9 minute read

Exness vs IC Markets Comparison | Which is better?

from Exness Global

In the fast-paced world of online trading, selecting the right broker can make or break your success. Two names that consistently stand out in the forex and CFD trading space are Exness and IC Markets. Both brokers have earned reputations for reliability, competitive offerings, and cutting-edge technology, but which one is truly better for your trading needs? In this comprehensive Exness vs IC Markets comparison, we’ll dive deep into their features, fees, platforms, and more to help you decide. Whether you’re a beginner dipping your toes into forex or a seasoned trader hunting for razor-thin spreads, this guide has you covered.

💥 Trade with Exness now: Open An Account or Visit Brokers

By the end of this article, you’ll have a clear understanding of how Exness vs IC Markets stack up against each other and which broker aligns best with your goals. Let’s get started.

Why Choosing the Right Broker Matters

Before we jump into the nitty-gritty of Exness vs IC Markets, let’s establish why your choice of broker is so critical. A trading broker acts as your gateway to the financial markets, providing the tools, platforms, and conditions you need to execute trades effectively. A poor broker can mean high fees, slow execution, or even risks to your capital, while a top-tier one can enhance your profitability and peace of mind.

Key factors like regulation, spreads, leverage, platform options, and customer support play a massive role in your trading experience. With Exness and IC Markets both boasting strong credentials, this comparison will break down their strengths and weaknesses to reveal which one comes out on top.

Overview of Exness

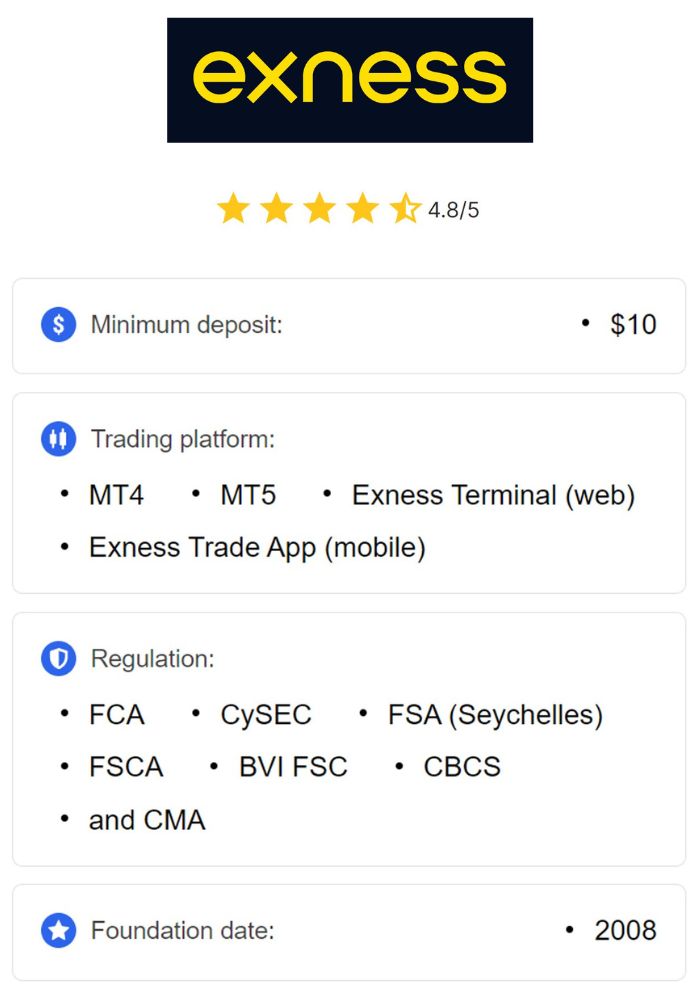

Founded in 2008, Exness has grown into a global powerhouse in the forex and CFD trading industry. Headquartered in Cyprus, the broker serves millions of clients worldwide and is known for its transparency, low spreads, and high leverage options. Exness caters to a wide range of traders, from novices to professionals, with a focus on delivering a seamless trading experience.

Exness operates under strict regulatory oversight from bodies like the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa, among others. This multi-jurisdictional regulation ensures client funds are secure and trading practices are fair.

Key Features of Exness

Low Spreads: Starting from 0.0 pips on some accounts.

High Leverage: Up to 1:2000 or unlimited in certain regions.

Account Variety: Standard, Pro, Raw Spread, and Zero accounts.

Trading Platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a proprietary mobile app.

Instruments: Forex, metals, cryptocurrencies, indices, and commodities.

Exness prides itself on fast execution speeds and a client-centric approach, making it a favorite among scalpers and high-frequency traders.

Overview of IC Markets

IC Markets, established in 2007, is an Australian-based broker renowned for its institutional-grade trading conditions. With headquarters in Sydney, IC Markets has built a loyal following by offering raw spreads, deep liquidity, and lightning-fast execution. It’s particularly popular among advanced traders, including scalpers and those using automated trading systems (Expert Advisors or EAs).

Regulated by the Australian Securities and Investments Commission (ASIC), CySEC, and the Financial Services Authority (FSA) of Seychelles, IC Markets adheres to high standards of safety and transparency. Its focus on ECN (Electronic Communication Network) trading ensures traders get direct access to market prices without interference.

Key Features of IC Markets

Raw Spreads: Starting from 0.0 pips with a commission.

Leverage: Up to 1:500 (varies by region).

Account Types: Standard, Raw Spread, and cTrader Raw.

Trading Platforms: MT4, MT5, and cTrader.

Instruments: Forex, stocks, indices, commodities, bonds, and cryptocurrencies.

IC Markets is often praised for its robust infrastructure, including servers in New York and London, which deliver ultra-low latency—a must for serious traders.

Exness vs IC Markets: A Head-to-Head Comparison

Now that we’ve introduced both brokers, let’s dive into a detailed comparison across critical categories. This section will help you see where each broker shines and where they might fall short.

1. Regulation and Safety

Safety is non-negotiable when choosing a broker. Both Exness vs IC Markets are well-regulated, but their approaches differ slightly.

Exness: Licensed by multiple regulators, including FCA, CySEC, FSCA, and the FSA of Seychelles. It offers negative balance protection and segregates client funds in tier-1 banks. Regular audits by firms like Deloitte add an extra layer of trust.

IC Markets: Regulated by ASIC, CySEC, and FSA Seychelles. Like Exness, it provides negative balance protection and keeps client funds separate from company assets. Its ASIC regulation is particularly appealing to traders who value stringent oversight.

Verdict: Both brokers are highly secure, but Exness edges out slightly with its broader regulatory coverage across more jurisdictions. If you prioritize global compliance, Exness might feel safer. For those who trust Australia’s rigorous standards, IC Markets is a strong contender.

2. Trading Fees and Spreads

Trading costs can eat into your profits, so let’s compare spreads and commissions.

Exness:

Standard Account: Spreads start at 0.2 pips with no commission.

Raw Spread Account: Spreads from 0.0 pips with a $3.50 commission per lot per side.

Zero Account: Spreads from 0.0 pips on select pairs, with variable commissions.

No deposit or withdrawal fees, which is a big plus.

IC Markets:

Standard Account: Spreads start at 0.8 pips with no commission.

Raw Spread Account (MT4/MT5): Spreads from 0.0 pips with a $3.50 commission per lot per side.

cTrader Raw Account: Spreads from 0.0 pips with a $3 commission per lot per side.

No deposit fees, but some withdrawal methods may incur charges.

Verdict: Exness offers lower starting spreads on its Standard account (0.2 pips vs. 0.8 pips), making it more cost-effective for beginners. IC Markets’ raw spreads are competitive, but its commission structure is nearly identical to Exness. For low-cost trading, Exness takes a slight lead due to its fee-free withdrawals.

3. Leverage Options

Leverage amplifies both profits and risks, so flexibility here is key.

Exness: Offers leverage up to 1:2000 or even unlimited in some regions (subject to conditions like account equity). This is among the highest in the industry, appealing to risk-tolerant traders.

IC Markets: Provides leverage up to 1:500 (reduced to 1:30 under ASIC and CySEC for retail clients). It’s more conservative but still generous compared to many brokers.

Verdict: Exness wins hands-down for traders seeking high leverage. IC Markets’ lower cap may suit those who prefer a more controlled risk profile.

💥 Trade with Exness now: Open An Account or Visit Brokers

4. Trading Platforms

Your platform is your trading cockpit—usability and features matter.

Exness:

Supports MT4 and MT5, industry standards loved for their reliability and EA compatibility.

Offers a proprietary mobile app and web terminal for on-the-go trading.

Clean, intuitive interfaces with fast execution.

IC Markets:

Offers MT4, MT5, and cTrader—a rare addition that provides advanced charting and Level II pricing.

Known for ultra-low latency thanks to Equinix NY4 servers.

Supports a wide range of third-party tools and plugins.

Verdict: IC Markets takes the lead with the addition of cTrader, which appeals to technical traders. Exness keeps it simple and effective with MT4/MT5, but lacks the extra platform diversity.

5. Account Types

Variety in account types ensures every trader finds a fit.

Exness:

Standard: Ideal for beginners, low spreads, no commission.

Standard Cent: Micro-lot trading for small budgets.

Pro: Tight spreads for active traders.

Raw Spread: ECN-like conditions with commissions.

Zero: Near-zero spreads on major pairs.

IC Markets:

Standard: Higher spreads, no commission.

Raw Spread (MT4/MT5): Low spreads with commissions.

cTrader Raw: Similar to Raw Spread but optimized for cTrader.

Verdict: Exness offers more variety, especially with the Standard Cent account for beginners and the Zero account for precision trading. IC Markets keeps it streamlined but lacks a micro-lot option.

6. Trading Instruments

Diverse markets allow you to spread your risk.

Exness: Over 100 instruments, including 96 forex pairs, cryptocurrencies, metals, indices, and commodities.

IC Markets: Over 2,250 instruments, including 61 forex pairs, 1,600+ stock CFDs, bonds, indices, commodities, and cryptocurrencies.

Verdict: IC Markets dominates with its massive range, especially for stock CFDs. Exness is solid for forex and crypto but falls short in overall diversity.

7. Deposits and Withdrawals

Ease of funding and withdrawing is a practical concern.

Exness:

Minimum deposit: $1 (varies by payment method).

Methods: Bank cards, e-wallets (Skrill, Neteller), crypto, and bank transfers.

No fees for deposits or withdrawals; instant processing for most methods.

IC Markets:

Minimum deposit: $200.

Methods: Bank cards, e-wallets (PayPal, Skrill), bank transfers, and more.

No deposit fees; withdrawal fees depend on the method.

Verdict: Exness wins with its ultra-low minimum deposit and fee-free transactions. IC Markets’ higher entry point may deter beginners.

8. Customer Support

Reliable support can save you in a pinch.

Exness: 24/7 support via live chat, email, and phone in multiple languages (15+).

IC Markets: 24/5 support via live chat, email, and phone, with fewer language options.

Verdict: Exness takes the edge with 24/7 availability and broader language support.

9. Education and Tools

Learning resources help you grow as a trader.

Exness: Offers webinars, articles, and market analysis, plus a demo account.

IC Markets: Provides webinars, tutorials, and a blog, with advanced tools like VPS hosting for EAs.

Verdict: IC Markets slightly outshines Exness with its tools for advanced traders, though both are decent for education.

Who Should Choose Exness?

Exness is ideal for:

Beginners who want a low entry barrier ($1 minimum deposit).

Traders seeking high leverage (up to 1:2000).

Scalpers and day traders who value tight spreads and fast execution.

Those who prefer fee-free deposits and withdrawals.

If you’re looking for a broker with a global presence, flexible accounts, and a focus on cost-efficiency, Exness could be your match.

Who Should Choose IC Markets?

IC Markets suits:

Advanced traders who need raw spreads and deep liquidity.

Technical traders who love cTrader’s advanced features.

Those trading a wide range of instruments, especially stock CFDs.

Scalpers and EA users who prioritize low latency.

If you value institutional-grade conditions and don’t mind a $200 minimum deposit, IC Markets is a powerhouse.

Pros and Cons

Exness Pros

Ultra-low minimum deposit.

High leverage options.

No deposit/withdrawal fees.

24/7 multilingual support.

Exness Cons

Fewer trading instruments.

No cTrader platform.

IC Markets Pros

Massive range of instruments.

cTrader availability.

Ultra-fast execution.

ECN trading environment.

IC Markets Cons

Higher minimum deposit.

Limited leverage compared to Exness.

Final Verdict: Which is Better?

So, Exness vs IC Markets—which is better? The answer depends on your trading style and priorities.

Choose Exness if you’re a beginner, want high leverage, or prefer lower costs with flexible funding options. It’s a versatile broker that balances affordability and performance.

Choose IC Markets if you’re an experienced trader, need a wider range of markets, or value advanced platforms like cTrader. It’s tailored for precision and speed.

Both brokers are excellent, with strong regulation and competitive conditions. For cost-conscious traders, Exness might edge out slightly. For those chasing institutional-grade trading, IC Markets is tough to beat.

Conclusion

The Exness vs IC Markets comparison reveals two top-tier brokers with distinct strengths. Exness excels in affordability and leverage, while IC Markets shines in market variety and platform diversity. Your choice hinges on what matters most to you—low costs or advanced tools.

Ready to trade? Test both with a demo account to see which feels right. Share your thoughts in the comments below—have you tried Exness or IC Markets? Let’s keep the conversation going!

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: