9 minute read

Is Exness Legal in Qatar? A Comprehensive Guide for Traders

The world of online trading has exploded in popularity over the past decade, and Qatar is no exception. As more Qatari residents explore financial markets like forex, commodities, and cryptocurrencies, one question frequently arises: Is Exness legal in Qatar? For those unfamiliar, Exness is a globally recognized online broker known for its competitive trading conditions, user-friendly platforms, and robust regulatory framework. But legality is a critical concern for traders in any jurisdiction, especially in a country like Qatar, where financial regulations are strict and influenced by Islamic principles.

💥 Trade with Exness now: Open An Account or Visit Brokers

In this in-depth guide, we’ll explore whether Exness is a legal and viable option for traders in Qatar. We’ll dive into the broker’s regulatory status, its offerings tailored to Qatari traders, the legal landscape of forex trading in Qatar, and practical steps to get started. Whether you’re a beginner or an experienced trader, this article will provide clarity and actionable insights to help you make an informed decision.

What Is Exness? An Overview of the Broker

Before addressing its legality in Qatar, let’s first understand what Exness is and why it’s a popular choice among traders worldwide. Founded in 2008, Exness is a multi-asset broker headquartered in Cyprus, offering trading services in forex, cryptocurrencies, commodities, indices, and stocks. The broker has built a reputation for transparency, fast execution speeds, low spreads, and a variety of account types catering to different trading needs.

Exness operates on industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside its proprietary Exness Trade app. With over 800,000 active traders globally and a monthly trading volume exceeding $4 trillion, Exness has established itself as a leader in the online trading space. Its appeal lies in features like unlimited leverage, instant withdrawals, and 24/7 customer support—attributes that resonate with traders in Qatar and beyond.

But popularity alone doesn’t determine legality. To answer whether Exness is legal in Qatar, we need to examine its regulatory compliance and how it aligns with Qatar’s financial laws.

Is Forex Trading Legal in Qatar?

To determine if Exness is legal in Qatar, we must first establish the legality of forex trading itself in the country. Qatar, a wealthy Gulf nation with a rapidly growing economy, has a well-regulated financial sector overseen by two primary authorities:

Qatar Central Bank (QCB): The QCB is the main regulatory body responsible for supervising financial institutions, including banks and currency exchange operations. It ensures economic stability and prevents illegal financial activities like money laundering.

Qatar Financial Centre Regulatory Authority (QFCRA): Operating within the Qatar Financial Centre (QFC), the QFCRA regulates international financial firms and ensures compliance with global standards.

Forex trading is legal in Qatar, but it comes with strict conditions. The QCB allows Qatari citizens and residents to engage in forex trading through licensed brokers, whether domestic or offshore. However, there are no locally licensed forex brokers operating directly under QCB oversight, which means most traders in Qatar turn to international brokers like Exness. This is permissible as long as the broker adheres to international regulations and complies with Qatar’s financial laws, including anti-money laundering (AML) and know-your-customer (KYC) requirements.

Additionally, Qatar’s predominantly Muslim population means that Islamic finance principles play a significant role. Forex trading must be Sharia-compliant to be considered fully permissible. This includes avoiding riba (interest), gharar (excessive uncertainty), and maysir (gambling). Brokers offering swap-free (Islamic) accounts are thus highly sought after by Qatari traders.

Exness’s Regulatory Status: A Global Perspective

Exness’s legality in Qatar hinges on its regulatory framework. Unlike some brokers that operate in a regulatory gray area, Exness is licensed by several reputable financial authorities worldwide. These include:

Cyprus Securities and Exchange Commission (CySEC): A top-tier regulator in the European Union, ensuring compliance with strict financial standards.

Financial Conduct Authority (FCA) in the UK: One of the most respected regulatory bodies globally, overseeing Exness’s operations in the UK.

Financial Sector Conduct Authority (FSCA) in South Africa: Enhancing its credibility in African markets.

Financial Services Authority (FSA) in Seychelles: Allowing Exness to serve clients globally under international standards.

While Exness is not directly regulated by the QCB or QFCRA, its international licenses provide a strong foundation of trust and security. These regulators enforce measures like segregated client funds, negative balance protection, and transparent trading practices—standards that align with Qatar’s emphasis on financial safety.

For Qatari traders, this means Exness operates legally under its offshore licenses, provided it adheres to local laws. The broker’s compliance with AML and KYC policies further ensures that its services are lawful and secure for users in Qatar.

Is Exness Legal in Qatar? The Definitive Answer

So, is Exness legal in Qatar? Yes, Exness is legal for traders in Qatar. Here’s why:

Offshore Regulation: Exness’s licenses from CySEC, FCA, FSCA, and FSA allow it to offer services globally, including in Qatar, where offshore brokers are permitted.

Compliance with Local Laws: Exness adheres to international AML and KYC standards, which align with Qatar’s regulatory requirements.

Sharia-Compliant Options: Exness offers swap-free Islamic accounts, making it a viable choice for Muslim traders in Qatar who prioritize Sharia compliance.

No Restrictions: Qatar does not appear on Exness’s list of banned countries, meaning residents can open accounts and trade without legal barriers.

💥 Trade with Exness now: Open An Account or Visit Brokers

While Exness isn’t regulated by a Qatari authority, this is not a requirement for offshore brokers serving Qatari clients. The absence of local forex brokers in Qatar further supports the reliance on well-regulated international platforms like Exness. As long as traders use the platform responsibly and comply with Qatar’s tax and financial reporting obligations, trading with Exness is both legal and safe.

Why Qatari Traders Choose Exness

Beyond legality, Exness stands out as a preferred broker for Qatari traders due to its tailored features and benefits. Let’s explore why it’s a top choice in the region.

1. Sharia-Compliant Islamic Accounts

For Muslim traders in Qatar, Exness offers swap-free accounts that eliminate overnight interest charges (swap fees), ensuring compliance with Islamic finance principles. These accounts replace interest-based fees with transparent commission structures, making trading halal and accessible.

2. Competitive Trading Conditions

Exness is renowned for its low spreads, starting from 0 pips on major forex pairs, and fast execution speeds. This is particularly appealing to Qatari traders looking to maximize profits while minimizing costs. The broker also offers flexible leverage options, including unlimited leverage, allowing traders to customize their risk levels.

3. Wide Range of Financial Instruments

Qatari traders can access over 200 financial instruments on Exness, including:

Forex pairs (e.g., EUR/USD, GBP/USD)

Cryptocurrencies (e.g., Bitcoin, Ethereum)

Commodities (e.g., gold, oil)

Indices and stocks

This diversity enables traders to diversify their portfolios and capitalize on global market trends.

4. User-Friendly Platforms

Exness supports MT4, MT5, and its mobile-friendly Exness Trade app, catering to traders of all experience levels. These platforms offer advanced charting tools, automated trading capabilities, and real-time market data—features that resonate with Qatar’s tech-savvy trading community.

5. Instant Deposits and Withdrawals

Exness provides a variety of payment methods suitable for Qatari traders, including bank cards, e-wallets, and local bank transfers. Deposits are processed instantly, and withdrawals are automated, often completed within minutes—a significant advantage in a fast-paced trading environment.

6. 24/7 Arabic Support

With customer support available in Arabic around the clock, Exness ensures that Qatari traders receive prompt assistance whenever needed. This localized support enhances the user experience and builds trust.

How to Start Trading with Exness in Qatar

If you’re convinced that Exness is a legal and suitable option, here’s a step-by-step guide to get started as a trader in Qatar.

Step 1: Register an Account

Visit the official Exness website.

Click “Open Account” and fill out the registration form with your email, phone number, and Qatar as your country of residence.

Verify your email via the confirmation link sent to your inbox.

Step 2: Complete Verification

Log in to your Exness Personal Area.

Upload a valid ID (e.g., Qatari ID or passport) for identity verification.

Submit a proof of residence (e.g., utility bill or bank statement) no older than six months.

Step 3: Choose an Account Type

Exness offers several account types to suit different trading styles:

Standard Account: Ideal for beginners with low minimum deposits.

Pro Account: For experienced traders seeking tighter spreads.

Zero Account: Offers zero spreads on select instruments.

Islamic Account: Swap-free for Sharia-compliant trading.

Select the account that aligns with your goals and risk tolerance.

Step 4: Deposit Funds

Navigate to the “Deposit” section in your Personal Area.

Choose a payment method (e.g., bank card, e-wallet, or local transfer).

Enter the amount in Qatari Riyal (QAR) or another supported currency and confirm the transaction.

Step 5: Start Trading

Download MT4, MT5, or the Exness Trade app.

Log in using your account credentials.

Explore the markets, analyze charts, and place your first trade.

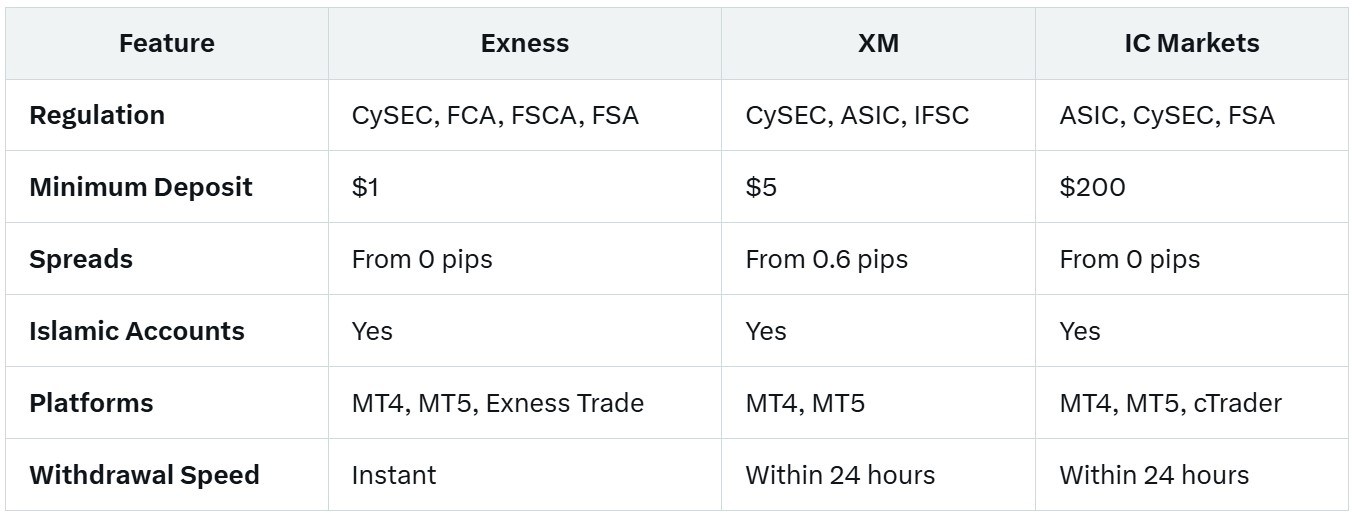

Comparing Exness to Other Brokers in Qatar

To provide a balanced perspective, let’s compare Exness to two other popular brokers available in Qatar: XM and IC Markets.

Exness stands out for its low entry barrier ($1 minimum deposit), instant withdrawals, and unlimited leverage, making it particularly attractive for Qatari traders seeking flexibility and cost-efficiency.

Challenges and Considerations for Qatari Traders

While Exness is legal and well-suited for Qatar, traders should be aware of potential challenges:

Lack of Local Regulation: Since Exness isn’t regulated by the QCB or QFCRA, some traders may prefer a locally licensed broker (though none currently exist for forex).

High Leverage Risks: Unlimited leverage can amplify both profits and losses, requiring careful risk management.

Tax Implications: Qatar does not impose personal income tax, but traders should consult a financial advisor to understand any reporting obligations.

Despite these considerations, Exness’s robust security measures and compliance with international standards mitigate most concerns.

Exness’s Commitment to Security and Transparency

Safety is paramount when choosing a broker, and Exness excels in this area. Client funds are held in segregated accounts, separate from the company’s operational funds, ensuring protection even in the unlikely event of insolvency. The broker also uses advanced encryption to safeguard personal and financial data, aligning with Qatar’s emphasis on financial security.

Exness’s transparency is evident in its no-hidden-fees policy and real-time market data, fostering trust among Qatari traders. Regular audits by its regulators further reinforce its credibility.

Conclusion: Is Exness the Right Choice for Qatari Traders?

In conclusion, Exness is legal in Qatar, offering a secure, Sharia-compliant, and feature-rich trading experience for residents. Its international regulatory licenses, competitive conditions, and tailored services make it a standout option in a market with limited local alternatives. Whether you’re trading forex, crypto, or commodities, Exness provides the tools and support needed to succeed.

If you’re ready to explore the financial markets, Exness is a reliable partner for your trading journey in Qatar. Sign up today, verify your account, and start trading with confidence—knowing you’re backed by a globally trusted broker.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: