts have been signed in SDP Kista, an area west of Stockholm, with data centers that will provide a total capacity of 20 megawatts of heat. The first of those data centers will start delivering heat in the spring of 2021. This project serves as an example of how the circular economy can work. Companies using the data centers can improve their sustainability records while earning money from a by-product that otherwise would have gone to waste.

Stockholm, like many other areas in the Nordic region, already has a district heating system, which was built in the 1950s. A district heating system consists of several thousand kilometers of pipes that transport hot water underground and thus provide heat to buildings. The heat can be generated by power plants or other sources. “In the 1980s, we started recovering waste heat from Stockholm’s sewage water,” said Erik Rylander, who heads SDP at Exergi. That stream of waste heat already accounts for about 5 to 10 percent of Stockholm’s heating. Any cost-effective heat recovery system has three basic requirements: (1) a heat source, (2) the infrastructure for transporting heat, and (3) customers interested in buying it (i.e., a market). SDP checks all three boxes. It

In Stockholm, heat recovered from data centers is captured and deployed to warm homes. Can other cities follow?

The Northern Virginia Data Centers, also known as “data center alley,” have expanded so quickly that many of the factors that fueled their growth are no longer able to meet demand. Land and power restrictions, two of a data center’s most crucial requirements, have recently compelled developers to look for and expand. The simplest route for growth is south and west to Prince William and Fauquier Counties, with support from the state government and competition to keep all development in Virginia. Developers were forced to look north into Maryland as power demand reached a tipping point, forcing new projects to wait years for electrical approvals.

Many data center developers are looking at expanding the data center corridor into Frederick County, MD, due to its proximity to Loudoun County, which has the highest concentration of data centers in the world. We will look at a number of the elements that show Frederick County to be a great place to grow and bring an entirely new industry to the region and the state.

Due to the significance of “critical application” uses for federal agency clients, site proximity to the Equinix IEX in Ashburn is essential. The distance between two facilities and the fiber’s carrying capacity determine the connection speed. Typically, federal agency clients will establish a list of requirements for their cloud storage and then contract with a facility end user, such as AWS, Microsoft, or others, to manage and maintain their data within the parameters they have provided for accessibility, redundancy, uptime, physical and digital security, among other factors.

Frederick County, specifically Doubs/Adamstown, represents the outer limit of a 30-kilometer radius that would qualify for these critical application uses and would provide the connectivity backbone required for future expansions within Maryland.

Maryland may not currently represent a significant portion of the national data center market, but northern Virginia’s preeminence is also a recent phenomenon. In terms of national capacity, Loudoun County only surpassed New York City as the largest data center market in 2016, and in 2011, the Virginia data center market was a mere footnote. If Maryland seizes this opportunity, there is no doubt that we will become the second-largest data center market, if not the largest. If we fail to seize this opportunity, Virginia will likely take an unassailable lead in as little as a year as they continue to add capacity despite power shortages and work to construct alternative transmission lines in order to maintain their market share in the data center industry.

Potomac Edison, which is owned by FirstEnergy, serves Frederick County, which has an efficient 230 KV transmission system. Under certain rate structures, users with a high load factor and a consistent load curve may be rewarded. Frederick County has some of the most competitive average commercial electricity rates in the capital region, with prices that are approximately 55% lower than the average rate in Maryland and 53% lower than the national average rate.

The Doubs Substation, one of the Mid-Atlantic region’s largest 500KV transmission interconnections, is one of the region’s most important power assets. The system provides dual 230-kilovolt services.

First Energy has already announced plans to build a transmission line from Maryland to Virginia in order to protect Virginia’s monopoly in the data center market. We believe it would be irresponsible to allow valuable power to flow from Maryland to Virginia when the revenue generated could be used to improve the lives of many of our fellow state residents.

Building a data center in the United States mission-critical for any organization. From articulating the business motivations behind the creation of such an asset to defining the key elements of an appropriate location, it is necessary to create a detailed picture of the critical and complex requirements in advance in order to successfully implement your vision for a data center. None of these decisions is more crucial than the location of the data center you intend to construct.

When determining the viability of a development, topography is a crucial factor. The terrain of Frederick County is divided into three distinct sections. On the west, there is a very mountainous terrain; in the center, the terrain is very flat, followed to the east by a more rough train. This corridor in the center of Frederick County contains relatively flat, bedrock-supported land that is optimal for construction or large-scale building. The relatively flat terrain of our site has a positive effect on all aspects of the project.

This incoming wave of infrastructure will have big implications for Frederick County governments and planners, particularly those interested in leveraging the new economic drivers they enable. The proximity of data centers to communities is key to attracting connected industries for applications like smart manufacturing as well as delivering high-quality advanced services like telehealth, remote learning, augmented and virtual reality, autonomous vehicles, drone delivery, and all the various smart city applications.

Despite this, relatively few local zoning codes define and regulate data centers, which have largely been located in industrial and office parks and complexes. The lack of an explicit code is what creates uncertainty and leads to various types of interpretation by the many. In light of this, Frederick County has the chance to show how forwardthinking it is and set an example for Maryland in terms of the most important factors for planners to take into account and methods to help your community succeed.

“The study finds a pervasive urban bias in the location of third-party data centers. For example, we find that all large metropolitan areas with over 700,000 population have at least one supplier. Less dense areas may or may not have any. Moreover, local entry rises with the presence of local information industries and intensive data users, such as finance, insurance, and real estate. Because less supply locates in the areas with lower density, a high fraction of buyers in small and medium-sized locations must get their services from nonlocal suppliers—likely located in the closest major city. Relatedly, we also find supply of more specialty services in denser and more competitive locations. We interpret all these patterns as the result of tension between economies of scale and user preference for proximity.

We find evidence of different strategies between third-party supply and the major cloud providers.The major cloud suppliers display less propensity to locate their own data centers in urban areas. Cloud suppliers are comparatively less responsive to local demand and more responsive to costs, such as electricity,construction wages, and land prices. Cloud providers also tend to concentrate their building in a small number of locations. Because our study focuses on an early moment in the shift towards the cloud, we interpret these differences as an indicator of a shift in where infrastructure locates at the time, and where it will locate in the future. Decisions at large providers will determine the small set of areas affected by this shift.

We considered a variety of factors, including IEX proximity, electricity availability, fiber presence, topography, local population density, and environmental sensitivity, when selecting a site for purchase. The Doubs site represents an exceptional opportunity to rapidly develop Maryland’s data center market without sacrificing the quality of life for local residents. Due to the site’s existing infrastructure and relative seclusion, it will be possible to construct a large hyperscale campus without causing significant disturbances to neighboring properties. The proximity to the QLoop and Aligned sites allows for the concentration of resources and minimization of the community’s impact, as well as the establishment of a local cluster that will assist in redundancy while allowing for sufficient separation to accommodate security concerns.

Upon completion of the Doubs/Adamstown project and the QLoop/Aligned site, we anticipate that the county will generate more than one billion dollars in annual revenue. This revenue will have a significant impact on the local economy, enable much-needed spending on the Frederick County education system, and demonstrate that Maryland is indeed business-friendly to companies like Amazon Web Services and Microsoft that had previously avoided our state. The development of our site would drastically alter the perception of Frederick County following the collapse of the AWS investment in 2019 and position us optimally for the second and third phases of our project across the state.

The difficulty faced by our site is typical of situations in which a new industry has outpaced previous planning. In 2019, Frederick County adopted a new comprehensive plan. The Livable Frederick Master Plan is an innovative blueprint that encompasses all aspects of life in the county. The framework enables the proposal or modification of corridor plans that target smaller, more specific areas of the county. The primary industrial area corridor plan is the “East Alcoa Growth Area,” which is located between the “South Corridor Growth Area” to the north and our location to the south. If you examine these two corridors and the connections between their industrial areas, it makes perfect sense to continue traveling south in the direction of Point of Rocks, which would include our site and surrounding area, which includes a substation (zoned industrial), a junk yard, a large hydroponic warehouse, and large transmission towers.

The problem is that our current zoning is agriculture, and at one point it was a large tract of farmland. Since then the land has been divided up and sold, losing all economic potential to benefit from farming activities. The previous comprehensive plan did not study the natural growth patterns that occur in these areas, instead using other zoning mechanisms to deter growth and maintain the status quo. Staff have asserted that this site is prime farmland but have provided no evidence, despite a mountain of evidence attesting to the lack of economic viability of farming the property provided by the United States Department of Agriculture. Tax incentives are often offered by the county to deter development. Housing developments are in turn promoted without any business development to provide the financial engine to sustain the necessary infrastructure to support an increasing population. . There are numerous counties that have been confronted with these obstacles; some have overcome them and brought great prosperity and growth to their county, while others continue to struggle and are impacted by any change in the economy as a whole.

Our environment is a finite resource which must be responsibly stewarded for the benefit of future generations. Part of our duty is to evaluate concerns from an objective standpoint based on verifiable facts and outcome consideration for all residents, current and future. Data Centers, much like cars, trucks, livestock operations, or even our homes, are sources of carbon emissions which are integrally tied to our daily existence and the world around us. In order to best manage this energy consumption and carbon output new technologies and protocols are constantly being developed and implemented to mitigate the impact of Data Center energy consumption. One of the most effective tools at limiting resource consumption of data centers is to consolidate them into large campuses that can operate more efficiently than multiple sites spread out across a much larger area. This limits the amount of new infrastructure that needs to be installed, reduces power consumption due to efficiency of scale and allows for more efficient and environmentally friendly practices such as utilizing recaptured wastewater for cooling and preventing any discharge via on site collection and recycling. Industry leaders such as Iron Mountain, Equinix and Digital Realty have transitioned to renewable energy usage across nearly all their sites and have simultaneously invested in renewable energy generation. This is particularly relevant to Fredrick County as those three companies are realistic partners for the site due to their Federal Agency contracts and the unique suitability of the site for secure applications.

There are many misconceptions around Data Centers which are the unfortunate result of how relatively little interest exists in them among the general public and the constant and drastic evolution they have undergone in the past two decades. Data Centers have existed in some capacity since the 90’s, however they previously were typically located in office buildings. In the late 1990’s I witnessed my father start up a server colocation business out of the basement of our home, which in essence became a microcosm of what a data center is today. By centralizing we not only are taking the most responsible action for our environment but also for our economy and security.

From a standpoint of renewable energy, remarkably the Doubs site was put forth as a host for a solar project which would generate clean energy for the attached substation, only to be blocked by the county in 2016. There are a small but vocal segment of people, some of whom are not stakeholders in the county, who are very insistent on projects like breweries or more townhome developments. I would ask those with that perspective to truly ask if more wait staff jobs at a brewery which do not even pay a living wage, to serve those with disposable income are better than data center jobs and the community investment they bring. Are more housing developments without funding for schools and infrastructure are somehow preferable to developing our economy in a responsible way and enabling the funding of our already underperforming schools? It is ironic that environmental concerns are often pushed to the forefront of any opposition agendas when in reality the EPA has documented that agricultural output and housing development with their associated increase in transportation emissions actually emit a greater amount of greenhouse gases than the projects they seek to stop while providing no benefits to the community and those who need it most.

Basics — A floating zone is a zoning district that delineates conditions which must be met before that zoning district can be approved for an existing piece of land. Rather than being placed on the zoning map as traditional zones are, however, the floating zone is simply written as an amendment in the zoning ordinance. Thus, the zone “floats” until a development application is approved, when the zone is then added to the official zoning map. Floating zones can be used to plan for future land uses that are anticipated or desired in the community, but are not confirmed, such as affordable housing, shopping centers, and urban development projects. They can also be used for cluster zoning, planned-unit developments (PUDs), and urban development projects.

As we began to consider options for rezoning a property from agricultural to industrial, we initiated conversations with county staff, community organizations, and neighbors. We were pleasantly surprised to find that our neighbors supported the change, realizing that they would also benefit from the utility upgrade and increase in property values. Limits on how quickly zoning changes can be implemented were brought up in an informal discussion with county staff. The typical approach is to demonstrate a “change” in the neighborhood’s character or an error in the previous zoning map. The major issue with “change” is that it is highly subjective, and no measurable method for determining the degree of change is provided. “Using the “change in neighborhood” rezoning strategy, there have been very few, if any, completed in all my years,” said one of the planners.

The quickest method for re-zoning this new data center parcel would be to apply a floating zone, which the American Planners Association recommends in similar situations when a sector has experienced significant growth and re-zoning is required.

Maryland currently has a unique opportunity to completely reinvigorate its economy on an unprecedented scale. By taking advantage of a set of unexpected circumstances in Virginia, we have a one-time chance to shift the bulk of new data center development into our state and do so in a responsible manner that will not only bring in tremendous tax revenue and job development but also steward our natural environment in a responsible manner while enabling us to simultaneously impact the lives of our neighbors who need assistance the most. Our strategy will follow a three-phase rollout, which will entail adding anchor sites in Prince George’s County, routing fiber under the Potomac near Fort Washington, and seeing Baltimore City established as a connecting hub between the Northern Virginia and Philadelphia Network Access Points in order to position Maryland as the most critical partner for federal data users moving forward.

Unlike projects that require subsidization from the state, our project will instead directly invest in multiple sectors of Maryland’s economy and generate jobs that do not simply provide a living wage but rather a thriving one. A $15 per hour minimum wage is certainly an improvement over the current level; however, with the average cost of rent in the state eclipsing $1600 per month and Montgomery County reaching over $2000 monthly, jobs that generate meaningful opportunity for economic advancement are becoming ever more necessary to see our fellow citizens thrive. Education is another extremely overburdened system in our state, with items such as schoolprovided breakfasts or laundry services for students becoming increasingly contentious issues. These services are incredibly low-cost relative to the tremendous amount of revenue generated by projects such as ours, and by utilizing the added revenue streams we generate, Maryland has the chance to dramatically impact the lives of hundreds of thousands of our children in ways we have never imagined.