9 minute read

Is Exness a True ECN Broker? A Comprehensive Analysis for Traders

The forex trading world is filled with brokers promising top-tier services, but not all live up to their claims. One question that frequently arises among traders is: "Is Exness a true ECN broker?" This is a critical inquiry for anyone seeking transparency, low spreads, and direct market access in their trading journey. In this in-depth guide, we’ll explore what defines an ECN (Electronic Communication Network) broker, analyze Exness’s operational model, evaluate its offerings, and help you decide if it aligns with your trading goals. Whether you’re a beginner or a seasoned trader, this article will provide clarity on Exness’s status in 2025.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is an ECN Broker? Understanding the Basics

Before diving into Exness, let’s establish what an ECN broker truly is. An Electronic Communication Network (ECN) broker facilitates direct trading between market participants—think banks, financial institutions, and individual traders—without acting as a middleman who takes the opposite side of your trade. Unlike traditional market makers, ECN brokers connect you to a network of liquidity providers, ensuring your orders are executed at the best available market prices.

Key Features of an ECN Broker

Direct Market Access: Orders are routed straight to the interbank market.

Variable Spreads: Spreads fluctuate based on market conditions, often tightening during high liquidity.

Transparency: Real-time bid and ask prices are visible, reducing hidden fees or markups.

No Conflict of Interest: The broker doesn’t profit from your losses; instead, they earn through commissions.

Fast Execution: Trades are processed instantly, minimizing slippage.

These characteristics make ECN brokers a favorite among scalpers, day traders, and high-frequency traders who prioritize speed and cost efficiency. But not every broker advertising "ECN-like" features is a true ECN broker—some operate hybrid models. So, where does Exness fit in?

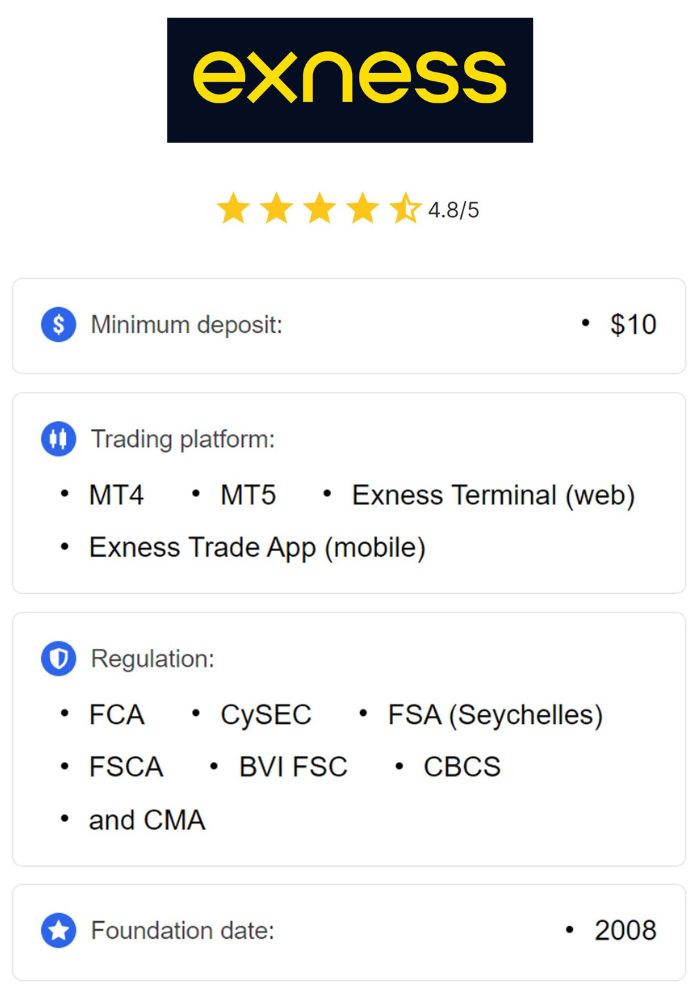

Who Is Exness? A Snapshot of the Broker

Founded in 2008, Exness has grown into a global powerhouse in the forex and CFD trading industry. Headquartered in Cyprus, the broker serves over 1 million active traders worldwide and boasts a monthly trading volume exceeding $4.8 trillion as of early 2025. Regulated by multiple authorities—including CySEC (Cyprus), FCA (UK), FSCA (South Africa), and FSA (Seychelles)—Exness has built a reputation for reliability, competitive spreads, and innovative technology.

Exness offers a variety of account types, including Standard, Pro, Raw Spread, and Zero accounts, alongside trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal. With a focus on low-cost trading and flexible leverage (up to 1:Unlimited in some regions), it’s no surprise that traders are curious about its execution model.

Does Exness Operate as an ECN Broker?

To determine if Exness is a true ECN broker, we need to examine its execution policies, account offerings, and trading conditions. Let’s break it down step by step.

Exness’s Execution Model: Hybrid or Pure ECN?

Exness operates a hybrid execution model, blending elements of both ECN and market-making structures. This approach allows it to cater to a wide range of traders, from beginners to professionals. However, its ECN-specific features are most prominent in its professional account types—namely the Raw Spread, Zero, and Pro accounts.

Raw Spread Account: Offers spreads starting from 0.0 pips with a small commission per lot, mimicking ECN conditions by providing raw market pricing from liquidity providers.

Zero Account: Features zero spreads on major pairs for most of the trading day, paired with a commission, resembling the tight pricing of ECN brokers.

Pro Account: Designed for experienced traders, it offers low spreads and instant execution, though it leans slightly toward a market-maker model in some cases.

In contrast, the Standard Account operates more like a market-maker model, with fixed or variable spreads and no commissions. This suggests that Exness isn’t a "pure" ECN broker across all accounts but integrates ECN technology selectively.

Liquidity and Market Access

A hallmark of true ECN brokers is their connection to multiple liquidity providers. Exness claims to aggregate prices from a network of top-tier banks and institutions, ensuring competitive pricing and deep liquidity. This is evident in its Raw Spread and Zero accounts, where traders experience near-zero spreads during high-liquidity periods—a trait aligned with ECN standards.

However, Exness doesn’t fully disclose the extent of its liquidity pool or whether all orders are routed directly to the interbank market. True ECN brokers typically emphasize their no-dealing-desk (NDD) environment, whereas Exness’s hybrid nature implies some orders may be internalized, especially in Standard accounts.

Transparency and Pricing

ECN brokers are known for transparent pricing, displaying real-time market depth. Exness provides tick-level data and transparent price history for all instruments, which is a strong nod toward ECN principles. Additionally, its commission-based accounts (Raw Spread and Zero) avoid spread markups, a common practice among market makers, further aligning with ECN transparency.

Yet, the lack of a visible order book or depth-of-market (DOM) feature on its platforms raises questions. True ECN brokers often allow traders to see buy and sell orders in the network, a feature Exness doesn’t explicitly offer.

Commissions vs. Spreads

ECN brokers typically charge a commission per trade rather than profiting from widened spreads. Exness follows this model in its Raw Spread and Zero accounts:

Raw Spread: Commissions start at $0.01 per side per lot, varying by instrument.

Zero: A fixed commission of $0.2 per side per lot applies.

Meanwhile, the Standard account relies solely on spreads without commissions, a market-maker trait. This dual approach confirms Exness’s hybrid status—ECN-like in some accounts, but not universally.

💥 Trade with Exness now: Open An Account or Visit Brokers

Comparing Exness to True ECN Brokers

To contextualize Exness’s standing, let’s compare it to brokers widely recognized as "true" ECN providers, like Pepperstone and IC Markets.

Exness vs. Pepperstone

Pepperstone’s Razor Account is a textbook ECN offering: raw spreads from 0.0 pips, commissions ($7 AUD round-turn), and direct market access via an NDD environment. Exness’s Raw Spread account is similar, with even lower commissions in some cases, but its hybrid model across other accounts dilutes its ECN purity compared to Pepperstone’s consistent approach.

Exness vs. IC Markets

IC Markets is another pure ECN broker, emphasizing deep liquidity, ultra-low spreads, and a transparent NDD execution. While Exness matches IC Markets in spread tightness and execution speed, its Standard account’s market-maker tendencies set it apart from IC Markets’ unwavering ECN framework.

Verdict: ECN-Like, Not Pure ECN

Exness isn’t a "true" ECN broker in the strictest sense—it doesn’t exclusively operate an NDD, ECN-only environment across all accounts. However, its professional accounts (Raw Spread, Zero, Pro) deliver ECN-like conditions, making it a viable choice for traders seeking ECN benefits without a fully ECN broker.

Benefits of Trading with Exness’s ECN-Like Features

Even if Exness isn’t a pure ECN broker, its hybrid model offers distinct advantages:

1. Ultra-Low Spreads

The Raw Spread and Zero accounts provide spreads as low as 0.0 pips, rivaling top ECN brokers. This is ideal for cost-conscious traders, especially scalpers and day traders.

2. High Execution Speeds

Exness boasts execution times under 1 millisecond, leveraging Equinix server clusters—a feature that mirrors ECN brokers’ focus on speed and reliability.

3. No Conflict of Interest in Commission Accounts

In its commission-based accounts, Exness doesn’t take the opposite side of your trades, aligning with ECN principles and fostering trust.

4. Flexible Leverage

With leverage up to 1:Unlimited (subject to conditions), Exness surpasses many ECN brokers, giving traders more control over their capital.

5. Regulatory Assurance

Multiple licenses from CySEC, FCA, and others ensure Exness adheres to strict financial standards, enhancing its credibility.

Drawbacks of Exness’s Hybrid Model

While Exness shines in many areas, its hybrid nature has limitations:

1. Not Fully Transparent

Unlike pure ECN brokers, Exness doesn’t offer a visible order book or full market depth, which may frustrate transparency-focused traders.

2. Standard Account Limitations

The Standard account’s market-maker traits (e.g., wider spreads, potential internalization) may not suit traders seeking pure ECN conditions.

3. Mixed Reputation

Some user reviews on platforms like Trustpilot praise Exness’s spreads and withdrawals, while others report issues with execution or support, hinting at inconsistencies in its hybrid approach.

Who Should Choose Exness?

Exness’s hybrid model makes it versatile, but its suitability depends on your trading style:

Scalpers and Day Traders: The Raw Spread and Zero accounts’ tight spreads and fast execution make Exness a strong contender.

Beginners: The Standard account’s simplicity and no-commission structure are beginner-friendly, though not ECN-based.

High-Volume Traders: Competitive commissions and deep liquidity in professional accounts cater to advanced traders.

Transparency Seekers: If you demand a pure ECN environment with visible market depth, you might prefer a broker like IC Markets.

How to Verify Exness’s Execution Model Yourself

Still unsure? Here’s how to investigate Exness’s ECN claims:

Review the Client Agreement: Check Exness’s Terms of Service for details on order execution and liquidity sourcing.

Test the Demo Account: Open a demo Raw Spread or Zero account to assess spreads, commissions, and execution speed.

Contact Support: Ask Exness’s 24/7 support team about their liquidity providers and execution policies.

Analyze Spreads Live: Compare spreads during volatile market conditions to see if they reflect raw market pricing.

User Experiences: What Traders Say About Exness

Trader feedback offers valuable insights:

Positive Reviews: Many praise Exness for its low spreads, fast withdrawals (95% processed instantly), and reliable platforms.

Criticisms: Some report slippage or widening spreads in Standard accounts, suggesting market-maker influence in non-ECN offerings.

These mixed experiences reinforce Exness’s hybrid nature—ECN-like in some aspects, but not universally.

Conclusion: Is Exness a True ECN Broker?

So, is Exness a true ECN broker? The answer is nuanced. Exness isn’t a pure ECN broker like Pepperstone or IC Markets, as it operates a hybrid model combining ECN and market-maker elements. However, its Raw Spread and Zero accounts deliver ECN-like conditions—tight spreads, commissions instead of markups, and direct liquidity access—making it a compelling choice for traders who value cost efficiency and speed without needing a fully transparent ECN setup.

For 2025, Exness remains a top-tier broker, blending flexibility, affordability, and reliability. If you’re seeking a pure ECN experience, you might look elsewhere. But if you want ECN benefits with added versatility, Exness is worth considering. Ready to test it? Open an account today and see how it fits your trading strategy.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: