8 minute read

How to Open Forex Account in Dubai: A Step-by-Step Guide

Forex trading has emerged as one of the most exciting and accessible financial markets globally, offering individuals the opportunity to trade currencies and potentially profit from exchange rate fluctuations. For residents and expatriates in Dubai—a thriving financial hub in the Middle East—opening a Forex account is a gateway to tapping into this dynamic market. With its strategic location, investor-friendly regulations, and advanced infrastructure, Dubai has become a hotspot for Forex enthusiasts.

Top 4 Best Forex Brokers in Dubai

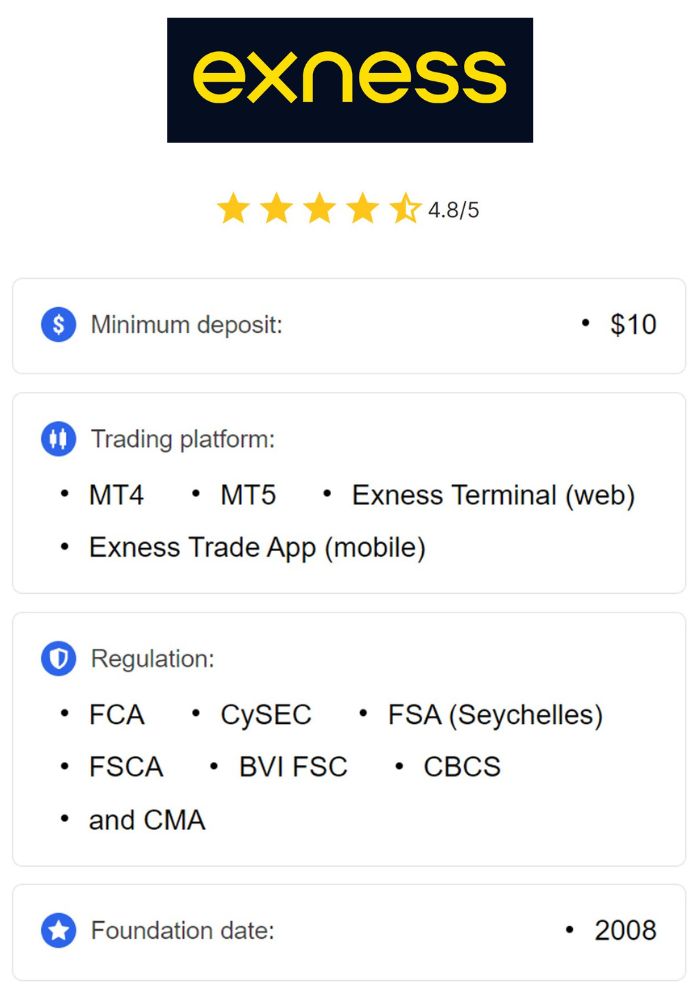

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

If you’re wondering how to get started, this guide will walk you through every step of opening a Forex account in Dubai. From understanding the basics of Forex trading to selecting a broker and complying with local regulations, we’ve got you covered. Let’s dive into the details and set you on the path to financial success.

What is Forex Trading and Why Dubai?

Before jumping into the process, it’s worth understanding what Forex trading entails and why Dubai is an ideal location for it. Forex, short for foreign exchange, involves trading one currency for another, such as buying US dollars (USD) with UAE dirhams (AED) or euros (EUR) with British pounds (GBP). The Forex market operates 24/5, making it highly flexible for traders worldwide.

Dubai stands out as a Forex trading hub for several reasons:

Strategic Location: Positioned between Europe, Asia, and Africa, Dubai offers a timezone advantage for trading across global markets.

Regulatory Framework: The Dubai Financial Services Authority (DFSA) and other bodies ensure a secure and transparent trading environment.

Tax Benefits: The UAE’s tax-free status means traders keep more of their profits.

Advanced Technology: Dubai’s cutting-edge infrastructure supports fast and reliable trading platforms.

Whether you’re a beginner or an experienced trader, Dubai provides an ecosystem that fosters growth and opportunity in Forex trading.

How to Open a Forex Account in Dubai

Opening a Forex account in Dubai is a straightforward process if you follow the right steps. Below, we’ll break it down into actionable stages to ensure you’re ready to trade confidently and legally.

Step 1: Educate Yourself on Forex Trading Basics

Before opening an account, take time to learn the fundamentals of Forex trading. Understanding key concepts like pips, leverage, margin, and currency pairs will help you make informed decisions. Many brokers offer free educational resources, including webinars, eBooks, and demo accounts, which are perfect for beginners.

In Dubai, you can also attend trading workshops or seminars hosted by financial institutions or brokers. Knowledge is your first line of defense against the risks inherent in Forex trading.

Step 2: Choose a Reputable Forex Broker

The broker you select will play a critical role in your trading experience. In Dubai, you have two main options: locally regulated brokers under the DFSA or offshore brokers licensed by reputable international authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

Here’s what to look for in a broker:

Regulation: Ensure the broker is licensed and complies with UAE laws if operating locally.

Trading Platform: Popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) should be available.

Fees and Spreads: Compare spreads, commissions, and withdrawal fees.

Customer Support: Opt for brokers with 24/7 support, ideally in English and Arabic.

Account Types: Look for options like micro, standard, or Islamic (swap-free) accounts.

Some well-known brokers operating in Dubai include Exness, Saxo Bank, and XM. Research each broker’s reputation by reading reviews and checking their licensing status.

💥 Trade with Exness now: Open An Account or Visit Brokers

Step 3: Gather Required Documentation

To open a Forex account in Dubai, brokers will require specific documents to verify your identity and residency. These typically include:

A valid passport or Emirates ID (for UAE residents).

Proof of address (e.g., a utility bill or bank statement).

Bank account details for deposits and withdrawals.

A completed application form provided by the broker.

For expatriates, additional documents like a residency visa may be needed. Ensure all documents are up-to-date to avoid delays in the account approval process.

Step 4: Open and Fund Your Account

Once you’ve chosen a broker and prepared your documents, follow these steps:

Visit the Broker’s Website: Navigate to the “Open Account” or “Register” section.

Complete the Application: Fill out the online form with your personal details.

Submit Documents: Upload scanned copies of your ID and proof of address.

Account Verification: Wait for the broker to verify your details (this usually takes 1-3 business days).

Deposit Funds: After approval, fund your account using bank transfers, credit/debit cards, or e-wallets like Skrill or Neteller. Minimum deposits vary by broker, ranging from $100 to $1,000.

In Dubai, many brokers accept AED deposits, saving you from currency conversion fees.

Step 5: Download a Trading Platform

After funding your account, download the broker’s trading platform (e.g., MT4 or MT5) on your desktop or mobile device. Most platforms are user-friendly and come with tools like real-time charts, technical indicators, and automated trading options. Take time to familiarize yourself with the interface before placing your first trade.

Step 6: Start Trading with a Demo Account (Optional)

If you’re new to Forex, consider practicing with a demo account first. Most Dubai-based brokers offer virtual accounts with simulated funds, allowing you to test strategies without risking real money. This step builds confidence and sharpens your skills.

Step 7: Place Your First Trade

Once you’re ready, log into your live account, select a currency pair (e.g., EUR/USD), and execute your trade. Start small to minimize risk, and use stop-loss orders to protect your capital. Monitor market trends and news to refine your approach over time.

Understanding Forex Regulations in Dubai

Dubai’s Forex market is regulated to protect traders and maintain market integrity. The DFSA oversees financial activities in the Dubai International Financial Centre (DIFC), while the UAE Central Bank governs broader financial operations. Brokers operating outside the DIFC may fall under the Securities and Commodities Authority (SCA).

Key regulatory points to note:

Licensing: Only trade with brokers licensed by the DFSA, SCA, or reputable offshore regulators.

Investor Protection: Regulated brokers segregate client funds from company assets, ensuring your money is safe.

Sharia Compliance: For Muslim traders, many brokers offer Islamic accounts that avoid interest (riba), aligning with UAE cultural values.

Always verify a broker’s regulatory status before committing funds. Unregulated brokers pose significant risks, including fraud and loss of capital.

Benefits of Trading Forex in Dubai

Trading Forex in Dubai comes with unique advantages that enhance your experience:

Tax-Free Profits: Unlike many countries, the UAE imposes no personal income tax, allowing you to keep 100% of your gains.

High Leverage: Brokers in Dubai often offer leverage up to 1:500, amplifying your trading potential (though it increases risk).

Diverse Currency Pairs: Access major, minor, and exotic pairs, including AED-based options.

Global Connectivity: Dubai’s financial ecosystem connects you to international markets seamlessly.

These perks make Dubai an attractive destination for both novice and seasoned traders.

Common Mistakes to Avoid When Opening a Forex Account

While the process is simple, beginners often stumble. Here are pitfalls to watch out for:

Skipping Research: Choosing a broker without checking reviews or regulation can lead to scams.

Overleveraging: High leverage can wipe out your account if not managed carefully.

Ignoring Risk Management: Failing to use stop-losses or diversify trades increases exposure to losses.

Rushing In: Trading without practice or a clear strategy often ends in disappointment.

Patience and preparation are key to long-term success in Forex trading.

Tips to Succeed as a Forex Trader in Dubai

To maximize your potential, consider these expert tips:

Stay Informed: Follow global economic news (e.g., interest rate changes, geopolitical events) that impact currency prices.

Develop a Strategy: Whether you prefer scalping, day trading, or swing trading, stick to a plan.

Use Technology: Leverage trading tools like Expert Advisors (EAs) or signals for better decision-making.

Network Locally: Join Dubai’s trading communities or forums to learn from experienced peers.

Track Performance: Regularly review your trades to identify strengths and weaknesses.

Consistency and discipline will set you apart in this competitive market.

Popular Forex Brokers in Dubai

Here’s a quick look at some trusted brokers operating in Dubai:

Exness: Regulated by DFSA, offering tight spreads and a robust platform.

Saxo Bank: Known for advanced tools and a wide range of currency pairs.

XM: Popular for low deposits and beginner-friendly features.

AvaTrade: Offers MT4/MT5 and excellent customer support.

Each broker caters to different needs, so choose one aligned with your goals.

Conclusion: Your Forex Journey Starts Here

Opening a Forex account in Dubai is more than just a financial decision—it’s an entry into a world of opportunity. With the right broker, a solid understanding of the market, and adherence to local regulations, you can build a rewarding trading career in this vibrant city. Take your time to research, practice, and refine your skills, and soon you’ll be navigating the Forex market like a pro.

💥 Trade with Exness now: Open An Account or Visit Brokers

Ready to take the plunge? Follow the steps outlined above, and let Dubai’s thriving financial landscape propel you toward success. Happy trading!

Read more: