11 minute read

Exness vs OctaFX Comparison | Which is better?

from Exness Global

The world of online trading offers countless opportunities, but success often hinges on one critical decision: choosing the right broker. With so many options available, traders frequently find themselves comparing platforms like Exness vs OctaFX—two well-established names in the forex and CFD trading space. Both brokers have earned reputations for reliability, competitive features, and user-friendly services, but which one truly stands out? In this in-depth Exness vs OctaFX comparison, we’ll explore their offerings, from trading platforms and fees to regulation and customer support, to help you decide which is better suited to your trading goals in 2025.

💥 Trade with Exness now: Open An Account or Visit Brokers

The forex trading landscape continues to evolve, with brokers adapting to new technologies, regulatory changes, and trader demands. Whether you’re a beginner dipping your toes into forex or an experienced trader seeking advanced tools, this guide will break down every aspect of Exness and OctaFX. Let’s dive in and uncover the strengths, weaknesses, and unique selling points of these two powerhouse brokers.

Overview of Exness and OctaFX

Before we delve into the nitty-gritty, let’s establish a foundation by understanding who Exness vs OctaFX are and what they bring to the table.

What is Exness?

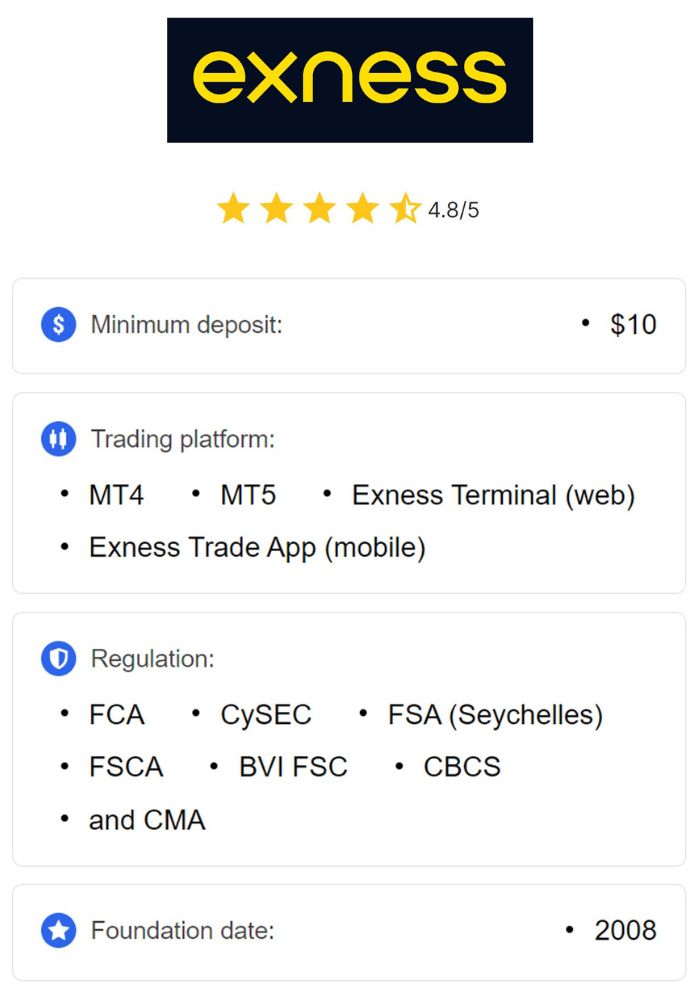

Founded in 2008, Exness has grown into one of the most prominent brokers in the global trading industry. Headquartered in Cyprus, the company boasts a client base spanning over 180 countries and a staggering monthly trading volume exceeding $4 trillion as of recent reports. Exness is known for its transparency, cutting-edge technology, and a wide range of trading instruments, including forex, cryptocurrencies, commodities, and indices. The broker caters to traders of all levels with multiple account types and platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal.

Exness has built its reputation on ultra-fast execution speeds, competitive spreads starting from 0.0 pips, and a commitment to client satisfaction. With licenses from top-tier regulators like the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC), Exness prioritizes safety and trust.

What is OctaFX?

OctaFX, established in 2011, is a younger but equally formidable player in the forex market. Based in St. Vincent and the Grenadines, with additional operations regulated by CySEC, OctaFX has attracted over 6 million traders worldwide. The broker focuses on delivering low-cost trading, intuitive platforms, and a strong emphasis on education and copy trading. OctaFX offers access to MT4, MT5, and its proprietary OctaTrader platform, alongside a variety of CFD instruments like forex pairs, commodities, and cryptocurrencies.

Known for its beginner-friendly approach, OctaFX provides competitive spreads, zero-commission accounts, and attractive promotions like deposit bonuses. While its regulatory framework isn’t as extensive as Exness’s, it has earned accolades for reliability and innovation, particularly in emerging markets.

Regulation and Safety: Which Broker is More Trustworthy?

When choosing a broker, safety is paramount. Your funds and personal data must be secure, and regulation plays a key role in ensuring this.

Exness Regulation

Exness operates under a robust multi-regulatory framework, which enhances its credibility. The broker is licensed by:

Financial Conduct Authority (FCA) – UK

Cyprus Securities and Exchange Commission (CySEC) – Cyprus

Financial Sector Conduct Authority (FSCA) – South Africa

Financial Services Authority (FSA) – Seychelles

This multi-tiered oversight ensures that Exness adheres to strict standards for fund segregation, transparency, and operational integrity. The FCA and CySEC, in particular, are renowned for their rigorous requirements, making Exness a top choice for traders prioritizing security. Additionally, Exness offers negative balance protection, ensuring you never lose more than your deposit.

OctaFX Regulation

OctaFX’s regulatory landscape is less extensive but still reputable. It is primarily regulated by:

Financial Services Authority (FSA) – St. Vincent and the Grenadines

Cyprus Securities and Exchange Commission (CySEC) – Cyprus (for its European entity)

While the FSA in St. Vincent and the Grenadines is a common offshore regulator, it doesn’t carry the same weight as the FCA or ASIC. However, the CySEC license for OctaFX’s European operations adds a layer of credibility, ensuring compliance with EU financial standards. Like Exness, OctaFX provides negative balance protection and segregates client funds, though its offshore entity may raise concerns for cautious traders.

Verdict: Regulation

Exness takes the lead in regulation due to its broader and more stringent oversight from top-tier authorities. If safety and trust are your top priorities, Exness offers greater peace of mind. That said, OctaFX remains a reliable option, especially for traders comfortable with its CySEC-regulated entity.

Trading Platforms: Tools for Success

A broker’s trading platforms can make or break your experience. Let’s compare what Exness vs OctaFX offer.

Exness Trading Platforms

Exness provides a versatile suite of platforms:

MetaTrader 4 (MT4): A timeless favorite, MT4 offers robust charting, automated trading via Expert Advisors (EAs), and a user-friendly interface.

MetaTrader 5 (MT5): An advanced version of MT4, MT5 includes additional timeframes, more order types, and enhanced analytical tools.

Exness Terminal: A proprietary web-based platform designed for simplicity and speed, ideal for beginners and mobile traders.

Exness Trade App: A mobile app that mirrors the desktop experience, offering real-time trading and account management.

Exness’s platforms are optimized for low-latency execution, making them a go-to for scalpers and high-frequency traders. The proprietary Exness Terminal stands out for its intuitive design and sentiment indicators, which show market trends based on trader behavior.

OctaFX Trading Platforms

OctaFX also offers a strong lineup:

MetaTrader 4 (MT4): Similar to Exness, OctaFX’s MT4 supports EAs, technical indicators, and fast execution.

MetaTrader 5 (MT5): With added features like economic calendars and advanced charting, MT5 caters to sophisticated traders.

OctaTrader: OctaFX’s proprietary platform integrates TradingView charts, one-click trading, and price alerts, making it a standout for ease of use.

OctaFX Copytrading App: A dedicated mobile app for copying trades from successful traders, perfect for beginners or passive investors.

OctaFX’s platforms are reliable and beginner-friendly, with the OctaTrader platform earning praise for its sleek design and powerful tools. The copy trading app adds a unique dimension, appealing to those who prefer a hands-off approach.

Verdict: Trading Platforms

Exness edges out slightly with its broader platform variety and the polished Exness Terminal, which rivals OctaTrader in usability. However, OctaFX shines with its copy trading app and TradingView integration, making it a strong contender for novices and intermediate traders. Your choice depends on whether you prioritize advanced tools (Exness) or simplicity and social trading (OctaFX).

Account Types: Flexibility for Every Trader

Both brokers offer diverse account types to suit different trading styles. Let’s break them down.

Exness Account Types

Exness provides five main account options:

Standard Account: No commissions, spreads from 0.3 pips, $10 minimum deposit—ideal for beginners.

Standard Cent Account: Micro-lot trading with a $10 minimum deposit, perfect for testing strategies.

Pro Account: Spreads from 0.1 pips, no commissions, $200 minimum deposit—designed for experienced traders.

Raw Spread Account: Spreads from 0.0 pips, $3.5/lot commission, $200 minimum deposit—great for scalpers.

Zero Account: Zero spreads on top instruments, $3.5/lot commission, $200 minimum deposit—best for high-volume traders.

Exness’s accounts cater to a wide spectrum, from novices to professionals, with flexible leverage up to 1:2000 (depending on regulation).

OctaFX Account Types

OctaFX offers three primary accounts:

MT4 Account: Zero commissions, spreads from 0.6 pips, $25 minimum deposit—suitable for beginners.

MT5 Account: Similar to MT4 but with more instruments, spreads from 0.6 pips, $25 minimum deposit.

OctaTrader Account: Floating spreads, zero commissions, $25 minimum deposit—geared toward intermediate traders.

OctaFX keeps things simple with low entry barriers and leverage up to 1:1000. Its accounts are less varied than Exness’s but focus on cost efficiency.

Verdict: Account Types

Exness wins for variety and customization, offering specialized accounts like Raw Spread and Zero for advanced traders. OctaFX’s simpler structure is better for beginners or those who prefer straightforward options. If flexibility matters, Exness is the better pick.

💥 Trade with Exness now: Open An Account or Visit Brokers

Fees and Spreads: Keeping Costs Low

Trading costs can significantly impact profitability. Here’s how Exness vs OctaFX stack up.

Exness Fees and Spreads

Spreads: Start at 0.0 pips (Raw Spread and Zero accounts) and 0.3 pips (Standard accounts).

Commissions: $3.5/lot on Raw Spread and Zero accounts; zero on Standard and Pro accounts.

Swap Fees: Charged on overnight positions, though swap-free (Islamic) accounts are available.

Inactivity Fees: None, making Exness ideal for occasional traders.

Exness’s tight spreads and commission-free options make it cost-competitive, especially for high-volume traders.

OctaFX Fees and Spreads

Spreads: Start at 0.6 pips across all accounts, with no zero-spread option.

Commissions: Zero on all accounts, relying solely on spreads for revenue.

Swap Fees: Applied unless you opt for a swap-free account.

Inactivity Fees: None, aligning with Exness in this regard.

OctaFX’s zero-commission model is attractive, but its spreads are slightly higher than Exness’s premium accounts.

Verdict: Fees and Spreads

Exness offers lower spreads and more cost flexibility, particularly with its Raw Spread and Zero accounts, making it better for active traders. OctaFX’s zero-commission approach suits budget-conscious beginners, though its spreads are less competitive.

Trading Instruments: What Can You Trade?

Diversity in trading instruments allows you to explore various markets. Let’s compare the offerings.

Exness Trading Instruments

Exness provides over 200 instruments, including:

Forex: 90+ currency pairs, above the industry average.

Cryptocurrencies: 7 pairs, including BTC/USD and ETH/USD.

Commodities: Gold, silver, oil, and more.

Indices: 10+ major indices like S&P 500 and NASDAQ.

Stocks: Limited CFDs on popular equities.

Exness excels in forex variety and offers a decent range of other assets, though its stock CFD selection is modest.

OctaFX Trading Instruments

OctaFX offers over 250 instruments:

Forex: 52 currency pairs, solid but fewer than Exness.

Cryptocurrencies: 34 pairs, outpacing Exness in crypto variety.

Commodities: 5 options, including gold and oil.

Indices: 10 indices, comparable to Exness.

Stocks: None available.

OctaFX shines with its crypto offerings but lags in forex pair diversity and lacks stock CFDs.

Verdict: Trading Instruments

Exness is better for forex-focused traders, while OctaFX appeals to crypto enthusiasts. If you want a broader forex selection, Exness wins; for crypto diversity, OctaFX takes the lead.

Deposits and Withdrawals: Ease of Access

Seamless funding and withdrawals are crucial for a smooth trading experience.

Exness Deposits and Withdrawals

Methods: Bank cards, e-wallets (Skrill, Neteller), crypto, and local payment options.

Minimum Deposit: $10 (Standard accounts), $200 (professional accounts).

Processing Time: Instant deposits and withdrawals, a standout feature.

Fees: No deposit or withdrawal fees.

Exness’s instant withdrawals and low minimums make it highly accessible.

OctaFX Deposits and Withdrawals

Methods: Bank cards, e-wallets, crypto, and local payment systems.

Minimum Deposit: $25 across all accounts.

Processing Time: Deposits are instant; withdrawals take 1-3 hours.

Fees: No fees for most methods.

OctaFX offers quick transactions but can’t match Exness’s instant withdrawals.

Verdict: Deposits and Withdrawals

Exness leads with its lightning-fast withdrawals and lower minimum deposit, giving it an edge in convenience.

Education and Resources: Learning to Trade

Both brokers provide educational tools, but their approaches differ.

Exness Education

Exness Academy: Courses on trading basics, analysis, and risk management.

Webinars: Regular sessions with market experts.

Market Analysis: Daily updates and insights.

Exness offers a structured learning path, ideal for beginners and intermediates.

OctaFX Education

Trading School: Comprehensive lessons and tutorials.

Webinars: Frequent and beginner-focused.

Copy Trading Guides: Detailed resources for social trading.

OctaFX emphasizes practical learning and excels in copy trading education.

Verdict: Education

OctaFX slightly outshines Exness with its extensive resources and copy trading focus, though Exness’s Academy is highly effective for foundational learning.

Customer Support: Help When You Need It

Reliable support can save the day during trading hiccups.

Exness Customer Support

Channels: Live chat, email, phone.

Availability: 24/7 in multiple languages.

Response Time: Fast and knowledgeable.

Exness’s round-the-clock support is a major plus.

OctaFX Customer Support

Channels: Live chat, email, phone.

Availability: 24/5, with extended hours in some regions.

Response Time: Quick and helpful.

OctaFX’s support is solid but lacks full 24/7 coverage.

Verdict: Customer Support

Exness wins with its 24/7 availability, ensuring help is always at hand.

Bonuses and Promotions: Extra Value

Promotions can sweeten the deal for new traders.

Exness Bonuses

Exness rarely offers bonuses, focusing instead on low fees and quality service. Occasional referral programs may apply.

OctaFX Bonuses

50% Deposit Bonus: Boosts your initial capital.

Contests: Regular trading competitions with cash prizes.

Loyalty Program: Rewards for active trading.

OctaFX excels in promotional offerings.

Verdict: Bonuses

OctaFX is the clear winner for traders seeking extra incentives.

Final Verdict: Exness vs OctaFX – Which is Better?

After dissecting every aspect, here’s the bottom line:

Choose Exness if: You value top-tier regulation, ultra-low spreads, instant withdrawals, and a wide range of forex pairs. It’s ideal for experienced traders, scalpers, and those prioritizing safety and advanced tools.

Choose OctaFX if: You’re a beginner or budget-conscious trader who wants zero commissions, copy trading, and generous bonuses. It’s perfect for crypto enthusiasts and those seeking simplicity.

Ultimately, the “better” broker depends on your trading style, goals, and priorities. Exness offers a premium, professional-grade experience, while OctaFX delivers affordability and accessibility. Weigh your needs, test their demo accounts, and take the plunge with confidence in 2025!

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: