3 minute read

The Doubs Site

“The study finds a pervasive urban bias in the location of third-party data centers. For example, we find that all large metropolitan areas with over 700,000 population have at least one supplier. Less dense areas may or may not have any. Moreover, local entry rises with the presence of local information industries and intensive data users, such as finance, insurance, and real estate. Because less supply locates in the areas with lower density, a high fraction of buyers in small and medium-sized locations must get their services from nonlocal suppliers—likely located in the closest major city. Relatedly, we also find supply of more specialty services in denser and more competitive locations. We interpret all these patterns as the result of tension between economies of scale and user preference for proximity.

We find evidence of different strategies between third-party supply and the major cloud providers.The major cloud suppliers display less propensity to locate their own data centers in urban areas. Cloud suppliers are comparatively less responsive to local demand and more responsive to costs, such as electricity,construction wages, and land prices. Cloud providers also tend to concentrate their building in a small number of locations. Because our study focuses on an early moment in the shift towards the cloud, we interpret these differences as an indicator of a shift in where infrastructure locates at the time, and where it will locate in the future. Decisions at large providers will determine the small set of areas affected by this shift.

Advertisement

We considered a variety of factors, including IEX proximity, electricity availability, fiber presence, topography, local population density, and environmental sensitivity, when selecting a site for purchase. The Doubs site represents an exceptional opportunity to rapidly develop Maryland’s data center market without sacrificing the quality of life for local residents. Due to the site’s existing infrastructure and relative seclusion, it will be possible to construct a large hyperscale campus without causing significant disturbances to neighboring properties. The proximity to the QLoop and Aligned sites allows for the concentration of resources and minimization of the community’s impact, as well as the establishment of a local cluster that will assist in redundancy while allowing for sufficient separation to accommodate security concerns.

Upon completion of the Doubs/Adamstown project and the QLoop/Aligned site, we anticipate that the county will generate more than one billion dollars in annual revenue. This revenue will have a significant impact on the local economy, enable much-needed spending on the Frederick County education system, and demonstrate that Maryland is indeed business-friendly to companies like Amazon Web Services and Microsoft that had previously avoided our state. The development of our site would drastically alter the perception of Frederick County following the collapse of the AWS investment in 2019 and position us optimally for the second and third phases of our project across the state.

The Challenge

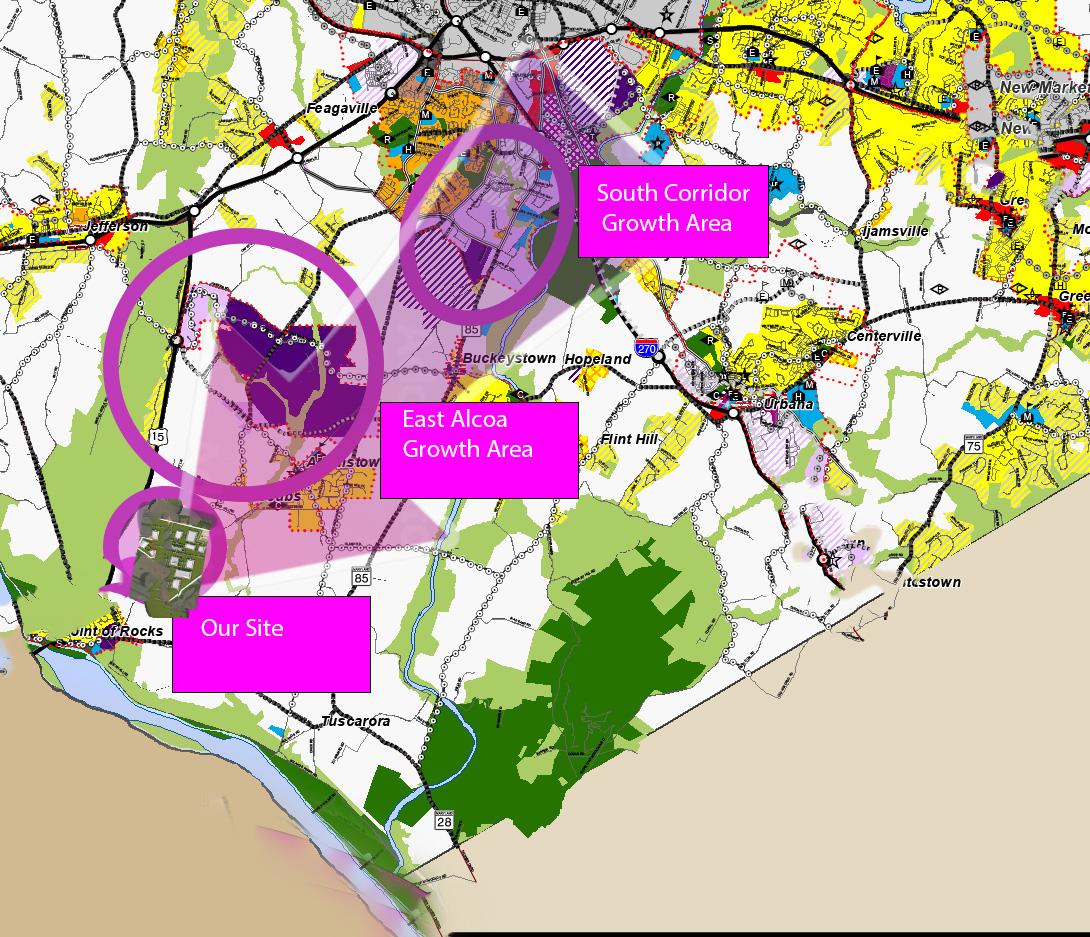

The difficulty faced by our site is typical of situations in which a new industry has outpaced previous planning. In 2019, Frederick County adopted a new comprehensive plan. The Livable Frederick Master Plan is an innovative blueprint that encompasses all aspects of life in the county. The framework enables the proposal or modification of corridor plans that target smaller, more specific areas of the county. The primary industrial area corridor plan is the “East Alcoa Growth Area,” which is located between the “South Corridor Growth Area” to the north and our location to the south. If you examine these two corridors and the connections between their industrial areas, it makes perfect sense to continue traveling south in the direction of Point of Rocks, which would include our site and surrounding area, which includes a substation (zoned industrial), a junk yard, a large hydroponic warehouse, and large transmission towers.

The problem is that our current zoning is agriculture, and at one point it was a large tract of farmland. Since then the land has been divided up and sold, losing all economic potential to benefit from farming activities. The previous comprehensive plan did not study the natural growth patterns that occur in these areas, instead using other zoning mechanisms to deter growth and maintain the status quo. Staff have asserted that this site is prime farmland but have provided no evidence, despite a mountain of evidence attesting to the lack of economic viability of farming the property provided by the United States Department of Agriculture. Tax incentives are often offered by the county to deter development. Housing developments are in turn promoted without any business development to provide the financial engine to sustain the necessary infrastructure to support an increasing population. . There are numerous counties that have been confronted with these obstacles; some have overcome them and brought great prosperity and growth to their county, while others continue to struggle and are impacted by any change in the economy as a whole.