7 minute read

EXNESS Review Nigeria: Pro, Cons, Legit Legal, Safe, a good broker 2026?

If you're in Nigeria and considering online forex trading in 2026, you've probably come across EXNESS. As one of the most talked-about brokers globally, EXNESS has gained a strong presence among Nigerian traders due to its user-friendly platforms, fast deposit and withdrawal methods, and a variety of account types to suit different experience levels. But is EXNESS legit in Nigeria? Is it safe to trade with? And most importantly—is it worth your time and money as a beginner?

In this full review, we’ll break down everything you need to know about EXNESS in Nigeria—including regulation, available trading accounts, local deposit options, platform features, pros and cons, and the most frequently asked questions. Whether you’re just starting or looking to switch brokers, this guide will help you decide confidently.

👉 Visit Official EXNESS Website

👉 Create Your Free EXNESS Account Here

⬇️⬇️⬇️

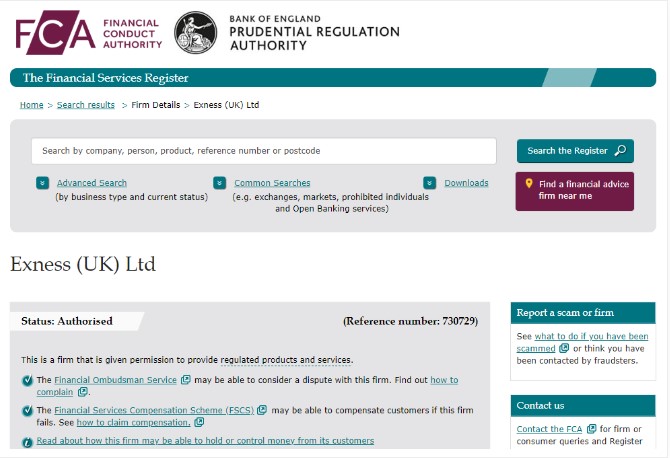

✅ Is EXNESS Legit and Safe for Nigerian Traders?

Yes, EXNESS is a legit and globally regulated forex broker. Although it is not regulated by the Central Bank of Nigeria (CBN) or the Nigerian SEC, EXNESS operates under strict oversight from international regulatory bodies such as:

Financial Conduct Authority (FCA) – United Kingdom

Cyprus Securities and Exchange Commission (CySEC) – Europe

Financial Sector Conduct Authority (FSCA) – South Africa

Financial Services Authority (FSA) – Seychelles

These licenses ensure that EXNESS follows strict rules to protect client funds and maintain transparent business operations. Nigerian traders are also protected through features like:

Negative balance protection, which prevents you from losing more than your deposit.

Segregated accounts, so your funds are kept separate from the broker’s operational capital.

Strong cybersecurity measures, including SSL encryption and 2FA (two-factor authentication) for account access.

All of this makes EXNESS a safe and reliable broker for Nigerian traders, even though it doesn’t have a local office.

💼 EXNESS Account Types for Nigerian Users

EXNESS offers multiple account types to suit various trading styles and experience levels:

1. Standard Account

Ideal for beginners

No commissions

Spreads from 0.3 pips

Supports micro-lot trading (0.01 lots)

2. Standard Cent Account

Similar to the Standard account but uses cents as base currency

Allows extremely low trade sizes

Great for practice with real money but minimal risk

3. Pro Account

Best for experienced traders

No commission

Spreads from 0.1 pips

Instant order execution

4. Raw Spread Account

Ultra-low spreads starting from 0.0 pips

Commission: $3.50 per lot per side

Designed for scalpers and high-frequency traders

5. Zero Account

Fixed 0.0 pip spread on major pairs for 95% of the trading day

Commission varies depending on instrument

Great for news traders and high-volume positions

All EXNESS account types are available with Islamic (swap-free) options, suitable for Muslim traders who wish to avoid interest on overnight positions.

🏦 Deposit and Withdrawal Methods for Nigeria

One of the strongest advantages of EXNESS in Nigeria is its local-friendly payment system. You can deposit and withdraw funds in Naira (NGN) using:

Local bank transfers

Credit/Debit cards (Visa/Mastercard)

E-wallets: Skrill, Neteller, Perfect Money

Cryptocurrencies: Bitcoin (BTC), Tether (USDT)

Minimum Deposit:Starts from as low as $1, making it accessible to all.

Withdrawal Time:

Most withdrawals are processed instantly or within a few hours.

Bank withdrawals may take up to 24 hours in some cases.

EXNESS does not charge internal deposit or withdrawal fees, making it more cost-effective than many other brokers.

📱 EXNESS Trading Platforms and Tools

You can trade on EXNESS through a variety of platforms:

1. MetaTrader 4 (MT4)

Widely used

Custom indicators and Expert Advisors (EAs)

Simple and stable for forex trading

2. MetaTrader 5 (MT5)

Supports more order types and timeframes

Better suited for stock and CFD trading

Faster execution and advanced charting

3. EXNESS Web Terminal

No download required

Trade directly from your browser

Secure and responsive interface

4. EXNESS Go App

All-in-one mobile trading platform

Create account, deposit/withdraw, analyze charts, place orders

User-friendly for both beginners and pros

Trading Tools Included:

Economic calendar

Forex calculators (pip, margin, profit)

Market news updates

Price alerts and risk management features

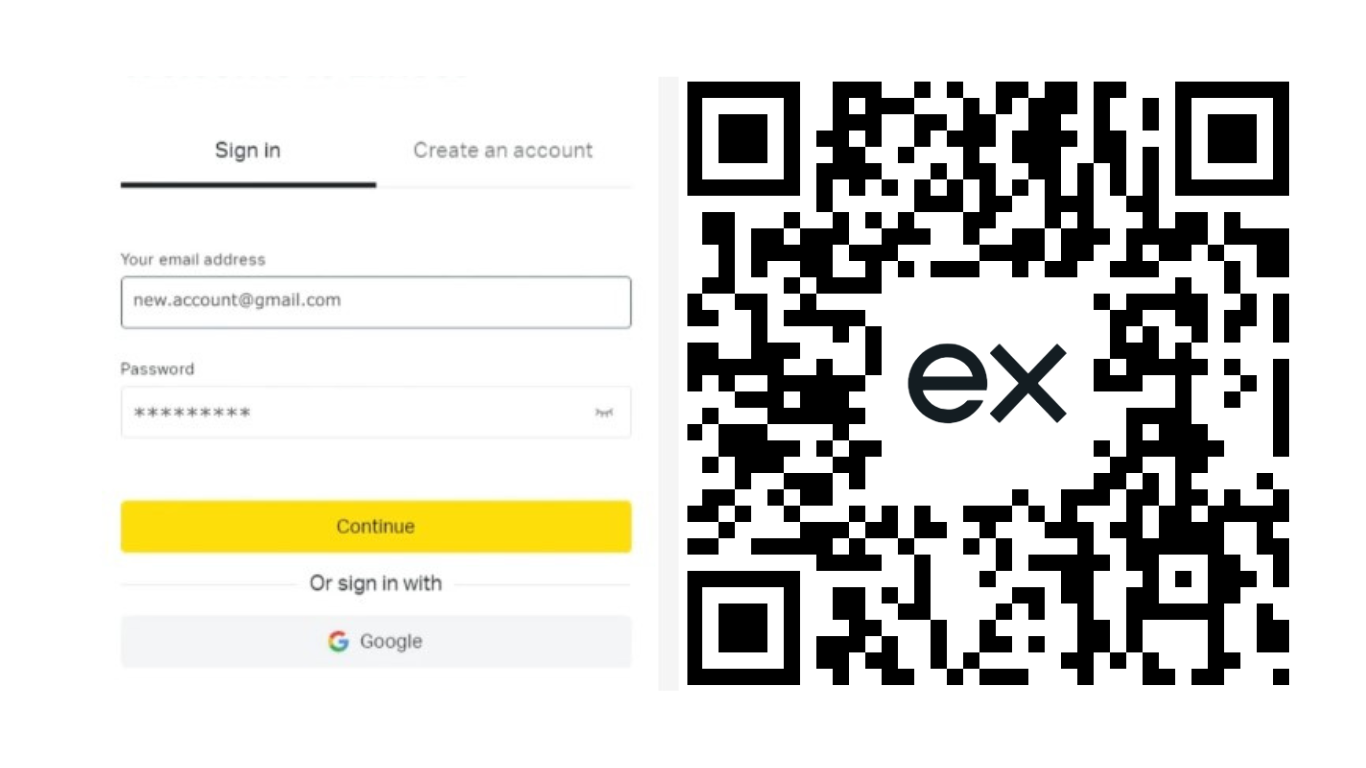

📝 How to Open an EXNESS Account in Nigeria

Opening an account with EXNESS is incredibly easy and takes less than 5 minutes. The process is fully online and beginner-friendly.

Step-by-step Exness guide:

Go to the official registration page:👉 Sign up with EXNESS here

Enter your email and select Nigeria as your country.

Create a password and verify your phone number.

Provide your personal details (name, date of birth, address).

Upload verification documents (ID/passport and utility bill).

Choose your preferred account type (Standard, Pro, Raw, or Zero).

Select your platform: MT4, MT5, or Exness Go App.

Fund your account using your local bank or e-wallet.

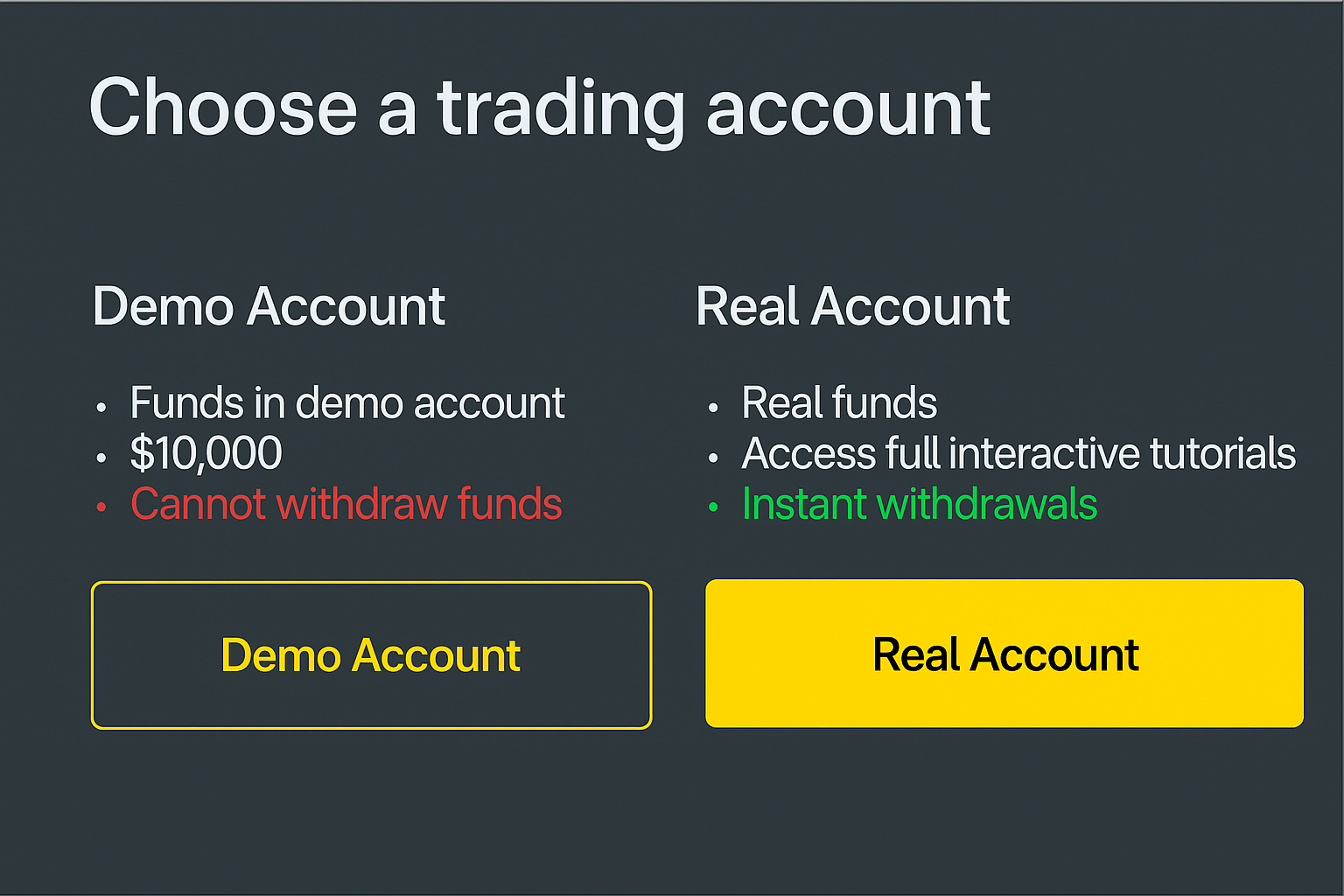

You can start trading as soon as your documents are verified. A free demo account is also available to practice without risking real money.

⚙️ Trading Conditions on EXNESS Nigeria

EXNESS offers some of the best trading conditions for both new and experienced traders in Nigeria.

Highlights:

Ultra-low spreads:

Raw/Zero Account: from 0.0 pips

Standard Account: from 0.3 pips

Flexible leverage:

Up to 1:2000 for verified traders

Unlimited leverage available under specific conditions

Fast execution:

Orders are executed in less than 0.1 seconds on average

Minimum trade size:

Start with 0.01 lot, ideal for small-cap traders and beginners

Available instruments:

Over 200+ assets including forex pairs, stocks, indices, crypto, energies, and metals

EXNESS offers swap-free (Islamic) trading options across most accounts and supports a wide range of strategies including scalping, hedging, and automated trading with Expert Advisors (EAs).

💬 EXNESS Nigeria Customer Support

EXNESS provides 24/7 multilingual support through the following channels:

Live chat on the website and in the Exness Go app

Email support, typically responds within 1–2 hours

Internal ticketing system for verified users

Although EXNESS has no physical office in Nigeria, their online support team is fast, professional, and helpful — ideal for local traders needing quick assistance.

Additionally, the platform interface, educational content, and technical help are all available in easy-to-understand English, making it great for beginners.

🎓 EXNESS Educational Resources & Trading Tools

EXNESS goes beyond just being a broker — it offers a full learning environment to help traders grow their skills and confidence.

Key resources include:

Free demo account

Unlimited virtual funds

Perfect for testing strategies without risk

Smart trading calculators

Calculate leverage, margin, pip value, and potential profit

Helps with precise trade planning and risk control

Economic calendar & market analysis

Track major global events affecting the markets

Get real-time data and event forecasts

Video tutorials and articles

Topics include account setup, trading strategies, platform use

Ideal for self-paced learning at any skill level

In-app education via Exness Go

Integrated tips and guidance while trading

Mobile-first education for traders on the go

👉 Access all educational tools directly through EXNESS Official Website or the mobile app after signing up.

✅ Benefits of Using EXNESS in Nigeria

Global regulation and a strong reputation in the industry

Low spreads and high leverage (up to 1:2000, or unlimited for pro clients)

Fast, local deposits and withdrawals in Naira

User-friendly mobile app for managing everything on the go

Free demo account to practice before trading real money

Multilingual 24/7 support, including in English

❌ Limitations You Should Know

Not regulated by Nigerian authorities (CBN/SEC)

Leverage can be risky if not properly managed

No physical office in Nigeria for in-person support

Some features like MT4 mobile trading require separate app download

❓ FAQs About EXNESS Nigeria

Is EXNESS legal in Nigeria?While it’s not regulated locally, EXNESS is legal to use and highly trusted.

What is the minimum deposit for EXNESS Nigeria?As low as $1 (approx. ₦1,500), depending on your payment method.

Can I use my Nigerian bank to deposit/withdraw?Yes, local bank transfers are supported.

Does EXNESS offer swap-free (Islamic) accounts?Yes, across most account types.

How fast are withdrawals from EXNESS Nigeria?Typically instant to a few hours; bank transfers can take up to 24 hours.

Is EXNESS suitable for beginners in Nigeria?Absolutely. Its Standard and Cent accounts are perfect for new traders.

Can I trade cryptocurrencies on EXNESS?Yes, EXNESS offers crypto CFDs including BTC, ETH, and USDT pairs.

Is the EXNESS Go App safe?Yes, it uses encrypted security and login verification.

What is the maximum leverage available?Up to 1:2000 or even unlimited for certain accounts.

How do I sign up with EXNESS Nigeria?Simply go to this secure signup link, fill in your email and country, and complete verification.

🧾 Final Verdict: Should You Use EXNESS in Nigeria?

EXNESS is one of the best choices for both beginner and advanced traders in Nigeria. With strong regulation, modern platforms, low fees, local payment methods, and fast execution, it offers everything you need to grow as a trader.

👉 Get started with EXNESS here – it’s free, fast, and fully online.

See more:

Revisión de EXNESS Broker: Ventajas y Desventajas

Recenzie EXNESS Broker: Avantaje și Dezavantaje

EXNESS Брокерын 2026 оны тойм: Давуу болон сул талууд

EXNESS Брокер Рецензија 2026: Предности и Недостаци