12 minute read

Is Exness Safe in India? Review Broker 2025

Forex trading has gained immense popularity in India over the past decade, with thousands of individuals exploring the global financial markets to diversify their investments and pursue financial freedom. Among the many brokers available, Exness stands out as a globally recognized platform, attracting Indian traders with its competitive trading conditions, advanced tools, and user-friendly interface. However, a critical question lingers in the minds of many: Is Exness safe in India?

💥 Trade with Exness now: Open An Account or Visit Brokers

In this in-depth article, we’ll explore every aspect of Exness’s safety for Indian traders. We’ll cover its regulatory status, security measures, legality in India, trading conditions, and real user experiences. Whether you’re a beginner or an experienced trader, this guide will help you make an informed decision about using Exness in India.

What Is Exness? An Overview of the Broker

Before diving into the safety concerns, let’s establish what Exness is and why it’s a popular choice among traders worldwide, including in India.

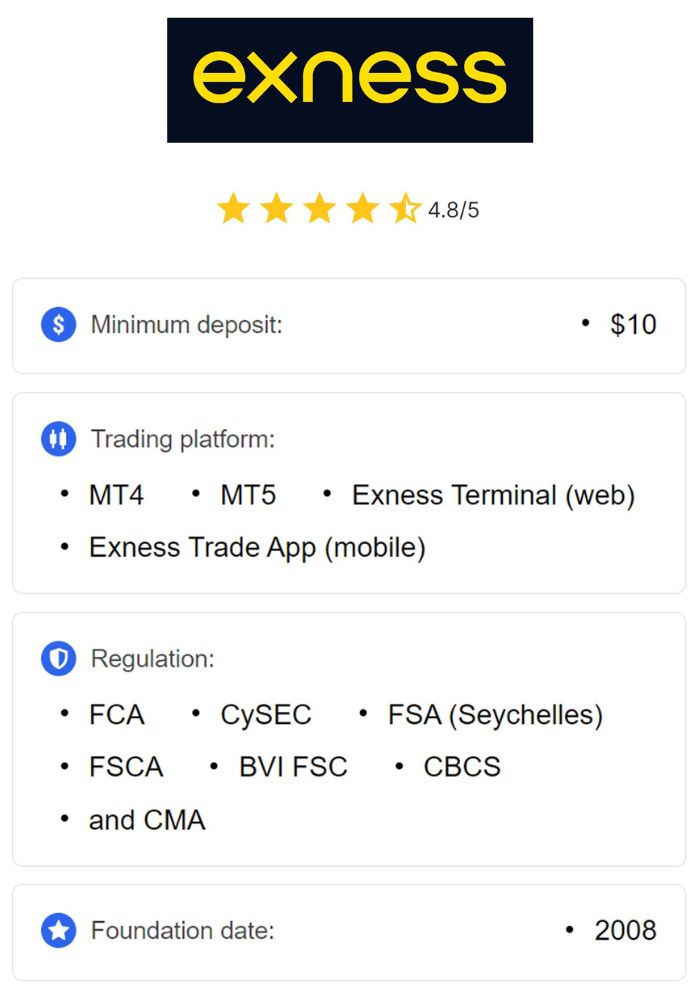

Exness is a global forex and Contracts for Difference (CFD) broker founded in 2008. Headquartered in Cyprus, it operates in over 180 countries and has built a reputation for transparency, low spreads, and innovative trading solutions. The platform offers access to a wide range of financial instruments, including forex pairs, cryptocurrencies, stocks, indices, and commodities. Traders can use popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary Exness Trader app to execute trades.

With a monthly trading volume exceeding $4 trillion and over 700,000 active clients globally, Exness has cemented its position as one of the largest brokers in the world. But how does this translate to safety for Indian traders? Let’s break it down step by step.

Forex Trading in India: The Legal Landscape

To determine whether Exness is safe in India, we must first understand the legal framework governing forex trading in the country.

Regulatory Bodies in India

Forex trading in India is regulated by two primary authorities:

Reserve Bank of India (RBI): The RBI oversees foreign exchange transactions and ensures compliance with the Foreign Exchange Management Act (FEMA), 1999. It restricts forex trading to currency pairs involving the Indian Rupee (INR), such as USD/INR, EUR/INR, or GBP/INR.

Securities and Exchange Board of India (SEBI): SEBI regulates financial markets and ensures that brokers operating within India adhere to strict guidelines. Only SEBI-registered brokers can legally offer forex trading services to Indian residents.

Restrictions on Forex Trading

Under FEMA, Indian residents are prohibited from trading foreign-to-foreign currency pairs (e.g., EUR/USD) unless done through SEBI-regulated exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE). Additionally, offshore brokers like Exness are not explicitly authorized to operate in India unless they obtain SEBI registration.

Can Indian Traders Use Offshore Brokers?

While the RBI and SEBI impose restrictions, there’s a gray area regarding the use of international brokers. Many Indian traders use offshore platforms like Exness to access a broader range of instruments and better trading conditions. Technically, trading non-INR pairs through offshore brokers violates FEMA regulations, but enforcement has been inconsistent. This raises the question: Does using Exness put Indian traders at legal risk?

Is Exness Regulated? A Look at Its Global Licenses

One of the most critical factors in assessing a broker’s safety is its regulatory status. While Exness is not registered with SEBI or RBI, it operates under multiple reputable international regulators. Let’s examine its licenses:

1. Cyprus Securities and Exchange Commission (CySEC)

Location: Cyprus (European Union)

Significance: CySEC is a Tier-1 regulator enforcing the Markets in Financial Instruments Directive (MiFID II). It ensures transparency, client fund protection, and compliance with EU financial standards.

Impact for Indian Traders: CySEC regulation adds a layer of credibility, as it requires Exness to segregate client funds and adhere to strict operational guidelines.

2. Financial Conduct Authority (FCA)

Location: United Kingdom

Significance: The FCA is one of the world’s most respected regulators, known for its rigorous oversight and investor protection schemes.

Impact for Indian Traders: FCA regulation enhances trust in Exness’s operations, though Indian traders typically fall under other entities.

3. Financial Sector Conduct Authority (FSCA)

Location: South Africa

Significance: FSCA ensures financial stability and client fund security in South Africa.

Impact for Indian Traders: This license reinforces Exness’s global compliance standards.

4. Other Licenses

Exness also holds licenses from the Financial Services Authority (FSA) in Seychelles and the Central Bank of Curaçao and Sint Maarten (CBCS). While these are considered less stringent than CySEC or FCA, they still provide oversight and accountability.

Exness’s Regulatory Status in India

Exness is not directly regulated by SEBI or RBI, meaning it operates as an offshore broker for Indian clients. However, its international licenses demonstrate a commitment to global standards, offering Indian traders a degree of reassurance despite the lack of local regulation.

How Does Exness Ensure Safety for Traders?

Beyond regulation, a broker’s safety depends on its security measures, fund protection policies, and operational transparency. Here’s how Exness safeguards its clients:

1. Segregation of Client Funds

Exness keeps client funds in segregated accounts, separate from its operational funds. This ensures that your money isn’t used for the company’s business activities and remains protected in case of insolvency.

2. Advanced Security Protocols

SSL Encryption: All data transmitted between traders and Exness is encrypted using Secure Socket Layer (SSL) technology, protecting it from cyber threats.

Two-Factor Authentication (2FA): Exness offers 2FA to secure account logins, adding an extra layer of protection against unauthorized access.

3. Negative Balance Protection

Exness provides negative balance protection, meaning traders cannot lose more than their deposited funds. This is especially crucial in volatile markets like forex, where losses can escalate quickly.

4. Regular Audits

Exness undergoes independent audits by reputable firms like Deloitte. These audits verify the broker’s financial health and compliance with regulatory standards, enhancing transparency.

5. Compensation Schemes

As a member of the Financial Commission since 2021, Exness clients can claim up to €20,000 in compensation if the broker faces financial difficulties. This adds an additional safety net for traders.

Relevance for Indian Traders

While these measures aren’t tailored specifically to India, they apply universally to all Exness clients. Indian traders benefit from the same robust security and fund protection as their global counterparts.

Is Exness Legal in India?

The legality of using Exness in India is a complex issue tied to the regulatory gray area mentioned earlier.

The Legal Perspective

Not SEBI-Registered: Exness lacks SEBI registration, so it doesn’t comply with India’s local forex trading framework.

FEMA Compliance: Trading INR-based pairs through Exness is permissible under FEMA, but trading non-INR pairs (e.g., EUR/USD) technically violates regulations.

No Explicit Ban: The RBI has not explicitly banned Exness or similar offshore brokers. However, posts on X and other platforms suggest growing scrutiny, with some claiming Exness has been “declared illegal” by the RBI—a claim lacking official confirmation.

Practical Reality

Despite legal restrictions, thousands of Indian traders use Exness without immediate consequences. The platform remains accessible, and Exness continues to onboard Indian clients. However, traders should be aware of potential risks:

Legal Repercussions: If the RBI cracks down on offshore trading, accounts could be frozen, or penalties imposed.

Fund Transfers: Some Indian banks restrict transactions with offshore brokers, forcing traders to rely on e-wallets or cryptocurrencies.

Conclusion on Legality

Exness isn’t “illegal” in the sense of being banned, but it operates outside India’s regulated framework. Indian traders must weigh the legal risks against the platform’s benefits.

💥 Trade with Exness now: Open An Account or Visit Brokers

Trading Conditions on Exness: Are They Safe and Reliable?

Safety isn’t just about regulation—it’s also about the trading experience. Here’s how Exness performs:

1. Spreads and Fees

Low Spreads: Exness offers spreads starting at 0.0 pips on certain accounts (e.g., Raw Spread and Zero accounts), making it cost-effective.

No Hidden Fees: Withdrawals and deposits are typically free, with transparent pricing.

2. Leverage

High Leverage: Up to 1:2000 for forex, which amplifies both profits and risks.

Risk Management: Traders must use leverage cautiously, as high levels can lead to significant losses.

3. Execution Speed

Ultra-Fast Execution: Trades are executed in under 25 milliseconds, minimizing slippage and ensuring reliability.

No Requotes: Exness guarantees stable execution, even during volatile market conditions.

4. Account Types

Exness offers multiple account types (Standard, Pro, Raw Spread, Zero, and Standard Cent), catering to beginners and professionals alike. The low minimum deposit ($10) makes it accessible for Indian traders.

5. Payment Methods

Localized Options: Indian traders can use bank cards, e-wallets (e.g., Skrill, Neteller), and cryptocurrencies.

Fast Withdrawals: Most withdrawals are processed instantly, a major advantage over competitors.

Safety Implications

Exness’s trading conditions are competitive and reliable, reducing the risk of financial mismanagement or unexpected costs. However, high leverage requires careful risk management, especially for inexperienced traders.

User Experiences: What Indian Traders Say About Exness

Real-world feedback provides valuable insights into Exness’s safety. Based on reviews from platforms like Trustpilot, Quora, and Medium, here’s what Indian traders report:

Positive Feedback

Fast Withdrawals: Many praise Exness for its instant withdrawal system, a sign of financial stability.

Customer Support: 24/7 support in multiple languages, including Hindi, is responsive and helpful.

Trading Platform: Users appreciate the stability and features of MT4, MT5, and the Exness app.

Negative Feedback

Payment Issues: Some report difficulties with bank transactions due to restrictions from Indian financial institutions.

Regulatory Concerns: A few traders express unease about the lack of SEBI regulation.

High Leverage Risks: Beginners occasionally lose funds due to misunderstanding leverage.

Sentiment Summary

The majority of Indian traders view Exness as a safe and reliable broker, with minor complaints tied to local banking limitations rather than the platform itself.

Risks of Trading with Exness in India

While Exness offers robust safety features, there are risks Indian traders should consider:

1. Legal Uncertainty

The lack of SEBI regulation means traders operate in a legal gray area, with potential future enforcement actions from the RBI.

2. Market Volatility

Forex markets are inherently volatile, and Exness’s high leverage can amplify losses if not managed properly.

3. Banking Restrictions

Some Indian banks block transactions with offshore brokers, complicating deposits and withdrawals.

4. Cybersecurity Threats

Despite Exness’s security measures, traders must protect their accounts from phishing or hacking attempts.

How to Trade Safely with Exness in India

If you decide to use Exness, follow these tips to maximize safety:

1. Stick to INR Pairs

Trade only INR-based currency pairs (e.g., USD/INR) to stay compliant with FEMA regulations.

2. Use Secure Payment Methods

Opt for e-wallets or cryptocurrencies to avoid banking restrictions and ensure smooth transactions.

3. Enable 2FA

Activate two-factor authentication to protect your account from unauthorized access.

4. Start with a Demo Account

Practice trading with a free demo account to familiarize yourself with the platform and strategies.

5. Manage Leverage

Use conservative leverage levels (e.g., 1:50 or lower) to minimize risk, especially as a beginner.

6. Stay Informed

Monitor RBI and SEBI updates for any changes in forex trading regulations that could affect offshore brokers.

Comparing Exness to Other Brokers in India

How does Exness stack up against SEBI-regulated brokers or other offshore platforms? Let’s compare:

Exness vs. SEBI-Regulated Brokers (e.g., Zerodha, Angel One)

Regulation: SEBI brokers are locally regulated; Exness relies on international licenses.

Instrument Variety: Exness offers a broader range (e.g., cryptocurrencies, global stocks); SEBI brokers focus on INR pairs.

Cost: Exness has lower spreads and fees compared to many SEBI brokers.

Legal Safety: SEBI brokers offer full legal protection; Exness carries regulatory risk.

Exness vs. Other Offshore Brokers (e.g., XM, FBS)

Regulation: Exness’s CySEC and FCA licenses are stronger than some competitors’ weaker offshore oversight.

Reputation: Exness has a higher trust score and trading volume than many peers.

Features: Exness excels in execution speed and withdrawal reliability.

Verdict

Exness outperforms many offshore brokers in safety and reliability while offering better conditions than some SEBI-regulated options. However, it lacks the legal certainty of local brokers.

Conclusion: Is Exness Safe in India?

After examining Exness from every angle—regulation, security, legality, trading conditions, and user feedback—we can draw a balanced conclusion.

The Pros

Global Regulation: Licenses from CySEC, FCA, and FSCA ensure compliance with international standards.

Robust Security: Segregated funds, SSL encryption, and 2FA protect traders’ assets and data.

Reliable Trading: Low spreads, fast execution, and instant withdrawals enhance the experience.

Accessibility: A low minimum deposit and localized payment options cater to Indian traders.

The Cons

No SEBI Regulation: Exness operates outside India’s legal framework, posing potential risks.

Legal Gray Area: Trading non-INR pairs could violate FEMA, though enforcement is rare.

Banking Challenges: Restrictions from Indian banks may complicate transactions.

Final Verdict

Exness is safe for Indian traders in terms of its operational security, fund protection, and global reputation. However, its safety comes with a caveat: the lack of SEBI regulation introduces legal uncertainty. If you’re willing to navigate this gray area and prioritize INR-based trading, Exness offers a secure and competitive platform. For those seeking absolute legal clarity, SEBI-regulated brokers may be a better fit.

💥 Trade with Exness now: Open An Account or Visit Brokers

Ultimately, the decision rests on your risk tolerance, trading goals, and understanding of India’s forex regulations. Whatever you choose, prioritize safety by staying informed and adopting sound risk management practices.

Frequently Asked Questions (FAQs)

1. Is Exness banned in India?

No, Exness is not explicitly banned in India, but it’s not regulated by SEBI or RBI. Trading non-INR pairs may violate FEMA regulations.

2. Can I withdraw money from Exness in India?

Yes, Exness offers instant withdrawals via e-wallets, cryptocurrencies, and bank cards. However, some Indian banks may block transactions.

3. What is the minimum deposit for Exness in India?

The minimum deposit is $10 for Standard and Standard Cent accounts, making it accessible for beginners.

4. Is Exness good for beginners in India?

Yes, with its low entry barrier, demo accounts, and user-friendly platforms, Exness is suitable for beginners—provided they manage risks carefully.

5. How can I contact Exness support from India?

Exness offers 24/7 support via live chat, email, and phone, with Hindi language options available.

Read more: