10 minute read

Exness Go app is legal in India? A Comprehensive Guide

The rise of mobile trading apps has transformed the financial landscape, offering traders unparalleled access to global markets from the palm of their hands. Among these platforms, the Exness Go app has gained significant traction worldwide, including in India, thanks to its user-friendly interface, advanced tools, and seamless trading experience. However, one question looms large for Indian traders: Exness Go app is legal in India? This article dives deep into the legality of the app, India’s forex trading regulations, the features of Exness Go, and practical tips for Indian traders to stay compliant while exploring its offerings.

💥 Trade with Exness now: Open An Account or Visit Brokers

Forex trading continues to grow in popularity in India, driven by increasing internet penetration and a burgeoning interest in global financial markets. Yet, the regulatory framework governing forex trading in India is complex, creating uncertainty for users of international platforms like Exness Go. In this guide, we’ll explore every angle of this topic, ensuring you have the clarity and insights needed to make informed decisions.

What is the Exness Go App?

Before addressing its legality, let’s understand what the Exness Go app is and why it’s appealing to traders. Developed by Exness, a globally recognized forex and CFD broker established in 2008, Exness Go is a mobile trading platform designed to simplify access to financial markets. Available on both Android and iOS devices, the app offers a robust suite of features, including:

Real-Time Market Access: Traders can monitor live price movements, execute trades, and manage accounts on the go.

Advanced Charting Tools: Customizable charts with technical indicators cater to both novice and experienced traders.

Diverse Trading Instruments: From forex pairs to commodities, cryptocurrencies, and indices, Exness Go provides a wide range of options.

Instant Deposits and Withdrawals: Seamless payment methods ensure quick funding and cashouts.

User-Friendly Interface: Its intuitive design makes trading accessible, even for beginners.

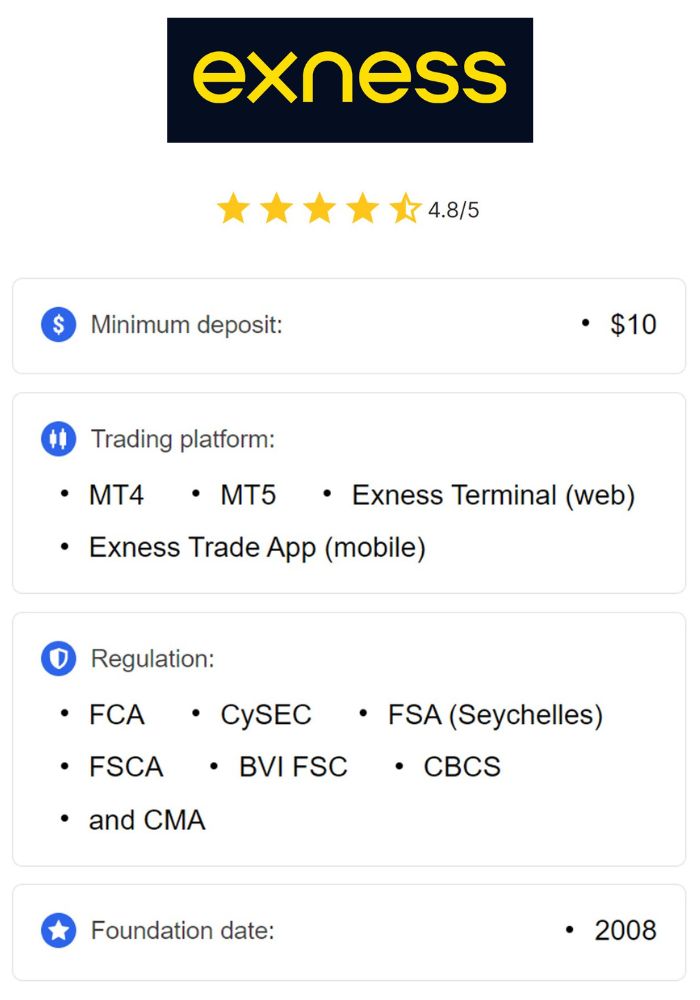

Exness, the parent company, operates under multiple international regulatory licenses, such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This global oversight enhances its credibility, but the key question remains: Does this translate to legality in India?

Forex Trading Regulations in India: The Legal Framework

To determine whether the Exness Go app is legal in India, we must first examine the country’s forex trading regulations. Forex trading in India is governed by two primary bodies: the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), under the umbrella of the Foreign Exchange Management Act (FEMA) of 1999.

Key Rules Under FEMA

FEMA imposes strict guidelines to regulate foreign exchange transactions and maintain economic stability. For forex trading, the following rules apply:

Permitted Currency Pairs: Indian residents can only trade currency pairs involving the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading non-INR pairs (e.g., EUR/USD) is prohibited for retail traders.

Regulated Platforms: Forex trading must occur through SEBI-registered brokers or recognized exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

Capital Controls: Funds transferred to offshore brokers for speculative trading in non-INR pairs violate FEMA’s restrictions on capital account transactions.

Tax Compliance: Profits from forex trading are subject to Indian tax laws, including capital gains tax.

SEBI and RBI Oversight

SEBI oversees securities and derivatives markets, ensuring brokers comply with local laws, while the RBI monitors foreign exchange flows. Together, they restrict Indian traders from engaging with unregulated foreign brokers for speculative forex trading outside the permitted INR pairs.

Given this framework, the legality of the Exness Go app hinges on how it aligns with these regulations—and how Indian traders use it.

Exness Go app is legal in India?

The short answer is: Yes, the Exness Go app is legal in India, but with conditions. Let’s break this down.

Exness’s Global Regulation

Exness operates as an offshore broker with licenses from reputable regulators like the FCA, CySEC, and the Financial Sector Conduct Authority (FSCA) in South Africa. These licenses ensure that Exness adheres to international standards for transparency, security, and client fund protection. However, Exness is not regulated by SEBI or the RBI, meaning it lacks a domestic license to operate directly in India.

Legal Use of Exness Go in India

Indian traders can legally use the Exness Go app under the following circumstances:

Trading INR Pairs: If you restrict your trading to INR-based currency pairs (e.g., USD/INR), you comply with FEMA guidelines. Exness offers these pairs, making it possible to trade legally.

Compliant Fund Transfers: Deposits and withdrawals must use RBI-approved methods, such as UPI, Net Banking, or bank transfers, avoiding unregulated offshore payment channels.

Tax Reporting: You must declare trading profits to the Indian tax authorities to remain compliant.

💥 Trade with Exness now: Open An Account or Visit Brokers

The Grey Area: Non-INR Pairs

Here’s where it gets tricky. The Exness Go app provides access to a vast array of non-INR pairs (e.g., EUR/USD, GBP/JPY), which are popular globally but illegal for Indian residents to trade under FEMA. If an Indian trader uses Exness Go to trade these pairs, they risk violating Indian law, even though the app itself is not banned.

Practical Reality

Despite these restrictions, many Indian traders use offshore platforms like Exness Go, often citing lax enforcement of FEMA rules. However, this doesn’t make such activities legal—it simply reflects a regulatory grey area. Traders caught violating FEMA could face penalties, including fines or restrictions on financial transactions.

Conclusion on Legality

The Exness Go app is legal to download and use in India as a tool. Its legality depends entirely on how you use it. Stick to INR pairs and compliant practices, and you’re within the law. Venture into non-INR trading, and you enter risky, unregulated territory.

Features of the Exness Go App: Why Indian Traders Love It

Assuming you use it legally, what makes the Exness Go app stand out? Here’s a closer look at its features and benefits for Indian traders.

1. Seamless Mobile Trading

The app’s design prioritizes convenience, allowing traders to monitor markets, place orders, and manage portfolios from anywhere. With India’s mobile-first population, this is a game-changer.

2. INR Pair Availability

Exness Go supports INR-based currency pairs, aligning with India’s legal requirements. This ensures traders can participate in forex markets without breaking the law.

3. Low Spreads and High Leverage

Exness is known for competitive spreads and flexible leverage options, which appeal to traders aiming to maximize profits. However, high leverage also increases risk, so caution is advised.

4. Fast Withdrawals

Indian traders appreciate the app’s quick withdrawal process, often completed within hours via e-wallets or bank transfers. This reliability builds trust.

5. Educational Resources

For beginners, Exness Go integrates access to Exness Academy, offering tutorials, webinars, and market analysis to sharpen trading skills.

6. Security Measures

With encryption, two-factor authentication (2FA), and segregated client funds, Exness Go prioritizes user safety—an essential factor for Indian traders wary of offshore platforms.

Risks of Using Exness Go in India

While the app offers compelling features, there are risks to consider, especially in the Indian context.

1. Lack of Local Regulation

Since Exness isn’t SEBI-registered, Indian traders lack local legal recourse in disputes. You’d need to rely on international regulators, which can be complex and less accessible.

2. FEMA Violations

Trading non-INR pairs or using unregulated payment methods could lead to legal consequences, including fines or account freezes by Indian authorities.

3. Market Risks

Forex trading inherently carries risks—leverage can amplify losses, and market volatility can wipe out capital. The app’s tools help, but they don’t eliminate these dangers.

4. Enforcement Uncertainty

While enforcement of FEMA violations has been inconsistent, the RBI and SEBI are increasingly scrutinizing offshore trading. Future crackdowns could impact Exness Go users.

How to Use Exness Go Legally in India: A Step-by-Step Guide

Want to trade safely and legally with Exness Go? Follow these steps:

Step 1: Download the App

Get Exness Go from the Google Play Store or Apple App Store. It’s freely available in India.

Step 2: Open an Account

Sign up with your email and verify your identity. Exness accepts Indian IDs like Aadhaar or PAN for verification.

Step 3: Fund Your Account

Use RBI-approved methods like UPI, Net Banking, or debit cards to deposit funds. Avoid cryptocurrencies or unregulated e-wallets to stay compliant.

Step 4: Trade INR Pairs Only

Navigate to the forex section and select INR-based pairs (e.g., USD/INR). Avoid non-INR pairs to comply with FEMA.

Step 5: Track Profits and Taxes

Record your trades and report profits as capital gains on your income tax return. Consult a tax professional for accuracy.

Step 6: Withdraw Funds Legally

Request withdrawals via bank transfer or UPI to ensure funds re-enter India through regulated channels.

By sticking to these steps, you can enjoy Exness Go’s benefits without legal headaches.

Exness Go vs. SEBI-Regulated Alternatives

How does Exness Go compare to local, SEBI-regulated brokers? Let’s explore.

Exness Go

Pros: Global market access, INR pairs available, high leverage, advanced tools.

Cons: No SEBI regulation, legal risks with non-INR pairs, limited local support.

SEBI-Regulated Brokers (e.g., Zerodha, ICICI Direct)

Pros: Full compliance with Indian laws, local legal recourse, INR-focused trading.

Cons: Limited to INR pairs, fewer global instruments, lower leverage.

For traders prioritizing legality and safety, SEBI-regulated platforms are the safer bet. For those seeking variety and flexibility—and willing to navigate the grey areas—Exness Go remains appealing.

User Experiences: What Indian Traders Say

Feedback from Indian traders offers real-world insights into Exness Go’s performance:

Positive Reviews: Many praise its fast execution, low spreads, and reliable withdrawals. “I’ve been trading USD/INR on Exness Go for a year—no issues so far,” says Ravi, a Mumbai-based trader.

Concerns: Some worry about its offshore status. “It’s great, but I’m cautious about non-INR pairs after reading about FEMA,” notes Priya from Delhi.

These experiences highlight the app’s strengths while underscoring the need for regulatory awareness.

Tips for Safe Trading with Exness Go in India

To maximize your experience and minimize risks, consider these tips:

Stay Informed: Regularly check RBI and SEBI updates on forex trading rules.

Use a Demo Account: Practice with Exness Go’s demo mode before risking real money.

Limit Leverage: High leverage can lead to big losses—start low and scale up.

Keep Records: Document all trades for tax purposes and legal compliance.

Seek Advice: Consult a financial advisor familiar with Indian forex laws.

The Future of Exness Go in India

The Exness Go app remains a viable option for Indian traders willing to operate within legal boundaries. However, its future depends on several factors:

Regulatory Shifts: Stricter RBI enforcement could limit offshore platforms’ appeal.

Local Partnerships: If Exness secures SEBI approval, it could solidify its position in India.

Trader Awareness: Growing education about FEMA may steer users toward compliant practices.

For now, Exness Go bridges the gap between global trading and India’s restrictive market, but its long-term legality hinges on regulatory evolution.

Conclusion: Should You Use Exness Go in India?

So, is the Exness Go app legal in India? Yes, it is—provided you trade INR pairs and follow FEMA guidelines. Its powerful features, global regulation, and accessibility make it a compelling choice for Indian traders. However, the lack of SEBI oversight and risks tied to non-INR trading warrant caution.

If you’re a beginner, start with a SEBI-regulated broker for peace of mind. If you’re experienced and understand the rules, Exness Go offers a gateway to forex trading with unmatched flexibility. Whatever your choice, prioritize compliance, education, and risk management to thrive in India’s evolving financial landscape.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: