19 minute read

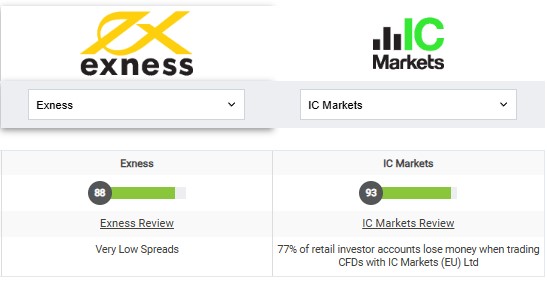

Exness vs IC Markets: Which Broker is Better? A Comprehensive Review

In the world of online trading, choosing the right broker can make a significant difference in your trading experience. The debate surrounding Exness vs IC Markets has been prominent among traders, as each platform presents its unique features and advantages. This article aims to provide an in-depth analysis of both brokers, helping you determine which is better for your trading needs.

Exness vs IC Markets: A Comprehensive Comparison

When discussing the nuances of online trading, one cannot overlook the importance of finding the right broker. In this section, we will examine the fundamental features that differentiate Exness and IC Markets, laying the groundwork for a more comprehensive discussion later in the article.

Start Exness Trade: Open Exness Account and Visit site

Overview of Exness

Founded in 2008, Exness has quickly become a reputable name within the forex trading community. With its headquarters located in Cyprus, it operates under the regulations of several financial authorities, ensuring a high level of trustworthiness. Exness offers a user-friendly interface, making it suitable for both novice and experienced traders.

See more: Exness Review 2025

One key aspect of Exness is its commitment to providing a variety of trading instruments. With over 100 trading assets, including forex pairs, cryptocurrencies, and commodities, users have access to numerous opportunities for diversification. Moreover, the company prides itself on its low spreads and fast execution times, making it an attractive option for scalpers and day traders alike.

Overview of IC Markets

IC Markets, established in 2007, is another major player in the online trading industry. Headquartered in Australia, it is well-regulated by the Australian Securities and Investments Commission (ASIC). IC Markets is particularly known for its low latency and high liquidity, catering primarily to professional traders and institutions.

The broker offers a wide array of trading options, with access to forex, indices, commodities, and cryptocurrencies. Traders benefit from tight spreads and no requotes, enhancing their trading efficiency. Additionally, IC Markets provides various trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, giving users the flexibility to choose their preferred trading environment.

Comparing Key Features

While both Exness comparicon vs IC Markets come with robust features, the differences become apparent upon closer examination. From account types to trading conditions, understanding these key features will give traders a clearer picture of what they can expect.

Which Broker is Better? Exness vs IC Markets Review

After exploring the fundamentals of Exness and IC Markets, it’s time to delve deeper into the specific aspects that may influence a trader's choice. As we review these two brokers, we will highlight their strengths and weaknesses, ultimately determining which broker stands out in various categories.

Trading Instruments Available

Both Exness and IC Markets boast an impressive range of trading instruments, but there are subtle differences in their offerings that can impact trading strategies.

Exness provides access to over 100 trading instruments, spanning multiple asset classes. This includes an extensive selection of currency pairs, cryptocurrencies, commodities, and even stocks. For those interested in cryptocurrency trading, Exness offers Bitcoin, Ethereum, Ripple, and other popular digital currencies, making it appealing to traders looking to tap into the growing crypto market.

On the other hand, IC Markets takes pride in offering more than 300 trading instruments. This extensive range includes a diverse selection of forex pairs, indices, commodities, and cryptocurrencies. The wider selection of trading instruments can be advantageous for those seeking greater diversification in their portfolios.

Trading Platforms Offered

The trading platform is a critical component of any trading experience, impacting usability and efficiency. Both Exness and IC Markets provide popular platforms, but let's explore their unique attributes.

Exness primarily offers the well-known MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are praised for their user-friendly interfaces and advanced functionalities, appealing to both beginners and experienced traders. Traders can utilize various analytical tools, including charting capabilities, technical indicators, and automated trading through Expert Advisors (EAs).

Start Exness Trade: Open Exness Account and Visit site

IC Markets also supports MT4 and MT5 while adding cTrader to its portfolio. cTrader is recognized for its innovative user interface and superior order execution speed, making it a favorite among professional traders. With cTrader, users enjoy features like algorithmic trading, advanced charting, and a customizable interface, contributing to a more efficient trading experience.

Customer Support Services

Effective customer support can significantly influence your overall trading experience. Let's take a look at how Exness and IC Markets fare in this crucial area.

Exness offers 24/7 customer support through multiple channels, including live chat, email, and phone. Their multilingual support team ensures that traders worldwide receive assistance in their preferred language. Generally, users have reported positive experiences with Exness’s customer service, praising their responsiveness and helpfulness.

In contrast, IC Markets also provides 24/7 customer support via live chat, email, and telephone. However, some users have expressed concerns about response times during peak periods. While many traders find the support satisfactory, others hope for improvements in efficiency during busy hours.

Key Features of Exness and IC Markets: An Analysis

Understanding the key features offered by Exness and IC Markets is paramount as it helps to gauge which broker aligns better with individual trading preferences and styles. Let’s take a closer look at these features, highlighting what sets them apart.

Account Types Offered

Both brokers cater to different types of traders through varied account types, but the nature of these accounts can influence trading strategies.

Exness account provides different account types tailored to traders' varying needs, including Standard, Pro, and Zero accounts. The Standard account is designed for beginners and offers low spreads and no commission fees. The Pro account targets advanced traders, featuring tighter spreads and enhanced trading conditions. The Zero account, as the name suggests, features zero spreads but comes with a commission per trade, suited for high-frequency traders.

Read more:

Exness Account Types Review: Standard, Raw Spread, Zero, Pro

Conversely, IC Markets offers three main types of accounts: Standard, Raw Spread, and cTrader Raw Spread. The Standard account is designed for retail traders and has no commissions, while the Raw Spread accounts offer raw spreads with lower trading costs. Similar to Exness, IC Markets caters to a broad audience, but the availability of Raw Spread accounts gives traders more options based on their trading style.

Leverage Options

Leverage is a vital factor for many traders as it allows for the potential of larger profits, though it also increases risk. Both Exness and IC Markets offer competitive leverage options that vary based on account type and regulatory jurisdiction.

At Exness, traders can enjoy leverage of up to 1:2000, allowing them to control larger positions with a smaller capital investment. This high leverage can be advantageous for experienced traders who understand the associated risks. However, such high leverage may not be suitable for all traders, especially beginners who may benefit from a more conservative approach.

IC Markets generally offers leverage of up to 1:500, which is still substantial and appeals to many traders. Unlike Exness, IC Markets typically follows stricter regulations that limit maximum leverage based on the trader's location. This regulatory adherence aims to protect inexperienced traders from excessive risk.

Deposit and Withdrawal Methods

Ease of funding your trading account and accessing your earnings is a crucial consideration when selecting a broker. Let’s explore how Exness and IC Markets facilitate deposits and withdrawals.

Exness offers a plethora of deposit and withdrawal methods, including bank transfers, credit/debit cards, and various e-wallets like Neteller and Skrill. The broker doesn't charge fees for deposits or withdrawals, allowing traders to retain more of their earnings. Additionally, the processing time for withdrawals is notably quick, with many transactions completed within minutes.

Start Exness Trade: Open Exness Account and Visit site

IC Markets also presents a diverse range of funding options, including bank transfers, credit cards, and e-wallets. Similar to Exness, the broker does not impose any deposit fees. However, depending on the payment method, withdrawal times may vary, with some options taking longer than others. Generally, IC Markets strives to maintain a smooth transaction process, but users may experience slight delays during peak withdrawal periods.

Trading Costs: Exness vs IC Markets Explained

When evaluating whether Exness or IC Markets is the better broker for your trading needs, it's essential to assess the trading costs associated with each platform. In this section, we will dissect the various components of trading costs, including spreads, commissions, and overnight financing fees.

Spreads

Spreads represent the difference between the bid and ask prices of an asset and are a crucial indicator of trading costs. A lower spread often translates to reduced costs for traders.

Exness offers competitive spreads across its account types. The Standard account features floating spreads starting from around 0.3 pips, while the Pro account provides even tighter spreads, beginning from approximately 0.0 pips. The Zero account has a similar structure, with spreads starting from 0.0 pips but incorporating a commission fee per trade.

Comparatively, IC Markets is well-known for its exceptionally low spreads, particularly on its Raw Spread accounts. Traders can expect average spreads starting from around 0.0 pips, although certain market conditions may lead to fluctuations. The Standard account typically offers slightly higher spreads but remains competitive in comparison to the broader industry.

Read more:

Is EXNESS a good trading platform

Commissions

While some brokers charge commissions on trades, others incorporate those costs into spreads. Understanding these differences is vital for traders aiming to minimize trading expenses.

Exness operates with a commission-free model on its Standard account, while the Pro and Zero accounts involve commission fees. The commission structure varies based on the specific account type, allowing traders to select the model most aligned with their trading strategy.

In contrast, IC Markets incorporates a commission structure primarily for its Raw Spread accounts. The commissions are relatively low, providing users with an opportunity to capitalize on tight spreads. The Standard account, however, does not require any commission, making it suitable for traders looking for straightforward pricing without additional costs.

Overnight Financing Fees

For traders holding positions overnight, understanding overnight financing fees (swap rates) is critical. These fees can impact overall profitability, especially for long-term traders.

Exness applies swap rates based on market conditions and the specific asset being traded. The fees may vary, so traders should check the current swap rates applicable to their positions before trading. Exness also offers an option for Islamic accounts, allowing traders to operate without incurring swap fees in compliance with Sharia law.

Similarly, IC Markets also charges swap rates based on prevailing market conditions. The rates are subject to change daily, reflecting the interest rate differential between the currencies involved in a trade. IC Markets also provides Islamic account options for traders seeking swap-free setups.

Customer Support: Who Wins – Exness or IC Markets?

When trading online, having reliable customer support can significantly enhance the trading experience. In this section, we’ll evaluate the customer service quality provided by Exness and IC Markets, comparing their approach and effectiveness.

Start Exness Trade: Open Exness Account and Visit site

Availability and Responsiveness

When traders encounter issues or have questions, timely support is imperative. Both Exness and IC Markets claim to offer 24/7 support, but how do they deliver on that promise?

Exness provides customer support through various channels, including live chat, email, and phone. Many users report prompt responses, with live chat being the most popular channel due to its immediate feedback. The multilingual support system caters to a global clientele, ensuring assistance in multiple languages.

IC Markets also boasts 24/7 customer support through similar channels. While many customers praise the quality of service, some users have shared mixed feelings regarding response times during peak trading sessions. While the support staff is knowledgeable, occasional delays in response times can hinder the experience.

Educational Resources

Traders often seek educational resources to enhance their trading skills and knowledge. Both Exness and IC Markets provide valuable instructional content, but their approaches can differ.

Exness features a dedicated educational section on its website, offering a wealth of articles, videos, and webinars aimed at educating traders of all skill levels. Their resources cover topics such as technical analysis, trading strategies, and risk management, equipping users with the knowledge needed to navigate the markets confidently.

IC Markets similarly focuses on education, providing traders with instructional materials, including guides, articles, and video tutorials. Furthermore, they host regular webinars led by professional traders, offering insights into market trends and trading techniques. The educational emphasis is a plus for both brokers, as informed traders tend to make better decisions.

User Feedback and Reputation

The reputation of a broker can significantly impact your choice. Exploring user feedback and reviews helps paint a clearer picture of what to expect with Exness and IC Markets.

Exness is generally regarded positively among traders, with many praising its user-friendly interface, excellent customer service, and competitive trading conditions. However, some users have raised concerns about the limited range of advanced trading tools compared to competitors.

IC Markets holds a strong reputation within the trading community, particularly among professional traders. Users frequently commend the broker for its low spreads, effective customer service, and advanced trading platforms. Nonetheless, some complaints regarding customer support response times during busy periods have surfaced.

Platform Usability: Comparing Exness and IC Markets

The usability of a trading platform plays a crucial role in a trader's success. Factors such as interface design, accessibility, and functionality can all contribute to a trader's experience. In this section, we will compare the platform usability of Exness and IC Markets.

Interface Design and Functionality

A well-designed interface can greatly enhance a trader's ability to execute trades efficiently. Let’s examine how both brokers stack up in terms of interface design.

Exness offers a clean and intuitive interface across its supported trading platforms. Both MT4 and MT5 are known for their user-friendly layouts, with easily navigable menus and customizable chart settings. Beginner traders typically find the platforms easy to understand, while experienced traders appreciate the depth of features and tools available.

IC Markets also prioritizes usability across its trading platforms. MT4, MT5, and cTrader all boast sleek designs and robust functionality, catering to a wide range of trading preferences. The platforms are equipped with advanced charting tools, multiple order types, and the ability to run automated trading strategies through EAs or cAlgo.

Mobile Trading Experience

A responsive mobile trading application is essential for traders who want to manage their positions on the go. Let’s explore how Exness and IC Markets perform in this regard.

Exness offers a mobile trading app compatible with both Android and iOS devices. The app reflects the desktop platform's ease of use, allowing traders to execute orders, monitor charts, and access their accounts seamlessly. The convenience of mobile trading enhances flexibility, enabling users to react quickly to market movements.

Similarly, IC Markets provides mobile versions of both MT4 and MT5, as well as a dedicated cTrader app. The mobile applications maintain the functionality of the desktop platforms, granting users access to advanced trading features while on the move. Traders can manage their accounts effectively, ensuring they stay connected to the market regardless of their location.

Customization Options

Customization options allow traders to tailor their platforms to meet their specific needs. Let's analyze the customization capabilities of both brokers.

Exness allows traders to personalize their trading environment by customizing chart settings, indicators, and layout preferences. Additionally, traders can save multiple profiles, enabling quick transitions between various trading setups.

IC Markets offers extensive customization options across all supported platforms. Traders can adjust chart types, color schemes, and templates, allowing for a personalized trading experience. The ability to create custom profiles enables users to switch seamlessly between different trading styles and strategies.

Account Types: Exness vs IC Markets Breakdown

Choosing the right account type is a fundamental decision for any trader and can significantly affect trading outcomes. In this section, we will break down the various account types offered by Exness and IC Markets, helping you identify which broker meets your specific needs.

Account Types at Exness

Exness caters to different categories of traders through its range of account types, each designed to suit varying trading preferences and strategies.

The Standard account is ideal for beginners and casual traders, offering competitive spreads and no commissions. This account type encourages traders to get started with minimal barriers to entry.

The Pro account is tailored to experienced traders, featuring tighter spreads and lower trading costs. This account type is beneficial for those utilizing advanced trading strategies, as the reduced expenses can improve overall profitability.

The Zero account offers raw spreads with a commission model, best suited for high-frequency traders who prioritize cost-effectiveness. This account structure benefits scalpers and day traders, as they can take advantage of ultra-low spreads paired with a commission.

Account Types at IC Markets

IC Markets also provides a range of account types designed to accommodate different trading styles and objectives.

The Standard account is designed for retail traders seeking simplicity; it features no commissions but offers competitive spreads. This account caters to individuals who prefer a straightforward pricing model without hidden costs.

The Raw Spread account is specifically crafted for traders looking for the lowest possible spreads. While this account incurs a small commission per trade, the overall trading costs remain highly competitive, making it appealing for those engaged in frequent trading.

The cTrader Raw Spread account allows users to access a different trading platform entirely. Similar to the Raw Spread account, it offers competitive spreads with a commission-based model, appealing to traders favoring cTrader's interface and features.

Considerations When Choosing an Account Type

Selecting the right account type is crucial, as it can directly influence your trading performance and overall satisfaction with the broker. When weighing your options between Exness and IC Markets, consider the following factors:

Trading Style: Determine whether you engage in scalping, day trading, or long-term trading. Certain account types may be more advantageous based on your approach.

Cost Structure: Analyze the spreads and commission structures associated with each account type to ascertain which model suits your trading strategy best.

Flexibility: Assess the level of flexibility each broker provides in switching between account types as your trading needs evolve over time.

Regulations and Safety: Exness and IC Markets Reviewed

Ensuring that your broker adheres to regulatory standards is paramount for safety and security. This section will delve into the regulatory environments surrounding Exness and IC Markets, evaluating the measures in place for safeguarding traders' funds.

Regulatory Oversight of Exness

Exness operates under the license of several regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) of Seychelles. This multi-regulatory approach helps instill confidence among traders, as oversight from authoritative entities promotes transparency and accountability.

The broker employs stringent measures to secure client funds, including the segregation of clients’ funds from operational funds. Additionally, Exness participates in compensation schemes that protect traders in the event of insolvency, further enhancing their safety protocols.

Regulatory Oversight of IC Markets

IC Markets is regulated by the Australian Securities and Investments Commission (ASIC), one of the most reputable financial regulators globally. The ASIC framework ensures that brokers adhere to strict conduct standards, promoting fair trading practices and protecting client interests.

Similar to Exness, IC Markets also maintains segregated accounts for client funds and participates in investor compensation schemes. These safeguards ensure that traders’ funds remain protected and provide peace of mind when trading with the broker.

Trader Security Measures

Both Exness and IC Markets implement robust security measures to protect user data and transactions. Both brokers utilize advanced encryption protocols to secure sensitive information, ensuring a safe trading environment.

Furthermore, both brokers prioritize transparency by providing detailed information about their services and fees. This commitment to clarity enhances the overall trustworthiness of the platforms, giving traders confidence in their choice.

User Experience: Exness vs IC Markets Insights

User experience encompasses a range of factors, including platform usability, customer support, and the overall trading environment. In this section, we will discuss the user experiences reported by traders of both Exness and IC Markets.

The Exness User Experience

Many traders have expressed satisfaction with the user experience offered by Exness. The platform's intuitive design and accessible features make it easy for newcomers to navigate the trading landscape.

Users often comment on the efficiency of the customer support team, noting the quick response times through various channels. The availability of educational resources also contributes to a positive experience, as traders can expand their knowledge and skills.

However, some users have noted a desire for more advanced trading tools and analytics to enhance their trading strategies further. While the platform caters well to beginners and casual traders, more experienced traders may seek additional functionalities.

The IC Markets User Experience

IC Markets has garnered positive feedback from traders, particularly those who prioritize low trading costs and advanced features. The broker's focus on providing a professional trading environment has made it a favorite among institutional and professional traders.

Users appreciate the diverse range of account types and trading platforms, allowing for customization based on individual preferences. The robust trading tools and research resources available on the platform add value to the overall experience.

However, some users have raised concerns about customer support response times during peak trading periods. While the majority of traders report satisfactory interactions, addressing these concerns could further elevate the overall user experience.

Final Verdict: Which Broker Should You Choose?

After examining the various aspects of Exness and IC Markets, we can arrive at a clearer understanding of which broker might be better suited to different trading profiles. Here’s a summary of the strengths and weaknesses of each broker.

Strengths of Exness

User-friendly interface that caters to beginners

Competitive spreads with various account types

Excellent customer support available 24/7

Fast withdrawal processing times

Extensive educational resources

Weaknesses of Exness

Limited advanced trading tools compared to some competitors

Higher minimum deposit requirements for certain account types

Strengths of IC Markets

Exceptional low spreads, ideal for professional traders

Diverse range of trading instruments across multiple account types

Advanced trading platforms like cTrader available

Strong reputation and regulatory oversight

Weaknesses of IC Markets

Some user reports of slower customer support response times during busy periods

May be less suitable for beginner traders due to complex offerings

Ultimately, the best broker for you will depend on your trading style, experience level, and personal preferences. If you’re a beginner looking for a user-friendly platform with strong support and educational resources, Exness may be the better choice. On the other hand, if you’re an experienced trader seeking low trading costs and advanced functionalities, IC Markets could be the ideal fit.

Conclusion

In the battle of Exness vs IC Markets, both brokers present compelling cases for traders. Each platform has its strengths and weaknesses, catering to different types of traders ranging from novices to seasoned professionals. By considering factors such as trading costs, platform usability, customer support, and regulatory oversight, traders can make informed decisions that align with their trading goals.

Read more: