10 minute read

Is Exness Legal in Nepal? A Comprehensive Guide for Traders

Forex trading has surged in popularity across the globe, and Nepal is no exception. As more Nepalese individuals explore online trading platforms to diversify their income streams, questions about legality and safety naturally arise. One platform that frequently comes up in discussions is Exness, a well-known international forex and CFD broker. But the big question remains: Is Exness legal in Nepal? In this in-depth guide, we’ll explore the legal status of Exness in Nepal, diving into the country’s regulatory framework, Exness’s global operations, and what Nepalese traders need to know to trade confidently and securely.

💥 Trade with Exness now: Open An Account or Visit Brokers

Whether you’re a beginner looking to dip your toes into forex trading or an experienced trader seeking clarity on using Exness in Nepal, this article will provide you with all the answers. Let’s break it down step by step.

What Is Exness? An Overview of the Platform

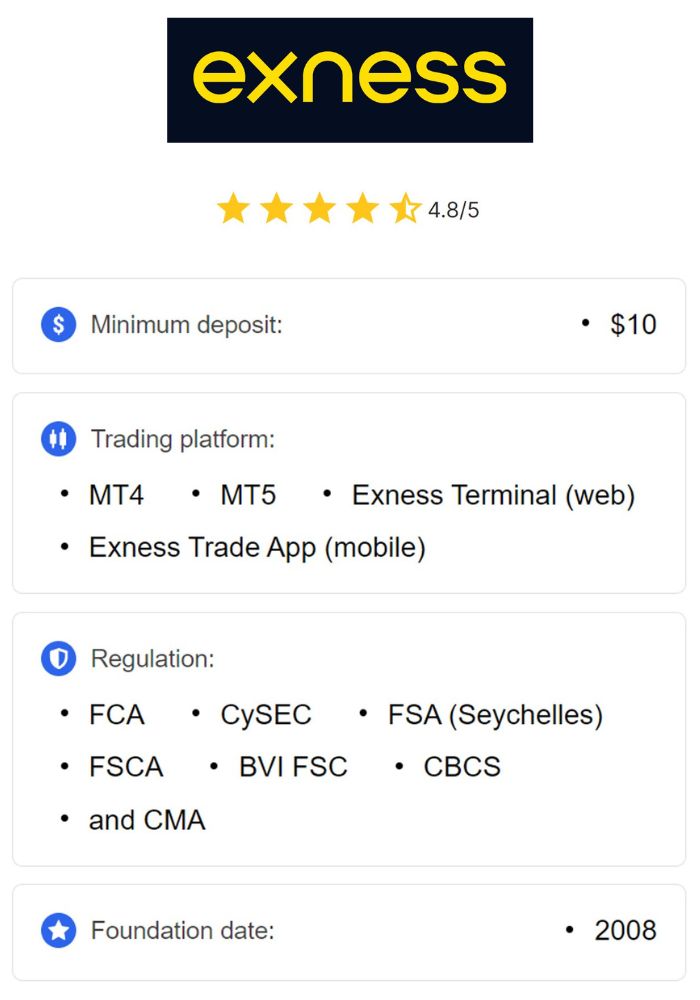

Before addressing its legality in Nepal, it’s essential to understand what Exness is and why it’s gained traction among traders worldwide. Founded in 2008, Exness is a globally recognized online brokerage offering a wide range of financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies. Headquartered in Cyprus, the company has expanded its reach to over 180 countries, serving millions of clients with a reputation for transparency, competitive spreads, and fast execution speeds.

Exness provides traders with access to popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside a proprietary mobile app for trading on the go. Key features that set Exness apart include:

Low Spreads: Starting from as little as 0.0 pips on certain accounts.

High Leverage: Up to 1:2000, depending on the account type and jurisdiction.

Instant Withdrawals: A standout feature for quick access to funds.

Multiple Account Types: Options like Standard, Cent, Raw Spread, and Pro accounts cater to traders of all levels.

With a monthly trading volume exceeding $4 trillion and over 700,000 active clients, Exness has established itself as a heavyweight in the forex industry. But how does this global presence translate to its operations in Nepal? To answer that, we need to examine Nepal’s financial regulations and how they apply to international brokers like Exness.

Forex Trading Regulations in Nepal: What’s the Legal Landscape?

To determine whether Exness is legal in Nepal, we must first explore the country’s regulatory environment for forex trading. Nepal’s financial sector is primarily overseen by the Nepal Rastra Bank (NRB), the central bank responsible for maintaining economic stability, regulating currency exchange, and supervising financial institutions.

Nepal Rastra Bank and Forex Trading

The NRB plays a pivotal role in controlling foreign currency transactions in Nepal. Due to the country’s economic structure and reliance on remittances, the NRB imposes strict guidelines on the movement of foreign exchange to prevent capital flight and stabilize the Nepalese Rupee (NPR). Under current laws:

Forex Trading Restrictions: Forex trading for speculative purposes by individual residents is heavily restricted. The NRB limits foreign currency exchanges to specific purposes, such as imports, travel, or education, requiring approval for transactions outside these categories.

Authorized Institutions: Only banks and financial institutions licensed by the NRB are permitted to conduct foreign exchange transactions. International forex brokers like Exness are not locally licensed or regulated by the NRB.

Online Trading Platforms: There are no explicit laws in Nepal that legalize or regulate online forex trading platforms operated by foreign entities. This creates a gray area for platforms like Exness.

The Gray Area of Online Forex Trading

Unlike countries with well-defined forex trading regulations (e.g., the US with the CFTC or India with SEBI), Nepal lacks a comprehensive legal framework for retail forex trading. The absence of specific legislation doesn’t outright ban forex trading, but it also doesn’t provide clear approval for individuals to trade with offshore brokers. As a result, many Nepalese traders operate in a legal limbo, using international platforms like Exness without explicit authorization from local authorities.

This ambiguity raises the question: If Nepal doesn’t regulate forex brokers like Exness, does that make them illegal? Let’s examine Exness’s operations and regulatory status to find out.

Exness’s Global Regulatory Framework

Exness operates as a multi-entity brokerage, with different subsidiaries regulated by various financial authorities worldwide. This structure allows the company to cater to clients in different regions while adhering to international standards. Here’s a breakdown of Exness’s regulatory oversight:

Cyprus Securities and Exchange Commission (CySEC): Exness (Cy) Ltd is regulated by CySEC, a Tier-1 authority in the European Union, ensuring high standards of transparency and client fund protection.

Financial Conduct Authority (FCA): Exness (UK) Ltd is licensed by the FCA in the UK, another top-tier regulator known for stringent oversight.

Financial Services Authority (FSA) Seychelles: Exness (SC) Ltd, the entity most relevant to Nepalese traders, is regulated by the FSA in Seychelles. This is a Tier-3 regulator with less stringent requirements than CySEC or FCA but still provides a level of oversight.

Other Licenses: Exness holds licenses from the Financial Services Commission (FSC) in Mauritius and the British Virgin Islands, the Central Bank of Curaçao and Sint Maarten (CBCS), and the Financial Sector Conduct Authority (FSCA) in South Africa.

Does Exness Operate Under Nepalese Regulation?

No, Exness is not regulated by the Nepal Rastra Bank or any other local authority in Nepal. Instead, Nepalese traders typically fall under the jurisdiction of Exness (SC) Ltd, the Seychelles-regulated entity. This is common for traders in countries without local forex regulations, as brokers often use their global entities to serve such markets.

While the FSA Seychelles provides some regulatory oversight, it doesn’t carry the same weight as Tier-1 regulators like CySEC or FCA. However, Exness’s compliance with multiple international regulators demonstrates its commitment to maintaining a secure and trustworthy trading environment.

Is Exness Legal in Nepal? The Verdict

So, is Exness legal in Nepal? The answer lies in the interplay between Nepal’s lack of specific forex regulations and Exness’s global operations.

The Legal Perspective

No Explicit Ban: Nepal’s laws do not explicitly prohibit individuals from trading forex with offshore brokers like Exness. The NRB’s restrictions focus on unauthorized currency exchanges rather than speculative trading on international platforms.

Global Regulation: Exness operates legally under its international licenses, including the FSA Seychelles, which allows it to offer services to Nepalese traders.

Practical Usage: Many Nepalese traders actively use Exness without reported legal repercussions, suggesting a tacit acceptance of such platforms in practice.

Based on this, Exness is legal for Nepalese traders to use, provided they comply with local laws regarding foreign currency transactions. However, the lack of NRB oversight means traders assume some risk, as they may not have recourse to local authorities in case of disputes.

💥 Trade with Exness now: Open An Account or Visit Brokers

Safety and Trustworthiness

Legality is only one part of the equation—safety matters too. Exness enhances its credibility through:

Segregated Accounts: Client funds are kept separate from company funds, reducing the risk of misuse.

Financial Commission Membership: Exness is a member of the Financial Commission, offering compensation of up to €20,000 per client in case of insolvency.

Transparent Operations: Real-time data on trading volumes and withdrawals builds trust.

For Nepalese traders, Exness appears to be a safe and reliable option, even without local regulation.

How to Start Trading with Exness in Nepal

If you’re convinced that Exness is a viable option, here’s a step-by-step guide to getting started:

Step 1: Open an Account

Visit the official Exness website.

Click “Register” and fill in your details, including your email, country (Nepal), and password.

Verify your email via the link sent by Exness.

Step 2: Complete KYC Verification

Submit identification documents (e.g., passport or national ID) and proof of address (e.g., utility bill).

This process typically takes a few minutes to a few hours.

Step 3: Deposit Funds

Log in to your Exness account.

Navigate to the “Funding” section.

Choose a payment method (e.g., bank card, e-wallet like Skrill or Neteller, or local bank transfer).

Enter the deposit amount and confirm.

Step 4: Start Trading

Download MT4, MT5, or the Exness app.

Log in with your credentials.

Explore the markets and place your trades.

Payment Options in Nepal

Exness supports multiple deposit and withdrawal methods suitable for Nepalese traders:

Bank Cards: Visa and Mastercard are widely accepted.

E-Wallets: Skrill, Neteller, and Perfect Money offer fast transactions.

Bank Transfers: Local bank options may be available, though processing times vary.

Note that converting NPR to foreign currencies for deposits may require compliance with NRB regulations, so use authorized channels to avoid issues.

Advantages of Using Exness in Nepal

Why choose Exness over other brokers? Here are some benefits tailored to Nepalese traders:

Accessibility: No local license is required to sign up, making it easy to access global markets.

Low Costs: Competitive spreads and no hidden fees keep trading affordable.

High Leverage: Ideal for traders with small capital looking to maximize returns (though it increases risk).

Educational Resources: Webinars, tutorials, and market analysis help beginners learn the ropes.

Risks and Considerations for Nepalese Traders

While Exness is a strong option, trading in Nepal comes with caveats:

Legal Uncertainty: The lack of clear NRB approval means future regulations could impact usage.

Currency Exchange Risks: Converting NPR to USD or other currencies may attract scrutiny if not done through authorized means.

No Local Protection: Disputes with Exness must be resolved through international channels, not Nepalese courts.

To mitigate risks, research thoroughly, start with a demo account, and consult a financial advisor familiar with Nepal’s laws.

Alternatives to Exness in Nepal

If you’re hesitant about Exness, consider these regulated alternatives:

XM: Offers similar features with strong CySEC and ASIC regulation.

IC Markets: Known for low spreads and a robust trading platform.

Local Banks: Some Nepalese banks offer limited forex services, though options are narrower.

Conclusion: Should You Trade with Exness in Nepal?

Exness is legal in Nepal within the context of the country’s current regulatory framework—or lack thereof. Its global licenses, safety measures, and practical usage by Nepalese traders make it a viable choice for those looking to enter the forex market. However, the absence of local oversight means traders must exercise caution, ensure compliance with currency exchange rules, and stay informed about potential regulatory changes.

💥 Trade with Exness now: Open An Account or Visit Brokers

For Nepalese traders, Exness offers a gateway to international markets with low costs and high flexibility. Whether you’re a novice or a seasoned trader, it’s a platform worth considering—just be sure to weigh the benefits against the risks. Ready to start? Sign up for a demo account today and explore what Exness has to offer.

FAQs

1. Is Exness regulated in Nepal?No, Exness is not regulated by the Nepal Rastra Bank, but it operates under international licenses like the FSA Seychelles.

2. Can I deposit Nepalese Rupees (NPR) into Exness?Exness doesn’t directly accept NPR. You’ll need to convert your funds to a supported currency (e.g., USD) via an authorized method.

3. Is forex trading legal in Nepal?Forex trading isn’t explicitly regulated or banned in Nepal, placing it in a gray area. Offshore platforms like Exness are commonly used despite this.

4. What happens if Exness faces issues?As a member of the Financial Commission, Exness offers up to €20,000 in compensation per client if the company becomes insolvent.

Read more: