10 minute read

Exness app is legal in Pakistan? A Comprehensive Guide

The world of forex trading has taken Pakistan by storm over the past decade, with mobile trading apps like Exness becoming increasingly popular among local traders. As more Pakistanis explore opportunities in the global financial markets, one question frequently arises: Exness app is legal in Pakistan? This article dives deep into the legal status of the Exness app in Pakistan, exploring the regulatory landscape, Exness’s global standing, practical implications for traders, and everything you need to know to make an informed decision in 2025.

💥 Trade with Exness now: Open An Account or Visit Brokers

With forex trading gaining traction as a viable income source, platforms like Exness offer accessibility, advanced tools, and competitive conditions that appeal to both novice and seasoned traders. However, legality remains a critical concern, especially in a country like Pakistan, where financial regulations can be complex and sometimes ambiguous. In this guide, we’ll answer the question of legality, provide insights into the Exness app’s features, and offer tips for Pakistani traders navigating this dynamic market.

What Is the Exness App?

Before delving into its legal status, let’s first understand what the Exness app is and why it’s so popular. Launched by Exness, a globally recognized forex and CFD broker established in 2008, the Exness app is a mobile trading platform designed to provide seamless access to financial markets. Available on both iOS and Android, the app allows users to trade forex pairs, commodities, indices, stocks, and cryptocurrencies from their smartphones or tablets.

Exness has built a reputation for transparency, reliability, and innovation, boasting over 1 million active traders worldwide and a monthly trading volume exceeding $470 billion as of 2025. The app itself is packed with features that cater to traders of all levels:

Real-Time Market Data: Live price tracking and customizable charts.

Wide Range of Instruments: Access to forex pairs, precious metals, energies, and more.

Advanced Tools: Technical analysis, one-click trading, and risk management features.

User-Friendly Interface: Intuitive design suitable for beginners and experts alike.

Fast Execution: Ultra-fast order execution to capitalize on market opportunities.

These qualities make the Exness app an attractive choice for Pakistani traders looking to participate in global markets. But does its global success mean it’s legally viable in Pakistan? Let’s explore.

Forex Trading in Pakistan: The Legal Framework

To determine whether the Exness app is legal in Pakistan, we must first examine the broader context of forex trading in the country. Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from exchange rate fluctuations. In Pakistan, this activity is governed by two primary regulatory bodies:

State Bank of Pakistan (SBP): As the central bank, the SBP oversees foreign exchange policies under the Foreign Exchange Regulation Act (FERA), 1947. It regulates currency transactions, capital flows, and remittances to ensure economic stability.

Securities and Exchange Commission of Pakistan (SECP): The SECP is responsible for supervising financial markets, including forex trading, under laws like the Securities Act, 2015 and the Companies Ordinance, 1984. Its focus is on transparency, investor protection, and compliance with anti-money laundering (AML) and know-your-customer (KYC) standards.

Forex trading itself is legal in Pakistan, but it comes with specific conditions. The SBP allows individuals to trade currencies through authorized brokers, while the SECP mandates that brokers offering financial services must be licensed locally or comply with Pakistani regulations if operating internationally. However, the legal framework for online forex trading with offshore brokers like Exness remains somewhat of a gray area.

Key Regulations for Forex Trading in Pakistan

Authorized Brokers: Only brokers regulated by the SECP or partnered with local entities are officially recognized.

Currency Restrictions: Trading is typically limited to specific currency pairs approved by the SBP, often involving the Pakistani Rupee (PKR).

Capital Controls: The SBP imposes restrictions on transferring funds abroad, requiring compliance with foreign exchange rules.

Taxation: Profits from forex trading are subject to taxation, and traders must report their earnings to comply with local laws.

While these regulations aim to protect traders and maintain financial stability, they leave room for interpretation when it comes to international platforms like Exness. So, where does the Exness app fit into this framework?

Exness’s Regulatory Status: A Global Perspective

Exness is not a local Pakistani broker—it operates as an international entity with a global reach. To assess its legality, we need to look at its regulatory credentials and how they apply to Pakistani traders.

Exness’s Licenses and Oversight

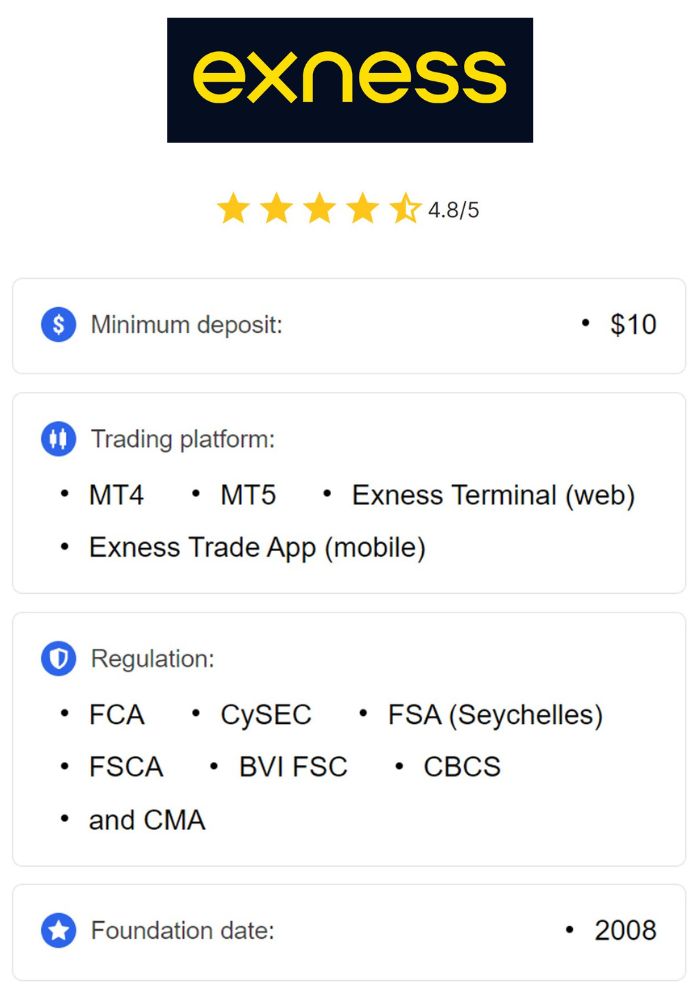

Exness is regulated by multiple reputable financial authorities worldwide, ensuring adherence to strict international standards. Its key licenses include:

Cyprus Securities and Exchange Commission (CySEC): License number 178/12, a top-tier regulator in the European Union.

Financial Conduct Authority (FCA): A prestigious UK regulator known for stringent oversight.

Financial Services Authority (FSA) Seychelles: License number SD025, governing its global entity, Exness (SC) Ltd.

Other Jurisdictions: Exness is also licensed by the Financial Sector Conduct Authority (FSCA) in South Africa, the Financial Services Commission (FSC) in Mauritius, and more.

These licenses require Exness to segregate client funds, maintain transparency, and provide negative balance protection—features that enhance trader security. However, Exness is not directly regulated by the SECP or SBP, meaning it operates as an offshore broker in Pakistan.

Offshore Brokers in Pakistan

Offshore brokers like Exness can legally offer services to Pakistani traders as long as the traders comply with local financial laws, such as SBP’s foreign exchange restrictions and tax obligations. The absence of SECP regulation doesn’t automatically make Exness illegal—it simply places it outside Pakistan’s local regulatory framework. Thousands of Pakistani traders use Exness without facing legal repercussions, suggesting a practical acceptance of its services.

Exness app is legal in Pakistan?

Now, let’s address the core question: Exness app is legal in Pakistan? The answer is nuanced.

The Legal Gray Area

Technically, the Exness app is not banned in Pakistan, and there are no explicit restrictions from the SBP or SECP preventing traders from using it. Pakistani residents can download the app, open accounts, and trade under Exness’s global entity (Exness SC Ltd), regulated by the FSA Seychelles. However, because Exness lacks SECP approval, it operates in a legal gray area.

Here’s why:

Accessibility: The app is fully accessible in Pakistan, with no blocks or bans imposed by local authorities.

Compliance: Pakistani traders can use Exness as long as they adhere to SBP rules on fund transfers and report profits for taxation.

Risks: Without SECP oversight, traders may lack local legal recourse in disputes, relying instead on Exness’s international regulators.

In practice, the Exness app is legal to use in Pakistan provided traders follow national financial regulations. However, its status as an unregulated offshore platform means it doesn’t offer the same protections as a locally licensed broker.

💥 Trade with Exness now: Open An Account or Visit Brokers

Evidence from Trader Experiences

Posts on platforms like X and user reviews indicate that many Pakistani traders actively use Exness without issues. They praise its low spreads, fast withdrawals, and Urdu-language support. While some express concerns about the lack of local regulation, there’s no evidence of widespread legal action against Exness users in Pakistan.

Benefits of Using the Exness App in Pakistan

Assuming you’re comfortable navigating the_scr

the legal gray area, what makes the Exness app an attractive choice for Pakistani traders? Here are some key benefits:

Low Entry Barrier: The app offers a minimum deposit as low as $1 for standard accounts, making it accessible to beginners with limited capital.

High Leverage: Leverage up to 1:2000 (subject to conditions) allows traders to maximize their potential returns, though it increases risk.

Diverse Instruments: Trade forex, commodities, indices, stocks, and cryptocurrencies—all from one platform.

Fast Withdrawals: Exness is renowned for instant withdrawals, with 95% processed in under a minute.

Advanced Platforms: Access to MT4, MT5, and the Exness Trade App ensures flexibility and robust trading tools.

Multilingual Support: Urdu-speaking support is available 24/7 via live chat, email, and phone.

These features make Exness a compelling option for cost-conscious traders prioritizing speed, accessibility, and variety.

Risks and Challenges for Pakistani Traders

While the Exness app offers significant advantages, there are risks to consider:

Regulatory Uncertainty: Lack of SECP regulation means limited local legal protection in disputes.

Fund Transfer Restrictions: SBP rules may complicate deposits and withdrawals, requiring compliance with foreign exchange limits.

Market Volatility: Forex trading is inherently risky, and high leverage can amplify losses.

Learning Curve: Advanced tools may overwhelm novices without proper education.

Traders should weigh these risks against the benefits and ensure they understand Pakistan’s legal requirements before proceeding.

How to Use the Exness App Legally in Pakistan

To trade with the Exness app while staying compliant, follow these steps:

Verify Your Account: Complete Exness’s KYC process with a government-issued ID and proof of residence.

Use Authorized Payment Methods: Fund your account via local bank accounts or approved international methods, ensuring compliance with SBP rules.

Report Earnings: Declare forex profits to tax authorities to meet legal obligations.

Educate Yourself: Learn risk management and trading strategies to minimize losses.

By adhering to these guidelines, you can mitigate legal and financial risks while using the app.

Exness vs. Local Alternatives

How does Exness compare to SECP-regulated brokers in Pakistan? Local brokers offer stronger legal protections but often lack the variety, low costs, and advanced tools of Exness. For example:

Exness vs. IC Markets: Exness edges out with a $1 minimum deposit and instant withdrawals, while IC Markets offers Australian regulation and a $200 entry point.

Exness vs. FP Markets: Exness provides faster withdrawals and lower entry costs ($1 vs. $100), though FP Markets offers similar tools with slightly less leverage.

For traders prioritizing global credibility and affordability, Exness often stands out, but those valuing local compliance may prefer regulated alternatives.

Practical Tips for Pakistani Traders Using Exness

To succeed with the Exness app, consider these tips:

Start Small: Use a demo account or the Standard Cent account to test strategies risk-free.

Manage Risk: Set stop-loss orders and avoid over-leveraging to protect your capital.

Stay Informed: Monitor SBP and SECP updates for changes in forex regulations.

Leverage Support: Use Exness’s 24/7 customer service for technical or account assistance.

These practices can enhance your trading experience while minimizing potential pitfalls.

The Future of Exness in Pakistan

As forex trading grows in Pakistan, the government may tighten regulations to protect traders and the economy. This could impact offshore brokers like Exness, potentially requiring local licensing or stricter compliance. For now, Exness remains a viable option, but traders should stay vigilant for policy shifts in 2025 and beyond.

Conclusion: Is the Exness App Legal in Pakistan?

In summary, the Exness app is technically legal for Pakistani traders to use, provided they comply with local financial laws. While it operates in a legal gray area due to the lack of SECP regulation, its global licenses, robust features, and practical acceptance among Pakistani traders make it a reliable choice. However, the absence of local oversight introduces risks, particularly around legal recourse and fund transfers.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

For Pakistani traders, the decision to use Exness hinges on balancing its benefits—low costs, high leverage, and advanced tools—against the uncertainties of offshore trading. By staying informed, managing risks, and following SBP guidelines, you can trade confidently with Exness in Pakistan. Whether you’re a beginner or a pro, this app offers a gateway to global markets—just ensure you’re prepared for the journey.

Read more: