10 minute read

Does Exness Have the Volatility 75 Index? A Comprehensive Guide

The world of online trading is vast and ever-evolving, with traders constantly seeking opportunities to diversify their portfolios and capitalize on market movements. One instrument that has gained significant attention in recent years is the Volatility 75 Index, often referred to as the VIX 75. Known for its high volatility and potential for substantial profits, this synthetic index has become a favorite among experienced traders. At the same time, Exness, a globally recognized forex and CFD broker, has established itself as a trusted platform for millions of traders worldwide. Naturally, a common question arises: Does Exness have the Volatility 75 Index available for trading? In this in-depth article, we’ll explore the answer to this question, dive into what the Volatility 75 Index is, examine Exness’s offerings, and provide actionable insights for traders interested in volatility-based trading.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is the Volatility 75 Index?

Before addressing whether Exness offers the Volatility 75 Index, it’s essential to understand what this instrument is and why it’s so popular. The Volatility 75 Index, commonly abbreviated as VIX 75, is a synthetic index designed to measure market volatility. Unlike traditional stock indices like the S&P 500 or FTSE 100, which track the performance of a basket of stocks, the VIX 75 is not tied to physical assets. Instead, it reflects the expected price fluctuations in the financial markets, often based on a proprietary algorithm or modeled after the CBOE Volatility Index (VIX), which tracks the implied volatility of S&P 500 options.

The VIX 75 is often dubbed the "Fear Index" because it tends to spike during periods of market uncertainty or turmoil, such as economic crises or geopolitical events. When investor confidence wanes, and stock markets decline, the Volatility 75 Index typically rises, making it an attractive tool for traders looking to profit from rapid price swings. Its key characteristics include:

High Volatility: The VIX 75 is known for its dramatic price movements, often shifting hundreds or even thousands of points in a single day.

24/7 Trading: Unlike traditional markets with set hours, the Volatility 75 Index is available for trading around the clock, offering flexibility for traders across different time zones.

CFD Trading: It is typically traded as a Contract for Difference (CFD), allowing traders to speculate on price movements without owning the underlying asset.

Given its dynamic nature, the VIX 75 appeals to short-term traders, such as scalpers and day traders, who thrive on frequent opportunities and high-risk, high-reward scenarios.

Who Is Exness? An Overview of the Broker

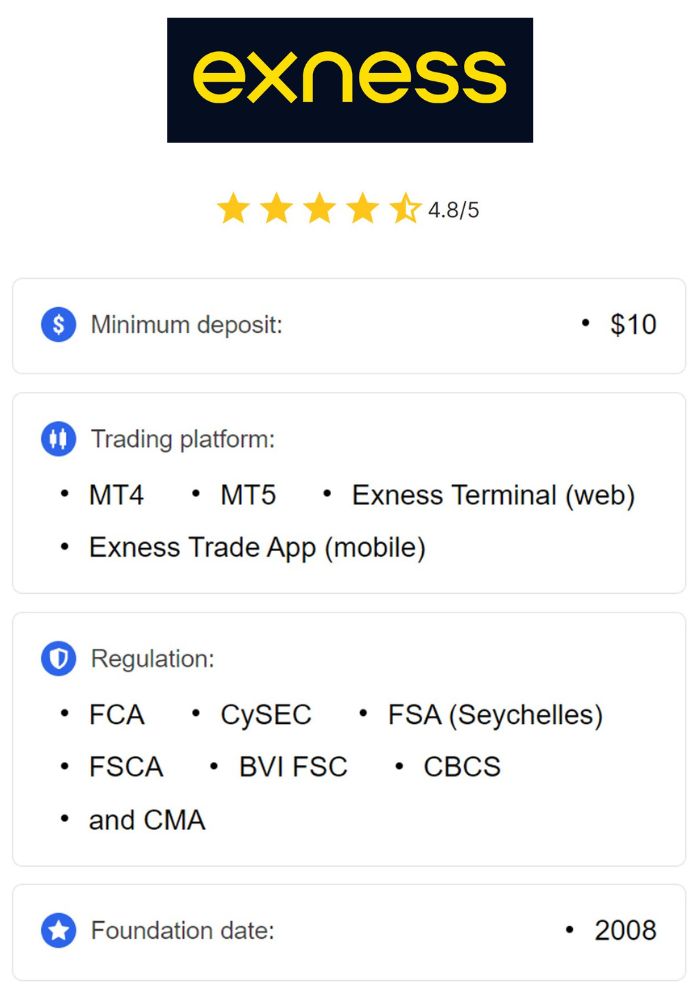

To determine whether Exness offers the Volatility 75 Index, we first need to understand what Exness brings to the table as a broker. Founded in 2008, Exness has grown into one of the largest retail forex and CFD brokers globally, boasting a reputation for transparency, competitive trading conditions, and a user-friendly experience. Regulated by multiple authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC), Exness prioritizes client security and compliance with international standards.

Exness offers a wide range of financial instruments, including:

Forex: Over 100 currency pairs, including majors, minors, and exotics.

Commodities: Gold, silver, oil, and other popular assets.

Indices: Major global indices like the S&P 500, NASDAQ 100, and FTSE 100.

Cryptocurrencies: Bitcoin, Ethereum, and other digital assets.

Stocks: CFDs on shares of leading companies.

The broker supports industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside its proprietary Exness Terminal, catering to traders of all experience levels. With tight spreads, high leverage options (up to 1:2000 in some regions), and instant withdrawals, Exness has earned the trust of millions of users worldwide.

Does Exness Offer the Volatility 75 Index?

Now, let’s address the core question: Does Exness have the Volatility 75 Index? The answer is no. Exness does not currently offer the Volatility 75 Index as a tradable instrument on its platform. While Exness provides access to a diverse selection of indices, such as the US 500 (based on the S&P 500), US 30 (Dow Jones Industrial Average), and UK 100 (FTSE 100), the synthetic Volatility 75 Index is notably absent from its offerings.

This absence may come as a surprise to some traders, given Exness’s extensive range of instruments and its reputation for catering to diverse trading preferences. However, the broker’s focus appears to be on traditional financial markets rather than synthetic indices like the VIX 75, which are more commonly offered by brokers specializing in volatility-based products, such as Deriv or Binary.com.

💥 Trade with Exness now: Open An Account or Visit Brokers

Why Doesn’t Exness Offer the VIX 75?

There could be several reasons why Exness has not included the Volatility 75 Index in its lineup:

Market Focus: Exness primarily caters to forex traders and those interested in traditional CFD markets (stocks, commodities, and indices tied to real-world assets). The VIX 75, being a synthetic index, may not align with the broker’s core audience or strategic direction.

Regulatory Considerations: Synthetic indices like the VIX 75 are often offered by brokers regulated in jurisdictions with less stringent oversight. Exness, with its licenses from top-tier regulators like the FCA and CySEC, may prioritize instruments that fit within stricter compliance frameworks.

Platform Limitations: While MT4 and MT5 are versatile platforms, the Volatility 75 Index is typically offered by brokers with proprietary platforms tailored to synthetic indices, such as Deriv’s DTrader. Exness may not have adapted its infrastructure to support this specific instrument.

Despite this limitation, Exness remains a robust platform for traders interested in volatility through other means, which we’ll explore later in this article.

Alternatives to the Volatility 75 Index on Exness

Although Exness doesn’t offer the VIX 75, it provides several alternatives that can satisfy traders seeking volatility-driven opportunities. Here are some options:

1. Major Stock Indices

Exness offers CFDs on major stock indices like the S&P 500 (US 500), Dow Jones (US 30), and NASDAQ 100 (USTEC). These indices often experience significant volatility during economic announcements, earnings seasons, or global events, making them viable substitutes for traders accustomed to the VIX 75’s rapid movements.

Why It Works: The S&P 500, for instance, has an inverse correlation with the CBOE VIX. When the S&P 500 drops, volatility typically rises, offering similar trading dynamics to the VIX 75.

Trading Tip: Use technical indicators like Bollinger Bands or the Relative Strength Index (RSI) to identify volatile periods in these indices.

2. Forex Pairs

Exness’s extensive forex market, with over 100 currency pairs, includes highly volatile pairs like GBP/JPY, USD/ZAR, and EUR/USD during major news events (e.g., interest rate decisions or Non-Farm Payroll reports). These pairs can mimic the fast-paced action of the VIX 75.

Why It Works: Forex volatility spikes during economic uncertainty, offering short-term trading opportunities.

Trading Tip: Leverage Exness’s tight spreads and high leverage to maximize returns, but always use stop-loss orders to manage risk.

3. Cryptocurrencies

Cryptocurrencies like Bitcoin (BTC/USD) and Ethereum (ETH/USD) are notorious for their price swings, often exceeding the volatility of traditional assets. Exness provides 24/7 crypto trading, aligning with the VIX 75’s round-the-clock availability.

Why It Works: Crypto markets are highly reactive to news, regulatory changes, and market sentiment, creating frequent trading opportunities.

Trading Tip: Monitor crypto news feeds and use Exness’s MT5 platform for advanced charting.

4. Commodities

Gold (XAU/USD) and oil (USOIL) are other volatile assets available on Exness. Gold, in particular, tends to surge during market uncertainty, much like the VIX 75.

Why It Works: Commodities respond to geopolitical and economic factors, offering volatility comparable to synthetic indices.

Trading Tip: Combine fundamental analysis (e.g., tracking oil inventories) with technical tools for optimal entry points.

Brokers That Offer the Volatility 75 Index

If trading the Volatility 75 Index is a non-negotiable priority, several reputable brokers specialize in this instrument. Here are some alternatives to consider:

1. Deriv

Deriv is a leading broker for synthetic indices, including the Volatility 75 Index, Volatility 10, Volatility 50, and more. It offers a proprietary platform (DTrader) and MT5 integration, with low minimum deposits and flexible lot sizes.

Pros: 24/7 trading, multiple volatility indices, beginner-friendly.

Cons: Limited traditional asset offerings compared to Exness.

2. Pepperstone

Pepperstone provides access to the VIX 75 as a CFD, alongside a broad range of forex pairs, indices, and commodities. It supports MT4, MT5, and cTrader, making it versatile for advanced traders.

Pros: Competitive spreads, robust platform options.

Cons: Higher minimum deposit than some competitors.

3. AvaTrade

AvaTrade offers the CBOE VIX (not the synthetic VIX 75) and a variety of other indices. It’s known for its educational resources and user-friendly interface.

Pros: Strong regulation, extensive learning materials.

Cons: No direct VIX 75 trading.

4. Binary.com

Binary.com (now part of Deriv) pioneered synthetic indices and remains a top choice for VIX 75 trading. It offers binary options and CFDs on volatility indices.

Pros: Low entry barriers, diverse trading styles.

Cons: Less focus on traditional markets.

How to Trade Volatility on Exness Without the VIX 75

For traders committed to using Exness, there are strategies to capitalize on volatility using the broker’s existing instruments. Here’s a step-by-step guide:

Step 1: Choose a Volatile Instrument

Select an asset with high volatility potential, such as GBP/JPY, XAU/USD, or the US 500. Check Exness’s economic calendar for upcoming events that could trigger price swings.

Step 2: Use Technical Analysis

Leverage Exness’s MT4/MT5 platforms to apply indicators like:

Moving Averages: Identify trends during volatile periods.

Bollinger Bands: Detect overbought or oversold conditions.

ATR (Average True Range): Measure volatility intensity.

Step 3: Implement Risk Management

Volatility trading carries significant risks. Use Exness’s tools to:

Set stop-loss and take-profit levels.

Adjust position sizes based on account balance (e.g., risk 1-2% per trade).

Avoid over-leveraging, despite Exness’s high leverage options.

Step 4: Monitor Market News

Stay informed about global events that could impact your chosen asset. Exness provides market news updates and an economic calendar to assist with this.

Step 5: Practice on a Demo Account

Exness offers a free demo account where you can test volatility strategies without risking real money. This is especially useful for adapting VIX 75-inspired tactics to other instruments.

Benefits of Trading with Exness

Even without the Volatility 75 Index, Exness offers compelling advantages for volatility traders:

Competitive Spreads: Tight spreads on forex and indices reduce trading costs during volatile periods.

High Leverage: Up to 1:2000 leverage amplifies potential profits (though it increases risk).

Fast Execution: Instant order execution ensures you don’t miss opportunities in fast-moving markets.

24/7 Support: Round-the-clock customer service assists with technical or account-related queries.

Educational Resources: Tutorials, webinars, and articles help traders master volatile markets.

Challenges of Trading the Volatility 75 Index

For those considering brokers that offer the VIX 75, it’s worth noting the challenges:

High Risk: Rapid price movements can lead to significant losses if not managed properly.

Technical Complexity: The VIX 75 requires precise timing and advanced analysis, which may overwhelm beginners.

Broker Dependency: Not all brokers offering the VIX 75 are as regulated or reliable as Exness.

Should You Trade the VIX 75 or Stick with Exness?

The decision depends on your trading goals:

If You Want the VIX 75: Explore brokers like Deriv or Pepperstone, which cater specifically to synthetic indices.

If You Prefer Exness: Leverage its robust platform and diverse assets to trade volatility indirectly through forex, indices, or crypto.

For many traders, Exness’s reliability, regulation, and versatility outweigh the absence of the VIX 75. However, if your strategy revolves around synthetic indices, diversifying with a second broker might be the best approach.

Conclusion

To recap, Exness does not offer the Volatility 75 Index. While this may disappoint traders fixated on the VIX 75, Exness compensates with a wide array of volatile instruments, competitive trading conditions, and a trusted platform. Whether you’re scalping forex pairs, trading crypto, or speculating on major indices, Exness provides ample opportunities to engage with market volatility.

For those determined to trade the Volatility 75 Index, alternative brokers like Deriv and Pepperstone are worth exploring. Ultimately, your choice depends on your trading style, risk tolerance, and preference for synthetic versus traditional markets. Whatever path you choose, prioritize education, risk management, and a clear strategy to succeed in the fast-paced world of trading.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: