11 minute read

Is Exness Valid in India? A Comprehensive Guide for Traders

from Exness Global

The world of online trading is buzzing with opportunities, and for Indian traders, platforms like Exness have become a popular choice. But a burning question remains: Is Exness valid in India? With forex trading gaining traction across the country, understanding the legitimacy, regulatory status, and practical considerations of using Exness is crucial for both beginners and seasoned traders. In this in-depth guide, we’ll explore whether Exness is a safe and viable option for Indian traders in 2025, diving into its features, compliance with Indian laws, benefits, risks, and more.

💥 Trade with Exness now: Open An Account or Visit Brokers

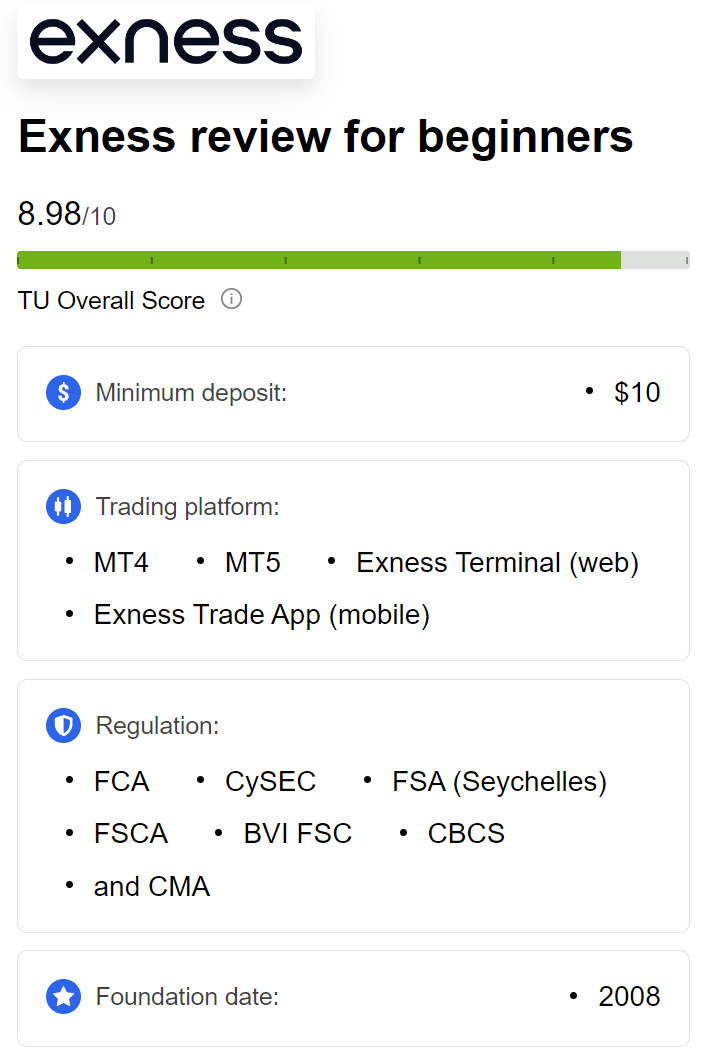

What Is Exness? An Overview of the Platform

Exness, founded in 2008, is a global forex and CFD (Contract for Difference) broker headquartered in Cyprus. It has grown into one of the largest online trading platforms worldwide, serving millions of clients across continents. The platform offers access to a wide range of financial instruments, including:

Forex pairs (e.g., USD/INR, EUR/USD)

Commodities (gold, oil, etc.)

Cryptocurrencies (Bitcoin, Ethereum)

Indices (S&P 500, NIFTY 50)

Stocks (via CFDs)

Exness is known for its competitive trading conditions, such as low spreads, high leverage (up to 1:2000 in some regions), and fast order execution. It supports popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal, making it accessible for traders of all experience levels.

For Indian traders, Exness stands out due to its user-friendly interface, multilingual support, and flexible account types (Standard, Cent, Pro, and Raw Spread). But before diving into its features, let’s address the core question: Is Exness legally valid for use in India?

The Legal Landscape of Forex Trading in India

To determine whether Exness is valid in India, we first need to understand the regulatory framework governing forex trading in the country. Forex trading in India is regulated by two primary bodies:

Reserve Bank of India (RBI): The RBI oversees foreign exchange transactions and enforces the Foreign Exchange Management Act (FEMA), 1999. According to FEMA, Indian residents are allowed to trade forex but with strict conditions.

Securities and Exchange Board of India (SEBI): SEBI regulates financial markets, including stock exchanges and derivatives trading. While SEBI oversees brokers operating within India, its role in regulating international forex brokers is limited.

Key Regulations for Forex Trading in India

INR-Based Pairs Only: Indian residents can legally trade currency pairs that include the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading non-INR pairs (e.g., EUR/USD) is prohibited for retail traders unless conducted through SEBI-regulated exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

No Offshore Brokers Without SEBI Approval: Forex brokers operating in India must be registered with SEBI or partnered with SEBI-regulated entities. International brokers like Exness, which operate offshore, fall into a gray area.

Capital Controls: The RBI imposes limits on foreign exchange transactions to prevent capital flight. For example, Indian residents can remit up to $250,000 per year under the Liberalised Remittance Scheme (LRS) for permissible activities, including investments.

Given these regulations, where does Exness stand?

Is Exness Valid in India? The Straight Answer

Exness is not explicitly banned in India, but it is not regulated by SEBI or the RBI. This places it in a complex position. Here’s the breakdown:

International Regulation: Exness is regulated by reputable global authorities, including:

Cyprus Securities and Exchange Commission (CySEC) in Cyprus

Financial Conduct Authority (FCA) in the UK

Financial Services Authority (FSA) in Seychelles

Financial Sector Conduct Authority (FSCA) in South Africa

These licenses ensure that Exness adheres to international standards for client fund protection, transparency, and fair trading practices. For instance, client funds are held in segregated accounts, and the broker undergoes regular audits.

Lack of SEBI Regulation: Exness does not have a specific license from SEBI to operate in India. This means it is considered an offshore broker for Indian traders. While Indian laws do not explicitly prohibit trading with offshore brokers, using Exness to trade non-INR pairs (e.g., EUR/USD) violates FEMA regulations.

Practical Usage: Many Indian traders use Exness to trade INR-based pairs, which aligns with RBI guidelines. As long as traders stick to permissible pairs and comply with tax obligations, using Exness can be considered valid within the legal framework.

💥 Trade with Exness now: Open An Account or Visit Brokers

In summary, Exness is a legitimate broker globally but operates in a gray area in India due to the lack of SEBI regulation. Indian traders can use the platform legally if they adhere to RBI and FEMA rules, particularly by trading only INR-based pairs.

Why Do Indian Traders Choose Exness?

Despite the regulatory nuances, Exness remains a top choice for Indian traders. Here’s why:

1. Competitive Trading Conditions

Low Spreads: Exness offers spreads as low as 0.0 pips on certain account types (e.g., Raw Spread and Zero accounts), reducing trading costs.

High Leverage: With leverage up to 1:2000 (subject to account type and region), traders can control larger positions with minimal capital. However, high leverage comes with significant risks.

Fast Execution: Exness boasts ultra-fast order execution, critical for scalpers and day traders in volatile markets.

2. Diverse Account Types

Exness caters to different trading styles with multiple account options:

Standard Account: Ideal for beginners with no minimum deposit and low spreads.

Cent Account: Perfect for practicing with micro-lots, minimizing risk.

Pro Account: Designed for experienced traders with tighter spreads and market execution.

Raw Spread/Zero Accounts: Offer near-zero spreads for high-frequency traders.

3. User-Friendly Platforms

Exness supports MT4, MT5, and its proprietary mobile app, allowing traders to access markets from desktops, smartphones, or tablets. The platforms feature advanced charting tools, technical indicators, and automated trading via Expert Advisors (EAs).

4. Flexible Deposits and Withdrawals

Indian traders can fund their accounts using methods like:

Bank cards (Visa, Mastercard)

E-wallets (Skrill, Neteller)

Local bank transfers

Cryptocurrencies (Bitcoin, USDT)

Exness processes withdrawals quickly, often within hours, and does not charge fees for most methods. However, traders should verify RBI compliance when transferring funds abroad.

5. Educational Resources

Exness provides webinars, tutorials, and market analysis to help beginners understand forex trading. Its demo account allows risk-free practice, which is especially valuable for new traders in India.

6. Multilingual Support

With 24/7 customer support in Hindi, English, and other languages, Exness ensures Indian traders can resolve issues promptly.

Risks of Trading with Exness in India

While Exness offers numerous benefits, there are risks to consider:

1. Regulatory Risks

Since Exness is not SEBI-regulated, Indian traders may have limited recourse in disputes. If a legal issue arises, Indian authorities may not intervene, as the broker operates outside their jurisdiction.

2. Non-INR Pair Violations

Trading non-INR pairs (e.g., EUR/USD) on Exness violates FEMA. Traders caught doing so could face penalties, including fines or account freezes. Always stick to INR-based pairs to stay compliant.

3. High Leverage Risks

High leverage (e.g., 1:2000) can amplify profits but also magnifies losses. Inexperienced traders may lose their capital quickly if they don’t use proper risk management (e.g., stop-loss orders).

4. Tax Implications

Forex trading profits in India are taxable as business income or capital gains, depending on the trading frequency. Traders must report earnings to the Income Tax Department and comply with FEMA for overseas remittances. Failure to do so could lead to scrutiny from tax authorities.

5. Technical Risks

Like any online platform, Exness is susceptible to occasional technical issues, such as server downtime or connectivity problems. While rare, these can disrupt trading, especially during volatile market events.

How to Trade Legally with Exness in India

To ensure you’re using Exness validly and legally in India, follow these steps:

1. Stick to INR-Based Pairs

Only trade currency pairs involving the INR, such as USD/INR or EUR/INR. Avoid non-INR pairs to comply with FEMA regulations.

2. Open a Compliant Account

When registering with Exness, provide accurate details and complete the Know Your Customer (KYC) process. Required documents include:

Proof of Identity: Aadhaar card, PAN card, passport, or driver’s license.

Proof of Residence: Utility bill, bank statement, or rental agreement (issued within the last three months).

PAN Card: Mandatory for tax compliance in India.

3. Use Authorized Payment Methods

Fund your account using RBI-approved methods, such as bank transfers or cards. Avoid unregulated channels to prevent violations of FEMA or anti-money laundering laws.

4. Practice Risk Management

Start with a demo account to learn the platform.

Use low leverage (e.g., 1:10 or 1:50) until you’re confident.

Set stop-loss orders to limit potential losses.

Never invest more than you can afford to lose.

5. Report Taxes

Keep records of your trades and profits. Consult a chartered accountant to ensure compliance with Indian tax laws. Forex profits are typically taxed at your income slab rate if treated as business income.

6. Stay Informed

Monitor RBI and SEBI announcements for updates on forex regulations. The regulatory landscape may evolve, impacting the validity of offshore brokers like Exness.

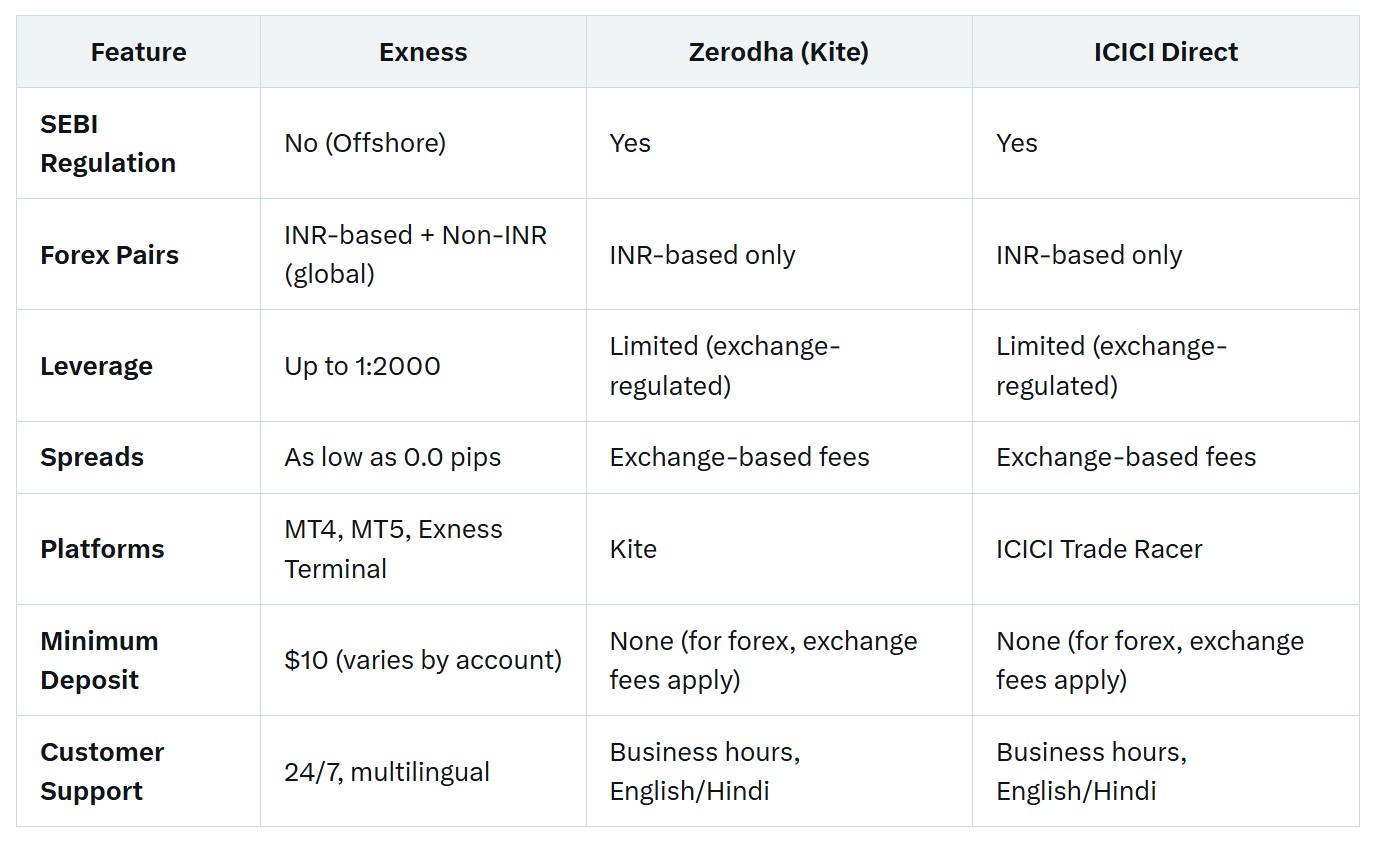

Comparing Exness to Other Brokers in India

To assess whether Exness is the best choice, let’s compare it to other brokers available to Indian trader

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Key Takeaways

Exness offers more flexibility (higher leverage, global pairs) but lacks SEBI regulation, making it riskier for non-compliant trading.

Zerodha and ICICI Direct are fully SEBI-regulated, ensuring legal safety but limiting forex trading to INR pairs with lower leverage.

Traders prioritizing global markets and advanced features may prefer Exness, while those seeking regulatory security may opt for local brokers.

User Experiences: What Indian Traders Say About Exness

To gauge Exness’s validity, let’s consider feedback from Indian traders (based on general trends, not specific reviews):

Positive Feedback

Ease of Use: Many traders praise Exness’s intuitive platforms and quick account setup.

Low Costs: Competitive spreads and no withdrawal fees are a big draw.

Support: 24/7 customer service in Hindi and English resolves issues promptly.

Demo Accounts: Beginners appreciate the risk-free practice environment.

Common Complaints

Regulatory Concerns: Some traders worry about the lack of SEBI oversight.

Withdrawal Delays: A few report occasional delays, though these are often resolved.

Learning Curve: New traders find high leverage confusing without proper education.

Overall, Exness enjoys a strong reputation among Indian traders, but success depends on using the platform responsibly and within legal boundaries.

Tips for Beginners Using Exness in India

If you’re new to forex trading and considering Exness, here are practical tips to get started:

Start with a Demo Account: Practice trading with virtual funds to understand the platform and markets.

Learn Forex Basics: Study concepts like pips, spreads, leverage, and margin before trading real money.

Choose the Right Account: The Standard or Cent account is ideal for beginners due to low risk and no minimum deposit.

Set a Budget: Decide how much you’re willing to risk and never trade with borrowed money.

Stay Compliant: Trade only INR-based pairs and report profits for tax purposes.

Join Communities: Engage with Indian trading forums (e.g., Reddit’s r/IndianStreetBets) to learn from experienced traders.

The Future of Exness in India

As of April 2025, Exness continues to expand its global presence, including in India. However, several factors could shape its validity in the future:

Regulatory Changes: The RBI or SEBI may tighten rules on offshore brokers, requiring Exness to seek local licensing or partner with Indian exchanges.

Market Growth: With forex trading gaining popularity, Exness could tailor its services further for Indian traders, such as offering more INR-based pairs or localized payment methods.

Technological Advancements: Exness may enhance its platforms with AI-driven tools, improving accessibility for beginners.

Traders should stay vigilant and adapt to any regulatory shifts to ensure compliance.

Conclusion: Is Exness a Valid Choice for Indian Traders?

So, is Exness valid in India? The answer is a cautious yes, provided traders use the platform within the boundaries of Indian law. Exness is a globally reputable broker with strong international regulation, competitive features, and a solid track record. However, its lack of SEBI regulation means Indian traders must exercise caution by:

Trading only INR-based pairs (e.g., USD/INR, EUR/INR).

Complying with RBI and FEMA regulations.

Reporting profits for tax purposes.

Using robust risk management strategies.

For those willing to navigate the regulatory nuances, Exness offers a powerful platform with low costs, flexible accounts, and global market access. Beginners can benefit from its demo accounts and educational resources, while experienced traders can leverage its advanced tools.

Before signing up, weigh the pros (low spreads, high leverage) against the risks (regulatory gray area, potential tax complexities). If you prefer a fully SEBI-regulated broker, consider local options like Zerodha or ICICI Direct. Ultimately, your success with Exness depends on informed decision-making, legal compliance, and disciplined trading.

Ready to explore Exness? Start with a demo account to test the waters, and always trade responsibly. Have questions or experiences to share? Drop them in the comments below—I’d love to hear from fellow traders!

Read more: