familiesonline.co.uk Families Suffolk: Issue 69 1 Issue 69: January/February 2023 familiesonline.co.uk FREETAKEMEHOME IN THIS ISSUE Clubs & Classes Family Law Education Family Health & Wellbeing Find out how you can get help to buy food and milk with the healthy start scheme.

Wear A Hat Day, an iconic and fun annual event, is one of the UK’s most popular and familyfriendly charitable fundraisers and it’s happening again on Friday, 31 March!

Running for more than ten years, this event raises millions for vital research into brain tumours – the biggest cancer killer of children and adults under the age of 40. Wear A Hat Day events help children explore their individuality and creativity, whilst learning to work together and think of others – in a really fun way.

Participation fosters friendships, creates better local and school communities, offers unique learning opportunities and provides new ways for children to explore ideas around different life experiences, all while giving hope to brain tumour patients and their loved ones.

Join this event, as a family or by persuading your local school to take part. Register now for more information and your FREE fundraising pack. Just use the quick and easy webform at www.wearahatday.org

Families Suffolk: Issue 69 familiesonline.co.uk 2 Volunteers Could you offer support and friendship to a Suffolk family? Urgently need more Scan the QR code for more information www.homestartinsuffolk.org | 01473 621104 Join our incredible community of more than 280 volunteers and make a difference to a family in your local area Our volunteers support Suffolk families through weekly home visits, telephone and video calls or supporting one of our regular group sessions Full training is provided Do something amazing in 2023... Be a volunteer A BETTER FUTURE STARTS HERE JUST DON’T FORGET YOUR HATS Help young minds thrive, fund vital research, and give hope to those in need. GET INVOLVED www.wearahatday.org Brain Tumour Research Registered charity number 1153487 (England and Wales) SC046840 (Scotland) Friday 31st March 2023

WEAR

FOR A BETTER FUTURE!

A HAT

EDITOR: Stacey Phillips

T: 07951 946736 E: editor@familiessuffolk.co.uk

Design: Stacey Phillips

Printed by: Buxton Press Next Issue: March/April 2023

Welcome

Welcome to our first issue of 2023, I wish you all a very happy and healthy new year.

Within this issue you can find out what Britten Pears Arts will be offering families and young people this year at The Red House in Aldeburgh and Snape Maltings. The Red House were also awarded Family Museum of the Year in 2022, so would highly recommend planning a visit there this year.

We also have some helpful mortgage advice in our Family Finance feature and our Family Law feature looks at the legal rights of cohabiting couples.

I hope you enjoy this new issue, and please do follow us on Facebook to stay up to date with more information and local event listings.

Best Wishes

Stacey Phillips

familiesonline.co.uk Families Suffolk: Issue 69 3

CONTACT US:

IN THIS ISSUE: Issue 69: January/February 2023 familiesonline.co.uk FREETAKEMEHOME IN THIS ISSUE Clubs & Classes Family Law Education Family Health & Wellbeing Get help to buy food and milk with the healthy start scheme To subscribe to our FREE online edition, please visit: www.bit.ly/2XolhJe. PRINT DISCLAIMER: Families Suffolk Magazine is part of Families Print Ltd, a franchise company. Families is a registered trademark of LCMB Ltd, Remenham House, Regatta Place, Marlow Road, Bourne End, Bucks SL8 5TD. The contents of this magazine are fully protected by copyright and none of the editorial or photographic matter may be reproduced in any form without prior consent of Families Print Ltd. Every care is taken in the preparation of this magazine, but Families Print Ltd, the distributors, franchisees and LCMB cannot be held responsible for the claims of advertisers nor for the accuracy of the contents, or any consequence thereof. 12,000 copies of the magazine are distributed throughout Suffolk. To request copies please contact the Editor. WELCOME & CONTENTS 4-6 7 8-10 11 12 13-14 15-16 What's on Family Finance Family Health & Wellbeing Family Pets Family Law Clubs & Classes Education RAYMOND GUBBAY presents Giselle Swan Lake The Nutcracker UK 2023 debut season for The Varna International Ballet & Orchestra RAYMONDGUBBAY.CO.UK Rediscover live ballet brought to life by magical special effects Thu 2 – Sat 4 February IPSWICH REGENT THEATRE ipswichtheatres.co.uk

be opening a new

which will explore the Suffolk environment past and present; the changes and challenges impacting our local area and what we can all do make a difference today. Suffolk’s Green Story: Reflect I Learn I Act will explore several themes ranging from the natural environment to agricultural change, through to the impact of our domestic homes and what we can all do to slow down climate change and choose greener ways of living. Come along to one of our branches to enjoy some craft activities inspired by the natural world and Suffolk’s Green Story.

Families Suffolk: Issue 69 familiesonline.co.uk 4 WHAT'S ON

LET’S GET CRAFTY – ECO CRAFTS The Hold, Ipswich Tues 14 and Wed 15 February 10.30am - 12.30pm

we

SUFFOLK’S GREEN STORY: REFLECT I LEARN I ACT NEW EXHIBITION Friday 3 February - 18 June 2023 Free entry www.suffolkarchives.co.uk/whatson @suffolkarchives LET’S GET CRAFTY - ENVIRONMENT Suffolk Archives, Bury St Edmunds Wed 15 February 10.30am - 12.30pm LET’S GET CRAFTY – ECO CRAFTS Suffolk Archives, Lowestoft Thurs 16 February 10.30am - 12.30pm THE MERMAID IPSWICH Yarmouth Road, Ipswich IP1 2EN www.mermaidpubipswich.co.uk Follow the Mermaid Ipswich on Facebook to stay up to date with all their family freindly events. to book Call: 01473 230278 Book now for Mothers Day Sunday 19th March

Image (c) Felixstowe Times

For Spring 2023

will

free exhibition

What does Britten Pears Arts offer

families and young people in 2023 - The Red House, Aldeburgh and Snape Maltings

The Red House was delighted to win Suffolk Museums prestigious Family Friendly Award at the end of 2022. As we begin a new year, Britten Pears Arts continue to offer a range of free musical and historical opportunities for families and young people across both sites.

Mini Music Makers

Mini Music Makers is a friendly and fun Friday morning session of music and play activities for 0-5-yearolds that takes place at The Red House, Aldeburgh. These sessions, which include exploring a museum environment, singing and creative play, are great for little ones to learn social skills, turn-taking, sharing and following instructions. These sessions take place from January 13th on Friday mornings from 10am - 11.30am.

Music Makers

In February half-term and throughout the year, older children can engage with music at Snape Maltings in a free afternoon of music making, exploring musical styles from jazz fusion to orchestral music. Sessions are for children aged 5-7, and 8-11, and the next session takes place on Wednesday 15th February 2023.

Group A

Group A is a fun and engaging singing group for young people in Suffolk. Working with 8-18-year-olds, Group A consists of vocal performance groups that rehearse and perform throughout the year. The project gives young people opportunities to work with a wide variety of professional musicians. New members are always welcome in Leiston, Ipswich and Lowestoft.

Family Activities

Over the school holidays The Red House offers a variety of activities for families of all ages. From hands on music making in the exhibition gallery, to exploring the site as a family with the 2023 Family Activity Book. Keep an eye on the website for details of larger 2023 events, such as the Audio Easter Egg Hunt and May Half Term Family Garden Days!

Visit: www.brittenpearsarts.org/take-part/families-young-people or email: community@brittenpearsarts.org

What's On at Suffolk Museums

Jan/Feb 2023

Toddler Time: Storytime and Crafts Food Museum 25 January 2023, 10-11 www.foodmuseum.org.uk

Love Nature Christchurch Mansion 14-15 February 2023 www.ipswich.cimuseums.org.uk

Creative February Half Term National Horseracing Museum 14-17 February 2023, 11-3 www.www.nhrm.co.uk

familiesonline.co.uk Families Suffolk: Issue 69 5

MORE INFORMATION...

FOR

Aldeburgh Carnival 2022

ride

newest Bike Park. All ages welcome –

to pro. Experience

on a bike. @phoenixcycleworks Kentford | Suffolk PHOENIXCYCLEWORKS.CO.UK BOOK ONLINE

play

eat Visit Suffolk’s

novice

a truly epic session

Mortgage Advice

Many people are concerned about the increases in the cost of living, and one of the biggest financial commitments you will have in your lifetime is a mortgage. In this issue Suffolk Mum and Independent Mortgage Advisor Sharon Wright shares some professional mortgage advice.

With interest rates rising and mortgage lenders tightening their criteria and affordability, you may be wondering when is a good time to review your mortgage and can you protect yourself against an increase in future payments?

Here are some of the common questions that I get asked by my clients...

When should I start to review my mortgage?

You can look to review your mortgage six to seven months before your current mortgage deal is due to end. This will give you an idea of what rates are available and the potential new mortgage repayments. It is important to find out what new mortgage rates your current lender will offer you too so that you can compare this to the other lenders. Each lender has their own criteria so it’s worth checking to see how early your lender can offer a new rate.

Whether you stay with your existing lender or look to remortgage to another provider, reviewing your options months before your fixed or tracker rate ends means that you could secure a new deal that protects you from further interest rises. Many lenders’ offers are valid for six months and if the rates come down then you could review this again before your deal ends.

What happens when my mortgage deal comes to an end?

Unless your mortgage is on a lifetime tracker, after your fixed or tracker rate mortgage ends you will automatically be moved over to the lenders SVR (Standard Variable Rate).

WHAT IS A STANDARD VARIABLE RATE? A mortgage that is on the SVR (Standard Variable Rate) is similar to a tracker rate in that the monthly payments can go up as well as down. The SVR is the rate set by the lender and changed at their discretion. It is up to each lender as to how much they will increase or decrease their rates and this increase could be more than the Bank of England base rate.

With the majority of lenders SVR’s being over 6% and continuing to rise at the present time, it is wise to plan ahead to avoid paying this default rate when your mortgage deal ends. How can I protect my mortgage repayments from a rise in interest rates?

It is difficult to predict where the interest rates will end up this year but one thing is for certain, we will not be enjoying the historically low rates of the last few years. There are some steps you can take to protect yourself financially against a mortgage rate rise.

A fixed rate will give you the certainty that whatever happens to the Bank of England base rate or your lenders SVR, your mortgage repayment will remain the same throughout the deal period. Rates can be fixed for 2,3,5 or even 10 years. The longer you are fixed the longer you are protected from any interest rate rises. However, if during your chosen period the rates become more competitive you may not be able to switch to a better deal without incurring charges.

Can I overpay my mortgage?

Most mortgages allow you to overpay a certain amount without penalty (check the terms and conditions of your mortgage). Overpaying your mortgage will reduce your mortgage balance, saving you interest over the full term.

If you are fixed into a low interest rate take advantage if you can, as overpaying now could give you a buffer for when you come to the end of the rate and source a new mortgage.

STRUGGLING TO KEEP UP THE PAYMENTS ON YOUR MORTGAGE?

Should you be in a position where you are having trouble keeping up your payments then you should contact your lender as soon as possible. There are options available depending on your financial situation and your lender can talk these through with you. The lender might offer to extend the mortgage term or suggest a reduced mortgage payment for a period of time. This will make your monthly repayments less but will increase the interest you pay over the term. This could however be a short term solution to get you back on your feet.

You can also get free money advice from various charities and organisations including Citizens Advice and Step Change Debt Charity

READER OFFER

I usually charge a fee of £275 for a mortgage or remortgage, which covers all administration costs. However, the initial consultation is free and the fee is only payable after a mortgage offer has been produced.

For readers of Families Suffolk Magazine I will reducing this fee to JUST £99 saving you £176.00.

Please use discount code: FamiliesSuffolk

For more information or to book a FREE CONSULTATION with Sharon Email: sharon@wolseymortgage.co.uk Call: 07955 199219

For more information about Wolsey Mortgage Company visit: www.wolseymortgage.co.uk

Your Home may be repossessed if you do not keep up repayments on your mortgage. Wolsey Mortgage Company Ltd is an appointed representative of The Right Mortgage Limited, which is authorised and regulated by the Financial Conduct Authority.

familiesonline.co.uk Families Suffolk: Issue 69 7

FAMILY FINANCE

Save

£176

START SCHEME

WHAT IS HEALTHY START?

If you’re pregnant or have children under the age of 4 you can get free payments every 4 weeks to spend on:

Cow’s milk

YOU COULD GET:

£4.25 each week of pregnancy (from the 10th week of your pregnancy) £8.50 each week for children from birth to 1 year old (£442 a year*) £4.25 each week for children between 1 and 4 years old (£221 a year total of £663*)

Fresh, frozen or tinned fruit and vegetables

Infant formula milk

Fresh, dried, and tinned pulses

You can also get Free Healthy Start vitamins.

To check if you can apply or to find out more speak to your Midwife or Health Visitor or visit www.healthystart.nhs.uk You can also call the Healthy Start helpline on 0345 607 6823

Over £1000 over 4 years* *costings based on 2021 data. Your money will stop after your child’s 4th birthday, or if you no longer receive benefits. Available in other languages www.healthysuffolk.org.uk or contact: HealthandWellbeing@suffolk.gov.uk

Families Suffolk: Issue 69 familiesonline.co.uk 8 GET HELP TO BUY FOOD AND MILK THE

THE TOPIC OF ‘CONTROL’ - PART OF THE MENTAL HEALTH AND WELLBEING ADVICE SERIES

How do you look after your mental health and wellbeing?

That’s the basis for a new campaign for 2023 which focuses on 12 ‘emotional needs’ – one for each month – to bring you practical tips, people’s stories and support to keep you well.

Be Well, Feel Well: A Healthier Suffolk in 2023, is a partnership between Suffolk Mind, Public Health and Communities and a range of community groups teaming up to focus on ways for you to be well throughout the year.

To meet the need for control, we need to feel that we have some say over our lives and personal choices. It can be helpful to recognise what we can take personal responsibility for and what we can influence and accept that there are some things which we cannot control.

1. 2. 3.

3 TOP TIPS FOR CONTROL

There are plenty of things in the news that may be causes of concern or worry. Remember, you are in control of your exposure to media content, so you can choose to give your attention elsewhere.

Some people find getting into a regular routine helps meet the need for control and also the need for security; we feel safer when we feel in control of our day-to-day life.

Finally, remind yourself when you need to that it is enough to do the best you can with the information you have.

Look out for a new theme every month with information for how you can keep healthy, get the help you need and even save money! Visit: www.infolink.suffolk.gov.uk

The Local Welfare Assistance Scheme (LWAS) helps those experiencing financial hardship and can provide financial help, guidance and advice. Find out more and apply online at www.suffolk.gov.uk/LWAS

For more support and money saving advice, visit www.suffolk.gov.uk/costofliving

familiesonline.co.uk Families Suffolk: Issue 69 9

Understanding the Menopause

By Sophia Howard

Menopause is a medical term to describe the 12 months without a menstrual period, after which you enter post-menopause. However many women will go months without menstruation, then have a period, at which point the 12 month count begins again. This unpredictable time before the Menopause is perimenopause and is the most troublesome phase for most women, sometimes lasting up to 10 years!

*90% of women experience menopausal symptoms such as hot flushes, insomnia, mood changes, breast pain, anxiety, depression, weight gain and brain fog which occur as a result of fluctuating hormones.

The symptoms don’t just affect us physically, many of us are busy looking after children, working and in relationships, menopause can have a dramatic impact on our ability to manage or cope with these responsibilities and relationships.

Divorce rates peak during peri-menopause (late 40’s early 50’s) as do suicide rates. It is important to have conversations with loved ones about how you are feeling or coping and what help and support may be needed.

*10% of women leave their jobs due to the menopause.

There is more advice available for employees regarding menopause and employers are being held more accountable, so it’s important to have that conversation.

Every woman’s experience of menopause is unique and will change during their phases of peri-menopuause and menopause, some symptoms may even continue into post-menopause.

It's never too early to educate yourself about menopause, prioritising your health and wellbeing. Lowering levels of oestrogen affects long term health, increasing your risks of osteoporosis, cardiovascular disease, Alzheimers and Dementia. There are a number of ways we can reduce the risks and symptoms.

HRT is one way. There are much safer versions of HRT available now and a number of different ways to take it; gels, patches, tablets and pessaries. All HRT (except vaginal HRT) carries an increased risk of breast cancer, however it’s important to note this increase is very low. In fact a woman taking HRT has a lower increased risk of breast cancer than a woman who is overweight, obese or who drinks moderately. It is important to speak to your Doctor or Nurse Practitioner about your HRT options.

There are a number of other ways to reduce symptoms and improve your long term health.

• Weight training and weight bearing exercise can strengthen bones and the muscles that support our skeletal structure as well as boosting mood.

• Improving gut health can stabilise our hormone fluctuations and energy levels.

• Increasing good quality protein to strengthen muscles and regulate hormones.

• Increasing fibre to support digestion, which in turn supports the pelvic floor.

Menopause Yoga

• Increasing healthy fats actually helps weight management and supports brain function.

• High quality sources of calcium paired with Vitamin D supports strong bones.

• Prioritise sleep and regular rest. Tips: have a regular routine, a cool bedroom, natural fibres, get daylight as early as possible, reduce lights in the evening, eat regularly and not late at night, for example.

• Finding ways to reduce stress will probably be the most valuable thing you can do during and after menopause.

• Talking to your family, friends and other women as you navigate this tricky, but transformative phase of your life.

• Keep communicating with your Doctor/Nurse Practitioner about your symptoms (even if you’re not taking HRT) as they may be similar to indicators of other serious conditions that need further investigation or treatment.

For more information visit: www.paperkiteyoga.co.uk

Families Suffolk: Issue 69 familiesonline.co.uk 10

Sudbury Menopause Yoga is a therapeutic approach to help manage symptoms and share experiences in a supportive space, and ease stress in the mind and body Your local accredited teachers: Sophia Howard www paperkiteyoga co uk paperkiteyoga@gmail com Kate Wyman www yoga-by-kate com katewy71@gmail com Ipswich

FAMILY HEALTH

seven reasons WHY PETS ARE GOOD FOR KIDS

By Dr Margit Muller

Pets and children can become the best of friends. They adore each other and form a deep-rooted bond and relationship that helps children, especially young ones, learn about social bonding. Pets can have an amazingly positive impact on children’s lives, their personal development and happiness. But what is it exactly that makes pets so great for kids?

1. BUILDING TRUST

Small children need to learn how to develop trust in others and themselves. A wonderful way to learn this is to have a pet. Children often regard their pets as their best friends. They love them and share their feelings and emotions with them including their secrets, hopes, dreams and also their worries and sadness too.

2. TAKING RESPONSIBILITY

Knowing how to take responsibility for oneself and others is one of the cornerstones for a successful life. This is where pets come in. Small kids are not yet used to being responsible for anything. However, caring for a pet teaches children how to take responsibility for another living being.

3. NURTURING

Early childhood is the best time to learn life skills. Pets can help young kids develop the character traits which will help them form strong and loving relationships at home and work.

4. ESTABLISHING SELF-ESTEEM

Children who lack self-esteem, will not be able to develop their full potential and become self-assured adults. Pets can be really helpful in building self-esteem, especially dogs or rare pets like birds or reptiles, although reptiles are more suitable for older children.

5. BUILDING SELF-CONFIDENCE

Today’s children face a lot of pressure at school and home. Their confidence can be shaken events such as moving school, divorce or exams. Feeding a pet, taking care of it and nurturing it, helps to create a sense of worthiness and rebuilds children’s confidence.

6. IMPROVING COMMUNICATION SKILLS

Communication skills, both verbal and non-verbal, are of utmost importance for positive relationships with parents, siblings, and friends and for being successful at school and later, at work. The easiest way to learn good communication skills is to observe pets.

7. Pets are great fun

And, lastly, of course, we mustn’t forget that pets are great fun and really bonding for families! So there are major advantages to letting our kids grow up with their beloved furry or feathery friends, whenever we can.

Families Suffolk: Issue 69 11

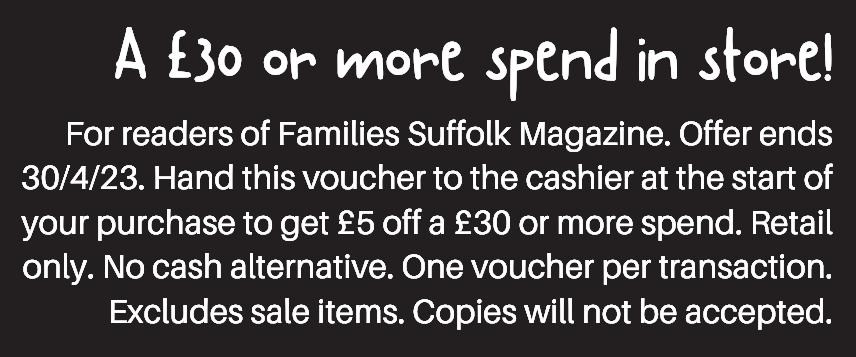

£5 Off £5 Off

FAMILY PETS

Areport published in August by the Women and Equalities Committee called for reform to family law in England and Wales to better protect cohabiting couples and their children from financial hardship in the event of separation. In November, the Government responded.

Cohabiting couples are the fastest growing family type in England and Wales, double the number recorded 25 years ago and representing one in every five families living together.

The main thrust of the report, which had the support of MPs, family lawyers and related professional bodies, was to highlight the current lack of legal protection for cohabiting couples. This status means that in the event of a family breakdown, women in particular can suffer relationship-generated disadvantage. Not for the first time in recent years, it was a call for the law to be adapted to reflect the social reality of modern relationships while still recognising the social and religious status of marriage. The report invited reform on how cohabitants are treated with regards to inheritance and pensions in the event of a partner dying; currently cohabitants do not automatically inherit from their partner. The report was also emphatic in the continued need to dispel the ‘common law marriage myth’ with a recommendation that the Government launch a public awareness campaign to inform people of the legal distinctions between getting married, forming a civil partnership and living together as cohabiting partners. In other words, there is still a need to, once and for all, stamp out the erroneous belief that if you live with someone for a number years, you have the same rights as a married couple. You don’t!

The Government, in its response to the Committee’s report, rejected most of these suggestions, noting that

the ‘existing work on the law of marriage and divorce must conclude before it could consider changes to the law about the rights of cohabitants’. The Government also stated it has no plans to extend the inheritance tax treatment of spouses and civil partners to cohabiting partners but would keep it under review. It partially accepts two recommendations on improved guidance and support to make cohabitants more aware of their legal rights. In short, the legal status of cohabiting couples remains unchanged.

This rejection of the Women and Equalities Committee’s report is disappointing but there is some glimmer of progress in the recognition of the recommendation to improve awareness of a cohabitants’ legal rights even if that is emphasising that without considerable attention to jointly protecting family assets, there really is no legal redress for anyone who has fallen for the “common law spouse” myth. In previous articles in Families magazine, we have explored some of ways you can legally protect yourself and your family, if unmarried.

In brief, the advice remains as follows:

• Seek advice as soon as possible – before there is an issue is better.

• A Cohabitation or Living Together Agreement – The best and easiest way to avoid any dispute in the future and to minimise difficulty at the end of a relationship is to set everything out in writing at the beginning – not very romantic but will save heartache and difficulty later on.

• Make a Will – This can cover what you would like to happen in the event of your death.

• Declaration of Trust – Joint interests, such as the proportions in which property is owned, can be set out in writing.

• Written agreement upon separation – The terms of any relationship breakdown is clear and unambiguous and sets out each party’s entitlements and obligations.

If you are co-habiting and would like further advice on the issues and options available both before or indeed after a relationship breakdown, contact a member of our Family team at Bates Wells and Braithwaite Solicitors, Ipswich. www.bates-wells.co.uk | 01473 219282

Families Suffolk: Issue 69 familiesonline.co.uk 12

THE GOVERNMENT HAS REJECTED THE CALL FOR THE IMMEDIATE REFORM OF LEGAL RIGHTS OF COHABITING COUPLES.

WHERE DOES THIS LEAVE YOU IF YOU ARE LIVING WITH YOUR PARTNER BUT NOT MARRIED?

Denise Head and Nicky Coates, family law specialists at Bates Wells & Braithwaite Solicitors, Ipswich, discuss the legal status of cohabiting couples and remind us what we can do to protect ourselves and our families.

Celebrating 10 years of babyballet® in Suffolk!

Miss Abigail’s babyballet journey started in 2012, when she fell in love with the award-winning babyballet® brand and their message that "everyone was welcome".

Abigail decided she wanted to bring the magic of babyballet® to Suffolk. And so, one Monday morning in April 2013 that dream became a reality when Miss Abigail held her first class with just 4 children and their mums. In those early days, Miss Abigail taught every class herself, but over the next 10 years the school grew and now there are nearly 40 classes a week taught by 4 teachers, all over the South of Suffolk. Classes are mainly in Ipswich, Bury St Edmunds and Sudbury, but more will be opening up in other locations in Suffolk very soon.

Your child's babyballet® journey can start from the age of 6 months in the babyballet® Tots class. This is a magical musical experience for grown-ups and babies or young toddlers to enjoy together. With babyballet® songs and nursery rhymes, the children are encouraged to clap their hands and point their good toes, all with their grown up joining in too. From 18 months in the babyballet® Tinies class the basics of ballet are enjoyed through imaginative stories, props and song, but still with grown-ups close by working towards the babyballet® Movers where, from the age of 3, they’re hopping, skipping and leaping all on their own! From 4.5 years old babyballet® Groovers is a more traditional ballet class, but still in a fun and relaxed environment.

"We have lots of children who start in Tots and stay with us until they are Groovers! We have families who have multiple children, so stay with us for years. One of our longest running families is now in child number 4 dancing with us, we love being a part of their pre-school adventures!"

Last year saw the return of the annual babyballet® Suffolk South show, with children as young as 3 taking to the stage at the Apex in Bury St Edmunds to perform in front of family and friends. "It's great to see proud parents watching their Little Stars wow the crowd with their confidence on the big stage. We will definitely repeat this in 2023."

Miss Abigail adds: “babyballet® is no ordinary ballet class - it's a fun way to encourage your child to build their strength and social confidence, as well as balance, coordination, musicality and self-control. And it’s more than just a dance class, offering a safe space for everyone to be themselves and have fun!” says Miss Abigail.

For more information: Visit: www.babyballet.co.uk/suffolksouth and start your babyballet® journey.

familiesonline.co.uk Families Suffolk: Issue 69 13 CLUBS & CLASSES

07580 693 747

the QR code or visit our website to view our full timetable and book a class! Or

South Suffolk Fun and exciting classes

Scan

contact Miss Abigail on: suffolksouth@babyballet.co.uk

Funky Monkey Keyboard Classes offer both face-to-face electronic keyboard lessons and video tutorials for the beginner musician between 4 and 12 years in central Ipswich. We are offering a GREAT DEAL of 2 free trials and 10% off your first term’s fee too, so it’s a great time to try us out!

HOW DOES IT WORK? In our face-to-face classes, small groups are taught how to play the electronic keyboard, read & write music. Our well-balanced, gently progressive lessons delight & inspire children every week! A 2nd option are our pre-recorded home tutorials. These enable a pupil to guide themselves with our charming step-by-step videos and workbooks.

HOW MUCH DOES IT COST?

Face-to-face: you have two free trials, then £16 per 50-minute class, payable by term with 10% off. There is a sibling discount. Keyboard hire is also available. Pre-recorded home tutorials are half price for the whole of January, just £35 for 10 videos, workbook, pencil and sticker set. You can do these any time to suit you!

HOW DO I REGISTER MY INTEREST?

Visit: www.funkymonkey.info and follow the links or call: 01732 457 100. We hope you will start an amazing musical journey in Ipswich with us soon!

Families Suffolk: Issue 69 familiesonline.co.uk 14 After School Club For children aged 5-11 years Tues-Weds-Thurs from 4:00pm BOOK ONLINE WWW.CLIPNCLIMBIPSWICH.COM just £10 per session! Learn to read, write & music with love 01732 457 100 www.funkymonkey.info Fun-packed, educational, unique group music lessons using electronic keyboards. Perfect for the 4-13 year old beginner musician! Burlington Baptist Church, London Road IP1 2EZ Weekly classes Thursdays/Saturdays FREE TRIAL! 20% off 1st term fees! www.LittleKickers.co.uk “Learning the FUNdamentals of Football” Football fun for children aged 18 months - 7 years. facebook.com/LittleKickersUKIpswich ipswich@littlekickers.co.uk 07762 341982 8 CLUBS & CLASSES Brighten up your January with Funky

Classes!

Monkey Keyboard

AN AWFULLY BIG ADVENTURE!

A stupendous adventure awaits all those children lucky enough to be attending our Prep School Open Morning on Thursday 2 February.

At St Joseph’s College, Ipswich, we strive to keep education as exciting as pre-schoolers believe it to be, so with every step along the way –whether academic, sporting or extracurricular – the wonder and magic are retained as essential components.

That’s why our Open Morning on Thursday, 2 February, won’t be limited to displays of work or dry explanations of courses of study. It will be a doing day for the children. After all, it’s their great adventure, this journey into knowledge of the world and all it has to offer.

We are calling the event ‘Prep for Adventure’ and all participants should expect to be amazed and delighted. School can and should be this much fun! The children will journey through six zones: Dinosaurs in the Wild, Sea Quest, Zero Gravity Gymnastics, Encounters with Beasts and Beats, Discovery Centre and T-Rex Team Sports.

For parents reading the subtext, the zones represent what St Jo’s specialises in – excellent educational practice across the year groups and curriculum.

Dinosaur bones aren’t discovered under desks; that’s why we are taking to the wooded grounds. And when it comes to Early Years, what constitutes adventure on the rolling main better than playdough starfish and pirate role play? That’s a Sea Quest in anybody’s language.

With an animal specialist on the teaching staff, giant creepy crawlies and outlandish small mammals are regular visitors, and they never cease to astound. For this event, however, we’re supplementing them with one of the largest land carnivores of all time, a ‘terrible lizard’ thought to have been extinct for 65 million years. We plan to unleash the beast – but don’t worry, your children will be perfectly safe!

School can and should be this much fun!

Did we mention robot building and the Forensics investigation? So much to do and so much to discover, children might need to pace themselves. St Joseph’s Prep and Senior is known for the quality of its sport and that is not being overlooked. We promise confidence-building teamwork

challenges and sports masterclasses with our outstanding professional coaches.

Think it could not sound any better? Well – it’s free! Happy children thrive and we hope your own will join us to test that theory for themselves. Drop in between 9am and 12.00pm on Thursday 2 February and let the adventure begin.

For more information about St Joseph's College Prep School visit: www.stjos.co.uk

familiesonline.co.uk Families Suffolk: Issue 69 15 EDUCATION

We take happiness seriously

At St Joseph’s we support the intellectual, spiritual, physical and emotional growth of every student.

Children who thrive are the happiest of all.

Prep School

Thurs 2 Feb & Sat 13 May

Whole School

Sat 18 March

Join us for our Prep and Senior School Open Days. Family tours also available, to find out more please visit stjos.co.uk or email admissions@stjos.co.uk

Independent day and boarding school for boys and girls aged 2–19. Nursery open all year round

Families Suffolk: Issue 69 familiesonline.co.uk 16