Japan’s leading fastener trading company, Sunco Industries, continues to demonstrate vitality and innovation on the world stage. Leveraging its original mascot Socket Boy and a newly constructed smart logistics center, it has been established as the most technologically advanced company in the Japanese fastener industry.

Sunco began expanding into overseas markets 3 years ago, launching the distinctive mascot Socket Boy. Through global trade shows, magazine exposure, and diverse media—including Morinaga’s Hi-Chew candy, acrylic standees, and plushies—Socket Boy’s global visibility has steadily grown, becoming a beloved symbol familiar in many countries’ fastener industries. The mascot's popularity has even returned to Japan, attracting significant attention at Osaka Expo 2025 and reaching more Japanese supporters. Sunco also featured Socket Boy on the new Japanese TV show "it’s a screw world!" appearing alongside the Sunco president and famous comedians to promote the charm of fasteners. The 6th issue of the official “Socket Boy” magazine—a namesake of the mascot, created exclusively for Sunco and Japan's fastener industry—along with its brand new official website was launched simultaneously on October 10 to further strengthen the global fastener industry network.

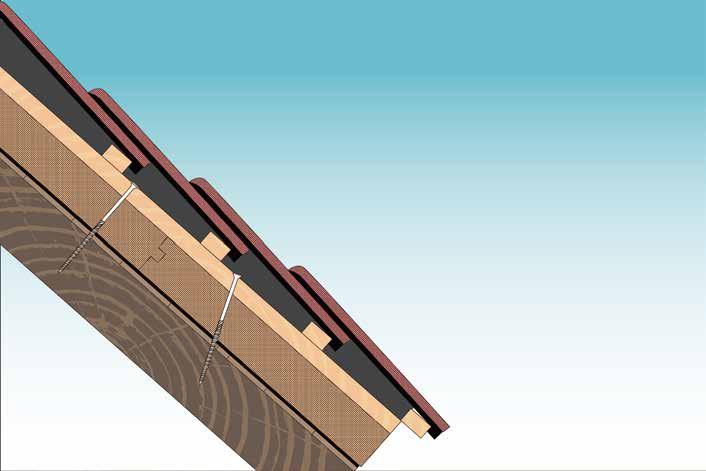

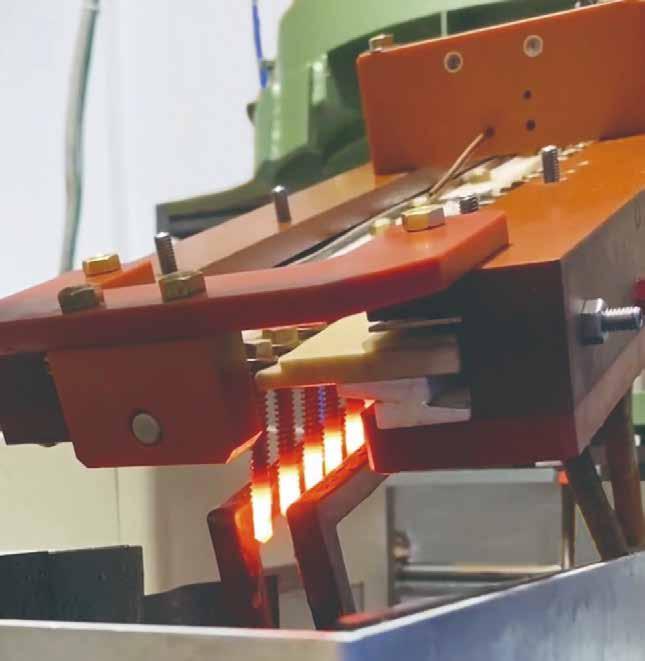

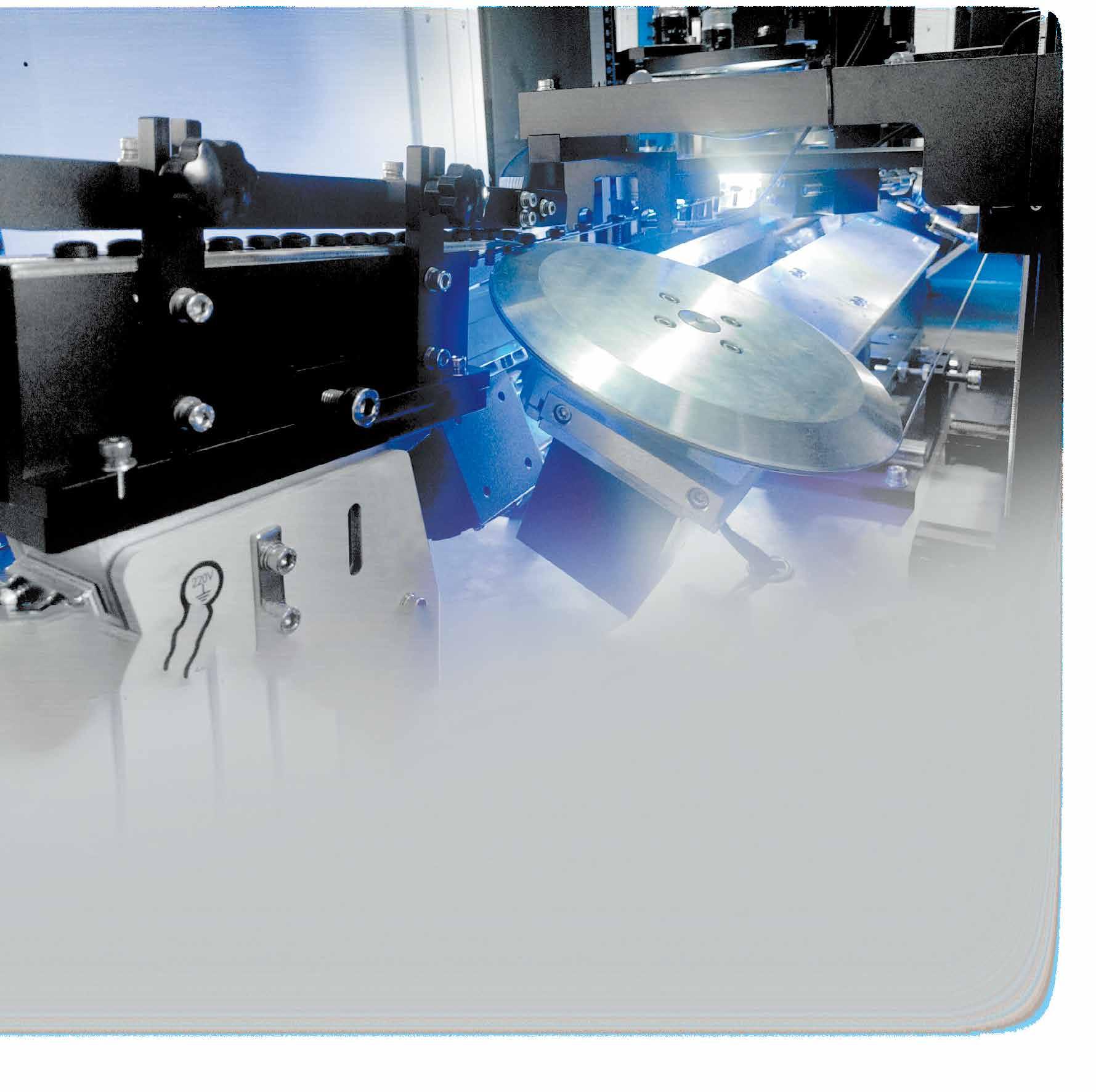

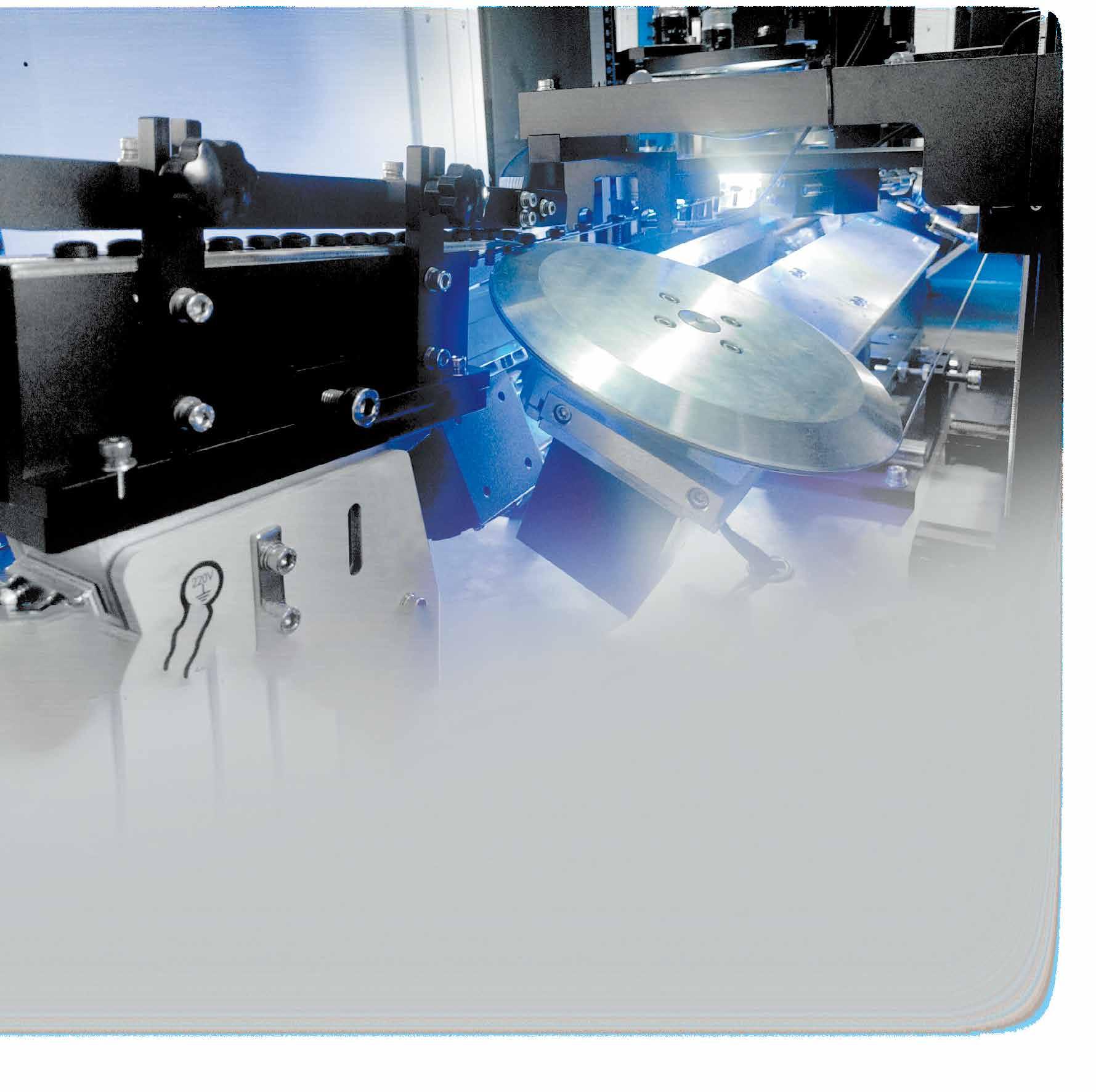

Since its early adoption of internet technologies, Sunco has remained at the forefront of technological innovation in the Japanese fastener industry. The newly built logistics center integrates proprietary mathematical models to optimize inventory management, shipping deadlines, and demand forecasting, ensuring top-level customer service. The facility houses 12,000 storage locations and is designed with a height exceeding 30 meters to address Japan’s limited land space and high land costs. A unique scheduling system divides nearly a hundred shipping zones by carrier, effectively reducing warehouse section space and maximizing both space utilization and transport efficiency. The center also focuses on enhancing “BARA (bulk goods) service,” enabling rapid delivery even of a single piece of screw, accounting for over 60% of company orders. The company continues to expand its catalog to register up to three million types of materials and has added dedicated rotating racks, embodying a "Just in Time" philosophy to minimize unnecessary inventory and customer pain points in stock management.

Sunco has achieved a remarkable breakthrough in unmanned logistics. “Hakobot” can carry up to 100 kg of fasteners, moving smoothly on outdoor roads and successfully delivering products to suppliers. Equipped with advanced sensors and AI obstacle avoidance systems, Hakobot reduces accidents and human errors, enhancing delivery safety and efficiency. Higashi Osaka is set to become a special industrial zone and future city, where Hakobot will play a key pioneering role.

Demonstrating commitment to customer convenience, the indevelopment 3Q-Net mobile app will incorporate a camera function that allows users to scan product barcodes to check stock, view drawings, and place orders directly—perfectly suited for users frequently on the move. Complementing the PC version, the app ensures customers enjoy a smooth ordering experience wherever they are.

Despite advanced equipment and systems, technology can sometimes feel distant. Sunco has crafted technology that balances technology with humanity, so customers not only benefit from automated smart systems but also feel warm and cared for. From the flexible 3Q-Net ordering system and thoughtful packaging designs to the flexible BARA service, the company continuously innovates with customer’s needs at the core to enhance service experience.

Entering 2026, Sunco will continue to expand its agile strategy of handling small quantities and diverse products and deepen exchanges with global fastener partners. Leveraging the influence of Socket Boy, the company will keep promoting the global recognition of Japan’s fastener industry and Higashi Osaka culture. Sunco’s story is not only a corporate journey but also a model for driving industrial digital transformation and supply chain innovation.

Sunco Industries’ contact: Mr. Tomokazu Takada, Assistant Manager of Purchasing Dept. of Intl. Trade Email: export@sunco.co.jp

216 310EXPRESS COMPANY (SAIMA) (Japan)

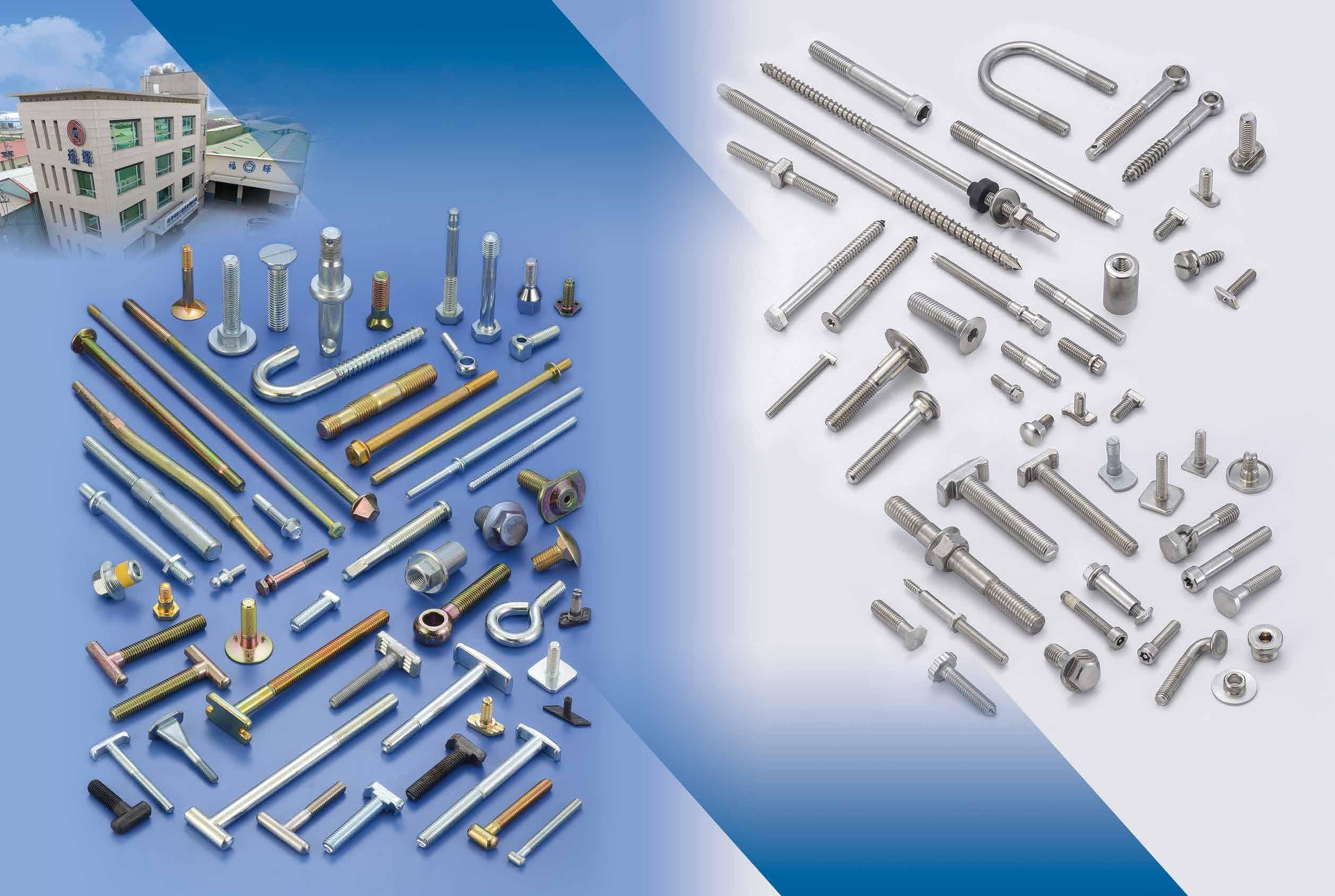

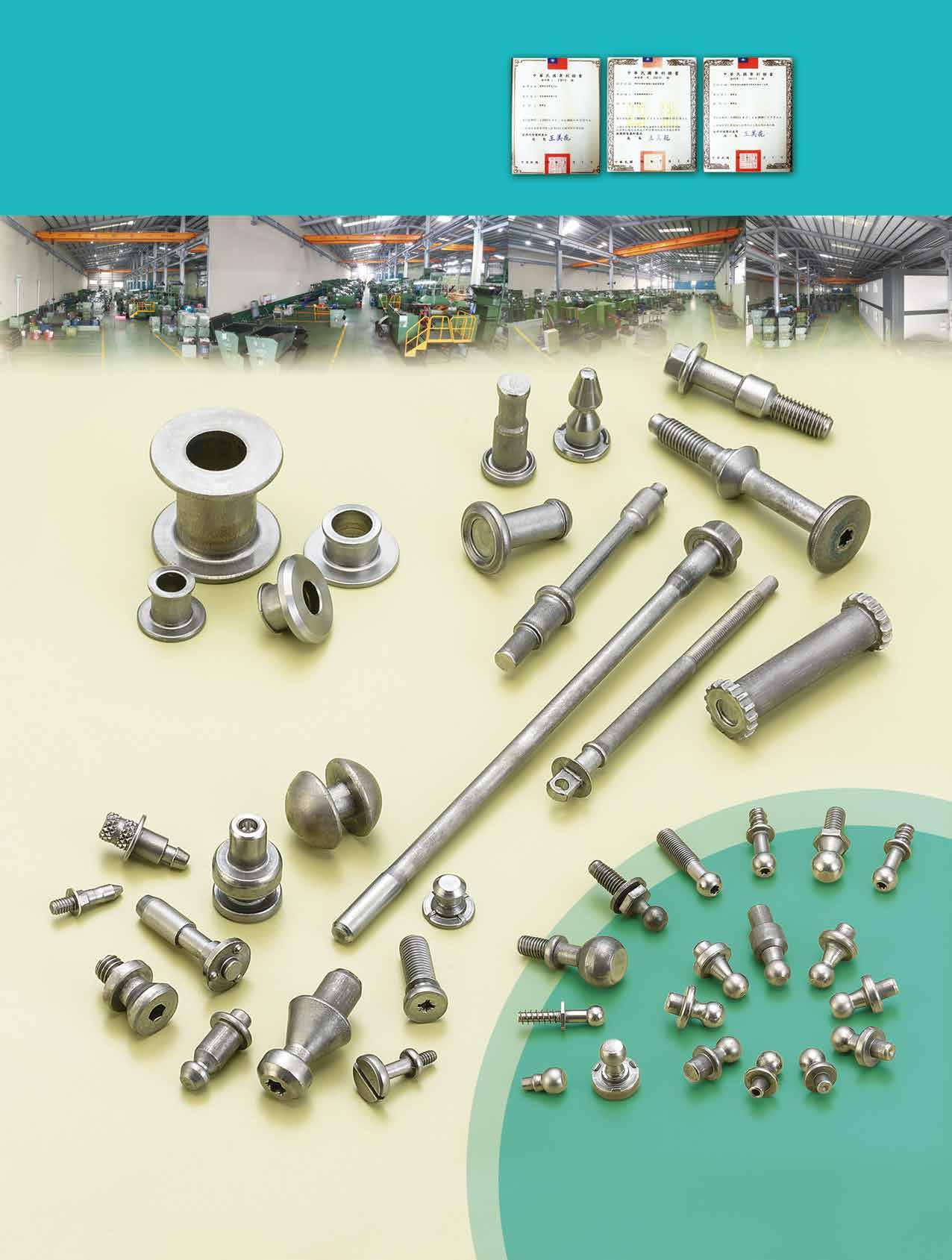

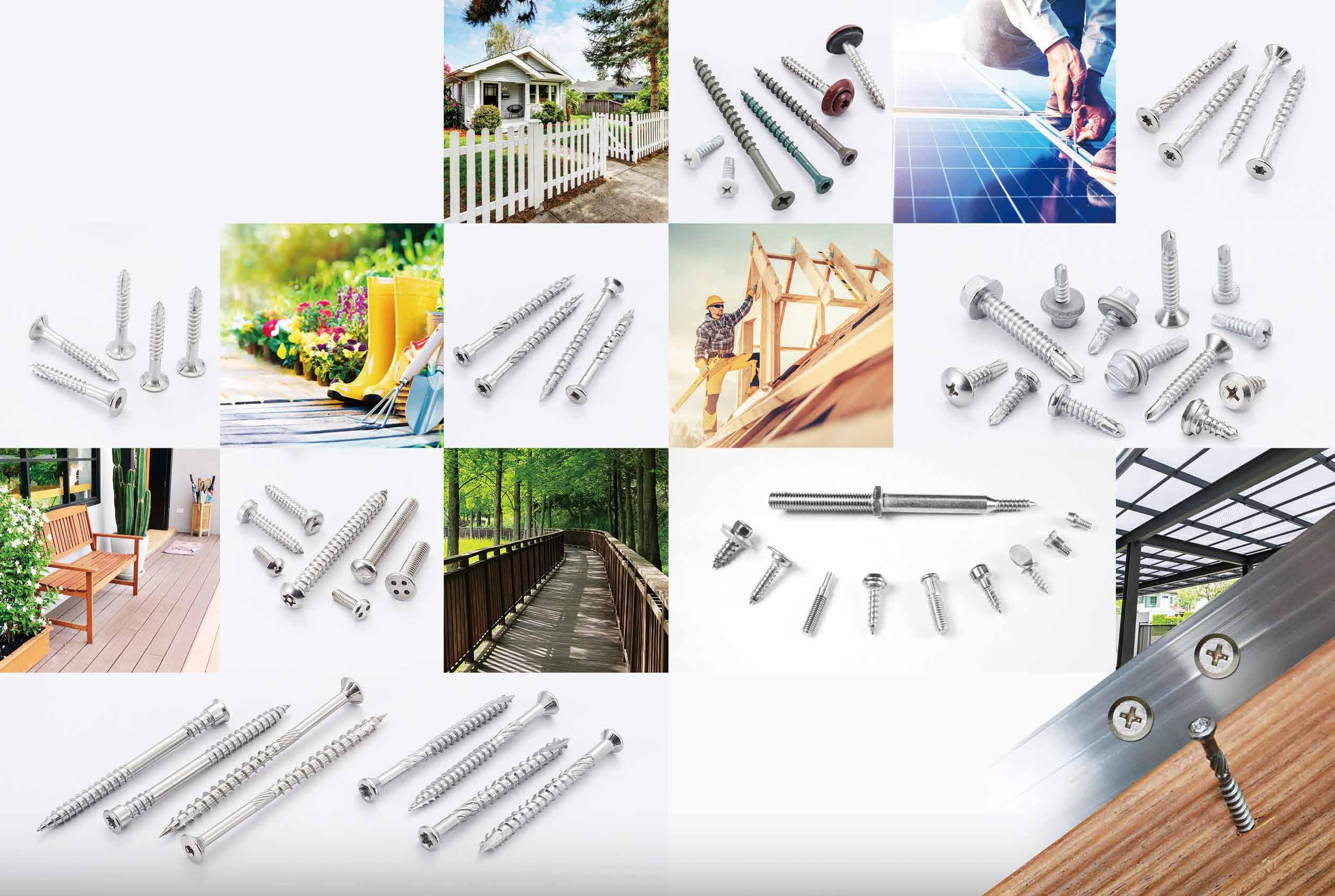

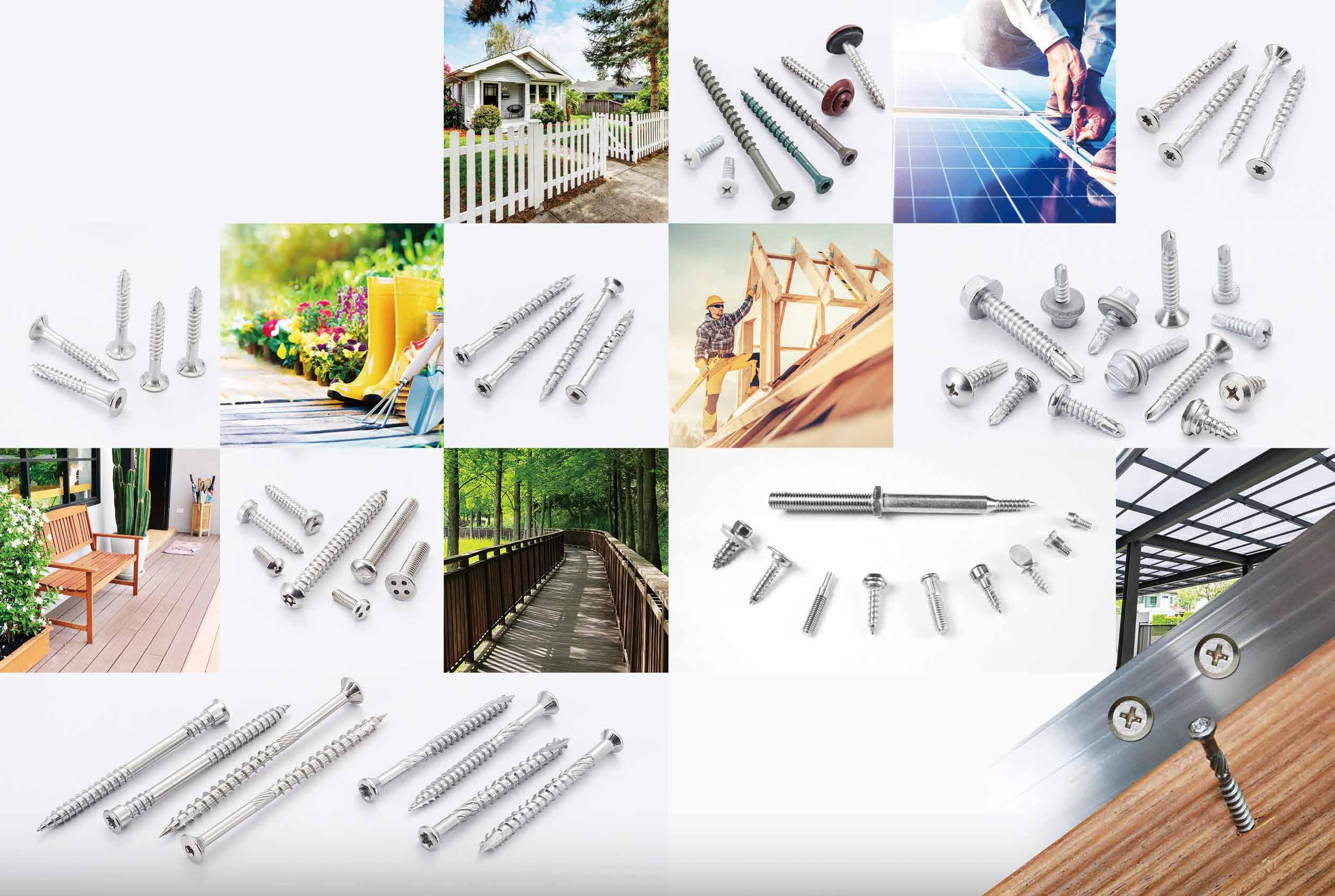

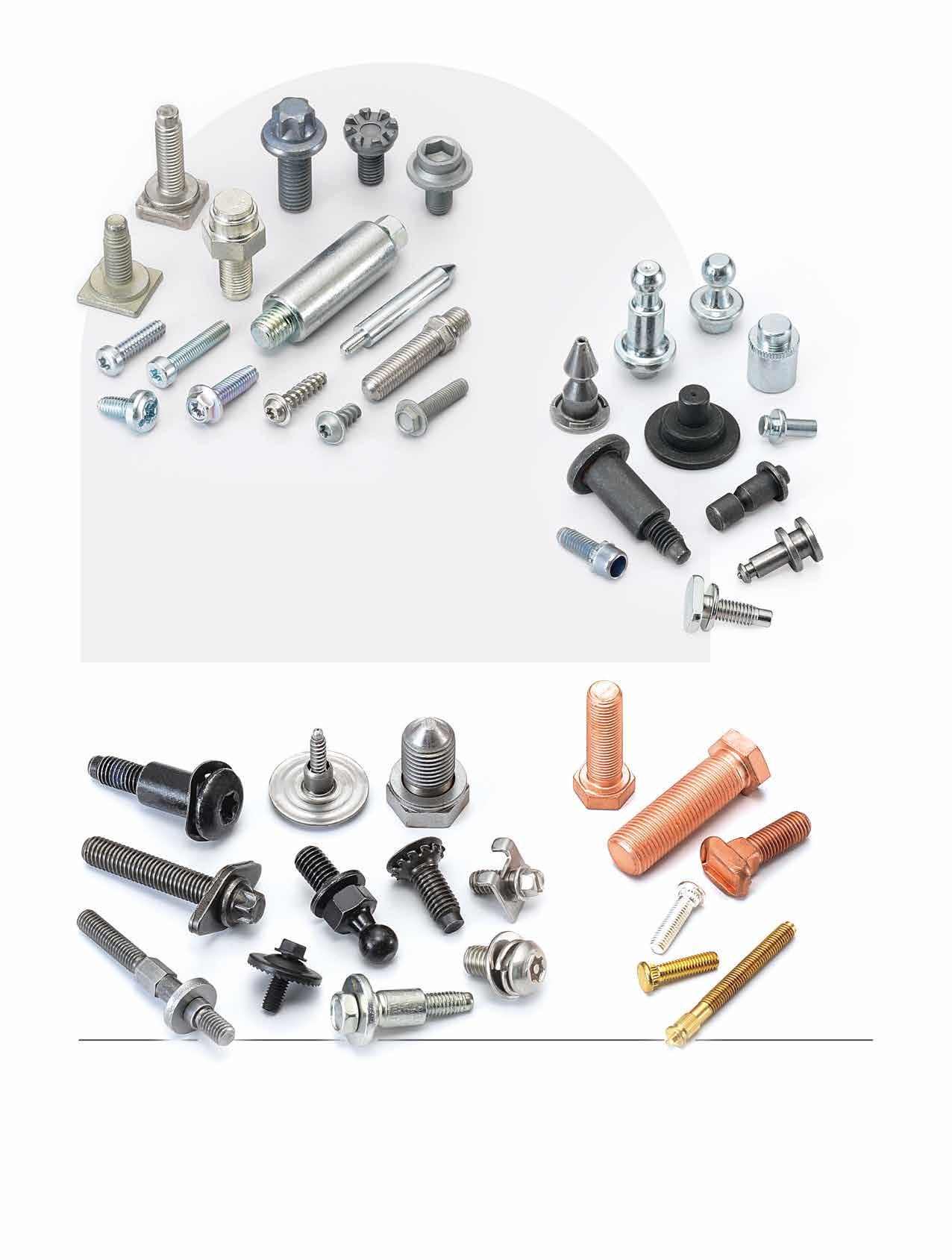

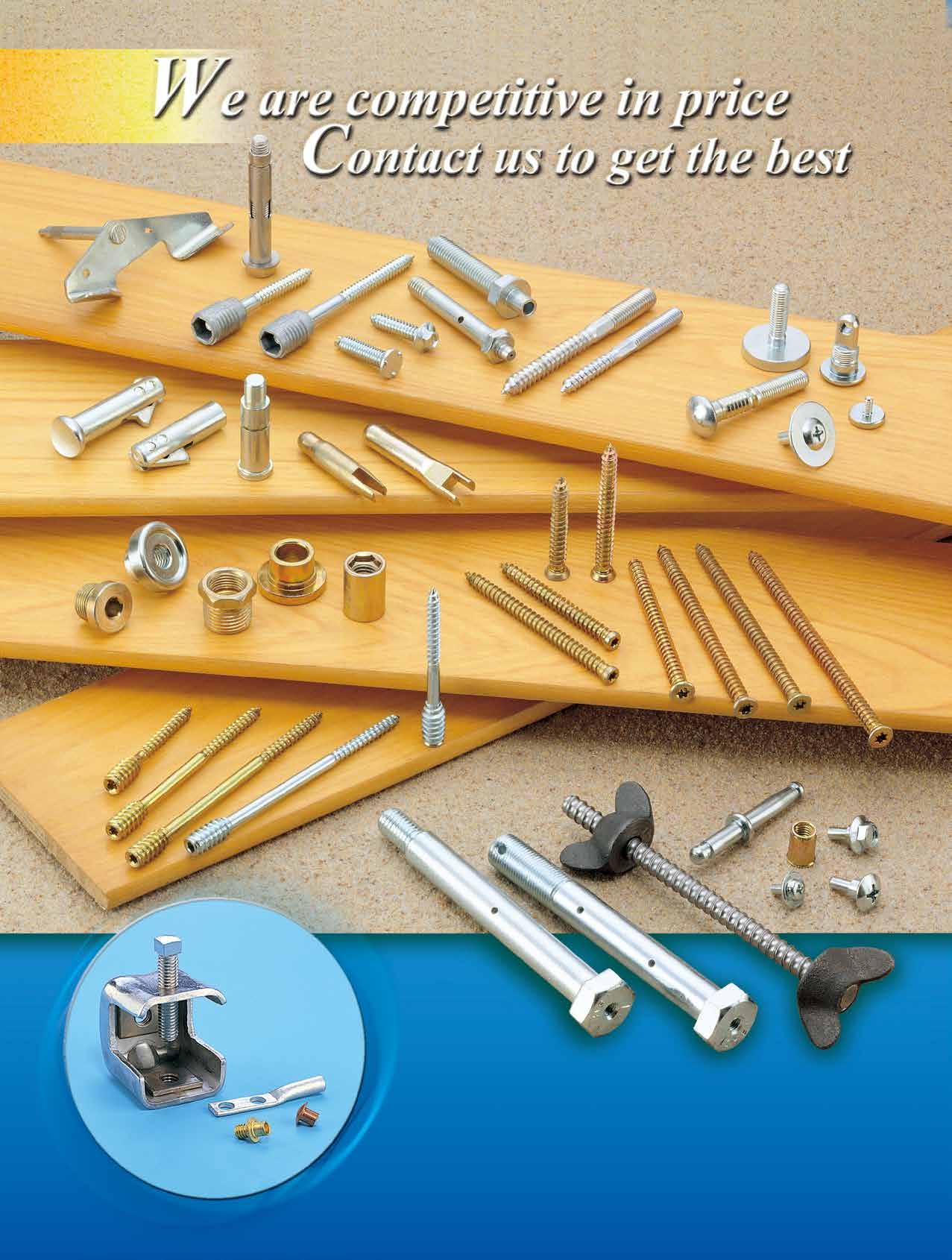

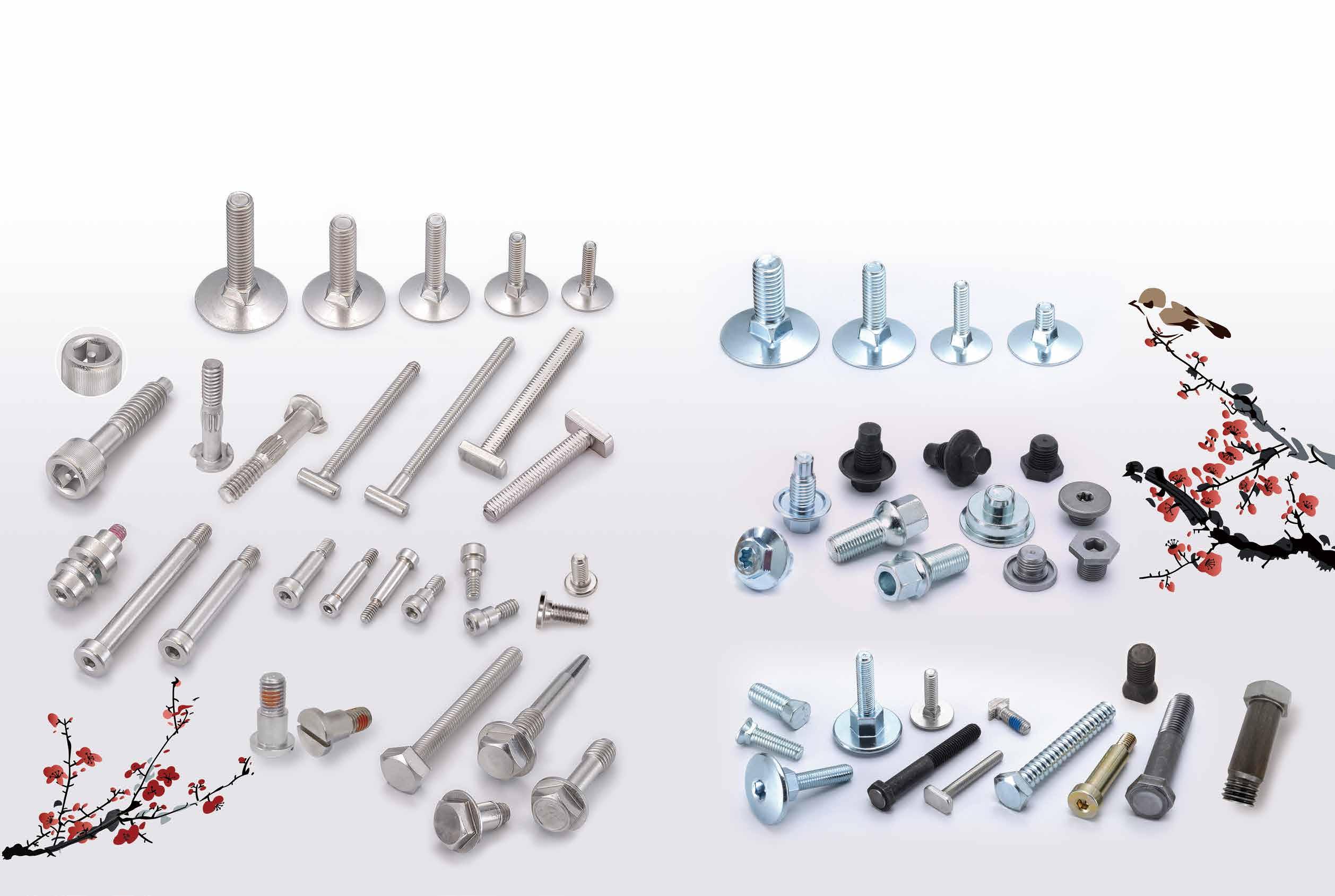

Security, Tamper Proof, Anti-theft Screws...

242 A-PLUS SCREWS INC.

Chipboard Screws, Customized Special Screws / Bolts...

148 A-STAINLESS INTERNATIONAL CO., LTD. 淳康

Chipboard Screws, Concrete Screws, Deck Screws...

209 AL-PRO METALS CO., LTD. 錦茂 Special Screws, Clinching Screws, Micro Screws...

442 ABC FASTENERS CO., LTD. 聯欣

Drop-in Anchors, Expansion Anchors, Wire Anchors...

253 ADOLF WüRTH GMBH & CO. KG 德商阿道夫 Screws, Screw Accessories, Anchors, Tools, Chemical-technical products...

319 ADVANCE FASTECH INDUSTRIAL CO., LTD. 毓盛 Aerospace Screws, Aircraft Nuts, Aluminum Bolts...

150 ADVANCED GLOBAL SOURCING LTD. 金永佳 Screw, Nut, Bolt, Machining/Stamping/Spring Parts...

138 AEH FASTEN INDUSTRIES CO., LTD. 鉞昌 Clevis Pins, Dowel Pins, Hollow Rivets...

321 AIMREACH ENTERPRISES CO., LTD. 盛融

Stainless Steel, Flanged Head Bolts, Hexagon Head Bolts...

39 ALEX SCREW INDUSTRIAL CO., LTD. 禾億 Button Head Cap Screws, Button Head Socket Cap Screws...

438 ALISHAN INTERNATIONAL GROUP CO., LTD. 奧立康 Fastener Tools, Bolts, Screws, Nuts, Stamping Parts...

84 AMBROVIT S.P.A. (Italy)

Chipboard Screws, Combined Screws, Machine Screws...

147 AMPLE LONG INDUSTRY CO., LTD. 寬長 Hollow Rivets, Drive Rivets, Semi-tubular Rivets...

454 ANCHOR FASTENERS INDUSTRIAL CO., LTD. 安拓

ETA Series, Anchor Bolts, Anchor Nuts, Automotive Parts...

67 APEX FASTENER INTERNATIONAL CO., LTD. 嵿峰 Nuts, Wing Nuts & Bolts, Turning Parts, Stamping Parts

179 ARK FASTECH CORP.

Multi-Station Cold Forging Bolts / Nuts...

方舟

56 ARUN CO., LTD. 鉅耕

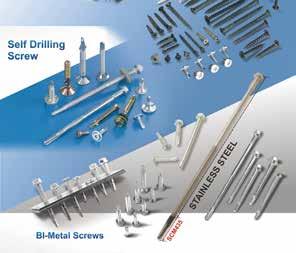

Bi-metal Screws, Chipboard Screws, Drywall Screws...

322 AT-HOME ENTERPRISE CO., LTD. 安鈜 Auto Parts, Elevator Bolts, Penta Head Bolts...

132 AUTOLINK INTERNATIONAL CO., LTD. 浤爵

Automotive Screws, Machine Bolts, Flange Nuts...

173 AVIOUS ENTERPRISE CO., LTD. 艾伯斯

Chipboard Screws, Drywall Screws, Flange Screws...

94 BCR INC.

Automotive Screws, Piston Pins, Weld Bolts (Studs)...

6 BOLTUN CORPORATION 恒耀工業

Automotive Screws, Nuts, Bolts, Special Parts...

338 CANATEX INDUSTRIAL CO., LTD. 保力德

Nuts, Turning Parts, Bolts, Plastic Injection Parts...

263 CELEBRITE FASTENERS CO., LTD. 曜維

Carbon Steel Screws, Collated Screws, Construction Fasteners...

162 CHAEN WEI CORPORATION 鍵瑋

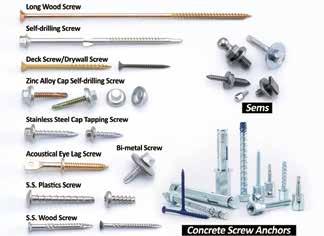

Machine & Thread Forming, Self Drilling Screws, Sems Screws...

20 CHAN HWEI ENTERPRISE CO., LTD. 昌徽

Stainless Steel Fasteners

273 CHANG BING ENTERPRISE CO., LTD. 彰濱

Hook Bolts, Holders / Hooks / Rings, Dowel Screws...

317 CHARNG JIH ENTERPRISE CO., LTD. 長驥

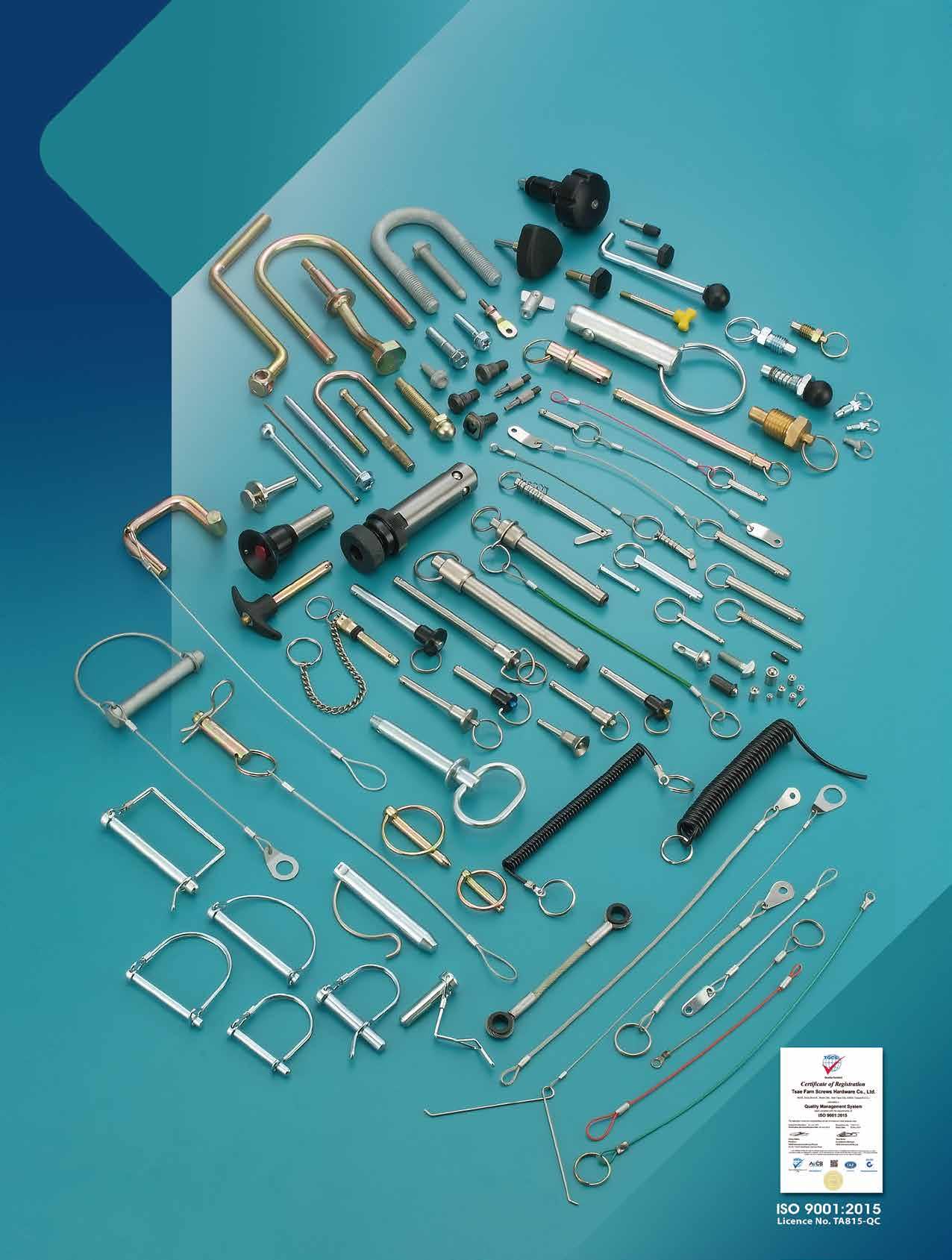

Bonded Washers, Cotter Pins, Quick Release Pins...

305 CHEN SHIN ENTERPRISE FACTORY 成興

Professional Plastic Container Manufacturer

336 CHEN YI FASTENERS INDUSTRY CO., LTD. 宸翊

Automobile Parts, Cold Forged Parts, Open Die Parts...

247 CHENG HENG INDUSTRIAL CO., LTD. 成亨

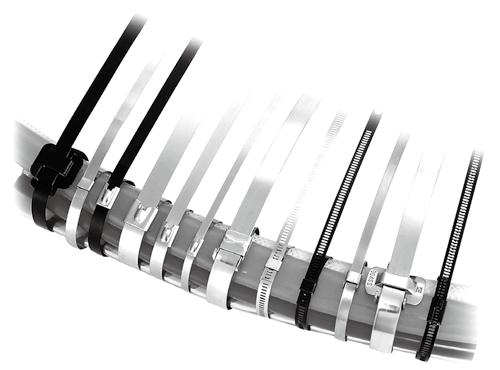

Stainless Steel Cable Ties, Hose Clamps, Band Buckles...

102 CHI HUNG RIVETS WORKS CO., LTD. 吉宏

Blind Rivets, Hollow Rivets, Solid Rivets, Split Rivets...

261 CHIA SING SCREW INDUSTRIAL CO., LTD. 佳興

Sems Screws, Customized Screws, Rivets, Lathe Turning Parts...

62 CHIAN YUNG CORPORATION 將運

SEMS Screws

201 CHIAO CHANG PNEUMATIC TOOL CORP. 喬章

Riveter Tools, Rivet Nut Tools, Cutting Tools, Engraving Pen...

160 CHIEH LING SCREWS ENTERPRISE CO., LTD. 捷領

Screws, Nuts, Hexagon Keys, Lug Wrenches, Rivets...

217 CHIH FU MECHANICS CO., LTD. 智富

Special Screws, Open Die Products...

83 CHIN LIH HSING PRECISION ENTERPRISE (CLH) 金利興

Automotive Nuts, Brass Inserts, Bushes, Bushings...

221 CHIN-TIEH SCREW CO. 進鐵

Stainless Steel Screws, Carbon Steel Screws, Long Screws...

127 CHIREK FASTENER CORPORATION 錡瑞

Stainless Steel Fasteners, Self-Drilling Screws, Washers...

44 CHONG CHENG FASTENER CORP. 宗鉦

Cap Nuts, Coupling Nuts, Conical Washer Nuts...

315 CIXI NONGER HARDWARE CO., LTD. 濃兒

All Kinds of Anchors

435 CO-WEALTH ENTERPRISE CO., LTD. 竟丞

必鋮

251 BEAR FASTENING SOLUTIONS, INC. 雄益

Drywall Screws, Decking Screws, Self-drilling Screws...

26 BI-MIRTH CORP.

Stainless Steel Screws, Chipboard Screws, Timber Screws...

吉瞬

Spring Pins, Flange Washers, Sems Washers...

195 COPA FLANGE FASTENERS CORP. 國鵬

Hex Nuts, Hex Flange Nuts, Combi Nuts, Weld Nuts...

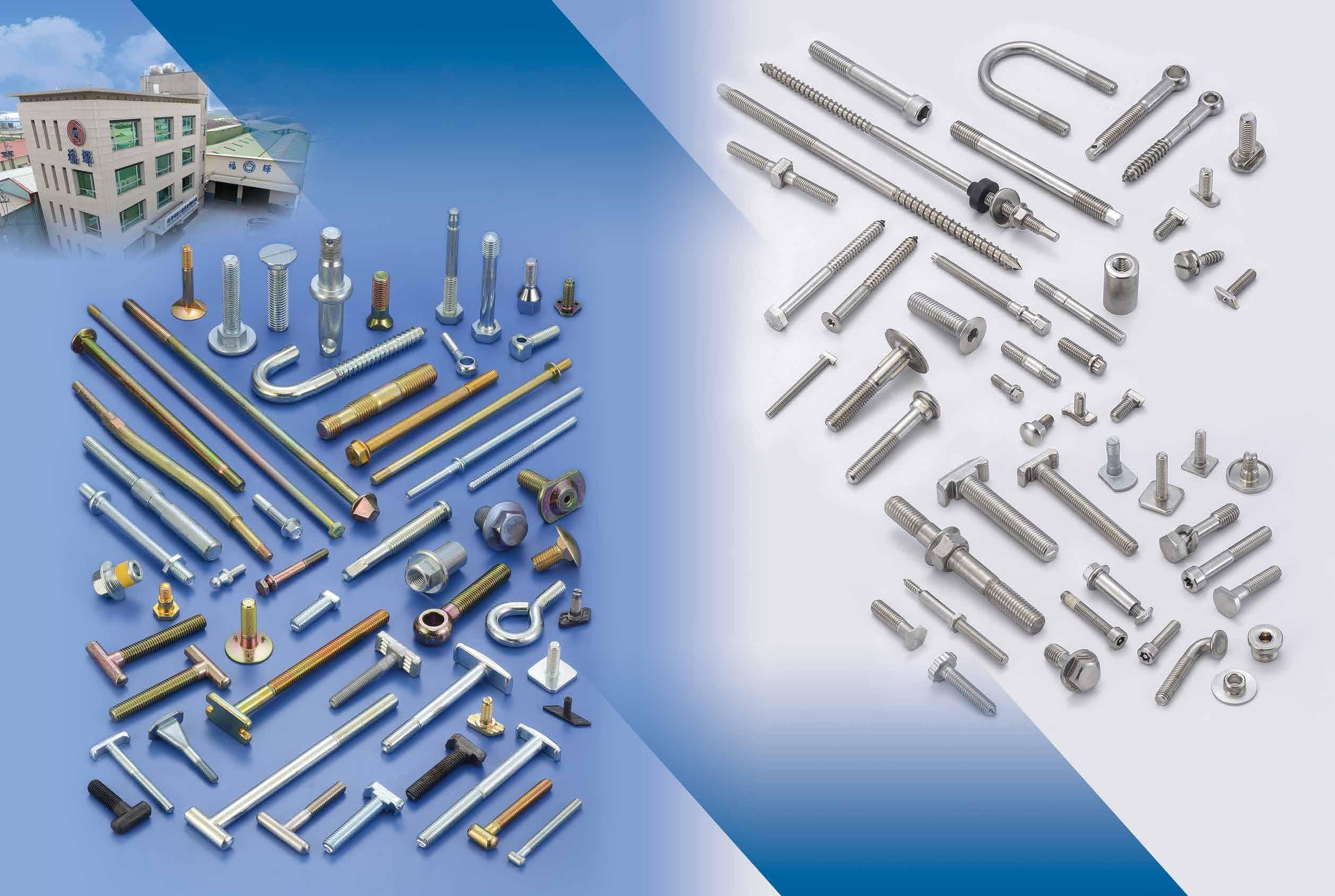

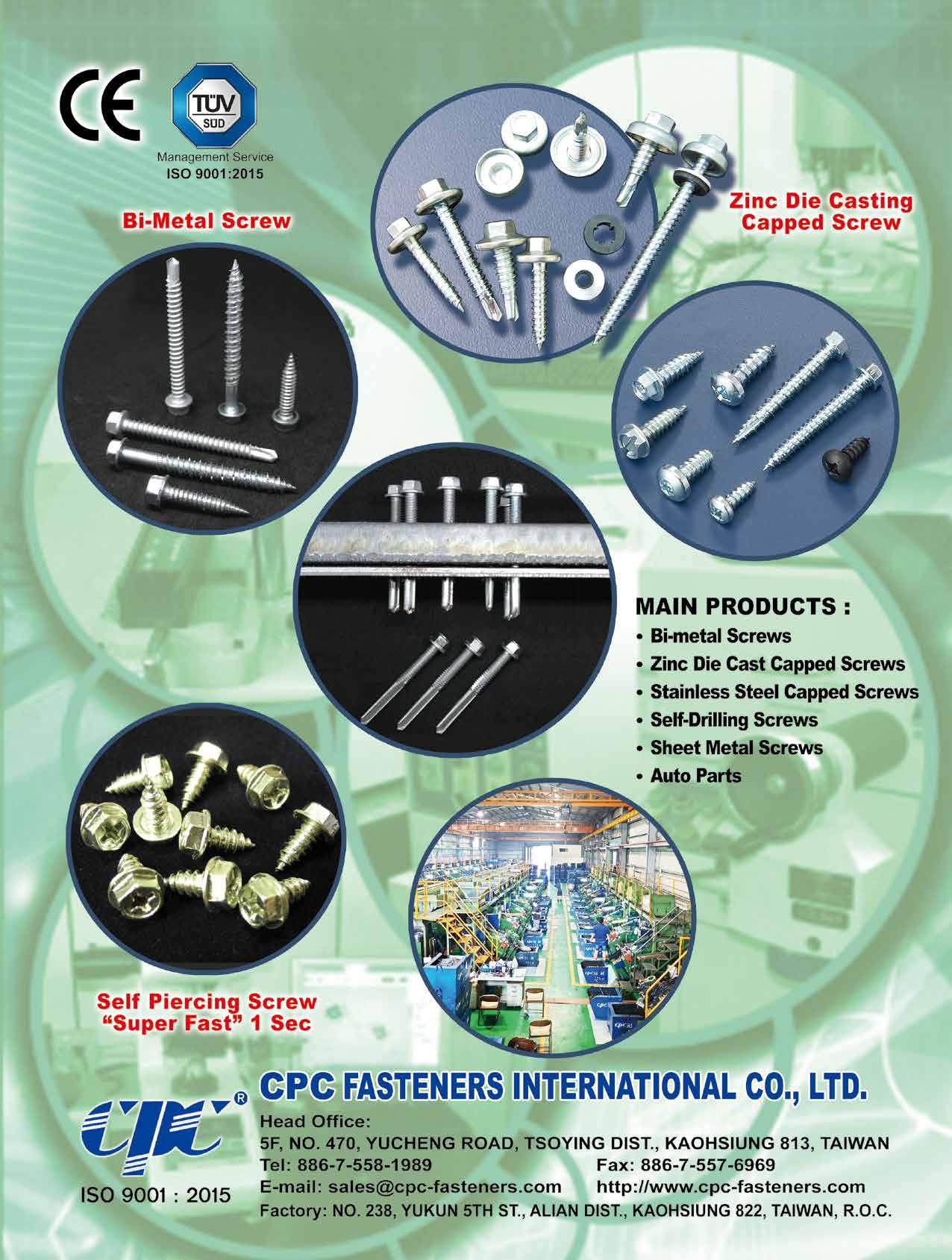

82 CPC FASTENERS INTERNATIONAL CO., LTD. 冠誠

Stainless Steel, Bi-metal Self-drilling Screws...

259

Electrical Wire Molding, Crash-proof Strip, Ventilation...

88 DAR YU ENTERPRISE CO., LTD.

Chipboard Screws, Drywall Screws, Screw Nails... 92 DE HUI SCREW INDUSTRY CO., LTD.

Drywall Screws, Decking Screws, Self-drilling Screws, Roofing Screws... 205 DICHA FASTENERS MFG. CO., LTD.

Expansion Anchors, Sleeve Anchors, Nylon Nail Anchors...

DIING SEN FASTENERS INDUSTRIAL CO., LTD.

Chipboard Screws, Corrosion Resistant Screws...

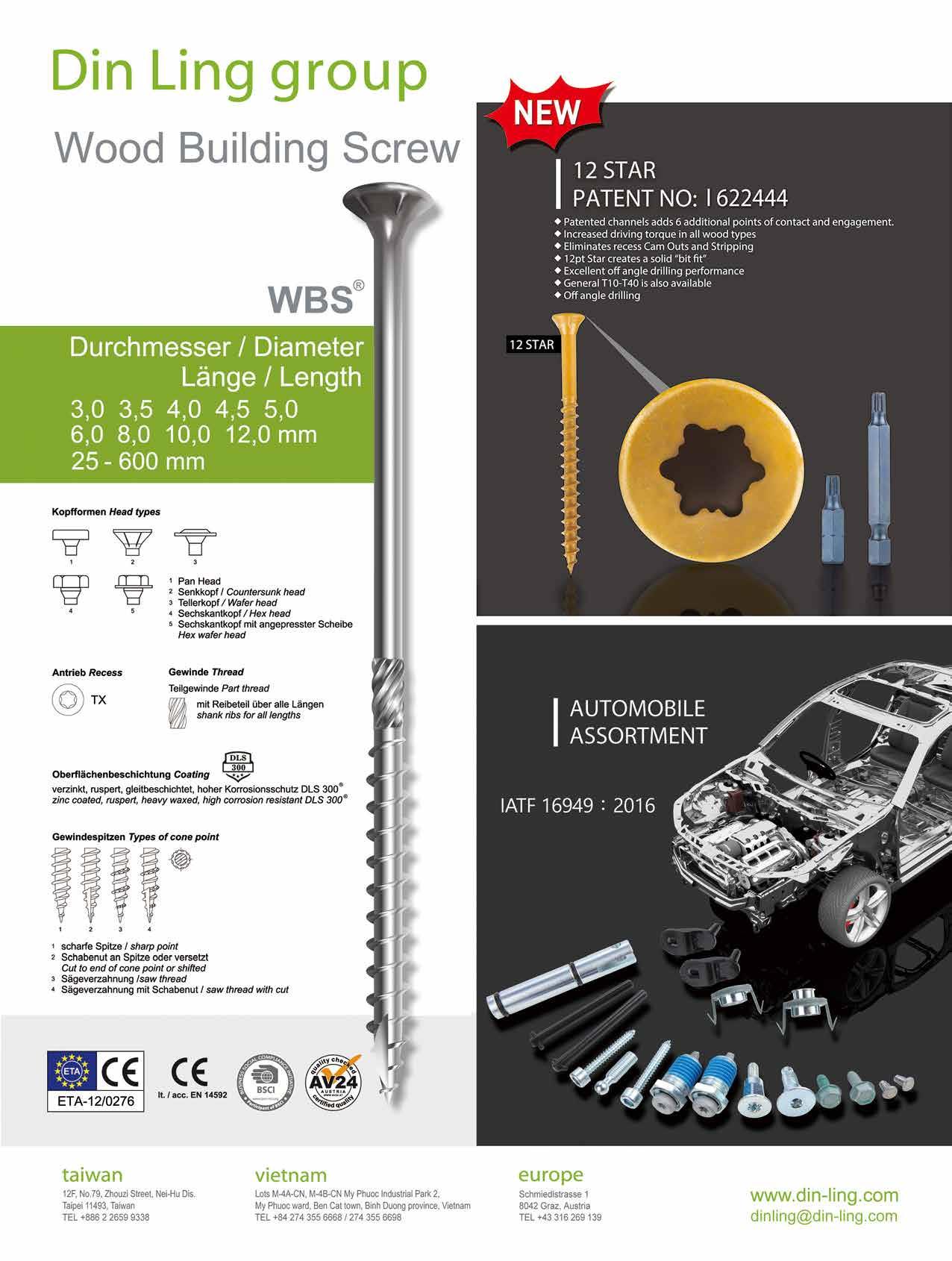

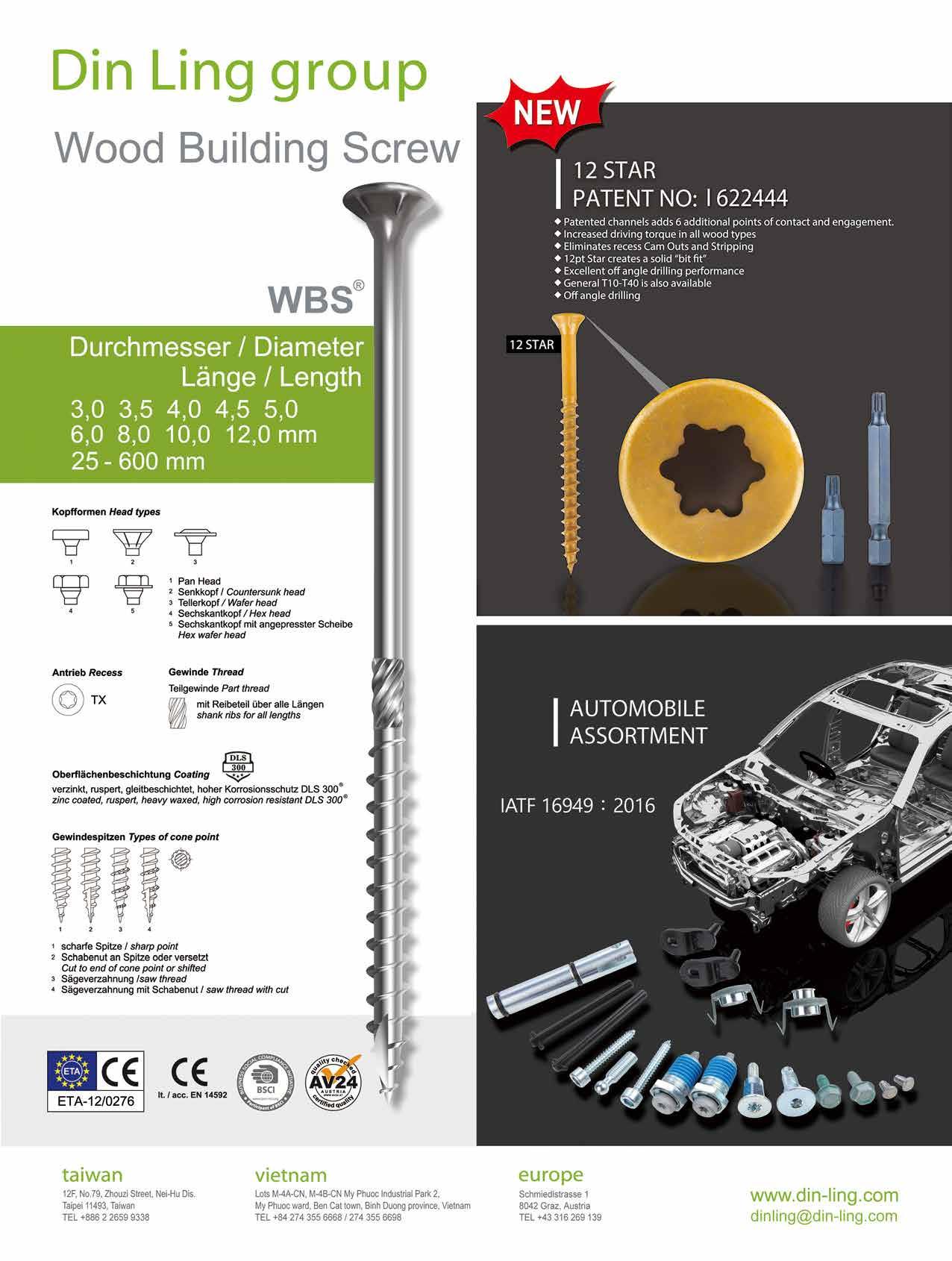

LING CORP.

Chipboard Screws, Drywall Screws, Furniture Screws... 155 DRAGON IRON FACTORY CO., LTD.

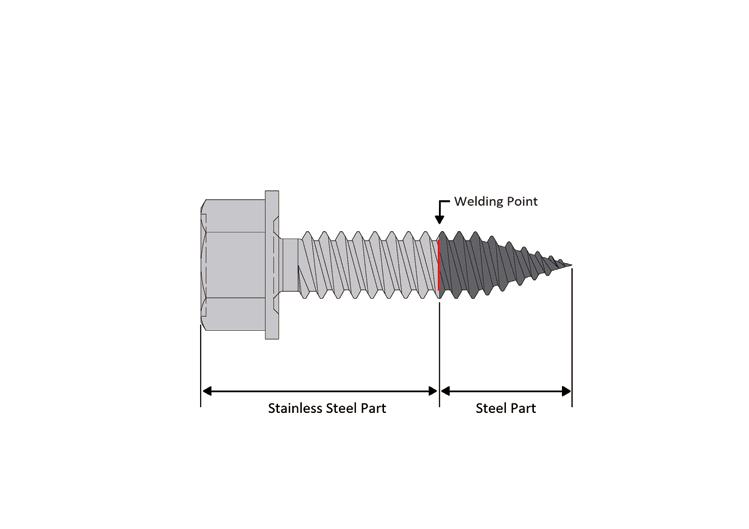

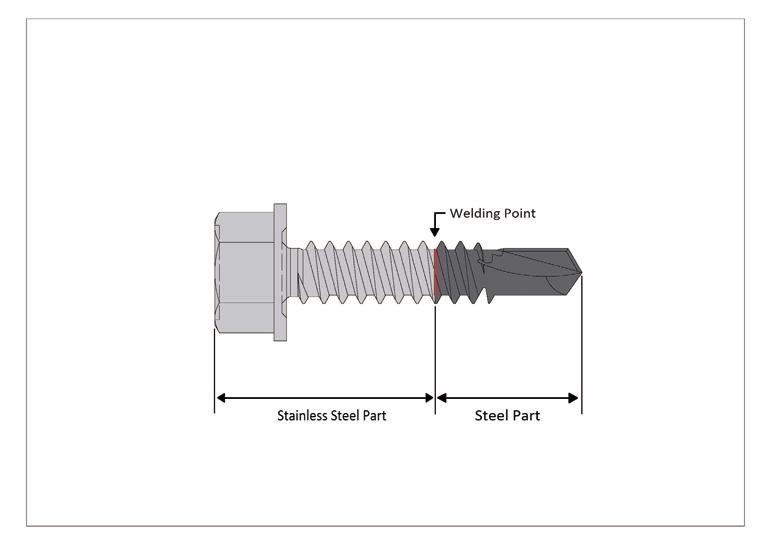

Bi-metal Self-drilling Screws, Sheet Metal Screws...

Chipboard Screws, Phillips Head Screws, TEK Screws...

DUNFA INTERNATIONAL CO., LTD.

Bushes, Spacers, Automotive Parts, Tubes, Turning Parts...

INDUSTRIAL INC.

Standard & Non-standard Fasteners...

52 E CHAIN INDUSTRIAL CO., LTD.

Chipboard Screws, Drywall Screws, Machine Screws...

Hose Clamps, Ear Clamps, Clamp Racks...

HARDWARE CORP.

Acme Nuts, Automotive Nuts, Castle Nuts, Cold Forged Nuts... 106 FAITHFUL ENGINEERING PRODUCTS CO., LTD.

Anchors, Box Nails, Door/Window Accessories...

Automotive & Motorcycle Special Screws / Bolts...

Shoulder Bolts, Button Head Socket Cap Screws..

JAMHER TAIWAN INC.

Automotive Nuts, Blind Nuts / Rivet Nuts, Bushings...

FASTNET CORP.

Dowel Pins, Flange Nuts, Weld Nuts, 4 Pronged T Nuts...

140 FILROX INDUSTRIAL CO., LTD.

Rivet Nuts, Bolt Rivet Nut, Blind Rivet, Special Tooling...

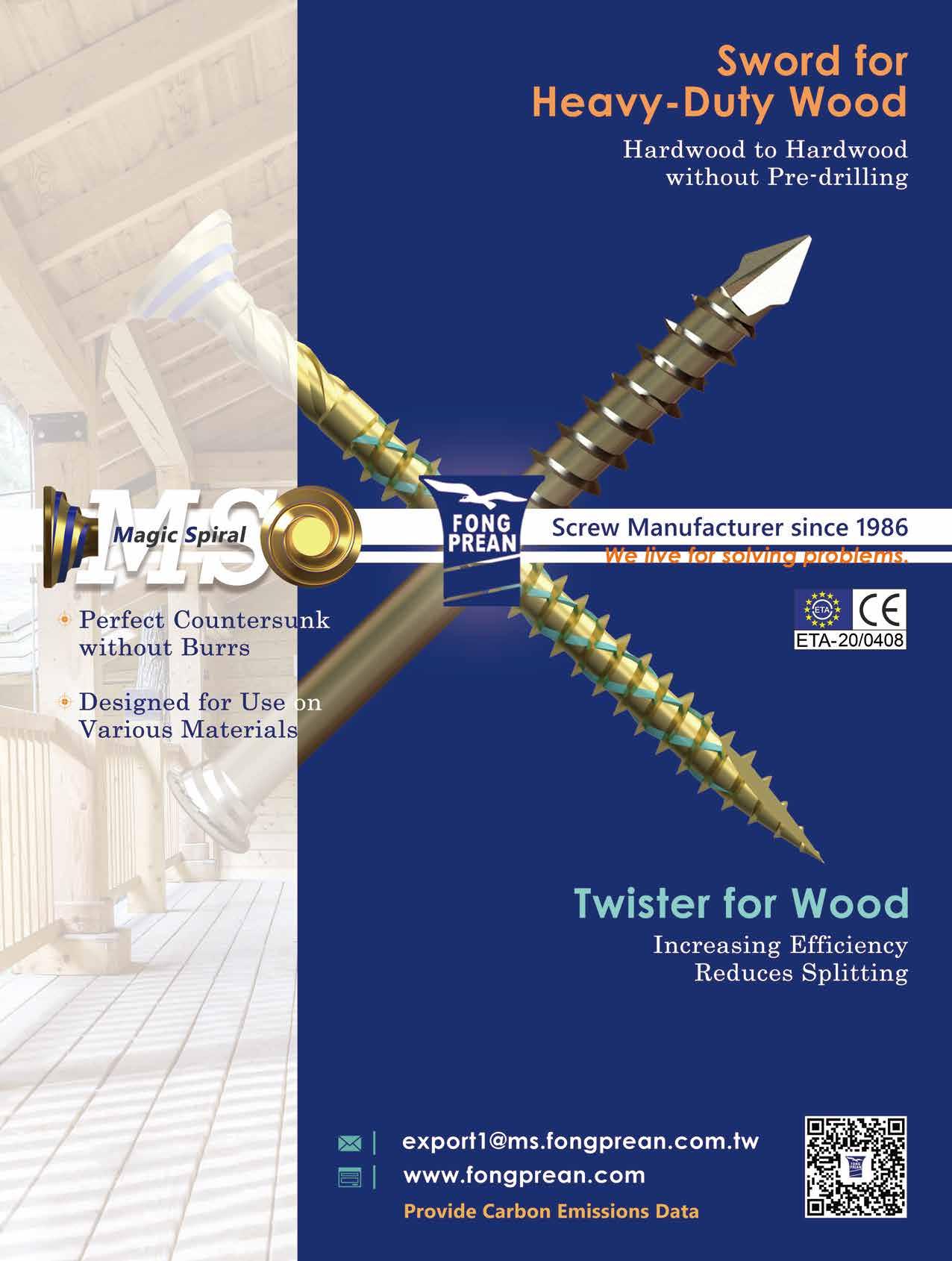

40 FONG PREAN INDUSTRIAL CO., LTD. 豐鵬

Automotive Screws, Bi-metal Screws, Brass & Bronze Screws...

119 FONG WUNS CO., LTD.

Flange Nuts, Stainless Steel Nuts, Special Parts...

121 FONG YIEN INDUSTRIAL CO., LTD.

Eyebolts, Spindles...

59 FORTUNE BRIGHT INDUSTRIAL CO., LTD.

Cap Nuts, Dome Nuts, Nylon Cap Insert Lock Nuts...

78 FU HUI SCREW INDUSTRY CO., LTD. 福輝

Automotive & Motorcycle Special Screws / Bolts...

233 FU KAI FASTENER ENTERPRISE CO., LTD.

Precision Electronic Screws, Special Screws, Weld Screws...

90 FUSHANG CO., LTD.

Carbon Steel Screws, Chipboard Screws, Concrete Screws...

332 GELA & COMPANY

Expansion Anchors, Eye Bolts, Hanger Bolts...

248 GINFA WORLD CO., LTD.

Chipboard Screws, Countersunk Screws, Drywall Screws...

152 GOFAST CO., LTD.

Open Die Parts, Stamping Parts, Assembly Parts...

156 GUANGZHE ENTERPRISE CO., LTD.

Collated Washer Paper Tape, Collated Screw Tape...

89 HAO CHENG PLASTIC CO., LTD.

PP Boxes, PET Jars, ABS Boxes, PC Boxes..

134 HARVILLE FASTENERS LTD.

Special Screws and Bolts, Sems Screws, Stainless Steel Fasteners...

333 HAUR FUNG ENTERPRISE CO., LTD.

External Tooth Washers, Long Carriage Bolts, Roofing Bolts...

240 HEADER PLAN CO. INC.

Chipboard Screws, Collated Screws, Deck Screws...

312 HEY YO TECHNOLOGY CO., LTD.

Precision Pins, Rollers, Dowel Pins...

339 HISENER INDUSTRIAL CO., LTD.

Wood Construction Screws, Chipboard Screws, Drywall Screws...

199 HO HONG SCREWS CO., LTD.

Alloy Steel Screws, Button Head Cap Screws, Chipboard Screws...

110 HOME SOON ENTERPRISE CO., LTD. 宏舜

Bit, Bit Holder, Magnetic Nut Setter, Spring Nut Driver...

183 HOMEYU FASTENERS CO., LTD. 宏宇鑫

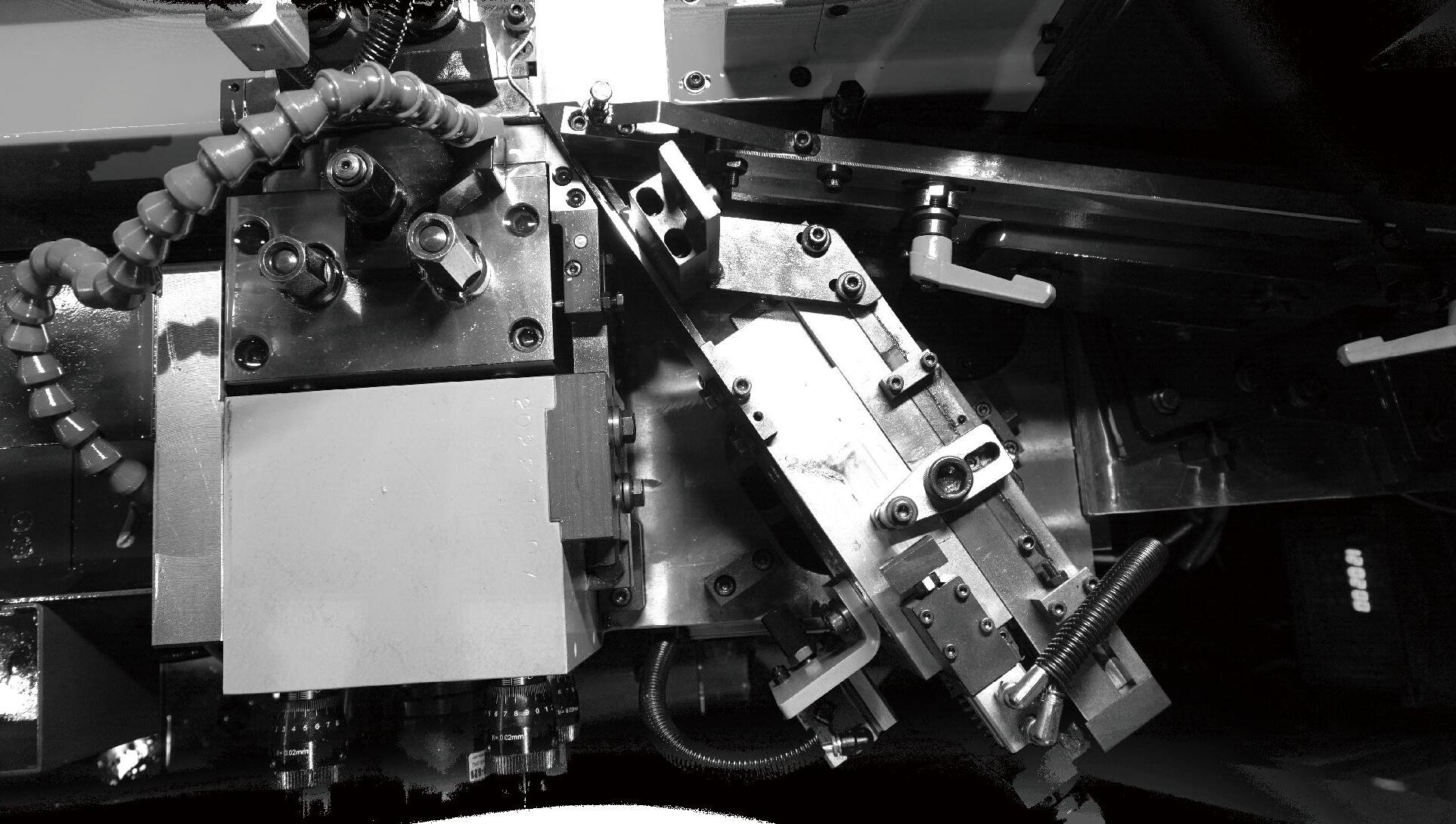

Cold Forging Stage, Machine Molds, Lathe, CNC Machining...

324 HON JEI ENTERPRISE CO., LTD.

鋐傑

Automotive & Motorcycle Screws, Special Screws, Cold Forged Parts...

239 HONG YING FASTENERS ENTERPRISE CO., LTD. 虹瑩

Alloy Steel Screws, Automotive Screws, Socket Head Cap Screws...

326 HOPLITE INDUSTRY CO., LTD.

Bushings, Prevailing Torque Nuts, PT Screws, Roofing Screws...

合利

101 HOSHENG PRECISION HARDWARE CO., LTD. 和昇

Auto Parts, CNC Machined Parts, Bolts...

197 HSIEN SUN INDUSTRY CO., LTD.

Hexagon Nuts, Tubular Nuts, Spacers, All Kinds of Screws...

憲順

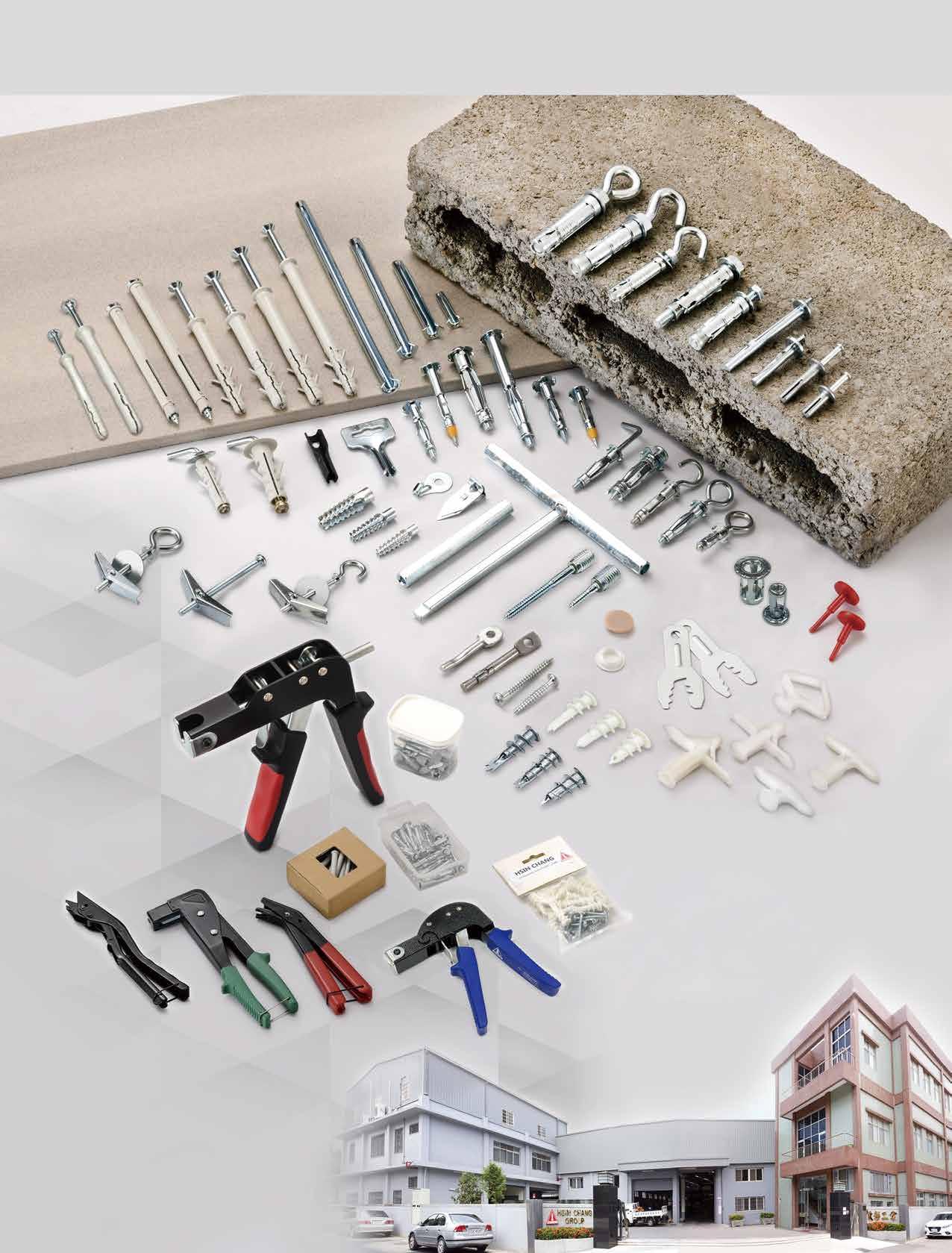

145 HSIN CHANG HARDWARE INDUSTRIAL CORP. 欣彰

Anchor Bolts, Anchors, Plastic Fasteners...

249 HSIN HO MEI PLASTIC CO., LTD. 鑫合美

Plastic Screws, Plastic Nuts, Plastic Washers, Plastic Anchors...

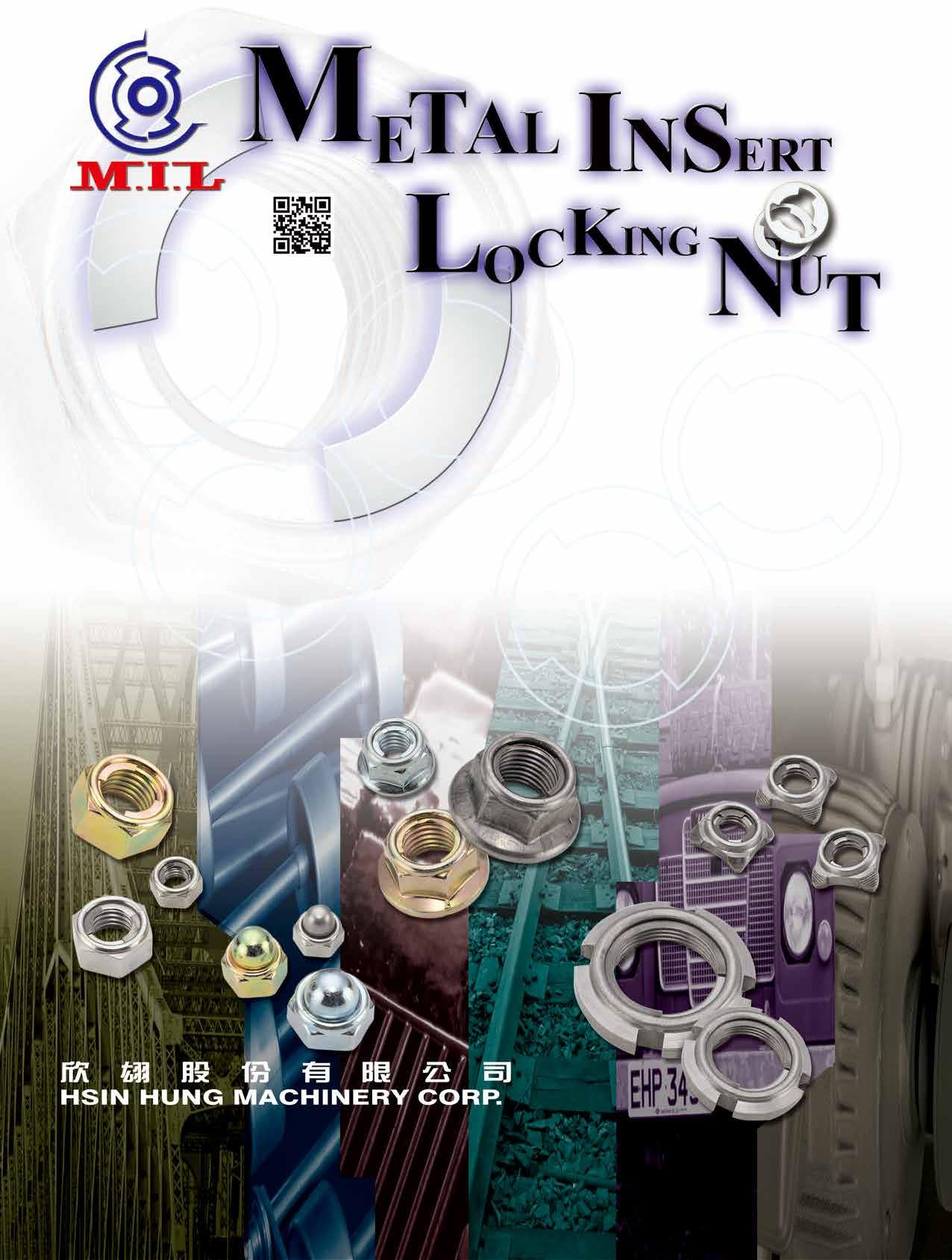

172 HSIN HUNG MACHINERY CORP. 欣翃

Cap Nuts, Flange Nuts, Hexagon Nuts, Dome Nuts...

25 HSIN JUI HARDWARE ENTERPRISE CO., LTD. 欣瑞

Bushes, Construction Bolts, Special Cold / Hot Forming Parts...

334 HSIN YU SCREW ENTERPRISE CO., LTD. 新雨

Acme Screws, Hexagon Head Cap Screws...

41 HU PAO INDUSTRIES CO., LTD.

Automotive Nuts, Flange Nuts, Hexagon Nuts...

如保

161 HUANG JING INDUSTRIAL CO., LTD. 皇晉

Custom Washers, Chipboard Screws, Drywall Screws...

330 HWA HSING SCREW INDUSTRY CO., LTD. 華興

Chipboard Screws, Collated Screws, Drywall Screws...

281 HWAGUO INDUSTRIAL FASTENERS CO., LTD. 華國

Springs, Special Washers, Multi-die Forming Fasteners...

107 HWALLY PRODUCTS CO., LTD.

Drop-in Anchors, Chipboard Screws, Anchors...

樺麟

213 HWEI NEN CO., LTD. 輝能

Automotive & Motorcycle Special Screws / Bolts...

81 INMETCH INDUSTRIAL CO., LTD.

Flanged Head Bolts, Locking Bolts, Stud Bolts...

48 INNTECH INTERNATIONAL CO., LTD.

All Kinds of Nuts, All Kinds of Screws, Automotive Special Screws...

224 ITAC LABORATORY CO., LTD.

Independent laboratory services for fastener tests

309 J. T. FASTENERS SUPPLY CO., LTD.

Drop-in Anchors, Floating Nuts, Connecting Nuts...

10 J.C. GRAND CORPORATION

All Kinds of Screws, Chipboard Screws...

JAU

Chipboard

275 JENG YUH PLASTICS CO., LTD. 政毓

Plastic Injection Products, Plastic Mold R&D…

203 JEOU YEUN SCREW CO., LTD. 久允

Screws, Bolts, SEMS, Standard Products, Customized Products…

38 JET FAST COMPANY LIMITED 捷禾

Blind Nuts / Rivet Nuts, Aircraft & Aerospace Washers...

269 JI LI DENG FASTENERS CO., LTD. 吉立登

Alloy Steel Screws, Appliance Screws, Automotive Screws...

237 JIAXING KINFAST HARDWARE CO., LTD. 海德

Stainless Steel Screws, Fasteners, Anchors...

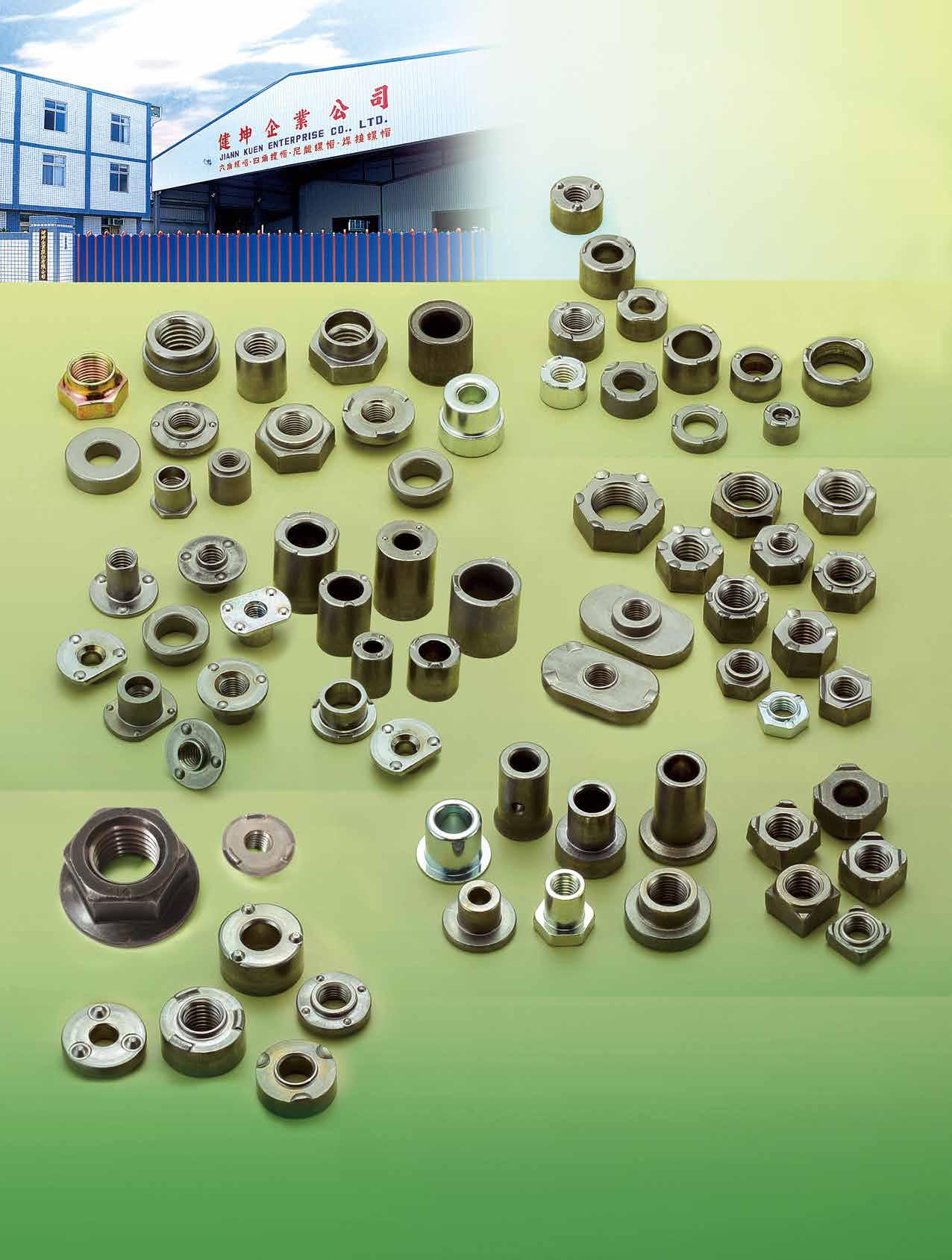

137 JIEN KUEN ENTERPRISE CO., LTD. 健坤

Hexagon Nuts, Nylon Cap Insert Lock Nuts, Square Nuts...

226 JINGFONG INDUSTRY CO., LTD. 璟鋒

Hex Nylon Insert Lock Nuts, Wing Nuts with Nylon Insert...

157 JOINTECH FASTENERS INDUSTRIAL CO., LTD. 群創

Customized Parts, Bolts, Screws, Nuts, Automotive Parts...

49 JOKER INDUSTRIAL CO., LTD. 久可

Hollow Wall Anchors, Concrete Screws, Jack Nuts...

124 JUNG SHEN TECHNOLOGY CO., LTD. 榮燊

Bi-metal Screws, Automatic Welding & Automatic Inspection...

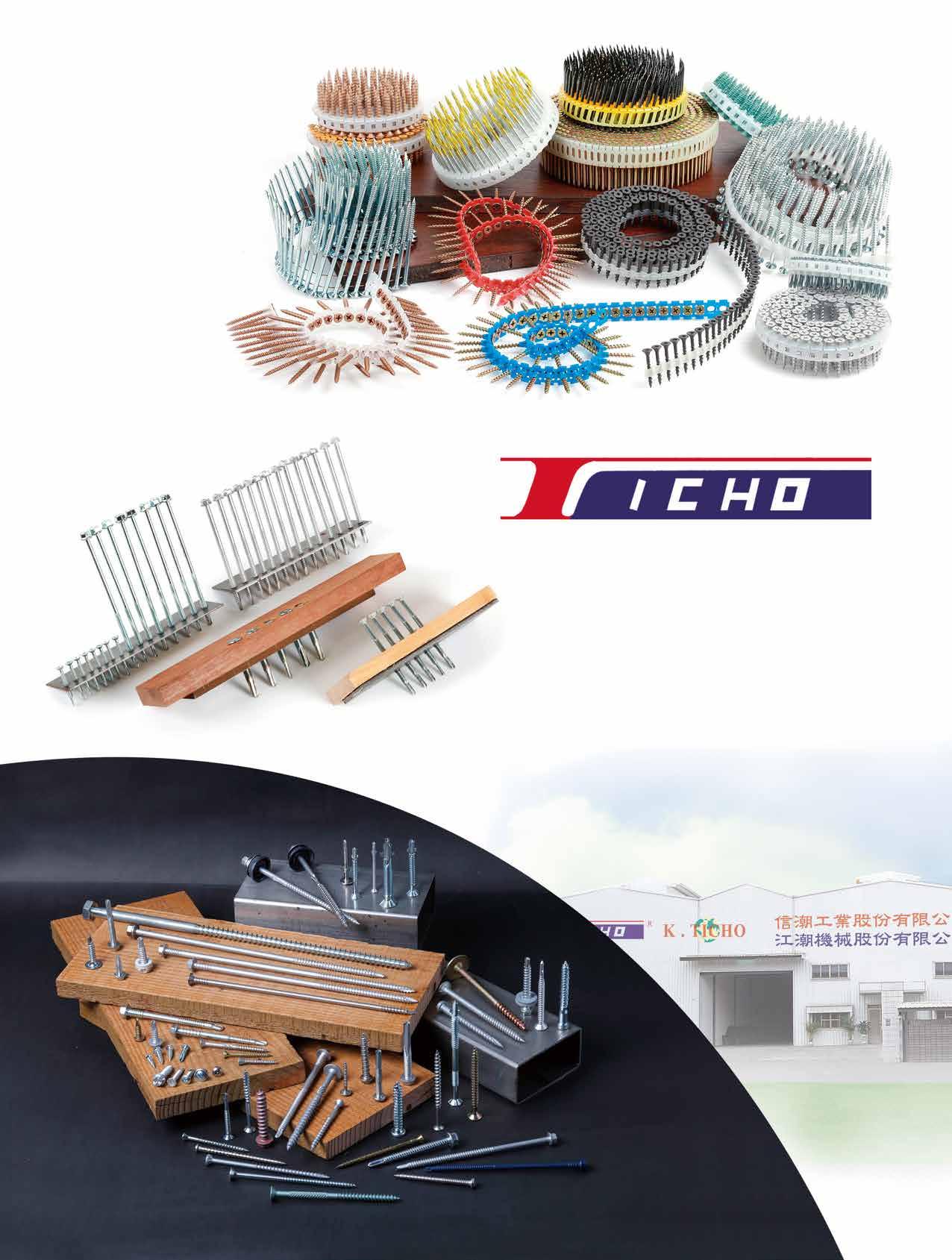

295 K. TICHO INDUSTRIES CO., LTD. 帝潮

Bi-metal Self-drilling Screws, Timber Screws, Collated Screws…

128 KAN GOOD ENTERPRISE CO., LTD. 鋼固

Fastener, Hardware, Plastic, Instruction Booklet Package in Bags...

187 KAO WAN BOLT INDUSTRIAL CO., LTD. 高旺

Hex Head Cap Screws, Carriage Bolts, Hex Lag Bolts...

115 KATSUHANA FASTENERS CORP. 濱井

Collated Screws, Drywall Screws, Roofing Screws...

335 KAY-TAI FASTENERS INDUSTRIAL CO., LTD. 鍇泰

K/D Fittings, Furniture Fittings, Cams, Nylon Nuts...

144 KEY-USE INDUSTRIAL WORKS CO., LTD. 凱雍

Flanged Head Bolts, Milled Bolts, Rim Bolts, Round Head Bolts...

135 KING CENTURY GROUP CO., LTD. 慶宇

Drop-in Anchors, Self-drilling Anchors, Sleeve Anchors...

178 KING HO CHANG CO., LTD. 金禾昌

Bit & Bit Sets, Bit Sets, Bits, Precision Screwdrivers...

328 KINGFUDA PRECISION CO., LTD. 星富達 Bi-Metal Screws, Chipboard Screws, Stainless Steel Screws...

211 KUNTECH INTERNATIONAL CORP. 鉅堃

All Kinds of Screws, Automotive & Motorcycle Special Screws / Bolts...

313 KUOLIEN SCREW INDUSTRIAL CO., LTD. 國聯 Advanced Fastener

76 KWANTEX RESEARCH INC. 寬仕

Chipboard Screws, Wood Construction Screws, Deck Screws...

142 L & W FASTENERS COMPANY 金大鼎

Construction Fasteners, Flat Washers, Heavy Nuts...

303 LIAN CHUAN SHING INTERNATIONAL CO., LTD. 連全興

Weld Nuts, Special Parts, Special Washers, Flat Washers...

244

306

456

13

LIANG YING FASTENERS INDUSTRY CO., LTD.

CNC Machining, CNC Milling, Turned Parts ...

LINK-PRO TECH CO., LTD.

Customized Screws/Nuts, Pressing & Deep Drawing...

LINKWELL INDUSTRY CO., LTD.

All Kinds of Screws, Automotive & Motorcycle Special Screws...

LOCKSURE INC.

Weld Nuts, Cage Nuts...

278 LONG HWA SCREW WORKS CO., LTD.

Chipboard Screws, Concrete Screws, Self-Drilling Screws...

129 LONG THREAD FASTENERS CORP.

Bi-metal Self-drilling Screws, Chipboard Screws...

139 LOYAL & BIRCH CO., LTD.

Construction Fasteners and Building Fasteners

93 MAC PRECISION HARDWARE CO.

Turning Parts, Precision Metal Parts, Cold Forged Nuts...

166 MAO CHUAN INDUSTRIAL CO., LTD.

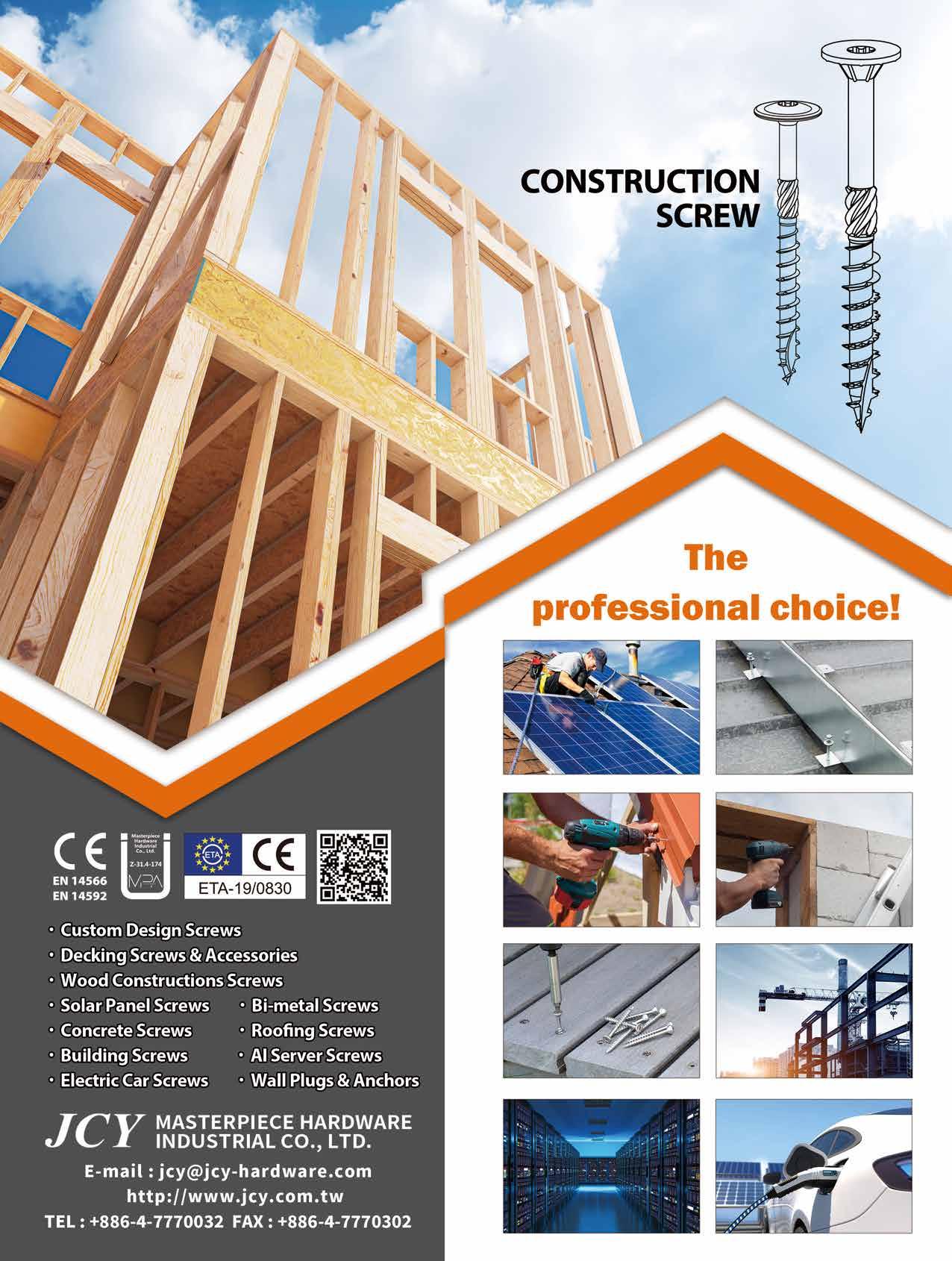

Professional Stamping Manufacturer 170 MASTERPIECE HARDWARE INDUSTRIAL

Brass Screws, Chipboard Screws, Deck Screws, Double End Screws...

66 MAUDLE INDUSTRIAL CO., LTD.

Button Head Socket Cap Screws, Flange Washer Head Screws...

257 MAXTOOL INDUSTRIAL CO., LTD.

Plastic Screws, Drop-in Anchors, Expansion Anchors...

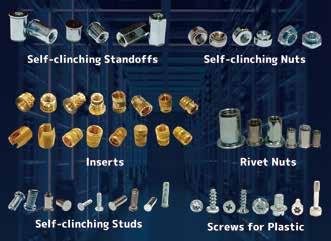

99 METAL FASTENERS CO., LTD.

Self-Clinching Standoffs, Inserts, Self-clinching Nuts...

267 METECK ENTERPRISES CO., LTD.

Automotive Fasteners, Brass Screws (Bolts), Building Fasteners... 16 MIN HWEI ENTERPRISE CO., LTD.

Button Head Socket Cap Screws, Chipboard Screws... 228 MOLS CORPORATION

Home Appliance Screws, Customized Screws, Thread Forming Screws...

136 MOUNTFASCO INC.

All Kinds of Screws, Alloy Steel Screws, Automotive Screws...

220 MULTI-OPERATION INDUSTRY TRADING

Proximity Switch Parts, Sensor Parts, Anti-Loosening Nuts...

112 NCG TOOLS INDUSTRY CO., LTD.

Tools for Fastening Anchors, Blind Nuts / Rivet Nuts... 104 NOVA. FASTENER CO., LTD.

Hexagon Nuts, Square Nuts, Wood Screws, Chipboard Screws...

Bi-metal Screws 325 PEARSON INDUSTRIAL CO.,

Automotive Cold Formed Parts, Self-Clinching Cold Formed

SEMs Screws, Special Screws, Binder Screws, PT Screws...

307 PRO POWER CO., LTD.

Screws, Bolts...

141 PS FASTENERS PTE LTD. (Singapore)

Washers, Socket Set Screws, U Bolts, Alloy Steel Screws...

146 Q-NUTS INDUSTRIAL CORP.

Flange Nuts, Weld Nuts, Special Nuts, Spacers...

117 QST INTERNATIONAL CORP.

Hexagon Head Bolts, Square Head Bolts, Weld Bolts (Studs)...

122 RAY FU ENTERPRISE CO., LTD.

Construction Screws, Automotive Parts, Special Fasteners...

219 RENETSAF CO., LTD.

Brass, Copper, Silicon Bronze, Aluminum and Customized Parts...

14 REXLEN CORP. 連宜

Clinch Nuts, Clinch Studs, CNC Parts, Stamped Parts...

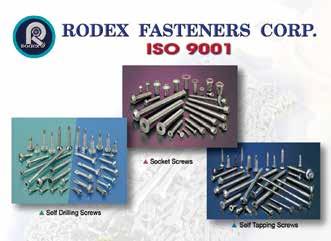

86 RODEX FASTENERS CORP.

Chipboard Screws, Hexagon Head Cap Screws...

436 RONG CHANG METAL CO., LTD.

Spring Lock Washer, Flat Washer, Conical Spring Washer...

437 S&T FASTENING INDUSTRIAL CO., LTD.

4

Carbon Steel Screws, Bi-metal Screws, Stainless Steel Screws...

SAN SHING FASTECH CORP.

Automotive Nuts, Automotive Parts, Carbide Dies...

三星

301 SANHWNG ENTERPRISE CO., LTD. 杉晃

271

64

Frame Screws, Special Screws, Bolts, Nuts, Anchors...

SCREW KING CO., LTD.

進旌

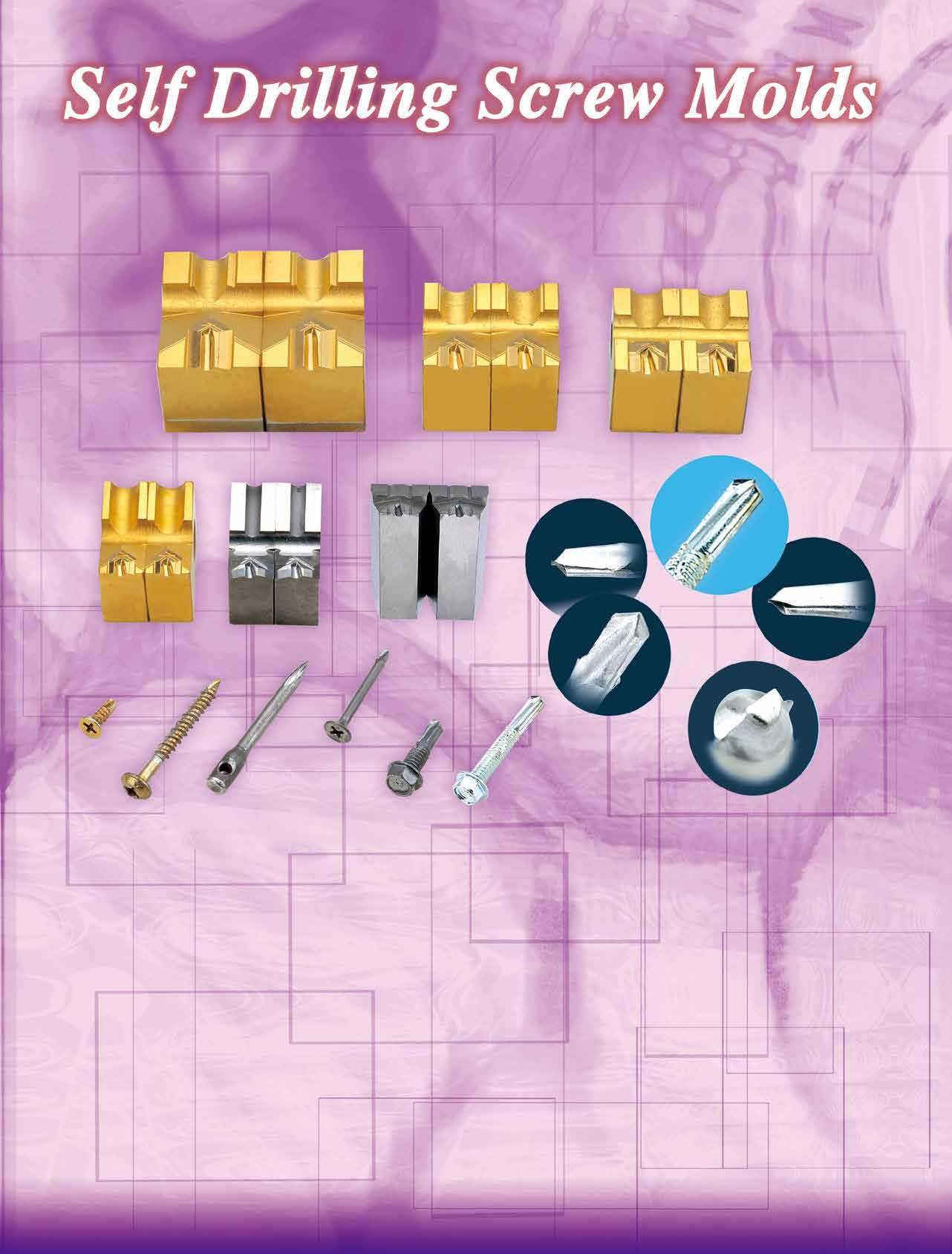

Drill Point Dies, Bi-metal Screws, Special Screws, Tapping Screws...

SCREWTECH INDUSTRY CO., LTD. 銳禾

Machined Parts, Thumb Screws, Micro Screws...

448 SEN CHANG INDUSTRIAL CO., LTD.

440

昇錩 Customized Special Screws / Bolts, Socket Head Cap Screws...

SHANGHAI FAST-FIX RIVET CORP. 飛可斯 Blind Rivets, High Shear Rivets, Closed End Rivets...

130 SHAW GUANG ENTERPRISE CO., LTD.

紹光 Cap Nuts, Conical Washer Nuts, Flange Nuts...

190 SHEH FUNG SCREWS CO., LTD. 世豐 Chipboard Screws, Countersunk Screws, Wood Screws...

192 SHEH KAI PRECISION CO., LTD. 世鎧 Bi-metal Concrete Screw Anchors, Bi-metal Screws...

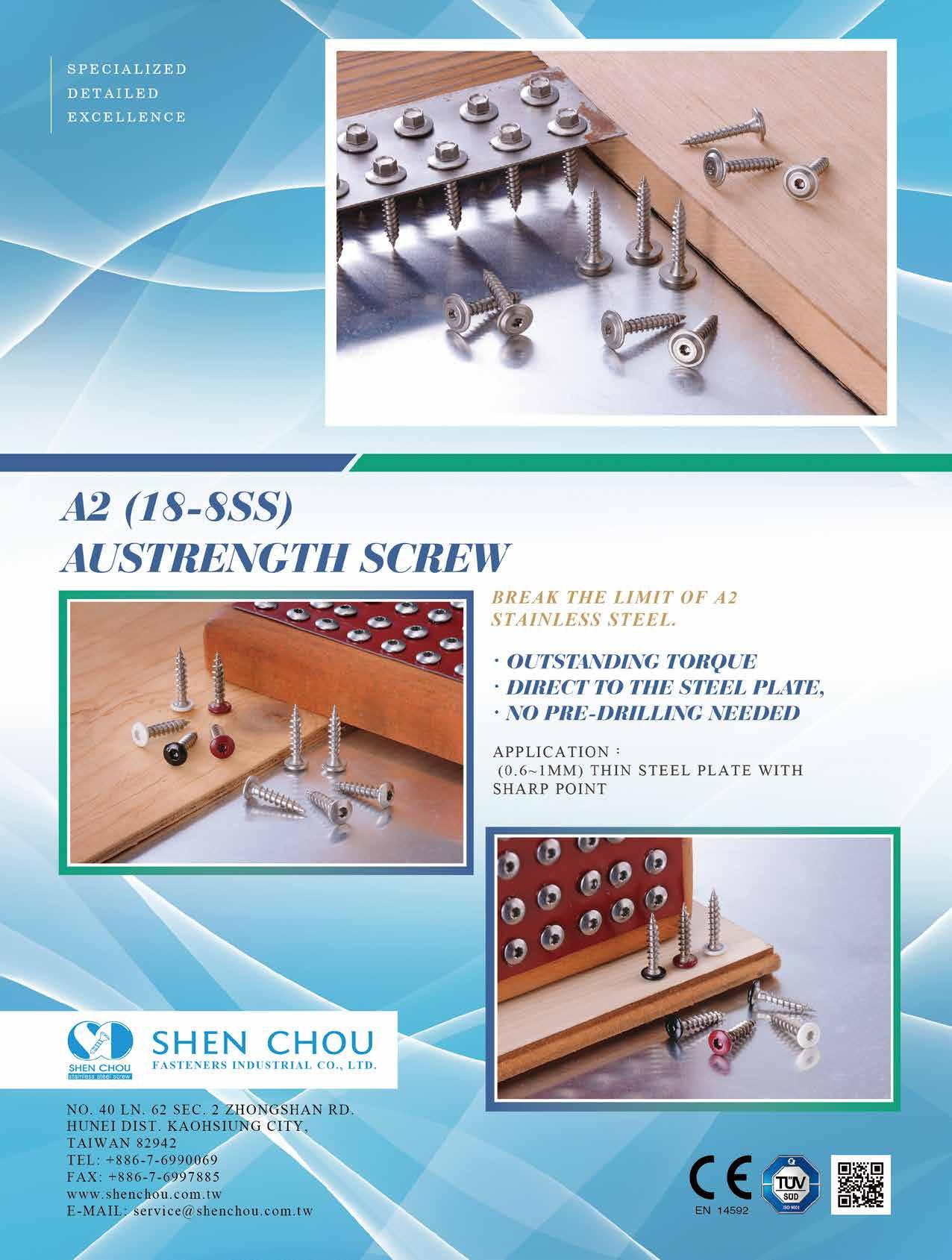

109 SHEN CHOU FASTENERS INDUSTRIAL CO., LTD. 神洲 Button Head Cap Screws, Chipboard Screws...

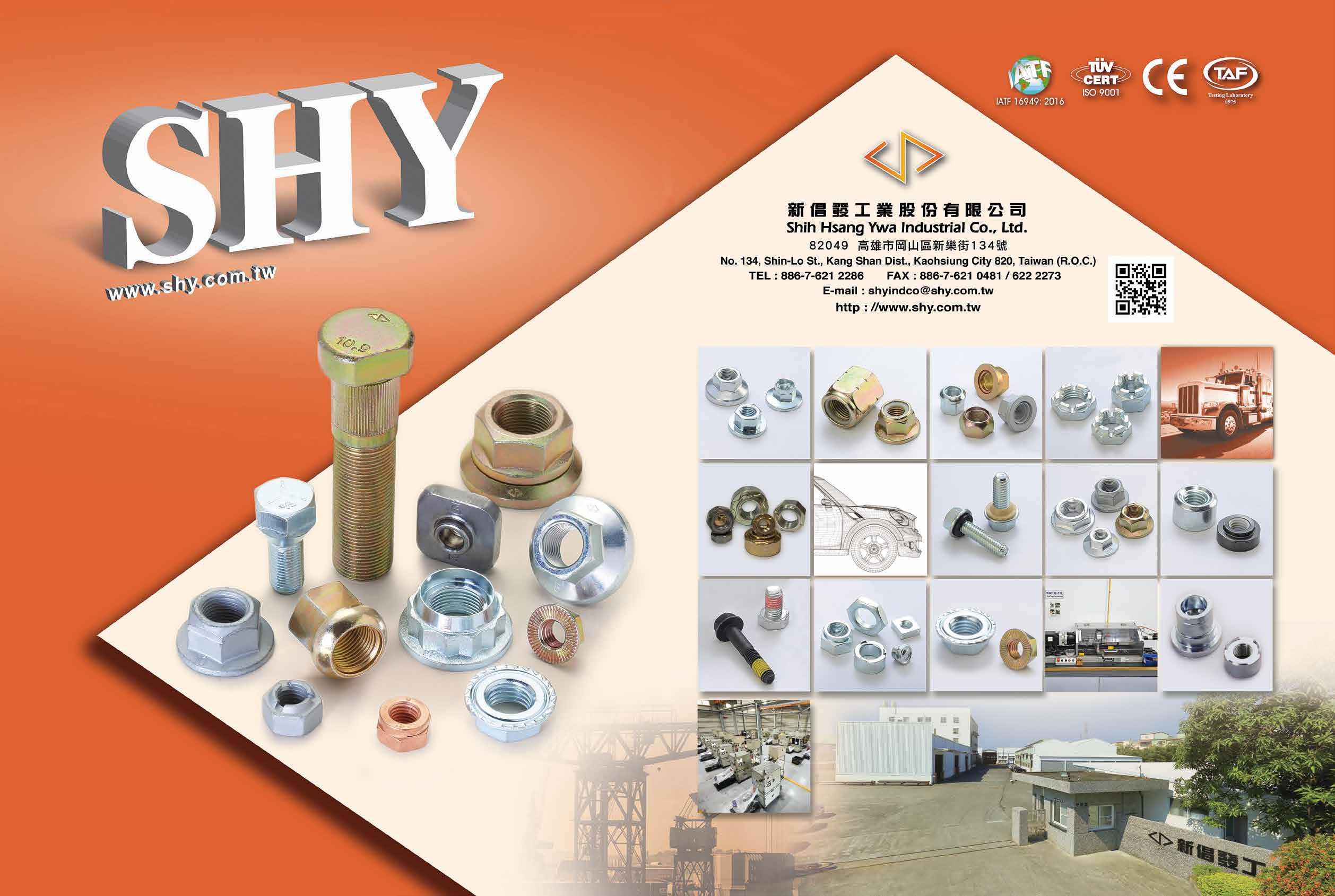

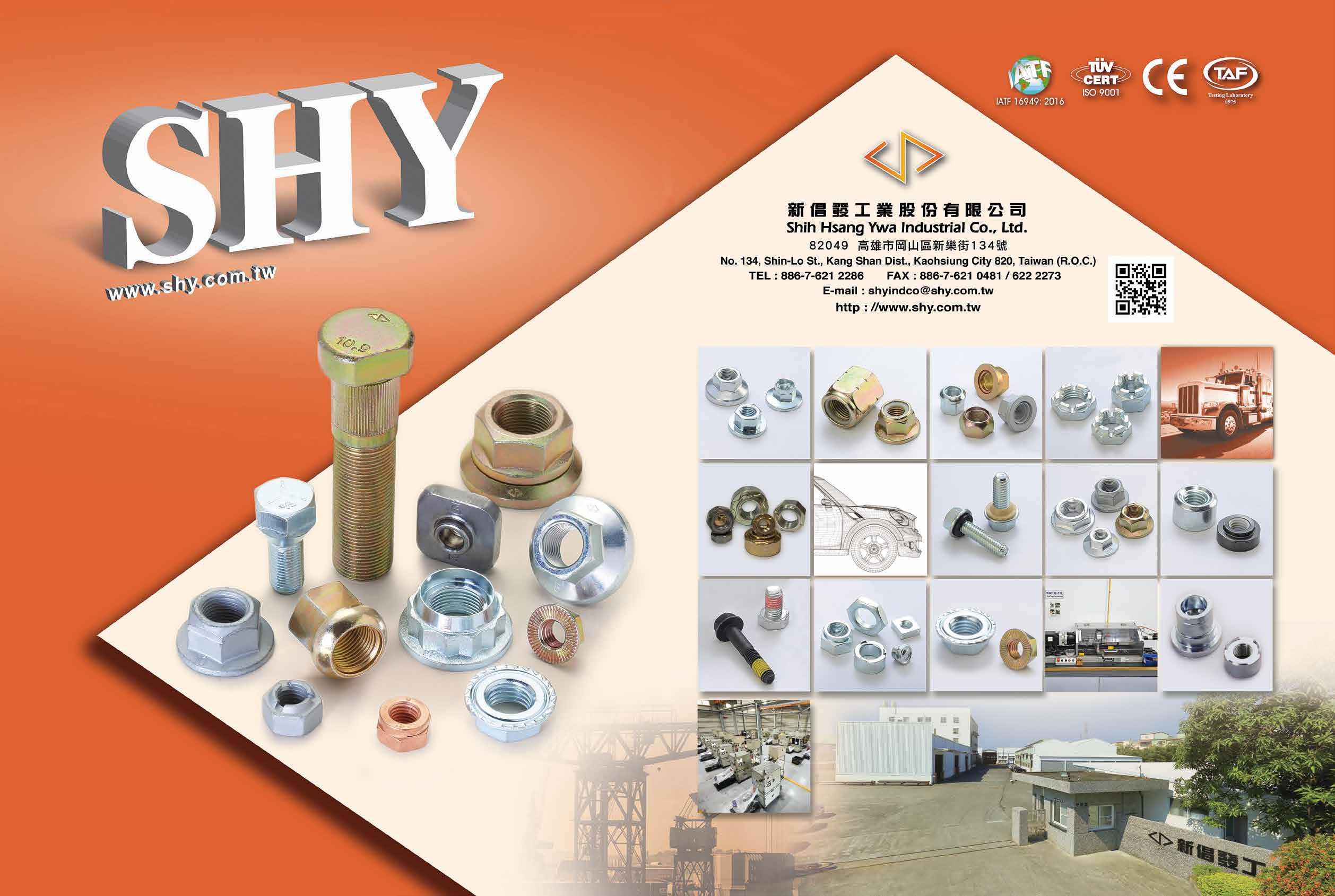

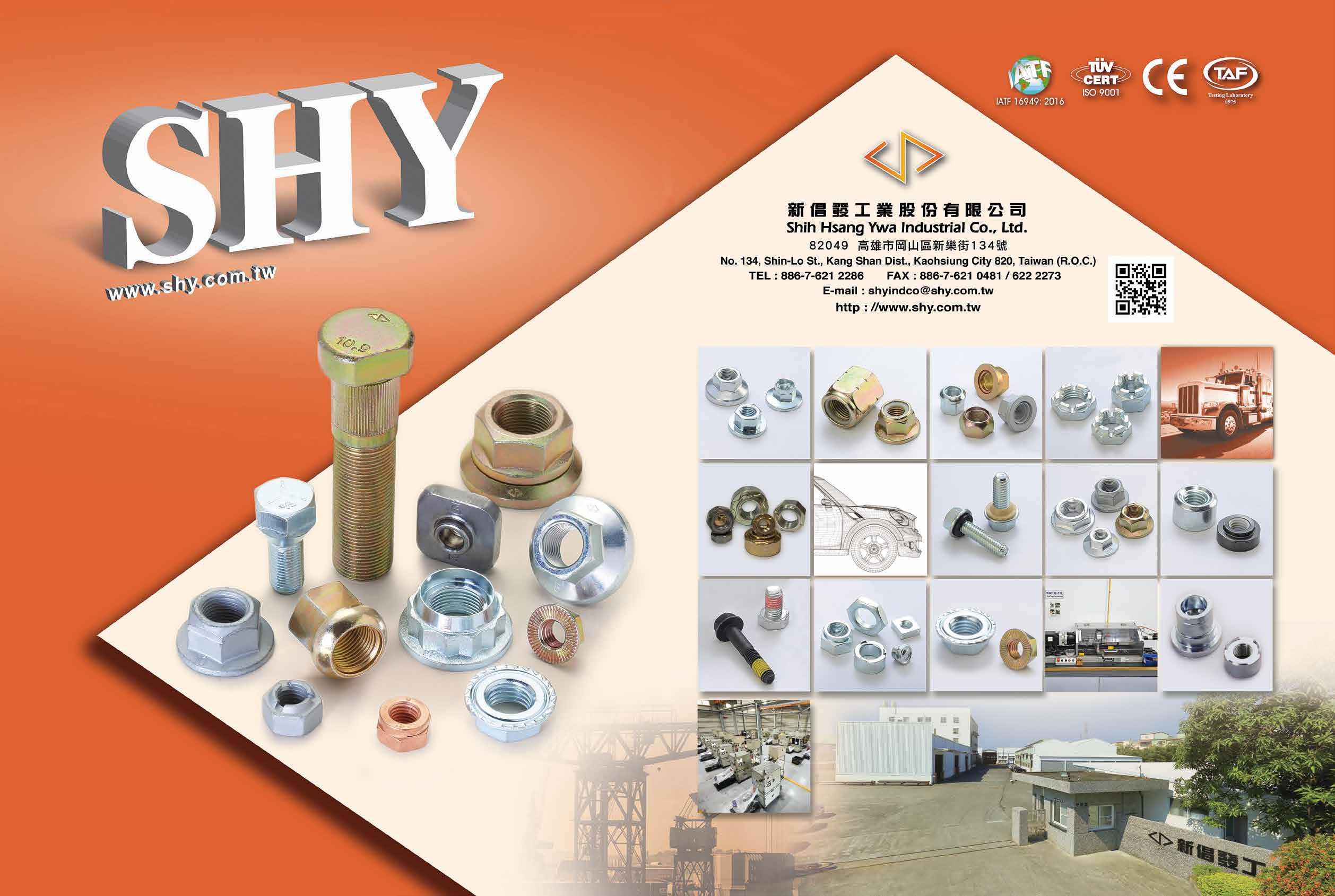

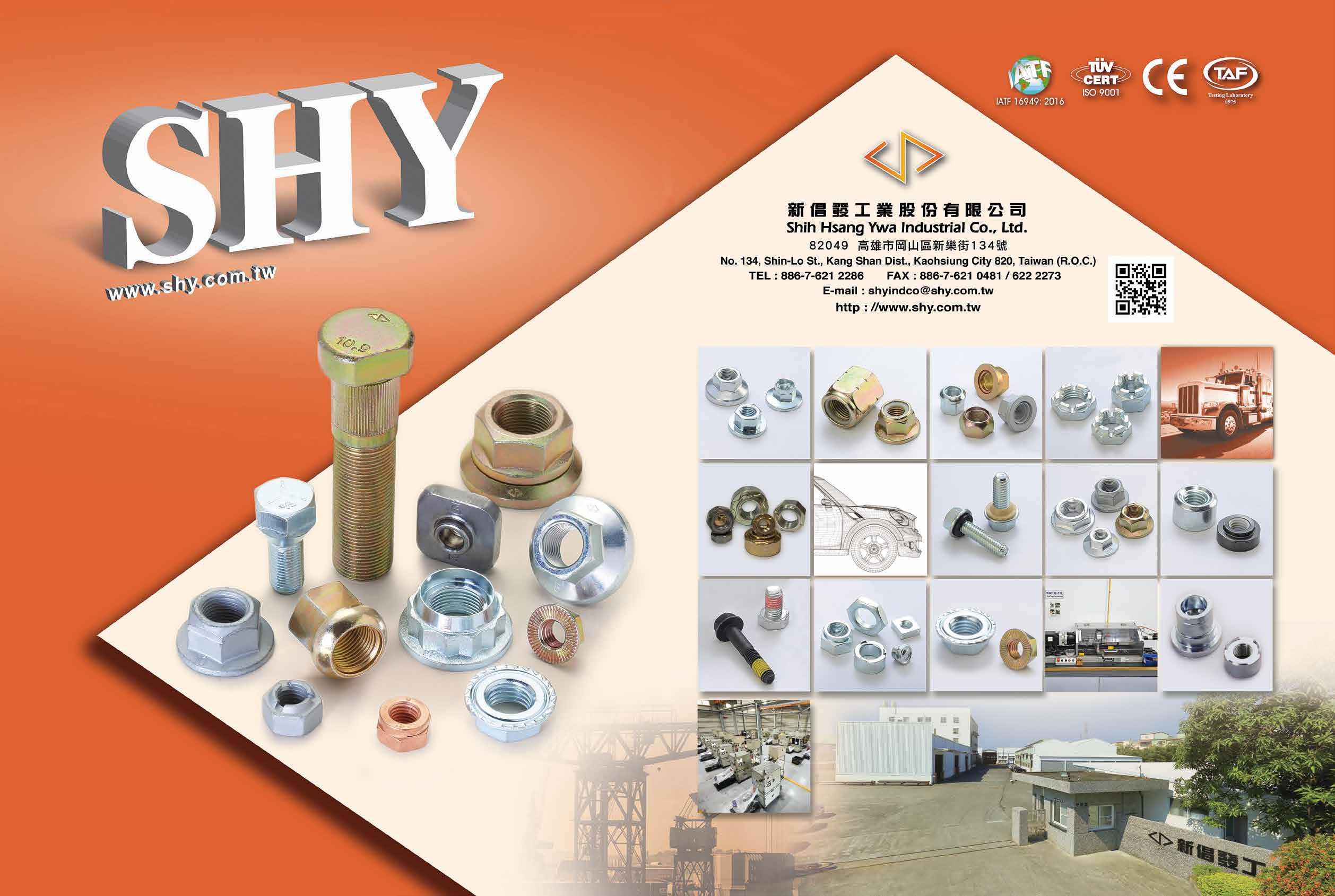

32 SHIH HSANG YWA INDUSTRIAL CO., LTD. 新倡發 Flange Nuts, Flange Nylon Nuts With Washers...

168

SHIN CHUN ENTERPRISE CO., LTD. 昕群 Automotive Screws, Chipboard Screws, Customized Screws...

131 SHIN JAAN WORKS CO., LTD. 新展 Flanged Head Bolts, Long Carriage Bolts, Round Head Bolts...

114

439

SHUENN CHANG FA ENTERPRISE CO., LTD. 舜倡發 Long Construction Fasteners and Other Modified Fasteners...

SHUN DEN IRON WORKS CO., LTD.

Fastener Tools, Bolts, Screws, Nuts, Stamped Parts…

165 SIN HONG HARDWARE PTE. LTD. (Singapore) 新豐

Hexagon Nuts, Hexagon Head Bolts, Blind Rivets...

329 SOON PORT INTERNATIONAL CO., LTD. 鴻錡

Collated Screws, Drywall Screws, Self-Drillig Screws...

169 SOURCING SOLUTIONS FASTENERS CO., LTD. 優德

Concrete Screws, Wood Construction Screws, Decking Screws...

22 SPEC PRODUCTS CORP. 友鋮

Lincensee Fasteners, Turned/Machined Parts...

8 SPECIAL RIVETS CORP. 恆昭

Blind Nuts / Rivet Nuts, Blind Rivets, Air Riveters...

123 SPRING LAKE ENTERPRISE CO., LTD. 春澤

Chipboard Screws, Thread Forming Screws...

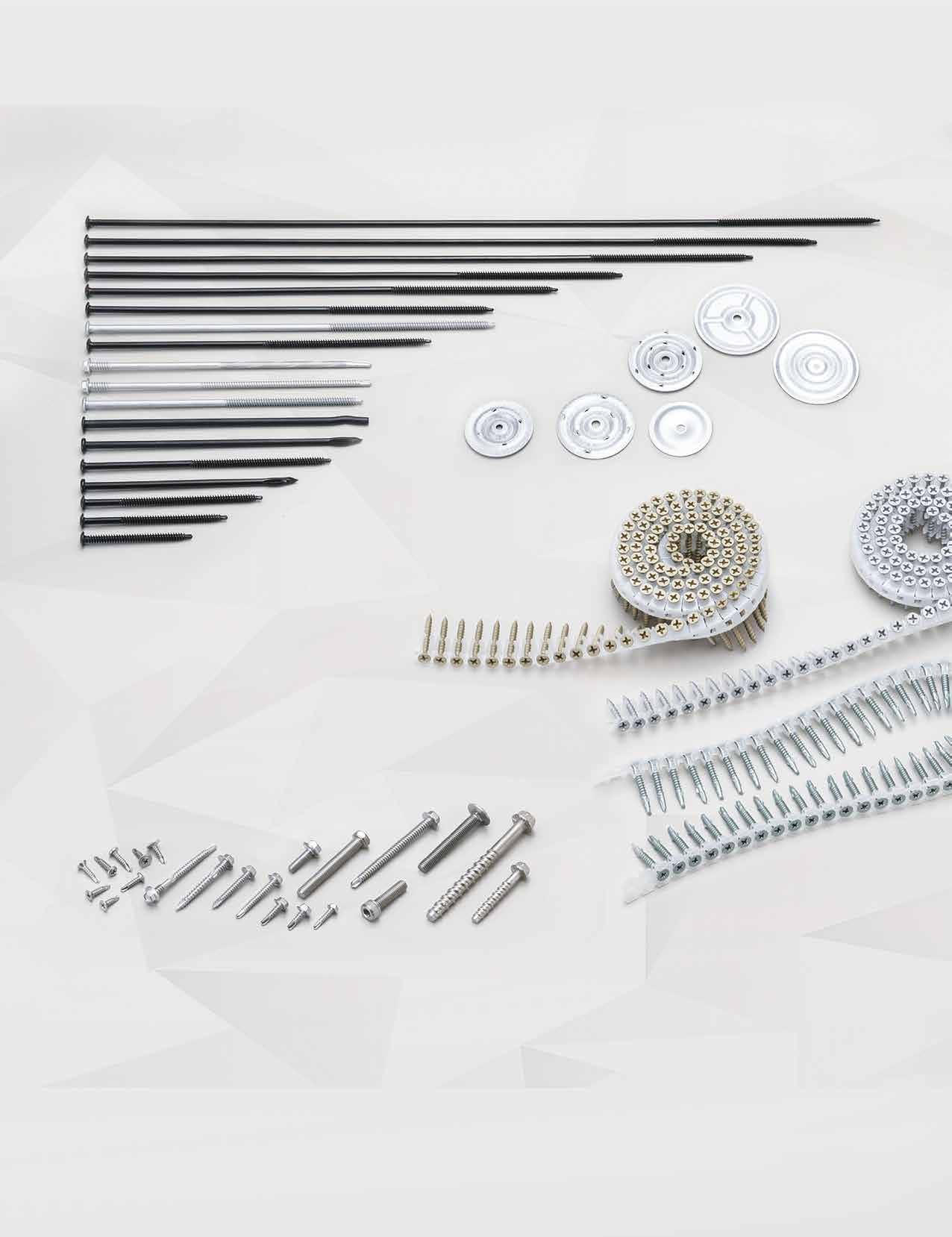

55 SUNCO INDUSTRIES CO., LTD. (Japan)

Distributor Specializing in Fasteners

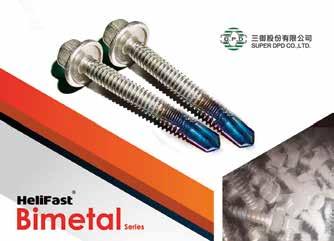

98 SUPER DPD CO., LTD.

All Kinds of Screws, Bi-metal Screws, Carbon Steel Screws...

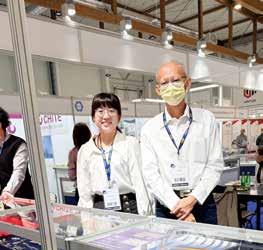

280 SUPREME FASTENER CORP. 至晟 Bolt & Screw, Special Fastener, Sems, Copper Bolt...

222 TAIWAN FASTENERS INTEGRATED SERVICE 全聯鑫

Bolts, Screws, Nuts, Precise Mechanical Parts, Stampings...

297 TAIWAN LEE RUBBER CO., LTD.

Bonded Washers, E.P.D.M. Vulcanized, Pipe Flashing...

95 TAIWAN PRECISION FASTENER CO., LTD.

Drywall Screws, Wood Construction Screws, Roofing Screws...

台力

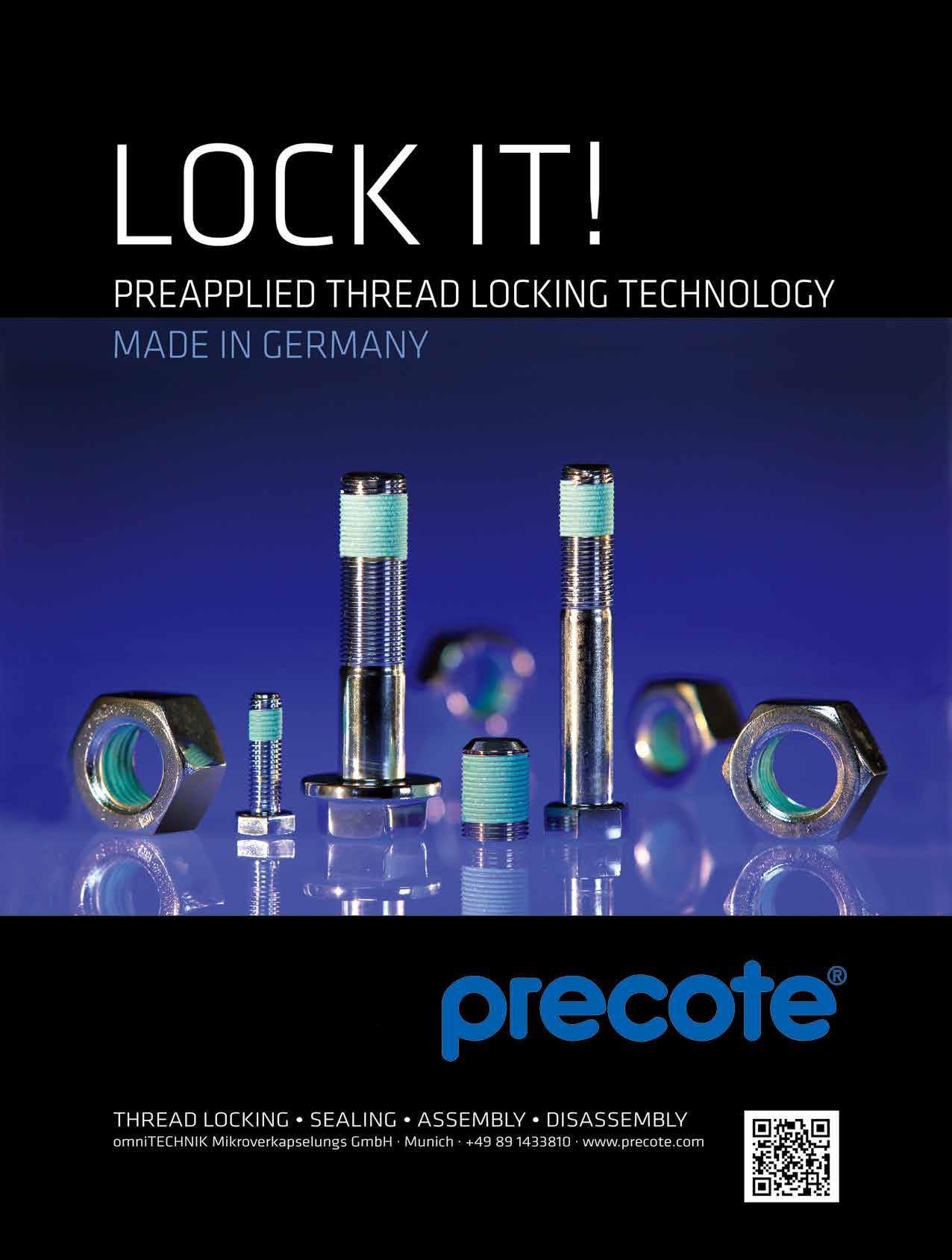

42 TAIWAN SELF-LOCKING CO., LTD. (TSLG) 台灣耐落

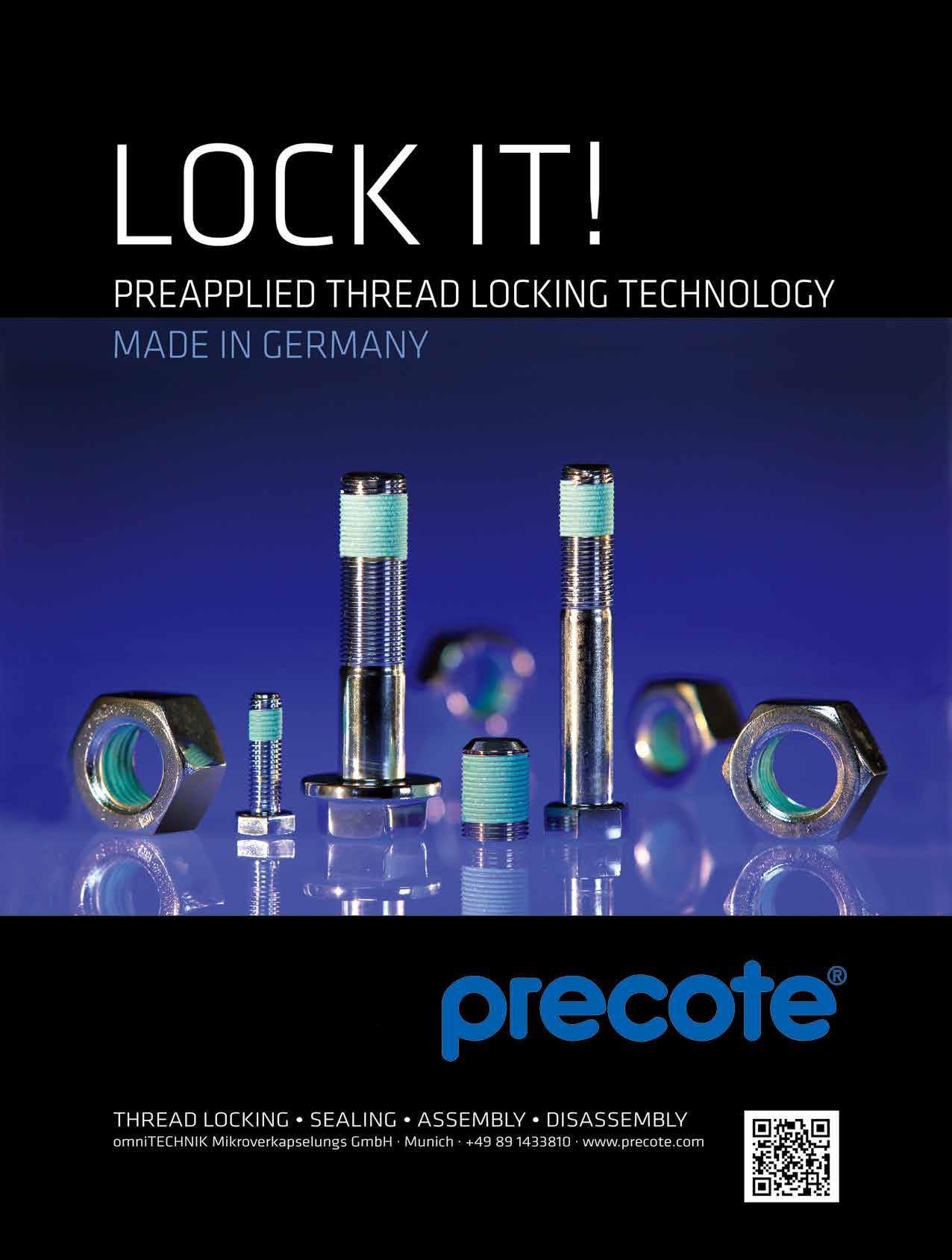

Nylok®, Precote®, Nycote®, Nyplas®, Loctite®...

158 TANG AN ENTERPRISE CO., LTD. 鏜安

Customized Automotive Parts and Special Fasteners

12 THREAD INDUSTRIAL CO., LTD. 英德

Chipboard Screws, Flange Nuts, Heavy Nuts...

153 THUNDERBOLT INDUSTRIAL CO., LTD. 雷霆 Combined Screws, Customized Special Screws/Bolts...

50 TONG HEER FASTENERS (THAILAND) CO., LTD.

Hex Bolts, Stud Bolts, Socket Cap Screws, Hex Nuts...

50 TONG HEER FASTENERS CO., SDN. BHD

Stainless Steel Metric Screws, Stainless Steel Screws...

18 TONG HWEI ENTERPRISE CO., LTD. 東徽

A2 Cap Screws, Button Head Socket Cap Screws...

51 TONG MING ENTERPRISE CO., LTD. 東明

Stainless Steel Fasteners, Wire Rods...

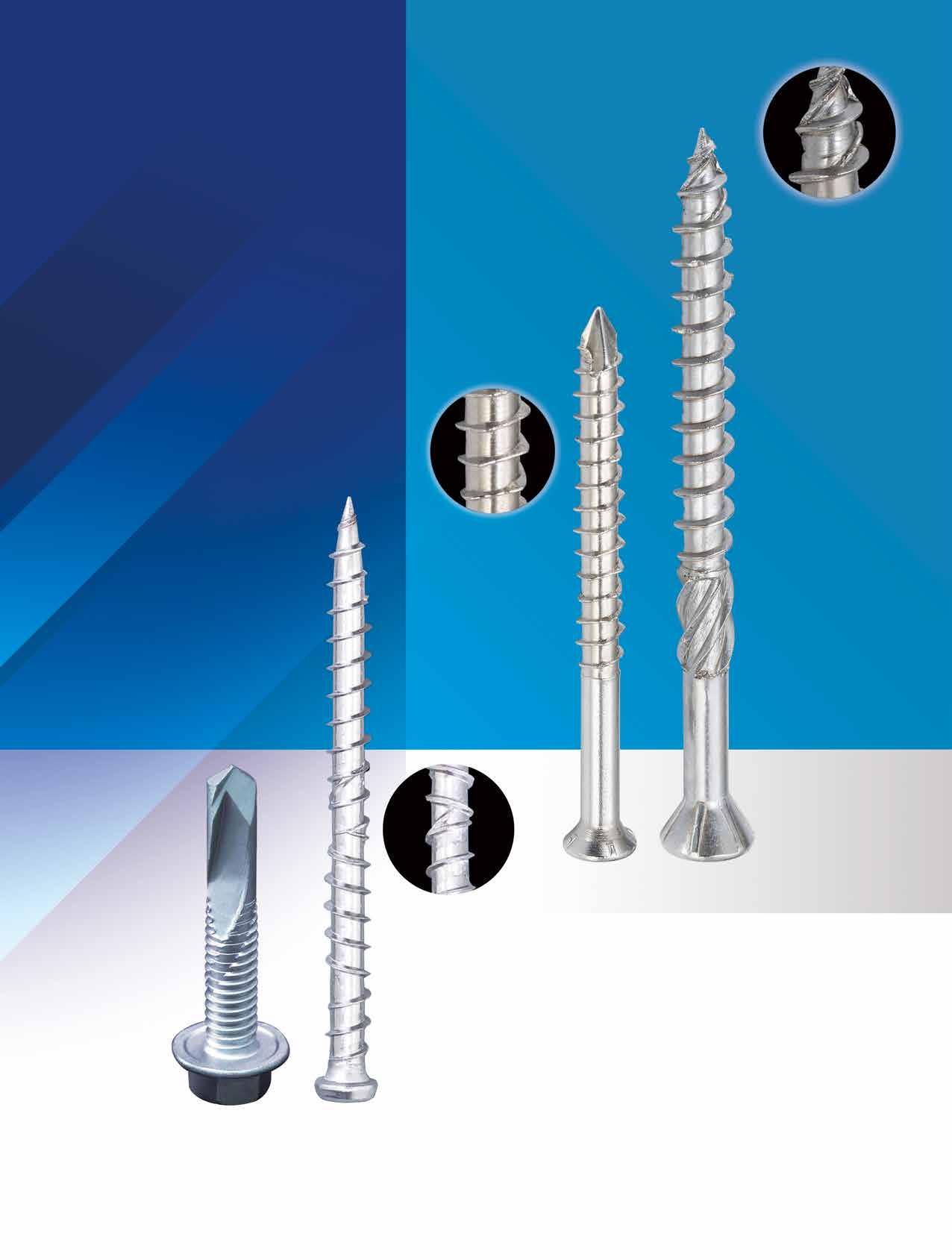

149 TSAE FARN SCREWS HARDWARE CO., LTD. 采凡

2 Cap Screws, Aircraft Nails, All Kinds of Screws...

116 TSENG WIN TRADING CO., LTD. 成盈

Ceiling Anchors, Cut Anchors, Drop-in Anchors...

154 U.S. FASTENER IMPORT & TRADING COMPANY (USA)

Standard and OEM Fasteners

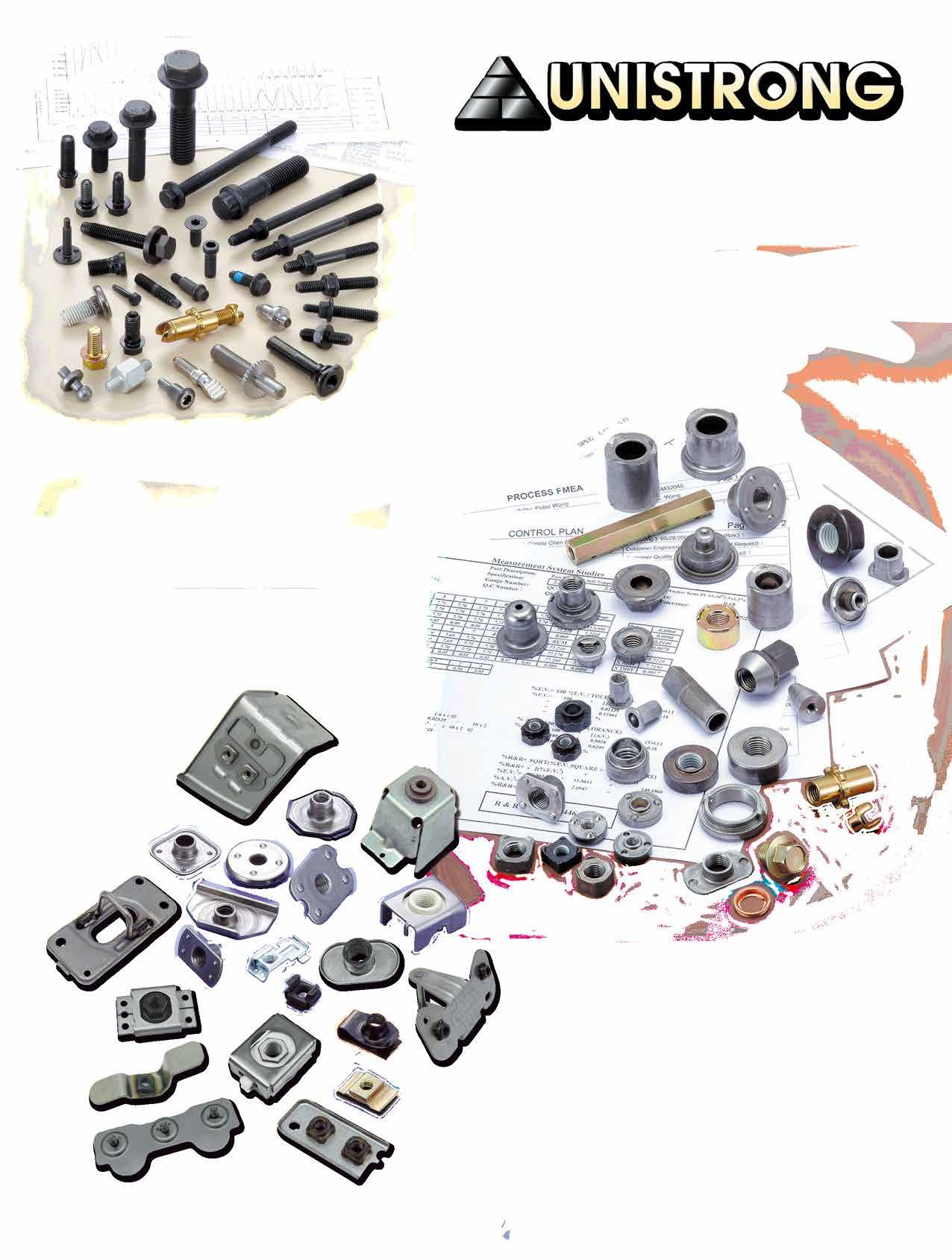

164 UNISTRONG INDUSTRIAL CO., LTD. 六曜

Retaining Nuts, Sleeve Nuts, Weld Nuts, Automotive Screws...

57 VERTEX PRECISION INDUSTRIAL CORP. 緯紘

6 Cuts/ 8 Cuts Self Drilling Screws, Barrel Nuts, Cap Screws

60 WE POWER INDUSTRY CO., LTD. 威力寶

Chipboard Screws, Concrete Screws, Drywall Screws...

265 WEI IN ENTERPRISE CO., LTD. 瑋瑩 Cone Nuts, Spacers, Special Nuts, Collars, Bushings...

185 WEI ZAI INDUSTRY CO., LTD. 葦在

Anchors, Automotive Nuts, Cap Nuts, Flange Nuts...

120 WEIMENG METAL PRODUCTS CO., LTD. 偉盟

Standard / Customized Parts, Machining Parts, Stamping Parts...

232 WEI-SHEN INDUSTRIAL FACTORY 維信

Split Rivets, Bifurcated Rivets...

225 WELLFLY ENTERPRISE CO., LTD. 瑋展

Automotive Fasteners, Turned Parts...

444 WILLIAM SPECIALTY INDUSTRY CO., LTD. 威廉特 Chipboard Screws, Concrete Screws, Drywall Screws...

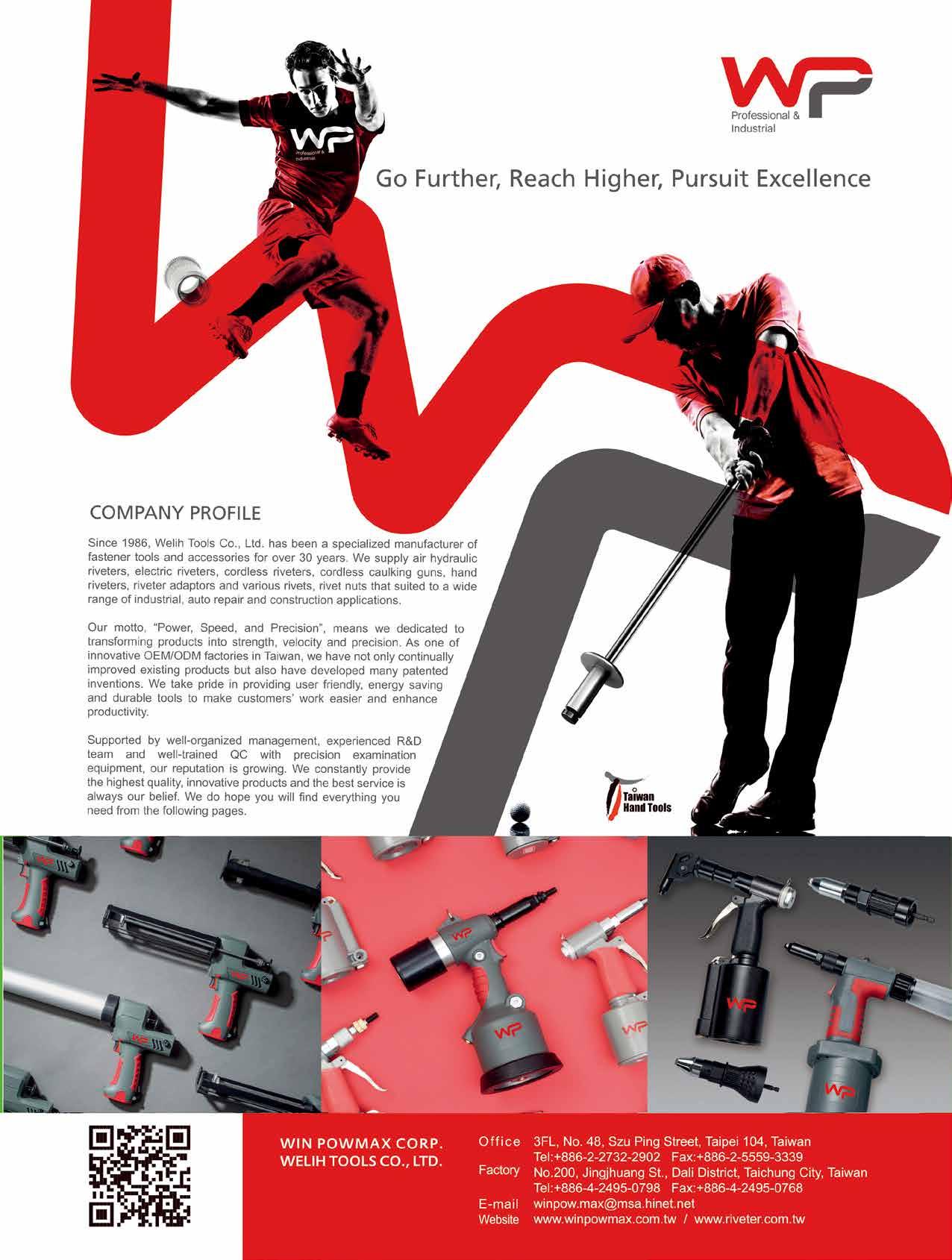

255 WIN POWMAX CORP. 優力克 Riveter, Grease Gun, Caulking Gun, Air Impact Wrench...

118 WINLINK FASTENERS CO., LTD. 岡山東穎

Stainless Steel Screws, Flange Bolts, Security Bolts, SEMS Screws...

311 WIZTECH FASTENER LTD. 創惠

Screws, Nuts, Machining Parts, Plastic Parts...

30 WYSER INTERNATIONAL CORP. 緯聯

Open-Die Parts, Automotive Parts...

291 YANGJIANG DE MENG HARDWARE CO., LTD. 得盟

Stainless Steel Screws, Bi-Metal Screws, Concrete Fasteners...

36 YI CHUN ENTERPRISE CO., LTD. 誼峻

Cap Screws, Socket Set Screws, Cage Nuts, Automotive Parts...

108 YI HUNG WASHER CO., LTD. 益弘

Rubber Washers, Plastic Screws, Custom Washers...

151 YING YI CO., LTD. 穎翊

Sems Parts, Special Nuts, Pressed Parts...

47 YOUR CHOICE FASTENERS & TOOLS CO., LTD. 太子

A2 Cap Screws, Bits & Bit Sets, Chipboard Screws...

450 YOW CHERN CO., LTD. 侑城

Flanged Head Bolts, Chipboard Screws, Floorboard Screws...

337 YU RUEN HARDWARE CO., LTD. 裕潤

Automotive Fasteners, Customized Nuts, Special Screws or Bolts

65 YUH CHYANG HARDWARE INDUSTRIAL CO., LTD. 鈺強

Automotive & Motorcycle Special Screws / Bolts...

126 YUN CHAN INDUSTRY CO., LTD. 雍昌

Bits & Bit Sets, Hex Keys, Nut Setters, Wrench Sets...

143 YUNG KING INDUSTRIES CO., LTD. 榮金

Pin, Retaining Ring, Clip, Washer, Spring Pins, Dowel Pins...

289 Z & D PLATING CO., LTD.

Precision Barrel Plating Finishes, Zinc & Zinc-Nickel Alloy...

159 ZYH YIN ENT. CO., LTD.

Euro Screws, Dowel Pins, Allen Keys, Confirmat Screws...

350 AN CHEN FA MACHINERY CO., LTD. 安全發

Straight Line Wire Drawing Machines with Computer Control...

349 BIING FENG ENTERPRISE CO., LTD. 秉鋒

Blind Nut Formers, Multi-station Cold Forming Machines...

344 CHIEN TSAI MACHINERY ENTERPRISE CO., LTD. 鍵財

Thread Rolling Machines

342 CHING CHAN OPTICAL TECHNOLOGY CO., LTD. 精湛

Eddy Current Sorting Machines, Fastener Makers...

370 CHUM YUAN CO., LTD.

High Speed Bolt Pointer

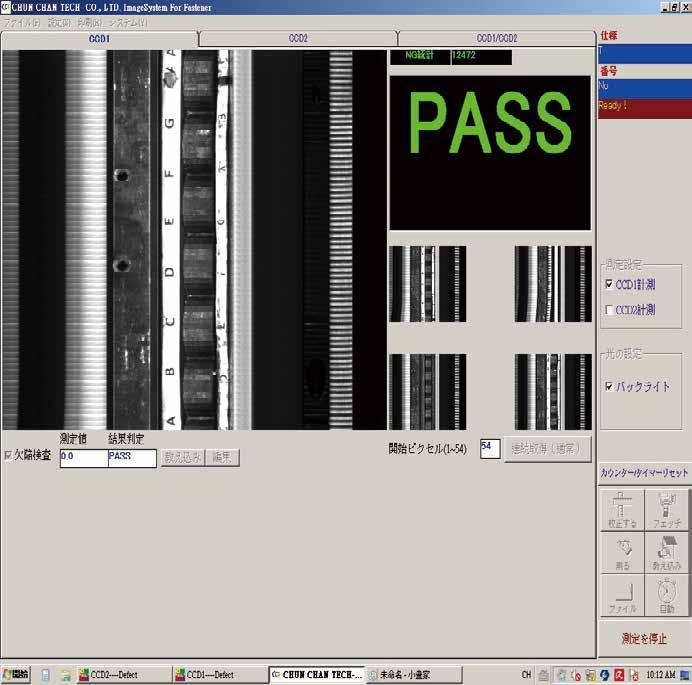

335 CHUN CHAN TECH CO., LTD.

Eddy Current Sorting Machine, Optical Measurement Instrument...

372 DAH-LIAN MACHINE CO., LTD. 大連

Fastener Maker, Thread Rolling Machines, Heading Machines...

358 E-UNION FASTENER CO., LTD. 奕盟

Conveyors, Thread Rolling Machines, Heading Machines...

382 GWO LIAN MACHINERY INDUSTRY CO., LTD. 國聯

Handstand Type Wire Drawing Machines, Non-Stop Coilers...

367 GWO LING MACHINERY CO., LTD. 國菱

Thread Rolling Machines, Slotting Machines...

353 HONG TAY YUE ENTERPRISE CO.,LTD. 鴻大裕

Wire Straighteners, Hydraulic Clamping Machines...

375 JAR HON MACHINERY CO., LTD.

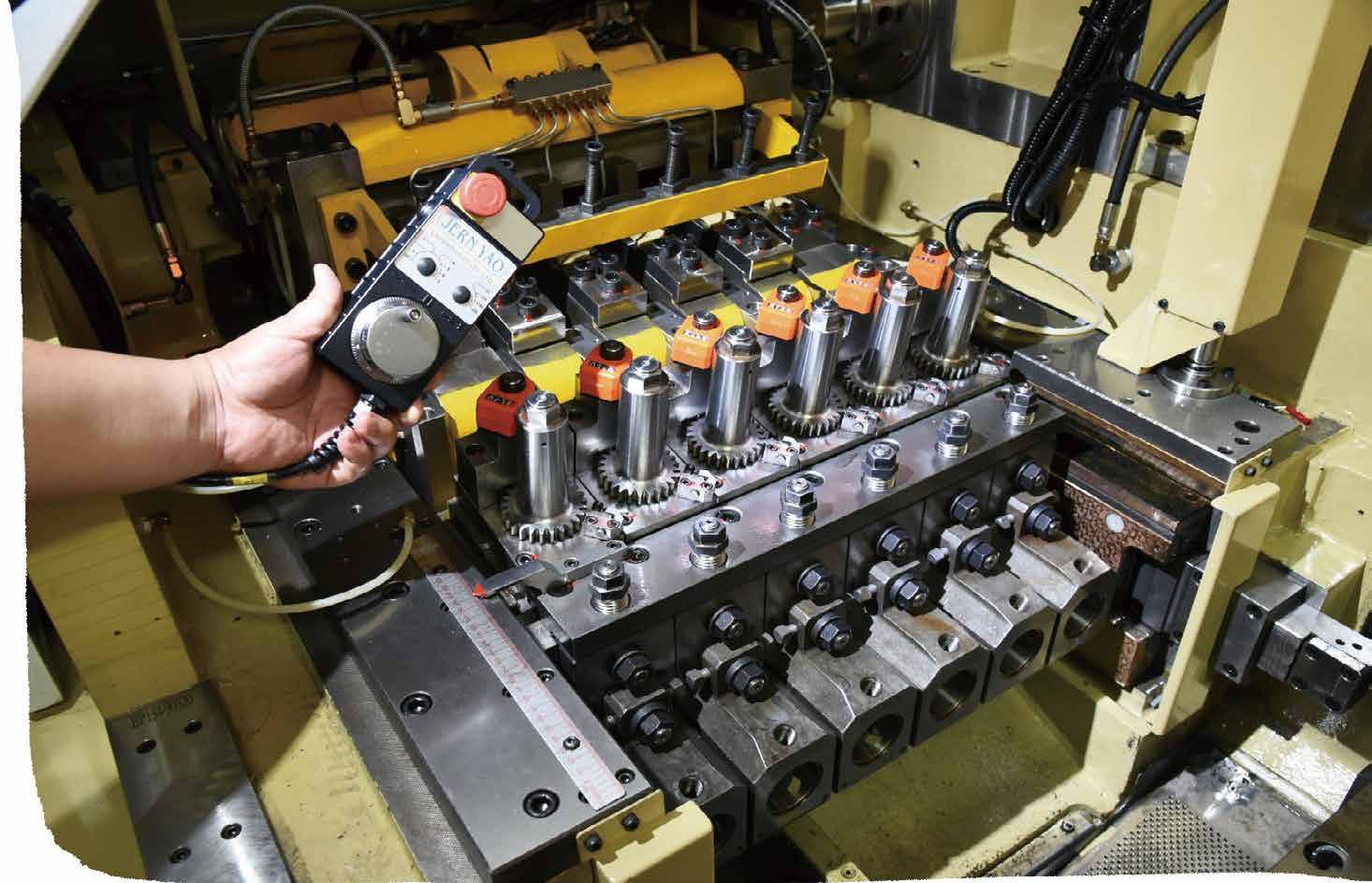

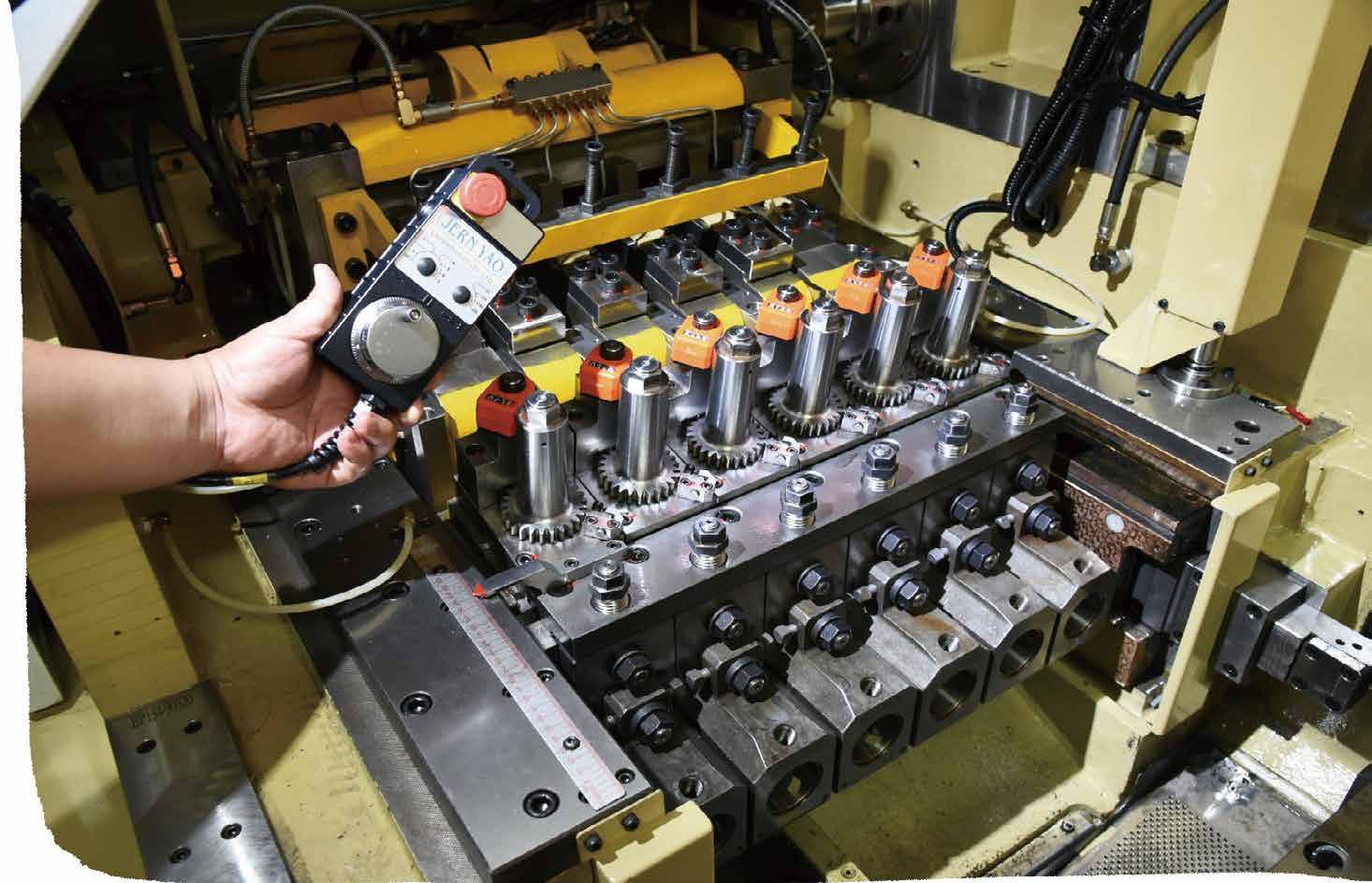

Assembly Machines, Nut Tapping Machines... 452 JERN YAO ENTERPRISES CO., LTD.

Multi-station Cold Forming, Parts Forming Machines...

380 JIE LE MACHINERY CO., LTD.

Consolidation of Artificial Intelligence Equipment 352 K. TICHO INDUSTRIES CO., LTD.

Nails, Screws, Bolts & Nuts Machinery…

KEIUI INTERNATIONAL CO., LTD.

Self-drilling Screw Forming Machines

KING SHANG YUAN MACHINERY CO., LTD.

Hydraulic Press for Lock Nut Notches & Fasteners Assembly

LI YUN MACHINERY CO., LTD.

Hot Dip Galvanizing, Machine Galvanizing...

LIAN SHYANG INDUSTRIES CO., LTD.

Automatic Cold Former, Nut Tapping Machines...

LIAN TENG MACHINERY INDUSTRY CO., LTD.

Cold Headers, Self-drilling Screw Forming Machines…

POINTMASTER MACHINERY CO., LTD.

Self-drilling Screw Forming Machines...

TZENG ENTERPRISE CO., LTD.

Forming & Tapping Oil for Bolts & Nuts

346 SAN YUNG ELECTRIC HEAT MACHINE CO., LTD. 三永

Mesh Belt Type Continuous Quenching Furnaces...

362 SHEEN TZAR CO., LTD.

Self-Drilling Screw Machines & Dies

238 SONG YI MACHINERY CO., LTD. 淞鎰

Spindle Tapping Machine, Thread Gauge Checking Machine...

364 SUN FAME MANUFACTURING CO., LTD. 商匯

Shank Slotting Machines, Screw Point Cutting Machine...

363 TZE PING PRECISION MACHINERY CO.,LTD. 智品

Open Die Machines, Cold Headers, Cold Forming Machines...

379 UNION MACHINERY CO., LTD. (KIM UNION) 金友聯

Thread Rolling Machine, Thread Rolling Dies...

381 UNIPACK EQUIPMENT CO., LTD.

Packaging/Labelling/Palletizing Machines...

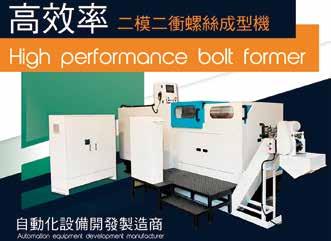

UTA AUTO INDUSTRIAL CO., LTD.

Blind Rivet Assembly Machine, Cable Clip & Nail Assembly Machine...

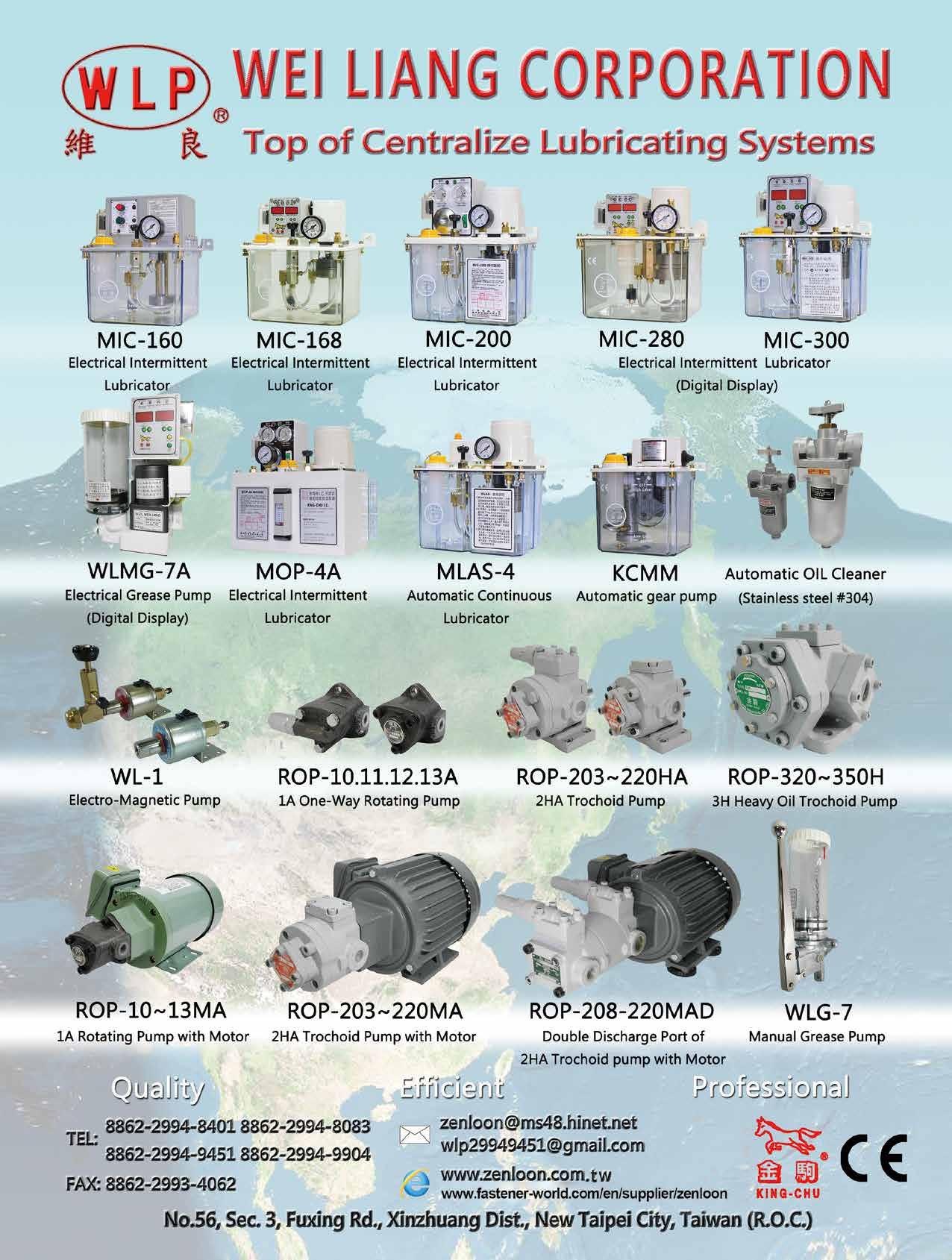

377 WEI LIANG CORPORATION

Centralized Lubricating Systems...

YESWIN MACHINERY CO., LTD.

Bolt Parts Formers, Multi-station Cold Forging Machines... 371 YIEH CHEN MACHINERY CO., LTD.

Thread Rolling Machine, Gears...

CHI NING CO.,

Machine, Nuts, Tooling...

GIAN-YEH INDUSTRIAL CO., LTD.

Rivet Dies, Self-drilling Screw Dies, Screw Tip Dies...

INFINIX PRECISION CORP.

Customized Punches and Dies 369 JIENG BEEING ENTERPRISE CO., LTD.

Forming Tool for Nut and Bolt, Dies, Molds...

KINGSYEAR CO., LTD.

Carbide Dies, Carbide Pins, Hex Recess Punches...

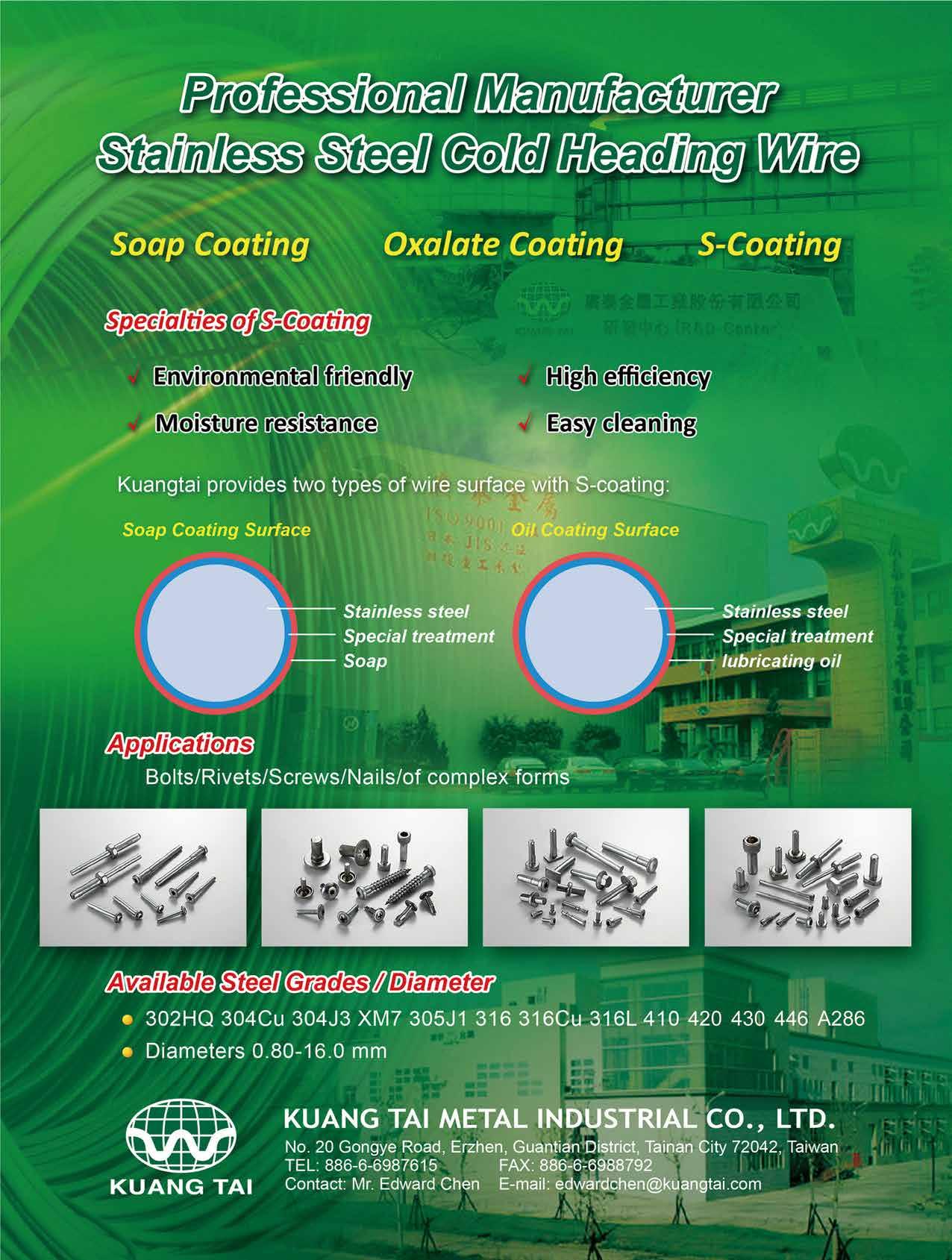

KUANG TAI METAL INDUSTRIAL CO., LTD.

Stainless Steel Cold Heading Wire

KUO CHEN MOLD CO., LTD.

Self-Drilling Dies 378 LU-YI DIE WORKS CO., LTD.

Drill Point Dies

359 TAIWAN INTERNATIONAL TOOL FORM LTD.

Nut Forming Dies, Tungsten Carbide Dies, Bolt Forming Dies... 355 TUNG FANG ACCURACY CO., LTD.

Carbide Pins, Carbide Dies, Polygon R-type Punches, Square Punches...

218 WAN IUAN ENTERPRISE CO., LTD.

Punches/Dies of Various Nuts, Screws, Sleeves and Socket Boxes

376 YUH HER PRECISION CO., LTD.

Drill Point Die, Self-Drilling Screw Die, Drill Point Forming Die...

Having served the fastener industry for 12 years, customers rely on U.S. Fastener Import & Trading Company (USFITC) to source, import, or export industrial fasteners, marine & rigging hardware, bearings, and aerospace & defense components. USFITC provides U.S. and global customers with screws, bolts, nuts, washers, anchors, springs, and custom parts sourced from its associate Taiwanese manufacturers. The company also acts as an authorized agent in the U.S. for Mizumoto Machine Mfg. Co., Ltd. (Japanese stainless steel chains and hardware producer), Jennweir Co., Ltd. (Taiwanese bearing supplier) and Elevate International (Taiwanese construction screws supplier). Strictly adhering to U.S. export control laws (incl. ITAR and EAR), USFITC’s export division procures fully-certified and traceable hardware (e.g. MS, NAS and AN parts) for approved international high-level end users in aerospace and defense sectors.

Based in California, most of USFITC’s sales focuses on domestic and international aerospace and defense sectors. Its strengths to rapidly source, manage, and deliver critical parts enable the team to better support growing demand for highly specialized U.S.-origin fasteners. Moreover, its expertise in sourcing hard-to-find and mission-critical aerospace and defense parts, as well as its efficiency, reliability, creativity, and a customer-centric mindset make it stand out from competitors.

“For sourcing industrial fasteners, we work closely with our Taiwan-based suppliers through clear communication, early alignment on requirements, and standardized processes. This coordination helps us cut lead times, ensure accuracy, and respond quickly to customer needs, making the sourcing process efficient and client-driven,” said USFITC President Vivian Chen.

USFITC works to offer clients the most suitable solutions to keep their projects moving forward. The company maintains an open attitude towards collaboration and expects to expand its role in aerospace and defense supply chains while continuing to support industrial and marine sectors.

Contact: Vivian Chen, President

Email: info@usfitc.com

From September 24 to 27, 2025, the 8th EFDA Conference took place at The Hotel Brussels, Belgium. This year's theme was "Shaping Tomorrow: Europe’s Fastener Distributor Industry in Motion," marking an important moment to reflect on the past and look forward to the future as the EFDA celebrates its 25th anniversary. Representatives from across Europe and the world gathered to discuss economic and political challenges facing the industry and future strategies.

EFDA President Mr. Andreas Bertaggia opened the conference stating, "This year's meeting is held in Brussels, Belgium, the heart of European political and regulatory affairs, which is highly significant. Since its founding in 2000, EFDA has connected fastener distributor associations and independent distributors across Europe to become an important platform for integrating industry interests." Bertaggia emphasized that this is a historic moment. Facing variable international trade policies including the CBAM, anti-dumping measures, and sanctions on Russia, EFDA has demonstrated strong coordination and adaptability by actively assisting members through working groups and committees to meet these challenges. He pointed out that EFDA does not merely react to changes but actively ensures that members can confidently respond to regulatory and market shifts, maintaining industry flexibility and competitiveness. Over the next 25 years, EFDA will continue to provide support and collaborative opportunities to bolster the resilience and growth of the European fastener distribution industry. Additionally, Bertaggia specially invited distinguished speakers from Europe, Asia, and the USA to share economic and political trends and chart a roadmap for the industry.

This conference was not only an event for industry exchange but also a platform for member companies to build cooperative networks and share the latest market information and policies. The conference included multiple working committee sessions and task force meetings, deeply discussing and practically applying the CBAM templates and anti-dumping measures. EFDA also provided members with regular updates and training to help them cope with increasingly complex regulatory requirements. Special networking dinners and cocktail parties were arranged to enhance member interaction and cooperation. Through these ongoing efforts, EFDA ensures the European fastener distribution industry moves steadily forward amid globalization and environmental changes.

The conference agenda featured keynote speeches and exchange sessions focusing on the impact of European and global economic and political situations on the fastener industry, and explored leadership and adaptability strategies for the future business environment. Key speakers and topics included:

Pozzi is CEO of the Agrati Group and a senior executive in the fastener manufacturing sector, focusing on advancing European manufacturing technology and international competitiveness. Topic: "Update on the European Fastener Manufacturers Industry."

Sam Potolicchio — Professor of Leadership and Political Communication at Georgetown University, USA, and President of the Preparing Global Leaders Forum

Dedicated to global leadership cultivation and organizational change.

Topic: "Leadership in a Globalized Economy: Navigating Complexity and Change."

Alexander Börsch — Chief Economist and Director of Research at Deloitte Germany

With expertise in European macroeconomics and geopolitical analysis, assisting organizations to grasp global trends and adjust strategies.

Topic: "Economic Outlook: Europe’s Geopolitical. And Competitiveness Challenges."

European Fastener Distributor Association, covering multiple national member associations and independent companies, with over 2,500 distributors and an annual turnover exceeding €1.5 billion.

Asociación de Distribuidores Españoles de Fijaciónes, a Spanish fastener distributors association with 12 members, focusing on promoting cooperation among importers and suppliers in Spain and improving adaptation to European standards and regulations.

British & Irish Association of Fastener Distributers, established for over 70 years, balancing interests between local manufacturers and distributors, with over 100 members actively addressing Brexit, anti-dumping, and CBAM challenges.

Fachverband des Schrauben-Großhandels e.V., a German fastener wholesale association, the largest fastener distributor group in Germany, covering most major wholesalers, focusing on anti-dumping and standardization, with a youth professional group named Young FDS.

Nederlandse Vereniging Van Importeurs van Bevestigingsmaterialen en Aanverwante Industriële Producten, a Dutch association for fastener and related industrial products importers, advocating free trade principles and actively participating in EU policy formulation.

Association des Distributeurs Français Spécialistes en Eléments de Fixations, a French fastener specialist distributor association, founded in 1987, promoting experience sharing and policy tracking within the French distribution market; also a founding member of EFDA.

Lúcio Vinhas de Souza —

Director of Economics Department and Chief Economist of BusinessEurope

With over 20 years of experience in EU economic policy and international cooperation, he focuses on European economic governance and industrial strategy. Topic: "The State of The Union: Where Does the EU Stand Economically and Politically?"

Arthur Chiang — Chairman of Taiwan Fastener Trading Association

Chiang leads the Taiwanese precision fastener manufacturing and trade community to promote industry consensus, strengthen technical exchange, and expand international markets, continuously enhancing Taiwan's industry competitiveness. Topic: "Current Status of the Taiwan Fastener Industry."

Unione Distributori Italiani Bulloneria, an Italian bolt distributors union, founded in 1976, providing a common voice for Italian fastener wholesalers, advancing industry policy and generational transition with a youth group UDIB YOUNG.

A subgroup established specifically for importers and distributors from European countries lacking a national distributor association, currently with 16 members from 8 countries, actively involved in EFDA affairs.

Since early this year, President Trump's tariff measures have dealt a heavy blow to the global economy, throwing global industrial supply chains including the fastener industry into disarray. The repercussions brought by the tariffs continue to reverberate among the industry. How do you assess the actual impact of the U.S. uncertain tariff policies on EU fastener manufacturers selling products to the U.S.?

The recent U.S. tariff measures (25% and now 50%) have certainly introduced a high level of uncertainty into the global trade environment, affecting industrial supply chains across many sectors, including fasteners. For European manufacturers exporting to the United States, these measures have created some challenges, particularly in terms of cost competitiveness and long-term business planning. Nevertheless, European manufacturers are renowned worldwide for their commitment to innovation, and reliability — values that continue to be appreciated by customers in the United States and across the globe. That said, the U.S. is not among the main export markets for EU fastener manufacturers. In the first eight months of 2025 (Source Eurostat), we observed a 2% decrease of EU27 exports of Fasteners (CN 7318) to USA vs the same period in 2024 (49.4 KTons to 48.3 KTons) showing the first signs of the impact of the U.S. tariffs in force. EU27 imports of fasteners from the United States also declined by 9% (from 8.2 K tons in January–August 2024 to 7.4 K tons in the same period of 2025).

We believe that open and fair trade remains the best foundation for sustainable industrial growth, and we hope that dialogue and mutual understanding will guide future policy decisions on both sides of the Atlantic

Amid the disruption caused by steel and aluminum tariffs, many manufacturers who previously focused their exports on the U.S. have shifted their business to other countries (particularly the EU) to avoid tariff impacts. Has this trend had any impact on the domestic sales market for EU manufacturers?

The redirection of exports toward the European market has created some additional competitive pressure for EU fastener manufacturers. As products originally intended for the U.S. market entered Europe, certain segments experienced higher supply levels and tighter margins.

However, the overall impact for the first eight months in 2025 on domestic sales has remained limited even if the first three import countries, China, Taiwan and Vietnam, increased relatively of 25,5%, 18,5%, 49% vs 2024. The European fastener market is serving industries such as automotive, construction, and machinery that rely on certified, high-performance products. This strong focus on compliance continues to protect European manufacturers from purely price-based competition. Moreover, many companies have successfully adapted by diversifying their export destinations and reinforcing their presence in the European market through innovation and service excellence. In this context, EIFI continues to work closely with European institutions to ensure fair competition and maintain a balanced market environment for all EU producers.

(Following Q2) Are local EU manufacturers taking any countermeasures or implementing strategies in response to increased market expansion efforts by overseas competitors in Europe?

European fastener manufacturers have reacted to the growing presence of overseas competitors by strengthening their strategic focus and enhancing their distinctive advantages. Rather than competing on price, many companies are investing in innovation, automation, and digitalization to improve efficiency and flexibility across their operations. At the same time, there is a clear shift toward specialization — developing advanced, high-performance, and customized fasteners that meet the strict technical and regulatory requirements of European industries. Sustainability has also become a defining priority, with manufacturers increasingly adopting low-carbon materials and circular production models to align with the EU’s Green Deal objectives.

Which industrial sectors currently represent the largest fastener demand market share and are of the greatest concern to EU manufacturers?

04 05

Within the European market, the largest share of fastener demand continues to come from the automotive, construction, and industrial machinery sectors, which together represent a substantial portion of total consumption. These industries are currently undergoing major transformations — from the electrification of vehicles and new mobility concepts to the push for energy-efficient buildings and advanced manufacturing technologies — all of which have a direct impact on fastener requirements. The energy transition is also creating new opportunities and challenges, particularly in renewable energy projects such as wind, solar, and hydrogen infrastructure, where fasteners must meet extremely demanding technical and safety standards. Additionally, aerospace and rail remain strategically important markets, requiring high-precision and certified components.

06

Beyond tariffs and CBAM, what other market factors do you believe are challenging the supply and demand of fasteners in the EU?

Beyond tariffs and the CBAM mechanism, several structural factors are currently influencing the balance of supply and demand in the European fastener market.

First, volatility in raw material and energy costs continues to affect production planning and pricing stability. Although conditions have improved compared to the peak of the energy crisis, uncertainty remains a concern for many manufacturers. Second, logistics and supply chain disruptions, partly linked to geopolitical tensions and transportation bottlenecks, have highlighted the importance of local sourcing, inventory flexibility, and stronger supplier networks within Europe. Third, the shortage of skilled labor and the need for continuous investment in digitalization and automation are shaping the competitiveness of the sector. Companies must balance efficiency gains with the ongoing need to train and retain qualified personnel.

Finally, sustainability and regulatory compliance are becoming central to every aspect of industrial operations. Meeting environmental targets while maintaining cost efficiency and global competitiveness is one of the defining challenges for the years ahead.

Earlier reports indicated that the EU

may consider adjusting the scope of entities required to report carbon emissions under the CBAM to target “only upstream major emitters (e.g., raw material suppliers)”, exempting downstream fastener processing plants with negligible carbon emissions from reporting obligations. Such an adjustment (if proved to be true) is expected to significantly reduce the burden of collecting carbon emission data for downstream processing facilities. Regarding this matter, do you have any recent official updates from the EU? What is EIFI's perspective and stance on this matter?

The latest revision of the Carbon Border Adjustment Mechanism (CBAM), aimed primarily at simplifying reporting and compliance obligations - particularly for small and medium-sized enterprises - is generally a positive step. However, it also risks creating a double standard within the European Union. While the European fastener industry continues to invest heavily in meeting the sustainability objectives set by legislators, the revised framework may allow the importation of products that do not adhere to equivalent environmental standards. Although the new regulation classifies the carbon footprint of fastener manufacturing as “negligible,” CO 2 emissions from fasteners produced using electric arc furnace steel can account for 30-40% of total emissions when considering the full production process - from annealing and cold forging to quenching, tempering, and coating. As one of the first downstream products integrated into CBAM, fasteners - comprising up to 99% steel - were rightly included in the mechanism given their essential role across numerous strategic sectors, including construction, automotive, mechanical engineering, energy, and defense. Maintaining CBAM coverage for downstream products in general, and for CN code 7318 (fasteners) in particular, would incentivize European manufacturers to further enhance the sustainability of their production processes and reduce emissions throughout the value chain. The European Industrial Fasteners Institute (EIFI) maintains that retaining the original inclusion of downstream products, as initially decided by the European Commission, is crucial to achieving EU climate objectives. Only through comprehensive and consistent regulation can the Commission ensure fair competition, strengthen European industrial production, and effectively advance the Union’s climate goals.

The “Fastener Poland” this year has just concluded, with many international exhibitors expressing optimism about the outlook for the European fastener demand market (particularly in Central and Eastern Europe). Do EU manufacturers or EIFI share the same view? Why?

Optimism surrounding the European fastener demand market in Central and Eastern Europe is driven by several key factors. These include significant government and EU investments in infrastructure projects (such as express roads, motorways, and strategic air bases), as well as a construction sector rebound supported by both national and EU-level programs like the NRRP and REPowerEU grants. Additionally, the expansion of major industries such as automotive and renewable energy continues to stimulate demand.

The region also benefits from its strategic geopolitical position and the EU’s focus on “strategic autonomy” and supply chain resilience, which have led to increased investments in domestic production capacity, local sourcing, and processing. These developments strengthen regional supply chains and bolster local manufacturing. Moreover, the ongoing adoption of advanced technologies - including IOT solutions and artificial intelligence - further enhances industrial efficiency and underpins the sustained growth in fastener demand across the region. At the most recent EIFI meeting in September, member confidence rose from 4.84 in September 2024 to 5.52 in the same month of 2025.

In what areas do you anticipate EIFI will engage in closer exchanges and cooperation with Taiwanese fastener industry in the future?

Both Europe and Taiwan are recognized for their innovation-driven fastener industries and their commitment to maintaining a reliable and transparent supply chain. The two regions have long fostered a fair and balanced partnership within the fastener sector and remain dedicated to upholding these principles in the future. In addition to its strong relations with Taiwanese fastener associations, the European Industrial Fasteners Institute (EIFI) has actively collaborated with the Taiwan Institute of Economic Research (TIER) to enhance mutual understanding of the EU’s Carbon Border Adjustment Mechanism (CBAM). This cooperation aims to support companies in both regions in effectively addressing the regulatory and operational implications of the CBAM framework.

EIFI just held its membership conference in Spain this past May. What other significant membership or international exchange events are scheduled next?

EIFI is preparing for its 2026 General Assembly, to be held in London, UK, from 21 to 23 May. This flagship in-person event represents the most significant gathering of the year. As in all previous editions, invitations will be extended to Fastener Associations worldwide. Over the past two years, the format of the open session of the Assembly has been structured to include a brief insight or update from each participating Organization, followed by a keynote focusing on a current and highly relevant topic for the fastener industry. Distinguished experts in fields such as geopolitics, automotive, construction, and economics will be invited to share their perspectives, providing valuable guidance to industry leaders and entrepreneurs in shaping their future strategic business decisions.

During 2026, EIFI will be hosting exclusive Members-only meetings for the Automotive and General Industry & Distribution Market Groups , along with dedicated events addressing key topics such as US tariffs, TDI, CBAM, and PFAS.

Looking ahead to 2026, we expect the European fastener market to demonstrate moderate but steady growth, driven by ongoing industrial modernization and the transition toward sustainable technologies. Sectors such as construction, renewable energy, and aerospace are likely to continue generating strong demand for fasteners that meet evolving technical and environmental standards. We anticipate that innovation, digitalization, and sustainability will remain key drivers of competitiveness. Companies that can combine efficiency with advanced engineering, environmental responsibility, and supply chain resilience are best positioned to succeed. While challenges such as material price volatility, regulatory pressures, and global competition will persist, the European fastener industry has repeatedly proven its adaptability and long-term resilience. Through collaborative initiatives, investment in new technologies, and a continued focus on quality and service, we are confident that the EU fastener sector will maintain its global leadership.

Since early this year, President Trump's tariff measures have dealt a heavy blow to the global economy, throwing global industrial supply chains including the fastener industry into disarray. The repercussions brought by the tariffs continue to reverberate among the industry. How do you assess the actual impact of the U.S. uncertain tariff policies on EU fastener distributors?

According to my calculations, the US imported around 13% of its total imports from the EU. I assume that the bigger portion comes from EU fastener manufacturers and a smaller portion of EU distributors. From this perspective, there is an impact on direct exports especially for the manufacturer. On the other hand the alternative for US importers to buy domestically are also somehow small. However, from an indirect perspective, where EU distributors sell to local OEM producers, the impact of tariffs is significant because those OEM producers may have a larger share of their turnover in US exports. Therefore, it will affect EU distributors as well in demand and price pressure as well.

Amid the disruption caused by steel and aluminum tariffs, many manufacturers who previously focused their exports on the U.S. have shifted their business to other countries (particularly the EU) to avoid tariff impacts. Based on your observations and available data, have there been any significant changes in the EU's fastener imports and exports since the implementation of these tariffs?

Currently, demand in the EU market is stable for the time being. The main sources are established, and prices generally remain at lower levels. If the economic outlook strengthens and demand rises, this may lead to increased sourcing opportunities, capacities, and competition. Ongoing changes in the supply market may influence future developments.

“Construction” and “automotive” have always been the major applications for fasteners globally. Could you briefly share the current demand status in the EU market for these two industry sectors?

The construction and automotive segments account for 40% of the EU fastener market in 2024. The construction sector appears to be stable, whereas the automotive sector is currently experiencing challenges due to various factors.

Beyond tariffs and CBAM, what other market factors do you believe are challenging the supply and demand of fasteners in the EU or creating additional business opportunities that everyone should start paying attention to?

Given current uncertainties, adaptability is crucial. With unpredictable geopolitical and economic shifts, regionalising suppliers and adopting multi-sourcing can help minimise supply chain risks. Meanwhile, some market segments continue to drive strong demand for fasteners, making agility, openness, and a positive mindset essential.

Earlier reports indicated that the EU may consider adjusting the scope of entities required to report carbon emissions under the CBAM to target “only upstream major emitters (e.g., raw material suppliers)”, exempting downstream fastener processing plants with negligible carbon emissions from reporting obligations. Such an adjustment (if proved to be true) is expected to significantly reduce the burden of collecting carbon emission data for downstream processing facilities. Regarding this matter, do you have any recent official updates or responses from the EU?

EFDA succeeded in persuading EU legislators to reduce the emissions relevant to CBAM to those emissions released during the production of precursors for fasteners. This means that emissions released during the production of the fastener itself will no longer be taken into account. This significantly reduces the administrative burden on fastener manufacturers outside the EU and should make CBAM somewhat easier to apply overall. The EU legislator has already made the fundamental decision in favour of this change. However, an implementing regulation from the European Commission is still required to specify the details.

At the writing of this interview outline, the trade show dedicated to fastener technology, Fastener Poland, was about to commence. Compared to the already mature fastener markets in Western Europe, what are your observations on the future prospects of the fastener markets in Central and Eastern Europe?

You are correct; compared to the mature and saturated market of Western Europe, Eastern Europe still has significant potential for increased fastener demand. Additionally, many factories continue to relocate production from Western to Eastern Europe.

Over the past few years, we have observed several major European fastener distributors enhancing their competitiveness by continuously expanding their market footprint across different sectors. This has been achieved through acquisitions of European peers or establishing operational bases in overseas markets such as Southeast Asia. What are your thoughts on this trend?

I completely agree—expansion is a natural strategy for market participants in any industry. Growth can be achieved through gaining market share, mergers and acquisitions, or both, and some even pursue vertical integration of their supply chain.

Besides the General Assembly that just concluded in Brussels at the end of September, what other significant membership or international exchange events has EFDA scheduled?

Following a highly successful 8th European Fastener Distribution Conference on 25–26 September 2025 in Brussels, attended by 120 guests, the focus will now shift to internal EFDA meetings. These include regular meetings of the EFDA Task Force, which primarily deals with ongoing anti-dumping measures such as the current antidumping investigation of the European Commission regarding imports of screws without head, including threaded rods, originating in the People's Republic of China, and other issues of international trade policy and the regulation of the supply chain. In addition, the EFDA CBAM Working Group meets very regularly to assist European fastener distributors with the implementation of CBAM, e.g. through the EFDA Template for Suppliers. The EFDA Assembly of Delegates is expected to meet in Amsterdam in autumn 2026. The 9th EFDA Conference is scheduled to take place in 2028 as this is a triennial conference. We will announce more details about this event at a later date.

At the beginning of the year, U.S. tariffs unleashed a heavy blow on the global economy, throwing industries worldwide including the fastener sector into turmoil. The repercussions continue to reverberate to this day. Chairman Chiang believes, “Under Trump's tariffs, although Taiwanese manufacturers haven't raised their quotes, U.S. customers are being forced to increase their selling prices. This may appear to boost manufacturers' profits, but whether consumers will accept the costs being transferred to them remains uncertain. Trump's tariffs were originally intended to encourage manufacturing to return to the U.S., but at this stage, the U.S. lacks sufficient skilled workers to meet the demand. Ultimately, it still needs to rely on foreign supply chains.” In the short term, orders from the U.S. to Taiwan have decreased. However, with the Thanksgiving shopping season arriving in Nov./ Dec. and the outcome of U.S.-China trade negotiations expected to be largely finalized by then, the market is projected to become clearer after January 2026. Furthermore, U.S. clients must maintain sufficient inventory to meet future production demands. Potential interest rate cuts by the Federal Reserve could stimulate consumer spending on automobiles and housing, indirectly boosting demand for fasteners. Taiwanese manufacturers need not be overly pessimistic.” However, Chairman Chiang cautioned that many European and U.S. businesses have recently gone bankrupt due to the ripple effects of tariffs, emphasizing the need for heightened vigilance regarding customer creditworthiness.

In 2025, Taiwan's fastener industry faces significant external challenges including U.S. tariffs, exchange rate fluctuations, rising raw material and energy costs, customer order cancellations, and the Carbon Border Adjustment Mechanism (CBAM). Internally, it grapples with a shortage of young workers, who are flocking to high-tech industries while showing little interest in basic precision industries like fasteners. This trend has led to labor shortages and a gap in the succession of skilled technical personnel. Businesses with weaker financial foundations have suffered significant setbacks amid these waves of shocks, and are reportedly resorting to measures like “working 4 days and taking 3 days off” to navigate the current difficulties. This situation has also raised concerns among many fastener manufacturers if Taiwan's fastener industry can weather these challenges and maintain its competitive edge in the future. Accordingly, TFTA Chairman Arthur Chiang shared his observations and insights on the industry's current state. He urged the government and relevant agencies to address the competitive challenges facing Taiwan's fastener industry and formulate more long-term, concrete industrial development policies to serve as the strongest backing for businesses. He noted, “Government officials must shift their mindset, for without fasteners, smartphones cannot be assembled, cars cannot hit the road, planes cannot take flight, skyscrapers cannot rise, and future humanoid robots certainly cannot be built! All these rely on Taiwan's robust technology and talent to develop and realize. We urge the government not to pour all resources into TSMC, for the fastener industry is the very root of sustainable industrial development.”

Regarding exchange rates, the New Taiwan Dollar (NTD)'s sharp appreciation earlier caused significant hidden losses for fastener manufacturers. Chairman Chiang noted, “Exporters generally quote prices based on contracts, with many orders shipping months later. If the currency appreciates rapidly in a short period, it inevitably inflicts heavy losses on businesses.” Although the exchange rate has stabilized now, the recent surge where the NTD climbed from 31 to 29 against the USD within days has eroded the meager profits many manufacturers had left. Currently, Taiwanese businesses are not only relying on clients reducing orders to minimize foreign exchange losses, but are also actively implementing measures such as rotating shifts, adopting a four-day workweek with three days off, or scaling back production line operations to cut operational costs.” In the long run, Chairman Chiang believes. “As long as manufacturers can mitigate the impact through flexible production line adjustments, development in 2026 will remain promising. Beyond providing financial support to manufacturers, the government must also delve into the root causes of why companies are failing to secure orders and devise truly fundamental solutions.”

Taiwanese manufacturers have long sought to enhance their competitiveness, yet persistently high raw material costs compared to competitors remain an unresolved challenge. The persistently elevated wire prices from Taiwan CSC consistently place manufacturers at a disadvantage from the outset in terms of production costs. Chairman Chiang stated, “Carbon steel raw materials are estimated to account for 45-50% of manufacturers' production costs, with stainless steel representing an even higher proportion. Currently, wire rod costs in Taiwan are 20-30% higher than in China. Coupled with official subsidies for Chinese steel mills, Taiwanese manufacturers simply cannot compete. We do not wish to see Taiwan CSC sustain long-term losses due to price reductions, however, if Taiwan Power Company can receive government subsidies, why shouldn’t it be possible for Taiwan CSC to receive similar support? The government often encourages businesses to explore new markets, but if manufacturers are significantly disadvantaged in raw material and labor costs, where is their competitive edge? Not to mention that during economic downturns, customers may switch to other suppliers to reduce costs.”

While

and

the

Taiwan's fastener industry has long dominated the global market with its superior quality, outstanding technology, and comprehensive customer service. Many product technologies have undergone decades of refinement and development, achieving significant advancements. In his keynote address at this year's EIFI and EFDA member conferences in Europe, Chairman Chiang specifically highlighted several advantages of sourcing fasteners from Taiwan, including consistently superior product quality that avoids “troublesome” issues, FedEx-like delivery efficiency, and fully accountable customer service. This reflects the mutual trust and collaborative synergy cultivated over many years between Taiwanese suppliers and their global clients. Chairman Chiang also highlighted a looming concern regarding the succession of industrial technology in Taiwan. He noted that “under the government's vigorous promotion of high-tech industries, basic precision industries like fasteners have been neglected. The expertise in these basic precision industries requires long-term cultivation and accumulation. Once the current generation of master craftsmen in their 40s and 50s, who possess mature skills, retire, a talent gap may emerge.” As high-tech professionals constitute only a minority

among Taiwan's workforce, if the government can guide the majority of non-high-tech workers toward basic precision industries, these sectors will avoid facing a shortage of successors.”

Manufacturers aiming to expand exports must understand that securing orders is only the beginning. They must also grasp their customers' true needs and priorities- an area where trading companies can provide invaluable support. Chairman Chiang stated, “Beyond possessing extensive knowledge of product technology and industry trends, traders must also have the communication skills and experience to engage with clients effectively. This enables them to help manufacturers uncover new market opportunities. Currently, TFTA is actively engaging with agencies such as the Industrial Development Bureau (IDB). We hope to leverage official resources such as regularly produced market reports to assist businesses in identifying expansion targets and broadening the marketing reach of Taiwanese fasteners beyond traditional markets like Europe and the U.S. to emerging markets.” Chairman Chiang believes that for Taiwan to survive amid fierce competition from numerous rivals, it must take more proactive and forward-looking actions; otherwise, it will merely amount to empty sloganeering.

The current issue with CBAM is that no clear information has been released regarding which entity will handle reporting and certification. It remains undecided whether the EU will designate a specific body or authorize other certification bodies. Previously, EFDA proposed to the EU that reporting requirements should be limited to upstream raw material suppliers of major emitters, but this matter also remains unresolved and awaits further announcement from the EU. Chairman Chiang believes, “Although supporting details remain to be announced, carbon reduction is an inevitable path for the industry's future. Manufacturers can pursue various green certifications such as ISO 14000 or 14064 to achieve cost reduction objectives. On the other hand, this also grants them priority when clients select partners, creating a competitive edge for themselves. Additionally, with ample time remaining before the CBAM formally imposes taxes in 2027, businesses can leverage government resources to proactively prepare for automation upgrades and transformation. We also encourage second-generation successors with innovative perspectives to engage in dialogue with government agencies and academic institutions, working together toward shared industrial development goals.”

(

✽ To promote networking among association members, TFTA will hold its members meeting at Queena Plaza Hotel in Tainan on December 12, 2025.)

Under the leadership of CEO Christian Reich, the U.S. division achieved exponential growth of over 3,500% within 5 years by providing high quality products, responsive service, and efficient delivery.

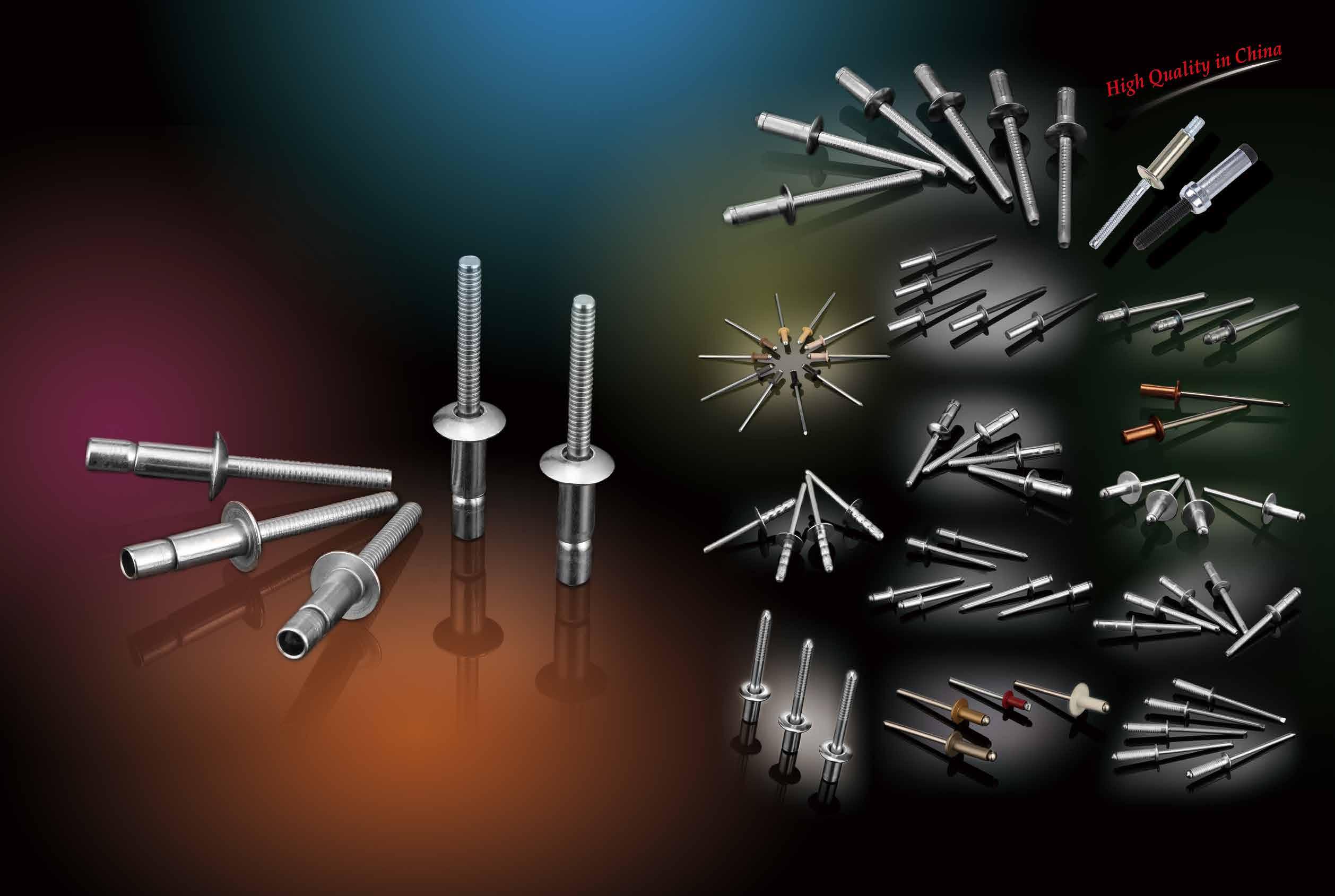

Founded in 1979 and globally headquartered in Erkrath, Germany, Goebel GmbH has grown into a global leader in fastening technology with subsidiaries in The Netherlands, Poland, the UK, France, China, and the U.S. Its product portfolio includes blind rivets, self-tapping/self-drilling screws, sealing washers, drill bits, nut drivers, toggle latches, hand & power tools, PPE equipment, and many more innovative specialty products. Currently in its 2nd generation, Marcel Goebel leads the Goebel Group through innovation and quality, his son Elias Goebel, 3rd generation, oversees R&D and the new reshored German factory that launched in 2024, the company continues to strengthen its global footprint through innovation and sustainable manufacturing. In efforts to expand the key North American market, Goebel Fasteners, Inc. serves as the U.S. HQ and distribution center which was established in Houston, Texas in 2016. Today, Goebel's products are distributed worldwide, serving industries such as oil & gas, automotive, HVAC, railroad, aerospace, telecommunications, construction, and so on.

Goebel’s success is rooted in its ability to identify market gaps and engineer innovative fastening solutions that meet evolving industry demands. Its patented G-Grip T304 Stainless Lockbolt System revolutionized fastening in the truck and trailer market,

while its 318LN Duplex Closed-End Rivets—made from corrosion-resistant 316L and 318LN stainless steel are ideal for offshore applications. The company has earned multiple ISO Innovation Awards for its bi-metal selfdrilling and self-tapping screws. Looking ahead, Goebel is developing a complete line of lockbolts in aluminum, steel, and stainless steel especially designed for the heavy truck, agriculture, solar, telecommunications, metal fabrication, and many other demanding sectors. With the ISO 9001 certification and full compliance with REACH, RoHS, and PROP65 regulations, Goebel maintains the highest global standards of quality and safety.

The company’s outlook for 2026 remains highly optimistic, as the U.S. blind rivet market continues to present significant opportunities for growth. Simultaneously, Goebel’s partnerships with key industry manufacturer reps across multiple territories have increased market share and brand awareness. These collaborations enable Goebel to reach new customers efficiently, expand its distribution network, and continue building market share in North America.

What distinguishes Goebel from its competitors is its commitment to quality, customer service, and innovation. Few companies in the fastener industry offer the same combination of technical excellence, global reach, and product diversity. Goebel’s philosophy centers on rapid response and customer satisfaction—its global operations maintain over US$10 million worth of inventory in stock at all times and support same-day or next-day shipping to ensure seamless supply chain reliability. The company also invests heavily in marketing support for its partnered distributors, offering rich technical resources, 3D CAD video models, and digital product visualization tools that strengthen brand engagement. By continuously developing new cordless fastening tools and expanding stock availability, Goebel demonstrates its forwardthinking approach to industry efficiency and customer needs. As “The Leading Rivet Source”, Goebel Fasteners is not only redefining fastening technology but also setting new benchmarks for performance, reliability, and partnership across global markets.

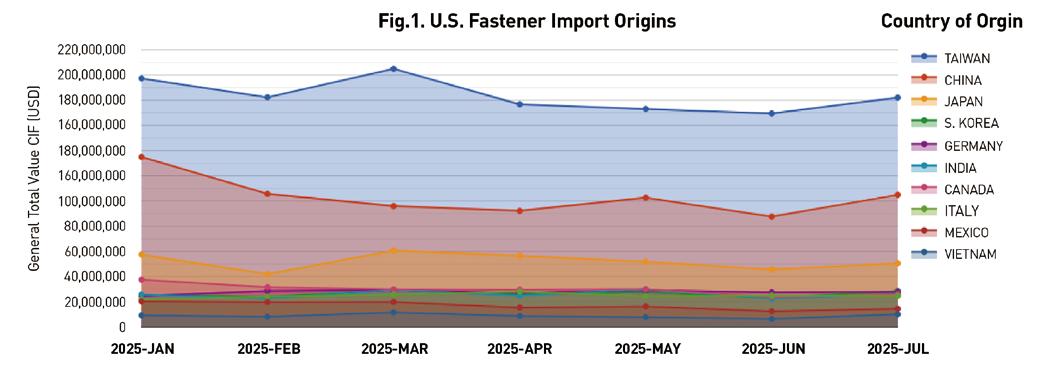

Data note:

The data for this article is derived from the US Census trade statistics. US Census trade statistics analyze imports and exports across all modes of transportation. That value is calculated in USD by general CIF for imports. Fasteners in this article are defined as any product under HS Code 7318 (screws, bolts, nuts, coach screws, screw hooks, rivets, cotters, cotter pins, washers and similar articles or iron or steel) and all subsequent HS codes including 731815, 731816, 731814, 731829, 731822, etc.

In 2025, the U.S. fastener industry finds itself navigating the continuing impact of steel and aluminum tariffs, a key element of trade policy initially implemented to safeguard domestic metal production. While originally aimed at addressing global overcapacity and national security concerns, the tariffs led to significant shifts in sourcing and pricing strategies throughout the manufacturing sector.

Under the Trump administration, these tariffs have not only remained in place but have been selectively expanded in 2025 to cover a broader array of derivative products, including more components essential to the fastener industry. Unlike the initial rollout of tariffs in 2018 which were met with widespread

pushback and exemption requests, the 2025 adjustments have been more targeted aiming to address persistent trade imbalances and reinforce domestic supply chain resilience in response to ongoing geopolitical and economic pressures.

Utilizing comprehensive U.S. Census data, this article examines the import dynamics of fastener classified under the Harmonized System (HS) code 7318 which encompasses screws, bolts, nuts, rivets, washers, and related items. Import trends from the first seven months of 2025 reveal how ongoing tariff enforcement is shaping trade flows and influencing procurement decisions in the U.S. fastener market.

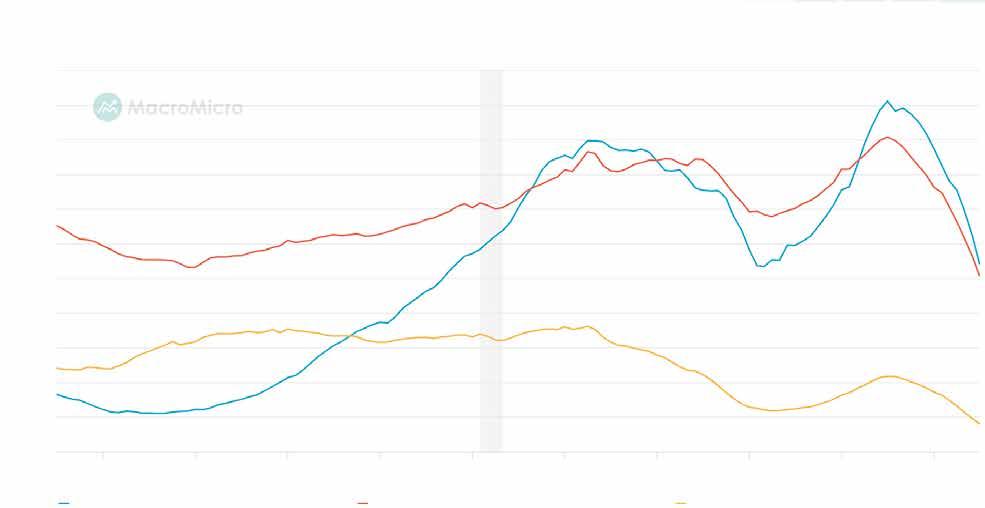

Taiwan has consistently held its position as the top fastener trading partner of the United States throughout 2025 (Fig. 1), supplying over 30% of the total fastener import value in U.S. dollars (USD) each month. This sustained dominance underscores Taiwan’s integral role in the U.S. fastener supply chain, particularly in the face of shifting global trade dynamics and tariff adjustments.

Trailing Taiwan is China, which has experienced a notable decline in its share of U.S. fastener import value. In January 2025, China accounted for approximately 22% of total fastener imports by value (USD). However, this dropped to 19% in February and further to 16% in March. While Chinese export values leveled off in subsequent months, modest rebounds were observed in May and July. Despite these upticks, the overall trend from January to July reflects a nearly 23% decrease in the value of fasteners exported from China to the U.S., suggesting an ongoing strategy of the U.S. to shift away from Chinese suppliers.

Mexico has followed a similar trajectory. By July 2025, the value of fastener exports from Mexico to the U.S. had decreased by almost 29% compared to January levels. These contractions in total import value from China and Mexico signal a broader trend: U.S. companies are diversifying their supplier base at an accelerated pace, seeking sources in countries with lower tariff burdens and more competitive pricing.

Among the beneficiaries of this diversification are South Korea and Germany. South Korea increased its fastener export value to the U.S. by 12% in July compared to January 2025, showing a steady rise in market share. Likewise, Germany recorded a similar 12% growth over the same period, reflecting growing interest in European sources with stable trade conditions and high-quality production standards. These shifts indicate that the U.S. fastener industry is actively recalibrating its import strategy in response to evolving trade policy and economic pressures.

The ongoing evolution of U.S. tariff policy in 2025 appears to be a driving force behind these trade shifts. The expanded enforcement of Section 232 tariffs on steel and aluminum products, along with derivative goods, has likely contributed to reduced import volumes from countries like China and Mexico, where the cost impact of these duties may be more pronounced. These tariffs not only raise the landed cost of fasteners but also incentivize U.S. buyers to explore more favorable sourcing options in tariff-exempt or lower-duty regions. The relative increase in imports from countries such as South Korea and Germany, two countries known for their high-quality manufacturing and favorable trade terms, suggests that tariff policy is actively influencing procurement behavior and accelerating diversification strategies across the U.S. fastener supply chain.

Within the broader 7318 HS category, several key subcategories dominate the U.S. fastener import landscape by value (Table 1). Threaded screws and bolts, classified under 731815, consistently account for the largest share, representing approximately 43% of the total monthly import value in USD throughout 2025. This subcategory has remained the most stable performer month over month, underscoring its foundational role in U.S. manufacturing and construction sectors. Threaded nuts of iron or steel, categorized under 731816, follow with a substantial share ranging between 20% and 22% of the monthly import value. Self-tapping screws (731814) rank closely behind, contributing roughly 18% to monthly totals, making these three subcategories the primary drivers of U.S. fastener imports in terms of value.

“Fastener

However, when comparing import values from January to July 2025 across the top 10 subcategories under 7318, all but one showed year-to-date declines. Among the most notable were subcategories 731822 (other washers) and 731823 (rivets), which experienced significant drops of approximately 20% and 21%, respectively. These reductions suggest shifting demand or sourcing disruptions potentially linked to cost increases, tariff exposure, or supply chain realignment.

The only subcategory to record growth during this period was 731812 (other wood screws), which posted a nearly 10% increase in July compared to January. This upward movement may reflect increased demand for corrosion-resistant or specialized fastening solutions in sectors like automotive, infrastructure, or energy, where stainless steel components are critical.