9 minute read

Is Forex Trading Legal in Nigeria? A Comprehensive Guide for Beginners

Forex trading has gained immense popularity worldwide, and Nigeria is no exception. With its promise of financial freedom and the ability to earn money from the comfort of home, many Nigerians are drawn to the foreign exchange market. However, a common question lingers in the minds of both beginners and seasoned traders: Is forex trading legal in Nigeria? This article dives deep into the legality of forex trading in Nigeria, exploring the regulatory framework, risks, opportunities, and practical tips for anyone looking to venture into this dynamic market.

Top 4 Best Forex Brokers in Nigeria

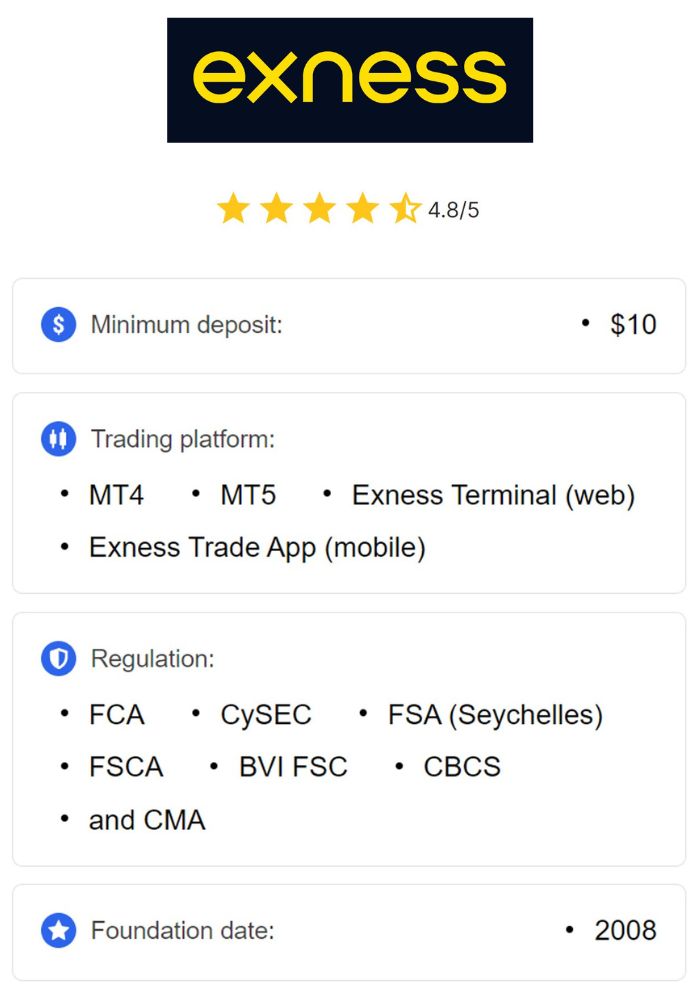

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

What Is Forex Trading?

Before addressing its legality, let’s clarify what forex trading entails. Forex, short for foreign exchange, is the global marketplace where currencies are bought and sold. Traders speculate on the price movements of currency pairs, such as USD/NGN (U.S. Dollar/Nigerian Naira) or EUR/USD (Euro/U.S. Dollar), aiming to profit from fluctuations in exchange rates.

The forex market operates 24 hours a day, five days a week, and is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Its decentralized nature allows individuals, businesses, and institutions to participate through online platforms provided by brokers.

In Nigeria, forex trading has surged in popularity due to high unemployment rates, a growing tech-savvy youth population, and the increasing availability of internet access. But the big question remains: Is it legal?

Is Forex Trading Legal in Nigeria?

Yes, forex trading is legal in Nigeria. There is no law in the country that explicitly prohibits individuals or entities from participating in the foreign exchange market. However, the legality comes with a caveat—regulation and oversight are critical factors that traders must consider.

The Central Bank of Nigeria (CBN) is the primary authority responsible for overseeing financial activities in the country, including foreign exchange transactions. While the CBN regulates the official forex market (e.g., transactions involving banks and authorized dealers), retail forex trading—where individuals trade through online brokers—falls into a gray area. This is because most retail forex brokers operating in Nigeria are based offshore and are not directly regulated by Nigerian authorities.

💥 Trade with Exness now: Open An Account or Visit Brokers

The Role of the Central Bank of Nigeria (CBN)

The CBN plays a pivotal role in Nigeria’s forex ecosystem. It controls the official exchange rate, manages the country’s foreign reserves, and implements policies to stabilize the Naira. For instance, the CBN has introduced measures like the Investors and Exporters (I&E) window to facilitate legitimate forex transactions for businesses and investors.

However, retail forex trading, where individuals speculate on currency pairs for profit, is not explicitly covered under CBN regulations. This lack of direct oversight has led to misconceptions that forex trading might be illegal. In reality, the absence of a specific ban means it is permissible, provided traders adhere to general financial laws, such as those against money laundering and fraud.

The Securities and Exchange Commission (SEC) in Nigeria

Another key player in Nigeria’s financial landscape is the Securities and Exchange Commission (SEC). The SEC regulates investment activities, including capital markets and securities trading. In recent years, the SEC has taken steps to address forex trading by issuing guidelines for brokers and firms offering forex-related services within Nigeria.

In 2020, the SEC declared that only registered Capital Market Operators (CMOs) are allowed to offer forex trading services to Nigerians. This move was aimed at protecting investors from unregulated brokers and scams. However, many Nigerians trade with international brokers that are not registered with the SEC, raising questions about compliance and safety.

Why Forex Trading Operates in a Gray Area in Nigeria

While forex trading itself is legal, the regulatory framework in Nigeria is still evolving. Here’s why it’s considered a gray area:

Offshore Brokers Dominate the Market: Most forex brokers accessible to Nigerians are based outside the country (e.g., in the UK, Cyprus, or South Africa) and are regulated by foreign bodies like the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC). These brokers are not required to register with the SEC, leaving Nigerian traders in a regulatory limbo.

Lack of Local Regulation: Nigeria does not yet have a comprehensive framework specifically designed for retail forex trading. This contrasts with countries like the United States, where the Commodity Futures Trading Commission (CFTC) tightly regulates forex brokers.

CBN Restrictions on Forex Access: The CBN has imposed restrictions on forex access for certain transactions (e.g., banning forex for importing specific goods). While these rules target businesses, they create confusion among retail traders about the broader legality of forex activities.

Despite this gray area, forex trading remains a legitimate activity as long as traders use reputable brokers and comply with tax and anti-money laundering laws.

The Risks of Forex Trading in Nigeria

While forex trading is legal, it’s not without risks. Nigerians venturing into the market should be aware of the following challenges:

1. Scams and Unregulated Brokers

The lack of local regulation has opened the door to fraudulent brokers and Ponzi schemes masquerading as forex trading opportunities. Many Nigerians have fallen victim to scams promising guaranteed profits or unrealistic returns. To avoid this, traders should verify a broker’s credentials and choose those regulated by reputable international authorities.

2. High Volatility

The forex market is inherently volatile, and the Naira’s instability exacerbates this risk for Nigerian traders. Currency fluctuations, driven by economic policies or global events, can lead to significant losses if not managed properly.

3. Leverage Risks

Forex brokers often offer high leverage (e.g., 1:100 or 1:500), allowing traders to control large positions with small capital. While this can amplify profits, it also increases the risk of devastating losses, especially for inexperienced traders.

4. Tax and Legal Compliance

Profits from forex trading are subject to taxation in Nigeria under the Personal Income Tax Act. However, many traders fail to report their earnings, which could lead to legal issues. Consulting a tax professional is advisable to ensure compliance.

Opportunities in Forex Trading for Nigerians

Despite the risks, forex trading offers significant opportunities for Nigerians:

1. Financial Independence

With a laptop and internet connection, anyone in Nigeria can participate in the global forex market. This accessibility makes it an attractive option for those seeking alternative income streams.

2. Hedge Against Naira Devaluation

The Naira has faced consistent depreciation over the years. Forex trading allows Nigerians to earn in foreign currencies like the U.S. Dollar or Euro, providing a hedge against local currency instability.

3. Skill Development

Forex trading requires knowledge of technical analysis, risk management, and global economics. For Nigerians willing to learn, it’s an opportunity to develop valuable financial skills.

How to Start Forex Trading Legally in Nigeria

If you’re convinced that forex trading is a viable option, here’s a step-by-step guide to getting started legally and safely:

Step 1: Educate Yourself

Before risking your money, learn the basics of forex trading. Resources like YouTube tutorials, online courses (e.g., Babypips), and books can help you understand market dynamics, trading strategies, and risk management.

Step 2: Choose a Reputable Broker

Select a broker regulated by a credible authority (e.g., FCA, CySEC, or ASIC). Popular brokers among Nigerians include Exness, HotForex, and FXTM. Check reviews, fees, and customer support before committing.

💥 Trade with Exness now: Open An Account or Visit Brokers

Step 3: Open a Trading Account

Most brokers offer demo accounts to practice trading without real money. Once confident, open a live account and deposit funds. In Nigeria, funding options often include bank cards, local bank transfers, or e-wallets like Skrill.

Step 4: Develop a Trading Plan

Define your goals, risk tolerance, and strategy. Avoid over-leveraging and stick to a disciplined approach to minimize losses.

Step 5: Stay Compliant

Report your forex earnings to the Federal Inland Revenue Service (FIRS) and pay applicable taxes. This ensures you remain on the right side of the law.

Popular Forex Brokers in Nigeria

Here are some trusted brokers commonly used by Nigerian traders:

XM: Known for low spreads and a user-friendly platform.

HotForex (HF Markets): Offers high leverage and local payment options.

FXTM: Provides educational resources and fast withdrawals.

OANDA: A globally recognized broker with a strong reputation.

Always verify a broker’s regulation status and read user reviews before signing up.

Forex Trading and Nigerian Law: Key Takeaways

To summarize, forex trading is legal in Nigeria, but it operates in a regulatory gray area due to the dominance of offshore brokers and the lack of a tailored local framework. The CBN and SEC play roles in overseeing financial activities, but retail forex trading largely falls outside their direct jurisdiction. Nigerians can trade forex legally by:

Using regulated international brokers.

Avoiding scams and unregistered platforms.

Complying with tax obligations.

The Future of Forex Trading in Nigeria

As Nigeria’s economy grows and its financial sector matures, the government may introduce stricter regulations for forex trading. The SEC’s 2020 guidelines signal a move toward greater oversight, which could benefit traders by reducing fraud and improving market transparency. Additionally, the rise of fintech and digital payments in Nigeria could make forex trading more accessible and secure.

For now, forex trading remains a viable and legal opportunity for Nigerians willing to navigate its complexities. With proper education, discipline, and caution, it can be a pathway to financial empowerment.

Conclusion

So, is forex trading legal in Nigeria? The answer is a resounding yes, with the caveat that traders must exercise due diligence. Whether you’re a beginner exploring the market or an experienced trader seeking new opportunities, understanding the legal landscape, risks, and rewards is crucial. By choosing reputable brokers, staying informed, and adhering to financial laws, Nigerians can participate in forex trading confidently and legally.

💥 Trade with Exness now: Open An Account or Visit Brokers

Ready to dive into forex trading? Start small, learn continuously, and trade responsibly. The forex market is vast, and with the right approach, it could be your gateway to financial success in Nigeria.

Read more: