5 minute read

EXNESS Broker Review Kenya: Is It Legit, Safe, and Regulated for Traders? Update 2025

If you're based in Kenya and exploring forex brokers in 2025, this EXNESS review gives you everything you need—no additional research required. You'll learn about its local licensing, account structures, platforms, payment methods (including M‑Pesa), customer service, educational resources, plus the biggest pros and cons.

⬇️⬇️⬇️

✅ EXNESS Legitimacy & Regulation in Kenya

EXNESS Kenya Limited is fully licensed by the Capital Markets Authority (CMA)—making it a legal broker within Kenya with strict oversight. Additionally, EXNESS holds licenses from FCA (UK), CySEC (EU), and FSCA (South Africa). These regulatory bodies ensure:

Client funds are held in segregated accounts

Negative balance protection is enforced

Operations follow global compliance and audit standards

Even without a local CBN license, these safeguards make EXNESS a trusted broker for Kenyan users.

📝 How to Open an EXNESS Account in Kenya

Opening an account is entirely online and beginner-friendly. Follow these detailed steps to get started:

Step by Step Exness Guide

Go to the official signup page:👉 Sign Up with EXNESS Kenya

Register with your email and Kenyan phone number.

Create a secure password and verify via SMS.

Input your personal details: name, birth date, and address.

Upload documents for KYC: national ID or passport and proof of address.

Choose between Standard, Pro, Raw Spread, or Zero account types.

Pick your trading platform: MT4, MT5, or Exness Go App.

Fund your account via M-Pesa, local bank, card, or e-wallet.

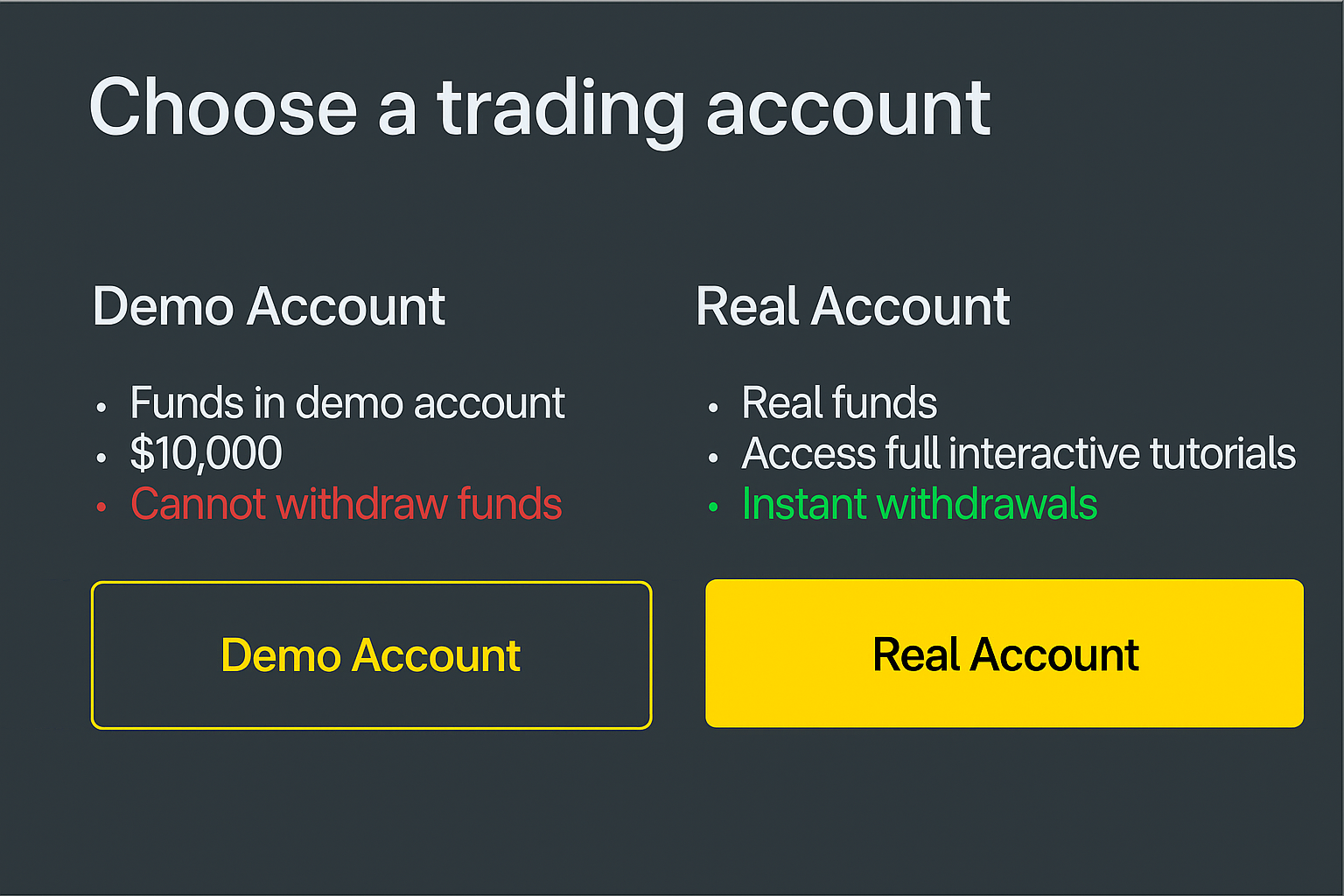

Once verified and funded, begin live trading—or use the free demo mode first.

⬇️⬇️⬇️

How to Create Exness Real Account 2025

⚙️ EXNESS Kenya Trading Conditions & Accounts

Account Types & Features

Standard/Cent accounts: No commission, floating spreads from ~0.3 pips.

Pro Account: Lower spreads (~0.1 pips), still commission-free.

Raw Spread: Near 0.0 pip spreads with $3.50 commission per lot side.

Zero Account: Fixed 0.0 pip spreads on major pairs, plus tiered commission.

All accounts offer Islamic swap‑free options for eligible traders.

Market Coverage & Leverage

Trade over 200+ instruments, including forex, indices, stocks, commodities, metals, and crypto CFDs.

Leverage up to 1:2000 or unlimited (depending on equity and asset class).

Execution speeds average under 0.1 second, helping scalpers and frequent traders.

🏦 Deposit & Withdrawal in Kenya

EXNESS makes funding seamless for Kenyan traders:

M-Pesa funding is instant and convenient.

Accepts NGN deposits/withdrawals via local banks, card, and e‑wallets like Skrill or Neteller.

Cryptocurrency (BTC, USDT) deposits and withdrawals are also supported.

Minimum deposit from approximately USD 10 (around KSh 1,300).

Most withdrawals are auto‑processed instantly; bank transfers may take up to 24 hours.

No internal EXNESS fees for deposits or withdrawals.

👉 Begin your EXNESS account setup here

📱 Trading Platforms & Tools Available

Platform Options

MetaTrader 4 & 5: Supports EAs, advanced indicators, and full desktop functionality.

Web Terminal: Browser-based trading without installation.

Exness Go App: Mobile-first platform allowing deposits, trades, analysis, alerts, and support—all in one.

Built-in Trading Tools

Pip, margin, and swap calculators

Economic event calendar with real-time alerts

Custom watchlists and price notifications

Live news and chat support embedded in platform

🎓 Educational Resources & Learning Tools

Beginners and experienced traders both benefit from EXNESS learning materials:

Free demo accounts for risk‑free strategy testing

Video tutorials and webinars covering trading basics to advanced analysis

Articles and blog posts in English and Swahili

Trading calculators, indicators, market news integrated into platforms

Step-by-step guides and tips in app accessible while trading

✅ Pros of EXNESS Kenya

Local and global regulatory compliance (CMA and others)

User-friendly account opening and easy KYC process

Wide account types and flexible leverage settings

Fast M-Pesa integration for deposits and withdrawals

Powerful mobile and desktop platforms

Rich educational content and user interface in local languages

❌ Cons & Things to Watch

Not licensed by CBN or SEC in Nigeria (but fully legal under CMA).

High leverage may lead to high risks if misused.

MT4 mobile functionality requires separate app install; Exness Go supports only MT5.

Some traders report minor technical glitches or delayed responses during busy times.

Complex strategies may require external tools not supported inside browser or app.

❓ FAQs About EXNESS Kenya

Is EXNESS regulated in Kenya?Yes—licensed by the Capital Markets Authority (CMA).

What’s the minimum deposit in KSh?From about USD 10 (~KSh 1,300). Larger for Pro or Raw accounts.

How fast are withdrawals via M‑Pesa?Instant in nearly all cases.

Can I use e-wallets like Skrill or Neteller?Yes—supported and usually processed within minutes.

Are swap-free (Islamic) accounts offered?Yes, available across Standard, Pro, Raw, and Zero accounts.

Which platforms can I use?MT4, MT5, web terminal, and Exness Go mobile app.

Is the Exness Go app secure?Yes—supports 2FA, encryption, PIN/biometric login.

Can I demo-trade before using real funds?Absolutely—full demo environment is available during signup.

How responsive is support in Kenya?24/7 live chat and local phone support; email responses within hours.

Why trade with EXNESS Kenya?Due to transparent regulation, local banking support, low fees, powerful platforms, and strong customer support.

✅ Final Verdict: Is EXNESS a Good Choice for Kenyan Traders?

Yes. EXNESS offers a full-featured, secure trading experience for Kenyan users in 2025. With local CMA licensing, seamless M-Pesa funding, flexible account options, and powerful mobile/desktop tools, it's highly recommended for both new and experienced traders.

👉 Begin your EXNESS account setup here

See more:

Ukaguzi wa Wakala wa EXNESS 2025: Faida na Hasara