7 minute read

Is Exness Legal in India? Review Broker 2025

Forex trading has surged in popularity across India in recent years, with more individuals seeking opportunities to engage in global financial markets. Among the many platforms available, Exness stands out as a globally recognized forex and CFD broker, known for its competitive trading conditions and user-friendly interface. However, a common question among Indian traders is: Is Exness legal in India? The short answer is yes, Exness is legal for Indian traders to use, provided they adhere to certain guidelines and regulations. In this article, we’ll explore the legal status of Exness in India, the regulatory framework governing forex trading, and why it’s a viable option for Indian traders.

💥 Trade with Exness now: Open An Account or Visit Brokers

Understanding Forex Trading in India

Before diving into the legality of Exness, it’s essential to understand the broader context of forex trading in India. Forex, or foreign exchange trading, involves buying and selling currencies to profit from fluctuations in their exchange rates. While forex trading is a global phenomenon, each country has its own rules and regulations to ensure financial stability and protect traders.

In India, forex trading is regulated by two primary bodies: the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). The RBI oversees foreign exchange transactions and ensures compliance with the Foreign Exchange Management Act (FEMA), 1999, while SEBI regulates financial markets, including forex brokers operating within India. These institutions work together to create a structured environment for trading activities.

One key restriction in India is that forex trading is limited to currency pairs involving the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading non-INR pairs (e.g., EUR/USD) through Indian exchanges is not permitted for retail traders. However, this restriction applies to domestic brokers and platforms, leaving room for offshore brokers like Exness to operate under specific conditions.

Who is Exness?

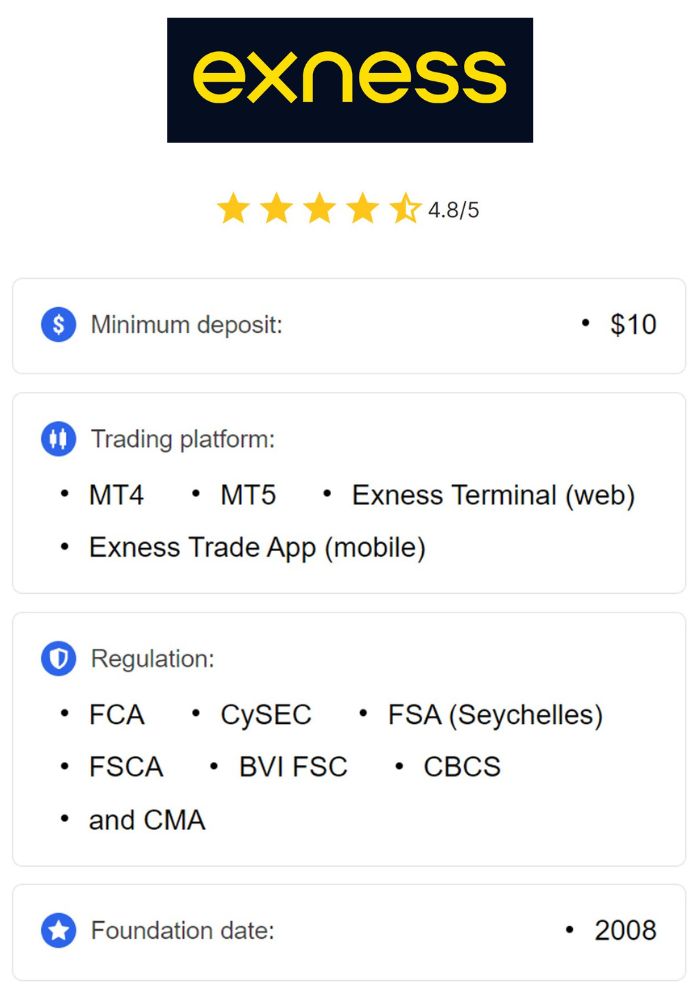

Exness is a globally renowned online trading platform established in 2008. With headquarters in Cyprus and operations spanning over 190 countries, Exness has built a reputation for transparency, reliability, and innovation. The broker offers a wide range of financial instruments, including forex, commodities, indices, cryptocurrencies, and stocks, making it a versatile choice for traders worldwide.

Exness is regulated by multiple international financial authorities, such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. These licenses ensure that Exness adheres to strict standards of financial conduct, client fund protection, and operational transparency. For Indian traders, this global regulation provides a layer of security, even though Exness does not hold a specific SEBI license.

Is Exness Legal in India?

Yes, Exness is legal in India. While it does not operate under direct SEBI regulation, Indian traders can legally use Exness as an offshore broker, provided they comply with FEMA guidelines and Indian tax laws. The legality stems from the fact that Indian regulations do not explicitly prohibit residents from trading with internationally regulated brokers like Exness. Instead, the restrictions primarily target domestic brokers and speculative trading in non-INR pairs.

💥 Trade with Exness now: Open An Account or Visit Brokers

The Legal Framework Supporting Exness in India

To understand why Exness is legal, let’s break down the regulatory landscape:

FEMA Compliance: The Foreign Exchange Management Act allows Indian residents to engage in forex trading with offshore brokers, as long as the funds used are remitted through authorized channels (e.g., RBI-approved banks). Exness supports deposits and withdrawals via methods compliant with Indian banking regulations, such as bank cards and wire transfers.

No Explicit Ban: The RBI and SEBI have issued warnings against unregulated brokers, but Exness is not unregulated—it holds reputable international licenses. Indian law does not ban citizens from using such platforms, making Exness a permissible option.

Tax Obligations: Profits from forex trading with Exness are subject to Indian income tax laws. Traders must declare their earnings as “income from other sources” and pay taxes accordingly. Compliance with tax regulations further solidifies the legality of trading with Exness.

Global Regulation: Exness’s oversight by tier-1 regulators like the FCA and CySEC ensures that it operates ethically and securely. This global credibility aligns with India’s acceptance of internationally regulated entities.

In summary, Exness is legal for Indian traders because it operates within a framework that aligns with Indian laws, even as an offshore entity. Traders must, however, exercise due diligence to ensure compliance with local regulations.

Why Indian Traders Choose Exness

Beyond its legal status, Exness offers several advantages that make it appealing to Indian traders:

Competitive Spreads: Exness provides tight spreads starting from 0.0 pips on certain accounts, reducing trading costs.

High Leverage: With leverage up to 1:2000, traders can maximize their capital, though they must manage risks carefully.

User-Friendly Platform: The Exness app and web platform are intuitive, supporting both beginners and experienced traders.

Fast Withdrawals: Exness is known for instant withdrawals, a critical feature for traders needing quick access to funds.

Diverse Instruments: From forex pairs to cryptocurrencies, Exness offers a broad range of assets to diversify portfolios.

These features, combined with its legal accessibility, position Exness as a top choice for Indian traders seeking global market exposure.

Risks and Considerations

While Exness is legal, there are risks and considerations to keep in mind:

Lack of SEBI Oversight: Since Exness isn’t SEBI-regulated, Indian traders may not have recourse to local authorities in case of disputes. However, its international licenses offer alternative protections.

Currency Conversion: Trading non-INR pairs involves currency conversion, which may incur additional costs or scrutiny from the RBI.

Regulatory Changes: India’s forex laws could evolve, potentially affecting the status of offshore brokers. Traders should stay informed about updates.

To mitigate these risks, traders should use Exness responsibly, maintain proper documentation, and consult financial advisors if needed.

How to Trade Legally with Exness in India

To ensure a fully legal trading experience with Exness, follow these steps:

Open an Account: Sign up on the Exness website or app, completing the KYC (Know Your Customer) process with valid Indian identification.

Fund Your Account: Use RBI-approved payment methods like bank transfers or debit/credit cards to deposit funds.

Trade INR Pairs: Focus on INR-based currency pairs to align with FEMA guidelines, though Exness also supports non-INR pairs for offshore trading.

Track Profits: Maintain records of your trades and profits for tax purposes.

File Taxes: Declare your earnings in your annual income tax return to stay compliant.

By adhering to these steps, Indian traders can use Exness legally and confidently.

Comparing Exness to Local Brokers

Local SEBI-regulated brokers offer INR-pair trading and direct oversight, but they often lack the global reach, low spreads, and high leverage of Exness. For traders seeking international exposure and advanced features, Exness provides a compelling alternative without compromising legality.

Community Feedback and Experiences

Indian traders on forums and social media often praise Exness for its reliability and ease of use. Many highlight its fast execution and withdrawal processes, reinforcing its reputation as a trusted platform. While some express concerns about its offshore status, the consensus is that Exness is a legitimate option when used responsibly.

Conclusion

So, is Exness legal in India? Yes, it is. Exness operates as a lawful offshore broker for Indian traders, supported by its global regulation and compliance with FEMA’s remittance rules. While it lacks SEBI registration, this does not render it illegal, as Indian law permits engagement with internationally regulated platforms. With its robust features, competitive conditions, and accessibility, Exness offers a legal and reliable gateway for Indian traders to explore forex and CFD markets. To maximize benefits and minimize risks, traders should stay informed, comply with tax obligations, and trade wisely.

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: How to open a real account on Exness