PERC Engineering is pleased to offer a comprehensive benefits package intended to protect your well-being and financial health. This guide is your opportunity to learn more about all of the benefits available to you and your eligible dependents from January 1 through December 31, 2026.

To get the best value from your health care plan, please take the time to evaluate your coverage options and determine which plans best meet the health care and financial needs of you and your family. By being a wise consumer, you can support your health and maximize your health care dollars.

Your benefits plan offers three medical coverage options. To help you make an informed choice and compare your options, your plan makes available a Summary of Benefits and Coverage (SBC). Copies of the SBCs are available by logging in to www.benefitsinhand.com and clicking on the Document Library. You can also view and/or download a copy by visiting www.bcbstx.com/member.

If you (and/or your dependents) have Medicare or will become eligible for Medicare in the next 12 months, a federal law gives you more choices about your prescription drug coverage. Please see page 30 for more details.

You are eligible for benefits if you are a regular, full-time employee working an average of 30 hours per week. Your coverage is effective on the first day of the month following or coinciding with your date of hire. You may also enroll eligible dependents for benefits coverage. The cost to you for dependent coverage will vary depending on the number of dependents you enroll and the particular plans you choose. When covering dependents, you must select and be on the same plans.

z Regular, full-time employee

z Average 30 or more hours per week

z Legal spouse

z Children under 26 years of age

z Unmarried mentally or physically disabled children, regardless of age

z Dependent grandchildren

Once you elect your benefit options, they remain in effect for the entire plan year until the following Open Enrollment. You may only change coverage during the plan year if you have a Qualifying Life Event, and you must do so within 30 days of the event.

z Marriage, legal separation, or annulment

z Birth, adoption, or placement for adoption of an eligible child

z Change in your spouse’s employment that affects benefits eligibility

z Change in residence that affects your eligibility for coverage

z Significant change in benefit plan coverage or cost for you, your spouse, or child

z FMLA leave, COBRA event, court judgment, or decree

z Receiving a Qualified Medical Child Support Order

z Change in your child’s eligibility for benefits (e.g., reaching the age limit)

z Divorce

z Death of a spouse or child

z Becoming eligible for Medicare, Medicaid, or TRICARE

z Dependent loss of eligibility

To begin the enrollment process, go to www.benefitsinhand.com. First time users follow steps 1-4. Returning users log in and start at step 5.

1. First-time users: Click on the New User Registration link. Once you register, you will use your username and password to log in.

2. Enter your personal information and Company Identifier of PERCengineering and click Next.

3. Create a username (work email address recommended) and password, then check the I agree to terms and conditions box before you click Finish

4. If you used an email address as your username, you will receive a validation email to that address. You may now log in to the system.

5. Returning users: Click the Start Enrollment button to begin the enrollment process.

6. Confirm or update your personal information and click Save & Continue

7. Edit or add dependents who need to be covered on your benefits. Once all dependents are listed, click Save & Continue.

8. Follow the steps on the screen for each benefit to select or decline coverage. To decline coverage, click Don’t want this benefit? and select the reason for declining.

9. When you finish making your benefit elections, review your selections. If correct, click the Click to Sign button to complete and submit your enrollment choices.

Have questions about your benefits or need help enrolling? Call the Employee Response Center at 866-419-3518. Benefits experts are available to take your call Monday through Friday from 7:00 a.m. to 6:00 p.m. CT.

Employee benefits can be complicated. The Higginbotham Employee Response Center can assist with the following:

z Enrollment

z Benefits information

z Claims or billing questions

z Eligibility issues

Call or text 866-419-3518 to speak with a representative Monday through Friday from 7:00 a.m. to 6:00 p.m. CT. If you leave a message after 3:00 p.m. CT, your call or text will be returned the next business day. You can also email questions or requests to helpline@higginbotham.net . Bilingual representatives are also available.

The medical plan options through Blue Cross Blue Shield of Texas (BCBSTX) are designed to protect you and your family from major financial hardship in the event of illness or injury. You can choose from three plans: a Preferred Provider Organization (PPO) copay plan, a High Deductible Health Plan (HDHP) that combines a PPO plan with a tax-free Health Savings Account (HSA), and a Health Maintenance Organization (HMO) plan.

The PPO plan offers copays for physician’ s office visits, urgent care, emergency room visits, and prescription drugs. With the HDHP, you will need to meet the deductible before the plan pays for any services. And the HMO plan requires you seek care from in-network providers within the BCBSTX HMO network, you select a primary care physician (PCP), and get referrals to see a specialist.

Preventive care is covered at 100% on all plans.

z Freedom to see any provider when you need care.

z In-network preventive care is covered at 100%.

z Plan is a qualified HDHP.

z Lower per paycheck cost, but you must satisfy a higher deductible that applies to almost all health care expenses, including those for prescription drugs.

z This plan is paired with a Health Savings Account that is used to pay for your medical expenses. See box below.

z PERC provides you with a Health Reimbursement Arrangement to keep your maximum out-of-pocket expenses low. See page 10 for more information.

z Freedom to see any provider when you need care.

z In-network preventive care is covered at 100%.

z In-network office visits, urgent care, emergency room, and prescription medications are covered with a copay.

z Most other in-network services are covered at the coinsurance level after you have met your deductible.

z Must choose a PCP to coordinate your care.

z Only in-network providers are covered, except in emergencies.

z In-network preventive care is covered at 100%.

z Higher per-paycheck cost than the HSA plan, but you pay less out of pocket when you receive care.

z This plan is not paired with a Health Savings Account (HSA).

If you enroll in the HSA PPO plan, you may be eligible to open and contribute pretax money through payroll deductions to an HSA. PERC Engineering will match your HSA contribution up to $750 if you cover only yourself (Single) or $1,200 if you also cover your dependents (Family). See page 11 for more information.

If you are not enrolled in the HSA or are not eligible for an HSA, you can open and contribute up to $3,400 to a Health Care Flexible Spending Account (FSA). See page 17 for more information about FSAs.

If you need emergency room care, do not sign the financial consent form for treatment and instead write in the below language:

Superseding other consents, I consent to responsibility (including insurance) for up to two times Medicare following receipt of an itemized bill for appropriate treatment coded at the correct level.

z You and PERC Engineering contribute money into your HSA each month.

z Pay $0 for in-network preventive care.

z Use the money in your HSA to pay for your medical expenses.

z After the deductible is met, the HSA PPO plan pays at 100%.

z Once you meet your out-ofpocket maximum, the HSA PPO plan pays 100% of covered network costs.

• $7,500 Individual

• $15,000 Family

z Pay for office visits, urgent care, and prescription drugs with copays.

z Pay $0 for in-network preventive care.

z Pay 100% for other covered care until you meet the deductible.

• $1,000 Individual

• $3,000 Family

z After meeting the deductible, the Traditional PPO plan covers 80% of your covered expenses, and you pay the remaining 20% (coinsurance).

z Once you meet your out-ofpocket maximum, the Traditional PPO plan pays 100% of covered network costs.

• $4,000 Individual

• $12,000 Family

z Pay for office visits, urgent care, and prescription drugs with copays.

z Pay $0 for in-network preventive care.

z Pay 100% for other covered care until you meet the deductible.

• $5,000 Individual

• $10,000 Family

z After meeting the deductible, the HMO plan covers 100% of your covered expenses.

z Once you meet your out-ofpocket maximum, the HMO plan pays 100% of covered network costs.

• $5,000 Individual

• $10,000 Family

•

2This plan is an HMO and has in-network benefits only.

3The amount you pay at a preferred in-network pharmacy versus a

A Health Reimbursement Arrangement (HRA) is an employer-funded health care account that reimburses you tax-free for qualified medical expenses up to a fixed dollar amount per year (per IRS regulations, the specifics of an HRA vary based on the options selected by the employer). If you enroll in the HSA PPO plan, PERC Engineering will provide an HRA to help you pay out-of-pocket costs associated with meeting your in-network deductible. Our HRA is managed by Higginbotham

Receive reimbursement from PERC Engineering over your share of the deductible by submitting an Explanation of Benefits (EOB) to Higginbotham.

1 The family deductible can be met by two members hitting their individual deductible or from a combination of expenses from all family members even if they have not individually met their own deductible.

The HRA is only for employees who enroll in the HSA PPO plan.

You must first pay your share of the innetwork deductible before requesting reimbursement from your PERC Engineering-funded HRA to cover the remaining deductible amount. To receive reimbursement, file an HRA claim form with Higginbotham with your EOB from Blue Cross Blue Shield of Texas. Contact Christine Do in Human Resources for the HRA claim form or download it from www.benefitsinhand.com

By enrolling in either the HSA PPO plan or HSA HMO plan, you have the option of opening an HSA through HSA Bank .

An HSA is like a 401(k) for health care. It is a tax-advantaged personal savings account you can use to pay for qualified health care expenses — now or in the future.

All contributions are made pretax, decreasing your overall taxable income.

Earn money tax-free through investments or interest payments.

Pay for qualified health care expenses tax-free from the money in your account.

z Portability (you keep your HSA, even if you change employers or medical insurance plans)

z Unused contributions or investment earnings roll over each year HOW MUCH CAN YOU CONTRIBUTE TO YOUR HSA?

You are eligible to open and contribute to an HSA if you:

z Are enrolled in an HSA-eligible HDHP

z Are not covered by another non-HDHP, such as your spouse’s health plan or a Health Care FSA

z Are not eligible to be claimed as a dependent on someone else’s tax return

z Are not enrolled in Medicare, Medicaid, or TRICARE

z Have not received Veterans Administration benefits

You can use the money in your HSA to pay for qualified medical expenses now or in the future. Your HSA can be used for your expenses and those of your spouse and dependents, even if they are not covered by the HDHP.

When you initially enroll in the HSA PPO plan in BenefitsInHand, you will automatically be enrolled in an account with HSA Bank. A welcome kit containing important account information will be mailed to you within 7-10 business days after HSA Bank receives your enrollment.

z If you are under age 65, the penalty for using your HSA to pay for nonqualifed expenses is 20% of the amount withdrawn plus regular income tax.

z If you contribute more than the maximum contribution limit, the excess amount must be withdrawn prior to April 15 of the following year to avoid paying a 6% excise tax.

Becoming familiar with your options for medical care can save you time and money.

NON-EMERGENCY CARE

VIRTUAL VISITS/ TELEMEDICINE

DOCTOR’S OFFICE

Access to care via phone, online video, or mobile app whether you are home, work, or traveling; medications can be prescribed 24 hours a day, 7 days a week

Generally, the best place for routine preventive care; established relationship; able to treat based on medical history

Office hours vary

Usually lower out-of-pocket cost than urgent care; when you can’t see your doctor; located in stores and pharmacies

RETAIL CLINIC

Hours vary based on store hours

When you need immediate attention; walk-in basis is usually accepted

URGENT CARE

EMERGENCY CARE

Generally includes evening, weekend and holiday hours

• Allergies

• Cough/cold/flu

• Rash

• Stomachache

• Infections

• Sore and strep throat

• Vaccinations

• Minor injuries/sprains/ strains

• Common infections

• Minor injuries

• Pregnancy tests

• Vaccinations

• Sprains and strains

• Minor broken bones

• Small cuts that may require stitches

• Minor burns and infections

2-5 minutes

15-20 minutes

HOSPITAL ER

FREESTANDING ER

Life-threatening or critical conditions; trauma treatment; multiple bills for doctor and facility

24 hours a day, 7 days a week

Services do not include trauma care; can look similar to an urgent care center, but medical bills may be 10 times higher 24 hours a day, 7 days a week

• Chest pain

• Difficulty breathing

• Severe bleeding

• Blurred or sudden loss of vision

• Major broken bones

• Most major injuries except trauma

• Severe pain

15 minutes

15-30 minutes

Minimal

Note: Examples of symptoms are not inclusive of all health issues. Wait times described are only estimates. This information is not intended as medical advice. If you have questions, please call the phone number on the back of your medical ID card.

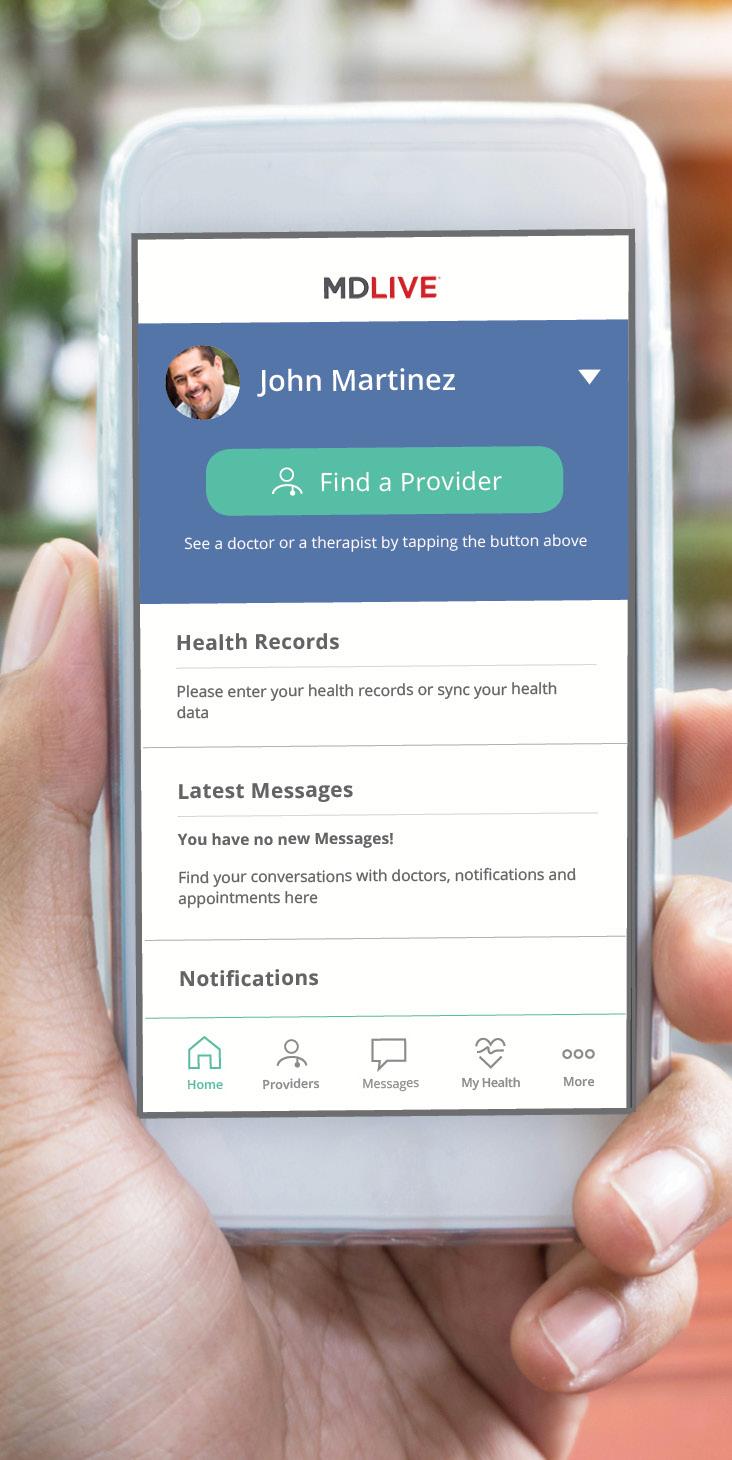

Your telemedicine program lets you see and talk to a doctor from your mobile device or computer without an appointment. Your BCBSTX plan includes telemedicine through MDLIVE . The program provides 24/7/365 access to a national network of board-certified doctors and pediatricians who can diagnose, recommend treatment, and prescribe medication. MDLIVE providers practice primary care, pediatrics, family, and emergency medicine.

z For non-emergency medical issues (especially as an alternative to the high cost of an emergency room or urgent care center)

z When your doctor or pediatrician is unavailable

z When you are traveling and need medical care

z When you need a prescription or refill

z When it is not convenient to leave your home or work

z Allergies

z Bronchitis

z Diarrhea

z Poison ivy

z Ear infections

z Sinus infections

z Cold and flu

z Constipation

z Fever

z Pink eye

z Vomiting

z Nausea

Blue Access for Members (BAM) is the secure BCBSTX member website where you can:

z Check claim status or history

z Confirm dependent eligibility

z Print EOB forms

z Locate in-network providers

z Print or request an ID card

To get started, log on to www.bcbstx.com and use the information on your BCBSTX ID card to complete the registration process.

MOBILE APP

The BCBSTX app can help you stay organized and in control of your health anytime, anywhere. Log in from your mobile device to access your BAM account, including:

z Track account balances and deductibles

z Access ID card information

z Find doctors, dentists, and pharmacies

Text BCBSTX to 33633 or search your mobile device’s app store to download.

Our dental plan helps you maintain good oral health through an affordable plan for preventive care, including regular checkups and other dental work. Coverage is provided through BCBSTX

Two levels of benefits are available with the DPPO plan depending on whether your dentist is in-network or out-of-network. You have the flexibility to select the provider of your choice, but benefits will be greater when you see an in-network provider. Out-ofnetwork providers are paid at a percentage of the prevailing fee in their ZIP code.

Basic Care

Fillings, Simple Extractions, Oral Surgery, Endodontics, Periodontics, Repairs of Bridges, Crowns and Inlays

1Calendar year is January 1 - December 31. Your calendar year deductible and

will reset to $0 every January 1.

Our vision plan through BCBSTX, using the EyeMed vision network, is designed to provide your basic eyewear needs and to preserve your health and eyesight. In addition to identifying vision and eye problems, regular exams can detect certain medical issues such as diabetes or high cholesterol. You may seek care from any licensed optometrist, ophthalmologist, or optician, but plan benefits are better if you use an in-network provider.

•

One way to plan ahead and save money over the course of a year is to participate in our Flexible Spending Account (FSA) programs. FSAs allow you to pay for certain health, dental, vision, and dependent care expenses with pretax dollars that reduce your taxable income and save you money. Our FSAs are administered by Higginbotham. There are three kinds of accounts: two for health care expenses and one for dependent care expenses. When you enroll, you must decide how much money to set aside from your paycheck for each account. Be sure to estimate your expenses conservatively as the IRS requires that you use the money in your account during the plan year and applicable grace period (the “use it or lose it” rule).

You may participate in the FSA programs even if you waive PERC Engineering medical benefits.

A Limited Purpose Health Care FSA is available if you are enrolled in the HSA PPO medical plan and have an HSA. You can use a Limited Purpose Health Care FSA to pay for eligible out-ofpocket dental and vision expenses only, such as:

z Dental and orthodontia care (e.g., fillings, X-rays, and braces)

z Vision care (e.g., eyeglasses, contact lenses, and LASIK surgery)

z Set aside pretax dollars from each paycheck

z Contribute up to $3,400 annually

z Pay for eligible health care expenses such as office visit copays, deductible, prescription drugs, braces, dental, and eye care expenses

z Available only if you do not have an HSA

z Compatible with the Traditional PPO medical plan

z Set aside pretax dollars from each paycheck

z Contribute up to $3,400 annually

z Pay for eligible vision and dental expenses

z Available only if you have an HSA

z Compatible with the HSA PPO medical plan

z Set aside pretax dollars from each paycheck

z Contribute $7,500 when filing jointly or head of the household, or $3,750 when married filing separately.

z Use for child or dependent eldercare expenses

z Allows you and your spouse to work or attend school full-time

z Cannot be used to pay for dependent health care expenses

Your plan includes a grace period that applies to your Health Care FSA and Dependent Care FSA. During this period, you may incur eligible FSA expenses and use the funds remaining in your account to cover those charges. The grace period is 2½ months.

When you incur a medical, dental, vision, or hearing expense, you will be reimbursed the full amount of the expense at that time (up to your annual election amount). You are entitled to the full election amount from day one of your plan year. When you incur a qualified health care expense, you can choose one of two reimbursement methods:

z Use your FSA debit card (see information below) to pay doctor visit and prescription copays. Your FSA will be charged for the amount and you will not need to submit a request for reimbursement.

z You can pay out-of-pocket and then submit your receipts to Higginbotham either online or via fax or email:

• Fax – 866-419-3516

• Email – flexclaims@higginbotham.net

You can only enroll in the Health Care FSA if you elect the Traditional PPO medical plan.

The Higginbotham Benefits Debit Card is a quick and easy way to pay for qualified expenses from your Health Care FSA. The debit card links directly to your FSA and gives you immediate access to funds when you are making a qualified purchase. You do not need to file a claim for reimbursement.

Note: If you use the debit card to pay anything other than a copay amount, you will need to submit an itemized receipt or an EOB. If you do not submit your receipts, you will receive a request for substantiation. You will have 60 days to submit your receipts after receiving the request for substantiation before your debit card is suspended.

Reimbursement from your Dependent Care FSA is limited to the total amount that is deposited in your account at that time. In order to be reimbursed, you must provide the tax identification or Social Security number of the party providing care, and that provider cannot be anyone considered your dependent for income tax purposes.

z Overnight camps are not eligible for reimbursement (only day camps can be considered).

z A dependent child must be under age 13 and claimed as a dependent on your federal income tax return, or a disabled dependent of any age incapable of caring for themselves and who spends at least eight hours a day in your home.

z If your child turns 13 midyear, you may only request reimbursement for the part of the year when the child is under age 13.

z You may request reimbursement for care of a spouse or dependent of any age who spends at least eight hours a day in your home and is mentally or physically incapable of self-care.

z The maximum per plan year you can contribute to a Health Care or Limited Purpose FSA is $3,400. The maximum per plan year you can contribute to a Dependent Care FSA is $7,500 when filing jointly or head of household and $3,750 when married filing separately.

z You cannot change your election during the year unless you experience a Qualifying Life Event.

z Expenses for services received during the 12-month period (or from the date you became covered) can be reimbursed from the money set aside from your pay during the 2026 plan year. You can continue to file claims incurred during the plan year for another 2½ months (up until March 15, 2027).

z Your Health Care FSA debit card can be used for health care expenses only. It cannot be used to pay for dependent care expenses.

The Higginbotham Portal has everything you need to manage your FSAs:

z 24/7 access to plan documents, letters and notices, forms, account balances, contributions, and other plan information

z Update your personal information

z Access Section 125 tax calculators

z Look up qualified expenses

z Request a new or replacement Benefits Debit Card REGISTER ON THE HIGGINBOTHAM PORTAL

Go to https://flexservices.higginbotham.net and click New User. Follow the instructions and scroll down to enter your information.

z Enter your Employee ID, which is your Social Security number with no dashes or spaces.

z Follow the prompts to navigate the site.

z If you have any questions or concerns, contact Higginbotham:

• Phone – 866-419-3519

• Email – flexclaims@higginbotham.net

• Fax – 866-419-3516

Your Health Care FSA can be easily accessed on your smartphone or tablet with the Higginbotham mobile app for iPhone and Android. To locate and load the app, search for Higginbotham FSA in your mobile device’s app store.

The app offers the following options:

z View Accounts – Includes detailed account and balance information

z Card Activity – Detailed expense information

z Manage Subscriptions – Set up email notifications to keep upto-date on all account and Health Care FSA debit card activity USING YOUR HIGGINBOTHAM FLEX MOBILE APP

Log in using the same username and password you use to log in to the Higginbotham portal.

Life insurance is an important part of your financial security, especially if others depend on you for support. Even if you are single, your beneficiary can use your Life insurance to pay off your debts such as credit cards, mortgages, and other final expenses.

Accidental Death and Dismemberment (AD&D) insurance provides you specified benefits for a covered accidental bodily injury that directly causes dismemberment (e.g., the loss of a hand, foot, or eye). In the event that death occurs from an accident, 100% of the AD&D benefit would be payable to your beneficiary(ies).

Basic Life and AD&D insurance are provided by PERC Engineering at no cost to you through BCBSTX . You are automatically covered at one times your annual salary up to a maximum of $200,000. Life and AD&D benefits reduce beginning at age 70.

You may purchase additional Life and AD&D insurance for you and your eligible dependents. During open enrollment for 2026, you are able to increase your current amount by $10,000, up to the guaranteed issue amount. All other amounts are subject to Evidence of Insurability (EOI). If you currently do not have coverage, EOI is required for any amounts. Spouse coverage changes or additions are subject to EOI.

You must elect Voluntary Life and AD&D insurance for yourself in order to elect coverage for your spouse or children. Coverage is provided through BCBSTX . If you leave PERC Engineering, you may be able to take the insurance with you. Life and AD&D benefits reduce beginning at age 65.

A beneficiary is the person or entity you designate to receive the death benefits of your Life insurance policy. You can name more than one beneficiary, and you can change beneficiaries at any time. If you name more than one beneficiary, you must identify the share for each.

z Increments of $10,000 up to $500,000

z Guaranteed Issue:

≤70 = $150,000

>70 = $10,000

z Increments of $5,000 up to $100,000 not to exceed 50% of employee coverage

z Guaranteed Issue:

≤70 = $30,000

>70 = $10,000

z $10,000 for children 14 days to 26 years

z $1,000 for children under 14 days of age

Disability insurance provides partial income protection if you are unable to work due to a covered accident or illness while insured. PERC Engineering provides both Short Term Disability (STD) and Long Term Disability (LTD) insurance at no cost to you through BCBSTX .

STD coverage pays a percentage of your salary for up to 12 weeks if you are temporarily disabled and unable to work due to an illness, non-work-related injury, or pregnancy. STD benefits are NOT payable if the disability is due to a job-related injury or illness.

LTD insurance pays a percentage of your salary for a covered disability or injury that prevents you from working for more than 90 days. Benefits begin at the end of an elimination period and continue while you are disabled up to a maximum benefit duration.

z Benefits begin on the 8th day of injury or illness

z Receive 60% of your pre-disability earnings

z $1,000 maximum weekly benefit

z 12-week maximum benefit period

z Benefits begin on the 91st day of injury or illness

z Receive 60% of your pre-disability earnings

z $10,000 maximum monthly benefit

z Maximum benefit period until you reach Social Security Normal Retirement Age

z Pre-existing condition exclusion applies

LTD benefits may not be paid for conditions for which you were treated within 12 months prior to your effective date until you have been covered under the plan for 12 months.

PERC Engineering offers you and your eligible family members the opportunity to enroll in additional coverage that complements our traditional health care programs. Health insurance covers medical bills, but if you have an emergency, you may face unexpected out-of-pocket costs, such as deductibles, coinsurance, travel expenses, and non-medical related expenses. The plans are offered through BCBSTX and are portable. If you leave your employment, you can take these policies with you.

Benefits are paid directly to you for covered accidental injuries, regardless of any other coverage you may have, and you can spend benefits it any way you choose. Benefits are paid according to a fixed schedule. Accident insurance covers hospitalization, fractures and dislocations, emergency room visits, major diagnostic exams, physical therapy, and more. Please refer to the benefit summary for details of the benefits.

•

Dislocations, ruptured discs, eye injuries, fractures, lacerations, concussions, etc.

Death & Dismemberment*

• You

*Percentage of benefit paid for dismemberment is dependent on type of loss.

Critical Illness insurance helps pay the cost of non-medical expenses related to a covered critical illness or cancer and provides a lump-sum benefit payment to you upon your first and second diagnosis of any covered critical illness or cancer. The benefit can help cover expenses such as lost income, out-of-town treatments, special diets, daily living, and household upkeep costs.

Employee

Spouse

Increments of $5,000 up to $20,000

Increments of $2,500 up to $10,000 not to exceed the employee’s amount Child(ren)

Increments of $2,500 up to $10,000 not to exceed the employee’s amount

* If you were treated for a condition 12 months prior to your effective date, benefits may not be paid until you have been covered under this plan for 12 months.

The Hospital Indemnity Plan helps you with the high cost of medical care by paying you a set amount when you have an inpatient hospital stay. Unlike traditional insurance that pays a benefit to the hospital or doctor, this plan pays you directly based on the care or treatment that you receive. These costs may include meals and transportation, childcare, or time away from work due to a medical issue that requires hospitalization.

As a BCBSTX member, you have the following value-add programs available to you and your eligible dependents at no cost.

This program, offered through LifeWorks (formerly Morneau Shepell), combines family wellness and security at the most difficult times. Services include grief and financial counseling, funeral planning, legal support as well as online will preparation.

Services for you and your family include:

z Online Will Preparation –

Creating a will is an important investment in your future. In minutes, you can create a personalized will with this program that keeps your information safe and secure. Log on to www.beneficiaryresource.com and enter the username: beneficiary Answer some simple questions on your computer or smart phone. You can then download and print any documents instantly.

z Online Funeral Planning – A funeral planning guide is available to download. There are also calculators to estimate and compare funeral expenses, along with information on funeral requirements and various religious customs.

Services for your beneficiaries and their families include:

z Unlimited phone contact is available for up to one year with a grief counselor, legal advisor, or financial planner.

z Up to five face-to-face working sessions are available. These can be split between different counselors depending on need.

z A comprehensive directory of qualified and accessible counselors will initiate follow-up calls when necessary for up to one full year from the date of initial contact.

For more information, call 800-769-9187

This program, through Assist America, provides travel assistance for you and your dependents if you are traveling more than 100 miles from home. Representatives can help with pre-trip planning or assistance in an emergency while traveling. Other services available are:

z Medical search and referral

z Medical monitoring

z Medical evacuation/return home

z Traveling companion assistance

z Dependent children assistance

z Visit by family member/friend

z Return of mortal remains

z Replacement of medication and eyeglasses

z Locating lost or stolen items

z Legal assistance/bail

z Interpretation/translation

To activate your services:

z Call 800-872-1414 (within the U.S.) and +1-609-986-1234 (outside the U.S.).

z Download the Assist America app. Enter the reference number: 01-AA-TRS-12201

z Email medservices@assistamerica.com

The following services through Disability Resource Services are available to you if you are enrolled in our LTD plan:

z Three face-to-face sessions to address behavioral issues.

z 24/7 unlimited telephone counseling with Master’s degree-level counselors to identify concerns, assess needs, and refer to specialists as needed.

z Web-based services through the GuidanceResources secure website, where you can access self-assessments, content on personal health, and tools to help with personal, relationship, legal, health, and financial concerns. Go to www.guidanceresources.com Your Company ID is DISRES.

For further information, call 866-899-1363.

DearbornCares provides an advance payment of the Life insurance benefit up to $50,000 to help beneficiaries cover immediate expenses, such as funeral costs and medical bills. Visit www.dearbornnational.com for more information.

PERC Engineering sponsors a 401(k) plan through T. Rowe Price allowing you to set aside money for retirement on a pretax or after-tax (Roth) basis, or a combination of both, up to a combined total of $24,500. If you are age 50 or older, you may contribute an additional $8,000 for a total contribution of $32,500.

In addition to your contributions, PERC Engineering helps you save for retirement by making a 100% (immediately vested) safe-harbor non-elective contribution equal to 3% of your eligible pay. PERC Engineering may also make an additional profit sharing contribution equal to a discretionary percent of your eligible pay. There are a number of investment options from which you can select, ranging from conservative to aggressive.

z $24,500 maximum

z 3% of your eligible pay

z $32,500 maximum if over age 50

z 100% vested

z Discretionary profit sharing contribution

z 100% vested

Contact Human Resources to make your deferral contribution, beneficiary elections, and obtain more information regarding the plan features.

Visit www.rps.troweprice.com or call 800-354-2351 to make investment selections, review your account, and make changes.

The shareholders of PERC Engineering (the Company) continue to extend to its employees the sense of belonging and contributing to the long-term growth of the Company with the Profit Sharing Cash Bonus Program (the Program) that was started in 2014. We want you to understand that for every dollar you help contribute to the bottom line of the Company, or every dollar you help save, there is the potential for you to receive a bonus out of the Company’s profits.

The following is a list of program guidelines:

1. For each calendar year, we set aside 15% of the Company’s after-tax profits for that year to distribute as cash bonuses to employees. The Company’s after-tax profits will be calculated by the board of directors (the Board) of the Company in a manner as determined by the Board in its sole discretion.

2. Bonus payments will take place between December of the applicable calendar year and March 15 of the following year, based on cash availability.

3. Bonuses will be subject to all federal, state, and local taxes, meeting all payroll and tax withholding requirements.

4. You may choose to contribute all or part of your bonus to your 401(k) in accordance with the 401(k) plan deferral requirements as long as you have not maxed out your 401(k) contribution for the year. The Company will not match any 401(k) contributions.

5. The amount of your individual bonus will be based on the following criteria to the extent applicable:

• Billable hours

• Quality of work

• Feedback from clients

• How much business you create as a result of your work and your relationship with your clients

• How well you represent the Company

• How well you utilize the Company’s resources

• Your help in recruiting quality team members

6. The total amount of bonus will be determined by management and approved by the Board in its sole discretion based on the foregoing criteria and will only be paid if you are continuously employed with the Company from January 1 of the applicable year through the actual payment date. If you are a new employee, you will be eligible for a pro rata bonus only if you are continuously employed with the Company from your hire date through the actual payment date. No bonus will be payable if your employment with the Company is terminated for any reason prior to the actual payment date, whether such termination is by you, the Company, or otherwise. Company employees will have no rights to any bonuses under this Program until the actual payment date.

7. This Profit Sharing Cash Bonus Program will be administered by the Board and the Board shall have the sole discretion to administer, construe, and interpret this Program, and its decisions shall be binding on all Company employees and other persons.

8. The Company, at its sole discretion, reserves the right to amend or terminate this Program without the consent of any Company employee or other person.

International Uplift offers additional compensation for employees based in the United States who accept assignments in foreign locations where the conditions of environment may differ from those in the United States.

FACTOR 1

FACTOR 2

Base percentage for accepting a foreign assignment:

z ≤ 14 days — 0%

z 15-90 days — 5%

z 91-180 days — 10%

Note: Number of days is based on a per rotation basis and not on a cumulative basis.

Field differential (offshore, jungle, camp) — 5%

FACTOR 3

A discretionary bonus of up to $500 may be authorized for accepting an assignment over the Thanksgiving, Christmas, or New Year’s holidays or accepting an assignment that requires mobilization in less than 72 hours. Other factors may be approved for a discretionary bonus on a case-by-case basis.

International Uplift is limited to a maximum of 50% (1½ times the employee’s base salary) and is determined by adding two components together: Factor 1 + Factor 2 = International Uplift.

Salary Rate = S

z International Uplift for less than or equal to 14 days: S × 0%

z Onshore International Uplift for 15-90 days: S × 5%

z Offshore International Uplift for 15-90 days: S × 5% + 5%

International Uplift is limited to a maximum of 1½ × S.

Q Is the International Uplift considered wages for tax purposes?

A Yes. It is considered wages and is included in gross income for federal income tax purposes. The amounts received will be reported on your W-2.

Q Will I receive the uplift on travel time?

A No. Travel time (hours) will be paid at your base salary.

Q What happens if my assignment is supposed to be less than 14 days but it is extended to a time greater than 14 days?

A You will be compensated retroactively according to the schedule provided.

Q If my assignment is for 70 days but is extended past 90 days, will I receive retroactive pay?

A Yes, you will receive retroactive pay back to day one of your assignment for a total uplift of 10%.

All full-time employees have 10 days scheduled and one floating holiday per calendar year (managerial notification and approval required). The office will be closed on the following days:

New Year’s Day

Good Friday

Memorial Day

Independence Day

Labor Day

Thanksgiving Day

Day After Thanksgiving

Day Before Christmas Eve

Christmas Eve

Thursday, January 1, 2026

Friday, April 3, 2026

Monday, May 25, 2026

Friday, July 3, 2026

Monday, September 7, 2026

Thursday, November 26, 2026

Friday, November 27, 2026

Wednesday, December 23, 2026

Thursday, December 24, 2026

Christmas Day

Friday, December 25, 2026

Floating Holiday Managerial notification and approval required

Holiday and floating holiday hours cannot be carried over to the following year.

Includes all paid time off (PTO) (sick, vacation, etc.).

You may carry over up to 160 hours of accrued PTO to the following year.

In October 1998, Congress enacted the Women’s Health and Cancer Rights Act of 1998. This notice explains some important provisions of the Act. Please review this information carefully.

As specified in the Women’s Health and Cancer Rights Act, a plan participant or beneficiary who elects breast reconstruction in connection with a mastectomy is also entitled to the following benefits:

z All stages of reconstruction of the breast on which the mastectomy was performed;

z Surgery and reconstruction of the other breast to produce a symmetrical appearance; and

z Prostheses and treatment of physical complications of the mastectomy, including lymphedema.

Health plans must determine the manner of coverage in consultation with the attending physician and the patient. Coverage for breast reconstruction and related services may be subject to deductibles and coinsurance amounts that are consistent with those that apply to other benefits under the plan.

This notice is being provided to ensure that you understand your right to apply for group health insurance coverage. You should read this notice even if you plan to waive coverage at this time.

Loss of Other Coverage or Becoming Eligible for Medicaid or a state Children’s Health Insurance Program (CHIP)

If you are declining coverage for yourself or your dependents because of other health insurance or group health plan coverage, you may be able to later enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage (or if the employer stops contributing toward your or your dependents’ other coverage). However, you must enroll within 31 days after your or your dependents’ other coverage ends (or after the employer that sponsors that coverage stops contributing toward the other coverage).

If you or your dependents lose eligibility under a Medicaid plan or CHIP, or if you or your dependents become eligible for a subsidy under Medicaid or CHIP, you may be able to enroll yourself and your dependents in this plan. You must provide notification within 60 days after you or your dependent is terminated from, or determined to be eligible for, such assistance.

If you have a new dependent as a result of a marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your dependents. However, you must enroll within 31 days after the marriage, birth, or placement for adoption.

To request special enrollment or obtain more information, contact:

PERC Engineering

Human Resources

1880 S. Dairy Ashford Road Suite 606 Houston, TX 77077 281-528-1356

Please read this notice carefully and keep it where you can find it. This notice has information about your current prescription drug coverage with PERC Engineering and about your options under Medicare’s prescription drug coverage. This information can help you decide whether or not you want to enroll in a Medicare drug plan. Information about where you can get help to make decisions about your prescription drug coverage is at the end of this notice.

If neither you nor any of your covered dependents are eligible for or have Medicare, this notice does not apply to you or the dependents, as the case may be. However, you should still keep a copy of this notice in the event you or a dependent should qualify for coverage under Medicare in the future. Please note, however, that later notices might supersede this notice.

1. Medicare prescription drug coverage became available in 2006 to everyone with Medicare. You can get this coverage through a Medicare Prescription Drug Plan or a Medicare Advantage Plan that offers prescription drug coverage. All Medicare prescription drug plans provide at least a standard level of coverage set by Medicare. Some plans may also offer more coverage for a higher monthly premium.

2. PERC Engineering has determined that the prescription drug coverage offered by the PERC Engineering medical plan is, on average for all plan participants, expected to pay out as much as the standard Medicare prescription drug coverage pays and is considered Creditable Coverage. The HSA plan is not considered Creditable Coverage.

Because your existing coverage is, on average, at least as good as standard Medicare prescription drug coverage, you can keep this coverage and not pay a higher premium (a penalty) if you later decide to enroll in a Medicare prescription drug plan, as long as you later enroll within specific time periods.

You can enroll in a Medicare prescription drug plan when you first become eligible for Medicare. If you decide to wait to enroll in a Medicare prescription drug plan, you may enroll later, during Medicare Part D’s annual enrollment period, which runs each year from October 15 through December 7 but as a general rule, if you delay your enrollment in Medicare Part D after first becoming eligible to enroll, you may have to pay a higher premium (a penalty).

You should compare your current coverage, including which drugs are covered at what cost, with the coverage and cost of the plans offering Medicare prescription drug coverage in your area. See the Plan’s summary plan description for a summary of the Plan’s prescription drug coverage. If you don’t have a copy, you can get one by contacting PERC Engineering at the phone number or address listed at the end of this section.

If you choose to enroll in a Medicare prescription drug plan and cancel your current PERC Engineering prescription drug coverage, be aware that you and your dependents may not be able to get this coverage back. To regain coverage, you would have to reenroll in the Plan, pursuant to the Plan’s eligibility and enrollment rules. You should review the Plan’s summary plan description to determine if and when you are allowed to add coverage.

If you cancel or lose your current coverage and do not have prescription drug coverage for 63 days or longer prior to enrolling in the Medicare prescription drug coverage, your monthly premium will be at least 1% per month greater for every month that you did not have coverage for as long as you have Medicare prescription drug coverage. For example, if nineteen months lapse without coverage, your premium will always be at least 19% higher than it would have been without the lapse in coverage.

For more information about this notice or your current prescription drug coverage:

Contact the Human Resources Department at 281-528-1356

NOTE: You will receive this notice annually and at other times in the future, such as before the next period you can enroll in Medicare prescription drug coverage and if this coverage changes. You may also request a copy.

For more information about your options under Medicare prescription drug coverage:

More detailed information about Medicare plans that offer prescription drug coverage is in the “Medicare & You” handbook. You will get a copy of the handbook in the mail every year from Medicare. You may also be contacted directly by Medicare prescription drug plans. For more information about Medicare prescription drug coverage:

z Visit www.medicare.gov

z Call your State Health Insurance Assistance Program (see the inside back cover of your copy of the “Medicare & You” handbook for their telephone number) for personalized help.

z Call 1-800-MEDICARE (1-800-633-4227). TTY users should call 877-486-2048.

If you have limited income and resources, extra help paying for Medicare prescription drug coverage is available. Information about this extra help is available from the Social Security Administration (SSA) online at www.socialsecurity.gov, or you can call them at 800-772-1213. TTY users should call 800-3250778.

Remember: Keep this Creditable Coverage notice. If you enroll in one of the new plans approved by Medicare which offer prescription drug coverage, you may be required to provide a copy of this notice when you join to show whether or not you have maintained creditable coverage and whether or not you are required to pay a higher premium (a penalty).

January 1, 2026

PERC Engineering

Human Resources 1880 S. Dairy Ashford Road Suite 606 Houston, TX 77077 281-528-1356

This notice describes how medical information about you may be used and disclosed and how you can access this information. Please review it carefully.

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) imposes numerous requirements on employer health plans concerning the use and disclosure of individual health information. This information known as protected health information (PHI), includes virtually all individually identifiable health information held by a health plan – whether received in writing, in an electronic medium or as oral communication. This

notice describes the privacy practices of the Employee Benefits Plan (referred to in this notice as the Plan), sponsored by PERC Engineering , hereinafter referred to as the plan sponsor.

The Plan is required by law to maintain the privacy of your health information and to provide you with this notice of the Plan’s legal duties and privacy practices with respect to your health information. It is important to note that these rules apply to the Plan, not the plan sponsor as an employer.

You have the right to inspect and copy protected health information which is maintained by and for the Plan for enrollment, payment, claims and case management. If you feel that protected health information about you is incorrect or incomplete, you may ask the Human Resources Department to amend the information. For a full copy of the Notice of Privacy Practices describing how protected health information about you may be used and disclosed and how you can get access to the information, contact the Human Resources Department.

Complaints: If you believe your privacy rights have been violated, you may complain to the Plan and to the Secretary of Health and Human Services. You will not be retaliated against for filing a complaint. To file a complaint, please contact the Privacy Officer.

PERC Engineering Human Resources

1880 S. Dairy Ashford Road Suite 606 Houston, TX 77077

281-528-1356

Conclusion

PHI use and disclosure by the Plan is regulated by a federal law known as HIPAA (the Health Insurance Portability and Accountability Act). You may find these rules at 45 Code of Federal Regulations Parts 160 and 164. The Plan intends to comply with these regulations. This Notice attempts to summarize the regulations. The regulations will supersede any discrepancy between the information in this Notice and the regulations.

If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, your state may have a premium assistance program that can help pay for coverage, using funds from their Medicaid or CHIP programs. If you or your children aren’t eligible for Medicaid or CHIP, you

won’t be eligible for these premium assistance programs but you may be able to buy individual insurance coverage through the Health Insurance Marketplace. For more information, visit www.healthcare.gov.

If you or your dependents are already enrolled in Medicaid or CHIP and you live in a State listed below, contact your State Medicaid or CHIP office to find out if premium assistance is available.

If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, contact your State Medicaid or CHIP office or dial 1-877-KIDS

NOW or www.insurekidsnow.gov to find out how to apply. If you qualify, ask your state if it has a program that might help you pay the premiums for an employer-sponsored plan.

If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your employer plan, your employer must allow you to enroll in your employer plan if you aren’t already enrolled. This is called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling in your employer plan, contact the Department of Labor at www.askebsa.dol.gov or call 1-866-444-EBSA (3272)

If you live in one of the following States, you may be eligible for assistance paying your employer health plan premiums. The following list of States is current as of July 31, 2025. Contact your State for more information on eligibility.

Website: http://www.myalhipp.com/ Phone: 1-855-692-5447

The AK Health Insurance Premium Payment Program Website: http:// myakhipp.com/ Phone: 1-866-251-4861 Email: CustomerService@MyAKHIPP.com Medicaid Eligibility: https://health.alaska.gov/dpa/Pages/default.aspx

Website: http://myarhipp.com/ Phone: 1-855-MyARHIPP (855-692-7447)

Health Insurance Premium Payment (HIPP) Program Website: http://dhcs. ca.gov/hipp

Phone: 916-445-8322

Fax: 916-440-5676

Email: hipp@dhcs.ca.gov

COLORADO – HEALTH FIRST COLORADO (COLORADO’S MEDICAID PROGRAM) AND CHILD HEALTH PLAN PLUS (CHP+)

Health First Colorado website: https://www.healthfirstcolorado.com/

Health First Colorado Member Contact Center: 1-800-221-3943/State Relay 711

CHP+: https://hcpf.colorado.gov/child-health-plan-plus

CHP+ Customer Service: 1-800-359-1991/State Relay 711

Health Insurance Buy-In Program (HIBI): https://www.mycohibi.com/ HIBI Customer Service: 1-855-692-6442

Website: https://www.flmedicaidtplrecovery.com/flmedicaidtplrecovery. com/hipp/index.html

Phone: 1-877-357-3268

GA HIPP Website: https://medicaid.georgia.gov/health-insurance-premiumpayment-program-hipp

Phone: 678-564-1162, Press 1

GA CHIPRA Website: https://medicaid.georgia.gov/programs/third-partyliability/childrens-health-insurance-program-reauthorization-act-2009chipra

Phone: 678-564-1162, Press 2

Health Insurance Premium Payment Program

All other Medicaid

Website: https://www.in.gov/medicaid/ http://www.in.gov/fssa/dfr/ Family and Social Services Administration

Phone: 1-800-403-0864

Member Services Phone: 1-800-457-4584

Medicaid Website: https://hhs.iowa.gov/programs/welcome-iowamedicaid

Medicaid Phone: 1-800-338-8366

Hawki Website: https://hhs.iowa.gov/programs/welcome-iowa-medicaid/ iowa-health-link/hawki

Hawki Phone: 1-800-257-8563

HIPP Website: https://hhs.iowa.gov/programs/welcome-iowa-medicaid/ fee-service/hipp

HIPP Phone: 1-888-346-9562

Website: https://www.kancare.ks.gov/ Phone: 1-800-792-4884

HIPP Phone: 1-800-967-4660

Kentucky Integrated Health Insurance Premium Payment Program (KI-HIPP)

Website: https://chfs.ky.gov/agencies/dms/member/Pages/kihipp.aspx

Phone: 1-855-459-6328

Email: KIHIPP.PROGRAM@ky.gov

KCHIP Website: https://kynect.ky.gov

Phone: 1-877-524-4718

Kentucky Medicaid Website: https://chfs.ky.gov/agencies/dms

Website: www.medicaid.la.gov or www.ldh.la.gov/lahipp

Phone: 1-888-342-6207 (Medicaid hotline) or 1-855-618-5488 (LaHIPP)

Enrollment Website: https://www.mymaineconnection.gov/benefits/ s/?language=en_US

Phone: 1-800-442-6003

TTY: Maine relay 711

Private Health Insurance Premium Webpage: https://www.maine.gov/dhhs/ ofi/applications-forms

Phone: 1-800-977-6740

TTY: Maine Relay 711

Website: https://www.mass.gov/masshealth/pa Phone: 1-800-862-4840

TTY: 711

Email: masspremassistance@accenture.com

Website: https://mn.gov/dhs/health-care-coverage/

Phone: 1-800-657-3672

MISSOURI – MEDICAID

Website: http://www.dss.mo.gov/mhd/participants/pages/hipp.htm

Phone: 573-751-2005

Website: https://dphhs.mt.gov/MontanaHealthcarePrograms/HIPP Phone: 1-800-694-3084

Email: HHSHIPPProgram@mt.gov

NEBRASKA – MEDICAID

Website: http://www.ACCESSNebraska.ne.gov

Phone: 1-855-632-7633

Lincoln: 402-473-7000

Omaha: 402-595-1178

Medicaid Website: http://dhcfp.nv.gov

Medicaid Phone: 1-800-992-0900

NEW HAMPSHIRE – MEDICAID

Website: https://www.dhhs.nh.gov/programs-services/medicaid/healthinsurance-premium-program

Phone: 603-271-5218

Toll free number for the HIPP program: 1-800-852-3345, ext. 15218

Email: DHHS.ThirdPartyLiabi@dhhs.nh.gov

Medicaid Website: http://www.state.nj.us/humanservices/dmahs/clients/ medicaid/

Phone: 1-800-356-1561

CHIP Premium Assistance Phone: 609-631-2392

CHIP Website: http://www.njfamilycare.org/index.html

CHIP Phone: 1-800-701-0710 (TTY: 711)

NEW YORK – MEDICAID

Website: https://www.health.ny.gov/health_care/medicaid/

Phone: 1-800-541-2831

NORTH CAROLINA – MEDICAID

Website: https://medicaid.ncdhhs.gov

Phone: 919-855-4100

NORTH DAKOTA – MEDICAID

Website: https://www.hhs.nd.gov/healthcare

Phone: 1-844-854-4825

OKLAHOMA – MEDICAID AND CHIP

Website: http://www.insureoklahoma.org

Phone: 1-888-365-3742

OREGON – MEDICAID

Website: https://healthcare.oregon.gov/Pages/index.aspx

Phone: 1-800-699-9075

PENNSYLVANIA – MEDICAID AND CHIP

Website: https://www.pa.gov/en/services/dhs/apply-for-medicaid-healthinsurance-premium-payment-program-hipp.html

Phone: 1-800-692-7462

CHIP Website: https://www.dhs.pa.gov/chip/pages/chip.aspx

CHIP Phone: 1-800-986-KIDS (5437)

RHODE ISLAND – MEDICAID AND CHIP

Website: http://www.eohhs.ri.gov/

Phone: 1-855-697-4347 or 401-462-0311 (Direct RIte Share Line)

SOUTH CAROLINA – MEDICAID

Website: https://www.scdhhs.gov

Phone: 1-888-549-0820

SOUTH DAKOTA – MEDICAID

Website: https://dss.sd.gov

Phone: 1-888-828-0059

TEXAS – MEDICAID

Website: https://www.hhs.texas.gov/services/financial/health-insurancepremium-payment-hipp-program

Phone: 1-800-440-0493

Utah’s Premium Partnership for Health Insurance (UPP) Website: https:// medicaid.utah.gov/upp/ Email: upp@utah.gov

Phone: 1-888-222-2542

Adult Expansion Website: https://medicaid.utah.gov/expansion/ Utah Medicaid Buyout Program Website: https://medicaid.utah.gov/ buyout-program/ CHIP Website: https://chip.utah.gov/ VERMONT– MEDICAID

Website: https://dvha.vermont.gov/members/medicaid/hipp-program

Phone: 1-800-250-8427

VIRGINIA – MEDICAID AND CHIP

Website: https://coverva.dmas.virginia.gov/learn/premium-assistance/ famis-select

https://coverva.dmas.virginia.gov/learn/premium-assistance/healthinsurance-premium-payment-hipp-programs

Medicaid/CHIP Phone: 1-800-432-5924

Website: https://www.hca.wa.gov/ Phone: 1-800-562-3022

Website: https://dhhr.wv.gov/bms/ http://mywvhipp.com/

Medicaid Phone: 304-558-1700

CHIP Toll-free phone: 1-855-MyWVHIPP (1-855-699-8447)

WISCONSIN – MEDICAID AND CHIP

Website: https://www.dhs.wisconsin.gov/badgercareplus/p-10095.htm Phone: 1-800-362-3002

WYOMING – MEDICAID

Website: https://health.wyo.gov/healthcarefin/medicaid/programs-andeligibility/ Phone: 1-800-251-1269

To see if any other States have added a premium assistance program since July 31, 2025, or for more information on special enrollment rights, can contact either:

U.S. Department of Labor Employee Benefits Security Administration www.dol.gov/agencies/ebsa 1-866-444-EBSA (3272)

U.S. Department of Health and Human Services Centers for Medicare & Medicaid Services www.cms.hhs.gov 1-877-267-2323, Menu Option 4, Ext. 61565

Under the Federal Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA), if you are covered under the PERC Engineering group health plan you and your eligible dependents may be entitled to continue your group health benefits coverage under the PERC Engineering plan after you have left employment with the company. If you wish to elect COBRA coverage, contact your Human Resources Department for the applicable deadlines to elect coverage and pay the initial premium.

Plan Contact Information

PERC Engineering

Human Resources

1880 S. Dairy Ashford Road Suite 606

Houston, TX 77077

281-528-1356

When you get emergency care or get treated by an out-ofnetwork provider at an in-network hospital or ambulatory surgical center, you are protected from surprise billing or balance billing.

What is “balance billing” (sometimes called “surprise billing”)?

When you see a doctor or other health care provider, you may owe certain out-of-pocket costs, such as a copayment, coinsurance, and/or a deductible. You may have other costs or have to pay the entire bill if you see a provider or visit a health care facility that isn’t in your health plan’s network.

“Out-of-network” describes providers and facilities that have not signed a contract with your health plan. Out-of-network providers may be permitted to bill you for the difference between what your plan agreed to pay and the full amount charged for a service. This is called “balance billing.” This amount is likely more than innetwork costs for the same service and might not count toward your annual out-of-pocket limit.

“Surprise billing” is an unexpected balance bill. This can happen when you can’t control who is involved in your care—like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-ofnetwork provider.

You are protected from balance billing for:

z Emergency services – If you have an emergency medical condition and get emergency services from an out-ofnetwork provider or facility, the most the provider or facility may bill you is your plan’s in-network cost-sharing amount (such as copayments and coinsurance). You cannot be balance billed for these emergency services. This includes services you may get after you are in stable condition, unless you give written consent and give up your protections not to be balanced billed for these post-stabilization services.

z Certain services at an in-network hospital or ambulatory surgical center – When you get services from an in-network hospital or ambulatory surgical center, certain providers there may be out-of-network. In these cases, the most those providers may bill you is your plan’s in-network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensivist services. These providers cannot balance bill you and may not ask you to give up your protections not to be balance billed.

If you get other services at these in-network facilities, outof-network providers cannot balance bill you, unless you give written consent and give up your protections.

You are never required to give up your protections from balance billing. You also are not required to get care out-of-network. You can choose a provider or facility in your plan’s network.

When balance billing is not allowed, you also have the following protections:

z You are only responsible for paying your share of the cost (like the copayments, coinsurance, and deductibles that you would pay if the provider or facility was in-network). Your health plan will pay out-of-network providers and facilities directly.

z Your health plan generally must:

• Cover emergency services without requiring you to get approval for services in advance (prior authorization).

• Cover emergency services by out-of-network providers.

• Base what you owe the provider or facility (cost-sharing) on what it would pay an in-network provider or facility and show that amount in your explanation of benefits.

• Count any amount you pay for emergency services or out-of-network services toward your deductible and outof-pocket limit.

If you believe you have been wrongly billed, you may contact your insurance provider. Visit www.cms.gov/nosurprises for more information about your rights under federal law.

This brochure highlights the main features of the PERC Engineering employee benefits program. It does not include all plan rules, details, limitations, and exclusions. The terms of your benefit plans are governed by legal documents, including insurance contracts. Should there be an inconsistency between this brochure and the legal plan documents, the plan documents are the final authority. PERC Engineering reserves the right to change or discontinue its employee benefits plans anytime.