9 minute read

Exness Account Opening India: A Comprehensive Guide for Beginners and Pros

The world of online trading has opened up incredible opportunities for individuals in India to participate in global financial markets. Among the many brokers available, Exness stands out as a trusted and reliable platform, offering a seamless experience for traders of all levels. If you’re an Indian resident looking to dive into forex, cryptocurrencies, or commodities trading, understanding the Exness account opening process in India is your first step toward financial success. In this detailed guide, we’ll walk you through everything you need to know about opening an Exness account, from eligibility criteria to step-by-step instructions, account types, and tips to maximize your trading journey.

💥 Trade with Exness now: Open An Account or Visit Brokers

Why Choose Exness for Trading in India?

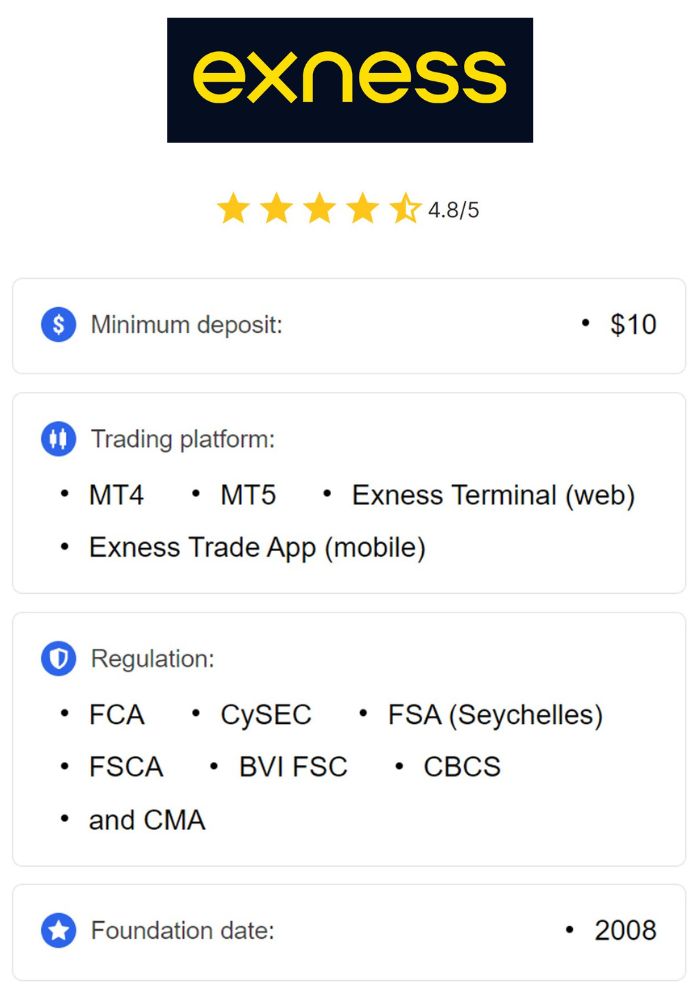

Before we dive into the account opening process, let’s explore why Exness is a top choice for Indian traders. Founded in 2008, Exness has grown into a globally recognized brokerage firm, serving millions of clients across more than 100 countries. Its reputation is built on transparency, competitive trading conditions, and cutting-edge technology, making it an ideal platform for both beginners and seasoned traders.

Key Benefits of Exness for Indian Traders

Regulation and Safety: Exness is regulated by multiple reputable authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This ensures a secure trading environment for Indian users.

Low Minimum Deposits: With a minimum deposit as low as $10 (approximately ₹800–1,000), Exness makes trading accessible to price-sensitive markets like India.

Competitive Spreads: Exness offers tight spreads starting from 0.0 pips on certain accounts, reducing trading costs significantly.

Variety of Instruments: From forex pairs to cryptocurrencies, commodities, and indices, Exness provides a diverse range of trading options.

Localized Support: Indian traders benefit from Hindi-language support and payment methods tailored to the local market, such as UPI and net banking.

Fast Withdrawals: Exness is known for its instant withdrawal processing, a feature highly valued by traders who need quick access to funds.

With these advantages in mind, let’s explore how you can open an Exness account in India and start trading.

Eligibility Criteria for Opening an Exness Account in India

Before you begin, it’s essential to ensure you meet the basic requirements to open an account with Exness. These criteria align with international regulations and local laws in India.

1. Minimum Age Requirement

You must be at least 18 years old to register with Exness. This aligns with India’s legal age for entering financial contracts and ensures responsible trading practices.

2. Residency Status

Exness accepts Indian residents, but you’ll need to confirm your country of residence during registration. While forex trading is legal in India, it’s regulated by the Reserve Bank of India (RBI). Ensure you comply with RBI guidelines, particularly when trading INR-based currency pairs.

3. Valid Identification

To complete the Know Your Customer (KYC) process, you’ll need to provide government-issued identification and proof of address. Acceptable documents include:

Proof of Identity: Aadhaar card, PAN card, passport, or driver’s license.

Proof of Address: Utility bill, bank statement, or any official document issued within the last three months showing your name and address.

4. Agreement to Terms

You’ll need to accept Exness’s terms and conditions, which outline your rights and responsibilities as a trader.

Meeting these criteria ensures a smooth account setup process. Now, let’s move on to the step-by-step guide.

How to Open an Exness Account in India: Step-by-Step Guide

Opening an Exness account is a user-friendly process that takes just a few minutes. Follow these steps to get started:

Step 1: Visit the Official Exness Website

💥 Trade with Exness now: Open An Account or Visit Brokers

Step 2: Fill in Your Details

You’ll be directed to a registration form. Provide the following information:

Country: Select “India” from the dropdown menu.

Email: Enter a valid email address for account verification and communication.

Phone Number: Provide an active Indian mobile number (e.g., in +91 format) for SMS verification.

Password: Create a strong password with a mix of letters, numbers, and symbols.

Step 3: Verify Your Email and Phone

After submitting the form, Exness will send a verification email and SMS. Click the link in the email and enter the code from the SMS to confirm your account.

Step 4: Choose Your Account Type

Exness offers several account types tailored to different trading needs. You’ll be prompted to select one during registration. Options include:

Standard Account: Ideal for beginners with low minimum deposits and no commissions.

Cent Account: Perfect for practicing with small amounts (in cents).

Pro Account: Designed for experienced traders with tighter spreads and advanced features.

Raw Spread Account: Offers the lowest spreads with a small commission per trade.

Zero Account: Provides zero spreads on select instruments for high-volume traders.

Choose an account that matches your trading goals and experience level.

Step 5: Complete KYC Verification

To comply with regulations, Exness requires identity and address verification. Upload clear scans or photos of:

Your government-issued ID (e.g., Aadhaar, PAN, or passport).

A recent utility bill or bank statement showing your address.

Verification typically takes a few hours, though it may vary based on the volume of applications.

Step 6: Fund Your Account

Once your account is verified, log in to your Exness Personal Area and deposit funds. Indian traders can use:

UPI: Instant deposits via apps like Google Pay or PhonePe.

Net Banking: Secure transfers processed within hours.

Debit/Credit Cards: Instant deposits with Visa or MasterCard.

E-Wallets: Options like Skrill and Neteller for fast transactions.

The minimum deposit varies by account type but starts at $10 for Standard accounts.

Step 7: Download a Trading Platform

Exness supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Trade app. Download your preferred platform from the website or app store, log in with your credentials, and start trading.

Congratulations! Your Exness account is now active, and you’re ready to explore the financial markets.

Exploring Exness Account Types for Indian Traders

Exness offers a variety of account types to suit different trading styles. Here’s a closer look at the options available:

1. Standard Account

Best For: Beginners and casual traders.

Minimum Deposit: $10.

Spreads: Starting from 0.3 pips.

Commission: None.

Leverage: Up to 1:2000 (depending on account balance).

Why Choose It: Simple, cost-effective, and flexible for new traders.

2. Cent Account

Best For: Novices practicing with minimal risk.

Minimum Deposit: $10.

Spreads: Starting from 0.3 pips.

Commission: None.

Leverage: Up to 1:2000.

Why Choose It: Trade in cents instead of dollars, reducing risk significantly.

3. Pro Account

Best For: Experienced traders seeking advanced features.

Minimum Deposit: $200.

Spreads: Starting from 0.1 pips.

Commission: None.

Leverage: Up to 1:2000.

Why Choose It: Tighter spreads and instant execution for precision trading.

4. Raw Spread Account

Best For: Scalpers and high-frequency traders.

Minimum Deposit: $200.

Spreads: Starting from 0.0 pips.

Commission: Up to $3.5 per lot per side.

Leverage: Up to 1:2000.

Why Choose It: Ultra-low spreads with transparent commissions.

5. Zero Account

Best For: High-volume traders.

Minimum Deposit: $200.

Spreads: 0.0 pips on select instruments.

Commission: Varies by instrument (e.g., $0.05–$20 per lot).

Leverage: Up to 1:2000.

Why Choose It: Zero spreads on major pairs for cost efficiency.

Each account type caters to specific needs, so consider your trading strategy and capital before choosing.

💥 Trade with Exness now: Open An Account or Visit Brokers

Funding Your Exness Account from India

Depositing funds into your Exness account is quick and convenient, thanks to localized payment options. Here’s how to do it:

Step-by-Step Deposit Process

Log In: Access your Exness Personal Area.

Go to Deposits: Click the “Deposit” tab.

Select Payment Method: Choose from UPI, net banking, cards, or e-wallets.

Enter Amount: Specify the deposit amount (minimum $10).

Confirm Transaction: Follow the prompts to complete the payment.

Tips for Indian Traders

Use INR: Select Indian Rupees as your account currency to avoid conversion fees.

Check Minimums: Ensure your deposit meets the account type’s requirement.

Verify First: Complete KYC before depositing to enable withdrawals later.

Deposits are typically instant, allowing you to start trading right away.

Withdrawing Funds from Exness in India

Exness is renowned for its fast withdrawal processing, a major advantage for Indian traders. Here’s how to withdraw funds:

Step-by-Step Withdrawal Process

Log In: Access your Personal Area.

Go to Withdrawals: Click the “Withdrawal” tab.

Choose Method: Select the same method used for deposits (e.g., UPI, bank transfer).

Enter Amount: Specify how much you want to withdraw.

Confirm: Submit the request and wait for processing.

Withdrawals via e-wallets are instant, while bank transfers may take 1–3 business days. Exness doesn’t charge withdrawal fees, though your bank or payment provider might.

Trading Platforms Available for Indian Traders

Exness offers multiple platforms to suit different preferences:

1. MetaTrader 4 (MT4)

Features: User-friendly, customizable charts, and automated trading via Expert Advisors (EAs).

Best For: Beginners and intermediate traders.

2. MetaTrader 5 (MT5)

Features: Advanced charting, more timeframes, and additional order types.

Best For: Experienced traders seeking robust tools.

3. Exness Trade App

Features: Mobile trading, real-time quotes, and account management on the go.

Best For: Traders who prefer flexibility.

Download your chosen platform after account setup and log in with your credentials.

Tips to Maximize Your Exness Trading Experience in India

To succeed with Exness, consider these practical tips:

1. Start with a Demo Account

Exness offers a free demo account with virtual funds ($10,000) to practice trading risk-free. It’s an excellent way to test strategies and familiarize yourself with the platform.

2. Manage Risk Effectively

Use stop-loss orders to limit potential losses.

Avoid over-leveraging, especially as a beginner.

Never risk more than you can afford to lose.

3. Leverage Educational Resources

Exness provides tutorials, webinars, and market analysis. Use these to enhance your skills and stay informed about market trends.

4. Monitor Market News

Follow economic calendars and financial news to anticipate market movements, especially for forex pairs involving INR.

5. Secure Your Account

Enable two-factor authentication (2FA) and use a strong, unique password to protect your funds and data.

Is Exness Legal in India?

Yes, Exness is legal for Indian traders. While it’s not registered with the Securities and Exchange Board of India (SEBI), it operates under global regulations and accepts clients from India. However, you must comply with RBI rules:

Trading INR-based pairs (e.g., USD/INR) is allowed.

Trading foreign-to-foreign pairs (e.g., EUR/USD) via offshore brokers like Exness is a gray area, so proceed with caution and consult a financial advisor if needed.

Exness’s global licenses and negative balance protection add an extra layer of security for Indian users.

Common Challenges and Solutions

1. Verification Delays

Issue: Slow KYC approval.

Solution: Ensure documents are clear, legible, and meet requirements.

2. Payment Issues

Issue: Deposit or withdrawal failures.

Solution: Double-check payment details and contact support if needed.

3. Platform Confusion

Issue: Difficulty navigating MT4/MT5.

Solution: Use the demo account and Exness tutorials to learn.

Conclusion: Start Your Trading Journey with Exness Today

Opening an Exness account in India is a straightforward process that unlocks a world of financial opportunities. With its low entry barriers, competitive conditions, and robust support, Exness is an excellent choice for Indian traders. Whether you’re a beginner testing the waters or a pro seeking advanced tools, this guide has equipped you with the knowledge to get started.

Read more: