9 minute read

Is Forex Trading Legal in Finland? A Comprehensive Guide

from Exness Global

Forex trading, the act of buying and selling currencies on the global market, has captivated millions worldwide. Its promise of financial freedom, flexibility, and high returns draws traders of all levels. But for those in Finland—or anyone considering trading from this Nordic nation—a key question arises: Is forex trading legal in Finland? The short answer is yes, but the full picture involves regulations, risks, and opportunities unique to this EU member state. In this in-depth guide, we’ll explore the legality of forex trading in Finland, the regulatory framework, how to start trading, and essential tips for success in 2025. Whether you’re a beginner or a seasoned trader, this article will equip you with everything you need to know.

Top 4 Best Forex Brokers in Finland

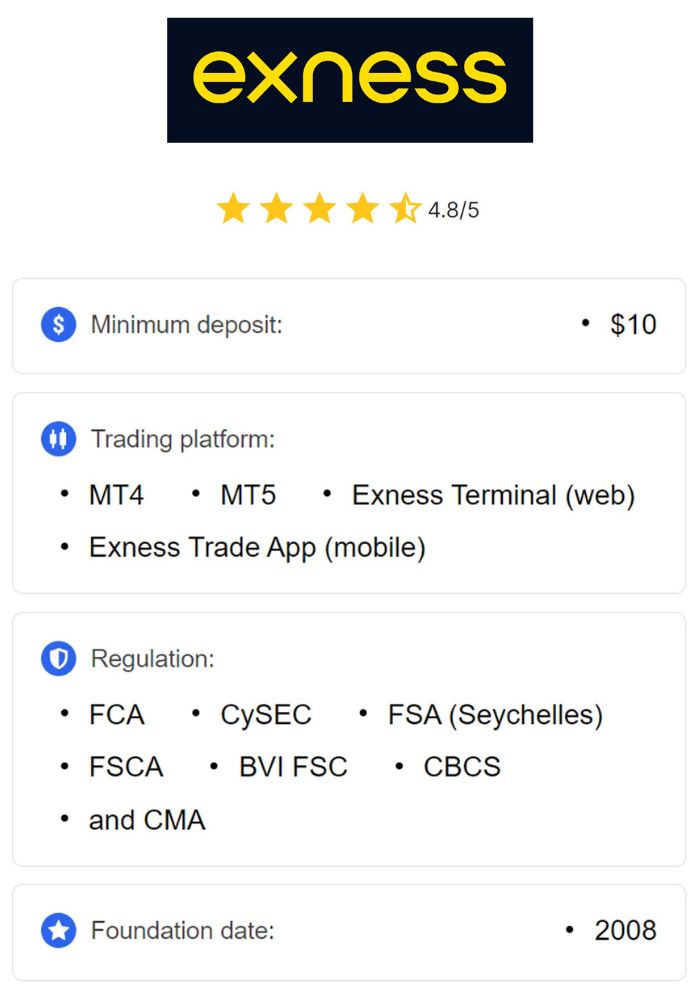

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

What Is Forex Trading?

Before diving into the legalities, let’s clarify what forex trading entails. Forex, short for "foreign exchange," involves trading currency pairs—like EUR/USD (Euro vs. U.S. Dollar)—to profit from fluctuations in exchange rates. It’s the world’s largest financial market, with a daily trading volume exceeding $7 trillion. Unlike stock markets, forex operates 24 hours a day, five days a week, across major financial hubs like London, New York, and Tokyo.

Forex trading appeals to individuals for its accessibility and potential rewards. With just a laptop, internet connection, and a brokerage account, anyone can participate. However, its decentralized nature and use of leverage—borrowing funds to amplify trades—also make it risky. This duality raises questions about its regulation and legality, especially in countries like Finland with robust financial systems.

Is Forex Trading Legal in Finland?

Yes, forex trading is unequivocally legal in Finland. As a member of the European Union (EU), Finland operates under a sophisticated financial framework that permits forex trading for individuals and institutions. Unlike some nations with outright bans or heavy restrictions, Finland embraces forex as a legitimate investment activity—provided traders adhere to national and EU regulations.

The Finnish government doesn’t prohibit forex trading, nor does it impose unreasonable barriers. Instead, it fosters a secure environment through oversight and consumer protections. This clarity makes Finland an attractive destination for forex enthusiasts, both locally and internationally. However, legality comes with conditions, and understanding these rules is crucial for compliant and safe trading.

💥 Trade with Exness now: Open An Account or Visit Brokers

💥 Trade with Exness now: Open An Account or Visit Brokers

The Regulatory Framework Governing Forex Trading in Finland

Finland’s forex market doesn’t exist in a vacuum—it’s shaped by a blend of national and EU regulations. Here’s how it works:

The Finnish Financial Supervisory Authority (FIN-FSA)

The Financial Supervisory Authority (FIN-FSA) is Finland’s primary regulator for financial markets, including forex. Established in 2009, the FIN-FSA oversees banks, insurance companies, investment firms, and forex brokers operating within the country. Its mission? To ensure market stability, transparency, and fairness while protecting investors from fraud and malpractice.

While the FIN-FSA doesn’t require forex brokers to be based in Finland, it mandates that any broker serving Finnish clients must comply with strict standards. These include financial stability, anti-money laundering (AML) measures, and client fund protection. The FIN-FSA also collaborates with the Bank of Finland and the European Central Bank to maintain a cohesive financial ecosystem.

EU Regulations and MiFID II

As an EU member, Finland adheres to the Markets in Financial Instruments Directive (MiFID II), a cornerstone framework for financial markets across the European Economic Area (EEA). MiFID II allows brokers regulated in one EU country—say, Cyprus or the UK—to "passport" their services to Finland without needing a separate FIN-FSA license. This system broadens options for Finnish traders while ensuring oversight.

The European Securities and Markets Authority (ESMA), an EU-wide regulator, also plays a pivotal role. Since 2018, ESMA has enforced rules to safeguard retail traders, including:

Leverage Limits: Retail traders in Finland face caps of 30:1 for major currency pairs (e.g., EUR/USD) and 20:1 for non-major pairs. Professional traders can access higher leverage if they meet specific criteria.

Negative Balance Protection: Brokers must ensure clients can’t lose more than their deposited funds, preventing debt.

Risk Warnings: Brokers must disclose the percentage of retail accounts losing money (typically 70-80%).

These measures balance opportunity with safety, making forex trading in Finland both legal and well-regulated.

Why Finland Lacks Domestic Forex Brokers

Interestingly, Finland has no prominent domestic forex brokers. Why? The country’s small population (around 5.5 million) and high regulatory standards make it less appealing for firms to establish local operations. Instead, Finnish traders rely on offshore brokers—often from Cyprus, the UK, or other EU nations—regulated under MiFID II and ESMA guidelines.

This absence doesn’t hinder access. Finnish traders enjoy a wealth of international options, from industry giants like IG and FOREX.com to social trading platforms like eToro. The key is choosing a broker that complies with EU regulations, ensuring safety and reliability.

Forex Trading vs. Gambling: Finland’s Legal Distinction

A common misconception is that forex trading resembles gambling. In Finland, the law disagrees. Unlike gambling—regulated separately with an age limit of 18—forex trading is classified as a financial investment activity. It involves skill, analysis, and strategy, not mere chance. Traders use economic data, technical charts, and global events to make informed decisions, setting it apart from games of luck.

This distinction reinforces forex’s legitimacy in Finland. It’s not subject to gambling laws but falls under financial regulations, offering traders legal protections and tax obligations.

Taxation of Forex Profits in Finland

Speaking of taxes, forex trading profits in Finland are taxable. The Finnish Tax Administration (Verohallinto) treats forex gains as capital income, taxed at:

30% for profits up to €30,000 annually.

34% for profits exceeding €30,000.

For example, if you earn €10,000 from forex in a year, you’d owe €3,000 in taxes. Losses can sometimes offset gains, reducing your tax burden, but documentation is key. Traders must report earnings annually, typically via the tax authority’s online portal. Given the complexity, consulting a tax professional is wise to ensure compliance.

How to Start Forex Trading in Finland

Ready to trade forex from Finland? Here’s a step-by-step guide for 2025:

1. Educate Yourself

Forex isn’t a get-rich-quick scheme—it demands knowledge. Start with the basics: currency pairs, pips, leverage, and margin. Free resources like Babypips, broker webinars, and YouTube tutorials can build your foundation. Understanding risk management is equally vital, as leverage amplifies both gains and losses.

2. Choose a Regulated Broker

Select a broker authorized by the FIN-FSA or another EU regulator (e.g., CySEC, FCA). Check their license on the regulator’s website. Key factors to consider:

Regulation: Ensures client fund safety and fair practices.

Trading Platform: MetaTrader 4 (MT4), MetaTrader 5 (MT5), or proprietary platforms like eToro’s.

Spreads and Fees: Look for competitive spreads (e.g., 0.1 pips on EUR/USD) and low commissions.

Customer Support: Multilingual support, ideally with Finnish, is a plus.

Popular choices for Finnish traders include IC Markets, Saxo Bank, and XTB.

3. Open a Trading Account

Most brokers offer a seamless online sign-up process. You’ll need:

Personal details (name, address, etc.).

Proof of identity (passport or ID card).

Proof of residence (utility bill or bank statement).

Due to AML and Know Your Customer (KYC) rules, verification is mandatory. Once approved, deposit funds via bank transfer, card, or e-wallets like Skrill.

4. Practice with a Demo Account

Before risking real money, use a demo account. Most brokers provide virtual funds (e.g., $10,000) to test strategies and platforms. It’s a risk-free way to gain confidence.

5. Develop a Trading Strategy

Success requires a plan. Common strategies include:

Day Trading: Fast-paced trades within a day.

Swing Trading: Holding positions for days or weeks.

Position Trading: Long-term trades based on fundamentals.

Incorporate risk management—never risk more than 1-2% of your capital per trade.

6. Start Trading

Fund your live account and begin with small trades. Monitor economic calendars for events like ECB interest rate decisions or U.S. jobs reports, which impact currency pairs like EUR/USD.

Benefits of Forex Trading in Finland

Why trade forex from Finland? Here are the advantages:

Robust Regulation: FIN-FSA and ESMA protections minimize fraud risks.

Stable Economy: Finland’s use of the Euro (EUR) and strong economic indicators create a reliable trading base.

Tech Infrastructure: High-speed internet and advanced platforms ensure seamless trading.

Global Access: Offshore brokers connect Finnish traders to worldwide markets.

Risks and Challenges

Forex isn’t without pitfalls:

High Risk: Leverage can lead to significant losses—70-80% of retail traders lose money.

Tax Burden: High tax rates on profits can eat into returns.

No Local Brokers: Reliance on offshore firms requires extra due diligence.

Volatility: Currency markets shift rapidly, demanding constant attention.

Effective risk management—stop-loss orders, diversification, and discipline—can mitigate these challenges.

Top Forex Brokers for Finnish Traders in 2025

Here are five brokers well-suited for Finland, based on regulation, features, and reputation:

Exness

Regulation: FSCA, CySEC, FSA.

Features: Tight spreads (from 0.0 pips), MT4/MT5, fast execution.

Best For: Advanced traders seeking low costs.

Saxo Bank

Regulation: Danish FSA, multiple Tier-1 authorities.

Features: SaxoTraderGO platform, extensive market access.

Best For: Professional traders with larger capital.

eToro

Regulation: CySEC, FCA, ASIC.

Features: Social trading, copy trading, user-friendly interface.

Best For: Beginners and social traders.

XTB

Regulation: FCA, KNF, CySEC.

Features: xStation 5 platform, no minimum deposit, educational resources.

Best For: All skill levels.

Regulation: CFTC, FCA, ASIC.

Features: Wide range of pairs, TradingView integration.

Best For: Versatile traders.

Always verify a broker’s license and read reviews before committing.

The Future of Forex Trading in Finland

What lies ahead for forex in Finland? Trends suggest growth:

Technological Advancements: AI-driven trading tools and mobile apps will enhance accessibility.

Regulatory Evolution: Stricter rules may emerge to protect retail traders further.

Rising Popularity: Financial literacy campaigns could boost participation.

Finland’s stable economy and EU membership position it well for continued forex expansion. However, traders must stay informed about regulatory shifts and market dynamics.

Tips for Successful Forex Trading in Finland

Stay Educated: Follow market news via Reuters, Bloomberg, or X posts from traders.

Use Risk Management: Set stop-losses and avoid over-leveraging.

Test Strategies: Backtest on demo accounts before going live.

Monitor Taxes: Keep detailed records for accurate reporting.

Choose Wisely: Prioritize regulated brokers with transparent fees.

Conclusion: Is Forex Trading Right for You in Finland?

Forex trading is legal, regulated, and accessible in Finland, offering a gateway to global markets. The FIN-FSA and ESMA ensure a safe environment, while the lack of domestic brokers opens doors to trusted international firms. Yet, success isn’t guaranteed—education, strategy, and discipline are non-negotiable.

If you’re in Finland and intrigued by forex, start small. Open a demo account, learn the ropes, and choose a reputable broker. The potential for profit exists, but so does the risk of loss. With the right approach, forex trading in Finland can be a rewarding venture in 2025 and beyond.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: