13 minute read

Is Forex Trading Illegal in Nigeria? A Comprehensive Guide

from Exness Global

Forex trading has surged in popularity across Nigeria, with thousands of individuals seeking to tap into the global currency market as a means of financial empowerment. From Lagos to Abuja, young Nigerians are drawn to the promise of profits through speculative trading, fueled by the accessibility of online platforms and the allure of financial independence. But amidst this growing enthusiasm, a critical question lingers: Is forex trading illegal in Nigeria?

Top 4 Best Forex Brokers in Nigeria

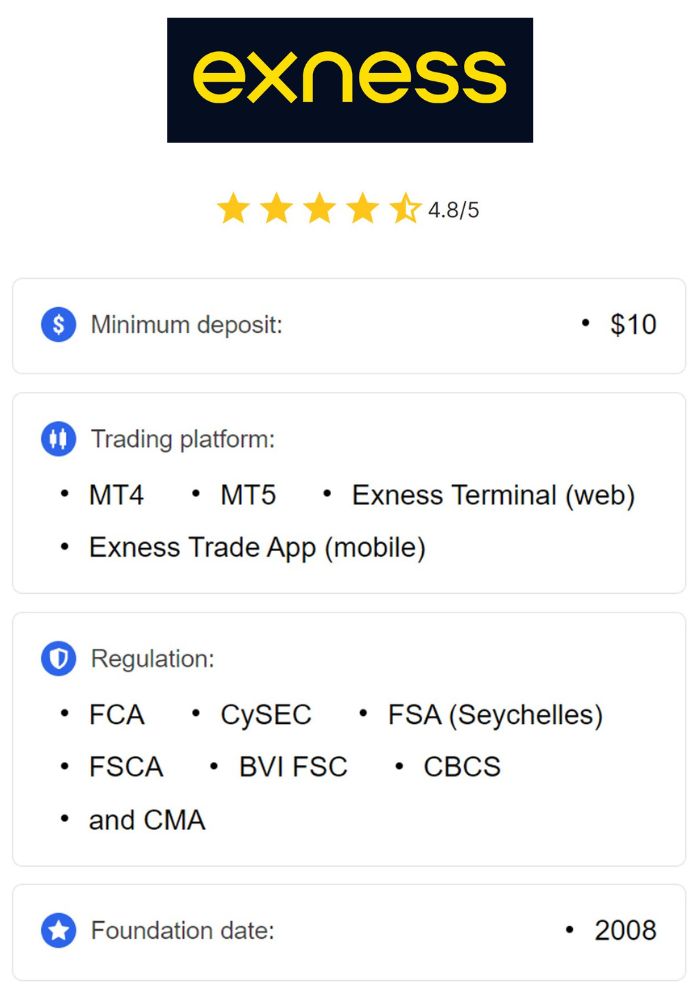

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

This question is not only relevant but also complex, given Nigeria’s unique economic landscape, regulatory framework, and evolving financial policies. Misinformation and myths surrounding forex trading can deter aspiring traders or lead them into risky ventures. In this in-depth guide, we’ll explore the legality of forex trading in Nigeria, unpack the regulatory environment, highlight key considerations for traders, and provide actionable steps to trade safely and legally in 2025. Whether you’re a beginner or an experienced trader, this article will equip you with the knowledge to navigate Nigeria’s forex market confidently.

Understanding Forex Trading: A Brief Overview

Before diving into the legality, let’s clarify what forex trading entails. Forex, short for foreign exchange, is the global marketplace where currencies are bought and sold. It’s the largest financial market in the world, with a daily trading volume exceeding $7 trillion, driven by banks, institutions, and retail traders speculating on currency price movements.

In Nigeria, forex trading typically involves retail traders using online platforms to speculate on currency pairs like USD/NGN (U.S. Dollar/Nigerian Naira) or EUR/USD (Euro/U.S. Dollar). Traders aim to profit from fluctuations in exchange rates. For example, if you predict the U.S. dollar will strengthen against the naira, you might buy USD/NGN and sell it later at a higher rate.

Forex trading appeals to Nigerians for several reasons:

Accessibility: You can start with as little as $50, thanks to brokers offering low minimum deposits.

Flexibility: The market operates 24 hours a day, five days a week, fitting around busy schedules.

Economic Motivation: With Nigeria facing inflation rates above 30% in 2024 and naira depreciation, forex offers a hedge against economic instability.

But with opportunity comes responsibility. The question of legality is paramount, as trading outside the law could lead to financial loss or penalties. So, let’s address the core issue: Is forex trading legal or illegal in Nigeria?

Is Forex Trading Legal in Nigeria?

The short answer is yes, forex trading is legal in Nigeria. There is no law that explicitly prohibits individuals from participating in the foreign exchange market. In fact, the Nigerian government recognizes the role of financial markets in economic growth, and forex trading aligns with this vision when conducted through legitimate channels.

However, legality comes with nuances. While retail forex trading is permitted, it operates within a broader regulatory framework overseen by key institutions like the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC). Understanding these regulations is crucial to ensure compliance and protect your investments.

The Legal Framework for Forex Trading in Nigeria

Nigeria’s financial system is governed by several laws and institutions that indirectly influence forex trading. Here’s a breakdown of the key components:

1. Central Bank of Nigeria (CBN)

The CBN is the apex monetary authority responsible for managing Nigeria’s foreign exchange reserves and stabilizing the naira. While the CBN doesn’t directly regulate retail forex trading, its policies impact traders in several ways:

Foreign Exchange Restrictions: The CBN occasionally limits access to foreign currency for certain transactions (e.g., imports). However, these restrictions typically don’t apply to retail forex trading conducted with personal funds.

Naira Volatility: The CBN intervenes in the forex market to manage naira fluctuations, which directly affects traders using NGN pairs.

Anti-Money Laundering (AML): The CBN enforces AML policies, requiring brokers and traders to adhere to Know Your Customer (KYC) protocols to prevent illicit activities.

2. Securities and Exchange Commission (SEC)

The SEC regulates Nigeria’s capital markets, including securities and derivatives like forex and contracts for difference (CFDs). In recent years, the SEC has taken a keen interest in forex trading due to the rise of online brokers and investment scams. Key SEC regulations include:

Broker Licensing: Forex brokers operating in Nigeria must obtain SEC licenses to ensure compliance with financial standards, such as maintaining minimum capital and protecting client funds.

Investor Protection: The SEC issues warnings against unregulated brokers and fraudulent schemes, urging traders to use licensed platforms.

3. Key Legislation

Several laws shape the forex trading landscape in Nigeria:

Investments and Securities Act (ISA) 2007: Grants the SEC authority to regulate brokers and financial services, including forex trading platforms.

Foreign Exchange (Monitoring and Miscellaneous Provisions) Act 1995: Outlines rules for foreign currency transactions, empowering the CBN to control forex flows.

Money Laundering (Prohibition) Act: Mandates KYC compliance to prevent forex trading from being used for illicit purposes.

What Makes Forex Trading Legal?

Forex trading is legal in Nigeria for the following reasons:

No Explicit Ban: Unlike some countries (e.g., India, where forex trading is restricted under certain conditions), Nigeria has no legislation prohibiting individuals from trading forex with their own funds.

Economic Liberalization: Since the 1990s, Nigeria has embraced policies encouraging participation in global financial markets, including forex.

Tax Compliance: Forex profits are subject to a 10% capital gains tax, legitimizing trading as a recognized income source.

However, legality hinges on compliance. Traders must use licensed brokers, declare earnings, and avoid practices like trading with other people’s funds without a license, which is illegal.

💥 Trade with Exness now: Open An Account or Visit Brokers

The Regulatory Gap: Why Forex Trading Feels “Unregulated”

Despite its legality, forex trading in Nigeria is often described as unregulated or poorly regulated. This perception stems from the absence of a dedicated forex regulatory body, unlike countries like the UK (Financial Conduct Authority) or the US (Commodity Futures Trading Commission). Here’s why this matters:

Lack of Specific Forex Regulations

The CBN and SEC focus on broader financial oversight rather than retail forex trading. While banks and large institutions are tightly regulated, retail forex brokers face less scrutiny unless they violate AML or securities laws. This creates a regulatory gap where:

Local Brokers: Few Nigerian brokers are fully licensed by the SEC, pushing traders toward international platforms.

High Leverage: Without leverage caps, brokers can offer ratios as high as 1:1000, increasing both potential profits and risks.

CFDs and Derivatives: Unlike heavily regulated markets, Nigeria permits CFD trading, which carries high risks due to leverage.

The Role of International Brokers

Most Nigerian traders use international brokers regulated by bodies like:

Financial Conduct Authority (FCA) – UK

Cyprus Securities and Exchange Commission (CySEC) – Cyprus

Australian Securities and Investments Commission (ASIC) – Australia

These brokers are legal to use in Nigeria as long as they comply with international standards and don’t violate local laws. However, the lack of local oversight means traders must exercise caution when choosing platforms.

Risks of the Regulatory Gap

The absence of robust regulation has pros and cons:

Pros:

Flexibility in leverage and trading products.

Access to a wide range of international brokers.

Fewer restrictions on trading strategies.

Cons:

Higher risk of scams and unregulated brokers.

Limited recourse if a broker engages in fraudulent practices.

Potential for future regulatory crackdowns.

In 2018, the SEC warned that online retail forex trading was “currently unregulated,” highlighting the risks of abuse. While this doesn’t make forex illegal, it underscores the need for vigilance.

Common Misconceptions About Forex Trading in Nigeria

Misinformation fuels confusion about forex trading’s legality. Let’s debunk some myths:

Myth 1: Forex Trading Is a Scam

While scams exist (e.g., Ponzi schemes disguised as forex investments), legitimate forex trading is a recognized financial activity. The key is choosing reputable brokers and avoiding unrealistic promises of “guaranteed profits.”

Myth 2: Forex Trading Is Gambling

Forex trading involves speculation, but it’s not gambling when approached with knowledge, strategy, and risk management. Professional traders rely on technical analysis, economic indicators, and disciplined planning.

Myth 3: You Need a License to Trade Forex

Retail traders don’t need a license to trade with their own funds. However, managing others’ money or operating as a broker requires CBN or SEC authorization.

Myth 4: Forex Trading Is Banned Due to CBN Restrictions

CBN policies, like limits on naira debit card spending abroad, affect funding trading accounts but don’t ban forex trading. Traders can use alternative payment methods like bank transfers or e-wallets.

Recent Developments in Nigeria’s Forex Market (2024–2025)

Nigeria’s forex market is dynamic, shaped by economic challenges and policy shifts. Here are key updates as of 2025:

1. CBN’s Nigeria Foreign Exchange Code (October 2024)

In response to market distortions caused by speculators and illicit traders, the CBN introduced the Nigeria Foreign Exchange Code, effective October 14, 2024. This framework aims to:

Enhance transparency and efficiency in the Nigerian Foreign Exchange Market (NFEM).

Set guidelines for banks, Bureau de Change (BDC) operators, and fintechs.

Require quarterly compliance reports to monitor adherence.

While the code focuses on wholesale forex transactions, it signals the CBN’s intent to tighten oversight, which could eventually impact retail trading.

2. Inflation and Naira Depreciation

As of Q1 2025, Nigeria’s inflation remains high, and the naira has weakened significantly (1 USD ≈ 1,500 NGN in February 2025). This volatility fuels forex trading interest but also increases risks, as currency pairs involving the naira are unpredictable.

3. Crackdowns on Illicit Forex Activities

The CBN has intensified efforts to curb illegal forex practices, such as:

Investigating platforms like AbokiFX in 2021 for alleged market manipulation.

Targeting unlicensed brokers promising unrealistic returns.

These actions don’t criminalize retail trading but emphasize the importance of using regulated platforms.

4. Rise of Digital Platforms

The proliferation of mobile trading apps has democratized forex access. Brokers like Octa, XM, and Exness offer naira-based accounts, making it easier for Nigerians to fund accounts despite CBN restrictions on debit card spending.

How to Trade Forex Legally in Nigeria

To trade forex legally and safely, follow these steps:

1. Choose a Reputable Broker

Selecting a broker is the most critical decision. Look for:

Regulation: Prefer brokers regulated by Tier-1 authorities (FCA, CySEC, ASIC) or SEC-registered local brokers.

Transparency: Check for clear fee structures and client fund protection (e.g., segregated accounts).

Naira Support: Brokers like Exness and HF Markets offer NGN accounts, simplifying deposits and withdrawals.

Reviews: Research user feedback on platforms like Trustpilot or forex forums.

Recommended Brokers for Nigerians in 2025:

Exness: Provides high leverage and fast withdrawals.

Octa: Known for low spreads and naira funding options.

XM: Offers robust education and FCA regulation.

💥 Trade with Exness now: Open An Account or Visit Brokers

2. Complete KYC Verification

All legitimate brokers require KYC documentation to comply with AML laws. You’ll need:

A valid ID (passport, driver’s license, or national ID).

Proof of address (e.g., utility bill or bank statement).

This process protects you and ensures compliance with Nigerian and international laws.

3. Start with a Demo Account

Before risking real money, practice on a demo account to:

Learn trading platforms like MetaTrader 4 or 5.

Test strategies without financial loss.

Understand market dynamics, such as leverage and margin.

4. Fund Your Account Responsibly

Use secure payment methods like:

Bank transfers.

Debit/credit cards (if permitted by your bank).

E-wallets (Neteller, Skrill, or local options like Flutterwave).

Start with an amount you can afford to lose, as forex trading carries high risks.

5. Declare Your Profits

Forex profits are subject to a 10% capital gains tax in Nigeria, whether earned through local or offshore brokers. Consult a tax professional to ensure compliance with the Federal Inland Revenue Service (FIRS).

6. Manage Risks

Forex trading is speculative, with 70–80% of retail traders losing money. Mitigate risks by:

Using stop-loss orders to limit losses.

Avoiding excessive leverage (e.g., stick to 1:50 or lower as a beginner).

Diversifying trades across multiple currency pairs.

Risks of Forex Trading in Nigeria

While forex trading is legal, it’s not without risks, especially in Nigeria’s unregulated environment. Here are the main challenges:

1. Scams and Fraudulent Brokers

Unregulated brokers may:

Manipulate prices or refuse withdrawals.

Disappear with client funds.

Promise guaranteed profits, which is impossible in forex.

To avoid scams, verify a broker’s license on the regulator’s website (e.g., SEC, FCA) and avoid platforms with overly aggressive marketing.

2. High Leverage Risks

Leverage amplifies both profits and losses. For example, with 1:100 leverage, a 1% market move can wipe out your account if not managed properly. Beginners should use low leverage until they gain experience.

3. Market Volatility

Nigeria’s economic instability, coupled with global events, makes forex markets unpredictable. Sudden naira devaluations or CBN interventions can lead to significant losses.

4. Lack of Local Recourse

If an international broker defrauds you, seeking redress in Nigeria can be challenging. Stick to brokers with strong reputations and client protection policies.

Opportunities in Nigeria’s Forex Market

Despite the risks, forex trading offers unique opportunities for Nigerians:

1. Wealth Creation

With proper education and discipline, forex can be a viable income source, especially in an economy with limited job opportunities.

2. Global Market Access

Forex connects Nigerians to global financial markets, allowing them to diversify income beyond naira-based assets.

3. Community and Education

Nigeria has vibrant forex trading communities, both online and offline. Platforms like Nairaland, local meetups, and webinars provide learning opportunities and peer support.

4. Technological Advancements

Mobile apps and fintech innovations make forex trading more accessible than ever, even in rural areas with internet access.

The Future of Forex Trading in Nigeria

As Nigeria’s economy evolves, so will its forex market. Here’s what to expect in the coming years:

1. Stronger Regulation

The CBN and SEC are likely to introduce specific forex regulations, similar to the 2024 FX Code for wholesale markets. This could include:

Licensing requirements for retail brokers.

Leverage caps to protect traders.

Enhanced investor education programs.

2. Integration with Fintech

Fintech startups are bridging gaps in forex access, offering naira-based trading solutions and local payment integrations. This trend will continue, making trading more seamless.

3. Economic Stabilization

If Nigeria addresses inflation and naira volatility, forex trading could become less speculative and more strategic, attracting institutional investors.

4. Increased Awareness

As more Nigerians succeed in forex, public perception will shift from skepticism to acceptance, driving demand for regulated platforms and education.

FAQs About Forex Trading in Nigeria

1. Is forex trading banned in Nigeria?

No, forex trading is legal in Nigeria. There’s no law prohibiting individuals from trading with their own funds, but you must use licensed brokers and comply with tax laws.

2. Do I need a license to trade forex?

No, retail traders don’t need a license. However, managing others’ funds or operating as a broker requires CBN or SEC authorization.

3. Are forex profits taxable in Nigeria?

Yes, forex profits are subject to a 10% capital gains tax. Declare earnings to the FIRS to avoid penalties.

4. Can I use international brokers?

Yes, international brokers regulated by bodies like the FCA or CySEC are legal to use, provided they comply with Nigerian laws.

5. How can I avoid forex scams?

Choose regulated brokers, verify licenses, start with small deposits, and avoid platforms promising guaranteed returns.

Conclusion: Trade Forex Legally and Wisely

Forex trading is unequivocally legal in Nigeria, offering a gateway to financial opportunities in a challenging economic climate. However, its legality doesn’t eliminate the need for caution. The absence of robust local regulation, combined with economic volatility, demands that traders approach forex with knowledge, discipline, and diligence.

By choosing reputable brokers, staying informed about CBN and SEC policies, and prioritizing risk management, Nigerians can harness the potential of forex trading while staying on the right side of the law. As the market evolves in 2025 and beyond, embracing education and community support will be key to thriving in this dynamic space.

Are you ready to explore forex trading? Start small, learn continuously, and trade responsibly. The global currency market awaits, and with the right approach, it can be a rewarding journey.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: