9 minute read

Is Exness Trusted Broker in India? Review Broker 2025

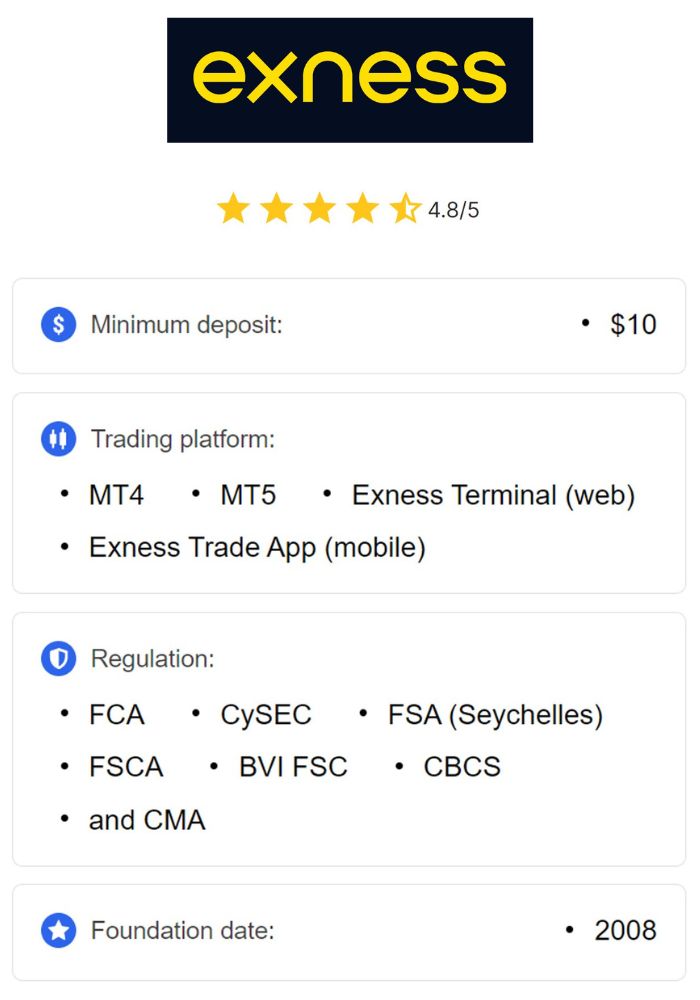

When it comes to forex trading in India, one question looms large for both novice and seasoned traders: Is Exness a trusted broker in India? With the rise of online trading platforms, Indian traders are increasingly seeking reliable brokers that offer transparency, security, and competitive trading conditions. Exness, a globally recognized forex and CFD broker established in 2008, has garnered attention for its user-friendly platforms, low spreads, and instant withdrawal features. But how does it fare for Indian traders specifically? In this in-depth article, we’ll explore Exness’s trustworthiness, regulatory status, services, and suitability for the Indian market.

💥 Trade with Exness now: Open An Account or Visit Brokers

What is Exness? An Overview of the Broker

Exness is an international brokerage firm headquartered in Cyprus, with a strong global presence spanning over 150 countries. Founded by a group of financial and IT professionals, Exness has grown into one of the world’s leading brokers, boasting over 700,000 active clients and a monthly trading volume exceeding $4 trillion. The broker specializes in forex trading, Contracts for Difference (CFDs) on commodities, indices, stocks, and cryptocurrencies, offering traders a diverse range of instruments.

For Indian traders, Exness stands out due to its localized support, including Hindi-language customer service, and payment methods tailored to the Indian market, such as UPI and Netbanking. But beyond these conveniences, the core question remains: Can Indian traders trust Exness with their funds and trading activities? To answer this, we need to dive into its regulatory framework, security measures, and reputation.

Understanding Forex Trading Regulations in India

Before assessing Exness’s trustworthiness, it’s crucial to understand the regulatory landscape for forex trading in India. Forex trading is governed by the Foreign Exchange Management Act (FEMA) of 1999, enforced by the Reserve Bank of India (RBI). Under FEMA, Indian residents are permitted to trade forex only in currency pairs involving the Indian Rupee (INR), such as USD/INR, EUR/INR, or GBP/INR. These transactions must occur through brokers or platforms registered with the Securities and Exchange Board of India (SEBI) and conducted on recognized exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

Trading with international brokers like Exness, which offer a broader range of currency pairs (e.g., EUR/USD or GBP/JPY), falls into a gray area. While not explicitly banned, such activities are not fully compliant with FEMA unless the broker is SEBI-registered. This raises a critical point: Exness is not directly regulated by SEBI. Does this mean it’s untrustworthy? Not necessarily. Many offshore brokers operate legally under international regulations and serve Indian clients without issue. Let’s explore Exness’s regulatory credentials next.

Is Exness Regulated? A Look at Its Global Licenses

One of the most reliable indicators of a broker’s trustworthiness is its regulatory status. Exness operates under multiple entities, each regulated by reputable financial authorities worldwide. Here’s a breakdown of its key licenses as of 2025:

Cyprus Securities and Exchange Commission (CySEC)

License Number: 178/12

CySEC regulates Exness (Cy) Ltd., ensuring compliance with European Union financial standards. This includes segregated client funds, transparency in operations, and adherence to anti-money laundering (AML) policies.

Financial Conduct Authority (FCA), United Kingdom

License Number: 730729

The FCA is one of the most stringent regulators globally. Exness (UK) Ltd. operates under its oversight, offering Indian traders confidence in the broker’s financial stability and ethical practices.

Financial Sector Conduct Authority (FSCA), South Africa

License Number: 51024

The FSCA oversees Exness ZA (PTY) Ltd., adding another layer of credibility for traders in emerging markets, including India.

Financial Services Authority (FSA), Seychelles

License Number: SD025

Exness (SC) Ltd. is regulated by the FSA, a common offshore jurisdiction for brokers. While less stringent than CySEC or FCA, it still enforces basic standards for client protection.

Financial Services Commission (FSC), Mauritius

License Number: GB20025294

Exness (MU) Ltd. caters to traders in regions like India, offering a regulated environment under Mauritius’s growing financial hub.

While Exness lacks SEBI registration, its oversight by top-tier regulators like the FCA and CySEC demonstrates a commitment to global standards. For Indian traders, this means Exness operates under robust frameworks that prioritize fund security and fair trading practices—key pillars of trustworthiness.

How Does Exness Ensure Security for Indian Traders?

Trust in a broker goes beyond regulation; it hinges on the security of funds and personal data. Exness employs several measures to safeguard its clients, including those in India:

1. Segregated Client Funds

Exness keeps client funds separate from its operational accounts, a practice mandated by regulators like CySEC and FCA. This ensures that traders’ money is protected even if the broker faces financial difficulties.

2. Advanced Encryption

The broker uses SSL encryption to secure all data transmissions, protecting sensitive information like bank details and personal IDs from cyber threats. Exness also complies with ISO 27001 standards for information security management.

3. Two-Factor Authentication (2FA)

To prevent unauthorized access, Exness offers 2FA via phone or email, adding an extra layer of account security for Indian traders.

4. Negative Balance Protection

Exness provides negative balance protection across all account types, meaning traders cannot lose more than their deposited funds—a crucial feature during volatile market conditions.

5. Instant Withdrawals

Unlike some brokers that delay payouts, Exness offers instant withdrawals, processed within seconds for most payment methods. This transparency builds trust, as Indian traders can access their funds quickly and reliably.

These security features align with industry best practices, making Exness a safe choice for traders concerned about protecting their investments.

💥 Trade with Exness now: Open An Account or Visit Brokers

Exness’s Trading Platforms: Are They Reliable for Indian Traders?

A trusted broker must offer reliable, efficient trading platforms. Exness supports two of the most popular platforms in the industry—MetaTrader 4 (MT4) and MetaTrader 5 (MT5)—along with its proprietary Exness Terminal and mobile apps. Here’s how they cater to Indian traders:

1. MetaTrader 4 (MT4)

Known for its simplicity and versatility, MT4 is ideal for beginners. It offers advanced charting tools, automated trading via Expert Advisors (EAs), and a stable interface.

Indian traders benefit from MT4’s compatibility with low-speed internet, a common challenge in rural areas.

2. MetaTrader 5 (MT5)

MT5 builds on MT4 with additional features like 38 technical indicators, 21 timeframes, and an economic calendar. It’s suited for advanced traders looking for deeper market analysis.

Its multi-asset support aligns with Exness’s diverse offerings, from forex to cryptocurrencies.

3. Exness Terminal and Mobile Apps

The Exness Terminal is a web-based platform with TradingView charts, customizable indicators, and a sleek design—perfect for traders who prefer browser-based trading.

The Exness Trader app (available on Android and iOS) offers one-tap deposits/withdrawals, real-time quotes, and market news, catering to India’s mobile-savvy population.

These platforms are renowned for their stability and uptime, ensuring Indian traders can execute trades without disruptions—a key factor in assessing trustworthiness.

Account Types: Options for Indian Traders

Exness offers a variety of account types tailored to different trading styles and experience levels, making it accessible for Indian traders:

Standard Account

Minimum Deposit: $10

Spreads: From 0.3 pips

Ideal for beginners due to its low entry barrier and no commission fees.

Standard Cent Account

Minimum Deposit: $10

Uses cent lots, minimizing risk for new traders testing strategies with small capital.

Raw Spread Account

Minimum Deposit: $200

Spreads: From 0.0 pips (with a commission)

Suited for scalpers and high-volume traders seeking the tightest spreads.

Zero Account

Minimum Deposit: $200

Zero spreads on top instruments for 95% of the trading day

Perfect for professionals targeting cost efficiency.

Pro Account

Minimum Deposit: $200

Market execution with no requotes

Designed for experienced traders who prioritize speed and precision.

With a low minimum deposit of $10, Exness caters to India’s price-sensitive market, while its advanced accounts appeal to seasoned traders. This flexibility enhances its trustworthiness by accommodating diverse needs.

Trading Conditions: Are They Competitive?

Trustworthy brokers offer competitive trading conditions to ensure traders can maximize profits. Exness excels in this area:

Spreads: Among the lowest in the industry, starting at 0.0 pips on premium accounts.

Leverage: Up to 1:2000 or unlimited for certain conditions, though Indian traders should use high leverage cautiously due to increased risk.

Execution Speed: Market execution with no requotes, ensuring fast and fair trade execution.

No Hidden Fees: Exness charges no deposit or withdrawal fees, though payment providers may apply their own charges.

These conditions make Exness attractive to Indian traders seeking cost-effective and reliable trading opportunities.

Payment Methods for Indian Traders

A trusted broker must support convenient, secure payment options. Exness offers a range of methods tailored to India:

UPI: Fast and popular among Indian users.

Netbanking: Supports major Indian banks.

Credit/Debit Cards: Visa and Mastercard accepted.

E-Wallets: Skrill, Neteller, and others for quick transactions.

Cryptocurrencies: Bitcoin and USDT for tech-savvy traders.

The instant withdrawal feature, combined with local payment support, reinforces Exness’s reliability for Indian clients.

Customer Support: Is It Accessible in India?

Reliable customer support is a hallmark of trustworthiness. Exness provides 24/7 support via:

Live Chat: Instant responses in English and Hindi.

Email: Detailed assistance for complex queries.

Phone: Direct lines to support agents.

Indian traders report quick resolution times and multilingual support, enhancing Exness’s reputation as a client-focused broker.

Exness’s Reputation: What Do Indian Traders Say?

User feedback offers valuable insights into a broker’s trustworthiness. On platforms like Trustpilot, Exness holds a 4-star rating based on over 13,000 reviews. Indian traders praise:

Fast withdrawals and deposits.

Competitive spreads, especially on gold and forex pairs.

Responsive customer service.

However, some negative reviews mention withdrawal delays or account verification issues, though these are often resolved upon escalation. Overall, the positive sentiment outweighs the negatives, suggesting Exness is well-regarded in India.

Pros and Cons of Trading with Exness in India

Pros

Regulated by top-tier authorities (FCA, CySEC).

Low minimum deposit ($10).

Instant withdrawals and local payment options.

Competitive spreads and high leverage.

Robust security measures.

Cons

Not SEBI-registered, posing a legal gray area.

Limited physical presence in India.

High leverage carries risks for inexperienced traders.

Is Exness Legal in India?

Exness is not explicitly illegal in India, but its lack of SEBI registration means it operates outside the RBI’s preferred framework. Indian traders can use Exness legally under FEMA if they comply with foreign remittance limits (e.g., the Liberalised Remittance Scheme, allowing up to $250,000 annually). However, there’s a risk of scrutiny from authorities, especially if large profits are repatriated. Consulting a financial advisor is recommended to ensure compliance.

Conclusion: Can Indian Traders Trust Exness?

After a thorough analysis, Exness emerges as a trusted broker for Indian traders in 2025, despite its lack of SEBI regulation. Its global licenses from FCA, CySEC, and others, combined with segregated funds, advanced security, and competitive trading conditions, make it a reliable choice. The broker’s tailored services—low deposits, local payment methods, and Hindi support—further enhance its appeal in India.

However, traders must weigh the legal gray area and exercise caution with high leverage. For those seeking a secure, efficient platform to access global markets, Exness is a strong contender.

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: