10 minute read

Does Exness charge commission? Review Broker

When choosing a forex broker, one of the most critical factors traders consider is the cost of trading. Among these costs, commissions play a pivotal role in determining overall profitability. Exness, a globally recognized forex and CFD broker, often comes up in discussions about trading fees due to its competitive offerings. But a common question arises: Does Exness charge commission? In this in-depth article, we’ll explore Exness’s commission structure, compare it with other brokers, and break down everything you need to know about its fees. Whether you’re a beginner or an experienced trader, this guide will help you make an informed decision.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? An Overview of the Broker

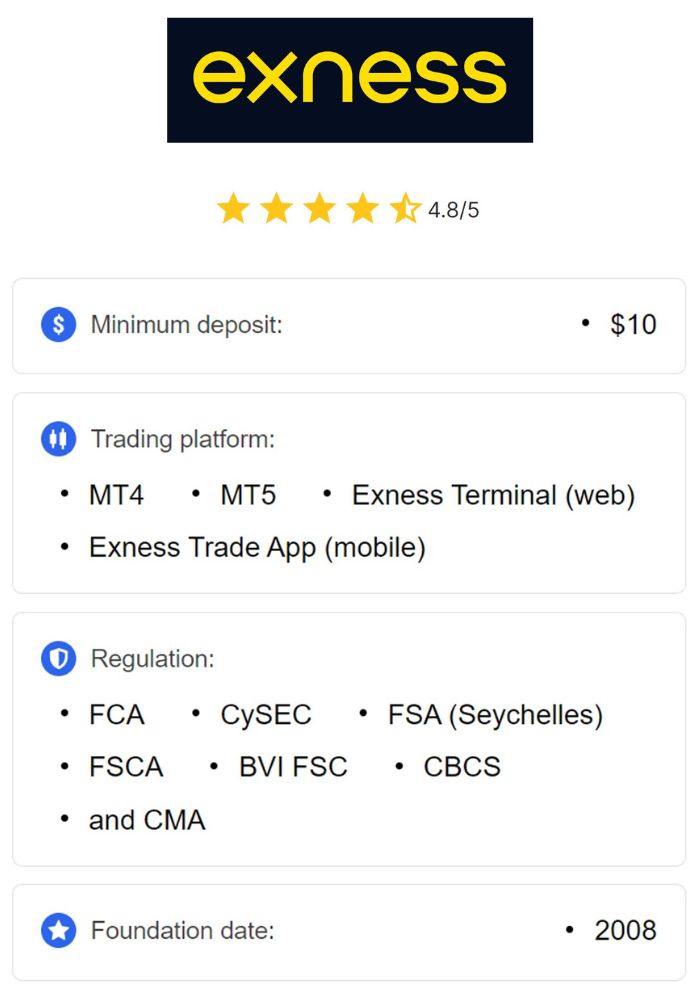

Before diving into the commission details, let’s briefly introduce Exness. Founded in 2008, Exness has grown into one of the leading online trading platforms, serving over a million traders worldwide. Headquartered in Cyprus, the broker operates under multiple regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK, and the Financial Sector Conduct Authority (FSCA) in South Africa. This multi-regulatory framework ensures a high level of trust and transparency.

Exness offers a wide range of trading instruments, including forex pairs, commodities, stocks, indices, and cryptocurrencies. Known for its tight spreads, fast execution speeds, and flexible account types, Exness caters to traders of all levels. But how does its commission structure fit into this picture? Let’s find out.

Understanding Trading Fees: Commissions vs. Spreads

To answer whether Exness charges commission, we first need to understand the two primary types of trading fees: commissions and spreads.

Commissions: These are fixed fees charged by brokers per trade or per lot traded. They are typically applied in addition to or instead of spreads, depending on the account type. Commissions are common in ECN (Electronic Communication Network) or raw spread accounts, where brokers provide direct market access.

Spreads: The spread is the difference between the bid (sell) and ask (buy) price of an asset. It’s a cost embedded in every trade and varies based on market conditions, account type, and the broker’s pricing model. Some brokers rely solely on spreads for revenue, offering commission-free trading.

Exness uses both models, depending on the account type you choose. This flexibility allows traders to select an account that aligns with their trading style and cost preferences. So, does Exness charge commission? The answer is: It depends on the account type.

Exness Account Types and Their Fee Structures

Exness offers five main account types, divided into two categories: Standard Accounts and Professional Accounts. Each has a unique fee structure, including commissions and spreads. Let’s break them down.

1. Standard Accounts

Standard accounts are designed for beginners and casual traders who prefer simplicity and low entry barriers. They include:

Standard Account

Commission: No commission is charged.

Spreads: Starting from 0.3 pips (variable).

Minimum Deposit: $10 (varies by region).

Trading Instruments: Over 120 options, including forex, metals, and cryptocurrencies.

The Standard Account operates on a spread-only model, meaning Exness earns its revenue through the spread rather than charging a separate commission. This makes it an attractive option for traders who want to avoid additional fees.

Standard Cent Account

Commission: No commission.

Spreads: Starting from 0.3 pips (variable).

Minimum Deposit: $10 (varies by region).

Trading Instruments: Limited to forex and metals, with cent-based lot sizes.

Similar to the Standard Account, the Standard Cent Account is commission-free and ideal for new traders testing strategies with smaller volumes. The spreads are slightly higher than professional accounts, but the absence of commissions keeps costs predictable.

2. Professional Accounts

Professional accounts cater to experienced traders seeking tighter spreads and advanced trading conditions. These include:

Pro Account

Commission: No commission.

Spreads: Starting from 0.1 pips (variable).

Minimum Deposit: $200 (varies by region).

Trading Instruments: Full range, including forex, commodities, stocks, and indices.

The Pro Account is commission-free, offering some of the lowest spreads among Exness’s offerings. It’s suitable for scalpers and high-frequency traders who prioritize low costs and fast execution.

Zero Account

Commission: Yes, starting from $0.05 per lot per side (varies by instrument).

Spreads: 0 pips on top instruments for 95% of the trading day.

Minimum Deposit: $200 (varies by region).

Trading Instruments: Focused on major forex pairs and select assets.

The Zero Account introduces commissions in exchange for ultra-tight spreads, often hitting 0 pips. The commission varies by instrument—for example, forex pairs might cost $3.50 per lot per side, while other assets could be higher or lower. This account is ideal for traders who want raw market pricing.

Raw Spread Account

Commission: Yes, up to $3.50 per lot per side.

Spreads: Starting from 0 pips (variable).

Minimum Deposit: $200 (varies by region).

Trading Instruments: Full range of assets.

The Raw Spread Account also charges commissions but offers some of the lowest spreads in the industry. The commission is fixed at $3.50 per lot per side for most instruments, making it transparent and predictable. This account suits professional traders who trade large volumes and need minimal spread costs.

Does Exness Charge Commission? The Verdict

So, does Exness charge commission? Yes and no. It depends on the account type you select:

Commission-Free Accounts: Standard, Standard Cent, and Pro accounts do not charge commissions. Instead, trading costs are covered by spreads, which start at 0.1 to 0.3 pips, depending on the account.

Commission-Based Accounts: Zero and Raw Spread accounts charge commissions, ranging from $0.05 to $3.50 per lot per side, in exchange for near-zero or zero spreads.

💥 Trade with Exness now: Open An Account or Visit Brokers

This dual approach gives traders the freedom to choose between commission-free trading with wider spreads or commission-based trading with tighter spreads. Your decision should depend on your trading strategy, volume, and cost tolerance.

How Exness Commissions Work: A Closer Look

For the commission-based accounts (Zero and Raw Spread), here’s how the fees are applied:

Per Lot, Per Side: Commissions are charged when you open and close a trade. For example, a $3.50 commission per lot per side means $3.50 when you enter the trade and $3.50 when you exit, totaling $7 per round-turn lot.

Instrument-Specific: The commission varies by asset. Forex pairs typically have lower commissions (e.g., $3.50 per lot per side), while commodities or indices might have different rates.

Transparent Pricing: Exness displays all fees upfront in its trading platforms (MT4, MT5, or the Exness Terminal), so you know exactly what you’re paying before executing a trade.

For example, if you trade 1 lot of EUR/USD on a Raw Spread Account with a $3.50 commission per side, your total commission would be $7, assuming no spread cost (if the spread is 0 pips). Compare this to a Standard Account, where you might pay a 1-pip spread (approximately $10 per lot), and the cost difference becomes clear.

Comparing Exness Commissions to Other Brokers

To understand whether Exness’s commission structure is competitive, let’s compare it with two popular brokers: XM and IC Markets.

Exness vs. XM

XM Standard Account: No commission, spreads from 1.0 pips.

XM Zero Account: $3.50 per lot per side, spreads from 0 pips.

Exness Advantage: Exness’s Standard Account offers lower spreads (0.3 pips) than XM’s (1.0 pips), and its Raw Spread Account matches XM’s Zero Account commission while maintaining a strong reputation for execution speed.

Exness vs. IC Markets

IC Markets Standard Account: No commission, spreads from 0.6 pips.

IC Markets Raw Spread Account: $3.50 per lot per side, spreads from 0 pips.

Exness Advantage: Exness’s Pro Account offers spreads from 0.1 pips with no commission, outperforming IC Markets’ Standard Account. The Raw Spread accounts are identical in commission, but Exness’s wider range of commission-free options gives it an edge.

Exness stands out for its flexibility and competitive pricing, especially for traders who prefer commission-free accounts with low spreads.

Additional Fees to Consider with Exness

Beyond commissions and spreads, Exness traders should be aware of other potential costs:

Swap Fees (Overnight Charges)

Swap fees apply when you hold a position overnight, based on the interest rate differential between the two currencies in a forex pair. Exness offers swap-free trading for certain instruments (e.g., gold, cryptocurrencies) and Islamic accounts, eliminating this cost for eligible traders.

Deposit and Withdrawal Fees

Exness does not charge fees for deposits or withdrawals, unlike some brokers. However, third-party payment providers (e.g., banks, e-wallets) may impose their own fees, which are outside Exness’s control.

Inactivity Fees

Exness does not charge inactivity fees, making it a cost-effective choice for traders who don’t trade frequently.

Currency Conversion Fees

If your account currency differs from the asset’s quote currency or your payment method, Exness applies a market-based conversion rate, which may include a small fee.

Why Does Exness’s Fee Structure Matter?

Understanding whether Exness charges commission—and how its fees work—directly impacts your trading profitability. Here’s why:

Cost Efficiency: Commission-free accounts like Standard and Pro are ideal for low-volume traders, while commission-based accounts (Zero, Raw Spread) suit high-volume traders who benefit from tighter spreads.

Transparency: Exness’s clear fee structure helps you calculate costs upfront, avoiding surprises.

Strategy Alignment: Scalpers and day traders may prefer Zero or Raw Spread accounts for low spreads, while long-term traders might opt for commission-free accounts to minimize fees.

Pros and Cons of Exness’s Commission Structure

Pros

Flexible options: Choose between commission-free or commission-based accounts.

Competitive spreads: Starting from 0 pips on professional accounts.

No hidden fees: Transparent pricing with no deposit, withdrawal, or inactivity charges.

Swap-free trading: Available for select instruments and Islamic accounts.

Cons

Higher spreads on Standard accounts: Compared to professional accounts, spreads are wider.

Commission variability: Fees on Zero and Raw Spread accounts depend on the instrument, requiring careful planning.

How to Choose the Right Exness Account for You

Selecting the best account depends on your trading goals:

Beginners: Start with the Standard or Standard Cent Account for commission-free trading and low deposits.

Scalpers/Day Traders: Opt for the Zero or Raw Spread Account for minimal spreads and manageable commissions.

High-Volume Traders: The Raw Spread Account offers the best value with fixed commissions and ultra-low spreads.

Balanced Approach: The Pro Account provides low spreads without commissions, ideal for intermediate traders.

Consider your trading frequency, volume, and preferred instruments when making your choice.

Tips to Minimize Trading Costs with Exness

Here are some practical tips to keep your costs low:

Match Account to Strategy: Use commission-based accounts for high-frequency trading and commission-free accounts for longer-term trades.

Monitor Spreads: Trade during peak market hours (e.g., London-New York overlap) when spreads are tightest.

Leverage Swap-Free Options: If eligible, opt for an Islamic account or trade swap-free instruments.

Avoid Currency Conversion: Fund your account in the same currency as your trades to skip conversion fees.

Conclusion: Is Exness Worth It?

So, does Exness charge commission? The answer varies by account type, offering traders the flexibility to choose what suits them best. With commission-free options like the Standard and Pro accounts and low-commission options like the Zero and Raw Spread accounts, Exness caters to a wide audience. Its competitive spreads, lack of hidden fees, and fast execution make it a top choice in 2025.

Whether you’re looking to avoid commissions entirely or willing to pay for tighter spreads, Exness delivers value. Compared to competitors like XM and IC Markets, it holds its own with a transparent and trader-friendly fee structure. If you’re ready to start trading, Exness offers a compelling mix of affordability and performance—perfect for beginners and pros alike.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: