14 minute read

Exness Account Types Review: Standard, Raw Spread, Zero, Pro -Comparison table

Exness Account Types Review: Exness is a renowned online forex trading platform that offers a variety of account types to cater to the diverse needs of traders. From the Standard account to the Pro account, Exness provides a range of options that allow traders to choose the one that best suits their trading style, risk appetite, and investment goals.

Here's a breakdown of the most popular options:

Exness Account type

1. Standard Account

Minimum Deposit: $10

Spreads: Variable, starting from 1 pip

Commissions: None

Best For: Beginners and those seeking low minimum deposits.

Start Exness Trade: Open Exness Account and Visit site

2. Cent Account

Minimum Deposit: $1

Spreads: Variable, starting from 1 pip

Commissions: None

Best For: Micro-traders and those practicing with minimal risk.

how to open cent account in exness

3. Pro Account

Minimum Deposit: $200

Spreads: Fixed, starting from 0.1 pips

Commissions: None

Best For: Experienced traders seeking tight spreads and fixed costs.

4. Raw Spread Account

Minimum Deposit: $500

Spreads: Raw, starting from 0 pips

Commissions: Applicable

Best For: Scalpers and high-frequency traders who prioritize the tightest spreads.

EXNESS zero spread account review

5. Zero Account

Minimum Deposit: $500

Spreads: Fixed, starting from 0 pips

Commissions: Applicable

Best For: Traders seeking the tightest possible spreads, even on major currency pairs.

Exness raw spread account review

Key Considerations When Choosing an Account:

Trading Style: Consider your preferred trading strategies (e.g., scalping, day trading, swing trading).

Risk Tolerance: Assess your comfort level with different leverage levels and potential losses.

Trading Frequency: Determine how often you plan to trade and the volume of your trades.

Budget: Evaluate your available capital and the minimum deposit requirements for each account type

Overview of Exness Account Types

Exness broker offers four primary account types: Standard, Raw Spread, Zero, and Pro. Each account type comes with its own set of features, benefits, and conditions, allowing traders to select the one that aligns with their trading preferences and experience level.

The Standard Account: A Balanced Approach

The Standard account is Exness' most popular and widely-used account type. It offers a balance of competitive spreads, accessibility, and user-friendly features, making it an attractive choice for both novice and experienced traders.

The Raw Spread Account: Tapping into Tight Spreads

The Raw Spread account is designed for traders who prioritize tight spreads and low trading costs. This account type provides access to raw market spreads, allowing traders to potentially benefit from tighter pricing.

The Zero Account: Targeting the Lowest Costs

The Zero account is Exness' offering for traders who are primarily focused on minimizing trading costs. This account type features commission-based pricing, with the potential for lower overall trading expenses.

The Pro Account: Catering to Experienced Traders

The Pro account is tailored for seasoned traders who seek advanced trading features and personalized support. This account type offers a range of exclusive benefits and is often chosen by professional or high-volume traders.

Start Exness Trade: Open Exness Account and Visit site

Standard Account: Features and Benefits

The Standard account is Exness' entry-level offering, but it still provides a comprehensive set of features and benefits that cater to a wide range of traders.

Competitive Spreads and Leverage

One of the key advantages of the Standard account is its competitive spreads. Exness aims to offer spreads that are among the tightest in the industry, allowing traders to potentially maximize their profits. Additionally, the Standard account provides access to leverage up to 1:2000, empowering traders to amplify their trading opportunities.

Diverse Trading Instruments

The Standard account offers traders access to a vast array of trading instruments, including major and minor currency pairs, precious metals, commodities, and select indices. This diversity allows traders to diversify their portfolios and explore various market opportunities.

User-Friendly Trading Platform

Exness' trading platform is renowned for its user-friendly interface and intuitive design. The Standard account provides access to this robust trading platform, which offers a range of advanced charting tools, technical indicators, and order execution capabilities.

Seamless Deposit and Withdrawal Options

Exness understands the importance of convenient and reliable financial transactions. The Standard account offers a variety of deposit and withdrawal methods, including bank transfers, e-wallets, and credit/debit cards, ensuring that traders can manage their funds with ease.

Comprehensive Educational Resources

Exness places a strong emphasis on empowering its traders through comprehensive educational resources. The Standard account provides access to a wealth of educational materials, including video tutorials, webinars, and market analysis, helping traders to enhance their knowledge and trading skills.

Start Exness Trade: Open Exness Account and Visit site

Raw Spread Account: What You Need to Know

The Raw Spread account is designed for traders who prioritize tight spreads and low trading costs as the primary drivers of their trading strategy.

Raw Market Spreads

The defining feature of the Raw Spread account is its access to raw market spreads. Unlike the Standard account, which offers fixed or variable spreads, the Raw Spread account provides traders with direct access to the interbank spread, potentially resulting in tighter pricing.

Commission-Based Pricing

The Raw Spread account utilizes a commission-based pricing model, where traders pay a small commission per trade instead of relying solely on the spread. This structure is often preferred by traders who value minimizing the overall trading costs.

Leverage and Instrument Selection

The Raw Spread account offers leverage up to 1:500, slightly lower than the Standard account's 1:2000. However, the account still provides access to a diverse selection of trading instruments, including major and minor currency pairs, precious metals, commodities, and select indices.

Trading Platform and Execution

Traders using the Raw Spread account benefit from Exness' robust trading platform, which offers fast and reliable order execution. The platform's advanced charting tools and technical indicators support traders in making informed decisions.

best leverage for $10 account on EXNESS free

how to get unlimited leverage on EXNESS

how to increase leverage in EXNESS

Suitability for Experienced Traders

The Raw Spread account is often preferred by more experienced traders who have a deep understanding of market dynamics and are willing to actively monitor and manage their trading costs. The focus on raw spreads and commissions requires a higher level of trading expertise.

Zero Account: Conditions and Advantages

The Zero account is Exness' offering for traders who are primarily focused on minimizing their overall trading costs.

Start Exness Trade: Open Exness Account and Visit site

Commission-Based Pricing Structure

The Zero account operates on a commission-based pricing model, where traders pay a small commission per trade instead of relying solely on the spread. This structure is designed to provide traders with the potential for lower total trading costs.

Tight Spreads and Leverage

While the Zero account does not offer the raw market spreads of the Raw Spread account, it still provides traders with competitive spreads and leverage up to 1:500. This balance of tight spreads and leveraged trading opportunities appeals to cost-conscious traders.

Diverse Instrument Selection

The Zero account grants access to the same wide range of trading instruments as the Standard and Raw Spread accounts, including major and minor currency pairs, precious metals, commodities, and select indices. This diversity allows traders to diversify their portfolios and explore various market opportunities.

Trading Platform and Execution

Traders using the Zero account benefit from Exness' robust trading platform, which offers fast and reliable order execution. The platform's advanced charting tools and technical indicators support traders in making informed decisions.

Suitability for Cost-Conscious Traders

The Zero account is particularly suitable for traders who prioritize minimizing their trading costs above all else. This account type is often preferred by traders who have a strong focus on managing their overall trading expenses and maximizing their net profits.

Pro Account: Targeting Experienced Traders

The Pro account is Exness' premium offering, designed to cater to the needs of experienced and high-volume traders.

Personalized Support and Dedicated Account Manager

One of the key features of the Pro account is the personalized support and dedicated account manager provided to each trader. This personalized attention ensures that Pro account holders receive tailored guidance and assistance in navigating the complexities of the financial markets.

Enhanced Leverage and Instrument Selection

The Pro account offers enhanced leverage of up to 1:1000, providing traders with increased opportunities to amplify their trading positions. Additionally, the account grants access to a comprehensive selection of trading instruments, including major and minor currency pairs, precious metals, commodities, and a wider range of indices.

Customized Trading Conditions

Traders with the Pro account benefit from the ability to negotiate and customize their trading conditions, including spreads, commissions, and other parameters. This level of personalization allows experienced traders to optimize their trading strategies and potentially enhance their profitability.

Advanced Trading Tools and Features

The Pro account provides access to a suite of advanced trading tools and features, such as advanced charting capabilities, automated trading strategies, and exclusive market analysis. These tools empower traders to make more informed decisions and potentially gain a competitive edge in the markets.

See more:

how to open exness real account on mt5

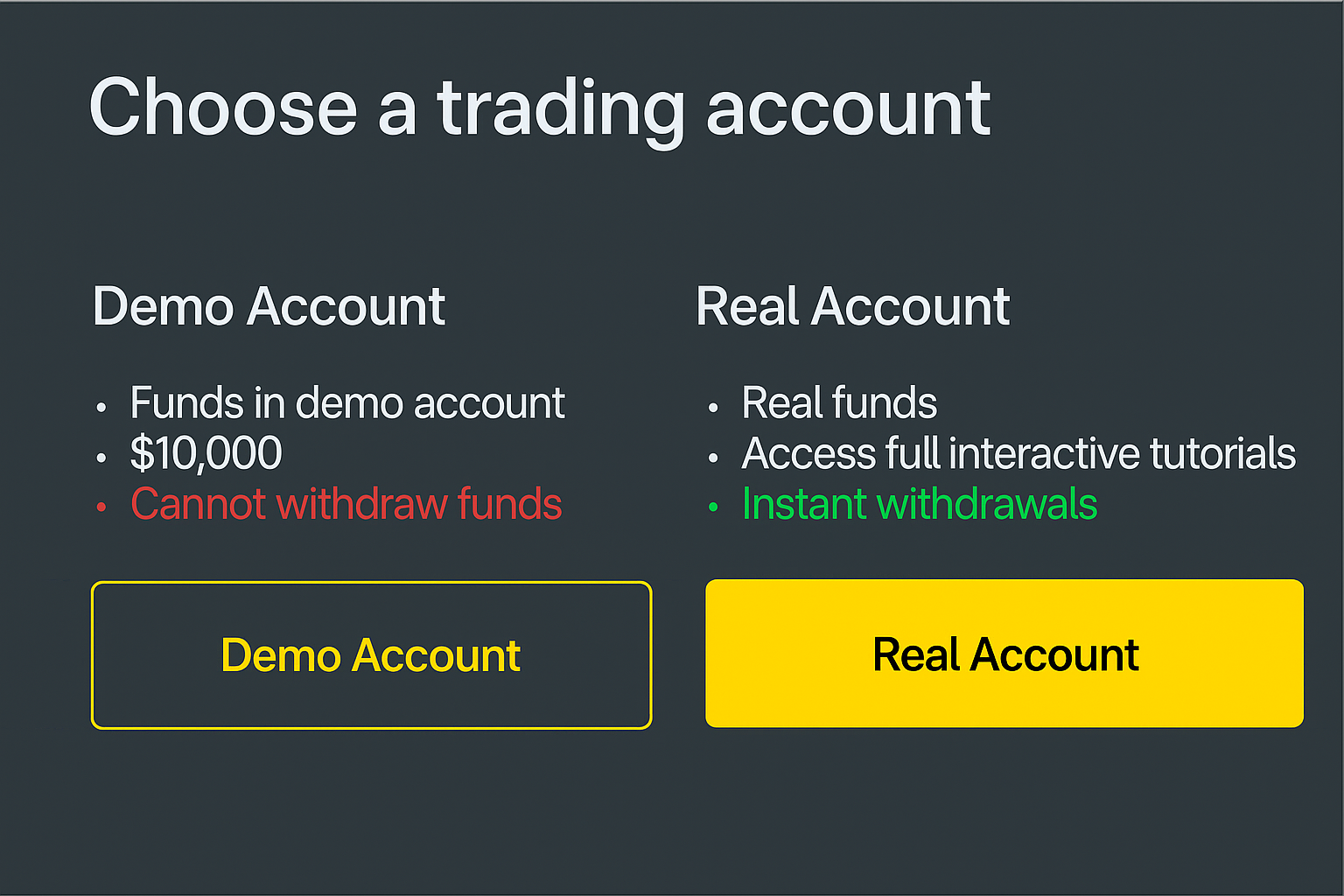

how to open exness demo account on mt5

How to get demo account on Exness?

Suitability for Professional and High-Volume Traders

The Pro account is primarily targeted at professional traders, institutional investors, and high-volume traders who demand the highest level of personalized service, customized trading conditions, and access to advanced trading tools and resources. This account type is often preferred by traders with significant trading experience and a strong understanding of market dynamics.

Comparative Analysis of Exness Account Types

When selecting an Exness account type, it is essential to consider the unique features, benefits, and conditions of each option to determine the one that best aligns with your trading goals, risk tolerance, and experience level.

Spread and Commission Comparison

One of the key factors to consider is the trading costs associated with each account type. The Standard account offers competitive fixed or variable spreads, while the Raw Spread and Zero accounts focus on commission-based pricing structures.

Leverage and Instrument Selection

Another important aspect to compare is the leverage and instrument selection offered by each account type. The Standard account provides the highest leverage at 1:2000, while the Raw Spread, Zero, and Pro accounts offer leverage up to 1:500, 1:500, and 1:1000, respectively. All account types provide access to a diverse range of trading instruments, catering to the needs of various traders.

Trading Platform and Execution

Exness' trading platform is consistent across all account types, offering a user-friendly interface, advanced charting tools, and reliable order execution. However, the Pro account may provide access to additional features and customization options.

Educational and Analytical Resources

Exness places a strong emphasis on empowering its traders through comprehensive educational resources and market analysis. All account types have access to these valuable resources, but the Pro account may offer additional personalized support and guidance.

Suitability for Different Trader Profiles

When comparing the Exness account types, it's essential to consider your trading experience, risk appetite, and investment goals. The Standard account is suitable for a wide range of traders, while the Raw Spread and Zero accounts are more suited for experienced, cost-conscious traders. The Pro account is tailored for professional and high-volume traders seeking personalized support and advanced trading tools.

Choosing the Right Exness Account for Your Trading Style

Selecting the right Exness account type is a crucial decision that can have a significant impact on your trading experience and overall performance. By carefully evaluating the features, benefits, and conditions of each account type, you can make an informed choice that aligns with your trading preferences and goals.

Assessing Your Trading Objectives and Risk Tolerance

Before choosing an Exness account, it's essential to reflect on your trading objectives and risk tolerance. Consider factors such as your investment goals, the amount of capital you're willing to allocate, and your appetite for risk. This self-assessment will help you narrow down the account type that best suits your trading style.

Evaluating Your Trading Experience and Expertise

Your level of trading experience and expertise is another crucial factor to consider when selecting an Exness account. Novice traders may find the Standard account a suitable starting point, as it offers a balance of features and accessibility. More experienced traders may gravitate towards the Raw Spread or Zero accounts, which cater to a higher level of market understanding and cost-consciousness.

Prioritizing Your Trading Costs and Profitability

For traders who place a strong emphasis on minimizing trading costs and maximizing profitability, the Zero account or the Raw Spread account may be the most appealing options. These account types focus on commission-based pricing structures, potentially offering lower overall trading expenses.

Seeking Personalized Support and Advanced Features

Traders who require personalized support, customized trading conditions, and access to advanced trading tools and resources may find the Pro account to be the most suitable choice. This premium account type is tailored for professional and high-volume traders who demand the highest level of service and specialized features.

Considering Your Long-Term Trading Plans

When choosing an Exness account, it's essential to consider your long-term trading plans and aspirations. As your trading experience and capital grow, you may want to explore the option of upgrading your account type to better suit your evolving needs and goals.

Start Exness Trade: Open Exness Account and Visit site

Exness Account Types: Spreads and Commissions Explained

Understanding the trading costs associated with different Exness account types is crucial for making an informed decision and managing your trading expenses effectively.

Standard Account Spreads and Commissions

The Standard account offers competitive fixed or variable spreads, which are the difference between the bid and ask prices of a trading instrument. Exness strives to provide some of the tightest spreads in the industry, allowing traders to potentially maximize their profits. The Standard account does not charge any additional commissions.

Raw Spread Account Spreads and Commissions

The Raw Spread account provides traders with direct access to raw market spreads, potentially resulting in tighter pricing. However, this account type utilizes a commission-based pricing structure, where traders pay a small commission per trade. The commission rates are typically lower than the spread costs of the Standard account.

Zero Account Spreads and Commissions

The Zero account also employs a commission-based pricing model, where traders pay a small commission per trade. While the spreads may not be as tight as the Raw Spread account, the Zero account is designed to offer traders the potential for lower overall trading costs.

Pro Account Spreads and Commissions

The Pro account offers the highest level of customization, allowing traders to negotiate their trading conditions, including spreads and commissions. This personalized approach enables experienced and high-volume traders to optimize their trading costs and potentially enhance their profitability.

Analyzing the Impact of Spreads and Commissions

When comparing the different Exness account types, it's essential to analyze the impact of spreads and commissions on your trading strategy and profitability. Consider factors such as your trading volume, the instruments you trade, and your overall risk management approach to determine the account type that aligns best with your financial objectives.

User Experiences with Exness Account Types

Understanding the real-world experiences of traders using different Exness account types can provide valuable insights and help you make a more informed decision.

Positive Feedback on the Standard Account

Many traders have reported positive experiences with the Standard account, citing the competitive spreads, user-friendly trading platform, and accessible educational resources as key advantages. Users have highlighted the account's versatility in catering to both novice and experienced traders.

Favorable Reviews of the Raw Spread Account

Traders who have opted for the Raw Spread account have generally praised the tight spreads and the potential for lower overall trading costs. However, some have noted that the commission-based pricing structure requires a higher level of market awareness and active cost management.

Satisfaction with the Zero Account

Traders who prioritize minimizing trading costs have expressed satisfaction with the Zero account, appreciating the commission-based pricing model and the potential for lower total expenses. Some users have also highlighted the account's competitive spreads and diverse instrument selection.

Positive Experiences with the Pro Account

Traders who have chosen the Pro account have often cited the personalized support, customized trading conditions, and access to advanced trading tools as key benefits. These users have reported a high level of satisfaction with the tailored service and the ability to optimize their trading strategies.

Diverse Trader Perspectives

It's important to note that individual trading experiences can vary, and factors such as trading style, risk management, and market conditions can all impact the perceived performance of different Exness account types. Conducting thorough research and considering multiple user reviews can help you gain a well-rounded understanding of the different account options.

Start Exness Trade: Open Exness Account and Visit site

Conclusion: Which Exness Account is Best for You?

Choosing the right Exness account type is a highly personal decision that depends on your trading objectives, risk tolerance, and experience level. By carefully evaluating the features, benefits, and conditions of each account type, you can make an informed choice that aligns with your unique trading needs.