8 minute read

Industry Overview

Data centers have increasingly developed into an integral part of our daily lives, affecting matters ranging from national security to how we operate smart appliances in our homes. Every industry and every service we use now has a digital footprint in a data center and utilizes their cloud storage in order to function efficiently and effectively. In fact, the “cloud” consists entirely of these buildings and the fiber that connects them. This allows us to take advantage of economies of scale that not only increase our efficiency and lower our costs, but also reduce our carbon footprint in comparison to the older and more widely dispersed data centers we previously employed.

Data centers have become a crucial component of modern society, providing the infrastructure necessary for our increasingly digital world. They enable us to access and utilize information in real-time, while also promoting sustainability through their efficient use of resources. As technology continues to advance, it is likely that data centers will play an even greater role in shaping our lives and the world around us.

Advertisement

Trends

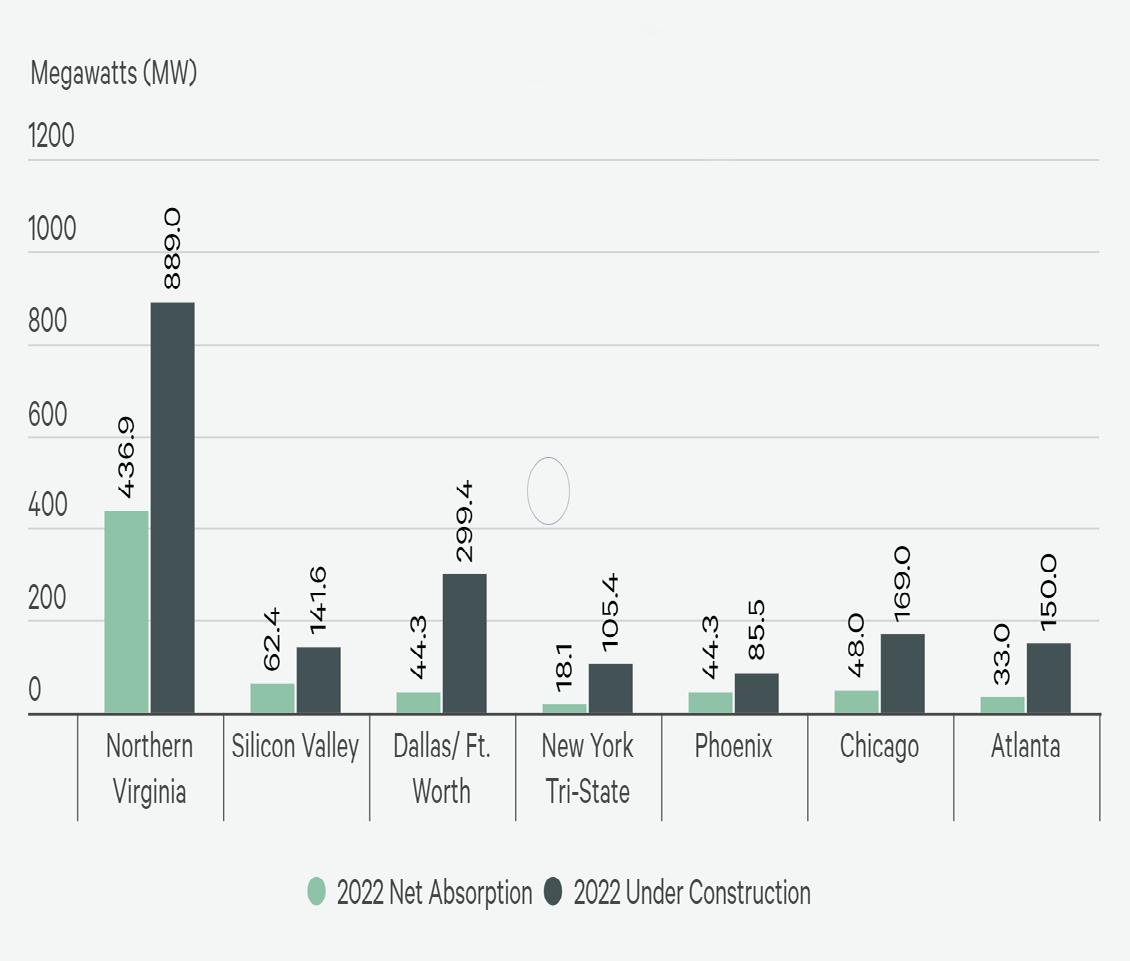

Over the last two years, the general public has witnessed unprecedented technological transformations related to how we work, play, and communicate. As expected for 2021, the cloud migration that began in 2020 continued to transform businesses and data centers, 5G rollouts accelerated, IoT powered the trend to make nearly everything “smart,” AI went from experimental to essential, and remote work became a way of life for many.

These trends have proven so important to how businesses, communities, and families are adapting to change that they will continue unabated in 2023 and beyond. In addition, the accelerating adoption of single-mode fiber for faster processing of more data and automated infrastructure management (AIM) for increased system interoperability will have a significant impact on data centers. Here’s how these trends are expected to evolve:

Cloud migration

Scalability and cost continue to drive companies to the cloud. In late 2021, HPE reported that year-over-year (YoY) orders for its GreenLake cloud platform increased by 46%, and AWS reported YoY growth of around 40%. Renting infrastructure and scaling it within days instead of waiting for a multiyear build is just too compelling. Both public and private cloud infrastructure will grow. Large enterprises will use a hybrid model, while smaller companies will use the public cloud alone. The only real inhibitor of this growth is concern around data security and compliance restrictions, such as privacy and compliance regulations that require protecting individual health care information or keeping some data within a country or on-premises.

IoT

According to Statista, the number of IoT devices worldwide will reach more than 25.4 billion in 2030, tripling from the 8.74 billion devices in 2020. However, this is still just the beginning, as businesses are starting to understand how they can optimize operations, such as shipping and logistics, by collecting and analyzing data from sensors. Once again, the impact on data centers will be enormous, as all that data needs to be stored and processed somewhere, which is increasingly in the cloud.

Consider the number of data points required for a package tracking application: where a package originated, where it is, where it’s going, estimated time of arrival, environmental conditions (including temperature, humidity, altitude, pressure, etc.), delivery company, driver, vehicle status and history, etc. Now multiply the data for one package by hundreds of thousands or even millions of packages.

AI/AR

In the past few years, most companies have still been figuring out their AI strategy. In 2023, AI will be essential to understanding all the data companies are collecting; big data analytics just can’t be done manually. From facial recognition and contact tracing to supply chain and logistics analytics, AI is the key to process optimization and business competitiveness.

Over the next year, building AI capabilities and capacity will be a major initiative for most enterprises, even as we begin a long-term trend toward increased reliance on Augmented Reality (AR). While AR will initially be adopted for gaming and personal interaction, it will begin to play an increasing business role in marketing, sales, training, and other service applications. For instance, field technicians already use AR to connect with a call center via a smartphone to get answers to questions pertaining to their installations and repairs.

Remote work

Remote work was a trend before the pandemic, and for vast numbers of workers and companies, it will become the standard way of doing business. It offers a better work-life balance for employees as well as lower operating costs and increased productivity for employers. Of course, this trend will have a significant impact on the need for high-speed internet access at home to support videoconferencing, not just for work but also for remote learning and entertainment. Once again, data center storage and performance requirements must increase to support high-quality video streaming, recording, and storage.

Local governments will need to invest in digital infrastructure to support the expansion of these new technologies and online services for their constituents. This includes providing reliable internet access to rural and underserved areas as well as ensuring the security of online transactions and data. Additionally, the shift towards remote work will likely lead to changes in urban planning, as people may no longer need to live in close proximity to their workplaces. This could result in a decentralization of urban centers and a greater emphasis on suburban and rural areas.

In 2020, the Maryland General Assembly passed SB 397, which created a sales and use tax exemption program for data centers. The passage of SB 397 was an attempt to bring Maryland in line with the 31 other states that offer incentives for data centers in order to attract the unrivaled amounts of investment and tax revenue that they generate. The list of Tier 1 counties in the bill, while an excellent beginning, does show how challenging it is to create legislation that takes into account the technical and commercial aspects of these operations. The list notably omits Frederick County, the first and most critical location for us to develop in order to compete with Virginia or any of the other major markets.

The example showcases the challenge for governments in adopting legislation that supports the growth of digital infrastructure, as seen in Maryland’s exclusion of critical areas such as Frederick County from its data center exemption program. This highlights the need for comprehensive and inclusive policies that consider not only technical and business factors but also regional disparities and public needs. Nevertheless, interest in Maryland as a potential market was generated for the first time since the collapse of the 2019 Amazon Web Services deal in Frederick County, which denied Maryland approximately 35 billion USD in investment and instead went to Virginia.

Overall, while there have been efforts in Maryland to incentivize the growth of data centers, the exclusion of critical areas like Frederick County highlights the challenges of creating legislation that considers all factors. However, there is renewed interest in Maryland as a potential market for data centers following the collapse of the Amazon Web Services deal in 2019. Going forward, it will be important for policymakers to adopt comprehensive and inclusive policies that take into account regional disparities and public needs in order to support the growth of digital infrastructure.

Stafford County, VA Weighs Proposal for Massive Data Center

Stafford County has been working to become part of the data center building boom in Virginia. A new proposal for a 5.5 million square foot campus featuring 25 data centers could add a new hub for NoVA cloud storage...

Switch Poised for Growth as DigitalBridge Completes $11 Billion

After the completion of its $11 billion acquisition by DigitalBridge and IFM, Switch is poised to shift into building mode in an industry facing capacity constraints in key markets.

Dec. 7, 2022

Google Has Invested $5 Billion in its Iowa Data Centers

Google has completed the latest phase of construction at its data center in Council Bluffs, Iowa, bringing its total investment in its Iowa campus to $5 billion. The milestone.

Feb. 7, 2022

KKR, GIP to Acquire CyrusOne in Blockbuster $15 Billion Deal

Investment giants KKR and Global Infrastructure Partners will acquire data center developer CyrusOne for $15 billion, taking the company private in the largest M&A deal in the.

Nov. 15, 2021

Facebook Has 47 Data Centers Under Construction

Meta currently has 47 data centers under construction, the company said this week, reflecting the extraordinary scope of the ongoing expansion of world’s digital infrastructure

Nov. 10, 2021

Vantage Raises $1.25 Billion in Equity Capital to Fund Data Center

Vantage Data Centers has raised $1.25 billion in equity funding from its current investors, led by Digital Colony. The funding reinforces the value proposition of building wholesale..

Nov. 19, 2021

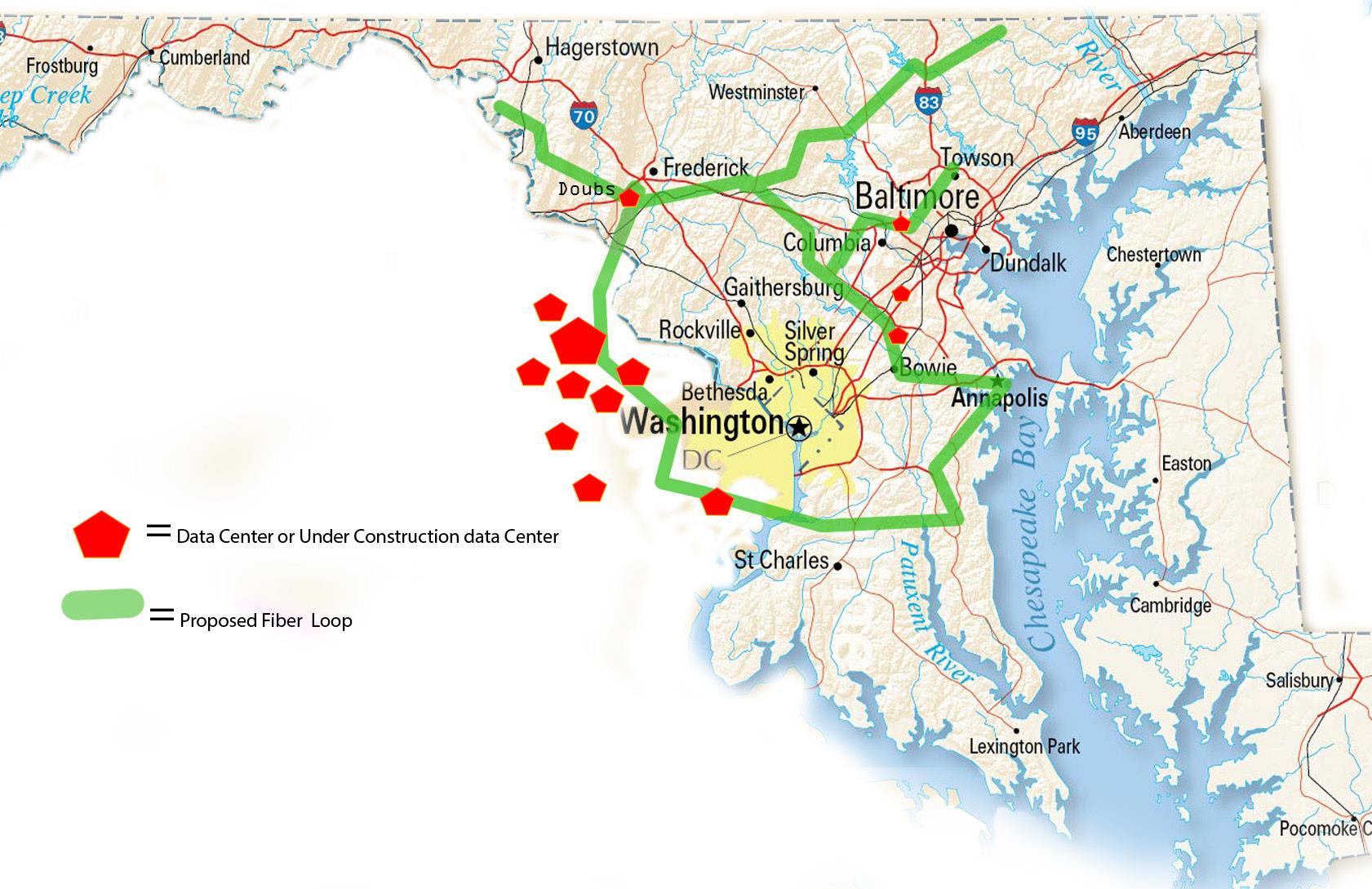

Proposed Maryland Fiber Loop

In order to facilitate long-term sustainable growth and position Maryland as the most important element of our national fiber backbone, we intend to develop a multiple redundancy network throughout the state, beginning in Frederick County given its proximity to the Northern Virginia Network Access Point (NAP) in Loudoun County. It is impossible to overstate the significance of proximity to the Loudoun County Network access point. Reason why, as we are witnessing, the first large-scale hyperscale data centers are being constructed in Frederick County. Second, the access to power and land that Fredrick County can provide is a unique characteristic of the county that other counties will find difficult to replicate because they have a higher population density and projects will take longer to initiate.

When the data center market in Frederick County opens, the focus should shift to Prince George’s County. As Northern Virginia connects its counties (Loudoun and Prince William), it forms a crescent that will connect Prince George County in the east to Frederick County in the west, forming a semicircle around Washington, D.C., and into Maryland. This expansion of the data center market into Prince George’s County is a natural progression as the demand for cloud computing and big data analytics continues to grow. With its proximity to Washington, D.C., and major transportation hubs, Prince George’s County is poised to become a major player in the data center industry.

The loop’s final phase will connect Anne Arundel County, Baltimore County, and Baltimore City. Aside from Baltimore City, the greatest difficulty will be locating land suitable for data centers in high-density areas that meets the requirements of these data centers. Frederick County and Prince George’s County would become a major hub for federal data traffic and storage with the establishment of our Fort Washington Loop, thereby enhancing the viability of a Baltimore-to-Philadelphia Internet Exchange (IEX).

Future Sustainability

The largest driver of hyperscale site development is their resource efficiency when compared to multiple smaller sites totaling a similar capacity. Advances in cooling have led to drastically reduced water usage, and commonsense steps such as utilizing non-potable water and renewable energy such as solar have led to some of our first zero-carbon emission sites in the last two years. The development of utility-scale renewable energy has been heavily promoted and financed by the data center industry, with sites in some regions sourcing 100 percent of their power needs from renewable energy sources. Our own experience with solar energy has enabled our first major data center facility in the Middle East to operate with over 99% uptime in an environment that does not yet have a stable energy grid by leveraging our ability to install utility-scale solar fields adjacent to our site.

“When working with suppliers, data centers have begun adding multiple sustainability-related requirements into their RFPs and RFIs, asking for information pertaining to carbon usage in the supply chain, the level of reuse and recycling programs in place, and the energy efficiency of infrastructure components.

Every new infrastructure purchase evaluation should take sustainability-related factors into account, but it’s important to keep in mind that the industry is still developing in terms of its capacity to precisely measure and track such metrics, particularly outside of their own organizations (e.g., across the supply chain). However, decision-makers in the data center should continue to press for information because doing so will encourage the necessary increase in maturity. However, in the short term, they might want to concentrate primarily on the criteria that infrastructure vendors can precisely measure, namely energy efficiency and, more specifically, energy efficiency per infrastructure capability, or, more simply put, power consumption per usable capacity at the required performance level.”

AWS Eyes New Strategies to Meet Energy Goals for its $15 Billion Oregon Cloud Region

Amazon Web Services has invested $15 billion in its cloud cluster in Oregon, and is pursuing new approaches to energy - including on-site generation - to create a path to sustainable.

May 1. 2023

Center Concept I