9 minute read

Is Forex Trading Legal in India? A Comprehensive Guide for Beginners

from Exness Global

Forex trading, also known as foreign exchange trading, has gained immense popularity worldwide as a lucrative way to earn profits by speculating on currency price movements. However, for individuals in India, one question often looms large: Is forex trading legal in India? The answer is not a simple yes or no—it’s nuanced, governed by strict regulations, and depends on how, where, and what you trade. In this in-depth guide, we’ll explore the legality of forex trading in India, the rules set by the Reserve Bank of India (RBI), the risks involved, and practical tips for Indian traders looking to navigate this financial landscape.

Top 4 Best Forex Brokers in India

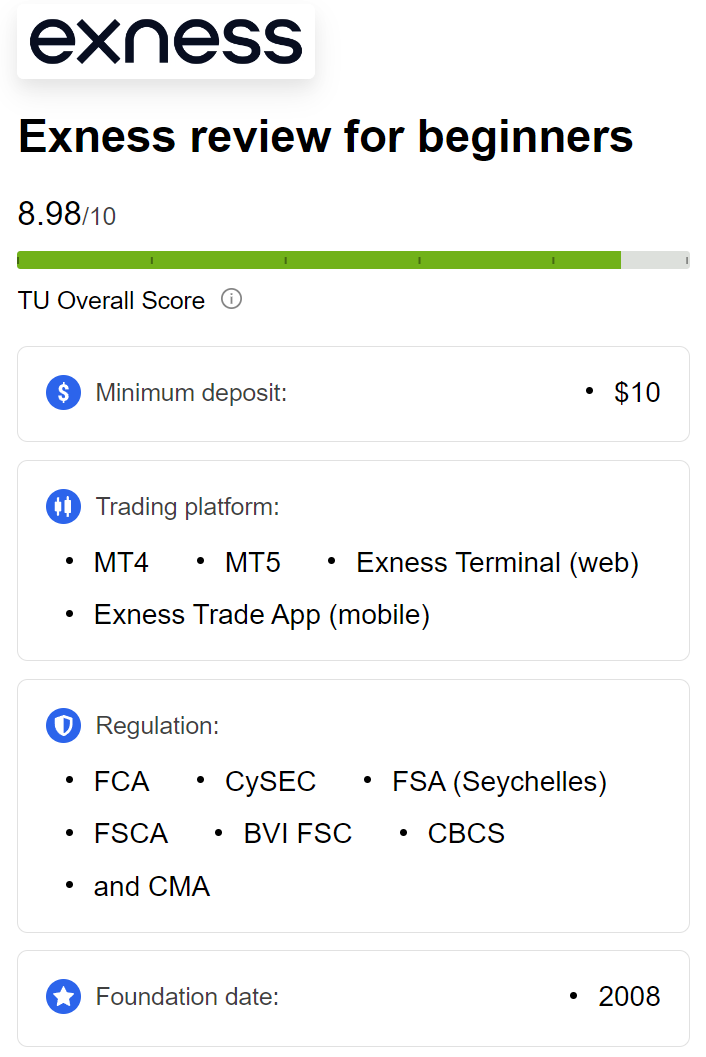

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

By the end of this article, you’ll have a clear understanding of whether forex trading is permissible in India, the legal avenues available, and how to get started responsibly.

What Is Forex Trading? A Quick Overview

Before diving into the legalities, let’s clarify what forex trading entails. Forex trading involves buying and selling currencies in the global foreign exchange market, the largest and most liquid financial market in the world. Traders speculate on the rise or fall of one currency’s value against another, such as the US Dollar (USD) versus the Indian Rupee (INR).

For example, if you believe the USD will strengthen against the INR, you might buy USD/INR. If your prediction is correct, you profit from the price difference. The appeal of forex trading lies in its accessibility, high liquidity, and potential for profit—attributes that attract millions globally, including Indians.

But while forex trading thrives internationally, India imposes specific restrictions to protect its economy and citizens from financial risks. So, is forex trading legal in India? Let’s break it down.

The Legal Framework of Forex Trading in India

Forex trading in India is regulated by the Reserve Bank of India (RBI), the country’s central banking authority, under the Foreign Exchange Management Act (FEMA), 1999. The RBI’s primary goal is to maintain stability in the Indian rupee and prevent illegal capital outflows. As a result, forex trading isn’t entirely banned, but it’s heavily restricted and only allowed under specific conditions.

1. Forex Trading Through Authorized Channels

The RBI permits forex trading in India, but only through authorized dealers and within designated currency pairs. Indian residents cannot freely trade forex like their counterparts in the US or Europe, where retail forex brokers abound. Instead, forex trading must occur via platforms regulated by the Securities and Exchange Board of India (SEBI) or exchanges recognized by the RBI, such as the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), or Metropolitan Stock Exchange (MSE).

Additionally, the RBI restricts forex trading to INR-based currency pairs. This means you can legally trade pairs like:

USD/INR (US Dollar vs. Indian Rupee)

EUR/INR (Euro vs. Indian Rupee)

GBP/INR (British Pound vs. Indian Rupee)

JPY/INR (Japanese Yen vs. Indian Rupee)

These pairs are available as currency derivatives (futures and options) on SEBI-regulated exchanges. Trading other pairs, such as EUR/USD or GBP/JPY, is not permitted for Indian residents unless done through illegal offshore brokers—a practice the RBI strongly discourages.

2. Restrictions on Retail Forex Trading

Unlike many countries where individuals can open accounts with international forex brokers like XM, IG, or Forex.com, India prohibits its residents from engaging in retail forex trading with offshore brokers. The RBI views such activities as a violation of FEMA, as they involve transferring money abroad without approval, potentially destabilizing the rupee.

If an Indian resident sends money to an offshore forex broker or trades non-INR pairs, they risk penalties, including fines or legal action. The RBI has issued multiple warnings against unauthorized forex trading platforms, emphasizing that only SEBI-registered brokers and INR-based trades are legal.

3. Liberalized Remittance Scheme (LRS) Exception

There’s a small loophole: the Liberalized Remittance Scheme (LRS). Under LRS, Indian residents can remit up to $250,000 per financial year abroad for permissible transactions, such as education, travel, or investments. Some argue this could include forex trading with international brokers. However, the RBI has not explicitly approved forex trading under LRS, and using it for speculative trading remains a gray area. Traders attempting this route should consult legal experts to avoid violating FEMA.

Why Does India Restrict Forex Trading?

India’s cautious stance on forex trading stems from several factors:

1. Economic Stability

The RBI prioritizes rupee stability to prevent excessive volatility that could harm the economy. Unregulated forex trading could lead to significant capital outflows, weakening the INR and disrupting India’s balance of payments.

2. Protection Against Scams

The forex market is notorious for scams, especially unregulated offshore brokers promising high returns. By restricting forex trading to authorized channels, the RBI aims to shield Indian citizens from fraudulent schemes.

3. Capital Control Policies

India maintains strict capital controls under FEMA to regulate foreign exchange transactions. Allowing unrestricted forex trading would undermine these controls, potentially leading to speculative bubbles or financial crises.

While these restrictions may frustrate aspiring traders, they reflect India’s broader economic priorities. That said, legal avenues do exist for those willing to comply with the rules.

How to Trade Forex Legally in India

If you’re an Indian resident eager to trade forex, here’s how to do it legally:

Step 1: Choose a SEBI-Registered Broker

Select a broker registered with SEBI and affiliated with a recognized exchange (NSE, BSE, or MSE). Popular options include:

Exness

Upstox

Angel Broking

These brokers offer currency derivatives trading, which is the legal form of forex trading in India.

💥 Trade with Exness now: Open An Account or Visit Brokers

Step 2: Open a Trading Account

You’ll need a trading and demat account to trade currency futures and options. The process is straightforward:

Submit KYC documents (Aadhaar, PAN, etc.).

Link your bank account.

Fund your trading account with INR.

Step 3: Trade INR-Based Currency Pairs

Focus on the four permitted pairs (USD/INR, EUR/INR, GBP/INR, JPY/INR). These are available as futures or options contracts, allowing you to speculate on price movements without physically exchanging currencies.

Step 4: Understand the Costs

Trading currency derivatives involves:

Brokerage fees

Exchange transaction charges

Margin requirements

Ensure you understand these costs to maximize profitability.

Step 5: Stay Compliant

Avoid offshore brokers or non-INR pairs. Monitor RBI and SEBI circulars for updates on forex trading regulations.

Risks of Illegal Forex Trading in India

Some Indian traders, lured by the promise of higher leverage or exotic currency pairs, turn to offshore brokers. This is a risky move with serious consequences:

1. Legal Penalties

Violating FEMA can result in fines, confiscation of funds, or imprisonment. The RBI collaborates with enforcement agencies to crack down on illegal forex activities.

2. Financial Losses

Unregulated brokers often operate scams, manipulating trades or refusing withdrawals. Without SEBI oversight, you have little recourse if funds vanish.

3. Account Freezes

Banks may freeze accounts linked to offshore forex transactions, as they’re obligated to report suspicious activities to the RBI.

The risks far outweigh the rewards of illegal trading. Sticking to legal channels ensures safety and peace of mind.

Benefits of Legal Forex Trading in India

For those who trade within the rules, forex trading offers several advantages:

1. Hedging Opportunities

Businesses and individuals with foreign exposure (e.g., importers, exporters, or NRIs) can use currency futures to hedge against rupee volatility.

2. Low Entry Barrier

Currency derivatives require less capital than stock trading, making them accessible to beginners.

3. High Liquidity

INR-based pairs on Indian exchanges are highly liquid, ensuring smooth trade execution.

4. Regulated Environment

SEBI oversight minimizes fraud, offering a secure trading experience.

Common Misconceptions About Forex Trading in India

Myth 1: Forex Trading Is Completely Illegal

False. It’s legal when done through SEBI-regulated platforms and INR pairs.

Myth 2: You Can Freely Use Offshore Brokers

No. Trading with unauthorized brokers violates FEMA.

Myth 3: Forex Trading Guarantees Profits

Like any investment, forex trading carries risks. Success requires skill, strategy, and discipline.

The Future of Forex Trading in India

As India’s economy grows and integrates with global markets, calls for liberalizing forex trading regulations are increasing. Some experts predict the RBI may eventually allow limited retail forex trading with international brokers, provided strict safeguards are in place. However, no major changes have been announced.

For now, Indian traders must work within the existing framework. The rise of fintech and increased financial literacy could push regulators to adapt, but economic stability will remain the RBI’s top priority.

Tips for Aspiring Forex Traders in India

Educate Yourself: Learn technical analysis, fundamental analysis, and risk management.

Start Small: Practice with a demo account before risking real money.

Monitor News: Economic events (e.g., RBI policy changes, US Fed decisions) impact currency prices.

Use Stop Losses: Protect your capital from sudden market swings.

Stay Legal: Avoid shortcuts that could land you in trouble.

Conclusion: Is Forex Trading Legal in India?

Yes, forex trading is legal in India—but with caveats. You can trade INR-based currency pairs through SEBI-regulated brokers and exchanges, but retail forex trading with offshore brokers or non-INR pairs is prohibited under FEMA. The RBI’s strict rules aim to safeguard the economy and protect citizens, though they limit the flexibility enjoyed by traders elsewhere.

For Indian residents, legal forex trading offers a viable way to participate in the global market, provided you follow the guidelines. Whether you’re hedging risks or seeking profits, understanding the regulations is key to success.

Ready to start? Open an account with a SEBI-registered broker, master the basics, and trade responsibly. The forex market awaits—legally and securely.

FAQs

Q1: Can I trade forex with an international broker from India?No, it’s illegal under FEMA unless explicitly permitted by the RBI.

Q2: What currency pairs can I trade legally in India?Only INR-based pairs like USD/INR, EUR/INR, GBP/INR, and JPY/INR.

Q3: Is forex trading profitable in India?It can be, but it requires skill, research, and risk management—profits aren’t guaranteed.

Q4: What happens if I trade forex illegally?You risk fines, legal action, or loss of funds to scams.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: