10 minute read

Is Exness Legal in Oman? A Comprehensive Guide for Traders

Forex trading has become increasingly popular across the globe, and Oman is no exception. As more Omani investors seek opportunities to diversify their portfolios and tap into international financial markets, platforms like Exness have caught the attention of traders. However, a critical question remains: Is Exness legal in Oman? In this in-depth guide, we’ll explore the legality of using Exness in Oman, its regulatory framework, features, benefits, and everything Omani traders need to know before diving into the world of forex trading with this broker in 2025.

💥 Trade with Exness now: Open An Account or Visit Brokers

Understanding Forex Trading in Oman

Before addressing the legality of Exness, it’s essential to understand the broader context of forex trading in Oman. The Sultanate of Oman has a growing economy driven by oil, tourism, and trade. In recent years, financial literacy and interest in global markets have surged among Omanis, leading to a rise in retail forex trading. Unlike some countries with strict prohibitions on forex activities, Oman adopts a relatively open stance, allowing individuals to participate in the global foreign exchange market.

The Central Bank of Oman (CBO) is the primary regulatory authority overseeing financial activities in the country. While the CBO regulates local banks and financial institutions, its jurisdiction over international forex brokers like Exness is limited. This creates a unique situation where forex trading is permitted but not heavily regulated at the local level for foreign platforms. As a result, Omani traders often turn to globally recognized brokers like Exness, raising questions about their legality and safety.

What Is Exness? A Quick Overview

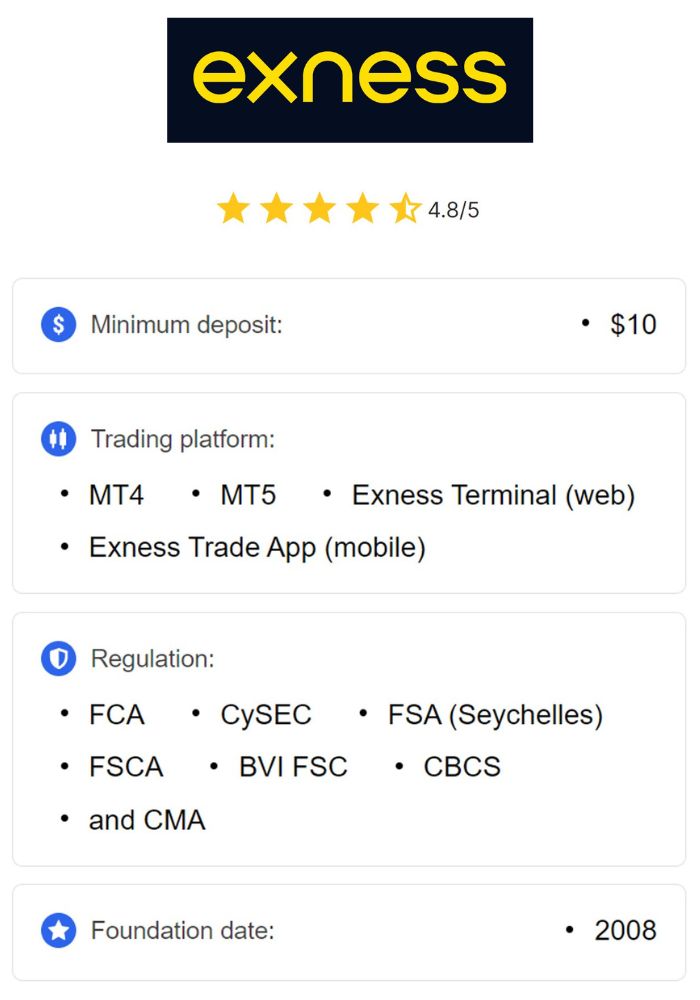

Exness is a globally recognized forex and CFD (Contract for Difference) broker established in 2008. Headquartered in Cyprus, the company has grown into one of the largest retail forex brokers worldwide, boasting millions of clients across more than 100 countries. Exness offers a wide range of financial instruments, including forex pairs, commodities (like gold and oil), cryptocurrencies, stocks, and indices.

What sets Exness apart from its competitors? It’s known for its competitive trading conditions, such as ultra-low spreads, high leverage options (up to unlimited leverage in some cases), lightning-fast execution speeds, and instant withdrawals. The broker provides access to popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal, catering to both novice and experienced traders. Additionally, Exness emphasizes transparency, reliability, and customer satisfaction, making it a top choice for traders globally—including in Oman.

Is Exness Legal in Oman? The Short Answer

Yes, Exness is legal to use in Oman. Forex trading itself is not prohibited in the Sultanate, and there are no specific laws banning Omani residents from using international brokers like Exness. However, the broker is not directly regulated by the Central Bank of Oman, which introduces a layer of complexity. Instead, Exness operates under licenses from several reputable international regulatory bodies, ensuring it adheres to global financial standards. For Omani traders, this means that while Exness isn’t locally licensed, it remains a legitimate and accessible option as long as traders comply with Oman’s financial regulations.

Let’s break this down further to provide clarity.

💥 Trade with Exness now: Open An Account or Visit Brokers

The Regulatory Framework of Exness

Exness operates under a multi-tiered regulatory framework, which is a key factor in determining its legitimacy. The broker holds licenses from some of the most respected financial authorities worldwide, including:

Cyprus Securities and Exchange Commission (CySEC): A leading regulator in the European Union, CySEC ensures Exness complies with strict financial standards, including client fund protection and transparency.

Financial Conduct Authority (FCA) in the UK: The FCA is renowned for its rigorous oversight, adding credibility to Exness’s operations.

Financial Services Authority (FSA) in Seychelles: This license allows Exness to serve clients globally, including in regions like Oman where local regulation may not apply.

Financial Sector Conduct Authority (FSCA) in South Africa: This enhances Exness’s reputation in emerging markets.

Capital Markets Authority (CMA) in Kenya: Another layer of regulation for African markets.

These licenses demonstrate Exness’s commitment to maintaining high standards of security, transparency, and ethical trading practices. For Omani traders, the absence of a CBO license doesn’t render Exness illegal. Instead, its international regulatory status provides a robust foundation for safe trading, as long as users adhere to local tax and financial reporting requirements.

Forex Trading Regulations in Oman

To fully understand Exness’s legality, we must examine Oman’s regulatory environment for forex trading. The Central Bank of Oman oversees financial institutions operating within the country, such as banks and money exchange services. However, its authority doesn’t extend directly to international forex brokers like Exness, which operate offshore.

In Oman, forex trading is permissible under the following conditions:

No Explicit Ban: There’s no law explicitly prohibiting Omani residents from trading forex with international brokers.

Tax Compliance: Traders must report their earnings to the relevant authorities and comply with Oman’s tax laws, though personal income tax is currently not imposed in Oman as of 2025.

Capital Controls: While Oman doesn’t impose strict capital controls, traders should ensure their transactions align with CBO guidelines on foreign currency transfers.

Since Exness isn’t regulated by the CBO, Omani traders fall into a gray area where they can legally use the platform, provided they choose a broker with strong international oversight. Exness fits this criterion, making it a viable option for traders in the Sultanate.

Why Omani Traders Choose Exness

Exness has gained popularity among Omani traders for several reasons. Let’s explore the key features that make it an attractive choice:

1. Competitive Trading Conditions

Exness offers some of the tightest spreads in the industry, starting as low as 0.0 pips on certain account types like the Raw Spread and Zero accounts. This is a significant advantage for Omani traders looking to minimize costs. Additionally, the broker provides high leverage options, which can amplify potential profits (though it also increases risk).

2. Fast and Reliable Execution

With execution speeds often under 25 milliseconds, Exness ensures trades are processed quickly, reducing slippage—a critical factor in volatile markets like forex.

3. Instant Withdrawals

One of Exness’s standout features is its instant withdrawal system. Omani traders can access their funds within minutes using various payment methods, including bank cards, e-wallets, and local payment systems.

4. Sharia-Compliant Accounts

For Muslim traders in Oman, Exness offers swap-free (Islamic) accounts that comply with Sharia law by eliminating interest-based fees on overnight positions. This makes it an inclusive platform for Oman’s predominantly Muslim population.

5. User-Friendly Platforms

Exness supports MT4, MT5, and its own mobile app and web terminal, all of which are intuitive and packed with tools like advanced charting, technical indicators, and real-time market data.

6. Multilingual Support

Exness provides 24/7 customer support in multiple languages, including Arabic, ensuring Omani traders can get assistance in their native language whenever needed.

These features collectively make Exness a compelling choice for traders in Oman, but legality remains the top concern. Let’s dive deeper into how Exness ensures safety and compliance.

How Exness Ensures Safety for Omani Traders

Safety is a top priority for any trader, and Exness takes several measures to protect its clients:

1. Segregation of Funds

Exness keeps client funds in segregated accounts, separate from the company’s operational funds. This ensures that traders’ money is protected, even in the unlikely event of the broker’s insolvency.

2. Negative Balance Protection

Exness offers negative balance protection, meaning traders cannot lose more than their deposited amount—a crucial safeguard in volatile markets.

3. Regular Audits

As a regulated broker, Exness undergoes regular audits by independent firms to verify its financial health and compliance with regulatory standards.

4. Advanced Security Protocols

The platform uses SSL encryption and two-factor authentication (2FA) to secure user accounts and transactions, protecting Omani traders from cyber threats.

These measures align with international best practices, offering Omani users a secure trading environment despite the lack of local regulation.

Potential Risks of Using Exness in Oman

While Exness is legal and safe, there are risks to consider:

1. Lack of Local Oversight

Since Exness isn’t regulated by the CBO, Omani traders may have limited recourse through local authorities in case of disputes. However, its international licenses provide a strong alternative framework for dispute resolution.

2. Market Risks

Forex trading inherently involves risks like volatility and leverage-related losses. Omani traders must educate themselves and use risk management tools (e.g., stop-loss orders) to mitigate these risks.

3. Tax Implications

Although Oman doesn’t currently impose personal income tax, future regulatory changes could affect forex earnings. Traders should stay informed about evolving laws.

Despite these risks, Exness’s global reputation and robust safeguards make it a reliable option for most Omani traders.

How to Start Trading with Exness in Oman

Ready to trade with Exness? Here’s a step-by-step guide for Omani traders:

Step 1: Register an Account

Visit the Exness website or download the mobile app. Click “Register,” provide your email and phone number, and select Oman as your country of residence.

Step 2: Verify Your Identity

Complete the Know Your Customer (KYC) process by uploading a valid ID (e.g., passport or national ID) and proof of address (e.g., utility bill). Verification typically takes a few hours.

Step 3: Choose an Account Type

Exness offers several account types:

Standard: Ideal for beginners with low minimum deposits.

Raw Spread: Low spreads with a small commission, suited for scalpers.

Zero: Zero spreads on select instruments for advanced traders.

Pro: No commissions and tight spreads for professionals.

Select the one that matches your trading goals.

Step 4: Deposit Funds

Fund your account using bank cards, e-wallets (like Skrill or Neteller), or local payment methods available in Oman. Deposits are instant, with no fees from Exness.

Step 5: Start Trading

Download MT4, MT5, or use the Exness Terminal. Analyze the markets, place trades, and monitor your positions.

Step 6: Withdraw Profits

Request withdrawals via the same method used for deposits. Most withdrawals are processed instantly.

This straightforward process makes Exness accessible to Omani traders of all experience levels.

Exness vs. Other Brokers in Oman

How does Exness stack up against competitors like XM, Pepperstone, or IC Markets? Here’s a quick comparison:

Spreads: Exness offers some of the lowest spreads (e.g., 0.0 pips on Zero accounts), outperforming many rivals.

Leverage: Exness’s unlimited leverage is unmatched, though Pepperstone and IC Markets offer high leverage too (up to 1:500).

Withdrawals: Exness’s instant withdrawals give it an edge over XM and others, which may take 1–2 days.

Regulation: All four brokers are well-regulated, but Exness’s multi-jurisdictional licenses provide broad coverage.

Islamic Accounts: Exness, XM, and Pepperstone offer swap-free accounts, catering to Omani traders’ needs.

Exness stands out for its speed, cost-effectiveness, and flexibility, making it a top contender in Oman.

User Experiences: What Omani Traders Say

Feedback from Omani traders on platforms like Trustpilot and forex forums highlights Exness’s strengths:

“Fast withdrawals and great support in Arabic—perfect for Omanis!” – Ahmed, Muscat.

“The low spreads on gold trading saved me a lot compared to other brokers.” – Fatima, Salalah.

“I was worried about legality, but after researching Exness’s licenses, I feel confident.” – Said, Nizwa.

Some users note minor delays during high volatility, but overall, Exness enjoys a positive reputation in Oman.

Conclusion: Is Exness a Good Choice for Omani Traders?

So, is Exness legal in Oman? Yes, it is. While it lacks direct regulation from the Central Bank of Oman, its international licenses from CySEC, FCA, and other bodies ensure it operates within a secure and transparent framework. For Omani traders, Exness offers a compelling mix of low costs, fast execution, Sharia-compliant options, and robust security—making it a trustworthy platform in 2025.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

However, traders should remain cautious, educate themselves about forex risks, and stay updated on Oman’s financial regulations. If you’re an Omani resident considering Exness, it’s a legitimate and feature-rich option to explore. Sign up today, start with a demo account, and see if it suits your trading style!

Read more: