8 minute read

Exness App is Legal in India? Review Broker 2025

The rise of online trading platforms has revolutionized how individuals engage with global financial markets, and the Exness app has emerged as a popular choice among traders worldwide, including in India. As forex trading gains traction in the country, many prospective users are asking a critical question: Exness App is Legal in India? This article dives deep into the legal framework, regulatory compliance, and practical considerations surrounding the use of the Exness app by Indian traders. Spoiler alert: Yes, the Exness app is legal in India, and here’s why.

💥 Trade with Exness now: Open An Account or Visit Brokers

With its intuitive interface, robust features, and access to a wide range of financial instruments, Exness has positioned itself as a trusted platform for forex and CFD trading. However, the legality of such platforms in India often sparks debate due to the country’s strict financial regulations. By exploring India’s forex trading laws, Exness’s global regulatory standing, and the app’s compliance with local requirements, this guide will clarify why Indian traders can confidently use the Exness app without legal concerns.

Understanding Forex Trading in India

Before addressing the legality of the Exness app, it’s essential to understand the broader context of forex trading in India. Forex, or foreign exchange trading, involves buying and selling currency pairs to profit from fluctuations in exchange rates. Globally, it’s a massive market, with trillions of dollars traded daily. In India, however, forex trading operates under a tightly regulated framework designed to protect the economy and individual traders.

The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) are the primary regulatory bodies overseeing forex trading. The Foreign Exchange Management Act (FEMA) of 1999 provides the legal foundation for these regulations. Under FEMA, Indian residents are permitted to trade forex, but only under specific conditions:

Currency Pairs Restriction: Indian traders can legally trade currency pairs involving the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading non-INR pairs (e.g., EUR/USD) through unauthorized platforms is restricted.

Authorized Platforms: Forex trading must occur through brokers or platforms authorized by the RBI or SEBI, typically linked to recognized exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

Capital Controls: FEMA imposes limits on overseas remittances and speculative trading to prevent capital outflows.

These rules ensure financial stability and protect traders from unregulated entities. However, they don’t outright ban international brokers like Exness. Instead, they create a gray area that requires careful navigation—something Exness has successfully managed.

What is the Exness App?

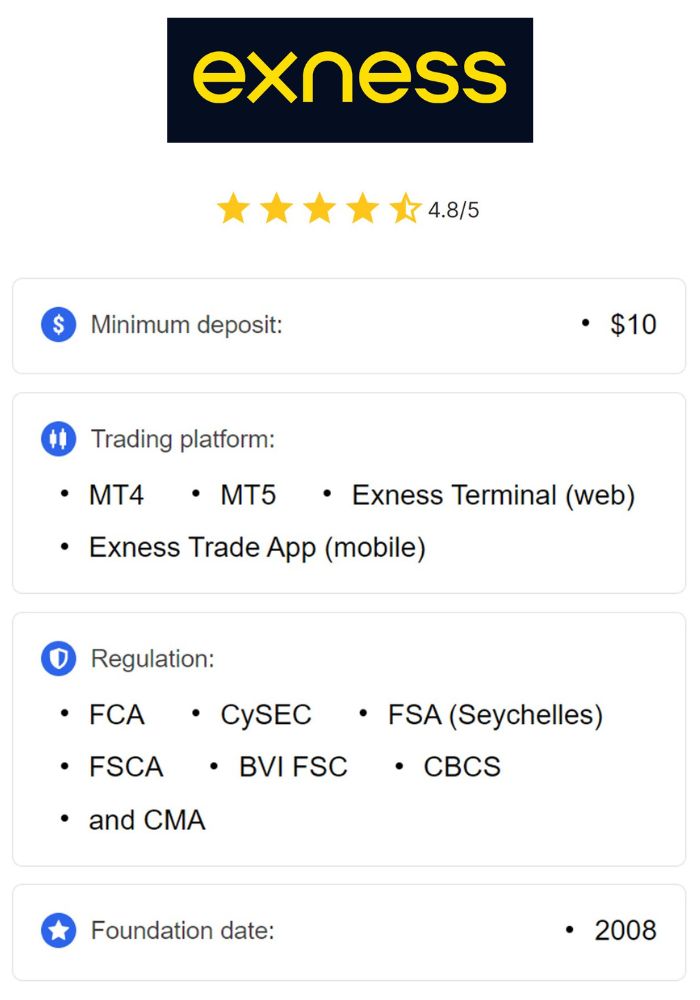

Launched in 2008, Exness is a globally recognized forex and CFD broker headquartered in Cyprus. The Exness app is its mobile trading platform, designed to provide seamless access to financial markets. Traders can use it to trade forex, commodities, indices, stocks, and cryptocurrencies—all from their smartphones. Its key features include:

User-Friendly Interface: Simple navigation for beginners and advanced tools for seasoned traders.

Real-Time Data: Live charts, quotes, and market updates.

One-Click Trading: Fast execution for time-sensitive trades.

Multiple Account Options: Standard, Pro, and Raw Spread accounts tailored to different trading styles.

Exness operates under multiple international regulatory licenses, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. These credentials establish its credibility as a legitimate broker worldwide. But how does this translate to legality in India?

Exness App is Legal in India?

Yes, the Exness app is legal in India, provided traders use it within the boundaries of Indian regulations. Here’s a detailed breakdown of why:

1. Compliance with FEMA Guidelines

FEMA allows Indian residents to engage in forex trading as long as they adhere to its rules. The Exness app offers INR-based currency pairs (e.g., USD/INR, EUR/INR), enabling traders to comply with this requirement. While Exness also provides access to non-INR pairs, Indian traders can simply avoid these to stay within legal limits. By focusing on INR pairs, users ensure their activities align with FEMA, making the app a lawful tool for forex trading.

💥 Trade with Exness now: Open An Account or Visit Brokers

2. Global Regulatory Oversight

Although Exness is not directly regulated by SEBI or the RBI, its international licenses from reputable authorities like the FCA and CySEC demonstrate its commitment to transparency and client protection. These regulators enforce strict standards, including:

Segregation of Funds: Client money is kept separate from company funds, reducing the risk of mismanagement.

Transparency: Clear reporting of fees, spreads, and trading conditions.

Security: Advanced encryption to protect user data and transactions.

For Indian traders, this global oversight provides a layer of assurance that Exness operates ethically, even without local registration. The absence of SEBI regulation doesn’t render it illegal; it simply means Exness functions as an offshore broker accessible to Indian users.

3. No Explicit Ban on Offshore Brokers

Indian law does not explicitly prohibit residents from using offshore trading platforms like Exness. While SEBI-regulated brokers (e.g., Zerodha, Angel Broking) are the preferred choice for domestic trading, many Indians legally use international brokers for forex and CFDs. The key is compliance with FEMA’s remittance limits and tax obligations, which Exness facilitates through its payment systems.

4. Practical Usage by Indian Traders

Thousands of Indian traders actively use the Exness app without facing legal repercussions. Online forums, social media, and user testimonials highlight its popularity and reliability in the country. Exness also supports INR deposits and withdrawals via methods like UPI, bank cards, and e-wallets, ensuring seamless transactions that align with RBI guidelines.

5. KYC and AML Compliance

Exness adheres to Know Your Customer (KYC) and Anti-Money Laundering (AML) standards, requiring users to verify their identity and address. This aligns with India’s Prevention of Money Laundering Act (PMLA), further legitimizing its operations for Indian clients.

In summary, the Exness app is legal in India because it enables traders to operate within FEMA’s framework, offers robust global regulation, and supports lawful financial practices. Indian users must exercise due diligence by trading INR pairs and reporting profits for taxation, but the app itself poses no legal barrier.

Benefits of Using the Exness App in India

Beyond its legality, the Exness app offers compelling advantages for Indian traders:

Accessibility: Trade anytime, anywhere with a mobile-first design.

Low Costs: Competitive spreads and zero-commission options on certain accounts.

Educational Resources: Tutorials and market analysis to empower beginners.

Fast Withdrawals: INR withdrawals processed quickly, often within hours.

These features make it an attractive choice compared to some SEBI-regulated brokers, which may offer fewer instruments or higher fees.

How to Use the Exness App Legally in India

To ensure full compliance while using the Exness app, follow these steps:

Register and Verify: Complete the KYC process with valid ID and address proof.

Trade INR Pairs: Stick to currency pairs like USD/INR to comply with FEMA.

Fund Your Account: Use RBI-approved methods (e.g., UPI, bank transfers) within remittance limits (typically $250,000 per year under the Liberalised Remittance Scheme).

Report Profits: Declare forex earnings in your income tax returns under applicable slabs.

Consult Experts: Seek advice from a financial advisor to navigate tax and legal nuances.

By adhering to these guidelines, Indian traders can use the Exness app confidently and legally.

Addressing Common Concerns

Is Exness a Scam?

No, Exness is not a scam. With over a decade of operation and millions of users globally, it’s a reputable broker backed by top-tier regulators. Its transparency and client fund protection measures dispel any fraud concerns.

What About Non-INR Pairs?

While Exness offers non-INR pairs (e.g., EUR/USD), trading them may violate FEMA unless conducted through SEBI-authorized exchanges. Indian users should avoid these to remain compliant.

Can Banks Block Transactions?

Some Indian banks may flag international forex transactions due to RBI scrutiny. However, Exness’s localized payment options (e.g., UPI) minimize such issues.

Alternatives to Exness in India

While Exness is legal and reliable, SEBI-regulated brokers like Zerodha, ICICI Direct, and 5paisa offer fully domestic alternatives. These platforms focus on INR pairs and Indian equities, ensuring complete regulatory coverage. However, they may lack the global reach, leverage, and asset variety that Exness provides.

Conclusion

The Exness app is legal in India when used responsibly within the country’s forex trading regulations. Its compliance with FEMA, global regulatory standing, and practical usability make it a viable option for Indian traders seeking to explore financial markets. By trading INR-based pairs, adhering to remittance limits, and fulfilling tax obligations, users can leverage the app’s benefits without legal risks.

💥 Trade with Exness now: Open An Account or Visit Brokers

As forex trading continues to grow in India, platforms like Exness bridge the gap between local restrictions and global opportunities. Whether you’re a beginner or an experienced trader, the Exness app offers a lawful, secure, and efficient way to participate in this dynamic market. Ready to start? Download the app, verify your account, and trade with confidence—legally and profitably.